– and the March Towards MASSIVE IOT by James Blackman Editor, Enterprise Iot Insights FEATURE REPORT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 January 2011 HSPA+ and LTE Device Tracker (2).Xlsx

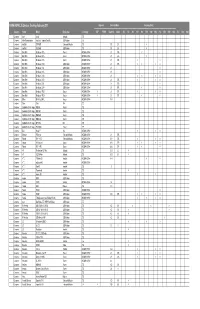

GSMA HSPA/LTE Devices Tracking February 2011 Approval Data rate (Mb/s) Frequency (MHz) Category Vendor Model Device type Technology GCF PTCRB Downlink Uplink 450 700 800 850 900 1700 1800 1900 2100 2300 2500 2600 2700 3300 3800 Consumer Acer Iconia Netbook LTE Consumer Altair Semiconductor FourGee™ ExpressCard UE USB Modem LTE Consumer AnyData DTP960S Embedded Module LTE 50 25 x Consumer AnyData ADU960S USB Modem LTE 50 25 x Consumer BandRich BandLuxe R300 Router WCDMA HSPA+ 21 5.76 xx Consumer BandRich BandLuxe R305 Router WCDMA HSPA+ 21 5.76 x Consumer BandRich BandLuxe R306 Router WCDMA HSPA+ 21 5.76 xx Consumer BandRich BandLuxe C320 USB Modem WCDMA HSPA+ 21 5.76 xx xx Consumer BandRich BandLuxe C321 USB Modem WCDMA HSPA+ 21 x Consumer BandRich BandLuxe C325 USB Modem WCDMA HSPA+ 21 x Consumer BandRich BandLuxe C326 USB Modem WCDMA HSPA+ 21 xx xx Consumer BandRich BandLuxe C330 USB Modem WCDMA HSPA+ 21 5.76 xxx Consumer BandRich BandLuxe C331 USB Modem WCDMA HSPA+ 21 5.76 x Consumer BandRich BandLuxe C339 USB Modem WCDMA HSPA+ 21 5.76 xx Consumer BandRich BandLuxe PR30 Router WCDMA HSPA+ x 21 5.76 xxx Consumer BandRich BandLuxe PR39 Router WCDMA HSPA+ x 21 5.76 xx Consumer Billion BiPAC 6200NXL Router WCDMA HSPA+ 14.4 Consumer Cisco Cius N/A LTE Consumer CradlePoint Technology MBR90 Router LTE Consumer CradlePoint Technology MBR900 Router LTE Consumer CradlePoint Technology MBR1000 Router LTE Consumer CradlePoint Technology MBR1200 Router LTE Consumer CradlePoint Technology NFS750L N/A LTE Consumer CradlePoint Technology PCS1400L Router -

Form 20-F for the Fiscal Year Ended March 31, 2017

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or Í ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2017 or ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from/to or ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report: Commission file number 1-6439 Sony Kabushiki Kaisha (Exact Name of Registrant as specified in its charter) SONY CORPORATION (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, KONAN 1-CHOME, MINATO-KU, TOKYO 108-0075 JAPAN (Address of principal executive offices) J. Justin Hill, Senior Vice President, Investor Relations Sony Corporation of America 25 Madison Avenue, 26th Floor New York, NY 10010-8601 Telephone: 212-833-6722 E-mail: [email protected] (Name, Telephone, E-mail and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares* New York Stock Exchange Common Stock** New York Stock Exchange * American Depositary Shares evidenced by American Depositary Receipts. Each American Depositary Share represents one share of Common Stock. ** No par value per share. Not for trading, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. -

Evaluation of LTE-M Towards 5G Iot Requirements

White Paper Evaluation of LTE-M towards 5G IoT requirements Contributing and Supporting Companies: V1.0 December 2017 Evaluation of LTE-M towards 5G IoT requirements for Category-M1 Devices White Paper Executive Summary LTE-M, a machine-focused variant of the 3GPP LTE standard, is designed to meet the high-coverage, low-cost, and low- power consumption requirements of the Internet of Things (IoT). In January 2017, a group of more than a dozen industry players evaluated LTE-M’s coverage performance, and published a white paper which concludes that LTE-M supports the very deep coverage required for IoT applications [1]. This follow-up paper takes the next step to evaluate the message latency, battery life, and capacity performance for LTE-M category-M1 devices. More specifically, this paper evaluates LTE-M performance against the initial Cellular IoT (CIoT) requirements in 3GPP TR 45.820 [2], but – perhaps more importantly – also compares LTE-M performance to the more recently published 3GPP 5G IoT or massive Machine-Type Communications (mMTC) requirements. The 5G IoT requirements for coverage, message latency, and battery life are specified in 3GPP TR 38.913 [3] and the capacity requirements are defined by the two ITU reports IMT-2020 evaluation guidelines [4] and IMT-2020 requirements [6]. Starting with the CIoT requirements, the message latency for LTE-M in extremely deep coverage conditions was found to be 6.2 seconds, which is well under the stated goal of 10 seconds. Battery life in extremely deep coverage conditions was determined to be 10.4 years, which is over the 10-year requirement assuming one 200 byte uplink message per day. -

MTC 008 V1.1.1 (2010-05) Group Specification

ETSI GS MTC 008 V1.1.1 (2010-05) Group Specification Mobile Thin Client (MTC); Use Cases and Requirements 2 ETSI GS MTC 008 V1.1.1 (2010-05) Reference DGS/MTC-0001 Rqmts Keywords ETSI 650 Route des Lucioles F-06921 Sophia Antipolis Cedex - FRANCE Tel.: +33 4 92 94 42 00 Fax: +33 4 93 65 47 16 Siret N° 348 623 562 00017 - NAF 742 C Association à but non lucratif enregistrée à la Sous-Préfecture de Grasse (06) N° 7803/88 Important notice Individual copies of the present document can be downloaded from: http://www.etsi.org The present document may be made available in more than one electronic version or in print. In any case of existing or perceived difference in contents between such versions, the reference version is the Portable Document Format (PDF). In case of dispute, the reference shall be the printing on ETSI printers of the PDF version kept on a specific network drive within ETSI Secretariat. Users of the present document should be aware that the document may be subject to revision or change of status. Information on the current status of this and other ETSI documents is available at http://portal.etsi.org/tb/status/status.asp If you find errors in the present document, please send your comment to one of the following services: http://portal.etsi.org/chaircor/ETSI_support.asp Copyright Notification No part may be reproduced except as authorized by written permission. The copyright and the foregoing restriction extend to reproduction in all media. © European Telecommunications Standards Institute 2010. -

Check Point Altair Semiconductor Solution Brief

Check Point and Altair Semiconductor | Solution Brief CHECK POINT + ALTAIR THREAT PREVENTION FOR MOBILE IOT DEVICES INSIGHTS Benefits Security is key for the safe and reliable operation of IoT (Internet of Things) connected devices. Security concerns cover personal privacy, financial transactions, the threat of Inspect all communications to and cyber theft, and safety. Network firewalls and protocols can manage the high-level from Altair LTE (Long-Term Evolution) chipsets on IoT devices traffic coursing through the Internet. IoT devices that usually have a very specific, with Check Point Capsule Cloud to defined mission with limited resources also have to be protected. prevent threats before they arrive into the device Applying common internet security practices in the IoT world requires substantial Offload security processing from IoT reengineering to address device constraints. Blacklisting, for example, requires too devices to Capsule Cloud much disk space to be practical for IoT applications. Embedded devices are designed Secure IoT devices with advanced for low power consumption, with a small silicon form factor, and often have limited threat prevention connectivity. They typically have only as much processing capacity and memory as Increase visibility of threats targeting needed for their tasks. IoT devices The endless variety of IoT applications poses an equally wide variety of security challenges. For example: tracking a device’s location, turning on the camera and microphone, and extracting application data information. A smart meter - one which is able to send energy usage data to the utility operator for dynamic billing or real-time power grid optimization - must be able to protect that information from unauthorized usage or disclosure. -

Smartphones 37 4.1 Customer Need: Mobility 37 4.2 Vendors 38 4.3 Operating System Duopoly 39 4.4 Hardware Specifications 40 Acronyms 46 Notes 47

Digital Services in the 21st Century IEEE Press 445 Hoes Lane Piscataway, NJ 08854 IEEE Press Editorial Board Tariq Samad, Editor in Chief Giancarlo Fortino Xiaoou Li Ray Perez Dmitry Goldgof Andreas Molisch Linda Shafer Don Heirman Saeid Nahavandi Mohammad Shahidehpour Ekram Hossain Jeffrey Nanzer Zidong Wang Digital Services in the 21st Century A Strategic and Business Perspective Antonio Sánchez Belén Carro Universidad de Valladolid, Spain Copyright 2017 by The Institute of Electrical and Electronics Engineers, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 750-4470, or on the web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permission. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. -

Technology Fair

Company Short Profile Web site Telecommunication Altair Semiconductor is the world's leading developer of ultra-low power, small footprint and high performance 4G chips for LTE. The company's chipsets are the most mature solutions in the market, offering device manufacturers integrating LTE into their products Altair with a power-optimized, robust and cost-effective solution. www.altair-semi.com BroadLight supplys IC devices and solutions to equipment vendors for FTTH applications. Thier technology spans from optical access to home networking which enables us to deliver highly integrated, low-cost, end-to-end solutions from the central office to the Broadlight customer premise. www.broadlight.com ColorChip designs and manufactures optical sub-systems and components that are based on Application Specific Photonic Integrated Circuits (ASPICs) that leverage the company’s unique Color Chip and robust PLC technology. www.color-chip.com Compass Electro-Optical Systems has developed breakthrough technology that enables the Internet evolution into the future. Using this technology, Compass-EOS is bringing to market a radically different system architecture that results in an order-of-magnitude increase in price-performance. Compass technology and products Compass deliver terabits of bandwidth at a fraction of the size and power www.compass- EOS required of conventional systems. eos.com DesignArt Networks provides innovative solution for LTE, WiMAX or HSPA RAN equipment. The company offers powerful SoC platforms, pre-loaded with field-proven SW packs for high- performance, yet extremely compact base stations (BTS), radio heads (RRH), or mesh and backhaul solutions (PMP), with the www.designartnetwo DesignART lowest power consumption rks.com Dorfour develops a world class communications IP. -

CEATEC JAPAN 2006 Exhibition Report

CONTENTS CEATEC JAPAN 2006 JAPAN CEATEC 1. SHOW INFORMATION 01 2. CHAIRMAN'S COMMENTS 02 3. OPENING EVENTS 03 4. EXHIBITION CONFIGURATION 04 5. EXHIBITION SITE 05 6. EXHIBITION TRENDS 06 7. SPONSORS PROJECTS AND SPECIAL EXHIBITS 13 8. CONFERENCE 15 9. EXHIBITORS 16 10. NUMBERS AND ANALYSIS OF VISITORS 19 11. ADVERTISING AND PUBLICITY 22 12. CEATEC JAPAN OFFICIAL WEB SITE 24 00 1. SHOW INFORMATION CEATEC JAPAN 2006 JAPAN CEATEC NAME CEATEC JAPAN 2006 (Combined Exhibition of Advanced TEChnologies-Providing Image, Information and Communications) OBJECTIVES 1.To allow visitors to experience the newest technologies, products, systems and software for the digital network age, and the convergence of communications, information and imaging technologies 2.To function as a highly specific exhibition capturing the interest and responding to the needs of users by presenting the industries' latest achievements and trends 3.As Asia's largest interactive exhibition of information on the communications, information and imaging fields, to present the achievements, trends and vitality of these industries to the world 4.To gather industry organizations to present clear social messages, thereby supporting industrial development and contributing to lifestyles, economies and society in the digital network age DURATION Tuesday, October 3-Saturday, October 7, 2006 (5 days), from 10:00 a.m.-5:00 p.m. Premiere Time: Tuesday, October 3, 10:00 a.m.-12:00 p.m. LOCATION Makuhari Messe 2-1 Nakase, Mihama-ku, Chiba, Japan ADMISSION Registration required Visitors Pre-registered on the Web: Free entry Visitors registering at the Gate: General: 1,000 (Students: 500) Note: Groups of 20 or more students and children under 12 years of age were admitted free of charge. -

SEMICONDUCTOR BIZ INSIGHT - Your 5 Minutes Monthly E-Link Digest Brought to You by VLSI Consultancy

February 2016 issue SEMICONDUCTOR BIZ INSIGHT - Your 5 minutes monthly e-link digest brought to you by VLSI Consultancy Hi, KEY TAKEAWAY Cloud computing, Machine learning, Artificial intelligence have been some of From the Asian arena the hot topics this month. Toshiba to sell chip operations and focus on its flash memory business, Alibaba has teamed up with NVidia with Foxconn to expand in India, Samsung, TSMC top available a $1B bet on cloud computing, wafer fab capacity embedded vision chip company Movidius has extended its collaboration with Google for Deep Learning, Google Mergers & Acquisitions has created a VR arm and then some Apple (Flyby Media), Sony (Altair more. Semiconductor), JV (Qualcomm & TDK, Qualcomm and Guizhou province in China) …..Leaves quite a bit of opportunity facets for the semiconductor industry. Have a good read and wish you Gong Xi Fa Cai from this part of the world. Warm Regards Meenu CONTACT Meenu Sarin | Director, VLSI Consultancy | Tel +65-98629814| Providing techno-commercial services to the semiconductor industry Website www.asic-vlsi.com |Email [email protected]| Blog www.asic-vlsi.com/newblog |Twitter @meenusarin | Facebook VLSI Consultancy | LinkedIn http://sg.linkedin.com/in/meenusarin INDEX Local Asia Pacific News Industry Headlines Financial Watch Mergers & Acquisitions, Joint Ventures, Spin-offs Market Outlook Views & Opinions Stock Watch Ps: If you see a need for Talent Development: Training for your engineers (pl. visit http://asic-vlsi.com/training.html for a list of offerings) Strategic Planning: Detailed research and an in-depth analysis for your specific market & technology intelligence requirements, Industry/Domain know-how for your financial/equity analysis, Do let me know; we can value-add. -

3D Cursor Tackles Augmented Reality

european www.electronics-eetimes.com September 2015 business press 3D CURSOR TACKLES AUGMENTED REALITY Special Focus: Energy Harvesting FREE SHIPPING CEO interview: Ambiq’s Mike Noonen ON ORDERS OVER €65! DIGIKEY.COM/ EUROPE 020212_FRSH_EET_EU_Snipe.indd 1 2/2/12 12:37 PM 150429_SUPR_EET_EU.indd 1 4/28/15 10:42 AM WHICH SINGER WORE A MEAT DRESS? RIGHT, AND WHICH MICROBIOLOGIST MAKES CLOTHES OUT OF MILK YARN? #WHYISIT Why is it that most of us know the woman who caused quite a stir when she pioneered a dress made out of meat, but nobody knows the woman who transforms fermented milk into yarn? Isn’t it time we recognized the people who invent the things that make our lives better? People like Anke Domaske, whose biopolymers, made from fermented milk, represent a natural alternative to traditional plastics, and could be used to make textiles and electronics more sustainable. Let’s celebrate the heroes of innovation. arrow.com/whyisit ARO=CC_15_2_17_Domaske_200x297mm.indd 1 27.08.15 16:39 WHO SAID “HASTA LA VISTA, BABY”? AND WHO SAID, “ ANYONE CAN PROGRAM A ROBOT”? #WHY ISIT Why is it that most of us know a fictional robot with a thick Austrian accent, but we don’t know the German engineer who makes real robots more intelligent? Isn’t it time that we recognized the people, whose inventions improve the world? People like Dr. Rainer Jäkel, who teaches industrial robots new workflows by physically demonstrating them. Let’s celebrate the heroes of innovation. arrow.com/whyisit ARO=CC_15_2_17_Jaekel_200x297mm.indd 1 27.08.15 16:40 SEPTEMBER 2015 OPINION 24 Motion engine beats gestures 4 Is 3D XPoint based on phase-change memory? 26 Augmented theatre: a 100% French feat 50 Let consumers figure out a use case for EEG During this summer’s Avignon festival, French cultural startup Theatre in Paris provided foreign theatre goers see- NEWS & TECHNOLOGY through and customizable surtitles. -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

Sequans Communications-Form 20-F 2019

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number 001-35135 SEQUANS COMMUNICATIONS S.A. (Exact name of Registrant as specified in its charter) Not Applicable (Translation of Registrant’s name into English) French Republic (Jurisdiction of incorporation or organization) 15-55 Boulevard Charles de Gaulle 92700 Colombes, France (Address of principal executive offices) Georges Karam Chairman and Chief Executive Officer Sequans Communications S.A. 15-55 Boulevard Charles de Gaulle 92700 Colombes, France Telephone: +33 1 70 72 16 00 Facsimile: +33 1 70 72 16 09 (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Symbol Name of each exchange on which registered American Depositary Shares, each representing four ordinary shares, nominal value €0.02 per share SQNS New York Stock Exchange Ordinary shares, nominal value €0.02 per share New York Stock Exchange* * Not for trading, but only in connection with the registration of American Depositary Shares.