Peach Completes Integration with Vanilla Air ~ Delivering New Values and Becoming the Leading LCC in Asia ~

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BURSA ANNOUNCEMENT Airasia Japan Joint Venture Date: 21 St July 2011

BURSA ANNOUNCEMENT AirAsia Japan Joint Venture Date: 21 st July 2011 AirAsia Berhad (“AirAsia” or “the Company”) is pleased to announce that the Company will today be executing a Shareholders Agreement (“the Agreement”) with All Nippon Airways Co., Ltd (“ANA”) of Japan. The Agreement is formalised for the purpose of forging a joint venture cooperation between AirAsia and ANA to establish a low cost airline in Japan based on the successful AirAsia business model (“the Joint Venture”). The company to be incorporated in Japan for the Joint Venture is named AirAsia Japan Co., Ltd. (“AirAsia Japan”). 1) The rationale and prospects of the Joint Venture : The Low Cost Carrier (“LCC”) business model practiced by AirAsia enables the airline to offer affordable fares to passengers. The business model keeps operating costs low by encouraging travelers to make Internet bookings where its lowest fares are offered. Overall operating efficiency further enhances the affordability of the LCC model. The presence of AirAsia Japan is to serve the highly lucrative travel market in Japan. Air travel is deeply entrenched in the social and business life of the Japanese even under high cost environment. Both ANA and AirAsia firmly believe that AirAsia Japan will be a success as the Japanese market possesses the necessary ingredients for growth such as the population’s strong propensity to travel, its high per capita income coupled with deep and significant internet penetration. The AirAsia Brand is already accepted in the Japanese market and it has been further enhanced since AirAsia X Sdn Bhd had been flying to Japan from early this year. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

ANA and NCA Agree to a Strategic Business Partnership ~To Continue Contributing to Japan’S Economic Development ~

ANA and NCA Agree to a Strategic Business Partnership ~To continue contributing to Japan’s economic development ~ TOKYO, March 1, 2018 – All Nippon Airways (ANA) and Nippon Cargo Airlines (NCA) signed a Memorandum of Understanding (MOU) to enhance both, the service and the corporate value of the two airlines by building a strategic business partnership. The three key elements of this partnership which will give added value to ANA’s and NCA’s customers, and will provide them with seamless logistics experiences are: 1. Code Share Within the first half of the fiscal year 2018, ANA and NCA plan to add codeshares to each other’s flights(*). The codeshares will offer a broad network of flights and a wider range of choices to the partner’s customers, allowing seamless and convenient connections with outstanding Japan-quality service, and especially leveraging the synergy effect of ANA’s Boeing 767 operation to China and Asia, and NCA’s Boeing 747 freighter operation to North America and Europe. ANA’s plans to introduce Boeing 777 freighters will further increase the customer choice. 2. Block Space Through this partnership, the two airlines plan to expand the existing interline and block space agreement, with the aim to effectively utilize each other’s cargo space and provide a reliable and convenient connection service. 3. Maintenance Support Finally, the MOU includes a maintenance support agreement, by which ANA will allocate maintenance resources to support NCA’s operation. The agreement will enable active sharing of knowledge and enhancement of the technical abilities of both carriers. With this new partnership, ANA and NCA hope to provide their customers access to a large global freight network, highest quality of service, and convenient and flexible choices, responding to the growing demand. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

Announcement Regarding the Change of Representative Director and CEO

Press Release March 13,2020 Peach Aviation Limited Announcement Regarding the Change of Representative Director and CEO ・ Shinichi Inoue, who has been the Representative Director and CEO since the inception, will resign on March 31, and become the Member of the Board, Senior Executive Vice President of All Nippon Airways Co., Ltd. ・ Deputy CEO, Takeaki Mori, will become the new Representative Director and CEO from April 1 Osaka, March 13, 2020 - Peach Aviation Limited (“Peach”) announce the informal decision of the retirement of Representative Director and CEO, Shinichi Inoue, effective March 31, 2020. Deputy CEO, Takeaki Mori, will become the new Representative Director and CEO from April 1, 2020. *1. On March 1, 2012, just one year after its inception, Peach started its domestic service with three aircraft as the first LCC in Japan, and two months later, in May, started its international service. Since then, Peach has been promoting the value of LCC based on the idea of becoming the “Flying Train.” Its endeavor to create demand had led to the expansion of domestic and international services. March 1, 2020 marks the eighth anniversary of its first flight. Peach now operates 33 aircraft on 21 domestic and 18 international routes. Approximately 20,000 passengers fly Peach every day*2. Shinichi Inoue has been serving as the Representative Director and CEO of Peach since inception. “No one thought LCC would succeed in Japan. But, 35 million passengers have been on board in the last eight years since the company started. Now LCC has become a common method of transportation in Japan. -

Worldwide Direct Flights File

LCCs: On the verge of making it big in Japan? LCCs: On the verge of making it big in Japan? The announcement that AirAsia plans a return to the Japanese market in 2015 is symptomatic of the changes taking place in Japanese aviation. Low cost carriers (LCCs) have been growing rapidly, stealing market share from the full service carriers (FSCs), and some airports are creating terminals to handle this new type of traffic. After initial scepticism that the Japanese traveller would accept a low cost model in the air, can the same be said for low cost terminals? In this article we look at the evolution of LCCs in Japan and ask what the planners need to be considering now in order to accommodate tomorrow’s airlines. Looking back decades Japan was unusual in Asia in that it fostered competition between national carriers, allowing both ANA and Japan Airlines to create strong market positions. As elsewhere, though, competition is regulated and domestic carriers favoured. While low cost carriers (LCCs) have been given room to breathe in Japan their access to some of the major airports has been restricted, albeit by a lack of slot availability at airports such as Tokyo’s Haneda International Airport. The fostering of a truly competitive Japanese aviation market requires the opportunity for LCCs to thrive and that almost certainly means new airport infrastructure to deliver those much needed slots. State of play In comparison to the wider Asian region, LCCs in Japan are still some way from reaching comparable levels of market share. In October 2014, LCCs accounted for 26% of scheduled airline capacity within Asia; in Japan they have just reached a 17% share of domestic seats and have yet to gain a strong foothold in the international market, with just 9% of seats, or 7.5 million seats annually. -

What Role for Offsetting Aviation Greenhouse Gas Emissions in a Deep-Cut Carbon World?

Journal of Air Transport Management 63 (2017) 71e83 Contents lists available at ScienceDirect Journal of Air Transport Management journal homepage: www.elsevier.com/locate/jairtraman What role for offsetting aviation greenhouse gas emissions in a deep-cut carbon world? * Prof Susanne Becken a, , Prof Brendan Mackey b a Griffith Institute for Tourism, Griffith University, QLD 4222, Australia b Griffith Climate Change Response Program, Griffith University, QLD 4222, Australia article info abstract Article history: The long-term goal of containing average warming below the 2 C limit requires deep cuts in emissions Received 29 June 2016 from all sectors. The fast growing global aviation industry has committed to reduce carbon emissions. Received in revised form Carbon offsetting is an integral element of the sector's strategy. Already, airlines offer voluntary carbon 29 May 2017 offsetting to those customers who wish to mitigate the impact of their travel. To ensure carbon offsetting Accepted 29 May 2017 can make a meaningful and credible contribution, this paper first discusses the science behind ‘carbon Available online 7 June 2017 offsetting’, followed by the associated policy perspective. Then, against the context of different aviation emissions pathways, the paper provides empirical evidence of current airline practices in relation to Keywords: Carbon offset offsetting mechanisms and communication. Building on these insights, the challenges of reducing Emissions pathway aviation emissions and using carbon credits to compensate for ongoing growth are discussed. The paper Carbon budget concludes by proposing five principles of best practice for carbon offsetting that airlines can use as a basis Atmospheric carbon dioxide concentrations to develop credible emissions strategies, and that could inform the sectoral framework currently being Airlines developed by leading aviation organisations. -

An Economic Analysis of Low Cost Carriers and Insurance

Applied Economics and Finance Vol. 2, No. 4; November 2015 ISSN 2332-7294 E-ISSN 2332-7308 Published by Redfame Publishing URL: http://aef.redfame.com An Economic Analysis of Low Cost Carriers and Insurance Mahito Okura1 1Department of Social System Studies, Faculty of Contemporary Social Studies, Doshisha Women’s College of Liberal Arts, Kyoto, Japan. Correspondence: Mahito Okura, Department of Social System Studies, Faculty of Contemporary Social Studies, Doshisha Women’s College of Liberal Arts, Kodo, Kyotanabe, Kyoto, 610-0395, Japan. Received: July 17, 2015 Accepted: July 28, 2015 Available online: August 13, 2015 doi:10.11114/aef.v2i4.1029 URL: http://dx.doi.org/10.11114/aef.v2i4.1029 Abstract The purpose of this research is to analyze an airline market in which both low cost carriers (LCCs) and full service carriers (FSCs) coexist. LCCs propose cheaper air ticket prices, but the possibility of late arrival is higher than with FSCs. This research investigates the effect of the introduction of an insurance policy that covers the losses from late arrivals. In relation to this insurance, the following two questions are considered. The first is how the demand for LCC changes when the insurance is introduced. The second is how the introduction of this insurance influences the LCC’s investments to lower the possibility of late arrivals. The main results of this research are as follows. First, the introduction of late-arrival insurance increases the demand for LCC. Second, the impact of the introduction of this insurance becomes high when the possibility of late arrival is high and the insurance premium rate is low; however, the effect of the air ticket price of LCC is ambiguous. -

Arrival Gate of Domestic Airline

L EWA N E R From April 25, 2017 (Tuesday) The departure gates and the arrival gates of the domestic airline will be changed! Please be noted that the name of the departure gates on Floor 2 and the arrival gates on Floor 1 of the domestic airline will be changed since April 25 (Tuesday). Please also be noted that the departure gates (safety inspection area) and the arrival gates will be different subject to the airline company). Additionally, the name of the departure gates on Floor 2 (safety inspection area) is changed and some of them are relocated. Departure gates(safety inspection area)of domestic airline ANA ADO JAL Airline company in use All Nippon Airways Air Do Japan Airlines ANA All Nippon Airways JAL ADO Japan Airlines Air Do APJ SKY Peach Aviation Skymark Airlines *The departure gate B now in use will be closed since April 25. VNL FDA Vanilla Air Fuji Dream Airlines SJO C Spring Japan *New facility to be opened JJP Jetstar Airways Under construction D JAL (Old name:C) ANA ADO B FDA E (Old name:A) SKY (Old name:D) JJP A Under construction (Old name:N) F (Old name:E) Under construction Departure gate (safety inspection area) Airline company counter Arrival gate of domestic airline ANA Airline company in use All Nippon Airways ANA All Nippon Airways ADO Air Do JAL Japan Airlines JAL ADO APJ Japan Airlines Air Do Peach Aviation SKY APJ VNL Skymark Airlines Peach Aviation Vanilla Air FDA VNL SJO Fuji Dream Airlines Vanilla Air Spring Japan n JJP SJO constructio Jetstar Airways Spring Japan Under ANA group 3 (Old name:ANA) 4 APJ (Old name:JAL-A) VNL 2 SJO (Old name:ANA) 5 Under construction (Old name:JAL-B) 1 Arrival gate (Old name:N) Airline company counter. -

ANA HOLDINGS Financial Results for the Year Ended March 31, 2020

ANA HOLDINGS NEWS ANA HOLDINGS Financial Results for the Year Ended March 31, 2020 Impact of the outbreak and spread of the Coronavirus (COVID-19) and resulting government mandated travel restrictions globally led to flight schedule cancellations, reduced domestic and international passengers, less cargo volume and decreased financial performance from the previous fiscal year. TOKYO, April 28, 2020 – ANA HOLDINGS INC. (hereinafter “ANA HD”) today reports its financial results for fiscal year 2019 (April 2019 – March 2020). Overview The consolidated performance during the 2019 fiscal year includes operating revenue of 1,974.2 billion yen due to a dramatic decrease in revenue centered on the air transportation business. While ANA sought to reduce costs and combat the increase in expenses - such as the expansion of arrival/departure slots at airports in the Tokyo metropolitan area - the number of scheduled flights were significantly reduced to match the sudden decline in demand in the fourth quarter, which led to operating income of 60.8 billion yen and ordinary income of 59.3 billion yen. Although ANA reported compensation for delays in the receipt of aircraft and engine operational service issues, extraordinary gains/losses for net income attributable to owners of the parent was 27.6 billion yen as a result of impairment of goodwill pertaining to Peach Aviation Limited. Consolidated Financial Performance Unit: billion yen (Except for % comparison, rounded down) FY2019 FY2018 Difference % Comparison Operating revenues 1,974.2 2,058.3 -84.0 -

Japan's Market Is Open to the World

Japan – France Partnership 17/12/2013 Susumu KATAOKA Ministry of Economy, Trade and Industry Expanding Japan-EU (France) Industry Partnership PSA – Toyota Motors Daimler – Toray Isagro – Sumitomo Chemical PSA – Mitsubishi Motors FIAT – Toshiba Areva – Mitsubishi Heavy Industries & etc.… 1 Big success of Japan – France Industry Partnership ・AREVA and MHI have created ATMEA Joint Venture to develop and market the ATMEA1 reactor(the mid-sized generation III+ Pressurized Water Reactor). ・Turkey has chosen Japan as its partner to develop Sinop nuclear power project in the Black Sea province, which would install 4 units of ATMEA1 Generation III+ reactors. On May 3, 2013, Turkish and Japanese governments agreed to cooperate in promoting the Sinop nuclear power project executing the inter-government agreement, paving the way to Japan for an “preferential negotiating rights to build a nuclear power plant”. ATMEA will provide the Nuclear Island part for the plant construction contract. The ATMEA1 reactor is under consideration for many other new nuclear power plants in the world as for Jordan and Vietnam. ATMEA1 is also considered in several countries in Europe, South East Asia and South America. (Citation) Source: ATMEA Press Release (http://www.atmea-sas.com/scripts/ATMEA/publigen/content/templates/Show.asp?P=273&L=EN)2 Alstom and J-TREC sign a partnership to develop the light rail transit and tramways in Japan ・This agreement will lead both companies to jointly contribute to the modernisation of existing tramway lines and the development of new lines in Japan. ・The MOU between Alstom and J-TREC is a first for both companies and is prompted by the on-going Japan-EU Economic Partnership Agreement discussions held between the Japanese government and the European Union. -

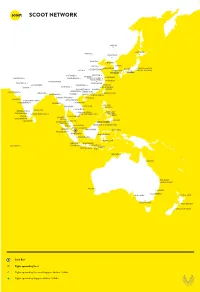

Scoot Network and Interline Destinations

SCOOT NETWORK HARBIN SAPPORO BEIJING SHENYANG TIANJIN DALIAN JINAN SEOUL QINGDAO TOKYO, NARITA ZHENGZHOU OSAKA XI’AN HIROSHIMA TOKYO, HANEDA FUKUOKA NAGOYA CHENGDU NANJING WUHAN SHANGHAI AMRITSAR CHONGQING WUXI / SUZHOU HANGZHOU NINGBO KATHMANDU NEW DELHI NANCHANG LUCKNOW CHANGSHA FUZHOU DHAKA KUNMING QUANZHOU GUANGZHOU XIAMEN TAIPEI AHMEDABAD NANNING SHENZHEN KOLKATA HANOI KAOHSIUNG MANDALAY MACAU HONG KONG LUANG PRABANG HAIKOU MUMBAI VISAKHAPATNAM CHIANG MAI HYDERABAD YANGON VIENTIANE CLARK DANANG BANGKOK MANILA SIEM REAP BENGALURU CHENNAI PHNOM PENH BORACAY COIMBATORE TIRUCHIRAPPALLI HO CHI MINH CITY KALIBO CEBU KOCHI KOH SAMUI PHUKET TRIVANDRUM KRABI COLOMBO DAVAO LANGKAWI HAT YAI KOTA KINABALU PENANG BANDAR SERI BEGAWAN IPOH KUANTAN KUALA LUMPUR MEDAN KUCHING MANADO PEKANBARU SINGAPORE BALIKPAPAN PALEMBANG MAKASSAR JAKARTA SEMARANG MALDIVES BANDUNG SURABAYA LOMBOK YOGYAKARTA BALI DARWIN CAIRNS BRISBANE GOLD COAST PERTH SYDNEY CANBERRA ADELAIDE AUCKLAND MELBOURNE WELLINGTON CHRISTCHURCH Scoot Base Flights operated by Scoot Flights operated by Scoot and Singapore Airlines / SilkAir Flights operated by Singapore Airlines / SilkAir SCOOT NETWORK AMERICA AFRICA EUROPE STOCKHOLM MOSCOW COPENHAGEN NEW YORK SAN FRANCISCO AMSTERDAM BERLIN MANCHESTER DÜSSELDORF LOS ANGELES JOHANNESBURG HEATHROW FRANKFURT PARIS HOUSTON MUNICH ZURICH HONOLULU MILAN FIUMICINO BARCELONA ISTANBUL CAPE TOWN ATHENS SAUDI ARABIA OPERATED BY NOKSCOOT OPERATED BY VANILLA AIR HAKODATE SHENYANG TIANJIN DALIAN DUBAI QINGDAO NANJING JEDDAH TAIPEI AMAMI NAHA *FROM BANGKOK