B COMMISSION REGULATION (EC) No 748/2009 of 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

CORSIA Aeroplane Operator to State Attributions

CORSIA Aeroplane Operator to State Attributions This is a preliminary version of the ICAO document “CORSIA Aeroplane Operator to State Attributions” that has been prepared to support the timely implementation of CORSIA from 1 January 2019. It contains aeroplane operators with international flights, and to which State they are attributed, based on information reported by States by 30 November 2018 in accordance with the Environmental Technical Manual (Doc 9501), Volume IV – Procedures for Demonstrating Compliance with the CORSIA, Chapter 3, Table 3-1. Terms used in the tables on the following pages are: • Aeroplane Operator Name is the full name of the aeroplane operator as reported by the State; • Attribution Method is one of three options as selected by the State: "ICAO Designator", "Air Operator Certificate" or "Place of Juridical Registration" in accordance with Annex 16 – Environmental Protection, Volume IV – Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), Part II, Chapter 1, 1.2.4; and • Identifier is associated with each Attribution Method as reported by the State: o If the Attribution Method is "ICAO Designator", the Identifier is the aeroplane operator's three-letter designator according to ICAO Doc 8585; o If the Attribution Method is "Air Operator Certificate", the Identifier is the number of the AOC (or equivalent) of the aeroplane operator; o If the Attribution Method is "Place of Juridical Registration", the Identifier is the name of the State where the aeroplane operator is registered as juridical person. Disclaimer: The designations employed and the presentation of the material presented herein do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. -

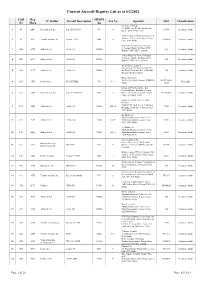

To Access the List of Registered Aircraft As on 2Nd August

Current Aircraft Registry List as at 8/2/2021 CofR Reg MTOM TC Holder Aircraft Description Pax No Operator MSN Classification No Mark /kg Cherokee 160 Ltd. 24, Id-Dwejra, De La Cruz Avenue, 1 41 ABW Piper Aircraft Inc. Piper PA-28-160 998 4 28-586 Aeroplane (land) Qormi QRM 2456, Malta Malta School of Flying Company Ltd. Aurora, 18, Triq Santa Marija, Luqa, 2 62 ACL Textron Aviation Inc. Cessna 172M 1043 4 17260955 Aeroplane (land) LQA 1643, Malta Airbus Financial Services Limited 6, George's Dock, 5th Floor, IFSC, 3 1584 ACX Airbus S.A.S. A340-313 275000 544 Aeroplane (land) Dublin 1, D01 K5C7,, Ireland Airbus Financial Services Limited 6, George's Dock, 5th Floor, IFSC, 4 1583 ACY Airbus S.A.S. A340-313 275000 582 Aeroplane (land) Dublin 1, D01 K5C7,, Ireland Air X Charter Limited SmartCity Malta, Building SCM 01, 5 1589 ACZ Airbus S.A.S. A340-313 275000 4th Floor, Units 401 403, SCM 1001, 590 Aeroplane (land) Ricasoli, Kalkara, Malta Nazzareno Psaila 40, Triq Is-Sejjieh, Naxxar, NXR1930, 001-PFA262- 6 105 ADX Reno Psaila RP-KESTREL 703 1+1 Microlight Malta 12665 European Pilot Academy Ltd. Falcon Alliance Building, Security 7 107 AEB Piper Aircraft Inc. Piper PA-34-200T 1999 6 Gate 1, Malta International Airport, 34-7870066 Aeroplane (land) Luqa LQA 4000, Malta Malta Air Travel Ltd. dba 'Malta MedAir' Camilleri Preziosi, Level 3, Valletta 8 134 AEO Airbus S.A.S. A320-214 75500 168+10 2768 Aeroplane (land) Building, South Street, Valletta VLT 1103, Malta Air Malta p.l.c. -

List of Attendees

AIRCRAFT FINANCE AND LEASE RUSSIA & CIS 8th international conference 14 April 2016, Moscow Metropol Hotel List of Attendees Company Name Position Sales & Marketing Manager, Russia & A J Walter Aviation Natasha Meerman CIS AerCap David Beker Vice President Aergo Capital Gerry Power Chief Commercial Officer Aergo Capital Martin Browne Marketing Manager Aerocredo Anton Kuznetsov Commercial Director Head of Analytical Group of Department of Planning and Fleet Aeroflot - Russian Airlines Yuri Alimbek Development Aeroflot - Russian Airlines Evgeniy Artemov Chief Expert Aeroflot - Russian Airlines Diana Balakina Chief Expert Fleet Management Group Aeroflot - Russian Airlines Evgenia Burlakova Chief Expert of Analytical Group Chief Specialist Fleet Management Aeroflot - Russian Airlines Natalia Evdokimova Group Aeroflot - Russian Airlines Evgeniy Kozhukhar Chief Expert Fleet Management Group Aeroflot - Russian Airlines Sergey Korolev Lead Expert Leading Expert Fleet Management Aeroflot - Russian Airlines Aleksey Kukolev Group Head of Fleet Management Group Aeroflot - Russian Airlines Evgeny Kurochkin Continuing Airworthiness Department Aeroflot - Russian Airlines Elena Ozimova General Expert Deputy Director Planning and Aeroflot - Russian Airlines Aleksey Siluanov Development of the Aircraft Fleet Aeroflot - Russian Airlines Yuliya Smirnova Lead Expert Aeroflot - Russian Airlines Irina Solokhina Leading Expert of Analytical Group Aeroflot - Russian Airlines Veronica Tyurina Chief Expert Head of Aircraft Fleet Management Aeroflot - Russian Airlines -

Aviation Report Mar 2020

AVIATION REPORT MAR 2020 Prepared by Business Centre British Business Group Vietnam December, 2019 BBGV HCMC Office BBGV Hanoi Office 25 Le Duan, Ben Nghe Ward, 4th Flr, Belvedere Building, 28A District 1, Ho Chi Minh City Tran Hung Dao,Hoan Kiem, Hanoi T: +84 28 3829 8430 (Ext. 122) T: +84 24 3633 0244 E: [email protected] E: [email protected] OUR TEAM CUSTOMER RELATIONS ASSISTANT TRADE SERVICES ASSISTANT Nhi Nguyen Tuan Thieu HEAD OF BUSINESS SERVICES An Doan BUSINESS SERVICES MANAGER Truc Doan LEGAL & FINANCE LEAD Minh Pham EXECUTIVE DIRECTOR Peter Rimmer what we do ? The British Business Group Vietnam (BBGV) was officially established in Ho Chi Minh in 1998 with its Ha Noi branch founded in 2007. BBGV aims to support and develop Vietnam-UK business links while raising the profile of Vietnam in the British business community and vice versa. As an accredited British Chamber, BBGV in association with the Department for International Trade (DIT), is committed to promote strong business links between Vietnam and the UK. BUSINESS MATCHING: BUSINESS DEVELOPMENT REPRESENTATIVE: Partner search and one-to-one Provide a professional business meetings with potential clients, development representative to act locally agents/distributors or outsourcing on your behalf, strengthen existing partners engagements with the Vietnam market on a long term basis and develop further business relationships within the market. BUSINESS REGISTRATION: BUSINESS SERVICES EVENTS: Offer step-by-step support to Organise trade missions, product launches setting up -

COVID-19) on Civil Aviation: Economic Impact Analysis

Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis Montréal, Canada 11 March 2020 Contents • Introduction and Background • Scenario Analysis: Mainland China • Scenario Analysis: Hong Kong SAR of China and Macao SAR of China • Summary of Scenario Analysis and Additional Estimates: China • Scenario Analysis: Republic of Korea • Scenario Analysis: Italy • Scenario Analysis: Iran (Islamic Republic of) • Preliminary Analysis: Japan and Singapore 2 Estimated impact on 4 States with the highest number of confirmed cases* Estimated impact of COVID-19 outbreak on scheduled international passenger traffic during 1Q 2020 compared to originally-planned: • China (including Hong Kong/Macao SARs): 42 to 43% seat capacity reduction, 24.8 to 28.1 million passenger reduction, USD 6.0 to 6.9 billion loss of gross operating revenues of airlines • Republic of Korea: 27% seat capacity reduction, 6.1 to 6.6 million passenger reduction, USD 1.3 to 1.4 billion loss of gross operating revenues of airlines • Italy: 19% seat capacity reduction, 4.8 to 5.4 million passenger reduction, USD 0.6 to 0.7 billion loss of gross operating revenues of airlines • Iran (Islamic Republic of): 25% seat capacity reduction, 580,000 to 630,000 passenger reduction, USD 92 to 100 million loss of gross operating revenues of airlines * Coronavirus Disease 2019 (COVID-19) Situation Report by WHO 3 Global capacity share of 4 States dropped from 23% in January to 9% in March 2020 • Number of seats offer by airlines for scheduled international passenger traffic; -

Air Transport in Russia and Its Impact on the Economy

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Tomsk State University Repository Вестник Томского государственного университета. Экономика. 2019. № 48 МИРОВАЯ ЭКОНОМИКА UDC 330.5, 338.4 DOI: 10.17223/19988648/48/20 V.S. Chsherbakov, O.A. Gerasimov AIR TRANSPORT IN RUSSIA AND ITS IMPACT ON THE ECONOMY The study aims to collect and analyse statistics of Russian air transport, show the in- fluence of air transport on the national economy over the period from 2007 to 2016, compare the sector’s role in Russia with the one in other countries. The study reveals the significance of air transport for Russian economy by comparing airlines’ and air- ports’ monetary output to the gross domestic product. On the basis of the research, the policies in the aviation sector can be adjusted by government authorities. Ключевые слова: Russia, aviation, GDP, economic impact, air transport, statistics. Introduction According to Air Transport Action Group, the air transport industry supports 62.7 million jobs globally and aviation’s total global economic impact is $2.7 trillion (approximately 3.5% of the Gross World Product) [1]. Aviation transported 4 billion passengers in 2017, which is more than a half of world population, according to the International Civil Aviation Organization [2]. It makes the industry one of the most important ones in the world. It has a consid- erable effect on national economies by providing a huge number of employment opportunities both directly and indirectly in such spheres as tourism, retail, manufacturing, agriculture, and so on. Air transport is a driving force behind economic connection between different regions because it may entail economic, political, and social effects. -

It-Tlettax-Il Leġiżlatura Pl 1928

IT-TLETTAX-IL LEĠIŻLATURA P.L. 1928 Dokument imqiegħed fuq il-Mejda tal-Kamra tad-Deputati fis-Seduta Numru 135 tal-25 ta’ Ġunju 2018 mill-Ministru għat-Trasport, Infrastruttura u Proġetti Kapitali. ___________________________ Raymond Scicluna Skrivan tal-Kamra TRANSPORT MALTA Annual Report 2017 transport.gov.mt TABLE OF CONTENTS EXECUTIVE SUMMARY 2 MEMBERS OF THE BOARD OF TRANSPORT MALTA 4 MISSION STATEMENT 5 MAIN OBJECTIVES AND POLICIES 6 INTEGRATED TRANSPORT STRATEGY DIRECTORATE 7 PORTS AND YACHTING DIRECTORATE 10 MERCHANT SHIPPING DIRECTORATE 26 ROADS AND INFRASTRUCTURE DIRECTORATE 37 LAND TRANSPORT DIRECTORATE 45 CIVIL AVIATION DIRECTORATE 60 CORPORATE SERVICES DIRECTORATE 76 ENFORCEMENT DIRECTORATE 86 INFORMATION & COMMUNICATION TECHNOLOGY DIRECTORATE 100 TRANSPORT MALTA | Annual Report 2017 | 1 EXECUTIVE SUMMARY This report covers the activities of the Authority for Transport in Malta for the year ending 31st December 2017. This was the eighth year of operation for the Authority, which was set up on the 1st of January 2010 following the enactment of the Authority for Transport in Malta Act (Act XV) of 2009. The major accomplishments of the operations of Transport Malta (TM) can be summarised as follows: Merchant Shipping As at end December 2017, the number of ships registered under the Merchant Shipping Act was 8,123 with a total gross tonnage of 75.2 million. This represents a healthy growth rate of 8% over the previous year, with Malta maintaining its position as the largest register in Europe and one of the 10 largest registers in the world in terms of gross tonnage. The Directorate has also further strengthened its presence in the super yacht sector. -

Autoritatea Aeronautică Civilă Română ______PART-MG Evaluare Ediţie Nr

Autoritatea Aeronautică Civilă Română _____________________________________________________________________________________________________________________________________________________________________________________________ PART-MG Evaluare Ediţie Nr. Organizaţia Adresa Telefon / Fax Tipul aeronavei navigabilitate Autorizaţia iniţială/revizie No. Organisation Adress Phone / Fax Aircraft type Airworthiness Authorisation Issue review initial/revision 1 2 3 4 5 6 7 8 COMPANIA Calea Bucureştilor Tel A318/ 319/ 320/ 321 (CFM 56) DA/YES NAŢIONALĂ DE Nr. 224 F (021) 201 3370 B737- 300/400/500 (CFM 56) DA/YES Revizia 5 1 TRANSPORTURI Oraş Otopeni RO.MG.001 Fax B737- 600/700/800/900 (CFM56 DA/YES 26.11.2007/08.04.2019 AERIENE ROMÂNE Judeţul Ilfov (021) 201 4989 ATR 42/72 (PWc 120) DA/YES TAROM S.A. ROMÂNIA Tel Ion Ionescu de la Brad nr 15 DA/YES Revizia 11 CARPATAIR (0256) 277905 FOKKER 70/100 2 Timisoara. Jud. Timis NU/NO RO.MG.003 26.11.2007/10.10.2019 S.A. Fax Embraer ERJ-190 ROMÂNIA (0256) 306 962 Şos. Cristianului Tel DA/YES COBREX TRANS nr. 26, cod 2200 (0268) 472 537 SA 365N1 Revizia 9 3 DA/YES RO.MG.004 S.R.L. Braşov Fax B737- 300/400/500 (CFM 56) 24.12.2007/20.08.2019 ROMÂNIA (0268) 476 147 Gulfstream G200 DA/YES Calea Bucureştilor Tel AGUSTA AW139 DA/YES ION ŢIRIAC AIR nr. 224G, oraş Otopeni (021350 50 41 Revizia 11 4 A109E (PW 206/207) DA/YES RO.MG.005 S.A. Judeţul Ilfov Fax 26.02.2008/ 13.02.2019 GLOBAL 5000 DA/YES ROMÂNIA (021) 204 22 24 EMBRAER EMB 505 DA/YES Şos. Bucureşti-Ploieşti Tel A.A.C.R. -

GROWTH Worldreginfo - 47Dc746a-9F11-4E19-95B7-A05ce8c15228 2017 At

ANNUAL REPORT AND ACCOUNTS 2017 PURPOSEFUL AND DISCIPLINED Annual report and accounts 2017 and accounts Annual report GROWTH WorldReginfo - 47dc746a-9f11-4e19-95b7-a05ce8c15228 2017 at 2017 has been a year of purposeful and disciplined growth to develop our market positions at slot-constrained airports. We have grown our share in a number of key airports, with our fleet up-gauging process also allowing us to add capacity where our competitors cannot. Our sustained focus on cost control and lean initiatives is supported by our fleet development and increased use of digital to improve our customers’ experience. We moved quickly in response to the UK’s referendum vote to leave the European Union by establishing a new airline, easyJet Europe, in Austria. easyJet Europe is now operational and will enable easyJet to continue to operate flights both across and domestically within all European countries after the UK has left the EU, regardless of the outcome of talks on a future UK-EU aviation agreement. We continue investing in innovation, which has already revolutionised our customer offer and we expect to continue to harness technology to deliver cost and reliability benefits as well as exciting improvements in customer experiences that will keep easyJet a structural winner at the forefront of the aviation industry. easyJet’s customer proposition continues its positive development and, backed by a strong balance sheet, will deliver long-term shareholder value. WorldReginfo - 47dc746a-9f11-4e19-95b7-a05ce8c15228 STRATEGIC REPORT Investment -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc.