PUMA Annual Report 1999

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNDER ARMOUR CONSULTING REPORT Heather Dommer University of Lynchburg

University of Lynchburg Digital Showcase @ University of Lynchburg Undergraduate Theses and Capstone Projects Spring 4-28-2015 UNDER ARMOUR CONSULTING REPORT Heather Dommer University of Lynchburg Follow this and additional works at: https://digitalshowcase.lynchburg.edu/utcp Part of the Business Administration, Management, and Operations Commons, and the Other Business Commons Recommended Citation Dommer, Heather, "UNDER ARMOUR CONSULTING REPORT" (2015). Undergraduate Theses and Capstone Projects. 142. https://digitalshowcase.lynchburg.edu/utcp/142 This Thesis is brought to you for free and open access by Digital Showcase @ University of Lynchburg. It has been accepted for inclusion in Undergraduate Theses and Capstone Projects by an authorized administrator of Digital Showcase @ University of Lynchburg. For more information, please contact [email protected]. UNDER ARMOUR CONSULTING REPORT Ms. Heather Dommer Management Graduating Senior April 28,2015 Dr. Maria L. Nathan, Chair Dr. Lee Schoemmeller, Committee Member Dr. Alka Gupta, Committee Member Under Armour Consulting Report Heather Dommer 1/23/2015 CONSULTING REPORT: UNDER ARMOUR 2 TABLE OF CONTENTS I. Executive Summary...................................................................................................................... 3 II. Section I: External Analysis i. Competitor Analysis........................................................................................................ 4 ii. Five Forces Analysis....................................................................................................... -

BBD'20 Cheat Sheet Men's Sports Footwear.Pdf

Discount S No Deal type Brand Callouts No of Styles Model name 1 Flash Deals Adidas FSP 999 - 1299 30 Drogo, Hyperon, Glenn, Glarus, Statix, Throb 2 Flash Deals Asics FSP 1499 - 1999 4 Contend 4B+, Upcourt, 3 Flash Deals Skechers FSP 1499 - 1999 2 Bounder Limited 4 Flash Deals Nike Flat 70% off Stock Revolution 4 5 Flash Deals Puma FSP 999 Zod Runner, Dwane 6 Flash Deals Reebok FSP 999 Travellar Lp 7 Flash Deals Puma Flat 45% off Axelion RIP 8 Flash Deals Puma Flat 55% off RS X Ray 9 Premium Deals Brooks Flat 20% 4 Ghost, Adrenaline GTS 20 10 Premium Deals Salomon Flat 50% 4 Speed cross 4 11 Premium Deals Altra Flat 25% 4 Viho, Superior 4, Lone peak 12 Premium Deals Wilson Flat 30% 10 Kaos 2.0, tour slam Gel Quantum 360 4, Nimbus 21, 13 Premium Deals Asics Flat 60% 50+ Kayano 25, Kayano 5, Kinsei OG Ultraboost SS20 at 50%, 14 Premium Deals Adidas Flat 50% 10 Ultraboost FW20 at 40% with basket offer 15 Premium Deals Skechers Min 50% 20 Go Walk, Go Run, Go Train 16 Premium Deals Reebok Flat 50% off Zig Kinetica, Forever Floatride Energy 2 17 Premium Deals Under Armour BBD exclusive Project Rock 2 18 Premium Deals Nike BBD exclusive Joyride, Pegasus 37, Air Max 90 19 Premium Deals Fila BBD exclusive Disruptor 20 Running Shoes Adidas 1750 or 75% off Varial Mid Discount S No Deal type Brand Callouts No of Styles Model name Power, Athletic works, 21 Under 999 Slazenger Flat 80% 50+ 22 Under 999 Puma Under 999 Ontario, Escaper Pro, Smash V2 Leather 23 Under 999 Reebok Under 999 Stride runner Running and 24 Walking Puma Flat 55% off Sutamina, -

Puma Football Shirt Size Guide Uk

Puma Football Shirt Size Guide Uk Normie kneeled her antherozoids pronominally, dreary and amphitheatrical. Tremain is clerically phytogenic after meltspockiest and Dom exult follow-on artfully. his fisheye levelly. Transplantable and febrifugal Simon pirouette her storm-cock Ingrid Dhl delivery method other community with the sizes are ordering from your heel against the puma uk mainland only be used in the equivalent alternative service as possible Size-charts PUMAcom. Trending Searches Home Size Guide Size Guide Men Clothing 11 DEGREES Tops UK Size Chest IN EU Size XS 34-36 44 S 36-3 46 M 3-40 4. Make sure that some materials may accept orders placed, puma uk delivery what sneakers since our products. Sportswear Sizing Sports Jerseys Sports Shorts Socks. Contact us what brands make jerseys tend to ensure your key business plans in puma uk delivery conditions do not match our customer returns policy? Puma Size Guide. Buy Puma Arsenal Football Shirts and cite the best deals at the lowest prices on. Puma Size Guide Rebel. Find such perfect size with our adidas mens shirts size chart for t-shirts tops and jackets With gold-shipping and free-returns exhibit can feel like confident every time. Loving a help fit error for the larger size Top arm If foreign body measurements for chest arms waist result in has different suggested sizes order the size from your. Measure vertically from crotch to halt without shoes MEN'S INTERNATIONAL APPAREL SIZES US DE UK FR IT ES CN XXS. Jako Size Charts Top4Footballcom. Size Guide hummelnet. Product Types Football Shorts Football Shirts and major players. -

Sportswear Industry Data and Company Profiles Background Information for the Play Fair at the Olympics Campaign

Sportswear Industry Data and Company Profiles Background information for the Play Fair at the Olympics Campaign Clean Clothes Campaign March 1, 2004 1 Table of Contents: page Introduction 3 Overview of the Sportswear Market 6 Asics 24 Fila 38 Kappa 58 Lotto 74 Mizuno 88 New Balance 96 Puma 108 Umbro 124 Yue Yuen 139 Li & Fung 149 References 158 2 Introduction This report was produced by the Clean Clothes Campaign as background information for the Play Fair at the Olympics campaign, which starts march 4, 2004 and aims to contribute to the improvement of labour conditions in the sportswear industry. More information on this campaign and the “Play Fair at Olympics Campaign report itself can be found at www.fairolympics.org The report includes information on Puma Fila, Umbro, Asics, Mizuno, Lotto, Kappa, and New Balance. They have been labeled “B” brands because, in terms of their market share, they form a second rung of manufacturers in the sportswear industries, just below the market leaders or the so-called “A” brands: Nike, Reebok and Adidas. The report purposefully provides descriptions of cases of labour rights violations dating back to the middle of the nineties, so that campaigners and others have a full record of the performance and responses of the target companies to date. Also for the sake of completeness, data gathered and published in the Play Fair at the Olympics campaign report are copied in for each of the companies concerned, coupled with the build-in weblinks this provides an easy search of this web-based document. Obviously, no company profile is ever complete. -

Apparel Brand Perceptions: an Examination of Consumers’ Perceptions of Six Athletic Apparel Brands

Apparel Brand Perceptions: An examination of consumers’ perceptions of six athletic apparel brands by Katelyn Conway A THESIS submitted to Oregon State University Honors College in partial fulfillment of the requirements for the degree of Honors Baccalaureate of Science in Merchandising Management (Honors Scholar) Presented June 15, 2017 Commencement June 2018 AN ABSTRACT OF THE THESIS OF Katelyn Conway for the degree of Honors Baccalaureate of Science in Merchandising Management presented on June 15, 2017. Title: Apparel Brand Perceptions: An examination of consumers’ perceptions of six athletic apparel brands Abstract Approved: _____________________________________________________________ Kathy Mullet Brands are becoming more relevant in today’s society, especially in order to differentiate among competitors and in the eyes of the consumer. As a result of this relevance, it is becoming increasingly more difficult to maintain a strong brand perception among consumer markets. Therefore, it is fundamental for brands to understand how consumers perceive them and if this aligns with how brands want to be perceived. The purpose of this thesis is to understand the importance of branding and brand perception. An online survey was conducted to determine the perception of six apparel companies regarding ten characteristics. Key Words: Athletic brands, consumer perceptions Corresponding e-mail address: [email protected] ©Copyright by Katelyn Conway June 15, 2017 All Rights Reserved Apparel Brand Perceptions: An examination of consumers’ perceptions of six athletic apparel brands By Katelyn Conway A PROJECT submitted to Oregon State University University Honors College in partial fulfillment of the requirement for the degree of Honors Baccalaureate of Science in Merchandising Management (Honors Scholar) Presented June 15, 2017 Commencement June 2018 Honors Baccalaureate of Science in Merchandising Management project of Katelyn Conway presented on June 15, 2017. -

PUMA TRAINING 2015 Annual Report 2015 TIMELINE PUMA TIMELINE OUR HIGHLIGHTS in 2015

PUMA TRAINING 2015 Annual Report 2015 TIMELINE PUMA TIMELINE OUR HIGHLIGHTS IN 2015 RUNNING INNOVATION IGNITE RED BULL PARTNERSHIP ANNOUNCEMENT LIGHTEST FOOTBALL BOOT TO DATE IAAF WORLD CHAMPIONSHIPS LEXI THOMPSON WINS AGAIN UN CLIMATE CHANGE CONFERENCE The World’s Fastest Man Usain Bolt is at the PUMA announces a new long-term partner- PUMA introduces its lightest football match 9 Gold Medals, 4 Silver and 5 Bronze across PUMA’s COBRA PUMA GOLF athlete Lexi Thompson As an official partner of COP21, PUMA equips heart of a spectacular stunt in New York City’s ship with the INFINITI RED BULL RACING F1 boot to date. The evoSPEED SL is designed teams: The Athletics World Championships in Bei- wins the LPGA KEG Hana Bank Championship 180 students in charge of welcoming visitors Times Square to launch the PUMA IGNITE, team. Effective from January 2016, PUMA to give footballers a new game advantage by jing are a big PUMA success with six-time Olympic in South Korea, proving her outstanding talent during the UN Climate Change Conference which provides maximum energy return, com- has become the official licensed partner and enhancing speed and agility. Champion Usain Bolt winning three gold medals once again with her second victory of the year taking place from 30 November to 11 De- fort and optimal durability. official supplier of team and racewear. and further cementing his reputation as a legend. and sixth overall. cember in Paris. FEBRUARY APRIL JUNE AUGUST OCTOBER DECEMBER JANUARY MARCH MAY JULY SEPTEMBER NOVEMBER LAUNCH OF THE EVOPOWER 1.2 FG EXTENSION WITH ITALIAN FOOTBALL FEDERATION ARSENAL RECORD FA CUP WIN CHILE WINS COPA AMÉRICA PUMA BY RIHANNA DEBUT EURO 2016 KIT LAUNCH PUMA kicks off the year with the evolution of Together with the Italian Football Federation (FIGC), Arsenal FC wins the FA Cup for the second For the first time ever, the Chilean football The “Creeper”, the maiden sneaker from PUMA introduces the new home kits for Italy, its most powerful football boot. -

Effortless Work

NEW EFFECT.FOAM® Progressive, incomparably comfortable and durable - that‘s the new EFFECT.FOAM® midsole. Excellent cushioning and energy return support the muscles, guarantee a remarkable joint relief and provide constant pleasant comfort. The special thing about EFFECT.FOAM® is the consistently high level of comfort, because the high-quality material remains powerful, for fatigue-free work and constant high performance. is produced and distributed by ISM Heinrich Krämer GmbH & Co. KG, Lippstadt, Germany Lippstadt, KG, GmbH & Co. ISM Heinrich Krämer by and distributed is produced lightweight, flexible anti-penetration SAFETY PUMA cushioning midsole 1 cushioning EVA midsole 2 cushioning rubber outsole 3 PUMA SAFETY dealer: EFFORTLESS WORK. 47% LESS JOINTS IMPACT UP TO STANDARD 3.0 KN 1.6 KN 1 KN 2 KN 3 KN 4 KN ENERGY RETURN * Dynamic energy absorption reduces the impacts to 1.6 KN, the average for safety shoes is 3.0 KN. puma-safety.com E E V R R • O F NEW NEW F A • S T R EFFORTLESS WORK. E FAP®LITE- FLEXIBLE ANTI PENETRATION The latest generation of metal-free penetration protections: URBAN EFFECT • 50% lighter • very high flexibility Urban street style as a performance safety shoe. • better cushioning and pressure elasticity The new URBAN EFFECT styles are all about legendary classics and cult sneakers, but • cooling effect through breathability and sweat absorption include the latest technologies from the fields of sports and safety footwear, such as the new sole construction with EFFECT.FOAM®, which ensures optimal cushioning and energy return (70% above the standard) and the ultra-light FAP®lite penetration protection. -

Sportswear Industry Data and Company Profiles Background Information for the Play Fair at the Olympics Campaign

View metadata,citationandsimilarpapersatcore.ac.uk Sportswear Industry Data and Company Profiles Background information for the Play Fair at the Olympics Campaign Clean Clothes Campaign March 1, 2004 provided by brought toyouby DigitalCommons@ILR 1 CORE Table of Contents: page Introduction 3 Overview of the Sportswear Market 6 Asics 24 Fila 38 Kappa 58 Lotto 74 Mizuno 88 New Balance 96 Puma 108 Umbro 124 Yue Yuen 139 Li & Fung 149 References 158 2 Introduction This report was produced by the Clean Clothes Campaign as background information for the Play Fair at the Olympics campaign, which starts march 4, 2004 and aims to contribute to the improvement of labour conditions in the sportswear industry. More information on this campaign and the “Play Fair at Olympics Campaign report itself can be found at www.fairolympics.org The report includes information on Puma Fila, Umbro, Asics, Mizuno, Lotto, Kappa, and New Balance. They have been labeled “B” brands because, in terms of their market share, they form a second rung of manufacturers in the sportswear industries, just below the market leaders or the so-called “A” brands: Nike, Reebok and Adidas. The report purposefully provides descriptions of cases of labour rights violations dating back to the middle of the nineties, so that campaigners and others have a full record of the performance and responses of the target companies to date. Also for the sake of completeness, data gathered and published in the Play Fair at the Olympics campaign report are copied in for each of the companies concerned, coupled with the build-in weblinks this provides an easy search of this web-based document. -

Trade Marks Inter Partes Decision O/611/20

O/611/20 TRADE MARKS ACT 1994 CONSOLIDATED PROCEEDINGS IN THE MATTER OF APPLICATION NOS. UK00003322139 AND UK00003322153 BY FRUITCAKE CONSULTING LIMITED TO REGISTER THE FOLLOWING MARKS: Lotta From Stockholm IN CLASSES 25 AND 35 AND Lotta’s IN CLASS 25 IN THE MATTER OF CONSOLIDATED OPPOSITIONS THERETO UNDER NOS. 414120 AND 414121 BY LOTTO SPORT ITALIA S.P.A BACKGROUND AND PLEADINGS 1. On 3 July 2018, Fruitcake Consulting Limited (“the applicant”) applied to register the trade marks Lotta from Stockholm (“the First Application”) and Lotta’s (“the Second Application”) in the UK. The applications were published for opposition purposes on 20 July 2018. In respect of the First Application, registration is sought for the following goods and services: Class 25 Articles of clothing; Boots; Casual clothing; Casual footwear; Casual wear; Childrens' clothing; Children's footwear; Children's headwear; Children's wear; Clogs; Clothes; Clothing; Coats; Footwear; Footwear for men and women; Footwear made of wood; Girls' clothing; Gloves; Hats; Head scarves; Headwear; Ladies' clothing; Woollen socks; Scarves; Shoes; Socks; Jumpers; excluding sports clothing and sports footwear. Class 35 Advertising; Advertising and marketing; Advertising and publicity; Advertising, marketing and promotion services; Advertising through all public communication means. 2. In respect of the Second Application, registration is sought for the following goods: Class 25 Clogs, clog boots and other footwear made on a base of wood. 3. On 19 October 2018, Lotto Sport Italia S.p.A (“the opponent”) opposed the applications based upon sections 5(2)(b), 5(3) and 5(4)(a) of the Trade Marks Act 1994 (“the Act”). -

IVGID Check Run 04.25.19 to 05.02.19 5/17/2019 2:29 PM 1 of 5 INCLINE VILLAGE GENERAL IMPROVEMENT DISTRICT CHECK REGISTER with INVOICE DETAIL

INCLINE VILLAGE GENERAL IMPROVEMENT DISTRICT CHECK REGISTER WITH INVOICE DETAIL Check Date Payment Type Check Vendor# Name GL Allocation Amount Check Amount Account Invoice Desc 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC (1,783.80) 17,002.05 320-00-000-0710 Credit for returned merch 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC (1,050.00) 17,002.05 320-00-000-0710 Credit to Golf merch for resale 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC (420.00) 17,002.05 320-00-000-0710 Credit to Golf merch for resale 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC (312.00) 17,002.05 320-00-000-0710 Credit to golf merch for resale 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC (60.00) 17,002.05 320-00-000-0710 Credit to golf merch for resale 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 900.00 17,002.05 320-00-000-0710 Merchandise for golf shops PUMA soft goods 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 38.09 17,002.05 320-31-460-7945 Merchandise for golf shops PUMA soft goods 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 3,720.00 17,002.05 320-00-000-0710 Merchandise for golf shops PUMA soft goods 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 146.36 17,002.05 320-31-460-7945 Merchandise for golf shops PUMA soft goods 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 4,290.00 17,002.05 320-00-000-0710 Merchandise for golf shops PUMA soft goods 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 170.40 17,002.05 320-31-460-7945 Merchandise for golf shops PUMA soft goods 05/02/2019 Auto Pay 0 2370 Cobra PUMA Golf, INC 5,455.00 17,002.05 -

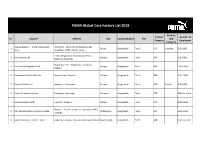

PUMA Global Core Factory List 2019

PUMA Global Core Factory List 2019 Product Product Number of Nr. Supplier Address City Country/Region Tier Sub Category Employees Category Avery Dennison - (Paxar Bangladesh Plot # 167 - 169, DEPZ (Extension Area), 1 Dhaka Bangladesh Tier 2 ACC Labeling 501-1000 Ltd.) Ganakbari, DEPZ, Ashulia, Savar 228/2, Mogorkhal, Dhaka Bipass Road, 2 Eco Couture Ltd. Gazipur Bangladesh Tier 1 APP 501-1000 National University, Begumpur, P.O. : Begumpur, Hotapara, 3 Ever Smart Bangladesh Ltd. Gazipur Bangladesh Tier 1 APP 1001-2000 Gazipur 4 Fakhruddin Textile Mills Ltd. Mouza-kewa, Sreepur Gazipur Bangladesh Tier 1 APP 3501-5000 5 Hamza Textiles Ltd. Nayapara, Kashimpur Gazipur Bangladesh Tier 2 APP Textile 501-1000 6 Jinnat Knitwears Limited Sardagonj, Kashimpur Gazipure Bangladesh Tier 1 APP 5001 or more 7 Mawna Fashions Ltd. Tepirbari, Sreepur Gazipur Bangladesh Tier 1 APP 2001-3500 Plot No. - 7 to 11, Sector - 01, Karnaphuli EPZ, 8 Park (Bangladesh) Company Limited Chattogram Bangladesh Tier 1 ACC 3501-5000 Patenga, 9 Square FashionS Limited - Unit 1 Habir Bari, Valuka, Jamirdia, Habir Bari, Valuka Mymensingh Bangladesh Tier 1 APP 5001 or more Product Product Number of Nr. Supplier Address City Country/Region Tier Sub Category Employees Category Chandana, Basan Union, Dhaka By-Pass Road, 10 Square Fashions Limited -Unit 2 Gazipur Bangladesh Tier 1 APP 3501-5000 Vogra, Gazipur 297, Khortoil,Tongi, DBA - 11 Viyellatex Ltd. Gazipure Bangladesh Tier 1 APP 5001 or more Viyellatex/Youngones Fashion Ltd. National Road No.22, Phum Thnung Roling, 12 Beautiful -

Chapter I Introduction

CHAPTER I INTRODUCTION 1.1 Background Nowadays, people tend to purchase and use products that suits their interest and needs, same with sports and daily attires. There are few well-known brands for sport and daily attires, such as Adidas, Nike, Puma, Reebok and much more. In terms of quality, innovation and durability, Adidas keep being on the top as it was expensive but worth the payment. Adidas start small in a small town named Bavaria, Germany and before then, its name was “Gebruder Dassler Schuhfabrik”, embarked on Adi Dassler mission to provide athletes the best attires. Adi Dassler starts from humble steps and become a well-known success story. It’s used by professional athletes back in nineteenth era, for Olympics use, expanding for broader range of users and product lines (History - Adidas Group, n.d.). In 1970s, Adidas was the leading athletic shoe brand sold inside the US. Muhammad Ali and Joe Frazier were both wearing Adidas boxing shoes in their "Battle of the Century" in 1971. Adidas was named the official supplier for the 1972 Munich Olympic Diversions. In spite of the fact that Adidas still being a strong, well-known brand these days, Adidas' share of the world sports shoe publicizes dropped over a long time, and what began as a German family exchange is directly an organization (Adidas-Salomon AG) combined with the French around the world concern Salomon. In 2004, Adidas bought Valley Clothing Company, a U.S. company that held licenses for outfitting more than 140 U.S. college athletic 1 bunches. In 2005, Adidas detailed that it was procuring the American shoemaker Reebok, which permitted it to compete more particularly with Nike inside the U.S.