Brandfinance® Banking 500 League Table Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Berenberg Sustainability Report 2019

2019 Sustainability report for the financial year 2019 CONTENTS Foreword 3 Business model and environment 5 Organisational profile 6 Strategy and business divisions 7 Wealth and Asset Management central business unit 8 Investment Bank and Corporate Banking central business unit 9 Cross-divisional services 9 Significant changes in the reporting year 10 Our business environment 12 Risk management 14 Key performance indicators 16 Environment 17 Management approach 18 Outcomes and performance indicators 20 Use of natural resources 20 Measures to reduce carbon emissions 21 Project financing to promote sustainable technologies 23 Employees 24 Management approach 25 Outcomes and performance indicators 27 Recruiting the next employee generation 27 Goal-based personnel development 29 Attractive employee benefits 29 Work/life balance 30 Diversity 31 1 CONTENTS Society 32 Management approach 33 Outcomes and performance indicators 35 Sustainable investments and products that benefit society 35 Social involvement 37 Human rights 41 Management approach 42 Outcomes and performance indicators 44 Equal treatment of all employees 44 Compliance with minimum standards in the supply chain 45 Anti-corruption and fraud 46 Management approach 47 Outcomes and performance indicators 50 Client perspective: know your customer 50 Employee perspective: protection of employees 51 About this report 52 Reporting principles 52 Frameworks and selection of reporting topics 52 2 The Managing Partners (from left to right): Dr Hans-Walter Peters and Hendrik Riehmer Dear clients and business associates, Acting responsibly is the hallmark of our corporate values, and is also our guiding principle. Being successful on the market for over four hundred years requires a value creation process that is geared to the long term. -

Stephan Hutter Additional Experience Partner, Frankfurt Capital Markets

Dr. Stephan Hutter Additional Experience Partner, Frankfurt Capital Markets Transactions handled by Dr. Hutter prior to joining Skadden include advising: - the initial purchasers, led by BNP Paribas, Deutsche Bank, HSBC and J.P. Morgan, in a €2 billion high-yield bond offering ofSchaeffler Finance B.V.; - the underwriters, led by BofA Merrill Lynch, Mediobanca and UniCredit, in a €7.5 billion rights offering and a €4 billion rights offering ofUniCredit S.p.A.; - the underwriters, led by Berenberg Bank and UniCredit, in the IPO of Prime Office REIT AG; - Aareal Holding in a capital increase of Aareal Bank AG; - the initial purchasers, led by Credit Suisse, Deutsche Bank and J.P. Morgan, in a €2 billion high- yield bond offering byKabel Baden-Württemberg (IFLR Europe’s High Yield Deal of the Year 2012); T: 49.69.74.22.0170 F: 49.69.742204.70 - the initial purchasers, led by Citigroup, RBS and Deutsche Bank, in several high-yield bond offer- [email protected] ings in an aggregate issue volume of €3 billion of Conti-Gummi Finance B.V. (IFLR Europe’s Debt and Equity-Linked Deal of the Year 2011); - A-TEC Industries AG in its IPO and several subsequent capital increases (including a convertible bond offering); - the underwriters, led by Morgan Stanley and Commerzbank, in the IPO of Air Berlin Plc; and Deutsche Bank, Morgan Stanley and Commerzbank in a capital increase by Air Berlin Plc and a convertible bond offering byAir Berlin Finance BV; - the underwriters, led by Credit Suisse, Morgan Stanley and HVB, in the IPO of Premiere; J.P. -

Berenberg Capital Markets LLC

Berenberg Capital Markets LLC Statement of Financial Condition December 31, 2018 FILED PURSUANT TO RULE 17A-S(e)(3) AS A PUBLIC DOCUMENT Berenberg Capital Markets LLC Contents Facing page to Form X-17A-5 ................................................................................................................. 3A Affirmation of Officer............................................................................................................................... 38 Independent Auditors' Report. ................................................................................................................. 4 Statement of Financial Condition as of December 31, 2018 .................................................................5 Notes to Statement of Financial Condition ........................................................................................ 6-14 2 UNITED~"'TATES 0MB APPROVAL SECURITIES AND EXCHANGE COMMISSION 0MB Number: 3235-0123 Washington, D.C. 20549 Expires: August 31, 2020 Estimated average burden ANNUAL AUDITED REPORT hours per response .... 12.00 FORM X-17A-5 SEC FILE NUMBER PART Ill 8-68821 FACING PAGE Information Required of Brokers and Dealers Pursuant to Section 17 of the Securities Exchange Act of 1934 and Rule l 7a-5 Thereunder REPORT FOR THE PERIOD BEGINNING__ __0_ 1_/_0_1_/1_8___ A ND ENDING___ 1_ 2_/_3_1_/1_8___ _ MM/DD/YY MM/DD/YY A. REGISTRANT IDENTIFICATION NAME OF BROKER-DEALER: BERENBERG CAPITAL MARKETS LLC OFFICIAL USE ONLY ADDRESS OP PRINCIPAL PLACE OF BUSINESS: (Do not use P.O. Box No.) FIRM -

Facing the Sanctions Challenge in Financial Services a Global Sanctions Compliance Study Contents

Facing the sanctions challenge in financial services A global sanctions compliance study Contents 1 Interviewees 3 Executive summary 5 Introduction 7 The growing challenge 11 Worries beneath the surface 15 Movements in leading practices 21 Conclusion 23 Contacts As used in this document, “Deloitte” means Deloitte Financial Advisory Services LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Interviewees Lord Patten Peter Ziverts Former Commissioner for External Affairs Vice President, Compliance European Union Western Union Roberto Hollander Neville Hall Director, Compliance and Risk Management Global Head of Compliance Banco Bradesco Travelex Michael Hamar Daren Allen Former Chief Risk Officer Partner National Australia Bank DLA Piper Reinhard Preusche Guy Boyd Chief Compliance Officer Head of AML Sanctions Compliance Allianz ANZ Stephen Lock Mohamoud H Abdalle Farah Head, Group Financial Crime and Security Chairman of Board of Directors Old Mutual Amal Express Guido Sollors Augusto Restrepo Former Managing Partner Administrative Vice President and Legal Representative Berenberg Bank Bancolombia Axel Kappstein Mark Musi Head of Compliance Chief Compliance and Ethics Officer Berenberg Bank Bank of New York Mellon Joseph Cachey III Burkhard Varnholt Chief Compliance Officer Chief Investment Officer Western Union Bank Sarasin Valerie Dias Chief Risk and Compliance Officer Visa Europe Facing the sanctions challenge in financial services A global sanctions compliance study 1 2 Executive summary Sanctions1 are as much a fact of life for modern business as global markets. Financial services firms in particular are devoting increasing attention to sanctions compliance, as they navigate a shifting regulatory landscape in which guidelines are often unclear. -

Equity Capital Markets Team Germany

Equity Capital Markets Team Germany allenovery.com Our strength is our experience with complex assignments Capital markets are difficult to predict and present serious challenges to investors and issuers. Both investment banks and corporate entities need competent support, especially when it comes to developing innovative and tailor-made structures; they need lawyers who have the necessary specialist knowledge coupled with the practical experience for implementing their ideas. This is why Allen & Overy’s Equity Capital Markets team comprises only acknowledged experts who, thanks to their experience and expertise, ensure that we are very well versed with the ins and outs of the market and offer top-quality advice to our clients at all times. Equity Deal Ranked 1st Tier 1 of the Year EMEA Equity IPO: Chambers Global and IFLR Europe Awards Issuer by value, Legal 500 2020 2016, 2017, 2018 Bloomberg Q3 2020 “Clients speak highly of the team’s The team “handled a very responsiveness and availability, complex, multi-jurisdictional and describe the lawyers as ‘reliable, transaction brilliantly, with a very client-oriented and pragmatic’!” fast turnaround and a focus on Chambers Europe Germany 2019 the core issues at hand.” (Client) Chambers Europe Germany 2020 2 Equity Capital Markets Team Germany | 2020 What you can Our expect from us expertise Leading ECM practice Our Equity Capital Markets team in Germany provides you with access to excellent, Our German Equity Capital Markets team, led by experienced lawyers with a track record of Dr Knut Sauer, has advised on many of the most high- advising our clients on some of the most profile ECM transactions in Germany in recent years. -

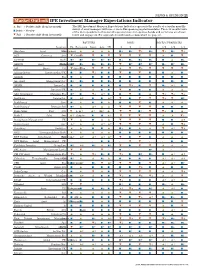

Market Outlook IPE Investment Manager Expectations Indicator

NEWS & OPINION 21 Market Outlook IPE Investment Manager Expectations Indicator ▲ Rise • Positive shift (from last month) The IPE Investment Manager Expectations Indicator represents the results of a regular monthly survey of asset managers with one or more European segregated mandates. The 6-12 month views • Stable – No view of the 96 respondents to this month’s questionnaire for equities, bonds and currencies are shown ▼ Fall • Negative shift (from last month) below and on page 22. For aggregated results and a commentary see page 23. EQUITIES BOND PRICES CURRENCIES Location US Euro-zone Japan Asia UK $ ¥ £ € $/€ $/¥ $/£ Aberdeen Asset ManagementUK ▲ ▲ ▲ ▲ ▲ •• •• ▼• •• ▼• •• ▼• ACT Currency Swi ▼ Partner▼ ▼ • ▼ ▼ ▼ ▼ ▼ ▲ • ▼ ACTIAM Neth •• •• •• •• •• •• •• •• •• • ▲ •• AEGON Asset ManagementNeth •• •• •• •• •• ▼ •• •• •• •• •• •• A.G. Bisset US ▼ Associates▼ ▼ ▼ ▼ ▲ ▼ ▼• ▼ ▼ ▼ ▼ Allianz Global Investors Ger/UK • • ▼• • • ▼ • ▼ • • ▲ • Amundi Fra • ▲ • • • • • • • • • • Apo Asset Management Ger •• •• • • •• • • • • • •• • AVANA Invest Ger • • • • • • ▼• • ▼ •• ▲• • Aviva Investors UK • ▲ ▲ • • ▼ • • • ▲ ▲ ▲ AXA Investment Managers Fra •• • ▼• ▲• • • ▼ • ▲ ▼• ▼• ▼• Bankhaus Lampe Ger • ▲• • • ▲• ▼ • ▼ ▼ ▼• ▼ •• BankInvest Den • ▲ • • ▲ • • ▼ • ▲ ▲ ▲ Bank Degroof Petercam Bel •• ▲ ▲• ▲ ▲ ▼ ▼ ▼ ▼ • • • Bank Julius Baer Swi ▼ & ▲• ▲• Co.▲• ▲ ▼ ▼ •• ▼ ▼• • ▲ Bank J. Safra Swi ▲• Sarasin▲ • • ▲• ▼ ▼ ▼ ▼ ▲ ▲ ▼• Baring Asset Management UK ▼ ▲ • ▲ ▲ ▼ ▼ ▼ ▼ • • ▲• BayernInvest Ger ▲• ▲ ▲ ▲• ▲• ▼ ▼ ▼ ▼ ▲ • ▼• Berenberg Bank Ger ▲ ▲ • • ▲ •• • -

Representative Legal Matters Dr

Representative Legal Matters Dr. Norbert Mueckl Advised the initial purchasers Deutsche Bank, Barclays, Bayerische Landesbank and Citigroup on the offering by Schaeffler Finance B.V. of EUR300 million in high-yield bonds. Advised REIT-AG on a variety of REIT law, real estate transfer tax and other tax matters on an ongoing basis. Advised Dow Chemical in the divestiture of its polypropylene business to Braskem. Advised a consortium of 27 banks led by BofA Merrill Lynch, Mediobanca and UniCredit Corporate & Investment Banking as joint global coordinators in connection with the EUR7.5 billion (USD10 billion) rights offering of UniCredit. Advised the initial purchasers, led by BNP Paribas, Deutsche Bank, and HSBC, on the offering by Schaeffler Finance B.V. of more than EUR2 billion equivalent in high-yield bonds. Advised International Petroleum Investment Company (IPIC), Abu Dhabi, on a settlement agreement with commercial vehicle and engineering group MAN. Advised 20/10 PERFECT VISION AG in the exit from its joint venture with Bausch & Lomb for a total company value of up to EUR450 million. Advised Rakuten on its acquisition of an 80 percent stake in Tradoria, one of Germany’s leading online e-commerce platforms. Advised the underwriters led by UniCredit Bank and Berenberg Bank in connection with the IPO of Prime Office AG, a German real estate company focused on high-end office buildings. Advised Heckler & Koch on its EUR295 million high-yield bond offering. Advised Barclays Capital, Credit Suisse and HSBC, as initial purchasers in connection with R&R Ice Cream plc’s EUR350 million senior secured bond offering. -

Electra Data Sources V20200420 Page 1

Electra Data Sources v20200420 Page 1 Electra Data Sources April 2020 New “Electra Data Sources” are highlighted in purple bold and new feeds from data sources are highlighted in purple italics. Electra Data Sources v20200420 Page 1 • ABN AMRO Bank/RFS Holdings • Argent Trust (Ruston, LA) • Bank of America Merrill Lynch (Chicago, IL) • Artisan Partners (Milwaukee, Swaps/CDS • Abundance Wealth Counselors WI) • Bank of America Merrill Lynch (State College, PA) • AssetMark Trust (New York, NY) TBA Margins (Charlotte, NC) • Acadia Trust (Portland, ME) • Associated Banc-Corp • Bank of America Securities • Adirondack (Lake Luzerne, NY) (Green Bay, WI) (Atlanta, GA) • ADM Investor Services Futures • Atlantic Trust (Atlanta, GA) • Bank of America/Accruals & (Chicago, IL) • Avangard Bank (Ukraine) Bonds (New York, NY) • Advest, Inc. (New York, NY) • Baillie Gifford — NAV Reporting • Bank of Bermuda /HSBC Group • Aegon Asset Management (New York, NY) (Bermuda) (Boston, MA) • BAML Corporate Action & • Bank of Hawaii (Honolulu, HI) • AG Edwards (St. Louis, MO) Dividends (New York, NY) • Bank of Ireland Securities • Alerus Financial • BAML FIPB- Fixed Income Prime Services (Ireland) (Grand Forks, ND) Brokerage (Charlotte, NC) • Bank of New York – Futures • Aligned Partners • BAML FX Spots Forwards (New York, NY) (Menlo Park, CA) (New York, NY) • Bank of New York – Legacy • Allfirst Financial/M&T Bank • BAML Global and Prime (New York, NY) (Baltimore, MD) Brokerage (Charlotte, NC) • Bank of New York Mellon - • Alliance Bank (Syracuse, NY) • BAML OTC Options Checking (New York, NY) • Allianz Global Investors (New York, NY) • Bank of New York Mellon — (Germany) • BAML OPTIONS (New York, NY) Intraday (New York, NY) • ALPS Fund Services, Inc. -

Wealth and Asset Management 2021: Preparing for Transformative Change

Wealth and Asset Management 2021: Preparing for Transformative Change White Paper A white paper produced in conjunction with: Bank of Montreal, Broadridge, CFA Institute, Cisco, eToro, Schroders, SEI, and State Street Table of Contents Preface.......................................................................................................2 1. The Big Shift...........................................................................................5 2. The Rapidly Evolving Investor..............................................................13 3. Rethinking Product and Market Approaches......................................19 4. The Future Wealth Advisor.................................................................28 5. The Road Ahead: Driving Digital Transformation................................38 Preface Everywhere you look, the signs of change are there. The demographics of wealth are shifting dramatically around the world—from the growing dominance of women investors in North America to the rising middle class in emerging markets. As part of this shift, the wealth industry will see trillions of dollars of wealth transfer from baby boomers to a new generation of digital natives with very different investment behaviors. At the same time, technology is linking billions of people and devices through real-time connections, reinventing how investors communicate, interact, and make decisions. Artificial intellignece, virtual reality, blockchain, and real-time analytics are just some of the smart technologies investment providers are -

Information for Virtus Mutual Funds

Form 5500 (Schedule C) Information for Virtus Mutual Funds CAUTION FOR PLAN ADMINISTRATORS THIS DISCLOSURE DOCUMENT IS NOT, AND SHALL NOT BE DEEMED TO CONSTITUTE, LEGAL ADVICE TO PENSION PLANS SUBJECT TO FORM 5500 SCHEDULE C REPORTING OBLIGATIONS REGARDING COMPLIANCE WITH ERISA REPORTING REQUIREMENTS AND IS ONLY INTENDED TO FURNISH INFORMATION TO SUCH PLANS TO ASSIST THEM IN COMPLYING WITH THE FORM 5500 SCHEDULE C REPORTING OBLIGATIONS. THIS DISCLOSURE DOCUMENT IS NOT INTENDED TO CONSTITUTE AN OFFER TO SELL SECURITIES OR PROVIDE ANY DISCLOSURE REQUIRED BY SECURITIES LAWS. IT IS INTENDED SOLELY TO ASSIST PLANS IN COMPLYING WITH FORM 5500 SCHEDULE C REPORTING OBLIGATIONS. Reporting entities’ EINs: See below table Fund Information Location in Disclosure Documents Click here for the Mutual Fund Documents page of Virtus.com Fund Name: Front cover page of the Fund’s annual report Share Class: Fund Summary section of the Fund’s annual report Ticker symbol: Fund Summary section of the Fund’s annual report CUSIP: See Reporting EIN and CUSIP Information below Fiscal Year End: Front cover page of Fund’s annual report Total Fund Assets as of Fiscal Year End: Financial Highlights section of the Fund’s annual report Expense Ratio (net of waived fees): Disclosure of Fund Expenses section of the Fund’s annual report Fees and Expenses Location in Disclosure Documents Click here for the Mutual Fund Documents page of Virtus.com Management fees paid by the Fund: Fund Annual Report, in the following sections: Statements of Operations – Expenses – Investment -

When the Going Gets Tough…

Q1 09 - Q4 11 Three year RQ analysis of Euro 300 When the going gets tough… Since starting in 1998, AQ Research has been measuring CONTENTS the performance of equity research and publishing the TABLE 1: 21 ELIGIBLE Introduction ............... 1 results through Yearbooks and quarterly reports, as well Avg RQ Avg Stocks Country as through AQ Online. Our AQ Select quarterly reports Research Firm Outperformance per Quarter Methodology & sector winners ........ 2 look at the performance of research on the AQ300, a DayByDay 3.4 181 Ab Consensus selection of large market capitilisation companies with a Royal Bank of Scotland 2.7 153 Ab beating analysts ......... 3 robust variety of analyst research available. Credit Suisse 2.1 223 SR Historic winners ......... 4 By any measure the past three years have been UniCredit Global Res 1.9 128 IR the most turbulent since we started, with high volatility Exane BNP Paribas 1.4 215 SR and large index swings all underpinned by low trading DZ Bank 0.6 77 Ab volumes. Another feature is the high correlation Cheuvreux 0.1 200 IR between stocks, for instance as measured by the CBOE 1 S&P500 Implied Correlation Coefficient. We believe that Goldman Sachs 0.1 240 Ab investors are primarily focused on asset allocation rather Oddo Securities 0.1 124 Ab/SR than stock picking within equity. The result is a focus on A = Absolute SR - Sector Relative IR = Index Relative the most liquid (large cap) stocks which are cheap to volumes has been lower revenues for equity research. buy and sell. The other corollary of these lower traded All this has tested commitment to equity research. -

Berenberg Capital Markets LLC

Berenberg Capital Markets LLC Statement of Financial Condition December 31, 2019 FILED PURSUANT TO RULE 17A‐5(e)(3) AS A PUBLIC DOCUMENT Berenberg Capital Markets LLC Contents Facing page to Form X‐17A‐5…………………………………………………………………………………………………..3A Affirmation of Officer………………………………………………………………………………………………………………3B Independent Auditors’ Report…………………………………………………………………………………………………..4 Statement of Financial Condition as of December 31, 2019………………………………………………………5 Notes to Financial Statements………………………………………………………………………………………………6‐17 2 Tel: 212-885-8000 100 Park Avenue Fax: 212-697-1299 New York, NY 10017 www.bdo.com Report of Independent Registered Public Accounting Firm Board of Directors Berenberg Capital Markets LLC New York, New York Opinion on Financial Statement We have audited the accompanying statement of financial condition of Berenberg Capital Markets LLC (the “Company”) as of December 31, 2019, and the related notes (collectively referred to as “the financial statement”). In our opinion, the financial statement presents fairly, in all material respects, the financial position of the Company at December 31, 2019, in conformity with accounting principles generally accepted in the United States of America. Basis for Opinion The financial statement is the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statement based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB.