Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

Lu Zhiqiang China Oceanwide

08 Investment.FIN.qxp_Layout 1 14/9/16 12:21 pm Page 81 Week in China China’s Tycoons Investment Lu Zhiqiang China Oceanwide Oceanwide Holdings, its Shenzhen-listed property unit, had a total asset value of Rmb118 billion in 2015. Hurun’s China Rich List He is the key ranked Lu as China’s 8th richest man in 2015 investor behind with a net worth of Rmb83 billlion. Minsheng Bank and Legend Guanxi Holdings A long-term ally of Liu Chuanzhi, who is known as the ‘godfather of Chinese entrepreneurs’, Oceanwide acquired a 29% stake in Legend Holdings (the parent firm of Lenovo) in 2009 from the Chinese Academy of Social Sciences for Rmb2.7 billion. The transaction was symbolic as it marked the dismantling of Legend’s SOE status. Lu and Liu also collaborated to establish the exclusive Taishan Club in 1993, an unofficial association of entrepreneurs named after the most famous mountain in Shandong. Born in Shandong province in 1951, Lu In fact, according to NetEase Finance, it was graduated from the elite Shanghai university during the Taishan Club’s inaugural meeting – Fudan. His first job was as a technician with hosted by Lu in Shandong – that the idea of the Shandong Weifang Diesel Engine Factory. setting up a non-SOE bank was hatched and the proposal was thereafter sent to Zhu Getting started Rongji. The result was the establishment of Lu left the state sector to become an China Minsheng Bank in 1996. entrepreneur and set up China Oceanwide. Initially it focused on education and training, Minsheng takeover? but when the government initiated housing Oceanwide was one of the 59 private sector reform in 1988, Lu moved into real estate. -

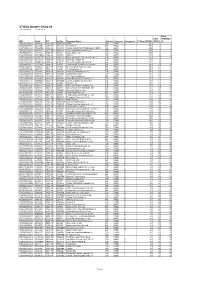

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

WIC Template 13/9/16 11:52 Am Page IFC1

In a little over 35 years China’s economy has been transformed Week in China from an inefficient backwater to the second largest in the world. If you want to understand how that happened, you need to understand the people who helped reshape the Chinese business landscape. china’s tycoons China’s Tycoons is a book about highly successful Chinese profiles of entrepreneurs. In 150 easy-to- digest profiles, we tell their stories: where they came from, how they started, the big break that earned them their first millions, and why they came to dominate their industries and make billions. These are tales of entrepreneurship, risk-taking and hard work that differ greatly from anything you’ll top business have read before. 150 leaders fourth Edition Week in China “THIS IS STILL THE ASIAN CENTURY AND CHINA IS STILL THE KEY PLAYER.” Peter Wong – Deputy Chairman and Chief Executive, Asia-Pacific, HSBC Does your bank really understand China Growth? With over 150 years of on-the-ground experience, HSBC has the depth of knowledge and expertise to help your business realise the opportunity. Tap into China’s potential at www.hsbc.com/rmb Issued by HSBC Holdings plc. Cyan 611469_6006571 HSBC 280.00 x 170.00 mm Magenta Yellow HSBC RMB Press Ads 280.00 x 170.00 mm Black xpath_unresolved Tom Fryer 16/06/2016 18:41 [email protected] ${Market} ${Revision Number} 0 Title Page.qxp_Layout 1 13/9/16 6:36 pm Page 1 china’s tycoons profiles of 150top business leaders fourth Edition Week in China 0 Welcome Note.FIN.qxp_Layout 1 13/9/16 3:10 pm Page 2 Week in China China’s Tycoons Foreword By Stuart Gulliver, Group Chief Executive, HSBC Holdings alking around the streets of Chengdu on a balmy evening in the mid-1980s, it quickly became apparent that the people of this city had an energy and drive Wthat jarred with the West’s perception of work and life in China. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Hang Seng Indexes Announces Index Review Results

25 February 2016 HANG SENG INDEXES ANNOUNCES INDEX REVIEW RESULTS Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 31 December 2015. All changes will be effective on 14 March 2016 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents is fixed at 50. Inclusion: Code Company FAF (%) Sub-Index Cheung Kong Infrastructure 1038 25 Utilities Holdings Ltd. Removal: Code Company FAF (%) Sub-Index China Resources Beer 291 50 Commerce & Industry (Holdings) Co. Ltd. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index There is no change to the constituents of the Hang Seng China Enterprises Index. The total number of constituents is fixed at 40. The list of constituents is provided in Appendix 2. 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 280 to 299. more… HANG SENG INDEXES ANNOUNCES INDEX REVIEW RESULTS/ 2 Inclusion: Code Company 10 Hang Lung Group Ltd. 109 Good Resources Holdings Ltd. 136 HengTen Networks Group Ltd. 400 Cogobuy Group 405 Yuexiu Real Estate Investment Trust 607 Fullshare Holdings Ltd. 715 China Oceanwide Holdings Ltd. 911 Hang Fat Ginseng Holdings Co. Ltd. 958 Huaneng Renewables Corporation Ltd. - H Shares 1071 Huadian Power International Corporation Ltd. - H Shares 1282 China Goldjoy Group Ltd. 1308 SITC International Holdings Co. -

Istoxx® Developed and Emerging Markets Ex Usa Pk Vn Real Estate

ISTOXX® DEVELOPED AND EMERGING MARKETS EX USA PK VN REAL ESTATE Components1 Company Supersector Country Weight (%) Vonovia SE Real Estate Germany 3.58 Goodman Group Real Estate Australia 2.31 Mitsubishi Estate Co. Ltd. Real Estate Japan 2.14 Mitsui Fudosan Co. Ltd. Real Estate Japan 2.06 Sun Hung Kai Properties Ltd. Real Estate Hong Kong 2.00 Link Real Estate Investment Tr Real Estate Hong Kong 1.79 DEUTSCHE WOHNEN Real Estate Germany 1.71 Sumitomo Realty & Development Real Estate Japan 1.50 SEGRO Real Estate Great Britain 1.44 CK Asset Holdings Ltd Real Estate Hong Kong 1.33 China Resources Land Ltd. Real Estate China 1.14 SM Prime Holdings Inc Real Estate Philippines 1.11 LEG IMMOBILIEN Real Estate Germany 1.06 SCENTRE GROUP Real Estate Australia 1.04 UNIBAIL-RODAMCO-WESTFIELD Real Estate France 1.04 AROUNDTOWN (FRA) Real Estate Germany 0.85 China Overseas Land & Investme Real Estate China 0.84 WHARF REIC Real Estate Hong Kong 0.78 Mirvac Group Real Estate Australia 0.78 DEXUS Real Estate Australia 0.77 Nippon Building Fund Inc. Real Estate Japan 0.77 Stockland Real Estate Australia 0.75 Japan Real Estate Investment C Real Estate Japan 0.73 SWISS PRIME SITE Real Estate Switzerland 0.73 CAPTIALAND INT COMM TRUST Real Estate Singapore 0.71 GECINA Real Estate France 0.70 Ayala Land Inc Real Estate Philippines 0.69 Ascendas Real Estate Investmen Real Estate Singapore 0.68 New World Development Co. Ltd. Real Estate Hong Kong 0.66 CANADIAN APARTMENT PROP REIT Real Estate Canada 0.66 NIPPON PROLOGIS REIT Real Estate Japan 0.63 NOMURA REIT.MASTER FUND Real Estate Japan 0.62 CapitaLand Ltd. -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

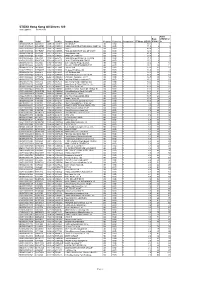

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 83.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 71.5 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 49.4 3 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 42.9 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 41.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 33.3 6 7 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 31.0 7 6 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 27.1 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.2 9 10 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 20.1 10 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 11 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 18.8 12 9 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.2 14 15 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.7 15 14 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.1 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

Cuam Csi 300-Afs 2016

ANNUAL REPORT CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI 300 INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) 31 December 2016 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI 300 INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 REPORT OF THE MANAGER TO THE UNITHOLDERS 2 - 5 REPORT OF THE TRUSTEE TO THE UNITHOLDERS 6 STATEMENT OF RESPONSIBILITIES OF THE MANAGER AND THE TRUSTEE 7 INDEPENDENT AUDITOR'S REPORT 8 - 12 AUDITED FINANCIAL STATEMENTS Statement of profit or loss and other comprehensive income 13 Statement of financial position 14 Statement of changes in net assets attributable to unitholders 15 Statement of cash flows 16 Notes to financial statements 17 - 44 INVESTMENT PORTFOLIO 45 - 56 MOVEMENTS IN INVESTMENT PORTFOLIO 57 - 69 PERFORMANCE RECORD 70 IMPORTANT: Any opinion expressed herein reflects the Manager's view only and is subject to change. For more information about the Sub-Fund, please refer to the prospectus of the Sub-Fund which is available at our website: http://www.99fund.com.hk Investors should not rely on the information contained in this report for their investment decisions. CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI 300 INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER SERVICE AGENT OR CONVERSION AGENT China Universal Asset Management (Hong Kong) Company HK Conversion Agency Services Limited Limited 1/F One & Two Exchange Square 3710-11, Two International Finance Centre 8 Connaught Place 8 Finance Street Central, Hong Kong Central Hong Kong AUDITOR Ernst & Young DIRECTORS OF THE MANAGER 22/F, CITIC Tower LI Wen 1 Tim Mei Avenue WAN Qing Central ZHANG Hui Hong Kong ADVISER PARTICIPATING DEALERS China Universal Asset Management Company Limited BNP Paribas Securities Services 22/F, Aurora Plaza 21/F-23/F, PCCW Tower Taikoo Place No. -

Semi-Annual Report DBX ETF Trust

November 30, 2020 Semi-Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Portfolio Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 3 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 4 Xtrackers MSCI All China Equity ETF .................................................... 5 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 6 Fees and Expenses ....................................................................... 7 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 8 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 13 Xtrackers MSCI All China Equity ETF .................................................... 21 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 26 Statements of Assets and Liabilities ........................................................ 34 Statements of Operations ................................................................. 35 Statements of Changes in Net Assets ....................................................... 36 Financial Highlights -

Annual Report 2014

CHINA OCEANWIDE HOLDINGS LIMITED 2014 年年報 ANNUAL REPORT 2014 中泛控股有限公司 2014 ANNUAL REPORT 201 4 年年報 (前稱和記港陸有限公司) (formerly known as Hutchison Harbour Ring Limited) 股份代號: 715 Stock Code: 715 CORPORATE INFORMATION CHINA OCEANWIDE HOLDINGS LIMITED 2014 ANNUAL REPORT CORPORATE INFORMATION BOARD OF DIRECTORS AUDIT COMMITTEE Executive Directors LIU Jipeng (Chairman) LO Wa Kei Roy HAN Xiaosheng (Chairman) ZHAO Yingwei LIU Bing LIU Hongwei REMUNERATION COMMITTEE LIU Guosheng CAI Hongping (Chairman) Non-executive Directors YAN Fashan HAN Xiaosheng QIN Dingguo (Deputy Chairman) ZHENG Dong (Deputy Chairman) NOMINATION COMMITTEE ZHAO Yingwei QI Zixin HAN Xiaosheng (Chairman) LIU Jipeng Independent Non-executive Directors YAN Fashan LIU Jipeng COMPANY SECRETARY CAI Hongping YAN Fashan LIANG Yanyu LO Wa Kei Roy AUDITOR PricewaterhouseCoopers BANKERS The Hongkong and Shanghai Banking Corporation Limited Standard Chartered Bank (Hong Kong) Limited CONTENTS CHINA OCEANWIDE HOLDINGS LIMITED 2014 ANNUAL REPORT CONTENTS Page Chairman’s Statement 2 Management Discussion and Analysis 5 Environmental, Social and Governance Report 7 Information on Directors 9 Information on Senior Management 15 Report of the Directors 16 Corporate Governance Report 30 Independent Auditor’s Report 49 Consolidated Income Statement 50 Consolidated Statement of Comprehensive Income 51 Consolidated Statement of Financial Position 52 Statement of Financial Position 54 Consolidated Statement of Cash Flows 55 Consolidated Statement of Changes in Equity 56 Notes to the Financial Statements 58 Five Year Summary 98 Particulars of Major Properties 99 Information for Shareholders 100 1 CHAIRMAN’S STATEMENT CHINA OCEANWIDE HOLDINGS LIMITED 2014 ANNUAL REPORT CHAIRMAN’S STATEMENT CHANGE OF CONTROLLING SHAREHOLDERS On 6 November 2014, immediately following the completion of the disposal of 6,399,728,952 shares of the Company by the former controlling shareholders to Oceanwide Holdings International Co., Ltd.