Steady Course Or Changing Tides? 2015 Trial Starts 2016 Clinical Trials Roundup – Steady Course Or Changing Tides?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Breakthrough Summit Co-Host Committee 2019 Breakthrough

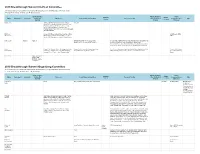

2019 Breakthrough Summit Co-Host Committee All relationships are considered compensated. Relationships are self-held unless otherwise noted. I = Immediate Family Member, Inst = My Institution Stock and Other Patents, Royalties, Travel, Speakers' Expert Name Employment Leadership Ownership Honoraria Consulting or Advisory Role Research Funding Other Intellectual Accommodations, Other Bureau Testimony Interests Property Expenses Dae Ho Lee Abbvie, AstraZeneca/MedImmune, Boehringer ST Cube Ingelheim, Bristol-Myers Squibb, Chong Kun Dang Pharmaceutical, CJ Healthcare, Janssen, Lilly, Merck, MSD, Mundipharma, Novartis, Ono Pharmaceutical, Pfizer, Roche/Genentech, Samyang, ST Cube, Takeda Ekaphop Amgen, AstraZeneca, Boehringer Ingelheim, Bristol- AstraZeneca, MSD, Sirachainan Myers Squibb, Diethelm Keller Logistics, LF Asia, Pfizer Merck, MSD, Mundipharma, Roche, Sanofi/Aventis Lillian L. Siu Agios (I) Agios (I) AstraZeneca/MedImmune, Loxo, Merck, Amgen (Inst), Astellas Pharma (Inst), AstraZeneca (Inst), Bayer (Inst), MorphoSys, Roche, Symphony Evolution Boehringer Ingelheim (Inst), Bristol-Myers Squibb (Inst), Genentech/Roche (Inst), GlaxoSmithKline (Inst), MedImmune (Inst), Merck (Inst), Novartis (Inst), Pfizer (Inst), Symphony Evolution (Inst) Virote Amgen, AstraZeneca, Bayer, Boehringer Ingelheim, Amgen, AstraZeneca, Boehringer Ingelheim, AstraZeneca, Boehringer Ingelheim, Bristol-Myers Squibb, Eisai, Lilly, Amgen, AstraZeneca, Sriuranpong Bristol-Myers Squibb, Eisai, Lilly, MSD Oncology, Eisai, MSD Oncology, Novartis, Roche MSD Oncology, -

Next Generation Immuno-Oncology Targeting Hot and Cold Tumors

Next generation immuno-oncology targeting hot and cold tumors March 2017 iTeos – General Disclaimer Company Presentation “This presentation has been prepared by iTeos and is furnished to you by iTeos on a confidential basis and solely for your information. This presentation contains forward-looking statements, including (without limitation) statements concerning the progress and expectations of our (pre-)clinical pipeline and the financials of the company. When used in this presentation, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” “will,” “plan,” “potential,” “possible,” “predict,” “objective,” “should,” and similar expressions are intended to identify forward- looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which might cause the actual results, financial condition, performance or achievements of iTeos, or industry results, to be materially different from any future results, financial conditions, performance or achievements expressed or implied by such forward-looking statements. All statements contained herein speak only as of the release date of this document. iTeos expressly disclaims any obligation to update any statement in this document to reflect any change or future development with respect thereto, any future results, or any change in events, conditions and/or circumstances on which any such statement is based, unless specifically required by law or regulation. Neither iTeos nor any of its officers, -

IGNYTE-ESO: a Master Protocol to Assess Safety and Activity of Letetresgene Autoleucel (Lete-Cel; GSK3377794) Victoria L

Sandra P. D’Angelo1, Jonathan Noujaim2, Fiona Thistlethwaite3, Albiruni R. Abdul Razak4, Silvia Stacchiotti5, Warren Chow6, John B.A.G. Haanen7, Anna Chalmers8, Steven I. Robinson9, Brian A. Van Tine10, Kristen N. Ganjoo11, Melissa L. Johnson12, 13 13 13 13 13 14 15 IGNYTE-ESO: a master protocol to assess safety and activity of letetresgene autoleucel (lete-cel; GSK3377794) Victoria L. Chiou , Thomas Faitg , Mary Woessner , Laura Pearce , Aiman Shalabi , Jean-Yves Blay , George D. Demetri 1Memorial Sloan Kettering Cancer Center, New York, NY, USA; 2Institut D’Hématologie-Oncologie, Hôpital Maisonneuve-Rosemont, Montreal, QC, Canada; 3The Christie NHS Foundation Trust and University of Manchester, Manchester, United Kingdom; 4Princess Margaret Cancer Centre and in HLA-A*02+ patients with synovial sarcoma or myxoid/round cell liposarcoma (Substudies 1 and 2) Mount Sinai Hospital, Toronto, ON, Canada; 5Fondazione IRCCS Istituto Nazionale dei Tumori, Milan, Italy; 6City of Hope Comprehensive Cancer Center, Duarte, CA, United States; 7Antoni van Leeuwenhoek Ziekenhuis, Amsterdam, Netherlands; 8Huntsman Cancer Institute, University of Utah, Salt Lake City, UT, USA; 9Mayo Clinic, Rochester, MN, USA; 10Washington University in St. Louis, St. Louis, MO, USA; 11Stanford University Medical Center, Stanford, CA, USA; 12Sarah Cannon Research Institute, Nashville, TN, USA; 13GlaxoSmithKline, Philadelphia, PA, USA; Poster No. TPS11582 14Centre Léon Bérard, Lyon, France; 15Dana-Farber Cancer Institute and Ludwig Center at Harvard, Boston, MA, USA Background Study design Study phases Unmet need IGNYTE-ESO (NCT03967223) is a master protocol that enables evaluation of multiple cell therapies Figure 3 displays the patient journey for both substudies, which includes leukapheresis for lete-cel manufacture, lymphodepletion chemotherapy, lete-cel infusion, and follow-up. -

Genomic Landscape of Cell-Free DNA in Patients with Colorectal Cancer

Author Manuscript Published OnlineFirst on December 1, 2017; DOI: 10.1158/2159-8290.CD-17-1009 Author manuscripts have been peer reviewed and accepted for publication but have not yet been edited. Genomic landscape of cell-free DNA in patients with colorectal cancer John H. Strickler1, Jonathan M. Loree2, Leanne G. Ahronian3, Aparna R. Parikh3, Donna Niedzwiecki1, Allan Andresson Lima Pereira2, Matthew Mckinney1, W. Michael Korn4,5, Chloe E. Atreya4, Kimberly C. Banks6, Rebecca J. Nagy6, Funda Meric-Bernstam2, Richard B. Lanman6, AmirAli Talasaz6, Igor F. Tsigelny7,8, Ryan B. Corcoran3 #, Scott Kopetz2 # 1Duke University Medical Center, Durham, NC, USA; 2University of Texas MD Anderson Cancer Center, Houston, TX, USA; 3Massachusetts General Hospital Cancer Center and Department of Medicine, Harvard Medical School, Boston, MA, USA; 4Helen Diller Family Comprehensive Cancer Center, University of California, San Francisco, San Francisco, CA; Caris Life Sciences, Phoenix, AZ, USA; 6Guardant Health, Inc., Redwood City, CA, USA; 7University of California San Diego, San Diego, CA, USA; 8CureMatch Inc., San Diego, CA, USA. #To whom correspondence should be addressed: Dr. Ryan B. Corcoran Massachusetts General Hospital Cancer Center, 149 13th St., 7th floor Boston, MA 02129 Phone: 617-726-8599 Fax: 617-724-9648 Email: [email protected] Dr. Scott Kopetz University of Texas MD Anderson Cancer Center, 1515 Holcombe Blvd, Unit 426 Houston, TX 77030 Phone: 713-792-2828 Fax: 713-563-2957 Email: [email protected] 1 Downloaded from cancerdiscovery.aacrjournals.org on September 28, 2021. © 2017 American Association for Cancer Research. Author Manuscript Published OnlineFirst on December 1, 2017; DOI: 10.1158/2159-8290.CD-17-1009 Author manuscripts have been peer reviewed and accepted for publication but have not yet been edited. -

Feasibility and First Reports of the MATCH-R Repeated Biopsy Trial At

www.nature.com/npjprecisiononcology ARTICLE OPEN Feasibility and first reports of the MATCH-R repeated biopsy trial at Gustave Roussy Gonzalo Recondo 1, Linda Mahjoubi2, Aline Maillard3, Yohann Loriot1,4, Ludovic Bigot1, Francesco Facchinetti1, Rastislav Bahleda2, Anas Gazzah2, Antoine Hollebecque2, Laura Mezquita4, David Planchard1,4, Charles Naltet4, Pernelle Lavaud4, Ludovic Lacroix1,5,6, Catherine Richon5, Aurelie Abou Lovergne7, Thierry De Baere8, Lambros Tselikas8, Olivier Deas9, Claudio Nicotra2, Maud Ngo-Camus2, Rosa L. Frias1, Eric Solary10, Eric Angevin2, Alexander Eggermont4, Ken A. Olaussen1, Gilles Vassal7, Stefan Michiels 3, ✉ Fabrice Andre 1,4, Jean-Yves Scoazec5,6, Christophe Massard1,2, Jean-Charles Soria1,4, Benjamin Besse1,4 and Luc Friboulet 1 Unravelling the biological processes driving tumour resistance is necessary to support the development of innovative treatment strategies. We report the design and feasibility of the MATCH-R prospective trial led by Gustave Roussy with the primary objective of characterizing the molecular mechanisms of resistance to cancer treatments. The primary clinical endpoints consist of analyzing the type and frequency of molecular alterations in resistant tumours and compare these to samples prior to treatment. Patients experiencing disease progression after an initial partial response or stable disease for at least 24 weeks underwent a tumour biopsy guided by CT or ultrasound. Molecular profiling of tumours was performed using whole exome sequencing, RNA sequencing and panel sequencing. At data cut-off for feasibility analysis, out of 333 inclusions, tumour biopsies were obtained in 303 cases (91%). From these biopsies, 278 (83%) had sufficient quality for analysis by high-throughput next generation sequencing (NGS). All 278 samples underwent targeted NGS, 215 (70.9%) RNA sequencing and 222 (73.2%) whole 1234567890():,; exome sequencing. -

Compugen Ltd. (Exact Name of Registrant As Specified in Its Charter and Translation of Registrant's Name Into English) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 DATE OF EVENT REQUIRING THIS SHELL COMPANY REPORT __________ COMMISSION FILE NO. 000-30902 ____________________________________________________ Compugen Ltd. (Exact name of registrant as specified in its charter and translation of registrant's name into English) ___________________________________________________________________ Israel (Jurisdiction of incorporation or organization) Azrieli Center, 26 Harokmim Street, Building D, Holon 5885849 Israel (Address of principal executive offices) ________________________________________________ Ari Krashin, Chief Financial Officer Phone: +972-3-765-8585, Fax: +972-3-765-8555 Azrieli Center, 26 Harokmim Street, Building D, Holon 5885849 Israel (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) ________________________________________________ Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Ordinary shares, par value NIS 0.01 per share The NASDAQ Stock Market LLC (The NASDAQ Global Market) Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 51,293,070 Ordinary Shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Understanding Life Science Partnership Structures

MARCH 2009 MEMBER BRIEFING LIFE SCIENCES PRACTICE GROUP Understanding Life Science Partnership Structures Krist Werling, Esquire Bart Walker, Esquire Jessica Smith, Esquire McGuireWoods LLP Chicago, IL, and Charlotte, NC Companies in every industry that have attempted to raise capital and make research and development (R&D) investments over the past twelve months have faced significant challenges. The pharmaceutical and biotechnology sectors are no exception. The Dow Jones U.S. Biotechnology Index was down 18% during 2008, the pharmaceutical index DRG.X lost 19% of its market value. The entire healthcare industry has been battered during this downturn; the medical supply index DJUSAM was down 35% in 2008; managed care companies are down nearly 60%.1 While a significant wave of consolidation is coming (as evidenced by Pfizer’s announced acquisition of Wyeth), the partnership options described in this article offer options for pharmaceutical and device companies in these challenging economic times. Dramatic declines in the capital markets have been in part caused by, and accompanied by the credit crunch. This restriction in available capital has brought significant challenges to transactions in all industries, including healthcare and biotechnology. The Biotechnology Industry Organization, a prominent trade group, recently stated that 180 publicly traded biotech companies have less than one year of cash on hand.2 Both venture capital firms and private equity funds have been unable to structure leveraged buyouts and 1 Lawrence C. Strauss, Health-Care Stocks for an Ailing Economy, BARRON’S, Nov. 24, 2008. 2 Ron Winslow, Investor Prospects Look Grim, WALL ST. J., Jan. 11, 2009. 1 combination transactions requiring significant amounts of debt. -

2019 Best of ASCO Planning Committee All Relationships Are Considered Compensated

2019 Best of ASCO Planning Committee All relationships are considered compensated. Relationships are self-held unless otherwise noted. I = Immediate Family Member, Inst = My Institution Name Employment Leadership Stock and Other Honoraria Consulting or Advisory Role Speakers' Research Funding Patents, Royalties, Other Expert Travel, Accommodations, Other Ownership Bureau Intellectual Property Testimony Expenses Relationship Interests Monica M. Bertagnolli Leap Syntalogic, Syntimmune Abbvie (Inst), Agenus (Inst), Astellas Pharma (Inst), AstraZeneca (Inst), Baxalta (Inst), Therapeutics Bayer Health (Inst), Breast Cancer Research Foundation (Inst), Bristol-Myers Squibb (Inst), Celgene (Inst), Complion (Inst), Eisai (Inst), Exelixis (Inst), Genentech (Inst), GHI Pharma (Inst), Gilead Sciences (Inst), GlaxoSmithKline (Inst), Incyte (Inst), Janssen (Inst), Jazz Pharmaceuticals (Inst), Leidos (Inst), Lexicon (Inst), Lilly (Inst), Matrex (Inst), Mayo Clinic (Inst), Merck (Inst), MGH (Inst), Millenium Pharamceuticals (Inst), Novartis (Inst), Patient Centered Outcomes Research Institute (PCORI) (Inst), Pfizer (Inst), Pharmacyclics (Inst), Robert Wood Johnson Foundation (Inst), Sagerock Advisors (Inst), Sanofi (Inst), Taiho Pharmaceutical (Inst), Takeda (Inst), Tesaro (Inst), Teva (Inst) Melissa L. Johnson Araxes Pharma (Inst), Astellas Pharma (I), Abbvie (Inst), Acerta Pharma (Inst), Adaptimmune (Inst), Amgen (Inst), Array BioPharma Abbvie, Astellas Pharma, AstraZeneca (Inst), BeiGene (Inst), (Inst), AstraZeneca (Inst), BeiGene (Inst), BerGenBio -

Annual Report 2017

Annual Report 2 017 Augmented Version Bayer Annual Report 2017 The integrated Bayer Annual Report 2017 is available in a print version and in an aug- mented online version (Annual Report 2017 – Augmented Version). The online version contains the notes to the consolidated financial state- ments of the Bayer Group, along with additional information on the management report. The Annual Report 2017 – Augmented Version can be found at www.bayer.com/AR17. Cover photo: Farmer Aaron Gingerich with his daughter Kylie on one of his cornfields in Illinois, United States. You can read more in the Magazine section, which starts on page 8. At a Glance Sales EBITDA Net Income Before Special Items 1 2 +1.5% -0.3 % + 61.9% 2016 2017 Core Earnings per Share Supplier Management Investment in Research and Development 2 +1.0 % 99.5% of all strategically important suppliers billion evaluated since 2012 €4.5 Proportion of Women Specific Greenhouse Gas Emissions3 Energy Efficiency3 in Senior Management 2 - % up by 4.5 2 % 3.8% 32 1 Currency- and portfolio-adjusted 2 Changes from 2016; 2016 figures restated 3 Bayer excluding Currenta Fiscal 2017 Bayer: business at prior-year levelFiscal 2017 – on track with strategy Bayer:Group sales business €35.0 billion (Fx at & portfolioprior-year adj. + 1.5%) levelAnother – recordon trackyear for Pharmaceuticals with strategy Weak business development at Consumer Health CrGropoup Science sales €35.0 business billion down (Fx &against portfolio prior adj. year + 1.5%) due to situation in Brazil – measures taking effect Another -

13Th Annual Oncology Grand Rounds

13th Annual Oncology Grand Rounds A Complimentary NCPD Live Webinar Series Held During the 46th Annual ONS Congress Colorectal and Gastroesophageal Cancers Wednesday, April 21, 2021 4:45 PM – 5:45 PM ET Medical Oncologists Oncology Nurse Practitioner Johanna Bendell, MD Jessica Mitchell, APRN, CNP, MPH Daniel Catenacci, MD Moderator Neil Love, MD Medical Oncologists Oncology Nurse Practitioner Johanna Bendell, MD Jessica Mitchell, APRN, CNP, MPH Chief Development Officer Assistant Professor of Oncology Director, Drug Development Unit Nashville Mayo Clinic College of Medicine Sarah Cannon Research Institute and Science Tennessee Oncology Rochester, Minnesota Nashville, Tennessee Daniel Catenacci, MD Associate Professor, Department of Medicine Section of Hematology and Oncology Director, Interdisciplinary Gastrointestinal Oncology Program Assistant Director, Translational Research Comprehensive Cancer Center The University of Chicago Medical Center and Biological Sciences Chicago, Illinois Commercial Support This activity is supported by educational grants from Lilly and Taiho Oncology Inc. Dr Love — Disclosures Dr Love is president and CEO of Research To Practice. Research To Practice receives funds in the form of educational grants to develop CME activities from the following companies: AbbVie Inc, Adaptive Biotechnologies Corporation, Agios Pharmaceuticals Inc, Alexion Pharmaceuticals, Amgen Inc, Array BioPharma Inc, a subsidiary of Pfizer Inc, Astellas, AstraZeneca Pharmaceuticals LP, Aveo Pharmaceuticals, Bayer HealthCare Pharmaceuticals, -

2021 Quality Care Symposium Planning Committee All Relationships Are Considered Compensated

2021 Quality Care Symposium Planning Committee All relationships are considered compensated. Relationships are self-held unless otherwise noted. I = Immediate Family Member, Inst = My Institution Name Employment Leadership Stock and Other Honoraria Consulting or Advisory Speakers' Bureau Research Funding Patents, Royalties, Other Expert Testimony Travel, Accommodations, Other Relationship (OPTIONAL) (OPTIONAL) Open Ownership Interests Role Intellectual Property Expenses Uncompensated Payments Link Relationships Kerin B. Adelson Emilio Health- Emilio Health- Carrum Health, Emilio Genentech Celgene, HERON, Roche Genentech/Roche Genentech Celgene, Genentech, Genentech/Roche Brightline Health (I) Brightline Health (I) Health-Brightline Health (I), DIS HERON, Roche DIS Lyra Health (I), MindNest Heath (I) Neeraj K. Arora Fumiko Chino Varian (Inst) Janet De Moor Biogen (I) Biogen (I) Biogen (I) John T. Hamm BrightPath AstraZeneca, Meda Abbvie (Inst), Amgen (Inst), ARMO BioSciences (Inst), Astellas Biotheraputics, Exelixis, Pharmaceuticals, Pfizer Pharma (Inst), AstraZeneca (Inst), Boehringer Ingelheim (Inst), Puma Biotechnology Boston Biomedical (Inst), BrightPath Biotheraputics (Inst), Bristol- Myers Squibb (Inst), Cancer Research and Biostatistics (Inst), Celgene (Inst), Clovis Oncology (Inst), Daiichi Sankyo (Inst), Dana Farber Cancer Institute (Inst), Deciphera (Inst), EMD Serono (Inst), EpicentRx (Inst), Exact Sciences (Inst), Five Prime Therapeutics (Inst), G1 Therapeutics (Inst), GBG Forschungs (Inst), Genentech (Inst), Gilead Sciences -

Precision Medicine

www.nature.com/npjprecisiononcology ARTICLE OPEN Precision medicine: preliminary results from the Initiative for Molecular Profiling and Advanced Cancer Therapy 2 (IMPACT2) study ✉ Apostolia Maria Tsimberidou 1 , David S. Hong1, Siqing Fu1, Daniel D. Karp1, Sarina Piha-Paul1, Merrill S. Kies2, Vinod Ravi3, Vivek Subbiah1, Sunil M. Patel4, Shi-Ming Tu5, Filip Janku1, John Heymach 2, Amber Johnson 6, Carrie Cartwright1, Li Zhao7, Jianhua Zhang7, Donald A. Berry8, David J. Vining9, Andrew Futreal7, Vincent A. Miller10 and Funda Meric-Bernstam1 Precision medicine is associated with favorable outcomes in selected patients with cancer. Herein, we report an interim analysis of IMPACT2, an ongoing randomized study evaluating genomic profiling and targeted agents in metastatic cancer. Patients with metastatic cancer underwent tumor genomic profiling (ClinialTrials.gov: NCT02152254), and 69 patients met the criteria for randomization. Tumor board and multidisciplinary review of molecular alterations optimized treatment selection. From 5/2014 to 4/ 2017, 320 patients (median age, 63 years; men, 47%) had tumor molecular aberrations, and 213 (66.56%) received anticancer therapy. The most frequently mutated genes were TP53 (42%), KRAS (16%), PIK3CA (12%), and CDKN2A (11%). The median OS was 10.9 months (95% CI, 8.8–12.9). OS was shorter in patients with higher tumor mutational burden. Independent factors associated with shorter OS were age ≥60 years, liver metastases, low albumin levels, high LDH levels, and KRAS and TP53 mutations. Outcomes for randomized patients will be reported after completion of the study. 1234567890():,; npj Precision Oncology (2021) 5:21 ; https://doi.org/10.1038/s41698-021-00159-2 INTRODUCTION (HR = 0.72; p < 0.001), and matched targeted therapy was an 4 In 2007, we initiated the first personalized medicine oncology independent factor predicting longer OS .