July 3 2020; Market Overview & Gold Commentary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

BMO Junior Gold Index ETF (ZJG) Summary of Investment Portfolio • As at September 30, 2015

QUARTERLY PORTFOLIO DISCLOSURE BMO Junior Gold Index ETF (ZJG) Summary of Investment Portfolio • As at September 30, 2015 % of Net Asset % of Net Asset Portfolio Allocation Value Holdings* Value Canada . 68.1 Royal Gold, Inc. 15.3 United States. 16.4 Kinross Gold Corporation . 11.3 Nicaragua . 5.5 Detour Gold Corporation. 10.3 Turkey. 3.7 Yamana Gold Inc. 9.0 Guyana . 2.3 New Gold Inc. 6.5 Mexico . 2.1 B2Gold Corp. 5.5 China . 1.9 Alamos Gold Inc. 5.4 Centerra Gold Inc. 5.1 Total Portfolio Allocation 100.0 NovaGold Resources Inc. 4.8 Torex Gold Resources Inc.. 4.2 % of Net Asset Alacer Gold Corporation . 3.7 Sector Allocation Value IAMGOLD Corporation. 3.6 Gold . 100.0 Semafo Inc.. 3.6 OceanaGold Corporation. 2.5 Total Sector Allocation 100.0 Guyana Goldfields Inc. 2.3 Primero Mining Corp. 2.1 China Gold International Resources Corp. Ltd. 1.9 Sandstorm Gold Ltd. 1.8 McEwen Mining Inc.. 1.1 NovaCopper Inc.** . 0.0 Total Holdings as a Percentage of Total Net Asset Value 100.0 Total Net Asset Value $36,269,676 *Represents entire portfolio. **Holdings of less than 0.05% are rounded to 0.0%. This Summary of Investment Portfolio may change due to the ETF’s ongoing portfolio transactions. Updates are available quarterly. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing. The exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. -

Annual Information Form February 26, 2018

Annual Information Form February 26, 2018 2017 Annual Information Form Table of Contents Nomenclature ................................................................................................................................................ 1 Cautionary Statement on Forward-Looking Information ............................................................................... 1 Glossary of Technical Terms ........................................................................................................................ 7 Corporate Structure ....................................................................................................................................... 9 Name, Address and Incorporation ........................................................................................................... 9 Intercorporate Relationships .................................................................................................................. 10 General Development of the Business ....................................................................................................... 12 Three-Year History ................................................................................................................................. 12 2015 .................................................................................................................................................. 12 2016 ................................................................................................................................................. -

Teck Annual Information Form

ANNUAL INFORMATION FORM March 15, 2010 TECK RESOURCES LIMITED Suite 3300, 550 Burrard Street Vancouver, British Columbia V6C 0B3 An additional copy of this Annual Information Form may be obtained upon request from the Corporate Secretary, Teck Resources Limited at the above address or from the company’s web site – www.teck.com TABLE OF CONTENTS NOMENCLATURE ................................................................................................................................................. III CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION ............................................... III GLOSSARY OF TECHNICAL TERMS ............................................................................................................... VI CORPORATE STRUCTURE .................................................................................................................................... 1 NAME, ADDRESS AND INCORPORATION ........................................................................................................ 1 INTERCORPORATE RELATIONSHIPS ................................................................................................................ 1 GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................................... 3 THREE-YEAR HISTORY ....................................................................................................................................... 3 2007 ..................................................................................................................................................................... -

BMO Equal Weight Global Gold Index ETF (ZGD) Summary of Investment Portfolio • As at September 30, 2019

QUARTERLY PORTFOLIO DISCLOSURE BMO Equal Weight Global Gold Index ETF (ZGD) Summary of Investment Portfolio • As at September 30, 2019 % of Net Asset % of Net Asset Portfolio Allocation Value Top 25 Holdings Value Canada ........................................................................................................ 60.1 Centerra Gold Inc. .............................................................. 3.6 United States .............................................................................................. 16.5 Gold Fields Limited, ADR ...................................................... 3.5 South Africa .................................................................................................. 9.7 OceanaGold Corporation ....................................................... 3.5 Australia ........................................................................................................ 3.5 Alacer Gold Corporation ....................................................... 3.5 Nicaragua ...................................................................................................... 3.4 Coeur Mining, Inc. ............................................................. 3.4 Cote D’Ivoire ................................................................................................. 3.3 Kirkland Lake Gold Ltd. ........................................................ 3.4 Brazil ............................................................................................................. 3.2 IAMGOLD Corporation -

Kinross Gold in Russia

Kinross Gold in Russia Stanislav Borodyuk, Vice-President, Head, Moscow Representative Office CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION All statements, other than statements of historical fact, contained or incorporated by reference in or made in giving this presentation and responses to questions, including but not limited to any information as to the future performance of Kinross, constitute “forward looking statements” within the meaning of applicable securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this presentation. Forward-looking statements contained in this presentation include those statements on slides with, and statements made under the headings “Tasiast Phase One Exceeds Expectations”, “Tasiast Expansion Update”, “Kinross Remains in Discussions with the Government of Mauritania”, “2019 Outlook”, “Project Milestones for 2019”, “Strong Balance Sheet and Financial Flexibility”, “Tasiast Project Financing Update”, “2019E Production and Costs”, “2019E Capital Expenditures”, “Solid Financial Position”, “Americas”, “Russia”, “West Africa”, “Development Projects”, “Portfolio of Development Projects”, “Round Mountain Phase W”, “Bald Mountain Vantage Complex”, “Fort Knox Gilmore”, “Chile Projects”, “Kupol Exploration Highlights”, “Another 1-Year Mine Life Extension in Russia”, “Chirano Exploration Highlights”, “Bald Mountain -

2021 Notice of Annual Meeting of Shareholders

Kinross Gold Corporation 2021 Notice of Annual Meeting of Shareholders 2021 Management Information Circular TSX: K NYSE: KGC Toronto Stock Exchange New York Stock Exchange Kinross is a global gold mining company with strong and consistent operating results driven by a high performance culture. With a balanced portfolio of mines and projects in three regions, our focus is delivering value based on the core principles of operational excellence, financial discipline and responsible mining. Expected Production Growth1,2 Expected 2021 Gold Production1,2 Our Core Values (Million Au eq. oz.) (Au eq. oz.) —— +/- 5% Putting people first. 2.7 2.9 Outstanding corporate citizenship. 2.4 20% High performance culture. • Americas Rigorous financial discipline. • Russia —— • West Africa 2.4M 58%22% 2021 2022 2023 Kinross Operations and Projects Fort Knox Kupol-Dvoinoye Manh Choh Chulbatkan-Udinsk Toronto (Head Office) Bald Mountain Round Mountain Tasiast Chirano Approximate Annual Production (koz.) <300 300-400 >400 Operating Assets Paracatu Development Projects La Coipa Lobo-Marte All figures in the Circular are in U.S. dollars unless otherwise stated. Annual production level for “Operating Assets” based on 2020 gold equivalent production. Annual production level for “Development Projects” based on previously disclosed expected total life-of- mine production divided by total mine-life. Endnotes referenced from this page through to and including page 15 can be found on page 140 of this document. Notice of 2021 Annual Meeting of Shareholders May 12, 2021 | 10:00 a.m. (EDT) Virtual only meeting via live audio webcast Webcast link: web.lumiagm.com/406172480 Meeting ID: 406-172-480 Password: kinross2021 Dear Kinross Shareholders, Accessing the virtual only meeting We invite you to attend Kinross’ 2021 annual meeting of Registered shareholders as of March 19, 2021 and duly shareholders (the meeting). -

FUND FACTS BMO Precious Metals Fund Series D May 26, 2021 Manager: BMO Investments Inc

FUND FACTS BMO Precious Metals Fund Series D May 26, 2021 Manager: BMO Investments Inc. This document contains key information you should know about BMO Precious Metals Fund. You can find more details in the fund's simplified prospectus. Ask your representative for a copy, contact BMO Investments Inc. at 1-800-668-7327 or [email protected] or visit www.bmo.com/gam/ca. Before you invest in any fund, you should consider how it would work with your other investments and your tolerance for risk. Quick facts Fund code(s): BMO31147 Fund manager: BMO Investments Inc. Date series started: November 21, 2017 Portfolio manager(s): BMO Asset Management Inc. Total value of fund on March 31, 2021: $82.8 Million Distributions: Annually in December (any net income and any net capital Management expense ratio (MER): 1.58% gains) Minimum investment: $500 initial, $50 additional What does the fund invest in? This fund’s objective is to increase the value of your investment over the long term by investing in securities of primarily Canadian companies in the precious metals industry. The fund invests mainly in Canadian companies that are involved in the exploration, mining, production or distribution of precious metals. The fund may invest up to 40% of the fund’s assets in foreign securities. The charts below give you a snapshot of the fund's investments on March 31, 2021. The fund's investments will change. Top 10 investments (March 31, 2021) Investment mix (March 31, 2021) 1. Newmont Corporation 9.8% Portfolio Allocation 2. Franco-Nevada Corporation 9.4% 72.3% Canada 3. -

Kinross Gold's 2020 Sustainability Report

2020 First Priorities Kinross Gold Corporation Sustainability Report OVERVIEW KINROSS ESG ACT ETHICALLY AND DO NO HARM MAKE A POSITIVE 2020 DATA TABLES INDEX PRIORITIES TRANSPARENTLY CONTRIBUTION Data tables organized by operating site and consolidated Contents into overall corporate metrics can be found on kinross.com. Overview ESG Priorities Act Ethically and Transparently Kinross Gold Profile 3 Kinross ESG Priorities 14 Ethical Conduct 19 CEO Message 4 Human Rights 19 2020 Performance Highlights 4 Responsible Procurement 20 Measuring our Progress 11 Public Policy 20 Understanding Emerging Risks 13 Tax Transparency 20 About this Report 100 Cybersecurity and Data Privacy 21 Commitment and Memberships (kinross.com) Do No Harm Make a Positive Contribution Data Tables, GRI and SASB Safety and Health 23 Employment 41 Production 56 Environment 25 Generating Value 47 Health and Safety 57 Community 34 Community Development 52 Workforce 59 Community Grievances 67 Local Procurement 68 Economic Value 69 Environmental 70 GRI and SASB Index 83 ESG Analyst Guide The content in this report is focused on our performance over the past year. The Management Approach (MA) narrative by topic is available in the Sustainability section of We recognize the increasing level of interest in our environmental, social and governance kinross.com. We have linked MA references in this report to the relevant content, which can (ESG) performance from our investors and the broader stakeholder community. To be found on our website. facilitate assessment of our record, we have highlighted the standards and principles that Kinross is using to guide our performance and reporting. We encourage readers to access Identifies the topic as a material ESG topic the indices in this report for information at the indicator level. -

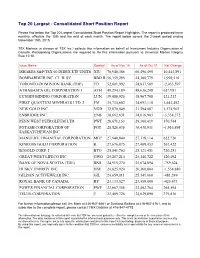

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Franklin Activequant Canadian Corporate Class

FRANKLIN ACTIVEQUANT As at September 30, 2020 CANADIAN CORPORATE CLASS Summary of Investment Portfolio REGIONAL WEIGHTINGS (%)* ASSET CLASS WEIGHTINGS (%) North America 98.57 Common Stocks 98.57 SECTOR WEIGHTINGS (%)* Short-term securities and all other assets, net 1.43 Financials 23.79 TOP 25 HOLDINGS (%) Materials 13.14 Intact Financial Corp. 3.18 Consumer Discretionary 12.20 Alimentation Couche-Tard Inc., B 3.08 Communication Services 11.42 Kinross Gold Corp. 3.05 Consumer Staples 10.92 Empire Co. Ltd., A 3.04 Industrials 10.48 Canadian Tire Corp. Ltd., A 3.01 Information Technology 9.85 Agnico Eagle Mines Ltd. 2.83 Energy 4.55 Canadian Pacific Railway Ltd. 2.83 Utilities 2.22 National Bank of Canada 2.82 Magna International Inc. 2.70 Waste Connections Inc. 2.69 Franco-Nevada Corp. 2.65 Canadian National Railway Co. 2.63 Wheaton Precious Metals Corp. 2.62 Royal Bank of Canada 2.61 Open Text Corp. 2.59 Cogeco Communications Inc. 2.54 Dollarama Inc. 2.53 Loblaw Companies Ltd. 2.48 CGI Inc., A 2.47 TMX Group Ltd. 2.42 Shopify Inc., A 2.42 TELUS Corp. 2.40 Sun Life Financial Inc. 2.40 Restaurant Brands International Inc. 2.40 Constellation Software Inc. 2.38 TOTAL NET ASSET VALUE: $3,765,000 * Excluding short-term securities and all other assets, net. The Fund invests substantially all of its assets in units of Franklin ActiveQuant Canadian Fund. Above is an outline of the investments held in Franklin ActiveQuant Canadian Fund as a percentage of its net assets. -

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending June 15th, 2014. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of June As of May Net Change 15 31 LUNDIN MINING CORPORATION LUN 57,731,739 58,112,509 -380,770 MANULIFE FINANCIAL CORPORATION MFC 48,856,265 40,100,862 8,755,403 BOMBARDIER INC. CL 'B' SV BBD.B 47,286,537 57,212,699 -9,926,162 TORONTO-DOMINION BANK (THE) TD 39,832,937 40,197,081 -364,144 NEW GOLD INC. NGD 35,183,624 35,086,936 96,688 ATHABASCA OIL CORPORATION J ATH 33,487,054 33,685,221 -198,167 KINROSS GOLD CORPORATION K 30,551,901 44,425,224 -13,873,323 THOMSON REUTERS CORPORATION TRI 29,802,166 30,112,958 -310,792 CELESTICA INC. SV CLS 29,124,816 29,341,668 -216,852 LEGACY OIL + GAS INC. LEG 28,989,039 28,300,550 688,489 ENBRIDGE INC. ENB 27,434,026 29,362,814 -1,928,788 ELEMENT FINANCIAL CORPORATION J EFN 26,104,583 22,747,466 3,357,117 GREAT-WEST LIFECO INC. GWO 25,910,830 20,130,441 5,780,389 BCE INC.