Handelsbanken Funds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

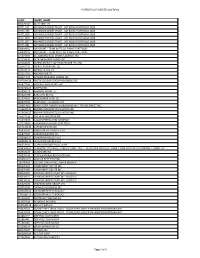

ANNUAL REPORT 2008 new for a New Era ANNUAL REPORT 2008 9-1, 2-ga, Namdaemun-ro, Jung-gu, Seoul 100-703, Korea Tel: (822) 2073-7114 www.kbfng.com CONTENTS 002 KB Financial Group at a Glance 003 Financial Indicators 004 Message from the Chairman 008 2008 Highlights 010 2008 Awards & Recognition New Star for New Corporate Value 014 Vision & Strategy 016 Senior Management 018 KB FGI Organization Chart 019 KB Financial Group Organization Chart 020 Synergy Creation 022 IT Systems 024 Risk Management New Star for New Social Value 030 Corporate Governance 032 Board of Directors 034 Ethical Management 036 Shareholder Relations 037 Corporate Culture 038 Social Contribution New Star for New Customer Value 042 Kookmin Bank 050 KB Investment & Securities 052 KB Futures 054 KB Asset Management 056 KB Real Estate Trust 058 KB Investment 060 KB Futures 062 KB Credit Information 064 KB Data Systems New Star for New Intrinsic Value 068 Management’s Discussion & Analysis 094 Auditor’s Report 188 Overseas Network 189 Forward-Looking Statements Business Summary Business Summary Business Summary Business Summary Business Summary Business Summary Business Summary Business Summary Business Summary Korea’s largest bank in terms of customers Joining KB Financial Group in March 2008, KB KB Life Insurance was established with KB Asset Management has made a vital KB Real Estate Trust seeks to lead the real KB Investment assists small and medium-sized KB Futures, a brokerage firm specializing in KB Credit Information specializes in the Established in 1991, KB Data Systems is a A new and branches, Kookmin Bank was also first Investment & Securities is a comprehensive capital participation by Kookmin Bank and ING contribution to the industry’s high growth with estate trust industry by providing superior enterprises in financial and business decision- derivatives, contributes to the development of management of unpaid receivables and specialized financial system company for IT in the financial industry to record net income securities company. -

KB Financial Group Inc. and Subsidiaries Consolidated Financial Statements December 31, 2019 and 2018

KB Financial Group Inc. and Subsidiaries Consolidated Financial Statements December 31, 2019 and 2018 KB Financial Group Inc. and Subsidiaries Index December 31, 2019 and 2018 Page(s) Independent Auditor’s Report ......................................................................................................... 1 - 5 Consolidated Financial Statements Consolidated Statements of Financial Position ........................................................................................ 6 Consolidated Statements of Comprehensive Income .............................................................................. 7 Consolidated Statements of Changes in Equity ....................................................................................... 8 Consolidated Statements of Cash Flows ................................................................................................. 9 Notes to the Consolidated Financial Statements .................................................................... 10 - 262 Independent Auditor’s Report (English Translation of a Report Originally Issued in Korean) To the Board of Directors and Shareholders of KB Financial Group Inc. Opinion We have audited the accompanying consolidated financial statements of KB Financial Group Inc. and its subsidiaries (collectively referred to as the "Group"), which comprise the consolidated statements of financial position as at December 31, 2019 and 2018, and the consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Wilmington Funds Holdings Template DRAFT

Wilmington Global Alpha Equities Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS USD/CAD FWD 20210616 00050 3.16% DREYFUS GOVT CASH MGMT-I 2.91% MORGAN STANLEY FUTURE USD SECURED - TOTAL EQUITY 2.81% USD/EUR FWD 20210616 00050 1.69% MICROSOFT CORP 1.62% USD/GBP FWD 20210616 49 1.40% USD/JPY FWD 20210616 00050 1.34% APPLE INC 1.25% AMAZON.COM INC 1.20% ALPHABET INC 1.03% CANADIAN NATIONAL RAILWAY CO 0.99% AIA GROUP LTD 0.98% NOVARTIS AG 0.98% TENCENT HOLDINGS LTD 0.91% INTACT FINANCIAL CORP 0.91% CHARLES SCHWAB CORP/THE 0.91% FACEBOOK INC 0.84% FORTIVE CORP 0.81% BRENNTAG SE 0.77% COPART INC 0.75% CONSTELLATION SOFTWARE INC/CANADA 0.70% UNITEDHEALTH GROUP INC 0.70% AXA SA 0.63% FIDELITY NATIONAL INFORMATION SERVICES INC 0.63% BERKSHIRE HATHAWAY INC 0.62% PFIZER INC 0.62% TOTAL SE 0.61% MEDICAL PROPERTIES TRUST INC 0.61% VINCI SA 0.60% COMPASS GROUP PLC 0.60% KDDI CORP 0.60% BAE SYSTEMS PLC 0.57% MOTOROLA SOLUTIONS INC 0.57% NATIONAL GRID PLC 0.56% PUBLIC STORAGE 0.56% NVR INC 0.53% AMERICAN TOWER CORP 0.53% MEDTRONIC PLC 0.51% PROGRESSIVE CORP/THE 0.50% DANAHER CORP 0.50% MARKEL CORP 0.49% JOHNSON & JOHNSON 0.48% BUREAU VERITAS SA 0.48% NESTLE SA 0.47% MARSH & MCLENNAN COS INC 0.46% ALIBABA GROUP HOLDING LTD 0.45% LOCKHEED MARTIN CORP 0.45% ALPHABET INC 0.44% MERCK & CO INC 0.43% CINTAS CORP 0.42% EXPEDITORS INTERNATIONAL OF WASHINGTON INC 0.41% MCDONALD'S CORP 0.41% RIO TINTO PLC 0.41% IDEX CORP 0.40% DIAGEO PLC 0.40% LENNOX INTERNATIONAL INC 0.40% PNC FINANCIAL SERVICES GROUP INC/THE 0.40% ACCENTURE -

Consolidated Annual Report 2013

Solutions for Demanding Business CONSOLIDATED ANNUAL REPORT 2013 CHAIRMAN´S LETTER MANAGEMENT REPORT SELECTED CONSOLIDATED FINANCIAL DATA CORPORATE GOVERNANCE CONSOLIDATED FINANCIAL STATEMENTS 4 March 2014 CONSOLIDATED ANNUAL REPORT 2013 CONTENTS I. CHAIRMAN´S LETTER .............................................................................. 4 II. MANAGEMENT REPORT ............................................................................ 6 1 GENERAL INFORMATION .......................................................................... 6 1.1 Organizational structure and nature of business operations ................ 6 1.2 General information ...................................................................... 6 2 SELECTED FINANCIAL DATA OF CONSOLIDATED FINANCIAL STATEMENTS .... 7 3 COMPANY VALUES .................................................................................. 8 3.1 Mission ........................................................................................ 8 3.2 Visions ........................................................................................ 8 3.3 The Company’s strategic goals ....................................................... 9 3.4 Characteristics of factors relevant to development of the Group .......... 9 3.5 Company management code ........................................................ 10 3.6 Code of conduct .......................................................................... 10 4 COMPANY´S AUTHORITIES .................................................................... 11 -

JNL SERIES TRUST Form NPORT-P Filed 2019-11-27

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2019-11-27 | Period of Report: 2019-09-30 SEC Accession No. 0001145549-19-048803 (HTML Version on secdatabase.com) FILER JNL SERIES TRUST Mailing Address Business Address 1 CORPORATE WAY 1 CORPORATE WAY CIK:933691| IRS No.: 381659835 | State of Incorp.:MA | Fiscal Year End: 1231 LANSING MI 48951 LANSING MI 48951 Type: NPORT-P | Act: 40 | File No.: 811-08894 | Film No.: 191256246 (517) 367-4336 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document JNL Series Trust Sub-Advised Funds (Unaudited) Schedules of Investments (in thousands) September 30, 2019 Shares/Par1 Value ($) JNL Multi-Manager Alternative Fund COMMON STOCKS 39.7% Financials 7.5% Act II Global Acquisition Corp. - Class A (a) 75 743 Alberton Acquisition Corp (a) (b) 150 1,534 Ally Financial Inc. 66 2,198 American International Group, Inc. (c) 90 4,988 Ameriprise Financial, Inc. 2 338 Aon PLC - Class A 8 1,533 Athene Holding Ltd - Class A (a) (c) 13 534 Bank of America Corporation (c) 95 2,782 Big Rock Partners Acquisition Corp. (a) 61 637 Brighthouse Financial, Inc. (a) 6 259 CF Finance Acquisition Corp. - Class A (a) 147 1,487 Chaserg Technology Acquisition Corp. - Class A (a) 24 243 China Construction Bank Corporation - Class H 656 500 Churchill Capital Corp II - Class A (a) 17 174 CIT Group Inc. (c) 62 2,828 Citigroup Inc. (c) 57 3,936 Citizens Financial Group Inc. 5 170 Collier Creek Holdings (a) 45 464 DBS Group Holdings Ltd. -

Emerging Markets Equity Income Fund MARKETING COMMUNICATION

WELLS FARGO (LUX) WORLDWIDE FUND | QUARTERLY COMMENTARY Q2 2021 | All information is as of 30 Jun 2021 unless otherwise indicated. Emerging Markets Equity Income Fund MARKETING COMMUNICATION Quarterly review GENERAL FUND INFORMATION ● The Emerging Markets Equity Income Fund underperformed the MSCI Emerging Portfolio managers: Alison Shimada, Markets Index (Net) but outperformed the MSCI Emerging Markets High Dividend and Elaine Tse Yield Index (Net) for the quarter that ended 30 June 2021. ● Positioning in communication services, utilities, South Africa and the Philippines Sub-adviser: Wells Capital contributed to relative attribution but was outweighed by negative stock selection in Management, Incorporated information technology (IT), industrials, China/Hong Kong and Taiwan. Benchmark: MSCI Emerging Markets Index (Net) Market review Fund inception: 29 Jun 2012 The MSCI Emerging Markets Index (Net) advanced 5.05% during the second quarter, INVESTMENT OBJECTIVES the fifth consecutive quarter of positive returns, taking the year-to-date return to AND PROCESS 7.45% and the one-year return to 40.90%. The MSCI Emerging Markets High Dividend ● The fund seeks long-term capital Yield Index (Net) underperformed, returning 2.31% during the second quarter. Ten out appreciation and current income. of eleven sectors generated positive returns during the quarter, including health care, ● The fund invests at least 80% of its industrials and energy. Real estate was the only sector that posted a negative return. At assets in dividend-paying emerging the country level, 17 out of 27 countries advanced, including Brazil, Poland, Hungary, market equity securities (companies the Czech Republic, Russia, the United Arab Emirates (UAE) and Saudi Arabia. -

POTENTIAL up DELETES 20170301 Page 1 of 9 CUSIP ISSUER NAME

POTENTIAL UP DELETES 20170301 CUSIP ISSUER_NAME 00507G102 ACTELION LTD 00771J121 ADVANCED SERIES TRUST - AST BOND PORTFOLIO 2028 00771J790 ADVANCED SERIES TRUST - AST BOND PORTFOLIO 2028 00771J816 ADVANCED SERIES TRUST - AST BOND PORTFOLIO 2028 00771J824 ADVANCED SERIES TRUST - AST BOND PORTFOLIO 2028 00771J857 ADVANCED SERIES TRUST - AST BOND PORTFOLIO 2028 00771J881 ADVANCED SERIES TRUST - AST BOND PORTFOLIO 2028 00889#102 AIM SHORT - TERM INVTS CO PRIME PORTFOLIO 00889#110 AIM SHORT - TERM INVTS CO PRIME PORTFOLIO 015271505 ALEXANDRIA REAL ESTATE EQUITIES, INC. 02133#110 ALTA MESA INVT HLDGS INC 02918A104 AMERICAN RLTY CAP HEALTHCARE TR II INC 03200*110 AMPAC PACKAGING LLC 03201#123 AMPAC HLDGS LLC 03311Y731 ANCHOR SER TR 03830*118 APPLIED RESEARCH WORKS INC 03970@124 ARCTIC GLACIER GROUP HOLDINGS INC 04287*106 ARSENAL WGH HLDGS INC 04367@123 ASEPTIA INC 06680#118 BANSHEE WINES LLC 06742A750 BARCLAYS BK PLC 08162#202 BENCHMARK HLDG CO 084670702 BERKSHIRE HATHAWAY INC. 10468*AD6 BRADY CORP / BRADY WORLDWIDE INC / TRICOR DIRECT INC 11566@119 BROWN INTEGRATED LOGISTICS INC 11566@127 BROWN INTEGRATED LOGISTICS INC 12632*150 CRC HEALTH GROUP INC 13123X409 CALLON PETROLEUM COMPANY 137137AA3 CANANDAIGUA NATL STAT TR III 14171@128 CAREGIVER SVCS INC 14387R302 CAROLINA FIRST MTG LN TR 146875505 CARVER BANCORP INC 15850@107 CHAMPION HOLDCO LLC 15850@115 CHAMPION HOLDCO LLC 18051#106 CLARION BRANDS HLDG CORP 18383M654 CLAYMORE EXCHANGE-TRADED FUND TRUST - GUGGENHEIM BULLETSHARES 2024 HIGH YIELD CORPORATE BOND ETF 18476#129 CLEARCARE INC 18683K408 CLIFFS NATURAL RESOURCES INC. 19326U100 COLE CR PPTY TR IV INC 19624R403 COLONY CAPITAL INC, SANTA MONICA 20367F2#7 COMMUNITY DEV TR INC 20367F3#6 COMMUNITY DEV TR INC 20823#109 CONNOR SPORT COURT INTL HLDG CO 20823#125 CONNOR SPORT COURT INTL HLDG CO 20823#133 CONNOR SPORT COURT INTL HLDG CO 22662X100 CRIMSON WINE GROUP LTD 228052205 CROWLEY HOLDINGS INC. -

League Tables Q1 2020 Q1 2020

KOREA CAPITAL MARKETS LEAGUE TABLES Q1 2020 Q1 2020 MANAGER RANKINGS KOREA CAPITAL MARKETS The Bloomberg Capital Markets Tables represent the top arrangers, bookrunners and advisors across a broad array of deal types including loans, bonds, equity and M&A transactions; according to Bloomberg standards. LEAG<GO> for a full range of league tables MA<GO> for a full range of merger & acquisition tables NI LEAG CRL<GO> or http://www.bloomberg.com/ for a full range of market-specific league table publications Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email Equities Joo Jeon +82 2 6360 1773 [email protected] Fixed Income Jin Ye Kim +82 2 6360 1763 [email protected] Seongji Ko +82 2 6360 1754 [email protected] Loans Soomi Oh +65 6231 3428 [email protected] © 2020 Bloomberg Finance L.P. All rights reserved. Bloomberg South Korea Capital Markets | Q1 2020 South Korea Bonds: Industry Breakdown South Korea Bonds 19% Q1 2020 Q1 2019 42% Mkt Volume (KRW Deal Prev Prev Mkt Mkt Share Firm Rank Share(%) Mln) Count Rank Share(%) Chg(%) KB Financial Group Inc 1 21.529 4,369,972 109 1 25.150 -3.621 39% NH Investment & Securities Co Ltd 2 18.937 3,843,787 76 2 22.397 -3.460 Korea Investment & Securities Co 3 13.741 2,789,058 80 3 10.509 3.232 SK Securities 4 10.251 2,080,772 78 4 8.581 1.670 Mirae Asset Daewoo Co Ltd 5 9.241 1,875,813 53 6 6.681 2.560 Government 42% Shinhan Financial -

The Mineral Industry of Czechia in 2016

2016 Minerals Yearbook CZECHIA [ADVANCE RELEASE] U.S. Department of the Interior March 2021 U.S. Geological Survey The Mineral Industry of Czechia By Lindsey Abdale In 2016, Czechia was the world’s 2d-ranked producer of Mineral Trade diatomite, having produced 15% of world output; the 4th-ranked producer of kaolin (9.7% of world output); and the 10th-ranked In 2016, Czechia’s total exports were valued at $163 billion producer of bentonite (1.9% of world output). The country did and its total imports were valued at $143 billion. Exports of not mine any metal ores but produced processed metal products, metals were valued at $14.3 billion; fuels (all types), $3 billion; such as crude steel, pig iron, and semimanufactured steel, as and all mineral products, $251 million. Imports of metals were well as secondary aluminum and lead metals. Production of valued at $15.4 billion; fuels, $6.4 billion; and all mineral mineral fuels and related materials included coal, small amounts products, $676 million. Germany received 32% of Czechia’s of crude petroleum, natural gas, and uranium. The country total exports; Slovakia, 8.3%; Poland 5.8%; France, 5.2%; and supplied about 70% of its total electricity demand through Austria, 4.2%. Czechia received 26.5% of its total imports from coal-fired thermal powerplants and nuclear powerplants in 2016 Germany; 12%, from China; 8.3%, from Poland; 5.1%, from (table 1; Euracoal, 2017; Crangle, 2018; West, 2018). Slovakia; and 3.2%, from France (Czech Statistical Office, 2017a; World Integrated Trade Solution, 2017). -

Cez Group: the Leader in Power Markets of Central and Southeastern Europe

CEZ GROUP: THE LEADER IN POWER MARKETS OF CENTRAL AND SOUTHEASTERN EUROPE Investment story, April 2019 AGENDA . Introduction, strategic priorities 1 . Traditional Generation 9 . Regulated and New Energy 18 . Financial performance 29 . Summary 35 . Backup 37 . Electricity market fundamentals 38 . Project of new nuclear in the Czech Republic 45 . EU ETS, derogation scheme in the CR 46 . Environmental, social and governance 48 . Regulation of distribution 52 . Renewables support schemes 56 . 2018 generation outlook 58 . Latest and historical financial results 59 1 CEZ GROUP RANKS AMONG THE TOP 10 LARGEST UTILITY COMPANIES IN EUROPE Top 10 European power utilities Top 10 European power utilities Number of customers in 2018, in millions Market capitalization in EUR bn, as of April 2, 2019 1 Enel 70.4 1 Enel 57.7 2 EDF 51.0 35.1 2 Iberdrola 3 Iberdrola 33.3 3 EDF 38.1 4 Innogy 22.0 4 Engie 32.9 5 E.ON 21.0 5 E.ON 22.0 6 Engie 20.6 6 Fortum 17.0 7 Vattenfall 11.0 7 Verbund 14.9 8 EDP 8.0 8 RWE 14.6 9 CEZ Group 6.9 9 EDP 13.0 10 EnBW 5.5 10 CEZ Group 11.2 2 Source: Bloomberg, Annual reports, companies’ websites and presentations CEZ GROUP IS AN INTERNATIONAL UTILITY WITH A STRONG POSITION IN CEE AND GROWING PRESENCE IN WESTERN EUROPE CEZ Group in the Czech Republic CEZ Group in Poland . Mining . Traditional Generation . Traditional Generation . Renewables . Renewables . ESCO, Sales . Distribution . ESCO, Sales CEZ Group in Romania . Renewables . Distribution CEZ Group in Germany . -

Morning Comments

Thursday, March 11, 2021 | daily publication Morning Comments Equity Market, Poland Research Department: Michał Marczak +48 22 438 24 01 Kamil Kliszcz +48 22 438 24 02 Jakub Szkopek +48 22 438 24 03 Aleksandra Szklarczyk +48 22 438 24 04 Michał Konarski +48 22 438 24 05 Paweł Szpigiel +48 22 438 24 06 Mikołaj Lemańczyk +48 22 438 24 07 Piotr Bogusz +48 22 438 24 08 Piotr Poniatowski +48 22 438 24 09 DJIA 32,297.0 +1.46% FTSE 100 6,725.6 -0.07% Copper (LME) 8,861.5 +0.93% S&P 500 3,898.8 +0.60% WIG20 2,003.6 +0.47% Crude Oil (Brent) 67.87 +1.42% NASDAQ 13,068.8 -0.04% BUX 43,579.4 +0.62% USD/PLN 3.8342 -0.09% DAX 14,540.3 +0.71% PX 1,070.9 +0.51% EUR/PLN 4.5738 +0.15% CAC 40 5,990.6 +1.11% PLBonds10 1.543 -0.030 EUR/USD 1.1929 +0.24% Company & Sector News ING BSK ING board recommends no dividend from 2020 Reduce – 2020-11-19 In market filling ING informed that board recommends to divide net profit from 2020 (PLN Target price: PLN 143.10 1337.6m) and unallocated profit from previous years (PLN 495.7m) into reserve capital in amount of PLN 675.4m, while leaving PLN 1157.9m unallocated. Up to now, we have assumed that ING will payout some minor dividend in 2021 (DY<2%), however it was rather symbolic. Leaving unallocated PLN 8.90 per share leaves hope for bigger future dividends.