Toyo Ink SC Holdings / 4634

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Nippon COMSYS Corporation Annual Report 1999

ANNUAL REPORT 1999 Fiscal Year Ended March 31, 1999 COMSYS — For Excellence in Telecommunications Profile Financial Highlights • Nippon COMSYS Corporation • • Years ended March 31, 1998 and 1999 • • • • • Thousands of Nippon COMSYS Corporation was founded in 1951 to assume the duties of the Millions of yen U.S. dollars Change 1998 1999 1999 (%) Construction Division of Nippon Telegraph and Telephone Public Corporation (NTT). Contract backlog at beginning of the year ¥ 57,684 ¥ 68,458 $ 570,483 18.7% Since its establishment, the Company has been a leader in the telecommunications New orders received during the year 234,877 228,838 1,906,983 –2.6% Net sales 224,103 219,764 1,831,366 –1.9% engineering field. A specialist in communications and computer technology, Contract backlog at end of year 68,458 77,532 646,100 13.3% COMSYS, is striving to grow its business to meet the 21st century, and to make a Net income ¥ 7,611 ¥ 5,075 $ 42,292 –33.3% contribution to the development of the information-based society. We are fostering Total assets 160,561 166,002 1,383,350 3.4% a corporate culture characterized by fresh thinking and open communication, in Shareholders’ equity 90,101 96,635 805,292 7.3% which each employee can take pride, each employee can thrive, and each employee Ye n U.S. dollars can give full expression to his talents and capabilities. We are a creative organization, Per share: Net income ¥ 60.96 ¥ 38.78 $ 0.32 –36.4% working toward a better future. Cash dividends 14.25 10.00 0.08 –29.8% Note: Yen figures have been converted from U.S. -

GIANTPLUS TECHNOLOGY CO., LTD. 2019 Annual Report

Stock Code: 8105 GIANTPLUS TECHNOLOGY CO., LTD. 2019 Annual Report Notice to readers This English-version annual report is a summary translation of the Chinese version and is not an official document of the shareholders’ meeting. If there is any discrepancy between the English and Chinese versions, the Chinese version shall prevail. Taiwan Stock Exchange Market Observation Post System: http://mops.twse.com.tw Printed on May 2, 2020 Spokesperson Name: YI-CHENG CHEN Title: Vice President of Finance & Accounting Center Tel: (037) 611-611 E-mail: [email protected] Acting Spokesperson Name: YU-CHUNG HSIEH Title: Assistant Vice President of Marketing and Sales Center Tel: (037) 611-611 E-mail: [email protected] Headquarters, Branches and Plant Headquarters: No. 15, Industrial Rd., Toufen, Miaoli, Taiwan (R.O.C.) Plant: No. 15 and No. 13, Industrial Rd., Toufen, Miaoli, Taiwan (R.O.C.) Tel: (037) 611-611 Plant: No. 1127, Heping Rd., Bade City, Taoyuan, Taiwan (R.O.C.) Tel: (03) 367-9978 Plant: No. 2-1, Wenhua Rd., Hukou Township, Hsinchu, Taiwan (R.O.C.) Tel: (03) 611-6198 Stock Transfer Agent Name: Yuanta Securities Address: B1F., No. 210, Sec. 3, Chengde Rd., Datong Dist., Taipei, Taiwan (R.O.C.) Tel: (02) 2586-5859 Website: http://www.yuanta.com.tw CPA of the most recent financial report Accountant: CHUNG-YI CHIANG, JUNG-LIN LEE Accounting Firm: KPMG Address: 68F., No. 7, Sec. 5, Xinyi Rd., Xinyi Dist., Taipei, Taiwan (R.O.C.) Website: https://www.kpmg.com.tw Tel: (02) 8101-6666 Overseas Securities Exchange: Not applicable Corporate Website http://www.giantplus.com.tw CONTENTS I. -

Anellotech Plas-Tcat Funding from R Plus Japan Press Release June 30

Anellotech Secures Funds to Develop Innovative Plas-TCatTM Plastics Recycling Technology from R Plus Japan, a New Joint Venture Company launched by 12 Cross-Industry Partners within the Japanese Plastic Supply Chain Pearl River, NY, USA, (June 30, 2020) —Sustainable technology company Anellotech has announced that R Plus Japan Ltd., a new joint venture company, will invest in the development of Anellotech’s cutting-edge Plas-TCatTM technology for recycling used plastics. R Plus Japan was established by 12 cross-industry partners within the Japanese plastics supply chain. Member partners include Suntory MONOZUKURI Expert Ltd. (SME, a subsidiary of Suntory Holdings Ltd.), TOYOBO Co. Ltd., Rengo Co. Ltd., Toyo Seikan Group Holdings Ltd., J&T Recycling Corporation, Asahi Group Holdings Ltd., Iwatani Corporation, Dai Nippon Printing Co. Ltd., Toppan Printing Co. Ltd., Fuji Seal International Inc., Hokkaican Co. Ltd., Yoshino Kogyosho Co. Ltd.. Many plastic packaging materials are unable to be recycled and are instead thrown away after a single use, often landfilled, incinerated, or littered, polluting land and oceans. Unlike the existing multi-step processes which first liquefy plastic waste back into low value “synthetic oil” intermediate products, Anellotech’s Plas- TCat chemical recycling technology uses a one-step thermal-catalytic process to convert single-use plastics directly into basic chemicals such as benzene, toluene, xylenes (BTX), ethylene, and propylene, which can then be used to make new plastics. The technology’s process efficiency has the potential to significantly reduce CO2 emissions and energy consumption. Once utilized across the industry, this technology will be able to more efficiently recycle single-use plastic, one of the world’s most urgent challenges. -

Electronics System Coordinator

Electronics System Coordinator RYOSAN CO., LTD. CORPORATE PROFILE 2020 Since its founding, Ryosan has conducted corporate activities based on the strong conviction that “a corporation is a public institution.” This phrase means that corporations are founded in order to benefit society in both the present and the future. Corporations are allowed to exist only if they are needed by society. In other words, corporations lose their meaning when they are no longer needed by society. Ryosan will continue its corporate activities with this strong conviction and firm resolution. “A corporation is a public institution.” Ryosan keeps this phrase firmly in its heart as the Company moves forward into the future. Ryosan History ~1960 1970 1980 1990 2000 2010~ 1953 1974 1981 1996 2000 2012 Ryosan Denki Co., Ltd. is established Hong Kong Ryosan Limited is The company name is changed to Ryosan Technologies USA Inc. The head office is moved to the current Ryosan Europe GmbH is established. in Kanda-Suehirocho, Chiyoda-ku, established. Ryosan Co., Ltd. is established. Head Office Building. Tokyo. Consolidated net sales exceed 300 2014 1976 1982 1997 billion yen. Ryosan India Pvt. Ltd. is established. 1957 Singapore Ryosan Private Limited Consolidated net sales exceed Zhong Ling International Trading The Company is reorganized as is established. 100 billion yen. (Shanghai) Co.,Ltd. is established. 2001 2016 a stock company as Korea Ryosan Corporation and Ryosan Engineering Headquarters obtain Ryosan Denki Co., Ltd. 1979 1983 1999 (Thailand) Co.,Ltd. are established. ISO9001 certification. Ryotai Corporation is established. Stock is listed on the Second Section Kawasaki Comprehensive Business 1963 of the Tokyo Stock Exchange. -

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

CSR REPORT 2012 Report on Corporate Social Responsibility Activities

中島 凸版印刷 CSRレポート2012 英語版 印刷費 本社 初校 表紙 (1-4) CSR REPOR T 2012 CSR REPORT 2012 Report on Corporate Social Responsibility Activities As a member of GPN, we incorporate Green Purchasing in our printing services. This report incorporates eye-friendly displays as a consideration for as many different types of people as possible, regardless of individual differences in color perception. Monitors from the Color Universal Design Organization (CUDO), a nonprofit organization, have reviewed and certified this report for its universal design. http://www.toppan.co.jp/english/ © TOPPAN 2012.10 K I Printed in Japan 耐磨 OP ニス 表紙 1 IEditorial Policy IEye-friendliness and Readability Toppan is disclosing information in the hopes of encouraging dialogues on social This report considers eye-friendliness and readability in accordance with Toppan’s and environmental activities with more people, especially people who have an in-house guidelines. It also incorporates universal-design displays for as many interest or stake in Toppan’s corporate social responsibility (CSR) activities. Toppan different types of people as possible, regardless of individual differences in color edits this CSR report in line with the seven core subjects set under ISO 26000, perception. The universal design in this report has been reviewed and certified by an international standard on social responsibility. the Color Universal Design Organization (CUDO), a nonprofit organization, on IPeriod Covered entrustment by Toppan. This report mainly covers activities in fiscal 2011 (from April 2011 to March 2012), though information on prior and later years is also included in parts. ICSR Report 2012: Detailed Data IScope and Boundary of this Report A PDF file with detailed information on CSR activities is posted on the Toppan In principle, this report covers the social and environmental activities of Toppan website. -

TECHNICAL REPORT – PATENT ANALYSIS Enhancing Productivity in the Indian Paper and Pulp Sector

TECHNICAL REPORT – PATENT ANALYSIS Enhancing Productivity in the Indian Paper and Pulp Sector 2018 TABLE OF contEnts ACKNOWLEDGEMENTS 10 EXECUTIVE SUMMARY 11 1 INTRODUCTION 13 2 OVERVIEW OF THE PULP AND PAPER SECTOR 15 2.1. Status of the Indian Paper Industry 15 2.2. Overview of the Pulp and Papermaking Process 20 2.3. Patenting in the Paper and Pulp Industry: A Historical Perspective 22 2.4. Environmental Impact of the Pulp and Paper Industry 25 3 METHODOLOGY 27 3.1. Search Strategy 27 4 ANALYSIS OF PATENT DOCUMENTS USING GPI 31 4.1. Papermaking; Production of Cellulose (IPC or CPC class D21) 31 4.2. Analysis of Patenting Activity in Different Technology Areas using GPI 38 5 ANALYSIS OF THE INDIAN PATENT SCENARIO WITHIN THE CONTEXT OF THIS REPORT 81 5.1. Analysis of Patents Filed in India 81 6 CONCLUDING REMARKS 91 REFERENCES 93 ANNEXURE 94 Annexure 1. Technologies related to paper manufacturing 94 Annexure 2. Sustainable/green technologies related to pulp and paper sector 119 Annexure 3. Emerging Technology Areas 127 List OF FIGURES Figure 2.1: Geographical Spread of Figure 4.11: (d) Applicant vs. Date of Indian Paper Mills .................................16 Priority Graph: Paper-Making Machines Figure 2.2: Share of Different Segments and Methods ........................................42 in Total Paper Production .......................19 Figure 4.11: (e) Applicant vs. Date of Figure 2.3: Variety Wise Production of Priority Graph: Calendars and Accessories ..43 Paper from Different Raw Materials ........19 Figure 4.11: (f) Applicant vs. Date of Figure 2.4: Different Varieties of Paper Priority Graph: Pulp or Paper Comprising Made from Various Raw Materials ..........19 Synthetic Cellulose or Non-Cellulose Fibres ..43 Figure 2.5: Diagram of a Process Block Figure 4.11: (g) Applicant vs. -

Cases of Electronic Display Materials Manufacturers

The International Journal of Economic Policy Studies Volume 2 2007 Article 8 INTERNATIONAL DEPLOYMENT OF THE JAPANESE ELECTRONIC MATERIALS INDUSTRY: CASES OF ELECTRONIC DISPLAY MATERIALS MANUFACTURERS Ryoichi Namikawa Professor, Faculty of Policy Study, Iwate Prefectural University Takizawa-Sugo 152-52, Takizawa, Iwate, JAPAN E-mail: [email protected] ABSTRACT The Japanese chemical industry has built general chemicals factories overseas. Nevertheless, it has been reluctant to build factories that produce high-technology functional chemicals overseas, first because these factories are inseparable from R&D laboratories, second, because not all Asian countries have reached a sufficiently high level of technology to provide the necessary infrastructure and services for such factories. However, the author takes notice that the chemical industry has recently built some factories that produce electronic display materials that are typical of high-technology functional chemicals, in Asian countries. The author first collects and analyzes cases in which chemical companies have built factories overseas and then analyzes the market structure of display materials to clarify the reasons why they do so. First, the author has found that such deployment is a result of the increased production of electronic display in Asia, led by Korean companies. Second, the author has found a more fundamental factor underlying such deployment by observing the relation between the chemical industry and the electronics industry in this field in Japan from the viewpoint -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

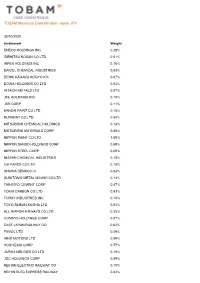

TOBAM Maximum Diversification Japan JPY

TOBAM Maximum Diversification Japan JPY 30/10/2020 Instrument Weight ENEOS HOLDINGS INC 0.28% IDEMITSU KOSAN CO LTD 0.51% INPEX HOLDINGS INC 0.16% DAICEL CHEMICAL INDUSTRIES 0.03% DENKI KAGAKU KOGYO K K 0.07% DOWA HOLDINGS CO LTD 0.04% HITACHI METALS LTD 0.07% JFE HOLDINGS INC 0.10% JSR CORP 0.11% KANSAI PAINT CO LTD 0.15% KURARAY CO LTD 0.04% MITSUBISHI CHEMICAL HOLDINGS 0.13% MITSUBISHI MATERIALS CORP 0.06% NIPPON PAINT CO LTD 1.09% NIPPON SANSO HOLDINGS CORP 0.59% NIPPON STEEL CORP 0.09% NISSAN CHEMICAL INDUSTRIES 0.18% OJI PAPER CO LTD 0.10% SHOWA DENKO K K 0.03% SUMITOMO METAL MINING CO LTD 0.13% TAIHEIYO CEMENT CORP 0.07% TOKAI CARBON CO LTD 0.83% TORAY INDUSTRIES INC 0.10% TOYO SEIKAN KAISHA LTD 0.04% ALL NIPPON AIRWAYS CO LTD 0.25% COMSYS HOLDINGS CORP 0.07% EAST JAPAN RAILWAY CO 0.02% FANUC LTD 0.49% HINO MOTORS LTD 0.05% HOSHIZAKI CORP 0.77% JAPAN AIRLINES CO LTD 0.16% JGC HOLDINGS CORP 0.09% KEIHAN ELECTRIC RAILWAY CO 0.10% KEIHIN ELEC EXPRESS RAILWAY 0.04% TOBAM Maximum Diversification Japan JPY 30/10/2020 Instrument Weight KEIO CORP 0.17% KINDEN CORP 0.05% KINTETSU CORP 0.20% KOMATSU LTD 0.06% KURITA WATER INDUSTRIES LTD 0.09% KYOWA EXEO CORP 0.06% KYUSHU RAILWAY COMPANY 0.08% LIXIL CORP 0.47% MABUCHI MOTOR CO LTD 0.05% MAKITA CORP 0.02% MITSUBISHI CORP 0.38% MITSUBISHI HEAVY INDUSTRIES 0.15% MIURA CO LTD 0.12% MONOTARO CO LTD 0.55% NAGOYA RAILROAD CO LTD 0.14% NIHON M&A CENTER INC 0.23% ODAKYU ELECTRIC RAILWAY CO 0.21% PARK24 CO LTD 0.48% SEIBU HOLDINGS INC 0.06% SEINO HOLDINGS CO LTD 0.05% SG HOLDINGS CO LTD 1.34% SHIMIZU -

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD.