Recent Legislative Changes to Mill Levy Maximums (845.0 KB Pdf)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CPY Document

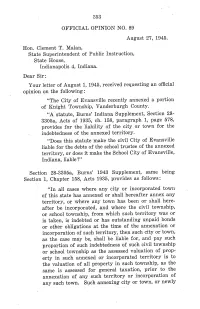

353 OFFICIAL OPINION NO. 89 August 27, 1945. Hon. Clement T. Malan, State Superintendent of Public Instruction, State House, Indianapolis 4, Indiana. Dear Sir: Your letter of August 1, 1945, received requesting an offcial opinion on the following: "The City of Evansvile recently annexed a portion of Knight Township, Vanderburgh County. "A statute, Burns' Indiana Supplement, Section 28- 3305a, Acts of 1935, ch. 158, paragraph 1, page 578, provides for the liabilty of the city or town for the indebtedness of the annexed territory. "Does this statute make the civil City of Evansvile liable for the debts of the school trustee of the annexed territory, or does it make the School City of Evansvile, Indiana, liable?" Section 28-3305a, Burns' 1943 Supplement, saine being Section 1, Chapter 158, Acts 1935, provides as follows: "In all cases where any city or incorporated town of this state has annexed or shall hereafter annex any territory, or where any town has been or shall here- after be incorporated, and where the civil township, or school township, from which such territory was or is taken, is indebted or has outstanding unpaid bonds or other obligations at the time of the annexation or incorporation of such territory, then such city or town, as the case mày be, shall be liable for, and pay such proportion of such indebtedness of such civil township or school township as the assessed valuation of prop- erty in such annexed or incorporated territory is to the valuation of all property in such township, as the same is assessed for general taxation, prior to the annexation of any such territory or incorporation of any such town. -

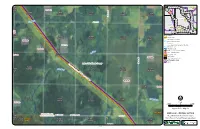

Volume 2 Appendix S Detailed Map Book Part 7 Central Section

! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 33 34 35 36 37 International ! 38 "11 T 158N 57 39 Falls R32W ! Red Lake 58 40 ! 59 41 S23 83 T 158N T 158N T 158N T 158N 60 42 80 81 82 ! T 158N 84 R32W S24 R31W S19 R31W S20 61 R31W S21 R31W S22 43 85 217" ! 44 " 17th Ave SW 62 86 ! 63 Koochiching 45 46 87 ! (! 64 County Big "65 "72 65 88" r " Falls 47 Riv!e 89 Rapid 67th St SW 66 48 ! (! 67 49 (! Beltrami (! 68 50 ! County 69 51 ! 70 71 "6 Kelliher Mizpah 72 " 90 73 52 ! 53 91 Northome 74 "1 75 76 54 Red ! 92 93 94 95 96 97 77 Funkley 98 55 Lake ! 78 79 56 T 158N ! Proposed Routes R32W S26 T 158N T 158N T 158N ! T 158N R32W S25 T 158N Orange Route R31W S30 R31W S29 (! ! R31W S28 ! (!( R31W S27 Anticipated Route Width Red Lake (! ! Anticipated Right-of-Way ! (! Residences ! Red Lake (! Commercial or Non-Residential Structure ! NHD Watercourse Red Lake ! PWI Watercourse ! Wildlife Management Area (WMA) reek yC ! o Indian Reservation Land T 158N Tr Snowmobile Trail Red Lake R31W! S31 ! Civil Township Red Lake ! Public Land Survey Section ! Existing Transmission Lines ! ! ! ! 500 kV 13th Ave SW Proposed! Orange Route Lake of the Woods County ! T 158N ! T 158N T 158N T 158N R32W S36 a ! T 158N Ch se Brook R31W S32 R32W ! R31W S33 R31W S34 S35 Xcel! Energy, Inc. 500kV ! ! ! ! ! ! Red Lake ! ! ! T 157N Red Lake ! R31W S3 -

""6 ""11 ""217 ""65 ""72

! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! T 159N R33W S5 T 159N R33W S4 T 159N ! T 159N T 159N T 159N 33 34 35 36 37 38 International R33W S3 ! "11 R33W S2 R33W S1 39 " Falls R32W S6 57 40 ! 58 59 41 Red Lake ! 80 81 82 83 60 42 84 ! 61 43 85 217" ! 44 " 62 86 ! 63 Koochiching 45 46 87 ! 64 County Big "65 "72 65 88" " Falls 47 ! 66 4889 T 159N ! T 159N T 159N 67 49 R33W S8 ! T 159N Beltrami R33W S9 R33W S10 T 159N 68 50 ! T 159N County R33W S11 69 51 R33W S12 R32W S7 Kelliher 70 71 "6 ! 90 Mizpah 72 52 73 53 ! 91 Northome 74 54 "1 75 76 ! 92 93 94 95 96 97 77 Funkley 98 55 79 ! 78 56 ! Xcel Energy, Inc. 500kV Proposed Routes ! Red Lake Orange Route ! Alternatives ! Route Variation ! Anticipated Route Width ! Anticipated Right-of-Way ! Proposed Orange Route USFWS Interest Lands ! Indian Reservation Land ! Public Land Survey Section ! Existing Transmission Lines T 159N T 159N ! T 159N ! ! 500 kV R33W S17 T 159N ! R33W S16 R33W S15 T 159N R33W S14 T 159N ! R33W S13 R32W S18 ! ! Lake of the Woods County ! ! Red Lake ! ! ! ! ! ! ! ! ! Beltrami South Variation ! T 159N T 159N ! T 159N R33W S20 T 159N R33W S21 T 159N ! R33W S22 R33W S23 T 159N R33W S24 !R32W S19 ! ! ! ! S ! a n t a ! A n I a ! F Red Lake o Feet r ! e s 2,000 0 2,000 -

IC 36-1-2 Chapter 2. Definitions of General Applicability

IC 36-1-2 Chapter 2. Definitions of General Applicability IC 36-1-2-1 Application to title Sec. 1. The definitions in this chapter apply throughout this title. As added by Acts 1980, P.L.211, SEC.1. IC 36-1-2-1.7 "Assessed value" Sec. 1.7. "Assessed value" has the meaning set forth in IC 6-1.1-1-3. As added by P.L.6-1997, SEC.202. IC 36-1-2-2 "Bonds" Sec. 2. "Bonds" means any evidences of indebtedness, whether payable from property taxes, revenues, or any other source, but does not include notes or warrants representing temporary loans that are payable out of taxes levied and in the course of collection. As added by Acts 1980, P.L.211, SEC.1. IC 36-1-2-3 "City" Sec. 3. "City" refers to a consolidated city or other incorporated city of any class, unless the reference is to a school city. As added by Acts 1980, P.L.211, SEC.1. IC 36-1-2-4 "Clerk" Sec. 4. "Clerk" means: (1) clerk of the circuit court, for a county; (2) county auditor, for a board of county commissioners or county council; (3) clerk of the city-county council, for a consolidated city; (4) city clerk, for a second class city; (5) clerk-treasurer, for a third class city; (6) clerk-treasurer, for a town; or (7) chief executive officer of a political subdivision not described in subdivisions (1) through (6). As added by Acts 1980, P.L.211, SEC.1. Amended by Acts 1981, P.L.44, SEC.35; P.L.186-2006, SEC.1. -

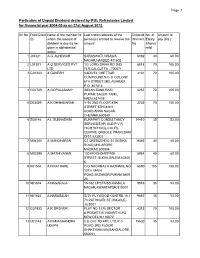

Particulars of Unpaid Dividend Declared by IFGL Refractories Limited for Finnancial Year 2004-05 As on 31St August 2012

Page :1 Particulars of Unpaid Dividend declared by IFGL Refractories Limited for finnancial year 2004-05 as on 31st August 2012 Srl No Folio/Client Name of the member to Last known address of the Dividend No. of Amount to ID whom the amount of person(s) entitled to receive the Warrant Equity pay (Rs.) dividend is due (to be amount No Shares given in alphabetical held order) 1 J03121 A G JILHEWAR SARASWATI,VISAWA 6092 40 60.00 NAGAR,NANDED,431602 2 L01301 A G SERVICES PVT 1/2 LORD SINHA RD 2ND 8018 70 105.00 LTD FLR,CALCUTTA,-,700071 3 G01203 A GANESH VADIVEL CHETTIAR 4101 70 105.00 COMPOUND,N G O COLONY 6TH STREET,MELAGARAM P.O.,627818 4 G01749 A GOPALASAMY INDIAN BANK,RASI 4267 70 105.00 PURAM,SALEM TAMIL NADU,637408 5 D03059 A K DHINAKARAN Y-94 2ND FLOOR 8TH 3732 70 105.00 STREET,6TH MAIN ROAD,ANNA NAGAR CHENNAI,600040 6 S08146 A L SUBHASHINI KURAPATI CONSULTANCY 14410 35 53.00 SERVICES,NR OLD P V R HIGH SCHOOL,COURL CENTRE ONGOLE PRAKESAM DIST,523002 7 M04200 A MANOHARAN C2 CRESCENDO,24 DESIKA 9345 40 60.00 ROAD,MYLAPORE MADRAS,600004 8 M03298 A MATHIVANAN 130 MOONGAPPADI 8984 40 60.00 STREET,GUGAI,SALEM,63600 6 9 K01504 A N KATHARE C/O NAGARAJ A KATHARE,NO 6690 105 158.00 107 II MAIN ROAD,SESHADRIPURAM,5600 20 10 N01674 A NAGARAJA 15-532 UPSTAISS,KAMALA 9916 35 53.00 NAGAR,AWANTAPUR,515001 11 N01624 A NARASAIAH SITY PLYWOOD CENTRE,18-1- 9887 35 53.00 73 PATHIVARI ST ONGOLE,- ,523001 12 G01933 A R GROVER FLAT NO 1275 SECTOR 4313 70 105.00 A,POCKET-B,VASANT KUNJ NEW DELHI,110072 13 U01148 A RAMACHANDRA E E O/O TD KPC LTD,R C 15830 35 53.00 UDUPA ROAD 3RD FLOOR SHAKTIBHAVAN,BANGALORE, 560001 Page :2 Particulars of Unpaid Dividend declared by IFGL Refractories Limited for finnancial year 2004-05 as on 31st August 2012 Srl No Folio/Client Name of the member to Last known address of the Dividend No. -

Introduction to Township Officials

Introduction to Township Officials Iowa residents living in rural areas outside of incorporated cities rely on their local township government to provide vital functions such as fire protection. Townships are also responsible for public cemeteries and resolving fence disputes. In addition, townships may choose to provide other services such as emergency medical service, township halls, parks, libraries, community centers, and playgrounds. The township trustees and township clerk are the locally elected officials who are responsible for seeing that these services are delivered effectively and economically. Their job is important and they represent the heart of local government for township residents. Yet many trustees and clerks assume their jobs with little or no training and experience. A Brief History of Township Government in Iowa The township as an institution of American local government had its beginnings in colonial New England. At that time, counties were subordinate to townships. In 1834, when Iowa was part of the Territory of Michigan, townships became an important factor in local affairs. During that time, counties and townships encompassed the same geographic area and the early responsibilities between them were often confusing. When Iowa became a state in 1848 there was considerable debate about the relationship between townships and counties. The first Iowa legislative assembly charged county commissioners with dividing counties into townships "as early as practicable." A civil township (one with election and revenue duties) was defined as 36 square miles. During this period the township was the preeminent source of government contact for the people as county government was not yet in place. By the late 1800s township trustees were responsible for property tax assessment, tax collection, schools, cemeteries, drainage districts, bridge construction, and animal disease control. -

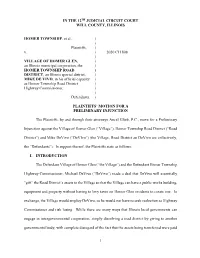

Plaintiff's Motion for a Preliminary Injunction

IN THE 12TH JUDICIAL CIRCUIT COURT WILL COUNTY, ILLINOIS HOMER TOWNSHIP, et al., ) ) Plaintiffs, ) v. ) 2020 CH 808 ) VILLAGE OF HOMER GLEN, ) an Illinois municipal corporation, the ) HOMER TOWNSHIP ROAD ) DISTRICT, an Illinois special district, ) MIKE DE VIVO, in his official capacity ) as Homer Township Road District ) Highway Commissioner, ) ) Defendants. ) PLAINTIFFS’ MOTION FOR A PRELIMINARY INJUNCTION The Plaintiffs, by and through their attorneys Ancel Glink, P.C., move for a Preliminary Injunction against the Village of Homer Glen (“Village”), Homer Township Road District (“Road District”) and Mike DeVivo (“DeVIvo”) (the Village, Road District an DeVivo are collectively, the “Defendants”). In support thereof, the Plaintiffs state as follows: I. INTRODUCTION The Defendant Village of Homer Glen (“the Village”) and the Defendant Homer Township Highway Commissioner, Michael DeVivo (“DeVivo”) made a deal that DeVivo will essentially “gift” the Road District’s assets to the Village so that the Village can have a public works building, equipment and property without having to levy taxes on Homer Glen residents to create one. In exchange, the Village would employ DeVivo, so he would not have to seek reelection as Highway Commissioner and risk losing. While there are many ways that Illinois local governments can engage in intergovernmental cooperation, simply dissolving a road district by giving to another governmental body, with complete disregard of the fact that the assets being transferred were paid 1 for, in part, by taxpayers other than residents of Homer Glen, is not one of them. Further, there is a way that the Road District may be legally dissolved, but the Village and Road District are not following the statutory procedure to do so because it requires voter approval that they know will not be forthcoming. -

PAN India Empanelled Hospital List As on 05 12 2014.Xlsx

MDINDIA HEALTHCARE SERVICES (TPA) PVT. LTD. Provider Management PAN India Empanelled Hospital List Date : 05_12_2014 Sr No Hospital Name Location City State Address Status PPN Hospital PPNCITY 1 Konaseema Institute Of Medical Sciences & Research Centre Amalapuram Amalapuram Andhra Pradesh Nh 2014 Chaitanya Naar Near Red Bridge Empanelled PPN Not Applicable Other 2 V N Nursing Home Opp Vasista Lodge Amalapuram Andhra Pradesh 3-2-117 E K N F Road Opp Vasista Lodge Empanelled PPN Not Applicable Other 3 Aasha Hospital Court Rd Anantapur Andhra Pradesh 7/201 Court Road Empanelled PPN Not Applicable Other 4 Chandra Superspeciality Hospital Rtc Bus Stand Anantapur Andhra Pradesh # 13-2-390 Shirdi Nagar Empanelled PPN Not Applicable Other 5 Devi Nursing Home Adimurthy Nagar Anantapur Andhra Pradesh Adimurthy Nagar Empanelled PPN Not Applicable Other 6 Dr Akbar Eye Hospital Sai Nagar Anantapur Andhra Pradesh D No 12-234, 6Th Lane Empanelled PPN Not Applicable Other 7 Dr Ysr Memorial Hospital Sai Nagar Anantapur Andhra Pradesh 12-2-878 I Cross Sai Nagar Near Sbi Main Branch Empanelled PPN Not Applicable Other 8 Meda Nursing Home Railway Station Road Anantapur Andhra Pradesh Railway Station Road Empanelled PPN Not Applicable Other 9 Sri Sai Krupa Nursing Home Sarojini Road Anantapur Andhra Pradesh 10/368, Sarojini Road, Anantapur Empanelled PPN Not Applicable Other 10 Vasan Eye Care Hospital Street Raju Road Anantapur Andhra Pradesh #15/581 Street Raju Road Anantapur Empanelled PPN Not Applicable Other 11 Snehalatha Hospitals Khoja Nagar Anantapuram -

North Dakota Election Laws

2015-2017 _____________________ NORTH DAKOTA ELECTION LAWS August 2015 North Dakota otes 2016 SECRETARY OF STATE Alvin A Jaeger State of North Dakota 600 E Boulevard Ave Dept 108 Bismarck ND 58505-0500 ELECTIONS UNIT (701) 328-4146 [email protected] www.vote.nd.gov Alternate formats for persons with disabilities are available upon request. * DISCLAIMER * The following excerpts of North Dakota law are from the North Dakota Century Code (NDCC) and pertain to elections and election procedures. Although every attempt has been made for accuracy, the reprint of these laws does not carry the same authority as the actual NDCC and should not be equated with the official NDCC. This compilation is only intended as a helpful resource and reference for consolidated election related laws. For official and legal purposes, the official NDCC should be used. In addition, the following excerpts of North Dakota law do not contain the material found in the notes following the various sections contained in the NDCC. These notes found in the NDCC may contain temporary provisions and effective dates. For a more comprehensive understanding of election related changes made during the 2015 session of the Legislative Assembly, please refer to 2015 Session Laws. * DISCLAIMER * 2015-2017 North Dakota Election Laws Page 1 (This page intentionally left blank) Page 2 2015-2017 North Dakota Election Laws Table of Contents TITLE 1 GENERAL PROVISIONS ............................................................................ 5 CHAPTER 1-01 – General Principles and Definitions -

SENATE BILL No. 35 _____

Introduced Version SENATE BILL No. 35 _____ DIGEST OF INTRODUCED BILL Citations Affected: IC 7.1-3-20-16.1; IC 36-1; IC 36-2-4-8; IC 36-5-1-20; IC 36-9-13-2. Synopsis: Statutes applicable to Lake and St. Joseph counties. Adds references to Lake County and St. Joseph County that were removed in P.L.278-2019. Makes conforming amendments. Effective: July 1, 2019 (retroactive). Houchin January 4, 2021, read first time and referred to Committee on Local Government. 2021 IN 35—LS 6302/DI 87 Introduced First Regular Session of the 122nd General Assembly (2021) PRINTING CODE. Amendments: Whenever an existing statute (or a section of the Indiana Constitution) is being amended, the text of the existing provision will appear in this style type, additions will appear in this style type, and deletions will appear in this style type. Additions: Whenever a new statutory provision is being enacted (or a new constitutional provision adopted), the text of the new provision will appear in this style type. Also, the word NEW will appear in that style type in the introductory clause of each SECTION that adds a new provision to the Indiana Code or the Indiana Constitution. Conflict reconciliation: Text in a statute in this style type or this style type reconciles conflicts between statutes enacted by the 2020 Regular Session of the General Assembly. SENATE BILL No. 35 A BILL FOR AN ACT to amend the Indiana Code concerning local government. Be it enacted by the General Assembly of the State of Indiana: 1 SECTION 1. -

Township Governance in Iowa ISSUE

ISSUE REVIEW Fiscal Services Division January 5, 2017 Township Governance in Iowa ISSUE This Issue Review provides an overview of township governance in Iowa, including township structure, the roles of trustees and clerks, the relationship between counties and townships, and statewide statistics on township revenue and expenditures for the past 10 years. AFFECTED AGENCIES Local Government Entities Department of Management CODE AUTHORITY Iowa Code chapters 359, 359A, and 360 DEFINITION OF TOWNSHIPS A township is a division of local government in the United States. The term may also be used to refer to a geographic subdivision of a county. For purposes of this Issue Review, the term “township” will be used to refer to both the geographic area and the local government. Townships in Iowa are classified as administrative subdivisions of the counties. For that reason, the U.S. Census Bureau does not count Iowa’s townships as separate governments and does not list Iowa among the states that have a civil township form of government.1 Today, there are 1,586 townships in Iowa. Many townships are instrumental in providing fire protection, emergency medical services, and other services to unincorporated areas. HISTORY OF TOWNSHIPS IN IOWA In the United States, the township form of local government originated in New England in the 17th Century, and it remains in nearly its original form in many parts of that region. As local government expanded westward and counties were established, township structure took one of two forms. In one form, the county was subordinate to the township. In the second form, the roles were reversed and the township was subordinate to the county. -

Irectionof the Ruraldivision 3 United Statesbureau Ofeducation

I. DEPARTMENTOF THEINTERIOR BUREAU OFEDUCATION Aso. 11..... BULLETIN,1924, No.36 AMANUALOFEDUCATIONAL LEGISLATION FORTHEGUIDANCEOFCOMMITTEESON EDUCATIONIN THESTATELEGISLATURES 4 1 . Prepared tinderthe directionof the RuralDivision 3 United StatesBureau ofEducation 4.- .% ; 4Ivrr /1 to ir-\1 WASHINGTON I! GOVERNMENTPRINTINGOFFICE 1925 111...011. I. ADDITIONAL COPIES OF Tins PUBLICATION MATBEPROCUREDTROIA THE SUPERINTENDENT OY DOCUMENTS GOVJERNM ENT PRINTING OFFICE WASHLNGTON, D. C. AT 10 CENTS PER COPY II - - teir CONTENTS Page CHAPTER I. Purposeand,:cope 1 The Stateand the school.: 2 A Stateprogram for education 3 II. Generalanalysis ofschool organizationand adpinistration_ ae- State educationalomnizations 4. 5 State boardsof education -rage 5 Statedepartments ofeducation a... 9 Chief Stateschool officer 9 Organizationfor localmanagenwnt _ 11 An effectivecounty unit 14 The county.:uperintendentof schook 16 Consolidated districtsand schools 17 III. Schoolcostand schoolsupport 23 Sources of schoolfund4k 25 Statetaxes and appropriations 26 Local =. W - - - d 'Methods ofdistributingschool funds 29 IV. Schoolattendance andcompulsoryattendancelaws__ 33 V. Physical education . _ _ 38 Object andscope_______ 39 Legislntive Provisions 40 VI. Schoolgrounds andbuildings 42 VII. The teaching staff 44 VIII. Certificationofteach.ers Ix. Schooltextbooks.... 49 ra . 411 41 4 . f"N Ii 'to k A MANUALOFEDUCATIONALLEGISLATION Chapter PURPOSEAND SCOPE This manualis printedprimarilyto presentto educationalcom- mittees ofthe Statelegislaturesthatconvenein1925