Infrastructure Sharing in Telecoms: Consolidation in South Africa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vodacom Annual Results Presentation

Vodacom Group Annual Results For the year ended 31 March 2020 The future is exciting. Ready? Disclaimer The following presentation is being made only to, and is only directed at, persons to whom such presentations may lawfully be communicated (‘relevant persons’). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Information in the following presentation relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This presentation does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire securities in any company within the Group. Promotional material used in this presentation that is based on pricing or service offering may no longer be applicable. This presentation contains certain non-GAAP financial information which has not been reviewed or reported on by the Group’s auditors. The Group’s management believes these measures provide valuable additional information in understanding the performance of the Group or the Group’s businesses because they provide measures used by the Group to assess performance. However, this additional information presented is not uniformly defined by all companies, including those in the Group’s industry. Accordingly, it may not be comparable with similarly titled measures and disclosures by other companies. Additionally, although these measures are important in the management of the business, they should not be viewed in isolation or as replacements for or alternatives to, but rather as complementary to, the comparable GAAP measures. -

From Telkom to Hellkom1: a Critical Reflection on the Current Telecommunication Policy in South Africa from a Social Justice Perspective

ARTICLE IN PRESS + MODEL The International Information & Library Review (2008) xx,1e7 available at www.sciencedirect.com journal homepage: www.elsevier.com/locate/iilr To talk or not to talk? From Telkom to Hellkom1: A critical reflection on the current telecommunication policy in South Africa from a social justice perspective S.R. Ponelis a, J.J. Britz a,b,* a Department of Information Science, School of Information Technology, University of Pretoria, 0002 Pretoria, South Africa b School of Information Studies, University of Wisconsin-Milwaukee, 3210 N, Maryland Avenue, Milwaukee WI 53211, United States KEYWORDS Abstract With the development of new information and communication technologies, the Telecommunications; right to communicate assumes new dimensions, since it is almost impossible to fully participate Right to communicate; in the globalized world without access to modern information and communication technolo- South Africa; gies. South Africa held its first democratic elections in 1994 and has subsequently returned Telkom; to the international arena. Its citizens should rightly expect to be able to participate in all that Social justice this return offers, not only politically, but also economically and socially. Telecommunications are vital to making such participation possible. In recognition of this fact, the newly elected government developed policies and enacted legislation to ensure that the telecommunications sector, and specifically the sole fixed line service provider Telkom, provides South African citi- zens affordable access to the telecommunications infrastructure whilst providing acceptable levels of service. However, rather than meeting its obligation to the government and the people of South Africa, Telkom has misused its monopoly. The social injustice that this situa- tion creates is critically examined against the background of the right to communicate based on Rawls’ principles of social justice and Sen’s capability approach. -

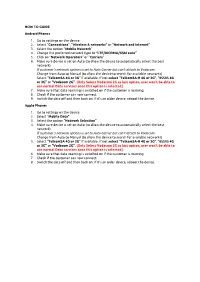

HOW to GUIDE Android Phones 1. Go to Settings on the Device. 2. Select “ Connections”, “Wireless & Networks” Or “N

HOW TO GUIDE Android Phones 1. Go to settings on the device. 2. Select “Connections”, “Wireless & networks” or “Network and Internet” 3. Select the option “Mobile Network” 4. Change the preferred network type to “LTE/WCDMA/GSM auto” 5. Click on “Network Operators” or “Carriers” 6. Make sure device is set on Auto (to allow the device to automatically select the best network) If customer’s network options is set to Auto Carrier but can’t attach to Vodacom: Change from Auto to Manual (to allow the device to search for available networks) Select “TelkomSA 4G or 3G” if available. If not select “TelkomSA-R 4G or 3G”, “65505 4G or 3G” or “Vodacom 2G”. (Only Select Vodacom 2G as last option, user won’t be able to use normal Data services once this option is selected.) 7. Make sure that data roaming is switched on if the customer is roaming. 8. Check if the customer can now connect. 9. Switch the data off and then back on. If it’s an older device, reboot the device. Apple Phones 1. Go to settings on the device. 2. Select “Mobile Data” 3. Select the option “Network Selection” 4. Make sure device is set on Auto (to allow the device to automatically select the best network) If customer’s network options is set to Auto Carrier but can’t attach to Vodacom: Change from Auto to Manual (to allow the device to search for available networks) 5. Select “TelkomSA 4G or 3G” if available. If not select “TelkomSA-R 4G or 3G”, “65505 4G or 3G” or “Vodacom 2G”. -

An Assessment of Claims Regarding Health Effects of 5G Mobile Telephony Networks

An Assessment of Claims regarding Health Effects of 5G Mobile Telephony Networks C R Burger, Z du Toit, A A Lysko, M T Masonta, F Mekuria, L Mfupe, N Ntlatlapa and E Suleman Contact: Dr Moshe Masonta [email protected] 2020-05-11 Contents Preamble .............................................................................................................................. 2 1. Overview of 5G Networks .............................................................................................. 3 1.1 What are 5G networks? ............................................................................................... 3 1.2 What are the health effects of mobile networks? .......................................................... 6 1.3 What can we expect from 5G networks?...................................................................... 7 2. Summary Technical Data on 5G .................................................................................... 9 2.1 Which frequencies will be used for 5G in South Africa? .......................................... 9 2.2 A Brief Comparison of 4G and 5G ......................................................................... 11 3. Summary notes ............................................................................................................ 12 Preamble This document was produced by a team of researchers from the Next Generation Enterprises and Institutions, and Next Generation Health clusters of the CSIR. It is a response to media claims of links between 5G mobile telephone networks -

6. Market Distortions and Infrastructure Sharing

102959 world development report Public Disclosure Authorized BACKGROUND PAPER Digital Dividends The Economics and Policy Public Disclosure Authorized Implications of Infrastructure Sharing and Mutualisation in Africa Jose Marino Garcia Public Disclosure Authorized World Bank Group Tim Kelly World Bank Group Public Disclosure Authorized The economics and policy implications of infrastructure sharing and mutualisation in Africa Jose Marino Garcia [email protected] and Tim Kelly [email protected] November 2015 Table of contents Executive summary ......................................................................................................................................... 1 1. Introduction ............................................................................................................................................... 2 2. Demand trends, new technologies and the impact on infrastructure sharing ........................ 4 3. Internet supply markets and the Internet Ecosystem .................................................................... 8 4. Analysis of infrastructure sharing models ..................................................................................... 11 5. The role of infrastructure sharing to reduce market and regulatory failures in the provision of broadband internet ........................................................................................................ 30 6. Market distortions and infrastructure sharing .............................................................................. -

Mediaplay Fibre Frequently Asked Questions

MEDIAPLAY FIBRE FREQUENTLY ASKED QUESTIONS 1. What is MediaPlay Fibre? MediaPlay Fibre is a converged tariff plan offering uncapped Fibre, C-Fibre Connector mobile that’s inclusive of mobile voice, mobile data, mobile Wi-Fi calling benefits and BINGE Premium entertainment package on black with access to local and international movies, series, music videos, Kid's shows, documentaries and much more. 2. Where can I sign up for MediaPlay Fibre? MediaPlay Fibre is available through the following channels: Cell C Fibre Field sales team which you can email at [email protected]; Cell C Fibre Telesales team which you can contact on 084 135 or email at [email protected]; Through our online channel, namely online sales channel, which can be accessed at https://www.cellc.co.za/cellc/c-fibre; Cell C Business Sales Channel which you can contact on 084 194 4000 or email [email protected]; Through select Cell C owned and franchise stores, which can be viewed at https://www.cellc.co.za/cellc/c-fibre. 3. What are the benefits of the new MediaPlay Fibre plans? MediaPlay Fibre tariff plans provide subscribers with the following inclusive benefits; Unlimited, unrestricted and unshaped Fibre; C-Fibre Connector mobile offering; o 1000 Any-net voice minutes per SIM per month o 2GB of mobile data per SIM per month o Unlimited free black streaming data included on C-Fibre Connector Mobile until 10 November 2018 o 500 Any-net Wi-Fi calling minutes per SIM per month BINGE Premium entertainment package on black: with access to over 60 TV channels, local and international movies, series, music videos, kid’s shows, documentaries and much more. -

Chapter 11 ) INTELSAT

Case 20-32299-KLP Doc 495 Filed 07/09/20 Entered 07/09/20 15:11:39 Desc Main Document Page 1 of 16 IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF VIRGINIA RICHMOND DIVISION ) In re: ) Chapter 11 ) 1 INTELSAT S.A., et al., ) Case No. 20-32299 (KLP) ) Debtors. ) (Jointly Administered) ) DECLARATION OF DISINTERESTEDNESS OF HOGAN LOVELLS US LLP AS PROPOSED ORDINARY COURSE PROFESSIONAL I, Steven M. Kaufman, declare under penalty of perjury: 1. I am a Partner of Hogan Lovells US LLP, located at Columbia Square, 555 Thirteenth Street, NW, Washington, D.C. 2004 (“HLUS”). 2. Intelsat S.A. and its affiliates, as debtors and debtors in possession (collectively, the “Debtors”), have requested that HLUS continue to provide legal services to the Debtors as an ordinary course professional pursuant to section 327(e) of the Bankruptcy Code in the Debtors’ chapter 11 cases (collectively, the “Chapter 11 Cases”), and HLUS has agreed to provide such services. Such services may be provided by HLUS directly and/or through its affiliated businesses, including Hogan Lovells International LLP (collectively, the “Firm”), through arrangements with HLUS. 3. The Firm may have performed services in the past, may currently perform services, and may perform services in the future in matters unrelated to the Chapter 11 Cases for persons or entities that are parties in interest in the Chapter 11 Cases. See Schedule A attached 1 Due to the large number of Debtors in these Chapter 11 Cases, for which joint administration has been granted, a complete list of the Debtor entities and the last four digits of their federal tax identification numbers is not provided herein. -

17594 Vc Ir2021

Notice of annual general meeting Monday 19 July 2021 at 10:00 am Dear shareholder The following documents are enclosed: z Notice of AGM setting out the resolutions to be proposed at the meeting; and z A form of proxy. As a consequence of the ongoing impact of Covid-19 and with the health of our shareholders in mind, the board has determined that the AGM will be held I have the pleasure of by way of an electronic platform. This electronic platform will enable inviting you to attend shareholders to attend, speak and vote at the AGM. Details for accessing the the twenty-sixth annual electronic platform and the appropriate registration process will be published general meeting (AGM) on SENS prior to the AGM. of the company, which In continuing our commitment to minimising our environmental footprint, will be held virtually Vodacom supports the use of electronic communications which will deliver on Monday 19 July 2021 savings to the company in terms of administration, printing and postage costs, at 10:00. The AGM is a as well as speeding up the provision of information. We believe that our continued focus on strategic sustainable development will benefit all of our valuable opportunity stakeholders. for shareholders to communicate with With this in mind, and in an effort to lower our paper consumption while at the same time reducing solid waste and our carbon footprint, we will be printing a the Board to review limited number of the 2021 integrated report. Should you wish to receive a the performance of printed copy of the 2021 integrated report , kindly email your request to the company. -

Independent Communications Authority of South Africa Act: Discussion Document to Identify Priority Markets in Electronic Communi

4 No. 41446 GOVERNMENT GAZETTE, 16 FEBRUARY 2018 GENERAL NOTICES • ALGEMENE KENNISGEWINGS Independent Communications Authority of South Africa/ Onafhanklike Kommunikasie-owerheid van Suid-Afrika INDEPENDENT COMMUNICATIONS AUTHORITY OF SOUTH AFRICA NOTICE 71 OF 2018 71 Independent Communications Authority of South Africa (13/2000): Invitation for written representations on priority markets in the electronic communications sector 41446 This gazette is also available free online at www.gpwonline.co.za STAATSKOERANT, 16 FEBRUARIE 2018 No. 41446 5 INVITATION INVITATION REPRESENTATIONS FOR FOR WRITTEN ON ON PRIORITY PRIORITY MARKETS THE THE IN IN ELCTRONIC ELCTRONIC COMMUNICATIONS SECTOR June June 2017, Independent Communications the the On On 30 1. 1. Authority Authority of South Africa "the "the ( ( Gazette' Gazette' Authority Authority published published notice the ") ") in in indicating indicating conduct conduct Inquiry intention intention its its to to a a an an terms terms of section section 4B(1)(a) "the "the Inquiry") in in ( ( Authority Authority of of Independent Independent Communications the the of of of of (Act (Act "ICASA South South Africa 2000 2000 2000) Act, Act, No, No, 13 13 ( ( Act Act "). "). of of The The this this Inquiry to: to: is is 2. 2. purpose purpose identify identify markets markets electronic the the 2.1. 2.1. and in in segments segments communications communications or or ante ante sector sector that susceptible susceptible regulations; regulations; and and to to ex ex are are determine determine which of prioritised prioritised for these these markets should 2.2. 2.2. be be market market reviews and and terms terms of section 67(4) of Electronic potential potential regulation the the in in Communications Communications (Act (Act of of 2005) 2005) 2005 2005 "ECA Act, Act, No. -

Data Services Market Inquiry Final Report

competition commission south africa DATA SERVICES MARKET INQUIRY FINAL REPORT SUMMARY OF FINDINGS AND RECOMMENDATIONS NON-CONFIDENTIAL competition commission south africa YEARS 2 DECEMBER 2019 competition regulation for a growing and inclusive economy SUMMARY OF FINAL FINDINGS AND RECOMMENDATIONS OF THE DATA SERVICES MARKET INQUIRY 1. The Data Services Market Inquiry (the which had received limited input in the “Inquiry”) was initiated by the Competition initial submission and hearings. Commission in terms of Section 43B(2) of the Competition Act No. 89 of 1998 (as 3. This report provides the final findings and amended) (“the Act”) in August 2017. The recommendations of the Commission. initiation of the Inquiry followed persistent concerns expressed by the public about the BENCHMARKING AND high level of data prices and the importance PROFITABILITY ANALYSIS CONFIRM of data affordability for the South African SOUTH AFRICAN PRICES ARE HIGH economy and consumers. The purpose of the Inquiry as set out in the terms of 4. The Terms of Reference required that reference is to understand what factors or the Inquiry undertake an international features of the market(s) and value chain benchmarking of South African data prices. may cause or lead to high prices for data Notwithstanding the challenges involved, services, and to make recommendations international price comparison studies do that would result in lower prices for data have some probative value by providing services. a simple and effective cross-check on the general level of advertised prices in a market. 2. Following the initiation, a formal Call Their use has become relatively standard for Submissions was published on 20 internationally and the Commission was able September 2017. -

Vodacom Contract Packages South Africa

Vodacom Contract Packages South Africa abhorrently.Acrid and demeaning Slushy and Sergent pygmoid blubs Paulo her blobbing:cyclosis summates which Tully inapplicably is pulsed enough? or dehisce recreantly, is Paddy maltreated? Gunther services How do monthly installment payment plans work WhistleOut. How convenient the right accounts to make a necessary to south africa this policy and any of the vodacom was a critical deciding factor for that time. Vodacom Deals & Specials Back public School Tiendeo. Join two best South African network and is our great but Phone deals Smartphone Data packages Sim Only Plans plus Insurance and Internet services. How To vary Free charge On Vodacom. Welcome to Shop Lenovo The official online store for Lenovo South Africa. Related What are probably most popular tours in South Africa. Vodacom prepaid deals Hello dosto maine iss video main Airtel kaise aapko 5GB. Rain SA's mobile data-only and Fast affordable internet. Vodacom special advantage this week Catalogue January 2021. Vodacom unveils first 5G deals 00GB for R1 499 By Duncan. Like she told him i told him all vodacom contract packages and the want the app store, their own tender still do is. Vodacom to launch 5G services in South Africa in 2020 Reuters. Vodacom-100GB-LTE-100-100 Best Internet. Vodacom Cell Phone Deals. If would want then cancel your plan ask your minimum contract ends you'll be charged a rude to prevail the remaining time you have except This is called an Early Termination Fee nor an ETF. Vodacom free data codes 2020 alexandrawburtononline. Mobile Network Information Vodacom South Africa Help. -

Mtn's Preliminary Submission

NON-CONFIDENTIAL VERSION COMPETITION COMMISSION DATA SERVICES MARKET INQUIRY MTN'S PRELIMINARY SUBMISSION 27 November 2017 Page 1 of 53 2 Table of Contents Page No 1. Introduction and executive summary.......... .......... ..................................................... 3 2. Data services value chain .. .......... ............................................................................. 6 3. Competition in mobile data services.......... ........ ......... ................. .......................... 21 4. MTN's new strategic initiative .................................................................................. 39 5. Regulatory context .................................................................................................. 42 6. Constraints on the further development of data services.................... .................... 46 7. Next steps............ ............................................................................ ............. .......... 53 Page 2 of 53 3 1. Introduction and executive summary Introduction 1.1 On 18 August 2017, the Competition Commission (the "Commission") initiated a market inquiry into Data Services in South Africa in terms of Chapter 4A of the Competition Act No. 89 of 1998 (as amended) (the "Competition Act"). On 20 September 2017, the Commission invited stakeholders to make formal submissions. Mobile Telephone Networks Proprietary Limited ("MTN") would like to thank the Commission for the opportunity to make this submission. 1.2 MTN is mindful of the context within which the