ETF Monthly Asia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Universidade Federal Do Rio Grande Do Sul Escola De Administração Especialização Em Mercado De Capitais

UNIVERSIDADE FEDERAL DO RIO GRANDE DO SUL ESCOLA DE ADMINISTRAÇÃO ESPECIALIZAÇÃO EM MERCADO DE CAPITAIS DIVERSIFICAÇÃO INTERNACIONAL DE PORTFÓLIOS DANIELA NASCIMENTO Orientador: Prof. Valter Bianchi Filho PORTO ALEGRE 2010 DANIELA NASCIMENTO DIVERSIFICAÇÃO INTERNACIONAL DE PORTFÓLIOS Monografia apresentada ao Programa de Pós-Graduação da Escola de Administração da Universidade Federal do Rio Grande do Sul, como requisito para a obtenção do título de Especialista em Mercado de Capitais sob a orientação do Prof. Valter Bianchi Filho. PORTO ALEGRE 2010 DIVERSIFICAÇÃO INTERNACIONAL DE PORTFÓLIOS DANIELA NASCIMENTO Aprovada em ____ / ____ / ____. BANCA EXAMINADORA _______________________________________________ Nome Completo _______________________________________________ Nome Completo _______________________________________________ Nome Completo CONCEITO FINAL: _________________ AGRADECIMENTOS Agradeço meus queridos pais por serem responsáveis pela minha educação e pelo apoio e amor que recebo em todos os momentos importantes da minha vida. Meu sincero agradecimento ao orientador, Professor Valter Bianchi Filho, pela generosidade e apoio, e por tudo que aprendi nesse trabalho e em sala de aula. E a todos meus professores pela dedicação ao ensino e, em especial, a esse curso de Especialização em Mercado de Capitais. RESUMO Este trabalho estuda os benefícios da diversificação internacional de portfólios, em especial, a boa relação entre risco e retorno. Inicialmente, foi apresentada a evolução do sistema monetário internacional, a qual mostra um aumento no fluxo financeiro entre os países, a exposição das economias, decorrentes das oscilações das taxas de câmbio, e o desenvolvimento dos mercados acionários. Em seguida, para caracterizar o mercado de capitais no âmbito internacional, as três últimas grandes ―Eras‖ são apresentadas de forma clara, justificando o comportamento dos mercados nos dias de hoje e evidenciando os problemas de risco que existem nesses mercados. -

United SSE 50 China ETF

August 2020 United SSE 50 China ETF Investment Objective Fund Information The investment objective of the Fund is to provide investment results that, before Fund Size fees, costs and expenses (including any taxes and withholding taxes), closely SGD 26.45 mil correspond to the performance of the SSE 50 Index. Base Currency Fund Performance Since Inception in Base Currency SGD United SSE 50 China ETF Benchmark Fund Ratings 180 140 100 as of 31 July 2020 60 Contact Details UOB Asset Management Ltd 20 11/09 06/11 01/13 08/14 03/16 10/17 05/19 80 Raffles Place #03-00 UOB Plaza 2 Fund performance is calculated on a NAV to NAV basis. Singapore 048624 Benchmark: SSE 50 Index Hotline 1800 22 22 228(8am to 8pm Cumulative Performance Annualised Performance daily, Singapore time) (%) (%) Performance Email 1M 3M 6M 1Y 3Y 5Y 10Y Since Incept [email protected] Website Fund NAV to NAV 11.54 14.40 12.68 11.16 4.74 0.95 3.33 0.68 uobam.com.sg Benchmark 11.09 14.30 13.06 13.20 9.26 6.17 7.69 4.83 Source: Morningstar. Performance as at 31 July 2020, SGD basis, with dividends and distributions reinvested, if any. Performance figures for 1 month till 1 year show the % change, while performance figures above 1 year show the average annual compounded returns. August 2020 United SSE 50 China ETF Portfolio Characteristics Sector Allocation(%) Country Allocation(%) Financials 46.17 China 99.68 Consumer Staples 16.81 Cash 0.32 Health care 8.47 Information Technology 6.51 Industrials 6.19 Consumer Discretionary 5.45 Materials 5.30 Energy 2.30 Others 2.48 Cash 0.32 Top 10 Holdings(%) KWEICHOW MOUTAI CO LTD 13.36 INNER MONGOLIA YILI INDUSTRIAL 3.45 PING AN INSURANCE GROUP CO OF 12.88 CHINA TOURISM GROUP DUTY FREE 3.40 CHINA MERCHANTS BANK CO LTD 5.57 INDUSTRIAL BANK CO LTD 3.04 JIANGSU HENGRUI MEDICINE CO LT 5.57 INDUSTRIAL & COMMERCIAL BANK O 2.72 CITIC SECURITIES CO LTD 3.95 LONGI GREEN ENERGY TECHNOLOGY 2.34 Share Class Details Bloomberg Subscription Share Class NAV Price Ticker ISIN Code Inception Date mode – SGD 2.630 USSE50 SP SG1Y89950071 Nov 09 Cash Min. -

Are Tightened Trading Rules Always Bad? Evidence from the Chinese Index Futures Market

Are Tightened Trading Rules Always Bad? Evidence from the Chinese Index Futures Market Hai Lin Victoria University of Wellington You Wang Xiamen University ∗ Friday 20th January, 2017 ∗Correspondence: Hai Lin, School of Economics and Finance, Victoria University of Wellington, Wellington 6140, New Zealand. Phone: (+64)- 4- 463- 5239 and email: [email protected]. You Wang, Department of Finance, School of Economics, Xiamen University, Xiamen 361005, China. We thank Toby Daglish and seminar participants at Victoria University of Wellington and Fifth International Conference on Futures and Other Derivatives for very helpful comments. Wang acknowledges the support from China Scholarship Council. Abstract This paper investigates the impact of tightened trading rules on the market efficiency and the price discovery function of Chinese stock index futures in 2015. In contrast with severe criticism of these changes, we fail to find empirical evidence that market efficiency and price discovery de- teriorated after these rule changes. Using variance ratio and spectral shape tests, we find that the Chinese index futures market became even more efficient after the tightened rules came into effect. Furthermore, by employing Schwarz and Szakmary (1994) and Hasbrouck (1995) price discovery measures, we find that the price discovery function, to some extent, became better. This is consis- tent with Stein (2009), who finds that regulations on leverage can be helpful in a bad market state, and Zhu (2014), who finds that price discovery can be improved with reduced liquidity. It also sug- gests that the new rules may effectively regulate the manipulation behaviour of the Chinese stock index futures market, and then positively affect its market efficiency and price discovery function. -

Glossary of Technical Terms

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. GLOSSARY OF TECHNICAL TERMS This glossary of technical terms contains explanations of certain technical terms used in this document. As such, these terms and their meanings may not correspond to standard industry meanings or usage of these terms. “14th Five-Year Plan” a series of social and economic development initiative drafted during the fifth plenum of the 19th Central Committee of the Communist Party of China in October 2020, covering the five-year period from 2021 to 2025 “AI” artificial intelligence “ASEAN” the Association of Southeast Asian Nations “Belt and Road Initiative” a global infrastructure development strategy adopted by the Chinese government in 2013 to invest in nearly 70 countries and international organizations “CAGR” compound annual growth rate “CRM” Customer Relationship Management “CSI 300 Index” a capitalization-weighted stock market index designed to replicate the performance of 300 stocks traded on the Shanghai Stock Exchange and Shenzhen Stock Exchange, which is compiled by the China Securities Index Co., Ltd. (中證指數有限公司) “CSI 500 Index” a capitalization-weighted stock market index compiled by the China Securities Index Co., Ltd. (中證指數有限公 司) and designed to replicate the performance of 500 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange “ETFs” exchange-traded funds “FICC” fixed-income, currencies and commodities “Generation Y” people who are born from 1980 to 1995 “Generation Z” people who are born from 1995 to 2010 “Guangdong-Hong Kong-Macau a megalopolis, consisting of nine cities and two special Greater Bay Area” administrative regions in South China, under a cooperative development framework signed in 2017 [REDACTED] “M&A” mergers and acquisitions –23– THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. -

China 50 ETF Monthly Report July 2006

China 50 ETF Monthly Report July 2006 Long-term Strategic Investment in China’s Strongest Shares: Transparent Access to China’s Growth Fund Summary The China 50 ETF was launched by China Asset Management (ChinaAMC) in cooperation with the Shanghai Stock Exchange, on November 29th 2004 and is the first ETF in Mainland China. It fully replicates the SSE 50 Index, whose constituents are the leading blue chip stocks that can best represent the Shanghai securities market. Investing in the China 50 ETF, investors gain the same return/risk characteristics as that of the SSE 50 Index. The China 50 ETF is a milestone innovation in China’s capital market and enables investors to capture the strongest elements of China’s growing economy. Fund Objective Fund Overview The China 50 ETF is an index exchange-traded fund that closely Type Index Exchange Traded Fund tracks the SSE 50 Index, minimizing tracking error. The Fund invests mainly in SSE 50 constituent and proxy stocks. Small Underlying Index SSE 50 Index quantities of other stocks and bonds may be purchased to enhance Manager ChinaAMC return with the objective of offsetting expenses of the fund. Through its basket of equities, the fund enables investors to gain Technical Advisor State Street Global Advisors exposure to China’s strongest shares, while benefiting from the Bloomberg Code 510050 CH flexibility of the secondary market where units are traded like ordinary stocks. ISIN Code CN000A0D83B1 Historical Performance Tracking Methodology Full Replication Since China 50 Dividend Payout Method When accumulated returns 1-month 3-month ETF Establishing exceed 1% of the same (12/30/2004) period’s index returns China 50 ETF -7.14% 8.90% 27.78% In-Kind Creation or 1,000,000 or whole multiples NAV Redemption Units thereof China 50 ETF -7.39% 8.47% N.A. -

February Update ETF Bi-Weekly Capital-Market Liquidity to Spur Gold/Silver Etfs On

February 3, 2012 ETF RESEARCH February update ETF Bi-weekly Capital-market liquidity to spur gold/silver ETFs on Asia-Pacific stock markets put in solid performances in January, rising a notable 3.1% in Indonesia and 10.6% in Hong Kong. US dollar-denominated returns were even higher thanks to the weakness of the greenback against Asian currencies—for example, the Kospi returned 7.1% for the month in won terms, while its USD-denominated return reached 10.7%. Amid rising expectations of an approaching resolution to the eurozone crisis, investors worldwide showed a growing preference for risky assets, which drove the technical market rebounds. Alongside stock markets, the commodity market also bounced back, led by strong demand for non-ferrous metals and agricultural products. Asia-Pacific ETF markets enjoyed a net inflow of USD7.5b in January, with USD3.7b flowing in during the first half of the month and USD3.8b during the second. ETFs listed on the Hong Kong Stock Exchange saw the largest net inflow of funds (USD2.6b), followed by Osaka (USD1.3b), Tokyo (USD0.9b), Korea (USD0.47b), and Taiwan (USD0.33b). We believe the increased global appetite for riskier assets in Analysts January sparked asset relocation back into ETFs and other index plays. Gyun Jun [email protected] Eight ETFs were newly listed on Asia Pacific markets in January—five in Korea, two in 822 2020 7044 Hong Kong, and one in Australia. As both new listings in Hong Kong were made by Korean ITCs, almost all of the new ETFs were related to Korea. -

China SME ETF

China SME ETF May 2006 [Abstract] The national economy and capital market in China will witness a rapid growth over the long run while SMEs (Small and Medium Enterprises) will be at the forefront of it. Given the fast revenue growth, strong profitability and lower level of valuation of the SME Board, one more good choice to allocate assets and increase income has thus been created for investors. With the asset allocation via indexing investment, it is possible for investors to diversify the risks in individual stocks of the SMEs as well as sharing fully the benefits from the market rise. The SME Index that is highly representative and investable with good liquidity will be an excellent indicator for indexing investment. In addition, the China SME ETF will be a highly efficient investment tool for investors to make asset allocations in on the SME Board. High Investment Value In terms of growth of the indices, the rise of the SME Board Index is much higher than the main board; in terms of the increase in revenue and profitability of enterprises, the growth of the SME Board is also obviously stronger than that of the main board and its profitability financial indicators are again stronger than the averages of A-share markets at both the Shanghai and Shenzhen Stock Exchanges. In addition to growth factors, the SME Board also possesses conspicuous valuation advantages; it is of relatively high investment value. Moreover, with its sharp-cut investment style, the SME Board is a good choice for asset allocations and the increase of income. -

Nomura Institute of Capital Markets Reseach | Reform of China's Split

Reform of China's Split-Share Structure Takes Shape Takeshi Inoue I. The Chinese Government Bites the Bullet In China listed companies can issue two classes of shares: those which are listed on an exchange and can be freely bought and sold by normal investors (tradable shares) and those which cannot (nontradable shares). The existence of nontradable shares, which account for more than 60% of all shares issued, has been the biggest impediment to the development of China's equity market and has caused the government a headache for many years. Following the publication in January 2004 of a blueprint for reforming the country's capital markets (the "State Nine Opinions"),1 the government has set about implementing its proposals in earnest. One of the most important is its proposals for solving the problem presented by the existence of nontradable shares. On 29 April 2005 the government set about dealing with the problem by means of a pilot program involving four medium-sized companies. This was followed, on 17 June 2005, with the announcement of a second phase, involving 42 companies (see Appendix 2). There have been several previous attempts to release these nontradable shares onto the market, but each has ended in failure as the stock market has reacted very negatively to the prospect of a huge increase in supply as well as to the offer price of the shares. Similarly, the stock market correction that began in 2001, when the market peaked, and has continued to this day was triggered by the government's announcement in June 2001 of its intention to release state-owned shares onto the market.2 The government has learnt some lessons from its past failure, and its latest program takes into account both trading conditions on the secondary market and the interests 1 State Council, "Some Opinions of the State Council on Reform, Opening and Steady Growth of Capital Markets," 31 January 2004. -

Fact Book 2013

Fact Book 2013 Contents Shanghai Securities Market.......................................................1 Historical Review .........................................................................................................................................1 Securities Products ......................................................................................................................................1 2012 Market Review....................................................................5 Overview ....................................................................................................................................................5 Securities Issuance and Listing ......................................................................................................................5 Major Events in the Securities Market 2012 ....................................................................................................6 Market Highlights .........................................................................................................................................9 Transactions ................................................................................................................................................9 Stock Indices .............................................................................................................................................10 Ratios .......................................................................................................................................................10 -

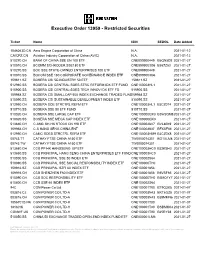

Executive Order 13959 - Restricted Securities

Executive Order 13959 - Restricted Securities Ticker Name ISIN SEDOL Date Added 1546063D.CN Aero Engine Corporation of China N.A. 2021-01-12 CAICPZ.CN Aviation Industry Corporation of China (AVIC) N.A. 2021-01-12 510270.CH BANK OF CHINA SSE EN 100 ETF CNE099900449 B6QN5D2 2021-01-27 510010.CH BCOMM SCHRODER SSE180 ETF CNE0999003G6 B557Z83 2021-01-27 510270.SS BOC SSE STATE-OWNED ENTERPRISES 100 ETF CNE099900449 2021-01-27 510010.SS BOCOM SSE 180 CORPORATE GOVERNANCE INDEX ETF CNE0999003G6 2021-01-27 159811.SZ BOSERA CSI 5G INDUSTRY 50 ETF 159811.SZ 2021-01-27 512960.SS BOSERA CSI CENTRAL-SOES STRC REFORM IDX ETF FUND CNE100003HL1 2021-01-27 515900.SS BOSERA CSI CENTRAL-SOES TECH INNOV IDX ETF FD 515900.SS 2021-01-27 159968.SZ BOSERA CSI SMALLCAP 500 INDEX EXCHANGE TRADED FUND159968.SZ 2021-01-27 515090.SS BOSERA CSI SUSTAINABLE DEVELOPMENT INDEX ETF 515090.SS 2021-01-27 512960.CH BOSERA SOE STRCTRL REFM ETF CNE100003HL1 BJCZ0T4 2021-01-27 510710.SS BOSERA SSE 50 ETF FUND 510710.SS 2021-01-27 510020.CH BOSERA SSE LARGE CAP ETF CNE100000QX3 B3W2QM82021-01-27 510020.SS BOSERA SSE MEGA CAP INDEX ETF CNE100000QX3 2021-01-27 513660.CH C-AMC SH-HK STOCK CN HSI ETF CNE1000028V7 BVL80K9 2021-01-27 159954.CH C-S HANG SENG CHINA ENT CNE100003837 BFXSF88 2021-01-27 512950.CH CAMC SOES STRCTRL REFM ETF CNE100003HM9 BJCZ0X8 2021-01-27 00743.TT CATHAY FTSE CHINA A150 ETF TW0000074301 BG1XLM8 2021-01-27 00743.TW CATHAY FTSE CHINA A150 ETF TW0000074301 2021-01-27 513680.CH CCB PP HK HANGSENG EP ETF CNE100003HC0 BJ2KSH3 2021-01-27 513680.SS CCB PRINCIPAL -

SSE 50 Index Consists of the 50 Largest and Most Liquid A-Share Stocks Listed on Shanghai SSE 50 Stock Exchange

31-August-2021 SSE 50 Index consists of the 50 largest and most liquid A-share stocks listed on Shanghai SSE 50 Stock Exchange. The Index aims to reflect the overall performance of the most influential leading Shanghai stocks. Name SSE 50 Index Ticker 000016 Launch 02-Jan-2004 Review Semiannually Constituents 50 RIC Ticker .SSE50 Base Date 31-Dec-2003 Base Point 1000 Currency CNY BBG Ticker SSE50 Performance 4500 4000 3500 3000 2500 2000 1500 2016 2017 2018 2019 2020 2021 Return 1M 3M YTD 1Y 3Y Annualized 5Y Annualized 2017 2018 2019 2020 -1.14% -15.15% -14.93% -7.38% 7.77% 6.76% 25.08% -19.83% 33.58% 18.85% Volatility Fundamental 1Y Annualized 19.25% P/E TTM 11.5 3Y Annualized 20.87% P/B 1.27 5Y Annualized 18.61% Yield 2.24% Market Cap (CNY Bn) Constituents Constituents Largest 1957.2 16158.6 Total Market Cap Constituents Smallest 65.1 Index Market Cap 7215.7 Constituents Average 323.2 31-August-2021 Exchange Breakdown Sector Breakdown 2.4% 2.6% 5.8% 6.2% Energy Materials Industrials 12.8% Consumer Disc. Shanghai 5.4% Consumer Staples 37.7% Health Care 20.0% Financials 100.0% 7.2% Information Tech. Telecom. Services Top 10 Constituents Ticker Name Sector Exchange Weight 600519 Kweichow Moutai Co Ltd Consumer Staples Shanghai 13.56% 600036 China Merchants Bank Co Ltd Financials Shanghai 8.40% 601318 Ping An Insurance (Group) Company of China Ltd Financials Shanghai 7.49% 601012 Longi Green Energy Technology Co., Ltd. Industrials Shanghai 5.37% 601166 Industrial Bank Financials Shanghai 3.73% 603259 WuXi AppTec Co., Ltd. -

United SSE 50 China ETF

UETF United SSE 50 China ETF Semi Annual Report for the half year ended 31 December 2019 UETF (Constituted under a Trust Deed in the Republic of Singapore) MANAGER UOB Asset Management Ltd Registered Address: 80 Raffles Place UOB Plaza Singapore 048624 Company Registration No. : 198600120Z Tel: 1800 22 22 228 DIRECTORS OF UOB ASSET MANAGEMENT Lee Wai Fai Eric Tham Kah Jin PehKianHeng Thio Boon Kiat TRUSTEE State Street Trust (SG) Limited 168 Robinson Road #33-01, Capital Tower Singapore 068912 CUSTODIAN / ADMINISTRATOR / REGISTRAR State Street Bank and Trust Company, acting through its Singapore Branch 168 Robinson Road #33-01, Capital Tower Singapore 068912 AUDITOR PricewaterhouseCoopers LLP 7 Straits View, Marina One East Tower, Level 12 Singapore 018936 -1- United SSE 50 China ETF (Constituted under a Trust Deed in the Republic of Singapore) A) Fund Performance Since Inception 12 November 3yr 5yr 10 yr 2009 3mth 6mth 1yr Ann Ann Ann Ann Fund Performance/ % % % Comp Comp Comp Comp Benchmark Returns Growth Growth Growth Ret Ret Ret Ret United SSE 50 China ETF 5.09 3.03 31.05 5.22 -1.12 -0.34 -0.13 Benchmark 5.34 3.81 33.53 10.53 4.14 3.86 4.09 Source: Morningstar. Note: The performance returns of the Fund are in Singapore Dollar based on a NAV-to-NAV basis with dividends and distributions reinvested, if any. The benchmark of the Fund: SSE 50 Index. For the six months ended 31 December 2019, the net asset value of the Fund increased 3.03% onanet asset value basis in Singapore Dollar terms, compared to the benchmark SSE 50 Index which increased 3.81% during the same period.