Daily Morning Note

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Overview Statutory Reports Financial Statements

Corporate Overview Statutory Reports Financial Statements Deepak Nitrite Limited | 1 INDEX CORPORATE OVERVIEW On a Golden Pedestal 01 Financial Highlights 03 Building Sustainable Future 04 Our Strength 06 Message from the Founder (Chairman Emeritus) 14 CEO’s Communique (Outgoing CEO) 17 Enhancing Value Brick by Brick 18 From the Desk of Chairman & Managing Director 21 CEO’s Letter 24 CFO’s Communique 27 Board Of Directors 30 Responsive to Challenges with Resilience 34 Building Sustainable Future with Responsible Chemistry 37 Our Team Our Strength 40 Creating Socially Inclusive and Empowered Society 42 Our COVID-19 Initiatives 47 Corporate Information 48 STATUTORY REPORTS Management Discussion and Analysis 50 Notice 66 Directors’ Report 74 Corporate Governance Report 114 FINANCIAL STATEMENTS Standalone Independent Auditor’s Report 135 Balance Sheet 142 Statement of Profit and Loss 143 Cash Flow Statement 144 Statement of Changes in Equity 146 Notes forming part of the Financial Statements 147 Consolidated Independent Auditor’s Report 189 Balance Sheet 196 Statement of Profit and Loss 197 Cash Flow Statement 198 Statement of Changes in Equity 200 Notes forming part of the Financial Statements 201 Forty-Ninth Annual General Meeting Day & Date : Friday, August 7, 2020 Time : 11:30 A.M. Through Video Conferencing/Other Audio Visual Means Cautionary Statement Regarding Forward-Looking Statement This Report may contain certain forward-looking statements relating to the future business, development and economic performance. Such Statements may -

Marketgrader India All-Cap Growth Leaders Index

Fact Sheet MarketGrader MarketGrader India All-Cap Growth Leaders Index RESEARCH & INDEXES The MarketGrader India All-Cap Growth Leaders Index consists of the 80 most fundamentally sound companies with the best growth prospects in India, whose shares are listed in the country’s national exchanges or in the United States. Its objective is to give investors access to the best companies in the world’s fastest growing large economy without overpaying for their shares. Constituents are selected across all market cap segments and all economic sectors after they have passed rigorous size and liquidity filters. Index Rules Performance Investable Universe CumulativeIndia Growth Leaders Total Return, Jan. 2008 - Jul. 2021 All data as of July 30, 2021 All companies domiciled in India that have 175% received a MarketGrader Score consistently for at least six months, whose shares are 150% listed on the National Stock Exchange, the 125% Bombay Stock Exchange or on U.S. national 100% exchanges. 75% Regulatory Requirements 50% Stocks are ineligible for Index selection if 25% they are included in the ‘Red Flag List,’ 0% maintained and published by the National Securities Depository Limited (NDSL) of India, -25% or on the ‘Breach List,’ maintained by the -50% Central Depository Services (India) Limited 07/30/21 -75% (CDSL), both of which govern foreign own- 12/31/07 12/31/08 12/31/09 12/31/10 12/30/11 12/31/12 12/31/13 12/31/14 12/31/15 12/30/16 12/29/17 12/31/18 12/31/19 12/31/20 ership limits of Indian securities. -

Marketgrader India All-Cap Growth Leaders Index

Fact Sheet MarketGrader MarketGrader India All-Cap Growth Leaders Index RESEARCH & INDEXES The MarketGrader India All-Cap Growth Leaders Index consists of the 80 most fundamentally sound companies with the best growth prospects in India, whose shares are listed in the country’s national exchanges or in the United States. Its objective is to give investors access to the best companies in the world’s fastest growing large economy without overpaying for their shares. Constituents are selected across all market cap segments and all economic sectors after they have passed rigorous size and liquidity filters. Index Rules Performance Investable Universe CumulativeIndia Growth Leaders Total Return, Jan. 2008 - Jan. 2021 All data as of Jan 29, 2021 All companies domiciled in India that have 125% received a MarketGrader Score consistently for at least six months, whose shares are 100% listed on the National Stock Exchange, the Bombay Stock Exchange or on U.S. national 75% exchanges. 50% Regulatory Requirements 25% Stocks are ineligible for Index selection if 0% they are included in the ‘Red Flag List,’ maintained and published by the National -25% Securities Depository Limited (NDSL) of India, or on the ‘Breach List,’ maintained by the -50% Central Depository Services (India) Limited 01/29/20 -75% (CDSL), both of which govern foreign own- 12/31/07 12/31/08 12/31/09 12/31/10 12/30/11 12/31/12 12/31/13 12/31/14 12/31/15 12/30/16 12/29/17 12/31/18 12/31/19 12/31/20 ership limits of Indian securities. -

Values Endure

TRUST BUILDS FAITH LASTS VALUES ENDURE th 50 Annual Integrated Report | 2020-21 DEEPAK NITRITE LIMITED Contents CORPORATE OVERVIEW STATUTORY REPORTS 02 Deepak: 66 Management Discussion and Analysis An Organisation Trusted to Deliver 81 Notice 04 Trusted across 96 Directors’ Report Diversified Business Operations 133 Corporate Governance Report 06 Manufacturing Footprint 07 Responding with Grit FINANCIAL STATEMENTS in a Challenging Year Standalone 10 Depend on Deepak 158 Independent Auditor’s Report 12 Chairman and Managing Director’s Message 166 Balance Sheet 16 CEO’s Message 167 Statement of Profit and Loss 20 Executive Director’s Message 168 Cash Flow Statement 22 Value Creation Model 170 Statement of Changes in Equity 24 Strategic Priorities for Sustained 171 Notes forming part of the Value Creation Financial Statements 26 Stakeholder Engagement 28 Managing Material Matters Consolidated 218 Independent Auditor’s Report 30 Managing Risks 224 Balance Sheet 32 Financial Capital 225 Statement of Profit and Loss 33 CFO’s Communique 226 Cash Flow Statement 38 Manufactured Capital 228 Statement of Changes in Equity 42 Human Capital 229 Notes forming part of the 46 Intellectual Capital Financial Statements 48 Social and Relationship Capital 54 Natural Capital Investor Welfare Scheme 56 Building Trust and Driving Value Creation with Strong Governance 58 BOD Profiles 62 Awards & Accolades 64 Corporate Information Fiftieth Annual General Meeting Day & Date : Friday, July 30, 2021 Time : 11:30 A.M. Through Video Conferencing/Other Audio Visual Means Forward-looking Statements Certain statements in this Report relating to our business operations and prospects may be forward-looking statements. These statements can be identified by usage of words such as ‘believes’, ‘estimates’, ‘anticipates’, ‘expects’, ‘intends’, ‘may’, ‘will’, ‘plans’, ‘outlook’ and other words of similar meaning in connection with a discussion of future operating or financial performance. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Aegon Life Indepth May 2021.Pdf

MAY 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | May 2021 | 2 Commentary on the Indian Securities Market for April 2021 Nifty (down 0.4%) was largely flat in April post a flattish march. The covid situation has worsened in the month of April in India leading to different levels of lockdowns in various states. The vaccination program for the age group of 18-44 years has been allowed from 1 st May. However, vaccination availability is a concern in the short term and may lead to some delays. The dollar index corrected after three months of up move. It was down 2.09% and closed at 91.28 level. Despite the fall in Dollar index, the rupee was weak and depreciated by 97 paise to close at 74.08 level. Brent Crude gained almost 6% after one month of correction and ended at 67.25 level. Gold was up by 3.6% after three months of correction. Foreign institutional investors (FIIs) investment turned negative after six month of positive inflows. They sold about $1.3 bn worth of equity in April. Domestic institutional investors (DIIs) investment continued to be positive for a second month in a row. -

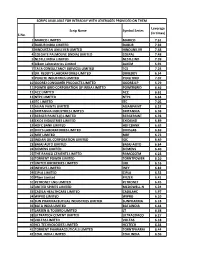

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

Aegon Life Indepth Mar 2021

MARCH 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | Mar 2021 | 2 Commentary on the Indian Securities Market for February 2021 Nifty (up 6.5%) was up for the month after a correction in January as the markets were enthused by a pro-growth Budget. In the budget, the government signalled its inten- tion to support growth without any meaningful change in tax regime. The active covid cases has seen a slight uptick in the month of February. The vaccination program has entered the second phase in the country with senior citizens and comorbid patients also eligible to receive vaccination from 1st March. The dollar index was up for second month in a row. It was up 0.3% and closed at 90.88 level. The rupee depreciated after three months of appreciation. It depreciated by 51 paise to end at 73.46 level. Brent crude continued its upmove and was up another 18% to close above $65 mark. It has moved up by 78% in the last four months. Gold corrected by 6% to close at $1734. Foreign institutional investors (FIIs) investment continued to be strong in February with inflow of $3.5 bn. -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

Today's Top Research Idea Market Snapshot

23 July 2021 Motilal Oswal values your support in the Today’s top research idea Asiamoney Brokers Poll 2021 for India Research, Sales, Corporate Access and UltraTech Cememnt: Margin outlook continues to improve Trading team. We request your ballot. Expansions provide strong growth visibility UltraTech Cement (UTCEM) continued to improve its costs and margins in 1QFY22; it reported the highest ever EBITDA/unit of INR1,536/t (+8% YoY) during the quarter. Coupled with volume growth of 47% YoY, this led to 59% YoY growth in EBITDA. Market snapshot Market share gains should continue, aided by the ongoing 20mtpa expansion Equities - India Close Chg .% CYTD.% program, which should drive a 13% volume CAGR over FY21–24E. Sensex 52,837 1.2 10.7 We estimate a 15%/26% CAGR in consolidated EBITDA/PAT over FY21–23E, Nifty-50 15,824 1.2 13.2 Nifty-M 100 27,538 1.1 32.1 driven by a 13% volume CAGR, better realizations, lower operating costs, and Equities-Global Close Chg .% CYTD.% lower interest costs. S&P 500 4,367 0.2 16.3 The valuation is reasonable at 13.7x FY23E EV/EBITDA – a 10% discount to its Nasdaq 14,685 0.4 13.9 last five years’ average. We value UTCEM at 16x FY23E EV/EBITDA to arrive at FTSE 100 6,968 -0.4 7.9 DAX 15,515 0.6 13.1 TP of INR8,770. Reiterate Buy. Hang Seng 10,007 1.8 -6.8 Nikkei 225 27,548 0.0 0.4 Commodities Close Chg .% CYTD.% Research covered Brent (US$/Bbl) 73 6.8 43.2 Gold ($/OZ) 1,807 -0.2 -4.8 Cos/Sector Key Highlights Cu (US$/MT) 9,418 1.2 21.5 Almn (US$/MT) 2,469 0.8 25.1 UltraTech Cement Margin outlook continues -

Specialty Chemicals : Genie Is Out! Trading Team

1 July 2021 Motilal Oswal values your support in the Today’s top research theme Asiamoney Brokers Poll 2021 for India Research, Sales, Corporate Access and Specialty Chemicals : Genie is out! Trading team. We request your ballot. Initiating coverage with a positive outlook on the space We initiate coverage with a positive outlook on the Specialty Chemicals space. We assign a Buy rating to Deepak Nitrite (DN - our top pick), Vinati Organics (VO), Galaxy Surfactants (GALSURF), and NOCIL; a Neutral rating to Atul (ATLP), Alkyl Amines (AACL), Navin Fluorine (NFIL), and Fine Organic (FINEORG). Capex plans of INR39b over FY22-24E (similar to FY19-21) would result in 52% Market snapshot revenue growth by FY24E (from FY21 levels), making these companies exciting Equities - India Close Chg .% CYTD.% plays. We expect EBITDAM expansion to 25% by FY24E (from FY20/FY21 levels Sensex 52,483 -0.1 9.9 Nifty-50 15,722 -0.2 12.4 of 22.5%/24.3%). Nifty-M 100 26,971 0.3 29.4 We expect our Coverage Universe to post an EBITDA/PBT CAGR of ~20%, with Equities-Global Close Chg .% CYTD.% return ratios of 23-25% over FY22-24E (up from 22% in FY19/FY21). S&P 500 4,298 0.1 14.4 Our Coverage Universe consists of net debt-free companies (excluding DN and Nasdaq 14,504 -0.2 12.5 FTSE 100 7,037 -0.7 8.9 GALSURF, which are expected to turn net debt-free by FY23E) that plan to incur DAX 15,531 -1.0 13.2 capex through internal accruals only.