Emami Companyname

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consumer Goods Recovery in Discretionary and Urban Sales Led to Better Q3 Sector Update

Consumer Goods Recovery in discretionary and urban sales led to better Q3 Sector Update Consumer goods companies’ Q3 performance was driven by sales recovery of Q3FY2021 Results Review discretionary categories (such as value-added hair oil and personal care products), sustained higher demand for healthcare and hygiene products, better traction to Sector: Consumer Goods new launches, and higher demand in rural markets coupled with improving demand in urban markets. General trade continues to grow strongly, e-commerce mix to Sector View: Positive overall revenue is improving due to higher sales and modern trade channel has witnessed sequential improvement due to recovery in urban sales. Most consumer goods companies under our coverage registered organic revenue growth of 6%-16%, driven by domestic volume growth of 7%-18% in Q3. Paint companies, including Asian Paints, registered strong volume growth of 30%, led by sustained high demand in tier III/IV towns and improving demand in metros and top cities due to receding scare of virus and improving construction and real estate activities. Overall, Sharekhan’s consumer goods universe registered revenue growth of ~14% in Q3FY2021, better than 9.1% growth achieved in Q2FY2021. Significant increase Our coverage universe in prices of palm oil, copra, other edible oils, and raw tea/coffee resulted in gross Companies CMP Reco. PT margin decline for companies such as HUL, Godrej Consumer Products (GCPL), (Rs) (Rs) Marico, and Tata Consumer Products (TCPL). However, lower ad spends and cost- Asian Paints 2,389 Buy 3,000 saving initiatives arrested the sharp decline of 80-100 bps in operating profit margins (OPM) for some companies. -

HSBC Saudi Arabia Limited

HSBC Saudi Arabia Limited HSBC China & India Equity Freestyle Fund - IAF Fund Details Monthly Factsheet Fund Manager HSBC Saudi Arabia Ltd. as of 31 January 2015 Inception Date 12 December 2005 Profile Inception Price USD 10 To provide capital appreciation through investing in a well-diversified portfolio comprising of shares in Indian and Chinese companies over a long period of five years and above . Fund Type Open ended Top Holdings Investment Policy Freestyle Management Stock Weight % Base Currency US Dollar of the Fund Tencent Holdings Ltd. 10 Baidu Inc. Sponsored ADR 9 Risk/Return Profile High Infosys Ltd. 8 Bloomberg Code SABCHIN AB Wipro Ltd. 7 Emami Ltd. 5 Zawya Code HSBCIEF.MF Oil & Natural Gas Corp. Ltd. 4 Fund Size (USD) 44 Million HCL Technologies Ltd. 4 Minimum Initial USD 2,000 Maruti Suzuki India Ltd. 4 Investment Cognizant Tech Solutions 4 Glenmark Pharmaceuticals Ltd. 4 Minimum Additional USD 1,000 Investment Fund Composition Valuation Day Monday & Thursday Cut off Time Before close of business; On Sunday for Monday valuation, and on Wednesday for Thursday valuation. Redeemed Funds Four business days Payment after valuation day Annual Management Fee 2% Subscription Fee Up to 2% Contact Details HSBC Saudi Arabia Limited Local Investors Toll Free Number 800 124 1212 International Investors Tel +966 1 299 2313 / +966 1 299 2314 Website www.hsbcsaudi.com Email: [email protected] Issued by HSBC Saudi Arabia Limited Authorized and regulated by Capital Market Authority License No. 05008-37 Please note that the above figures refer to past performance and that past performance is not a reliable indicator of future results. -

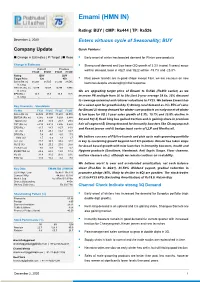

Emami (HMN IN)

Emami (HMN IN) Rating: BUY | CMP: Rs444 | TP: Rs526 December 2, 2020 Enters virtuous cycle of Seasonality; BUY Company Update Quick Pointers: Change in Estimates | ☑ Target | Reco . Early onset of winter has boosted demand for Winter care products Change in Estimates . Strong rural demand and Low base (3Q growth of 3.3% in past 5 years) augur Current Previous well for demand, base in 4Q21 and 1Q22 will be -19.7% and -25.8% FY22E FY23E FY22E FY23E Rating BUY BUY Target Price 526 450 . Most power brands are in good shape except F&H, we are cautious on new Sales (Rs. m) 31,293 34,585 31,293 34,585 launches despite encouraging initial response % Chng. - - EBITDA (Rs. m) 9,299 9,988 9,299 9,988 % Chng. - - We are upgrading target price of Emami to Rs526 (Rs450 earlier) as we EPS (Rs.) 16.7 18.8 16.7 18.8 % Chng. - - increase PE multiple from 26 to 28x (last 5-year average 38.6x, 25% discount to coverage universe) and rollover valuations to FY23. We believe Emami has Key Financials - Standalone hit a sweet spot for growth led by 1) Strong rural demand as it is 55% of sales Y/e Mar FY20 FY21E FY22E FY23E for Emami 2) strong demand for winter care products on early onset of winter Sales (Rs. m) 26,549 27,780 31,293 34,585 3) low base for 3Q ( 5 year sales growth of 3.3%, 19.7% and 25.8% decline in EBITDA (Rs. m) 6,905 8,594 9,299 9,988 4Q and 1Q) 4) Kesh king has gained traction and is gaining share in premium Margin (%) 26.0 30.9 29.7 28.9 PAT (Rs. -

Oman Chapter) an Open Access Journal DOI: 10.12816/0044909 Special Issue: PECTEAM 2018

Arabian J Bus Manag Review (Oman Chapter) An Open Access Journal DOI: 10.12816/0044909 Special Issue: PECTEAM 2018 Arabian Journal of Business and Management Review (Oman Chapter) ResearchResearch Article Homepage: www.arabianjbmr.com AGJ A STUDY ON APPLICATION OF BRAND VALUATION TECHNIQUES WITH REFERENCE TO FAST MOVING CONSUMER GOODS COMPANIES Aisha Banu Research Scholar - Bangalore University Presidency College, Kempapura, Hebbal, Bangalore – 560 024 Dr. Lily David Research Supervisor, Bangalore University St.Joseph College of Commerce, Bangalore Dr. K R Pundareekavittala Co-Research Supervisor Presidency College, Kempapura, Hebbal, Bangalore -560024 Abstract Brand Valuation for the purpose of technical valuation results In balance sheet reporting, tax planning, mergers and acquisitions and investor relations purpose. Though there are various brand valuation techniques available, none can be applied in order to arrive at more accurate value of brand. In light of this drawback, this research paper has been taken up to derive an appropriate brand valuation technique or model suitable to Fast Moving Consumer Goods Companies. The researcher has gathered top ten companies from FMCG based on market capitalisation. Their four years annual reports are analysed, using statistical techniques to substantiate the model arrived at. Introduction Brand refers to any name, design, symbol or any other feature that differentiates one product from another. It is intangible which includes trade names, trademarks, trade symbols, domain names, design rights, trade dress, packaging, copyrights, associated goodwill and advertising visuals. Brand is an intangible asset and very important to a wide variety of industries. The relative importance of intangible asset like brand varies industry wise. For a Pharmaceutical industry, knowledge asset is important, in a Retailing industry Business process asset is significant, for an Airline industry market position asset is primary driver and thus goes the list for various industries. -

20130118104321Small366.Pdf

Contents PERFORMANCE REPORT 2006-7 Forward looking statement In this Annual Report we have disclosed forward-looking information to enable investors to comprehend our prospects and take informed investment decisions. This report and other statements that we 10 periodically make contain forward-looking Yesterday’s statements that set out anticipated results wisdom, based on the management’s plans and tomorrow’s assumptions. We have tried wherever products possible to identify such statements by using words such as ‘anticipate’, Why does a nation of 1.1 billion ‘estimate’, ‘expects’, ‘projects’, ‘intends’, Cover story 30 consumers trust Emami? ‘plans’, ‘believes’, and words of similar substance in connection with any India’s FMCG success Wealth at discussion of future performance. story and Emami 18 the bottom of 26 Readers should bear in mind that we the pyramid cannot guarantee that these forward- looking statements will be realised, although we believe we have been prudent in our assumptions. The achievement of 12 results is subject to risks, uncertainties and The fame game: why brands estimates taken as assumptions. Should need celebrities known or unknown risks or uncertainties materialise, or should underlying Enhancing returns, Indian realty sector: assumptions prove inaccurate, actual 40 creating wealth 42 Gaining visibility results could vary materially from those anticipated, estimated or projected. 28 Emami and its global footprint 05 Inauguration of the new corporate office Also Opinions. Appreciation 02 Emami as a Group 46 -

Registered Msos As on 03.08.2020 S.No

Registered MSOs as on 03.08.2020 S.No. Name of MSO Address for Correspondence State Type of Entity Registration No. Date of issue Registation Phone No. Email Remarks of Valid Registration Upto (DD/M M/YYYY) 1 5 Star Network Surpura Road, Bahel Haryana Proprietorship 9/240/2016-DAS 31-10-2016 30-10-2026 98122 45678 5starnetworkbehal@gmail. Bhiwani – 127028 com 2 9 Star Digital Cable D.No. 15-195, Karampudi Road, Andhra Pradesh Partnership 9/109/2015-DAS 24-06-2016 23-06-2026 98483 18777 Palnadu.communications@ Network Gurazala gmail.com Dist. Guntur – 522415 3 A B C O Plot No.6, Ashok Nagar , Odisha Partnership 9/97/2016-DAS 17-05-2016 16-05-2026 98614 44555 [email protected] Bhubaneswar Opp. State Bank of Hyderabad, District Khurda – 751009 4 A Boss Digital System Murugandha Bhavanam, Tamil Nadu Proprietorship 9/491/2015-DAS 17-05-2016 16-05-2026 98421 66931 [email protected] 14-C AA Road Madurai – 625016 5 A– Vision Channel Vrindavan Colony Chhattisgarh Proprietorship 9/77/2016-DAS 26-02-2016 25-02-2026 94252 58909 [email protected] Jagdalpur District m Bastar – 494001 6 A.C.N Cable Pvt. Ltd. Trade Center, No. 29/4, Karnataka Company 9/44/2013-BP&L 21-07-2015 20-07-2025 80428 84888 [email protected] 4th Floor, Race Course Road, 95380 67831 [email protected] Banglore – 560001 080 4288-4288 7 Aadhar Digital Vision Pvt. 37/19, Ayalur Muthiah Street, Tamil Nadu Company 9/56/2012-BP&L 21-02-2014 20-02-2024 98409 03060 [email protected] Ltd Kondithope, Chennai - 600079 94449 99763 [email protected] 8 Aadhishakti Digital Plot No. -

Market Preview Domestic Indices Market Snapshot Global Indices

24-DEC-2020 Domestic Indices Market wrap up Domestic indices Key domestic indices ended with strong gains on Wednesday, index Close Prv close %Chg supported by rally in IT stocks. The Nifty closed above the crucial NIFTY 50 13,601.1 13,466.3 1.00 NIFTY SMALLCAP 50 3425.5 3327.15 2.96 13,600 mark. All the sectoral indices on the NSE ended in the NIFTY MIDCAP 50 5,757.5 5,598.5 2.84 green. Positive global cues boosted sentiment.The BSE Sensex NIFTY SMALLCAP 250 5881.8 5718.9 2.85 rallied 437.49 points to 46,444.18. The Nifty 50 index added NIFTY BANK 29,883.3 29,626.0 0.87 134.80 points or 1% to 13,601.10.HUL, ITC and Reliance NIFTY NEXT 50 31949.8 31417.3 1.69 NIFTY METAL 3,134.1 3,079.7 1.77 Industries advanced.The broader market rallied. The BSE Mid- INDIA VIX 20.5 21.99 -6.77 Cap index rose 2.40% and the BSE Small-Cap index gained Global indices 2.65%.Buyers outpaced sellers. On the BSE, 2,296 shares rose and 650 shares fell. A total of 151 shares were unchanged. index Close Prv close %Chg Global Market NASDAQ 11,854.0 11,849.3 0.04% The S&P 500 closed barely in positive territory on Wednesday as DOW 28,323.4 28,391.4 -0.24% CAC 40 5,495.0 5,407.1 1.60% an expected stimulus deal and falling jobless claims prompted DAX 11,137.0 10,919.8 1.95% investors to put their money into sectors most likely to benefit NIKKEI 25,527.0 24,985.8 2.12% from the economy re-opening when it recovers from the global HANG SENG 26,016.2 25,709.2 1.18% health crisis.The Dow Jones Industrial Average rose 114.32 NYSE 2,072.2 2,077.2 -0.24% FTSE 1,524.3 1,519.6 0.31% points, or 0.38%, to 30,129.83, the S&P 500 gained 2.75 points, or 0.07%, to 3,690.01 and the Nasdaq Composite dropped 36.80 As on 8.00 IST points, or 0.29%, to 12,771.11.Asian shares were set to rise on NiftyMarket Watch Snapshot Thursday ahead of the Christmas break, as global investors cheered a potential Brexit deal and economic recovery prospects, largely ignoring U.S. -

20130118104629Small41.Pdf

Crores of Indian households. A number of family members. Multiple needs. One choice. Joint promoters’ statement “A presence in every house, a recall in every mind – ‘ghar ghar mein Emami’ – has been our driving inspiration since inception” Joint promoters Shri R.S. Agarwal and Shri R.S. Goenka, highlight the Company’s direction and potential There are a number of numerical another year of our successful growth. Emami and growth parameters that one can use to Our performance improved While apparently it appears that 2007- demonstrate that we performed significantly as 2007-08 was a good 08 was tilted towards the industry, the creditably during the financial year year with our topline and bottomline fact remains that we confronted the 2007-08, but the one that stands the growing by 13% and 41% respectively. biggest challenges in terms of an test of industry, analysts and company We feel that there was a sustained unprecedented increase in the cost of is our performance compared with the growth in per capita income, riding on raw materials, a strong price- broad industry average. For instance, the ripple effect of India’s economic sensitivity across most product the broad FMCG industry in India grew growth which benefited a bigger categories, a greater need for wider at a CAGR of about 6% in the last concentration of households. As there and deeper distribution to reach three years; Emami grew at a CAGR was a perceptible increase in people’s customers and the ever-lingering of 25%. aspirations and purchasing power, our threat from counterfeit and This stellar performance sends multiple advertising and brand positioning unorganised products. -

Consumer Goods Recovery in Discretionary Categories Points to Steady Q3 Sector Update

Consumer Goods Recovery in discretionary categories points to steady Q3 Sector Update Consumer goods companies (barring ITC) are expected to post steady performance Q3FY2021 Results Preview in Q3FY2021 with revenue growth of 5-10%, largely driven by a rise in sales volumes of value-added hair oils (VAHO), hair colour, higher demand for winter care products Sector: Consumer Goods and sustained demand for healthcare products. Meanwhile, sales of products such as hand sanitizers that peaked during the pandemic, will moderate as the virus Sector View: Positive threat eases, while sales of biscuits and packaged foods will stabilise in Q3FY21 (but will stay high compared with Q3FY20). Rural demand will continue to outpace urban demand due to better rural economics driven by a strong kharif and rabi seasons. We expect HUL (core business - excluding GSK Consumer’s portfolio), Britannia and Our coverage universe Nestle India to achieve volume growth of 6-9% in Q3FY2021. We expect mid-cap CMP PT companies such as Dabur India, Marico, Emami and Godrej Consumer Products Companies Reco. (Rs) (Rs) (GCPL) to achieve volume growth of 7-12% driven by a recovery in discretionary categories and sustained high demand for healthcare products. Tata Consumer Asian Paints 2,803 Buy UR Products is expected to post strong double-digit growth driven by double digit Britannia 3,538 Buy 4,200 growth in India beverage and Tata Coffee businesses while the recently-acquired Industries foods business is set to register mid-to-high teen growth. ITC’s cigarette sales volume Colgate- are expected to grow in low single digit while non-cigarette FMCG business will Palmolive 1,598 Buy 1,850 maintain double digit growth momentum. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Aban Offshore ABG Shipyard ACC Limited Adani Group Aditya Birla

A . Aban Offshore . Amul[8] . ABG Shipyard . Andhra Bank . ACC Limited . Apollo Hospitals[9] . Adani Group . Apollo Tyres[10] . Aditya Birla Group.[2] . Archies Greetings & Gifts Ltd[11] . Ador Powertron Limited[3] . Aptech . Aftek . Arvind Mills . Air India[4] and subsidiary Air-India Express[5] . Ashok Leyland[12] . Air Sahara[6] . Asia Motor Works . Ajanta Group . Asian Paints[13][14] . Alang Ship Recycling Yard[7] . Axis Bank . Allahabad Bank . Ambuja Cements . Amrutanjan Healthcare [edit]B . Bajaj Auto[15] . Bhushan Steel . Balaji Telefilms[16] . Biocon . Bank of India[15] . BMR Advisors[21] . Bank of Baroda[17] . Bombay Dyeing[22] . Bharat Aluminium Company[18] . BPL group[23] . Bharat Electronics Limited[19] . Ballarpur Industries Limited[24] . Bharat Forge[20] . Bharat Earth Movers Limited . Bharat Heavy Electricals Limited[15] . Britannia Industries[25] . Bharat Petroleum[15] . BirlaSoft . Bharat Sanchar Nigam Limited . Bharati Shipyard . Bharti Airtel [edit]C . Camlin Ltd. Coal India Limited[31] . CMC Limited[26] . Container Corporation of India . Canara Bank[15] . Crest Animation Studios[32] . Cellebrum Technologies Limited[27] . Crompton Greaves . Central Bank of India . Cadila Healthcare[33] . CESC . Coromandel International[34] . CPCL . Catholic Syrian Bank . Cipla[28] . Cosmic Circuits . Club Mahindra Holidays[29] . Covansys India Limited[30] [edit]D . Dabur India Limited[35] . Dr. Reddy's . Damodar Valley Corporation[36] Laboratories[40] . Deccan Aviation Pvt. Ltd.[37][38] is an aviation company that operates Air . DLF Universal Limited Deccan . Directi . Delhi Metro Rail Corporation Limited[39] [edit]E . Educomp Solutions . Essar Group[44] . Eicher Motors[41] . Eureka Forbes . Engineers India Limited[42] . EID Parry . English Indian Clays Limited[43] . Evalueserve[45] . Escorts Group . -

Media Release

Media Release Review of S&P BSE indices Index Committee of S&P BSE Indices has decided to revise the composition of S&P BSE indices as detailed below, w. e. f. June 24, 2013: 1. S&P BSE 200 Index: Exclusions: Inclusions: Code Name Code Name FFF NEYVELI LIGNITE 513683 534816 BHARTI INFRATEL LIMITED CORPORATION LTD. 0.15 531500 RAJESH EXPORTS LTD. 531162 EMAMI LTD 0.30 500840 EIH LTD 533398 MUTHOOT FINANCE LIMITED 0.20 GUJARAT FLUOROCHEMICALS 500173 505200 EICHER MOTORS LTD. LTD. 0.45 532778 LANCO INFRATECH LTD. 532209 JAMMU AND KASHMIR BANK LTD. 0.50 CHAMBAL FERTILISERS & 500085 509480 BERGER PAINTS INDIA LTD CHEMICALS LTD 0.25 532524 PTC INDIA LTD 500034 BAJAJ FINANCE LIMITED 0.35 532670 SHREE RENUKA SUGARS LTD. 500260 MADRAS CEMENTS LTD., 0.55 502742 SINTEX INDUSTRIES LTD 532800 TV18 BROADCAST LTD. 0.45 532391 OPTO CIRCUITS (INDIA) LTD. 500008 AMARA RAJA BATTERIES LTD 0.50 532693 PUNJ LLOYD LTD 532218 SOUTH INDIAN BANK LTD. 1.00 530773 IVRCL LTD 532652 KARNATAKA BANK LTD. 1.00 2. S&P BSE 500 Index: Exclusions: Inclusions: Code Name Code Name FFF 531900 CCL INTERNATIONAL LTD 531465 NOUVEAU GLOBAL VENTURES 0.65 LIMITED 531426 TAMILNADU NEWSPRINT & 526045 LUMINAIRE TECHNOLOGIES LTD 0.75 PAPERS 523838 SIMPLEX INFRASTRUCTURES LTD 534690 LAKSHMI VILAS BANK LTD. 0.95 509631 HEG LTD 531522 RASOYA PROTEIBO LTD 0.70 524051 POLYPLEX CORP. LTD. 502420 ORIENT PAPER & INDUSTRIES LTD. 0.55 532481 NOIDA TOLL BRIDGE CO. LTD. 512105 SHREE NATH COMMERCIAL & 0.85 FINANCE LTD 509550 GAMMON INDIA LTD 512355 ANUKARAN COMMERCIAL 0.90 ENTERPRISES LT 512463 SHREE GLOBAL TRADEFIN LTD 530557 NCL RESEARCH & FINANCIAL 0.80 SERVICES LTD 513250 JYOTI STRUCTURES LTD 500027 ATUL LTD.