Supplemental Information Package

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

03.031 Socc04 Final 2(R)

STATEOF CENTER CITY 2008 Prepared by Center City District & Central Philadelphia Development Corporation May 2008 STATEOF CENTER CITY 2008 Center City District & Central Philadelphia Development Corporation 660 Chestnut Street Philadelphia PA, 19106 215.440.5500 www.CenterCityPhila.org TABLEOFCONTENTSCONTENTS INTRODUCTION 1 OFFICE MARKET 2 HEALTHCARE & EDUCATION 6 HOSPITALITY & TOURISM 10 ARTS & CULTURE 14 RETAIL MARKET 18 EMPLOYMENT 22 TRANSPORTATION & ACCESS 28 RESIDENTIAL MARKET 32 PARKS & RECREATION 36 CENTER CITY DISTRICT PERFORMANCE 38 CENTER CITY DEVELOPMENTS 44 ACKNOWLEDGEMENTS 48 Center City District & Central Philadelphia Development Corporation www.CenterCityPhila.org INTRODUCTION CENTER CITY PHILADELPHIA 2007 was a year of positive change in Center City. Even with the new Comcast Tower topping out at 975 feet, overall office occupancy still climbed to 89%, as the expansion of existing firms and several new arrivals downtown pushed Class A rents up 14%. For the first time in 15 years, Center City increased its share of regional office space. Healthcare and educational institutions continued to attract students, patients and research dollars to downtown, while elementary schools experienced strong demand from the growing number of families in Center City with children. The Pennsylvania Convention Center expansion commenced and plans advanced for new hotels, as occupancy and room rates steadily climbed. On Independence Mall, the National Museum of American Jewish History started construction, while the Barnes Foundation retained designers for a new home on the Benjamin Franklin Parkway. Housing prices remained strong, rents steadily climbed and rental vacancy rates dropped to 4.6%, as new residents continued to flock to Center City. While the average condo sold for $428,596, 115 units sold in 2007 for more than $1 million, double the number in 2006. -

2014-1015 Upenn FRES Annual Report

1 Penn Compact 2020 builds on the past decade of progress we have made in advancing the University of Pennsylvania. It is a far-reaching vision that outlines next steps to increase access to Penn’s exceptional intellectual resources; integrate knowledge across academic disciplines with emphasis on innovative understanding and discovery; and engage locally, nationally, and globally to bring the benefits of Penn’s research, teaching, and service to individuals and communities at home and around the world. – Amy Gutmann, President University of Pennsylvania Average number of construction workers on campus per day working on Penn projects during summer 2015 2 UNIVERSITY OF PENNSYLVANIA FACILITIES & REAL ESTATE SERVICES BI-ANNUAL REPORT FY2014 –FY2015 The physical manifestation of the Penn Compact is the Penn Connects campus development plan – an exciting blueprint for the campus adopted in 2006. Penn Connects 2.0 builds on In review... that comprehensive strategy and reinforces the University’s sustainability objectives. Over the last decade, Penn has added 27.25 acres of new open space, 6 million sq. ft. of new construction, and 2.4 million sq. ft. of renovation, representing a total commitment of public and private investment of $3.8 billion. Bringing to life the vision of the Penn Compact falls in the most tangible way to us in Penn’s Facilities and Real Estate Services. The Division provides the expertise, business practices, policies and standards required to plan, design, construct, operate, maintain, and renew the physical assets of the University. Through these actions, our staff members across all departments impact the ability of the University to meet its goals in teaching and scholarship, medical research and clinical care, living and learning, and campus and community. -

Program Code Title Date Start Time CE Hours Description Tour Format

Tour Program Code Title Date Start Time CE Hours Description Accessibility Format ET101 Historic Boathouse Row 05/18/16 8:00 a.m. 2.00 LUs/GBCI Take an illuminating journey along Boathouse Row, a National Historic District, and tour the exteriors of 15 buildings dating from Bus and No 1861 to 1998. Get a firsthand view of a genuine labor of Preservation love. Plus, get an interior look at the University Barge Club Walking and the Undine Barge Club. Tour ET102 Good Practice: Research, Academic, and Clinical 05/18/16 9:00 a.m. 1.50 LUs/HSW/GBCI Find out how the innovative design of the 10-story Smilow Center for Translational Research drives collaboration and accelerates Bus and Yes SPaces Work Together advanced disease discoveries and treatment. Physically integrated within the University of Pennsylvania’s Perelman Center for Walking Advanced Medicine and Jordan Center for Medical Education, it's built to train the next generation of Physician-scientists. Tour ET103 Longwood Gardens’ Fountain Revitalization, 05/18/16 9:00 a.m. 3.00 LUs/HSW/GBCI Take an exclusive tour of three significant historic restoration and exPansion Projects with the renowned architects and Bus and No Meadow ExPansion, and East Conservatory designers resPonsible for them. Find out how each Professional incorPorated modern systems and technologies while Walking Plaza maintaining design excellence, social integrity, sustainability, land stewardshiP and Preservation, and, of course, old-world Tour charm. Please wear closed-toe shoes and long Pants. ET104 Sustainability Initiatives and Green Building at 05/18/16 10:30 a.m. -

Current and Future Market Conditions Q4 2017

Current and Future Market Conditions Q4 2017 Current and Future Market Conditions Q4 2017 Philadelphia’s CBD rallied with 250,000 SF of positive absorption during Q4, largely resulting from Jefferson HealthCare’s remarkable expansion. Absorption for the year was positive at 300,000 SF despite three relatively stagnant quarters to begin the year. The vacancy rate at year‐end is 8% with 3.2 million SF still available. New Leases: Jefferson Healthcare signed a new lease for 250,000 SF at 1101 Market Street. The healthcare group will initially lease 150,000 SF plus an additional total of 100,000 SF divided into 50,000 SF segments to be leased in two and four years, respectively. This new long‐term lease successfully backfills Aramark's departure, which will relocate to 2400 Walnut Street. Jefferson Healthcare’s explosive growth is a welcome addition to the city as it seeks to consolidate suburban mergers and acquisitions into its CBD portfolio. Additionally, Jefferson signed various lease term extensions ranging from 5‐10 years on 200,000 SF at 833 Chestnut Street. Hussian School of Art will relocate 20,000 SF from The Bourse Building to 1500 Spring Garden Street. The school entered a long‐term lease. Baker Tilly extended lease term at One Liberty Place for 11 years on the 44th and 45th floors. Simon & Simon will upgrade their image and location when they vacate 1515 Market Street to begin a new 5‐year, 30,000 SF lease on the 20th floor at 1818 Market Street. The law firm will backfill the space formerly occupied by Five Below. -

2014 Investor Property Tour – Evo Cira Centre South

2014 Investor Property Tour – evo Cira Centre South 0 Welcome and Speaker Introduction Campus Crest Communities, Inc Ted W. Rollins Chairman & Chief Executive Officer Robert M. Dann Executive Vice President & Chief Operating Officer Donnie L. Bobbitt Executive Vice President & Chief Financial Officer Brian L. Sharpe Executive Vice President & Chief Construction and Facilities Officer Guest Speakers Gerard H. Sweeney President, Chief Executive Officer and Trustee of Brandywine Realty Trust Matt Bergheiser Executive Director of University City District Craig R. Carnaroli Executive Vice President of the University of Pennsylvania 1 evo at Cira Centre South • 33-story student housing tower in University City, Philadelphia at SE corner of 30th and Chestnut Streets • Joint venture between three leading real estate investors o Brandywine (30%) o CCG (30%) o Harrison Street (40%) • 344 units / 850 beds • Total cost of $158.5 million • Leasing underway for August 2014 opening 2 Market View 3 evo at Cira Centre South – Asset Level Capital Stack Equity Ownership Total Asset Capital Stack Total Capital Stack $158.5 Total Debt $97.8 61.7% $160.0 Total Equity 60.7 38.3% Total Cost $158.5 100.0% $140.0 $120.0 Equity Ownership CCG $18.2 30.0% HSRE 24.3 40.0% $100.0 BDN 18.2 30.0% Total Equity $60.7 100.0% $80.0 • Construction loan reflects ~61.7% LTV $60.0 • LIBOR+220 BPS 61.7% • Floating Rate $40.0 • Maturity date of 7/25/16 • Two 12 month extension options $20.0 • Campus Crest (CCG) reflects 30% equity ownership $0.0 • Brandywine Realty Trust (BDN) reflects 30% equity ownership Total Capital Stack • Harrison Street Real Estate (HSRE) reflects 40% equity ownership Debt CCG HSRE BDN 4 Guest Speakers Gerard H. -

Developments Introduction 1

2019 CENTER CITY PHILADELPHIA DEVELOPMENTS INTRODUCTION 1 DEVELOPMENTS MAP 4 6 COMMERCIAL/MIXED USE CULTURAL 9 GOVERNMENT & NONPROFIT INSTITUTIONS 10 HEALTH CARE & EDUCATION 11 HOSPITALITY 12 PUBLIC SPACE 15 RESIDENTIAL/MIXED USE 18 PROPOSED PROJECTS 29 ACKNOWLEDGMENTS 39 CENTER CITY DISTRICT & CENTRAL PHILADELPHIA DEVELOPMENT CORPORATION | CENTERCITYPHILA.ORG | Philly By Drone By | Philly W / Element Hotel W / Element INTRODUCTION Building upon a decade-long, sustained national economic Two large projects east of Broad Street are transforming Phila- expansion, 23 development projects totaling $2.8 billion were delphia’s former department store district. National Real Estate completed in Center City between Fairmount and Washington Development has completed another phase of East Market avenues, river to river, in the period from January 1, 2018 to adding more than 125,000 square feet of retail to their initial August 31, 2019. Eighteen projects totaling $3 billion in new office renovation and construction of two residential towers. A investment were under construction as of September 1, 2019. hotel in the historic Stephen Girard Building is currently under Another 21 projects with a total estimated development value of construction, while work is getting started on the final Chest- $1 billion are in the planning or proposal phase. nut Street phase of this full-block redevelopment. One block to the east, The Fashion District is opening in phases throughout The biggest of the completed projects is the largest develop- the fall of 2019, offering nearly 1 million square feet of shops, ment in Philadelphia’s history: the Comcast Technology Center, restaurants and a multiplex movie theater, designed to connect home to the Four Seasons Hotel, two restaurants, two local directly with public transit while animating both Market and broadcasting networks, an innovation hub and 4,000 Comcast Filbert streets. -

Temple University Snyder Report 2015-2016 Part A

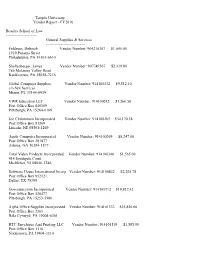

Temple University Vendor Report - FY2016 Beasley School of Law --------------------- General Supplies & Services -------------------------- Feldman, Deborah Vendor Number: 904210387 $1,045.00 1910 Panama Street Philadelphia, PA 19103-6610 Shellenberger, James Vendor Number: 907749507 $2,319.80 786 Molasses Valley Road Kunkletown, PA 18058-7216 Global Computer Supplies Vendor Number: 914100132 $9,512.10 c/o Syx Services Miami, FL 33144-0939 VWR Education LLC Vendor Number: 914100242 $1,266.50 Post Office Box 640169 Pittsburgh, PA 15264-0169 Joe Christensen Incorporated Vendor Number: 914100265 $34,170.38 Post Office Box 81269 Lincoln, NE 68501-1269 Apple Computer Incorporated Vendor Number: 914100269 $8,247.00 Post Office Box 281877 Atlanta, GA 30384-1877 Total Video Products Incorporated Vendor Number: 914100340 $1,565.00 414 Southgate Court Mickleton, NJ 08056-1246 Software House International Incorp Vendor Number: 914100842 $2,205.78 Post Office Box 952121 Dallas, TX 75395 Govconnection Incorporated Vendor Number: 914101112 $19,812.42 Post Office Box 536477 Pittsburgh, PA 15253-5906 Alpha Office Supplies Incorporated Vendor Number: 914101333 $35,826.60 Post Office Box 2361 Bala Cynwyd, PA 19004-6361 BTC Envelopes And Printing LLC Vendor Number: 914101519 $1,585.00 Post Office Box 1110 Norristown, PA 19404-1110 Temple University Vendor Report - FY2016 Beasley School of Law --------------------- General Supplies & Services -------------------------- Terra Dotta LLC Vendor Number: 914102165 $10,100.00 501 West Franklin Street Chapel -

Center City's 41.2 Million Square Feet (Sf) of Commercial Office Space Is

| Matt Stanley OFFICE Cozen O'Connor Center City’s 41.2 million square feet (sf) of commercial office ($56.64) and Washington, D.C. ($54.83). In Center City, the space is the backbone of the downtown economy. Well-served West Market Street submarket commands the highest rents at by transit, office buildings hold the densest concentration an average of $31.78/sf, with Independence Square following of employment opportunities in the region, providing 40% of closely behind at $31.27/sf. The submarkets east of Broad saw downtown jobs and the most diverse opportunities: high-skilled the highest rate appreciations in 2017, as older office buildings positions requiring at least a college degree, technical, support have been repositioned and the historic westward migration of and clerical jobs, as well as building engineers and managers, tenants has been counter-balanced by a broader resurgence of security personnel and custodians. Every time tenants turn the east side of downtown. over, construction trades are called on to renovate space. Co-working spaces are continuing to grow in Center City, but Office workers spend time and money in downtown shops, at a slower rate than previous years, accounting for 2.8% of restaurants, and entertainment venues, creating $230 million in all leasing activity in 2017. A total of 24 co-working locations annual retail demand. Business travelers accounted for almost occupy 502,000 sf of space with an additional 209,000 sf under one-third of all hotel room nights in 2017. construction. Despite the perception that co-working spaces Center City’s office occupancy rate slightly decreased from are filled with young entrepreneurs and startups, many large 87.8% in 2016 to 86.6% in 2017, though still surpassing companies are using co-working spaces downtown to test suburban occupancy levels of 85.3%. -

Comcast Technology Center Opens

Press Contact: Marlene K. Sahms T 610.755.6930 [email protected] FOR IMMEDIATE RELEASE Comcast Technology Center Opens Philadelphia, PA (July 24, 2018) — Newmark Knight Frank (NKF) released its second-quarter 2018 office reports for the greater Philadelphia region. The reports detail no slowdown in activity for Southeastern Pennsylvania, while the delivery of the Comcast Technology Center results in the Philadelphia Central Business District (CBD) recording over 1.0 million square feet of positive absorption. Both Delaware's suburban submarkets and the Southern New Jersey market struggle with rising vacancy. Southeastern Pennsylvania recorded 709,719 square feet of positive absorption for the first half of the year and surpassed 2017’s year-end absorption by 148,000 square feet. Overall vacancy decreased 60 basis points quarter-over- quarter to 14.0 percent. USSC Group’s expansion into 300,000-square-foot at 101 Gordon Drive, located in the Exton/Malvern submarket, accounted for most of the quarter’s 355,000 square feet of absorption. On the downside, some suburban tenants decided to shed excess space, which pushed year-over-year sublease availability up 10 basis points to 2.0 percent. In the Fort Washington submarket, T-Mobile relocated and downsized from 45,000 square feet at 500 Virginia Drive to 24,112 square feet at 475 Virginia Drive. Transamerica, located in the Exton/Malvern submarket, outsourced a number of business line jobs to a third-party provider, downsizing from 90,300 square feet at 300 Eagleview Boulevard to 9,500 square feet at 350 Eagleview Boulevard. During the second quarter, pharmaceutical distributer AmerisourceBergen announced that it planned to keep its headquarters in Conshohocken. -

Retail Brochure

schuylkillyards.com BY BRANDYWINE REALTY TRUST The Vision Schuylkill Yards transforms 14 acres adjacent to Philadelphia’s 30th Street Station, replacing parking lots with a vibrant 6.9 million SF neighborhood of parks, lifestyle experiences, and workspaces intentionally designed for productivity and wellbeing. Building upon our country’s historic values of invention, equity, entrepreneurship and courage, Schuylkill Yards introduces the next chapter for Philadelphia. Here, we are connecting people and communities, uniting bold brands with driven, entrepreneurial minded talent. Our vision is executed by the world’s best architects, engineers, planners and designers, and guided by an intentional, inclusive approach. Now, a new place is rising between Center City and University City—inspiring us to continue building the powerful legacy of Philadelphia. SF of4.8M Work Spaces SF of1.9M Living Spaces SF of Retail132K Experiences 6.5of Greenspace Acres The NEW HEART of America’s First Great City Your New Neighbors Our Neighborhood is Brilliant This is where talent flocks to and people set down roots after graduation. Anchored by several of the nation’s most acclaimed educational and medical institutions, University City continues to thrive as the center for innovation and opportunities. largest 4thpopulation of students in the U.S. with 440,000 students College54% Students Stay in Area after Talent Thrives Here Graduation It just got way easier to recruit the nation's top talent. Here, you are surrounded by Increase115% in College- the risk-takers, boundary-pushers, and educated 25-34 forward-thinkers. These people are driven by Year-olds, 2000-2017 passion and purpose, and they’re seeking like-minded companies and leaders who will push for advances in life sciences, technology and business. -

Office Snapshot Q1 2016 111 Ill 11111 WAKEFIELD PHILADELPHIA, PA - CBD

MARKETBEAT -- CUSHMAN & Office Snapshot Q1 2016 111 Ill 11111 WAKEFIELD PHILADELPHIA, PA - CBD PHILADELPHIA CBD OFFICE Economy The Philadelphia Metropolitan Area’s (MSA) unemployment rate declined Economic Indicators 12-Month to 4.8% in the first quarter 2016, a 100-basis-point drop year-over-year. Q1 15 Q1 16 Forecast Philadelphia’s total nonfarm employment increased by 2.1% over the Philadelphia Employment 2,799M 2,857M past year, with the professional and business services experiencing the Philadelphia largest growth of any sector, adding 18,100 jobs to the market. The 5.8% 4.8% Unemployment education and health services sector also added 15,300 new jobs, U.S. Unemployment 5.6% 4.9% increasing by 2.5% year-over-year. Market Indicators (Overall, All Classes) Market Overview The overall vacancy rate for the Philadelphia Central Business District 12-Month Q1 15 Q1 16 (CBD) declined to 9.8% in the first quarter 2016, down 210 basis points Forecast from the first quarter 2015. Most notably, the West of Broad submarket’s Vacancy 11.9% 9.8% overall vacancy dropped to 8.6% in the first quarter, the lowest vacancy Net Absorption -374k 271k experienced in the submarket since 2001. The West of Broad submarket Under Construction 1.9M 1.9M began the year with 459,337 square feet (sf) of positive absorption due Average Asking Rent $26.86 $28.22 - to several tenants that inked deals in 2015 taking occupancy this quarter. *Rental rates reflect gross asking $psf/year Independence Blue Cross (IBC) took occupancy during the first quarter 2016 at 1900 Market Street. -

Parkside Portfolio Four Properties | Parkside Ave | Urban Retail | Mixed Use

PARKSIDE PORTFOLIO FOUR PROPERTIES | PARKSIDE AVE | URBAN RETAIL | MIXED USE PARKSIDE LOFTS VALUE ADD CMX3 BUILDING Parkside Portfolio TABLE OF CONTENTS Section 1: Portfolio Summary Section 4: Parkside Lofts Portfolio Overview.....................................................4 Property Overview....................................................16 Site Plan....................................................................5 Rent Roll..................................................................17 OFFERED Investment Overview...................................................6 Income & Expenses...................................................18 EXCLUSIVELY BY Section 2: Davita Dialysis & Santander Bank Section 5: Value Add CMX3 Building Property Overview......................................................8 Property Overview....................................................20 Lead Agents: Rent Roll....................................................................9 Section 6: Tenant Descriptions Derrick Dougherty Income & Expenses...................................................10 Tenant Overviews................................................22-25 First Vice President Section 3: Goodwill & Oak Street Health Section 7: Market Overview Philadelphia, PA 215.531.7026 Property Overview...................................................12 Regional & Aerial Map.......................................27-28 [email protected] Rent Roll..................................................................13 Demographics..........................................................29