Telekom Malaysia Malaysia Building Society

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interim Report

MANULIFE INVESTMENT -CM FLEXI FUND CONTENTS PAGE 1 General Information 1 2 Manager’s Report 3 3 Policy On Stockbroking Rebates And So Commissions 9 4 Statement By The Manager 10 5 Trustee’s Report 11 6 Statement Of Comprehensive Income 12 7 Statement Of Financial Position 13 8 Statement Of Changes In Equity 14 9 Statement Of Cash Flows 15 10 Summary Of Signicant Accounting Policies 16 11 Notes To The Financial Statements 21 12 Corporate Information 36 MANULIFE INVESTMENT -CM FLEXI FUND 1 GENERAL INFORMATION 1.1 THE TRUST The Fund commenced operations on 23 January 2007 and will continue its operations until terminated as provided under Clause 48.2 of the Deed. 1.2 FUND TYPE / CATEGORY Growth / Mixed Assets 1.3 BASE CURRENCY Ringgit Malaysia (RM) 1.4 OBJECTIVE OF THE FUND The Fund seeks to provide Unit Holders with long-term capital appreciation. Note: Any material change to the Fund’s investment objective would require Unit Holders’ approval. 1.5 DISTRIBUTION POLICY Income distribution (if any) is incidental. 1.6 PERFORMANCE BENCHMARK 50% FTSE Bursa Malaysia Top 100 Index (FBM100) + 50% CIMB 12-month xed deposit (FD) rate. Note: The composite benchmark provides a balanced gauge on the asset allocation of the Fund which can invest up to 98% of its net asset value (NAV) in equities and/or equity-related instruments or xed income instruments. The composite benchmark is only used as a reference for performance gauge purpose. The risk prole of the Fund is not the same as the risk prole of this benchmark. -

2019 Robotics Process and Intelligent Automation Conference

2019 ROBOTICS PROCESS AND INTELLIGENT AUTOMATION CONFERENCE FOUR SEASONS HOTEL KUALA LUMPUR PRE-CONFERENCE MASTERCLASS: 10 JUNE 2019 MAIN CONFERENCE: 11 - 12 JUNE 2019 Driving Massive Benefits in Productivity Through Robotic Automation KEY SPEAKERS INCLUDE ROBERTO NEETI MAHAJAN KEY THEMES RAMIREZ PINSON Managing Director, - Senior Vice Global Service Centre • Bank of America: How RPA Will be a Game President, Retail Risk / Head of Workforce & Changer in the World of Data Regulatory Capacity Management Reporting Global Global Operations • How RPA Deliver Massive Benefits in Lead and Data HSBC Malaysia Productivity Through Automation of Manual Strategy Expert Citibank Singapore Process • Citibank: Importance of Governance Models in RPA Implementation Roll-Outs ALLAN BOCQ FERHAD ISMAIL Data Analytic Project Senior Manager - • Scaling RPA to the Next Level: From Local to Leader (Leading IT Customer Engagement, Global Implementation Robotic Process Commercial and Bid Automation (RPA) Management • Axiata: Dealing with Unstructured Data Analysis in East Asia Japan Toll Group and Unclear Rules-Based Processes in RPA Pacific), Schneider Electric Bhd • Lessons Learnt from Failed Robotic Process Implementation • Barclays: Assessing RPA Missteps to Avoid SELVEEN MUNIADY RAJESH Failures in the Long Run Head, Robotics NANDAKUMAR Process Automation Head of Enterprise • CEVA Logistics: Setting up an RPA Center of Architecture RHB Malaysia Excellence Governance Global Consumer Technology • HSBC: How RPA Delivers Value by Improving Asia & EMEA Citibank -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Malaysia USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country AirAsia Group Berhad 0.16 MALAYSIA Hong Leong Bank 1.83 MALAYSIA Press Metal Aluminium Holdings 2.07 MALAYSIA Alliance Bank Malaysia 0.48 MALAYSIA Hong Leong Financial 0.66 MALAYSIA Public Bank BHD 9.5 MALAYSIA AMMB Holdings 1.1 MALAYSIA IHH Healthcare 2.99 MALAYSIA QL Resources 1.31 MALAYSIA Astro Malaysia Holdings 0.22 MALAYSIA IJM 0.87 MALAYSIA RHB Bank 1.3 MALAYSIA Axiata Group Bhd 2.49 MALAYSIA IOI 2.73 MALAYSIA Sime Darby 1.65 MALAYSIA British American Tobacco (Malaysia) 0.27 MALAYSIA IOI Properties Group 0.31 MALAYSIA Sime Darby Plantation 3.39 MALAYSIA CIMB Group Holdings 4.14 MALAYSIA Kuala Lumpur Kepong 2.05 MALAYSIA Sime Darby Property 0.38 MALAYSIA Dialog Group 3.3 MALAYSIA Malayan Banking 8.28 MALAYSIA Telekom Malaysia 0.93 MALAYSIA Digi.com 2.8 MALAYSIA Malaysia Airports 0.74 MALAYSIA Tenaga Nasional 7.53 MALAYSIA FGV Holdings 0.41 MALAYSIA Maxis Bhd 2.65 MALAYSIA Top Glove Corp 8.82 MALAYSIA Fraser & Neave Holdings 0.64 MALAYSIA MISC 1.9 MALAYSIA Westports Holdings 0.8 MALAYSIA Gamuda 1.48 MALAYSIA Nestle (Malaysia) 1.69 MALAYSIA YTL Corp 0.72 MALAYSIA Genting 1.34 MALAYSIA PETRONAS Chemicals Group Bhd 3.28 MALAYSIA Genting Malaysia BHD 1.11 MALAYSIA Petronas Dagangan 1.18 MALAYSIA Hap Seng Consolidated 0.93 MALAYSIA Petronas Gas 1.79 MALAYSIA Hartalega Holdings Bhd 5.25 MALAYSIA PPB Group 2.49 MALAYSIA Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. -

Danajamin Nasional to Issue RM3 Bln Guarantees

B2 Thursday, April 8, 2010 BUSINESS Danajamin Nasional to issue RM3 bln guarantees Bursa shares close slightly higher KUALA LUMPUR: Share The rebound in exports positive with advancers KUALA LUMPUR: We are not competing with investment banks. Our capital of RM1 billion with a prices on Bursa Malaysia and optimism of leading decliners by 396 to Danajamin Nasional Bhd, capacity to underwrite closed marginally higher government’s new policy to 366 while 289 counters Malaysia’s first financial role is to support and provide credit enhancement policies of up to RM15 yesterday as late buying attract foreign investors were unchanged, 311 guarantee insurer, aims to for companies investing in the economy and allow billion. support on index-linked bode well for the market, untraded and 34 others issue RM3 billion It has been rated AAA by counters pushed the key he added. suspended. guarantees this year, says both large and small entities to tap the bond or RAM Rating Services Bhd index up by 0.05 per cent, The share market saw A total volume of 1.134 its chief executive officer, sukuk market. and the Malaysian Rating dealers said. some improvement and million shares worth Ahmad Zulqarnain Onn. Corporation Bhd. At 5pm, the FTSE Bursa there was support for RM1.648 million were He said Danajamin has to Ahmad Zulqarnain Onn, Danajamin Nasional Bhd chief executive officer As part of an ongoing Malaysia Kuala Lumpur heavyweights such as transacted, up from 1.122 date approved RM1.4 billion effort by the government to Composite Index edged up Tenaga Nasional and million shares worth guarantees to various ensure the continued flow 0.72 points to 1,345.09, off its Petronas Gas, while Pos RM1.545 million recorded industries such as oil and Ahmad Zulqarnain said tap the bond or sukuk of credit in the financial low of 1,341.55. -

Page 1 of 10 Delivery of Bank Confirmation Request

Delivery of Bank Confirmation Request: List of Contact Details for 26 Commercial Banks in Malaysia (including their respective Islamic banking arms) Updated December 2018 No Bank Contact Person 1. Affin Bank Berhad At domicile branch where account is maintained. For further enquiries, please contact: 1. Name: Fadhnita Binti Ariffin Designation: Executive, Loan Operation Telephone No: 03-27315269 Fax No: 03-20314984 Email Address: [email protected] Correspondence Address: Loan Administration and Documentation Department 9th Floor, Menara Affin 80 Jalan Raja Chulan 50200 Kuala Lumpur (Other than Mortgage, HP, Money Market, NPL customers) 2. Name: Ahmad Zahuri Idris Designation: Manager, Operations Telephone No: 03-20559646 Fax No: - Email Address: [email protected] Name: Anita Mahadi Designation: Team Leader, Admin Telephone No: 03-20559164 Fax No: - Email Address: [email protected] Correspondence Address: Special Asset Management 7th Floor, Menara Affin 80, Jalan Raja Chulan 50200 Kuala Lumpur 3. Name: Mohd Isham Hamzah Designation: Customer Supports Telephone No: 03-20559089 Fax No: - Email Address: [email protected] Dewan Akauntan, Unit 33-01, Level 33, Tower A, The Vertical, Avenue 3 Page 1 of 10 Bangsar South City, No.8, Jalan Kerinchi, 59200 Kuala Lumpur, Malaysia Website: www.mia.org.my | Tel: + 603 2722 9000 | Fax: + 603 2722 9100 No Bank Contact Person Name: Wan Mohd Faizal Wan Yazdad Designation: Customer Supports Telephone No: 03-20559100 Fax No: - Email Address: [email protected] Correspondence -

Malaysian Islamic Banks' Efficiency

International Journal of Business and Society, Vol. 16 No. 1, 2015, 19 - 38 MALAYSIAN ISLAMIC BANKS’ EFFICIENCY: AN INTRA-BANK COMPARATIVE ANALYSIS OF ISLAMIC WINDOWS AND FULL-FLEDGED SUBSIDIARIES Oladipupo Luqman Salami University Technology Petronas Adewale Abideen Adeyemi♣ International Islamic University Malaysia ABSTRACT This paper aims to fill an apparent dearth of empirical studies that compare the efficiency of Islamic banks in Malaysia during their operation as Islamic windows and later transformation to full-fledged Islamic banks. Data obtained from the annual financial reports of the sampled banks is analyzed using the Data Envelopment Analysis (DEA) via DEAP 2.1 software to assess both the technical and scale efficiency of the banks under sample. Results obtained indicate that the banks have improved over the years in terms of both scale and technical efficiency although the former takes prominence. In general, the banks were found to be more efficient as Islamic windows compared to being full-fledged subsidiaries. This augurs well for the current disposition where, as per the Islamic Financial Service Act 2013, Islamic banks in Malaysia may now operate as full-fledged banks from their hitherto Islamic banking window status. Keywords: Scale Efficiency; Technical Efficiency; Islamic Window; Full-Fledged Banks. 1. INTRODUCTION The banking industry is arguably the most regulated in any part of the world. This may be due to a plethora of reasons including the nature of their product – money, as well as their dual but conflicting obligations of liquidity and profitability to their depositors and shareholders respectively. As such, the need for banks to be efficient cannot be discounted. -

Public Listing Department Contact

PUBLIC LISTING DEPARTMENT CONTACT INFORMATION PLEASE REFER TO THE GROUPING BELOW TEAM TELEPHONE NO FAX NO E-MAIL TEAM 1 03-2034 7031 03-2026 0197 [email protected] TEAM 2 03-2034 7341 03-2026 0197 [email protected] TEAM 3 03-2034 7206 03-2026 0197 [email protected] TEAM 4 03-2034 7030 03-2732 3267 [email protected] TEAM 5 (ON IPO) 03-2034 7206 03-2026 0197 [email protected] TEAM 6 (ON RESTRUCTURING) 03-2034 7341 03-2026 0197 [email protected] TELEPHONE NO FAX NO E-MAIL 03-2034 7006 03-2034 7576 03-2732 3267 BURSA LINK CONTACT INFORMATION 03-2034 7130 [email protected] 03-2732 3263 03-2034 7238 03-2034 7190 TELEPHONE NO FAX NO Online Enquiry LISTING ADVISORY CONTACT INFORMATION 03-2034 7766 - http://asklisting.bursamalaysia.com #REG05004# PUBLIC CONTACT PERSONS FOR LISTING DIVISION NO. COMPANY NAME STOCK CODE GROUP 1 7-ELEVEN MALAYSIA HOLDINGS BERHAD 5250 3 2 ABF MALAYSIA BOND INDEX FUND 0800EA 2 3 ABLEGROUP BERHAD 7086 1 4 ABM FUJIYA BERHAD 5198 1 5 ACE INNOVATE ASIA BERHAD 03028 4 6 ACME HOLDINGS BERHAD 7131 1 7 ACO GROUP BERHAD 0218 4 8 ACOUSTECH BERHAD 7120 1 9 ADVANCE INFORMATION MARKETING BERHAD 0122 4 10 ADVANCE SYNERGY BERHAD 1481 3 11 ADVANCECON HOLDINGS BERHAD 5281 2 12 ADVANCED PACKAGING TECHNOLOGY (M) BHD 9148 1 13 ADVENTA BERHAD 7191 1 14 AE MULTI HOLDINGS BERHAD 7146 1 15 AEMULUS HOLDINGS BERHAD 0181 4 16 AEON CO. (M) BHD 6599 3 17 AEON CREDIT SERVICE (M) BERHAD 5139 2 18 AFFIN BANK BERHAD 5185 2 19 AGESON BERHAD 7145 2 20 AHB HOLDINGS BERHAD 7315 3 21 AHMAD ZAKI -

Secretariat for NACRA 2001 Organising Committee

NATIONAL ANNUAL CORPORATE REPORT AWARDS Secretariat for NACRA 2018 Organising Committee Malaysian Institute of Accountants Dewan Akauntan, Unit 33-01, Level 33, Tower A, The Vertical, Avenue 3, Bangsar South City, No. 8, Jalan Kerinchi, 59200 Kuala Lumpur [Phone] + 60 3 2722 9000 [Fax] + 60 3 2722 9100 [Email] [email protected] [Web] http://www.mia.org.my LIST OF WINNERS FOR NACRA 2018 OVERALL EXCELLENCE AWARDS MOST OUTSTANDING ANNUAL REPORT OF THE YEAR PLATINUM CIMB GROUP HOLDINGS BERHAD GOLD PETRONAS GAS BERHAD SILVER TELEKOM MALAYSIA BERHAD INDUSTRY EXCELLENCE AWARDS – MAIN MARKET CONSUMER PRODUCTS NESTLE (MALAYSIA) BERHAD INDUSTRIAL PRODUCTS & TECHNOLOGY PETRONAS GAS BERHAD TRADING & SERVICES TELEKOM MALAYSIA BERHAD FINANCE CIMB GROUP HOLDINGS BERHAD CONSTRUCTION & INFRASTRUCTURE GAMUDA BERHAD PROJECT COMPANIES PROPERTIES & HOTELS OSK HOLDINGS BERHAD PLANTATIONS & MINING FGV HOLDINGS BERHAD REAL ESTATE INVESTMENT TRUSTS (REITS) KLCC PROPERTY HOLDINGS BERHAD & KLCC & INVESTMENT FUNDS REITS PRESENTATION AWARDS BEST ANNUAL REPORT IN BAHASA MALAYSIA PLATINUM RHB BANK BERHAD GOLD TELEKOM MALAYSIA BERHAD SILVER PUBLIC BANK BERHAD BEST DESIGNED ANNUAL REPORT PLATINUM PETRONAS GAS BERHAD GOLD CIMB GROUP HOLDINGS BERHAD SILVER RHB BANK BERHAD JOINTLY ORGANISED BY: NATIONAL ANNUAL CORPORATE REPORT AWARDS Secretariat for NACRA 2018 Organising Committee Malaysian Institute of Accountants Dewan Akauntan, Unit 33-01, Level 33, Tower A, The Vertical, Avenue 3, Bangsar South City, No. 8, Jalan Kerinchi, 59200 Kuala Lumpur [Phone] + 60 3 2722 9000 -

Equities Listed Onbursa Malaysia Berhad

EQUITIES LISTED ONBURSA MALAYSIA BERHAD Bursa Malaysia Berhad As at 05 November 2020 International Securities Identification Number (ISIN) Issuer Name (Long) Issuer Name (Short) ISIN Issue Description Listing Date (yr/mth/d) Maturity Date (yr/mth/d) 7-ELEVEN MALAYSIA HOLDINGS BERHAD SEM MYL5250OO005 ORDINARY SHARE 20140530 A50CHIN-C62: CW ISHARES FTSE A50 CHINA ETF (MACQUARIE CAPITAL SECURITIES (MALAYSIA) SDN BHD) A50CHIN-C62 MYJ070362UC4 CALL WARRANT - FOREIGN 20200619 20201231 A50CHIN-C64: CW ISHARES FTSE A50 CHINA ETF (MACQUARIE CAPITAL SECURITIES (MALAYSIA) SDN BHD) A50CHIN-C64 MYJ070364V33 CALL WARRANT - FOREIGN 20200722 20210331 A50CHIN-C66: CW ISHARES FTSE A50 CHINA ETF (MACQUARIE CAPITAL SECURITIES (MALAYSIA) SDN BHD) A50CHIN-C66 MYJ070366V31 CALL WARRANT - FOREIGN 20200903 20210331 A50CHIN-H47: PW ISHARES FTSE A50 CHINA ETF (MACQUARIE CAPITAL SECURITIES (MALAYSIA) SDN BHD) A50CHIN-H47 MYJ070347UC5 PUT WARRANT-FOREIGN 20200619 20201231 A50CHIN-H49: PW ISHARES FTSE A50 CHINA ETF (MACQUARIE CAPITAL SECURITIES (MALAYSIA) SDN BHD) A50CHIN-H49 MYJ070349V33 PUT WARRANT-FOREIGN 20200722 20210331 A50CHIN-H51: PW ISHARES FTSE A50 CHINA ETF (MACQUARIE CAPITAL SECURITIES (MALAYSIA) SDN BHD) A50CHIN-H51 MYJ070351V38 PUT WARRANT-FOREIGN 20200903 20210331 ABF MALAYSIA BOND INDEX FUND ABFMY1 MYL0800EA002 ETF 20050718 ABLEGROUP BERHAD ABLEGRP MYL7086OO001 ORDINARY SHARE 20000327 ABM FUJIYA BERHAD AFUJIYA MYL5198OO006 ORDINARY SHARE 20130723 ABMB-C4: CW ALLIANCE BANK MALAYSIA BERHAD (AMBANK (M) BERHAD) ABMB-C4 MYL2488C4V32 CALL WARRANT - LOCAL -

List of Companies 20 July 2020

LISTING DEPARTMENT CONTACT INFORMATION PLEASE REFER TO THE GROUPING BELOW TEAM TELEPHONE NO FAX NO E-MAIL TEAM 1 03-2034 7031 03-2026 0197 [email protected] TEAM 2 03-2034 7341 03-2026 0197 [email protected] TEAM 3 03-2034 7206 03-2026 0197 [email protected] TEAM 4 03-2034 7030 03-2732 3267 [email protected] TEAM 5 (ON IPO) 03-2034 7206 03-2026 0197 [email protected] TEAM 6 (ON RESTRUCTURING) 03-2034 7341 03-2026 0197 [email protected] TELEPHONE NO FAX NO E-MAIL 03-2034 7006 03-2034 7576 03-2732 3267 BURSA LINK CONTACT INFORMATION 03-2034 7130 [email protected] 03-2732 3263 03-2034 7238 03-2034 7190 TELEPHONE NO FAX NO Online Enquiry LISTING ADVISORY CONTACT INFORMATION 03-2034 7766 - http://asklisting.bursamalaysia.com CONTACT PERSONS FOR LISTING DIVISION NO. COMPANY NAME STOCK CODE GROUP 1 7-ELEVEN MALAYSIA HOLDINGS BERHAD 5250 3 2 ABF MALAYSIA BOND INDEX FUND 0800EA 2 3 ABLEGROUP BERHAD 7086 1 4 ABM FUJIYA BERHAD 5198 1 5 ACE INNOVATE ASIA BERHAD 03028 4 6 ACME HOLDINGS BERHAD 7131 1 7 ACO GROUP BERHAD 0218 4 8 ACOUSTECH BERHAD 7120 1 9 ADVANCE INFORMATION MARKETING BERHAD 0122 4 10 ADVANCE SYNERGY BERHAD 1481 3 11 ADVANCECON HOLDINGS BERHAD 5281 2 12 ADVANCED PACKAGING TECHNOLOGY (M) BHD 9148 1 13ADVENTA BERHAD 7191 1 14 AE MULTI HOLDINGS BERHAD 7146 1 15 AEMULUS HOLDINGS BERHAD 0181 4 16 AEON CO. (M) BHD 6599 3 17 AEON CREDIT SERVICE (M) BERHAD 5139 2 18AFFIN BANK BERHAD 5185 2 19AGESON BERHAD 7145 2 20 AHB HOLDINGS BERHAD 7315 3 21 AHMAD ZAKI RESOURCES BERHAD 7078 2 22 AIRASIA -

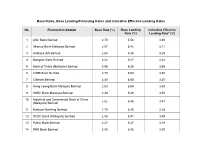

Base Rates, Base Lending/Financing Rates and Indicative Effective Lending Rates

Base Rates, Base Lending/Financing Rates and Indicative Effective Lending Rates No. Financial Institution Base Rate (%) Base Lending Indicative Effective Rate (%) Lending Rate* (%) 1 Affin Bank Berhad 2.70 5.56 3.30 2 Alliance Bank Malaysia Berhad 2.57 5.42 3.11 3 AmBank (M) Berhad 2.60 5.45 3.25 4 Bangkok Bank Berhad 3.22 5.87 4.42 5 Bank of China (Malaysia) Berhad 2.55 5.35 3.55 6 CIMB Bank Berhad 2.75 5.60 3.50 7 Citibank Berhad 2.40 5.55 3.20 8 Hong Leong Bank Malaysia Berhad 2.63 5.64 3.50 9 HSBC Bank Malaysia Berhad 2.39 5.49 3.50 10 Industrial and Commercial Bank of China 2.52 5.45 3.47 (Malaysia) Berhad 11 Malayan Banking Berhad 1.75 5.40 3.25 12 OCBC Bank (Malaysia) Berhad 2.58 5.51 3.45 13 Public Bank Berhad 2.27 5.47 3.10 14 RHB Bank Berhad 2.50 5.45 3.50 No. Financial Institution Base Rate (%) Base Lending Indicative Effective Rate (%) Lending Rate* (%) 15 Standard Chartered Bank Malaysia Berhad 2.27 5.45 3.50 16 United Overseas Bank (Malaysia) Bhd. 2.61 5.57 3.36 No. Islamic Financial Institution Base Rate (%) Base Financing Indicative Effective Rate (%) Lending Rate (%) 1 Affin Islamic Bank Berhad 2.70 5.56 3.30 2 Al Rajhi Banking & Investment Corporation 2.85 5.75 4.20 (Malaysia) Berhad 3 Alliance Islamic Bank Berhad 2.57 5.42 3.11 4 AmBank Islamic Berhad 2.60 5.45 3.25 5 Bank Islam Malaysia Berhad 2.52 5.47 3.25 6 Bank Muamalat Malaysia Berhad 2.56 5.56 3.56 7 CIMB Islamic Bank Berhad 2.75 5.60 3.50 8 Hong Leong Islamic Bank Berhad 2.63 5.64 3.35 9 HSBC Amanah Malaysia Berhad 2.39 5.49 3.50 10 Kuwait Finance House (Malaysia) Berhad 2.25 6.14 3.30 11 Maybank Islamic Berhad 1.75 5.40 3.25 No. -

Partner – Enhancing Banking Efficiency and Customer Services Towards True Business Partnership

PARTNER – ENHANCING BANKING EFFICIENCY AND CUSTOMER SERVICES TOWARDS TRUE BUSINESS PARTNERSHIP PHASE 1 INITIATIVE: STREAMLINING AND SIMPLIFYING SME LOAN APPLICATIONS Frequently Asked Questions (FAQs) 1. What is “PARTNER”? “PARTNER” is a series of initiatives undertaken by The Association of Banks in Malaysia (ABM) and its commercial bank members to support the growth and development of Small and Medium Enterprises (SMEs). Under “PARTNER”, we aspire to be a partner and not just financiers. Under Phase 1 of the initiatives, we have attempted to streamline and simplify the processes and procedures of applications for a SME loan. 2. How many banks will participate in “PARTNER”? A total of 14 commercial banks comprising 9 local banks and 5 locally incorporated international banks will participate in “PARTNER”. The following are the participating banks (listed in alphabetical order) in “PARTNER”:- 1. Affin Bank Berhad 8. HSBC Bank Malaysia Berhad 2. Alliance Bank Malaysia Berhad 9. Malayan Banking Berhad (Maybank) 3. AmBank (M) Berhad 10. OCBC Bank (Malaysia) Berhad 4. CIMB Bank Berhad 11. Public Bank Berhad 5. Citibank Berhad 12. RHB Bank Berhad 6. EON Bank Berhad 13. Standard Chartered Bank Malaysia Berhad 7. Hong Leong Bank Berhad 14. United Overseas Bank (Malaysia) Bhd 3. How are the processes and procedures of a SME loan application made easier? Under “PARTNER”, a simple loan application form is made available which can be used in the event the bank you wish to approach does not have its own. To the best of our knowledge, the following banks have their own application form(s) for SMEs:- 1. Alliance Bank Malaysia Berhad 6.