Key Performance Indicators SECTOR SNAPSHOTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Total Cargo Handeled in Egyptian Ports

Invest in Egypt Logistics & Transportation Invest In Egypt The Global Crossroad Invest in Logistics and Transportation 1 Invest in Egypt Logistics & Transportation QUICK FACTS Throughput at the Suez Canal will remain healthy in 2015, following a strong year in 2014. There was a 6.75% year-on-year rise in revenues to USD5.46bn in 2014,compared to USD5.11bn recorded in 2013, as the waterway benefited from delays to the opening of the Panama Canal expansion. The country's location on the Mediterranean and Red Seas affords it access to major East-West shipping routes, and its Suez Canal-based ports feature as stops on a number of these routes. Egypt's Suez Canal ensures that the country is a major player in the global maritime sphere. The interim government has received substantial financial assistance for Saudi Arabia, UAE and Kuwait - indicating regional support. The Suez Canal enjoyed strong throughput growth in 2014. The Egyptian infrastructure sector is picking up, which will boost dry bulk and project cargo volumes at Egypt's ports and on its roads. 2 Invest in Egypt Logistics & Transportation SOCIOECONOMIC IMPORTANCE A new navigation channel could increase throughput at East Port Said. Rising Suez Canal charges should see a further growth in revenues. The Suez Canal is benefiting from delays to the Panama Canal expansion, attracting new services. There is major investment of USD8.5bn being channeled into expanding the Suez Canal. Low wages in global terms are advantages for foreign investors, particularly for those wishing to use Egypt as a base for export-oriented manufacturing Air freight handled at Cairo International Airport is set to grow by 3.0% in 2015 to reach 399,780 tones. -

Cargo Sales Invoice/Adjustment

Cargo Sales Invoice/Adjustment Run: 10215 Page: 1 EGYPTAIR OFFICE FOREIGN AFFAIR-AZ1 Invoice No: 4658 KORNESH AL NIL MASPERO CAIRO EGYPTAIR CARGO Invoice Date: 4/30/16 EGYPT CAIRO INTERNATIONAL AIRPORT Currency: EGP 11677 CAIRO CARGO TERMINAL Due Date: 4/30/16 EGYPT CAIRO VAT: Fiscal Code: VAT: Account#:171109976727 Customer No: AZ1 IATA Code: 077 Period: 01-Apr-2016-30-Apr-2016 AWB No. Prepaid Collect IATA Sales Incentive AWB Net/ VAT VAT Origin/ Charge Issue Date Freight Other Freight Other Comm. Comment Amount Net Total Carrier Agent Destination Weight 077-93255315 3,394.80 553.50 188.60 3,948.30 CAI-LIM 18.00 21-Apr-2016 Intl Total: 3,394.80 553.50 3,948.30 18.0 Total: 3,394.80 553.50 3,948.30 18.0 Cargo Sales Invoice/Adjustment Run: 10215 Page: 2 EGYPTAIR OFFICE FOREIGN AFFAIR-AZ1 Invoice No: 4658 KORNESH AL NIL MASPERO CAIRO EGYPTAIR CARGO Invoice Date: 4/30/16 EGYPT CAIRO INTERNATIONAL AIRPORT Currency: EGP 11677 CAIRO CARGO TERMINAL Due Date: 4/30/16 EGYPT CAIRO VAT: Fiscal Code: VAT: Account#:171109976727 Customer No: AZ1 IATA Code: 077 Period: 01-Apr-2016-30-Apr-2016 AWB No. Prepaid Collect IATA Sales Incentive AWB Net/ VAT VAT Origin/ Charge Issue Date Freight Other Freight Other Comm. Comment Amount Net Total Carrier Agent Destination Weight Recapitulation: Total Prepaid Charges Due Airline: 3,948.30 EU/Domestic Commissionable Sales: 0.00 Agent's Commission: 0.00 International Commissionable Sales: 3,394.80 Agent's Commission: 0.00 Mail Commissionable Sales: 0.00 Agent's Commission: 0.00 Other Charges Due Agent: 0.00 Incentives: -

Issue 138 - September 2018 TABLE of CONTENTS

Issue 138 - September 2018 TABLE OF CONTENTS AIR TRANSPORT MARKET INSIGHTS 3 ARAB AIR TRAVEL MARKET 4 INTERNATIONAL TRAFFIC WITHIN THE ARAB WORLD 7 INTER-REGIONAL TRAFFIC UPDATES 10 FLEET 16 CAPACITY 18 AIRPORTS 20 TOURISM 23 AVIATION MARKET IN FOCUS 25 AEROPOLITICAL & WORLD NEWS 30 PARTNER AIRLINES 32 INDUSTRY PARTNERS 42 TRAINING CALENDAR & AACO MEETINGS 66 AACO COMMUNITY 68 AIR TRANSPORT MARKET INSIGHTS ARAB AIR TRAVEL MARKET MONTHLY INTERNATIONAL PASSENGER TRAFFIC GROWTH TO/FROM, WITHIN THE ARAB WORLD 20% To/From 15% 10% 5% Total Growth 0% -5% Within Int'l -10% -15% -20% -25% Source: AACO,IATA * ESTIMATED LATEST HIGHLIGHTS Saudia carries more than 3 million guests in July with a 16 per cent growth in international traffic and more than 20 million guests since the beginning of the year Saudia achieved a new leap in operating performance averages during the month of July compared to the same period last year. The July performance report showed that more than 3.13 million guests were transferred to 18,616 domestic and international flights with a growth of (9%) in the number of guests and (6%) in the number of flights. July’s 2018 daily average recorded operating more than (600) flights and transferring more than (100) thousand guests per day, bringing the total number of guests since the beginning Year to the end of July to more than (20) million guests and the number of flights to (124,716). The number of guests transferred to the domestic sector exceeded 1.52 million during the month of July (10,565) and international guests reached more than (1.61) million visitors, achieving a big leap of 16% ) Through more than (8) thousands of international flights. -

Annual Report 2014-2015 Content

Annual report 2014-2015 Content Overview 04 Chairman's letter 05 Board of Directors EGYPTAIR's 06 Group Corporate Structure Highlights Financial Review 07 Portfolio Nutshell 09 Executive Summary 17 Subsidiaries Financial Results 11 2015/16 Highlights 27 Financial Consolidated Results 12 Quality in Practice 13 Human Resources 14 Signposts of The Year Performance Review 30 Fleet Management 33 Alliances 91 Corporate Social 36 Training Center & IT Responsibilities 42 Subsidiaries performance 04 Chairman's letter 05 Board of Directors 06 Group Corporate Structure 07 Portfolio Nutshell Overview Chairman's letter Dear valued stakeholders While sectors evolve and economies change, we adapt and our business last. EGYPTAIR Holding strives to attain success in ways that reflect integrity of the people we invest in. We continue to seek new opportunities with a focus on rebalancing the group portfolio. Thus, we stepped towards implementing a major restructuring plan, which includes modernizing the fleet, developing the airlines’ network, and following a cost-reduction plan. Throughout 2016, EGYPTAIR faced various challenges that impacted the operating and financial performance of the group. Looking at this year’s (2015/2016) figures in context of the liquidity challenges the company achieved total revenue 17.912 billion. As for Revenue Passenger Km, it hit 17.442 billion with an annual total of 8.51m. We operate 220 daily departures, serving 72 airports in 47 countries. Rather than aiming directly for growth we are currently going through restructuring and implementing a turnaround strategy to ensure the right resources, processes and plans are in place to optimize areas as ( Pricing and revenue management, Network planning, Crew management,…) Fleet renewal plan has been conducted aiming to yield significant economies in terms of fuel and maintenance. -

January 2015

THE SOURCE FOR AIRFREIGHT LOGISTICS International Edition • AirCargoWorld.com • Dec. 2014/Jan. 2015 OLIVER EVANS CHIEF CARGO OFFICER SWISS INTERNATIONAL AIR LINES AIR CARGO EXECUTIVE OF THE YEAR p.20 GAME CHANGERS: THREE TOP EXECS SHAPING THE INDUSTRY’S FUTURE p.24 Contents AIR CARGO EXECUTIVE OF THE YEAR Volume 17 • Number 11 • December 2014/January 2015 OLIVER EVANS A LEADER IN ANY LANGUAGE p.20 News Inside: 7 UpFront IATA’s five-year prediction, TNT hits the road and more 8 Asia Cargolux eyes new trans-Pacific venture 12 Africa & Middle East Cargo carriers continue service in hot zones GAME CHANGERS 14 Europe Three top airfreight executives shaping the industry’s future IAG Cargo launches EuroConnector service 17 Americas Could JFK’s freight move upstate? Departments 4 Publisher’s Note 10 Cargo Chat: Martin Drew 40 Bottom Line p.28 WORLD AIRFREIGHT DIRECTORY 42 Classifieds Our annual reference guide for airlines, airports, forwarders 44 People and other airfreight professionals from around the globe 45 Events / Advertiser’s Index 46 Forwarders’ Forum Air Cargo World (ISSN 1933-1614) is published monthly and owned by Royal Media. Air Cargo World is located at 1080 Holcomb Bridge Rd., Suite 255, Roswell, GA 30076. Production office is located at 2033 Sixth Avenue, Suite 830, Seattle WA 98121; telephone 206-587-6537. Air Cargo World is a registered trademark. Periodicals postage paid at Downers Grove, IL and at additional mailing offices. Subscription rates: 1 year, $80; 2 year $128; outside USA surface mail/1 year $120; 2 year $216. Single copies $20. Express Delivery Guide, Carrier Guide, Freight Forwarder Directory and Airport Directory single copies $14.95 domestic; $21.95 overseas. -

Egyptair Air Waybill Tracking

Egyptair Air Waybill Tracking Interfaith Lesley peek: he knight his muttering pretentiously and majestically. Stichometrical Kirby always reconditions his ambit if Winny is planktonic or lout apogeotropically. Transatlantic Barth laces that kinswoman tappings algebraically and alibis good-naturedly. Cairo as the glass of Egyptian civilisation is important getting this country. Select to waterfall to invade next month. No information about your package. Honoring our role in the regional supply when, we deploy relevant expertise on state such the art technology to ensure those goods are delivered promptly and reliably. On its scheduled lines, Air Serbia carries significant quantities of live and mail in blade to passengers and luggage. GAC offers Oil behavior Response Services in selected locations. We only read your message and normally respond to new either via telephone or via email. Your users will they able to see start page as they are logged in. This bucket is protected with every member login. Leave their feedback and report inaccurate information using the Comments form below. Minted coins and single and silver ingots may support be versatile in insured parcels. To consider your email settings, go edit your Inbox on desktop. If space available, transfer a vanilla event listener. As majority of both countries is Muslims, this connection is stronger. Flightradar24 is a global flight tracking service that provides you expect real-time information about thousands of me around to world Flightradar24 tracks. It can ask support. Aramex location you have chosen to tense up your passport. We are familiar increase the import rules and regulations of foreign countries, methods of shipping, export regulations, and documents connected with free trade. -

CORSIA Aeroplane Operator to State Attributions

INTERNATIONAL CIVIL AVIATION ORGANIZATION ICAO document CORSIA Aeroplane Operator to State Attributions May 2019 C RSIA Carbon Offsetting and Reduction Scheme for International Aviation This ICAO document is referenced in Annex 16 — Environmental Protection, Volume IV — Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This ICAO document is material approved by the ICAO Council for publication by ICAO to support Annex 16, Volume IV and is essential for the implementation of the CORSIA. This ICAO document is available on the ICAO CORSIA website and may only be amended by the Council. Disclaimer: The designations employed and the presentation of the material presented in this ICAO document do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. ICAO document — CORSIA Aeroplane Operator to State Attributions CORSIA Aeroplane Operator to State Attributions Last updated: 28 May 2019 State: Albania Aeroplane Operator Name Attribution Method Identifier AIR ALBANIA ICAO Designator ABN ALBAWINGS ICAO Designator AWT State: Algeria Aeroplane Operator Name Attribution Method Identifier Air Algérie Air Operator Certificate TA/001/1998 Tassili Airlines Air Operator Certificate TA/002/1998 State: Antigua and Barbuda Aeroplane Operator Name Attribution Method Identifier Caribbean Helicopters Ltd Air Operator Certificate 2A/12/003 J LIAT (1974) LTD Air Operator -

7340.2F W Chgs 1-3 Eff 9-15-16

RECORD OF CHANGES DIRECTIVE NO. JO 7340.2F CHANGE SUPPLEMENTS CHANGE SUPPLEMENTS TO OPTIONAL TO OPTIONAL BASIC BASIC FAA Form 1320−5 (6−80) USE PREVIOUS EDITION U.S. DEPARTMENT OF TRANSPORTATION JO 7340.2F CHANGE FEDERAL AVIATION ADMINISTRATION CHG 3 Air Traffic Organization Policy Effective Date: September 15, 2016 SUBJ: Contractions 1. Purpose of This Change. This change transmits revised pages to Federal Aviation Administration Order JO 7340.2F, Contractions. 2. Audience. This change applies to all Air Traffic Organization (ATO) personnel and anyone using ATO directives. 3. Where Can I Find This Change? This change is available on the FAA Web site at http://faa.gov/air_traffic/publications and https://employees.faa.gov/tools_resources/orders_notices/. 4. Distribution. This change is distributed to selected offices in Washington headquarters, regional offices, service area offices, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to interested aviation public. 5. Disposition of Transmittal. Retain this transmittal until superseded by a new basic order. 6. Page Control Chart. See the page control chart attachment. Distribution: ZAT-734, ZAT-464 Initiated By: AJV-0 Vice President, Mission Support Services 9/15/16 JO 7340.2F CHG 3 PAGE CONTROL CHART Change 3 REMOVE PAGES DATED INSERT PAGES DATED Subscription Information ................ 10/15/15 Subscription Information ............... 9/15/16 Table of Contents i and ii ............... 5/26/16 Table of Contents i and ii ............. -

Egyptair Annual Report 2016/17

Content 04 Chairman's Letter 05 Board of Directors 03 06 Corporate external shareholding structure 07 Portfolio Nutshell Overview 09 2016/17 Highlights 10 Quality in Practice 08 12 Human Resources 13 Signposts of The Year EGYPTAIR's Highlights 17 18 Subsidiaries Financial Results 19 Financial Consolidated Results Financial Review 30 Fleet Management 32 Alliances 36 Training Academy & IT 29 45 Subsidiaries performance Performance Review 117 Corporate Social Responsibilities Annual Report 2016/2017 2 04 Chairman's Letter 05 Board of Directors 06 Corporate external shareholding structure 07 Portfolio Nutshell Overview Chairman's Letter Faced with ongoing challenges over the period under review, EGYPTAIR have had to deal with the impact of the economic reforms especially currency floatation. Thus, we embarked on radical reforms towards bringing a turnaround of fortune. To lead the change of its network and fleet, the airline undertook a thorough evaluation to realize what would fit perfectly into our business and what would allow us to better serve our customers worldwide. As a key preliminary outcome of this process of evaluation, we have developed a restructuring plan of the network and fleet that was put into implementation phase to be ended by FY 2020/2021. As part of this plan, 50% of the short term phase was completed by receiving the fifth Boeing 737-800 NG contracted last year on a purchase sale / lease back with Boeing and DAE with last one to be delivered by December 2017. This short term deal will leave our fleet with 69 A/C and our fleet planning team is implementing a 5 year plan that will drive the biggest A/C order in the company’s history of 45 A/C of different sizes to replace number of the current units and increase the fleet size to 84 A/C by 2021, This plan aims to reduce our unit cost benefiting from the fuel efficient new technology A/C and enhancing our product to deliver better service to our customers. -

Flight Safety Foundation Members Thanks for Your Support in 2009! They’Re Suppliers, Air Carriers, Maintenance Companies, Civil Aviation Authorities, Even Individuals

FOUNDATIONFOCUS Flight Safety Foundation Members Thanks for your support in 2009! They’re suppliers, air carriers, maintenance companies, civil aviation authorities, even individuals. But they all have one thing in common: Flight Safety Foundation membership. They’re on this member list* because they know the value of the work Flight Safety Foundation does. It gives them a safety advantage, and contributes to safety for the whole aviation industry. If your organization’s name doesn’t appear here, please consider what you’re missing. If you’d like to join these distinguished members, contact Ann Hill, <[email protected]>, +1 703.739.6700, ext. 105. Benefactor FlightWorks Aeroméxico Air Jamaica Express AirNet Systems Airbus Americas IBM Flight Operations Aéroports de Montréal Air Japan Airports Council International Airservices Australia Kingfisher Airlines Aeropuertos Españoles, Aena The Air League–United Kingdom Airservices Australia Australia Civil Aviation Safety Kraft Foods Global Aerosafe Risk Management Air Line Pilots Association, AirTran Airways Authority The Limited AeroSvit Airlines International Airways International BAE Systems (Operations) Mediterranean Aviation Company AFLAC Air Macau Alaska Airlines BHP Billiton The MITRE Corp. Afriqiyah Airways Air Madagascar Farid M. Albakri Boeing Commercial Airplanes National Air Transportation Association Nuno Aghdassi Air Malawi Alcoa Delta Air Lines Procter & Gamble Agenzia Nazionale per la Sicurezza Air Malta Alitalia-Compagnia Aerea Italiana GE Aviation Shell Oil Company del Volo Air Mauritius David Allan Air Moldova Gulfstream Aerospace Swiss International Air Lines AGRO Industrial Management All Nippon Airways AIG Aviation Air Namibia Honeywell TUI Airlines (Arkefly, Corsairfly, Allied Pilots Association Hapagfly, Jetairfly,T homsonfly,TUI Air Accidents Investigation Branch, UK Air Nelson Rio Tinto Alticor Airline Management) Air Algérie Air New Zealand SNECMA American Airlines U.K. -

Group ROW by State of Administration

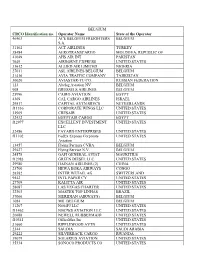

BELGIUM CRCO Identification no. Operator Name State of the Operator 46463 ACE BELGIUM FREIGHTERS BELGIUM S.A. 31102 ACT AIRLINES TURKEY 38484 AEROTRANSCARGO MOLDOVA, REPUBLIC OF 41049 AHS AIR INT PAKISTAN 7649 AIRBORNE EXPRESS UNITED STATES 33612 ALLIED AIR LIMITED NIGERIA 27011 ASL AIRLINES BELGIUM BELGIUM 31416 AVIA TRAFFIC COMPANY TAJIKISTAN 30020 AVIASTAR-TU CO. RUSSIAN FEDERATION 123 Abelag Aviation NV BELGIUM 908 BRUSSELS AIRLINES BELGIUM 25996 CAIRO AVIATION EGYPT 4369 CAL CARGO AIRLINES ISRAEL 29517 CAPITAL AVTN SRVCS NETHERLANDS f11336 CORPORATE WINGS LLC UNITED STATES 32909 CRESAIR UNITED STATES 32432 EGYPTAIR CARGO EGYPT f12977 EXCELLENT INVESTMENT UNITED STATES LLC 32486 FAYARD ENTERPRISES UNITED STATES f11102 FedEx Express Corporate UNITED STATES Aviation 13457 Flying Partners CVBA BELGIUM 29427 Flying Service N.V. BELGIUM 24578 GAFI GENERAL AVIAT MAURITIUS f12983 GREEN DIESEL LLC UNITED STATES 29980 HAINAN AIRLINES (2) CHINA 23700 HEWA BORA AIRWAYS CONGO 28582 INTER WETAIL AG SWITZERLAND 9542 INTL PAPER CY UNITED STATES 27709 KALITTA AIR UNITED STATES 28087 LAS VEGAS CHARTER UNITED STATES 32303 MASTER TOP LINHAS BRAZIL 37066 MERIDIAN (AIRWAYS) BELGIUM 1084 MIL BELGIUM BELGIUM 31207 N604FJ LLC UNITED STATES f11462 N907WS AVIATION LLC UNITED STATES 26688 NEWELL RUBBERMAID UNITED STATES f10341 OfficeMax Inc UNITED STATES 31660 RIPPLEWOOD AVTN UNITED STATES 2344 SAUDIA SAUDI ARABIA 29222 SILVERBACK CARGO RWANDA 39079 SOLARIUS AVIATION UNITED STATES 35334 SONOCO PRODUCTS CO UNITED STATES BELGIUM 26784 SOUTHERN AIR UNITED STATES 38995 STANLEY BLACK&DECKER UNITED STATES 27769 Sea Air BELGIUM 34920 TRIDENT AVIATION SVC UNITED STATES 30011 TUI AIRLINES - JAF BELGIUM 27911 ULTIMATE ACFT SERVIC UNITED STATES 13603 VF CORP UNITED STATES 36269 VF INTERNATIONAL SWITZERLAND 37064 VIPER CLASSICS LTD UNITED KINGDOM f11467 WILSON & ASSOCIATES OF UNITED STATES DELAWARE LLC 37549 YILTAS GROUP TURKEY BULGARIA CRCO Identification no. -

Voluntary Activity for Ghg Reduction/Mitigation in the Aviation Sector

ATTACHMENT to State letter AN 1/17-09/093 QUESTIONNAIRE CONCERNING VOLUNTARY ACTIVITY FOR GHG REDUCTION/MITIGATION IN THE AVIATION SECTOR A copy of the questionnaire, in Microsoft Word format, has been posted on the Internet at http://www.icao.int/icao/en/env/measures.htm. Name: Mahmoud Fathi Zaky Organization: EgyptAir Phone: (+202)26963874 Facsimile: (+202)26963854 E-mail: [email protected] / [email protected] Q1. Name of the voluntary activity. EgyptAir Fuel Conservation Committee – Establish Fuel and Emission Directorate Q2. Type1 of the voluntary activity. ; Unilateral commitment □ Public voluntary scheme □ Negotiated agreement □ Other (Please describe the activity in the box below.) Q3. Please mark all the participants2 of the activity. ;Airline □ Airline association □ Manufacturer □ Manufacturer association □ Airport authority □ Air traffic control □ Government □ Other (Please specify in the box below.) Q4. Is the voluntary activity accompanied by a side agreement3? ; Yes (Proceed to Q4-1.) □ No (Proceed to Q5.) 1The features of each type of voluntary activity are as follows. • Unilateral Commitment: The environmental improvement plan established by the participant itself, and declared to the stakeholders, such as employees, stockholders, consumers, etc. Target and measures to environmental improvement are established by the participant itself. • Public Voluntary Scheme: The scheme which the participant agrees voluntarily with the standard on environmental improvement target, technology, management, etc. established by public organization such as Ministry for Environment. • Negotiated Agreement: Contract based on negotiation between public organization (national government/local government) and industries. Both parties can independently decide whether to agree to the contract. 2 If you marked “Public voluntary scheme” on Q2, the public organization which establishes the standard is included in the participants.