Official Statement Dated July 12, 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Making It LOUD

Making it LOUD 2011 Annual Report WWW.USFIRST.ORG1 For over 20 years, FIRST® Founder Dean Kamen and everyone associated with FIRST have been on a mission to spread President Barack Obama, along with White House Technology Officer Aneesh Chopra, continued to feature FIRST teams as perfect examples of the president’s national White the word about the many educational, societal, economical, and House Science Fair initiative promoting STEM (science, technology, engineering, and Dean Kamen will.i.am planetary benefits of getting youth and adults alike involved in theFIRST math) education and celebrating science and math achievement in American schools. Morgan Freeman experience. Despite not having access to the millions of marketing Soledad O’Brien dollars required to make FIRST a household “brand,” the program has continued to grow each year at a blistering pace. …aND loudER Books, magazines, newspapers, cable TV, and the Web helped us create noise, too, with ongoing national coverage by Bloomberg, CNN, Popular Mechanics, In 2011, however, thanks to the fervent interest of major figures Popular Science, Wired, ESPN Magazine, WallStreetJournal.com, and more. Author Neal Bascomb brought the FIRST experience to life in his inspiring in government, the media, and mainstream entertainment, the book, The New Cool.Time Warner Cable incorporated “volume” of voices promoting FIRST... FIRST into its national “Connect A Million Minds™” initiative, featuring our FRC program in its TV show “It Ain’t Rocket Science.” The clamor of FIRST recognition continues to grow ...GOT TuRNED UP loud...VERY loud! louder every day. The continuing mainstream exposure is helping propel us toward our goal of making FIRST known and recognized around the globe. -

ANNUAL REPORT ONE YEAR of Hunt Frank of Courtesy Photo BUILDING 89.8% of Every Dollar Donated Went Directly Toward $ $ % TOGETHER Building Homes

2013 ANNUAL REPORT ONE YEAR OF Hunt Frank of courtesy Photo BUILDING 89.8% of every dollar donated TOGETHER went directly toward $32,012 $656 90.5% building homes. According to the Better Business is the average income of is the average monthly of Habitat homeowners Bureau Wise Giving Alliance, Habitat homeowners. mortgage payment of are families of responsible charities spend at least Habitat homeowners. color, helping A BY THE NUMBERS GLANCE 65% of total expenses on program and spend no more than 35% of close the minority AT HABITAT’S IMPACT related contributions on fundraising. homeownership gap. 3,478 7,569 13,634 3,575 25 67 generous people and volunteers helped hours of sweat equity tons of building homes completed children moved into organizations made a provide a hand up. were contributed by material kept from in Multnomah and safe, healthy homes. financial contribution. Habitat homeowners, landfills and sold at northern Clackamas building their three area ReStores. counties. homes and their neighbors’ homes. Habitat for Humanity Portland/Metro East Annual Report < 2 > DEAR FRIENDS, Through extraordinary efforts from staff and volunteers and support from our OUR NEW INITIATIVES community, this was a year of growth and change for Habitat for Humanity Portland/ Metro East. The growth kick-startedin the spring when we learned Habitat for Humanity WILL USE THE SAME International selected our affiliate as one of four cities to receive a grant from Lowe’s Photo courtesy of Sarah Galbraith to help us launch the Neighborhood Revitalization Initiative (NRI). We also received an additional grant from the Ann and Bill Swindells Charitable Trust, specifically for TRIED AND TRUE rehabbing foreclosed and abandoned homes as part of this new initiative. -

Amberglen Community Plan

Create a vibrant regional activity center enlivened with high-quality pedestrian and environmental amenities, taking advantage of the region’s light rail system. AmberGlen Community Plan CITY OF HILLSBORO, OREGON Adopted by Ordinance No. 5933, January 19, 2010 AmberGlen Community Plan Adopted by Ordinance No. 5933, January 19, 2010 Prepared by the City of Hillsboro with Cardno WRG David Evans and Associates, Inc. Johnson Reid Land Use Economics 2007 OHSU/AmberGlen Concept Plan Prepared for the City of Hillsboro by PB PlaceMaking Leland Consulting Group Kittelson & Associates, Inc. SWCA Environmental Consultants Cover Illustration Credit: Sabrina Henkhaus, 2009 TABLE OF CONTENTS ACKNOWLEDGEMENTS ....................................................................................................... 1 INTRODUCTION ..................................................................................................................... 2 Purpose..........................................................................................................................2 Plan Organization .........................................................................................................3 BACKGROUND ...................................................................................................................... 4 Context...........................................................................................................................4 Planning Process ..........................................................................................................8 -

728 Ne Dekum Street

728 NE DEKUM STREET 0.11 acres in Portland, OR Investment Real Estate • www. hfore.com • (503) 241.5541 OFFERING MEMORANDUM 0.11 ACRES ON NE DEKUM ST• PORTLAND, OR PRICE SUMMARY Located in the heart of the Dekum Triangle, the property at 728 NE Dekum offers developers a rare opportunity to acquire a pivotal corner lot in an extremely popular, yet still relatively Price: $850,000 unknown neighborhood hub in close-in Northeast Portland. Price Per Sq. Ft.: $170 Anchored by a collection of popular eateries, the Dekum Triangle serves as the social epicenter of the up-and-coming Woodlawn Neighborhood. Establishments like Breakside Brewery, the PHYSICAL INFORMATION Firehouse Restaurant, Good Neighbor Pizzeria, Woodlawn Coffee & Pastry, the Grand Army Address 728 NE Dekum St Tavern, the Village Ballroom, and the Oregon Public House all call the Dekum Triangle their home. It is not uncommon to find sidewalk picnic tables in front of these businesses filled with City Portland patrons enjoying brunch and happy hours. County Multnomah Zoning CM2 728 NE Dekum is a 5,000-square-foot lot with CM2 zoning, which generally allows for a 45-foot height limit and a 2.5:1 FAR, though certain bonuses and restrictions may apply (a developer’s Acres 0.11 (5,000 sf) package is available upon request). Existing Building Sq. Ft. 2,130 The property currently contains a small commercial building that is leased to several wellness-oriented tenants including a yoga studio, acupuncturist, and martial arts school. TAX INFORMATION The spaces currently lease month-to-month and total $3,000. -

06-07 Target Industry Plan Feb 2007 Update

Economic Development Target Industry Plan Fiscal Year 2006/2007 Economic Development Target Industry Plan Fiscal Year 2006/07 Executive ummary In 2001, the Portland Development Commission (PDC) was asked by the Mayor of Portland to reate a new e onomi development strategy for the ity of Portland. Through a pro ess of resear h, analysis, onsultation and debate, a new e onomi development strategy emerged. A entral theme of this strategy was the analysis and promotion of a number of &targeted industries'. Target industry analysis and development has be ome a entral omponent of regional e onomi development strategies. (tili)ing various forms of e onomi data, in luding lo al wages, lo ation quotients, growth patterns and shift-share, target industry analysis aims to reate a thorough pi ture of the state of an industry in an area. (tili)ing this information, e onomi development pra titioners are able to implement mu h more effe tive industry programs, apitali)ing on regional strengths and bolstering weaknesses. The final targeted industries were hosen for a number of reasons, in luding high wages, high growth potential, lo al strength and high lo al on entration in the Portland Metropolitan Area. These industries now play a entral role in the Portland Development Commission,s e onomi development a tivities, and are reported upon in the yearly Target Industry Plan. The industries hosen for targeted e onomi development a tivity are- A tivewear and .utdoor /ear0 1ios ien es0 Creative 2ervi es0 Distribution and 3ogisti s0 4ood Pro essing0 5igh Te h0 Metals and Transportation Equipment, Professional 2ervi es, and 2ustainable Industries. -

BUSINESS and LIFESTYLE PUBLISHED by the Bendchamber

FREE 2016 BENDBUSINESS AND LIFESTYLE PUBLISHED BY THE BENDChamber TECH BIOSCIENCE BREWING DISTILLING FOOD Brian Fratzke CHAIRMAN OF THE BEND CHAMBER OF COMMERCE Owner of Fratzke Commercial Real Estate Advisors MAKE Works on Saturdays in his sweatpants, a t-shirt and fl ip fl ops. LEARN MORE ABOUT BRIAN - PAGE 52 the move Relocation resources - page 65 LOOK IN THE RED PAGES FOR BEND’S PREFERRED BUSINESSES - PAGE 76 OUR GRATITUDE GOES OUT TO ALL WHO HAVE SUPPORTED THIS ENDEAVOR, ESPECIALLY THE BEND CHAMBER MEMBERS WHO MAKE IT ALL POSSIBLE. PRODUCTION TEAM PHOTO BY: CHRISTIAN HEEB CASCADE CENTER OF PHOTOGRAPHY DESIGN & LAYOUT STEPHANIE SHAVER [email protected] resource (541) 382-3221 Guides Bend Chamber Staff ..........................4 EDITOR Bend Chamber Board of Directors ...5 RACHAEL REES VAN DEN BERG Community Resources ......................6 [email protected] (541) 382-3221 Business Resources ...........................8 Transportation...................................16 ADVERTISING Relocation .......................................64 PATTY DAVIS Preferred Business Listings [email protected] Red pages.. ......................................76 (541) 382-3221 PUbLIcaTIon credITS : MEMBERSHIP PUbLISher: bend chamber, PrInTIng bY: The bULLeTIn coVer PhoTo bY: The hIdden ToUch PhoTograPhY coVer deSIgn bY STePhanIe ShaVer ©2015 bend chamber. SHELLEY JUNKER no PorTIon of ThIS PUbLIcaTIon maY be reProdUced In anY form WIThoUT WrITTen conSenT from The bend chamber. The InformaTIon In ThIS dIrecTorY IS gaThered In [email protected] SUch a WaY aS To enSUre maXImUm accUracY. (541) 382-3221 COVER PHOTO BY THE HIDDEN TOUCH PHOTOGRPAHY 2 | bend chamber of commerce inside LifestyleArticles Business Articles History of the chamber ................... 18 Don’t lose your marbles ................................... 9 Once upon a time in Bend .............. 20 Entrepreneurial ecosystem ............................ -

Opportunities for Commercial Business

Opportunities for Commercial Business In Forest Grove Oregon 2013/2014 Updated 1/15/14 0 Index Highlights ................................................................................... 2 Demographic Summary .............................................................. 4 Population & Other Demographics ............................................. 5 Workforce .................................................................................. 6 Housing Sales And Permits ......................................................... 8 Income & Consumer Buying Power ............................................ 9 Unmet Retail Needs ................................................................. 11 Traffic Counts & Transportation Access .................................... 15 Commercial Sector Opportunities ............................................ 17 RESTAURANT/DINING OPPORTUNITIES ............................................... 17 TOURISM/VISITOR GROWTH ............................................................ 21 Pacific University And Other Local Institutions ......................... 24 Available Sites .......................................................................... 26 Contacts ................................................................................... 28 Appendix ................................................................................. 28 AVAILABLE SITES & PROPERTIES ........................................................ 28 Updated 1/15/14 1 Highlights Forest Grove Oregon, sitting next to the Silicon -

Cedar Mill Business Roundup

Like us on Facebook FREE for timely updates Sign up to get The News online: Cedar Mill News cedarmillnews.com/ Volume 18, Issue 10 October 2020 signup History in the News Election security in Washington County With all the confusion and con- election office or dropbox (13). Heritage trees at JQA Young House troversy surrounding the national Same question about the vote counting In the earliest photo we election, we wanted to check with process: What type/amount of security have of the John Quincy Washington County about how will be at the site (Elections office Adams Young House on they are ensuring the safety of our where the counting is happening)? Cornell, you can see a fruit own voting process. Here are the Understandably, it is critical that tree with a ladder propped answers to our questions. security measures being under- up against it. That pear tree, How will the county handle any taken at the Elections office, and and the apple tree next to it, disruption to ballot collection? exactly what the Security Plan is, still stand next to the house! It depends on the level of “dis- not be divulged. Election Security The apple tree had a few ruption.” Some may require Law plans are exempt from disclosure branches that were very Enforcement officers to get involved; under the public records law. A close to the house. Cedar some may be of a less dangerous county’s written Election Security Mill Historical Society nature, where the advice is to “wait” plan has to be filed with the Secre- (CMHS) Board Member until it is safe to move to the box to tary of State Elections Division by Robert Dupuy, and our deposit or collect the ballots. -

Company 1-800-FLOWERS.COM, Inc. 1St Source Bank A-Dec Inc

Company 1-800-FLOWERS.COM, Inc. 1st Source Bank A-dec Inc. A.C. Moore AAA Life Insurance Company AAFMAA ABC Imaging LLC Accellent Inc. Accuvant, Inc. ACE Cash Express Acentia, LLC ACI Worldwide, Inc. Acme Packet, Inc. Acronis Inc. Addus HealthCare, Inc. ADTRAN, Inc. Advanced Health Media, LLC Advanced Home Care Adventist HealthCare Inc AEGIS Insurance Services, Inc. Affinity Gaming Airvana Corporation AirWatch Akron Children's Hospital Alacare Home Health & Hospice Alaska Communications Systems Alaska Native Medical Center Alaska USA Federal Credit Union Alegent Creighton Health Alfa Mutual Insurance Company Allen Systems Group, Inc. Almac Group North America Almost Family Inc. Altisource Portfolio Solutions Ambac Financial Group Amegy Bank America First Credit Union American Automobile Association American Campus Communities, Inc. American Medical Systems AMERICAN SYSTEMS Corporation American Traffic Solutions, Inc. Americo Life, Inc. AmeriHealth District of Columbia Amerisure Mutual Insurance Company Amscot Financial, Inc. AmWINS Group, Inc. Analogic Corporation Analysts International Corporation Anchor BanCorp Wisconsin, Inc. Anthelio Healthcare Solutions Applied Systems, Inc. APS Healthcare Aptara Inc. Aptean Argon ST Inc. Art Van Furniture arvato North America Aspect Software, Inc. Aspen Dental Aspen Technology, Inc. Aspirus ASRC Federal Holding Company Associated Press Athens Regional Medical Center, Inc. Atlantic Tele-Network, Inc. AtlantiCare Atlanticus Holdings Corporation ATMI, Inc. Atos IT Solutions and Services, NA Atrion Networking Corporation Attorneys' Title Fund Services, LLC Audax Group, LP Audiovox Corporation Aurora Bank FSB Auxilium Pharmaceuticals, Inc. Avanade Inc. AVG Technologies USA, Inc. AVI-SPL, Inc. Avid Technology, Inc. Axcelis Technologies Axcess Financial Services, Inc. Bain Capital, LLC Baker Tilly Virchow Krause, LLP Baldwin & Lyons, Inc. -

2018 Impact Report Board of Directors Ambassador Board

2018 IMPACT REPORT BOARD OF DIRECTORS AMBASSADOR BOARD Jenna Mooney—Chair Mary Gordon—Chair Davis Wright Tremaine The Standard • • Maddie Andrews Reed Allen Community Leader Avocor • • Sheelagh Bandettini Evan Amano Dear friend of Friends, Portland General Electric Campbell Global • • It has been a great honor to serve as the new Executive Director for Friends of the Children-Portland during a time of Christopher S. Brisbee Jamee Asher USI Insurance Services Schwabe, Williamson & Wyatt • • incredible growth and impact. Thank you for believing in our model and investing in the lifelong success of our youth. Elise Brown Sarah Cieri Ebi Public Affairs Perkins & Co. • • Ryan Buchanan Kecia Classen I find myself frequently in awe of the breadth and depth of the Friend role. Friends work on a highly individualized basis eROI Microsoft • • with each of their youth and their families to help them successfully set and achieve their goals. They also provide Carmen Calzacorta Milo Coy Schwabe, Williamson & Wyatt Viking Heating & Sheet Metal opportunities for enriching experiences, and they advocate for additional resources. During a youth’s elementary • • Cynthia Campbell Nick Fix Founder Wells Fargo school years, Friends focus on supporting literacy and math skills. They provide encouragement as youth begin to • • Duncan Campbell Alex Fogg explore new activities and build positive peer and teacher relationships. When youth get older, Friends help youth Founder AgeRight Advantage • • develop critical skills that prepare them for navigating life beyond high school. These skills include building a positive Alyson Day Heidi Goertzen Nike Becker Capital Management network, applying for school and jobs, and finding access to healthcare and housing. -

Moving Forward TV Highway Background

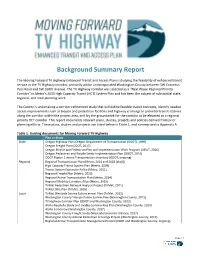

Background Summary Report The Moving Forward TV Highway Enhanced Transit and Access Plan is studying the feasibility of enhanced transit service in the TV Highway corridor, primarily within unincorporated Washington County between SW Cornelius Pass Road and SW 160th Avenue. The TV Highway corridor was selected as a “Next Phase Regional Priority Corridor” in Metro’s 2035 High Capacity Transit (HCT) System Plan and has been the subject of substantial state, regional, and local planning work. The County is undertaking a corridor refinement study that will define feasible transit concepts, identify needed access improvements such as bicycle and pedestrian facilities and highway crossings to potential transit stations along the corridor within the project area, and lay the groundwork for the corridor to be elevated to a regional priority HCT corridor. This report documents relevant plans, studies, projects and policies derived from prior planning efforts. These plans, studies and projects are listed below in Table 1, and summarized in Appendix A. Table 1. Guiding documents for Moving Forward TV Highway Plan or Study State Oregon Highway Plan (Oregon Department of Transportation (ODOT), 1999) Oregon Freight Plan (ODOT, 2017) Oregon Bicycle and Pedestrian Plan and Implementation Work Program (ODOT, 2016) Oregon Pedestrian and Bicycle Safety Implementation Plan (ODOT, 2014) ODOT Region 1 Active Transportation Inventory (ODOT, ongoing) Regional Regional Transportation Plan (Metro, 2014 and 2018 [draft]) High Capacity Transit System Plan (Metro, -

Portland Tribune

LOOK FOR INVITATIONS TO BID AND PUBLIC NOTICES STARTING ON PAGE 13 FEBRUARY 7, 2017 Tribune TUESDAY Business SMART CITIES SENSOR-SHIP BY JOSEPH GALLIVAN PCC STEM: SURVEY SAYS: GRANTS FOR DIRE MINORITIES, SHORTAGE OF WOMEN CONSTRUCTION WORKERS INSIDE 2 BUSINESS TRIBUNE Tuesday, February 7, 2017 5,000 LOCAL STORIES every month and GROWING! Beaverton Business Tribune Canby Clackamas Estacada Forest Grove Gresham—TuesdayGresham—Tuesday Gresham—FridayGresham—Friday Hillsboro King City Lake Oswego Oswego Madras Ashton Eaton talks track, life GETTING IT DONE World decathlon champion has new goals in mind — SEE SPORTS, B10 Blazers forward Ed Davis fl ies under the radar — SEE SPORTS, B10 PortlandTHURSDAY, DECEMBER 17, 2015 • TWICE CHOSEN THE NATION’S BEST NONDAILY PAPERTribune • PORTLANDTRIBUNE.COM • PUBLISHED TUESDAY AND THURSDAY PortlandTHURSDAY, DECEMBER 10, 2015 • TWICE CHOSEN THE NATION’S BEST NONDAILY TribunePAPER • PORTLANDTRIBUNE.COM • PUBLISHED TUESDAY AND THURSDAY The Portland Development Commission’s East Portlanders push Trang Lam discusses Lents redevelopment prospects outside Working back on gentrifi cation Class Acupuncture. landlord decided to sell the build- children. They wound up living in a Lents, starting As residents face more ing, so she’s living in an RV in her cramped hotel room for two months. to see new evictions, community tries brother’s backyard. Anna Litvinenko, her husband and vitality from “Now I’m fi nding that I might have their four children got evicted from urban renewal, to hold its ground to move out of the city limits just to their three-bedroom apartment in East is one of the survive,” says the Portland school em- Portland in October.