Actuarial Assumptions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reading Blue Coat School

BLHA Newsletter Chairman's Corner This will be the first Newsletter edited by John Chapman. I know he has many good ideas for its future, and would like to wish him well. As a well-known military historian, his servi- ces must be in great demand at present, so taking on this task cannot have been easy. Members of the committee are particularly keen to let the member societies know what the Association is doing, and what it can do for them. We want the Newsletter to be read as widely as possible by members of member societies. And we would like to hear what the societies are doing. There are around 40 of them, but we only hear regularly from about a dozen in the Newsletter. A recent change in the committee has been brought about by Elias Kupfermann volunteering his services. He is well-known in Windsor, Maidenhead and Slough as a local historian, and I would like to welcome him. There are a number of jobs which need to be done, and I hope he soon finds his niche, and can be formally elected at the next A.G.M. Incidentally, I notice that the Constitution of the Association says that the officers and committee members should “normally” retire after five years. To my surprise, I find that I was first elected in 2009, so I’ve already done my five years! And as for most of the rest of the committee . It needs thinking about. I was pleased to be invited to present the Berkshire History Prize this year: please see the short report and photograph later in this issue. -

Sports Bulletin 14Th- 18Th October 2019

Sports Bulletin 14th- 18th October 2019 Girls’ Fixtures w/c 14th October Boys’ Fixtures w/c 14th October CONT... Tuesday 15th October Under 14 Football Wednesday 16th October St Crispin’s v Holt (H) Year 10/11 Rugby Approx finish 5.00pm St Crispin’s v Icknield & Gillotts (A) To be held at Icknield Wednesday 16th October Approx. return 5.00pm Year 10 Netball League To be held at Bulmershe Wednesday 16th October Approx return 5.30.pm U18 County Cup St Crispin’s v Reading School (H) To be held at Icknield Boys’ Fixtures w/c 14th October Approx. finish 4.30pm Thursday 17th October Monday 14th October Year 11 National Cup Year 8 Rugby St Crispin’s v Wallingford (H) St Crispin’s v Willink & Denefield (A) Approx. finish 4.00pm To be held at Denefield TBC—At the moment this is a provisional fixture Approx. return 5.00pm Thursday 17th October Tuesday 15th October Year 8 Rugby Year 7 Rugby St Crispin’s v Piggott & Little Heath (A) St Crispin’s v Piggott & Maiden Erlegh (CE) (A) To be held at Piggott To be held at Maiden Erlegh Chiltern Edge Approx. return 5.00pm Approx. return 5.00pm Please note that this fixture is subject to change. Girls’ Results w/c 7th October Boys’ Results w/c 7th October Saturday 5th October Monday 7th October U16 Berkshire National Netball Tournament Year 9 Rugby Held at Theale Green School St Crispin’s v Maiden Erlegh (Wokingham) (H) St Crispin’s came 3rd overall winning 5 matches St Crispin’s won 38-33 Try Scorers: Isaac, Sam ad James W Monday 7th October Under 15 Netball Tuesday 8th October St Crispin’s v Luckley (H) -

Undergraduate Admissions by

Applications, Offers & Acceptances by UCAS Apply Centre 2019 UCAS Apply Centre School Name Postcode School Sector Applications Offers Acceptances 10002 Ysgol David Hughes LL59 5SS Maintained <3 <3 <3 10008 Redborne Upper School and Community College MK45 2NU Maintained 6 <3 <3 10011 Bedford Modern School MK41 7NT Independent 14 3 <3 10012 Bedford School MK40 2TU Independent 18 4 3 10018 Stratton Upper School, Bedfordshire SG18 8JB Maintained <3 <3 <3 10022 Queensbury Academy LU6 3BU Maintained <3 <3 <3 10024 Cedars Upper School, Bedfordshire LU7 2AE Maintained <3 <3 <3 10026 St Marylebone Church of England School W1U 5BA Maintained 10 3 3 10027 Luton VI Form College LU2 7EW Maintained 20 3 <3 10029 Abingdon School OX14 1DE Independent 25 6 5 10030 John Mason School, Abingdon OX14 1JB Maintained 4 <3 <3 10031 Our Lady's Abingdon Trustees Ltd OX14 3PS Independent 4 <3 <3 10032 Radley College OX14 2HR Independent 15 3 3 10033 St Helen & St Katharine OX14 1BE Independent 17 10 6 10034 Heathfield School, Berkshire SL5 8BQ Independent 3 <3 <3 10039 St Marys School, Ascot SL5 9JF Independent 10 <3 <3 10041 Ranelagh School RG12 9DA Maintained 8 <3 <3 10044 Edgbarrow School RG45 7HZ Maintained <3 <3 <3 10045 Wellington College, Crowthorne RG45 7PU Independent 38 14 12 10046 Didcot Sixth Form OX11 7AJ Maintained <3 <3 <3 10048 Faringdon Community College SN7 7LB Maintained 5 <3 <3 10050 Desborough College SL6 2QB Maintained <3 <3 <3 10051 Newlands Girls' School SL6 5JB Maintained <3 <3 <3 10053 Oxford Sixth Form College OX1 4HT Independent 3 <3 -

Headteacher's Newsletter - 6Th November 2020

Headteacher's Newsletter - 6th November 2020 Dear Parent/Carer/Guardian, Democracy has never felt more important to the world this week. The presidential election in the US has highlighted the need for leadership and to ensure all voices are heard; indeed ‘count all votes’ has become a rallying cry for many over the last day or so. As a French teacher, I love explaining to students that the French word ‘voix’ means both ‘voice’ and ‘vote’, that the act of voting gives individuals a voice in who and how a country is led. It is timely that this week is also UK Parliament Week and students have been learning about what it means to live in a parliamentary democracy. In addition, our own Pioneer Parliament has given all of our community the chance to vote and express their voice in choosing our Trust charity for the year. This year, the theme is diversity and the shortlisted charities reflect this. If you haven’t already voted, I would love you to fulfil your democratic duty by completing the form! I am also very pleased that student voice is a key feature of our internal quality assurance activities that begin next week. Asking students about their learning, where they are making progress and where they can be supported always gives rich insights and helps us with our aim of continuous improvement. As the country has entered a second lockdown this week, schools remain open. We do ask that parents read our behaviour addendum which has been updated following government guidance and will be made available on our website. -

Admissions to Secondary School September 2021 - 2022

Admissions to Secondary School September 2021 - 2022 Guide for Parents and Carers - Moving on to Secondary School 1 School Admission Guide Sept 2021 - 2022 | Apply at www.brighterfuturesforchildren.org/school-admissions INTRODUCTION Dear Parent/Carer, We are Brighter Futures for Children and we as smooth and straightforward as possible. took over the delivery of children’s services It contains a lot of detail and it is important that in Reading in December 2018 from Reading you read it carefully and follow the guidance Borough Council. step-by-step to ensure you maximise your We are wholly-owned by Reading Borough chances of reaching a successful outcome for Council but independent of it, with our own staff, you and your child. management team and Board. Throughout this guide you will see references to On behalf of the council, we deliver children’s both Brighter Futures for Children and Reading social care (including fostering and early help), Borough Council, as well as both ‘Children education, Special Educational Needs and Looked After’ and ‘Looked After Children’. We Disabilities (SEND) and youth offending services. use the former and are encouraging others to do so, as we’ve asked our children in care and it’s a Our vision and aim is to unlock resources to help term they prefer. However, as we took over part every child have a happy, healthy and successful way through a school year, this guide will refer to life. both. Part of our education remit is to deliver the However, the information is correct and this school admissions service, in line with local guide gives you a flavour of the full range of authority statutory duties. -

WINDSOR MIDDLE SCHOOL EXPANSION Contains Confidential NO - Part I Or Exempt Information? Member Reporting: Councillor Airey, Lead Member for Children’S Services

Report Title: WINDSOR MIDDLE SCHOOL EXPANSION Contains Confidential NO - Part I or Exempt Information? Member reporting: Councillor Airey, Lead Member for Children’s Services Meeting and Date: 24 May 2018 Responsible Officer(s): Kevin McDaniel, Director of Children's Services Wards affected: All REPORT SUMMARY 1. The Royal Borough’s ambitions for education are that: parents have a choice over schools for their children; all children have the opportunity to access high quality education, assessed as good/outstanding by Ofsted; and that all children make progress in their education attainment above national levels. 2. There is pressure for places in the Windsor middle schools from September 2019, and the borough consulted on a proposal to expand St Peter’s CE Middle School by 30 places per year group, starting with Year 5 in September 2019. That consultation has now finished, with two-thirds of respondents in favour. 3. The expansion at St Peter’s CE Middle School would give the school two additional classrooms, new toilets and group rooms, as well as a better kitchen for serving meals. Some work to the main entrance will also be required, to provide extra staff parking and better access to the site. 4. Approval from Cabinet to fund the expansion of St Peter’s CE Middle School will move the scheme to the next stage (more detailed design work, planning permission and procurement) in partnership with the school and its academy trust, the Oxford Diocesan Schools Trust (ODST). The ODST will seek formal permission for the school to expand from the Secretary of State for Education. -

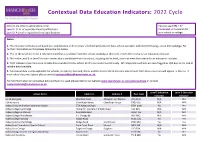

Education Indicators: 2022 Cycle

Contextual Data Education Indicators: 2022 Cycle Schools are listed in alphabetical order. You can use CTRL + F/ Level 2: GCSE or equivalent level qualifications Command + F to search for Level 3: A Level or equivalent level qualifications your school or college. Notes: 1. The education indicators are based on a combination of three years' of school performance data, where available, and combined using z-score methodology. For further information on this please follow the link below. 2. 'Yes' in the Level 2 or Level 3 column means that a candidate from this school, studying at this level, meets the criteria for an education indicator. 3. 'No' in the Level 2 or Level 3 column means that a candidate from this school, studying at this level, does not meet the criteria for an education indicator. 4. 'N/A' indicates that there is no reliable data available for this school for this particular level of study. All independent schools are also flagged as N/A due to the lack of reliable data available. 5. Contextual data is only applicable for schools in England, Scotland, Wales and Northern Ireland meaning only schools from these countries will appear in this list. If your school does not appear please contact [email protected]. For full information on contextual data and how it is used please refer to our website www.manchester.ac.uk/contextualdata or contact [email protected]. Level 2 Education Level 3 Education School Name Address 1 Address 2 Post Code Indicator Indicator 16-19 Abingdon Wootton Road Abingdon-on-Thames -

Co-Ordinated Admissions Scheme for All RBWM Schools Admission Arrangements for RBWM Community and Voluntary Controlled Schools

Appendix 1 Co-ordinated Admissions scheme for all RBWM schools Admission Arrangements for RBWM Community and Voluntary Controlled schools For September 2015 entry Contents Page Introduction 2 Section 1 Admission policy for primary age schools 3 Children with statements of special educational needs (SEN) 3 Oversubscription criteria 4 Tiebreaker 4 Multiple births or children with birth dates in the same academic year 4 Notes 4 Section 2 Admission policy for secondary age schools 5 Children with statements of special educational needs (SEN) 5 Oversubscription criteria 5 Tiebreakers 6 Multiple births or children with birth dates in the same academic year 6 Notes 6 Section 3 Admission policy for in-year entry 8 The application process for RBWM Community and Voluntary 8 Controlled Schools Section 4 Admission policy for sixth form entry 10 Roles and responsibilities 10 Published admission number (PAN) 10 Application process 10 Allocation of places (oversubscription criteria) 11 Tiebreaker 11 Waiting lists 11 Late applications 11 Multiple births or children with birthdates in the same academic year 12 Accepting or declining the offer of a place 12 Appeals 12 Section 5 Further Information 13 Social or medical criterion 13 Looked-after children (and previously looked-after children) 14 Denominational criterion 15 Section 6 RBWM co-ordinated admission scheme 16 Guidance information 16 Application process 17 Allocation process 18 National offer date 19 Further offer of places following parental responses 20 Late applications and late changes of preferences 20 Primary school entry point 21 Children educated outside of their chronological academic year 21 group Appeals 22 Co-ordination timetable 24 Section 7 Admission numbers of schools 25 Section 8 Definitions and explanations 27 Introduction The Royal Borough of Windsor and Maidenhead is the ‘Admitting Authority’ for Community and Voluntary Controlled schools within RBWM. -

Annual Report

ANNUAL REPORT 2018 – 2019 Windsor and Maidenhead Youth and Community Counselling Service Windsor Alma Road SL4 3HD – Maidenhead Marlow Road SL6 7YR Slough Church Street Tel: 01753 842444 01628 636661 An initiative of Churches Together in Windsor Supported by the Royal Borough of Windsor and Maidenhead Nominated for The Queen’s Award for Volunteering Registered Charity No. 1177138 BACP Accredited Service 1 I am not what happened to me, I am what I choose to become. Jung In memory of George 25/08/06 – 07/09/18 He understood the meaning of empathy. How can I provide a relationship, which this person may use for their own personal growth? Carl Rogers 2 Chair’s Report This has been a year of much development. We spent considerable time on our commissioning service level agreement with RBWM. The finalisation of the process was put on hold when Shula became unwell. RBWM as her employer stepped back to give her health first priority and I know that Shula was extremely grateful and appreciative of their response. The work will resume later this year. The appointment of the management team has greatly contributed to development. Alison Batey has a very clear programme for expanding the work in schools and securing income to support the work. She made a very detailed presentation to the trustees on the work she is doing. Damon has been preparing for our data handling with our own computer support rather than being a part of RBWM. He has investigated several possibilities and the best way forward is becoming clear. He has been very thorough in his reporting to the trustees, keeping us informed at all stages and on all matters in his remit. -

20Th November 2015 Dear Request for Information Under the Freedom

Governance & Legal Room 2.33 Services Franklin Wilkins Building 150 Stamford Street Information Management London and Compliance SE1 9NH Tel: 020 7848 7816 Email: [email protected] By email only to: 20th November 2015 Dear Request for information under the Freedom of Information Act 2000 (“the Act”) Further to your recent request for information held by King’s College London, I am writing to confirm that the requested information is held by the university. Some of the requested is being withheld in accordance with section 40 of the Act – Personal Information. Your request We received your information request on 26th October 2015 and have treated it as a request for information made under section 1(1) of the Act. You requested the following information. “Would it be possible for you provide me with a list of the schools that the 2015 intake of first year undergraduate students attended directly before joining the Kings College London? Ideally I would like this information as a csv, .xls or similar file. The information I require is: Column 1) the name of the school (plus any code that you use as a unique identifier) Column 2) the country where the school is located (ideally using the ISO 3166-1 country code) Column 3) the post code of the school (to help distinguish schools with similar names) Column 4) the total number of new students that joined Kings College in 2015 from the school. Please note: I only want the name of the school. This request for information does not include any data covered by the Data Protection Act 1998.” Our response Please see the attached spreadsheet which contains the information you have requested. -

Moving up to Secondary School in September 2015 Data As at 18 September 2015

Moving up to Secondary School in September 2015 Data as at 18 September 2015 Count area school primary Feeder school primary Feeder LA Home STTS required? Grammer school scoreMaths standardised Weighted scoreverbal Non- standardised Weighted score Verbal standardsied Weighted review? at qualified - Status SR 1 WYC Castlefield School 825 5 5.28 0.00 0.13 2 WYC Hamilton Academy School 825 6 6.83 0.00 0.00 3 WYC Meadows School, The 825 7 7.04 0.00 0.42 4 WYC Meadows School, The 825 11 8.16 0.00 3.74 5 CSB St Marys Farnham Royal CE Primary School 871 11 5.00 1.00 5.21 6 CSB Prestwood Junior School 825 12 8.79 1.18 2.90 7 AV Haydon Abbey Combined School 825 13 8.49 1.00 4.44 8 WYC Claytons Primary School 825 14 9.15 0.00 5.83 9 CSB Denham Green E-ACT Primary Academy 825 15 7.93 3.15 4.80 10 AV Thomas Hickman School 825 15 6.11 2.67 6.62 11 WYC Hannah Ball School 825 15 8.17 0.77 6.60 12 AV Bearbrook Combined School 825 15 7.44 0.00 8.22 13 AV Ashmead Combined School 825 15 5.33 2.94 6.86 14 CSB Dorney School 825 15 8.11 0.00 7.74 15 AV Ashmead Combined School 825 16 7.16 0.87 8.22 16 AV Oak Green School 825 17 9.09 3.95 4.49 17 AV Overstone Combined School 825 17 8.04 1.54 7.87 18 CSB St Josephs RC Primary School 825 17 11.63 0.00 5.83 19 CSB Iver Village Junior School 825 17 9.35 0.75 6.93 20 CSB Waterside Combined School 825 18 8.24 5.92 3.92 21 WYC Castlefield School 825 18 8.05 4.94 5.06 22 AV Broughton Junior School 825 18 7.98 6.55 3.70 23 WYC Beechview School 825 18 6.93 1.57 10.24 24 WYC Widmer End Combined School 825 18 7.88 2.27 -

Ofsted Rating: Good the Emmbrook School Is a 11-18 Community School in Wokingham. the School Has a Full-Time Careers Lead and De

Ofsted rating: Good The Emmbrook School is a 11-18 community school in Wokingham. The school has a full-time careers lead and delivers enterprise activities through Education Business Partnerships (EBPs). Enterprise Adviser David Cook is a semi-retired ex-Marketing Director of 3M, ex-LEP Director, Governor at a university and currently self-employed business consultant. He is situated local to the school with a vested interest in the school and local area. Work with the school David Cook and TVB Enterprise Co-ordinator met with the Career Lead and Head of Business establishing that, in the first instance, there would be a huge value add to the school pupils in learning from the EA’s knowledge around self- employment routes and entrepreneurial skills. The EA will create workshops to be shared with the school around these topics to be used with years 12 and 13, including an enrichment programme for students wishing to start their own business. Ofsted rating: Outstanding Edgbarrow School is a high performing school in Crowthorne, which strives to nurture and develop students who have a wide range of experiences, skills and qualities that can complement their academic abilities. The school has a Work-related Learning Co-ordinator, a governing body keen to engage with business and an Investors in Careers Award. Enterprise Adviser Ken Sankey is currently working part time helping directors/owners of SMEs develop their businesses. Prior to that he spent 20 years in the Thames Valley, working with corporate businesses, the latter 10 years as Director running a team of 100 people.