Galaxy Digital to Acquire Bitgo to Form Pre-Eminent Global Provider of Digital Asset Financial Services for Institutions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Galaxy Digital Announces Launch of Decentralized Finance (Defi) Index Fund

NEWS RELEASE Galaxy Digital Announces Launch of Decentralized Finance (DeFi) Index Fund 8/19/2021 The Fund seeks to track the newly launched Bloomberg Galaxy DeFi Index NEW YORK, Aug. 19, 2021 /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy Digital" or the "Company"), the pre-eminent global provider of blockchain and cryptocurrency nancial services for institutions, today announced the launch of the Galaxy DeFi Index Fund, a passively managed fund that seeks to track the performance of the newly-launched Bloomberg Galaxy DeFi Index (ticker: DEFI). As one of the fastest growing sectors in crypto, DeFi brings nancial services on-chain, enabling participants to borrow, lend, and exchange assets on blockchains governed by smart contracts instead of through centralized intermediaries. DeFi is distinct because it expands the use of blockchain from simple value transfer to more complex nancial use cases. At the time of writing, users have deposited over $80.7 billion worth of crypto into DeFi smart contracts up from $4.7 billion one year ago today. The Galaxy DeFi Index Fund seeks to provide institutional investors access to returns based on the performance of DeFi through a simple, secure vehicle with exposure to the largest, most liquid portion of the decentralized nance crypto market, one of the fastest-growing segments of the crypto ecosystem. The fund is seeded by NZ Funds, a wealth management rm that manages over $2bn of New Zealanders' savings. "Galaxy continues to pioneer inroads for institutions seeking exposure to the innovation happening within the crypto ecosystem," said Steve Kurz, Partner and Head of Asset Management at Galaxy Digital. -

Galaxy Digital Holdings Ltd. Management's Discussion And

Galaxy Digital Holdings Ltd. Management’s Discussion and Analysis November 12, 2020 Introduction This Management’s Discussion and Analysis (“MD&A”), dated November 12, 2020, relates to the financial condition and results of operations of Galaxy Digital Holdings Ltd. (“GDH Ltd.” or together with its consolidated subsidiary, the “Company”) as of November 12, 2020, and is intended to supplement and complement the Company’s condensed consolidated interim financial statements for the three and nine months ended September 30, 2020. The Company's only significant asset is a minority interest in Galaxy Digital Holdings LP ("GDH LP" or the "Partnership"), an operating partnership that is building a diversified financial services and investment management business in the cryptocurrency and blockchain space (See Transaction section). GDH LP has separately filed its condensed consolidated interim financial statements and MD&A for the three and nine months ended September 30, 2020, which are available on the Company's SEDAR profile at www.sedar.com. The Company's MD&A should be read in conjunction with GDH LP's condensed consolidated interim financial statements and MD&A. The Company has included GDH LP's MD&A as an appendix to this MD&A. This MD&A, when read in conjunction with GDH LP's MD&A, was written to comply with the requirements of National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”). The condensed consolidated interim financial statements and MD&A are presented in US dollars, unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (“IFRS”). In the opinion of management, all adjustments (which consist only of normal recurring adjustments) considered necessary for a fair presentation have been included. -

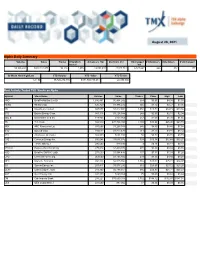

August 26, 2021 Alpha Daily Summary

August 26, 2021 Alpha Daily Summary Volume Value Trades # Symbols Advancers Vol Decliners Vol Unchanged # Advancers # Decliners # Unchanged traded Vol 53,396,832 $823,112,875 96,116 1,655 19,051,433 27,817,712 6,527,687 646 832 177 52-Week New High/Low YTD Volume YTD Value YTD Trades 68 / 36 15,720,274,735 $171,700,733,631 22,890,300 Most Actively Traded TSX Stocks on Alpha Symbol Stock Name Volume Value Trades Close High Low HND BetaProNatGas Lev Br 1,686,497 $6,404,242 664 $3.65 $4.09 $3.59 HEXO HEXO Corp. 636,320 $1,986,272 545 $3.12 $3.27 $3.05 BB BlackBerry Limited 567,077 $7,812,991 1,052 $13.72 $14.15 $13.36 BTE Baytex Energy Corp. 543,118 $1,128,584 248 $2.07 $2.10 $2.04 BBD.B Bombardier Cl B SV 449,865 $755,069 257 $1.69 $1.70 $1.65 TD T.D. Bank 388,529 $32,788,298 2,200 $83.86 $85.98 $83.70 ARX ARC Resources Ltd. 387,696 $3,208,743 646 $8.46 $8.46 $7.98 BTO B2Gold Corp. 382,047 $1,817,670 714 $4.77 $4.81 $4.72 ATH Athabasca Oil Corp J 368,900 $261,193 50 $0.72 $0.72 $0.70 CVE Cenovus Energy Inc. 350,548 $3,637,676 533 $10.34 $10.48 $10.27 TV Trevali Mining J 280,500 $49,090 9 $0.18 $0.18 $0.18 BTCC.B Purpose BitcnCA NCHg 275,816 $2,439,270 472 $8.86 $8.89 $8.76 HSD BetaPro S&P500 -2xBr 273,000 $1,994,438 107 $7.33 $7.33 $7.26 CPG Crescent Point Corp. -

Anticipated Acquisition by Capital Radio Plc of GWR Group Plc

Anticipated acquisition by Capital Radio Plc of GWR Group Plc The OFT's decision on reference under section 33(1) given on 22 December 2004 PARTIES 1. Capital Radio Plc (Capital) is a commercial radio group, providing 21 local analogue stations and 58 digital programme stations, including the Capital FM Network, Capital Gold, Century FM, Xfm and Choice FM. Capital owns outright four local digital multiplexes1, has a 50 per cent holding in three more and minority interests in a further seven. For the financial year to September 2004, Capital’s turnover was £119.9m. 2. GWR Group Plc (GWR) is a commercial radio group that owns Classic FM and 30 local analogue licences (providing 36 local stations) and 35 digital programme stations. It owns a controlling interest in the national commercial digital multiplex operator, controls 14 local digital multiplexes and has a minority investment in one London multiplex. GWR also has a minority shareholding in Classic Gold Digital Limited (CGDL), which owns 18 AM licences and digital services. For the financial year to March 2004, GWR’s turnover was £128.7m. 3. Both GWR and Capital Radio have shareholdings in Independent Radio News Limited (IRN) (Capital 45.64 per cent and GWR 8.97 per cent) and in Hit40UK Limited (Hit40UK) (Capital 38.1 per cent, GWR 34.2 per cent). These organisations, respectively, provide a national news service (Newslink) and a music chart show to radio stations of different groups across the UK in return for advertising space, which is currently sold by Capital (as an agent for IRN and Hit40UK). -

Galaxy Digital Expands Galaxy Fund Management with Acquisition of Vision Hill Group

NEWS RELEASE Galaxy Digital Expands Galaxy Fund Management with Acquisition of Vision Hill Group 5/24/2021 NEW YORK, May 24, 2021 /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy Digital" or the "Company") today announced that it has acquired Vision Hill Group, a premier investment consultant and asset manager in the digital asset sector that provides sophisticated investors with access to institutional-caliber investment products, data, benchmarks, and analytics for more informed investment decisions. The acquisition adds to Galaxy Fund Management's leading platform for institutions looking to unlock investment opportunities across the digital asset class. "As the institutionalization of digital assets accelerates, so does the need for comprehensive, institutional-grade platforms to support it and that's precisely what we're building at Galaxy," said Damien Vanderwilt, Co-President, and Head of Global Markets. "The powerful data capabilities that Scott Army, Dan Zuller, and the Vision Hill team have developed are the perfect addition to our full suite of technology-driven nancial services and investment management solutions, fostering the broader mainstream adoption of digital assets." The transaction will further expand Galaxy Fund Management's growing product suite and enable institutional clients to access an even broader array of data and intelligence to streamline research and inform investment decisions. Vision Hill Group's family of crypto hedge fund indices, leading crypto-market intelligence database VisionTrack, and sophisticated asset management capabilities with a crypto-focused fund of funds product sit at the intersection of information (data), expertise (strategies), and access (opportunities). "Galaxy Fund Management is rapidly expanding its capabilities to ultimately provide institutional-grade exposure to every investable corner of digital assets so that institutions can easily get involved in this booming industry," said Steve Kurz, Partner and Head of Asset Management at Galaxy Digital. -

Broadcast Bulletin Issue Number

O fcom Broadcast Bulletin Issue number 126 26 January 2009 1 Ofcom Broadcast Bulletin, Issue 126 26 January 2009 Contents Introduction 3 Notice of Sanction ITV Broadcasting Limited Breach of Channel 3 licence conditions in respect of ‘Out of London’ production in 2006 and 2007 4 Channel Television Ltd STV Central Ltd and STV North Ltd UTV Ltd Breach of Channel 3 licence conditions in respect of ‘Out of London’ production in 2006 and 2007 5 Standards cases In Breach Beat: Life on the Street ITV1, Series 1: 29 October - 3 December 2006, 18:00 and Series 2: 27 January - 2 March 2008, 18:00 6 Now That’s What I Call Music Chart Chart Show TV, 18 November 2008, 16:00 12 Pizza Man by Cisco Kid Clubland TV, 4 November 2008, 19:30 13 Not In Breach Steve Sutherland Galaxy Birmingham, 29 November 2008, 21:55 14 Fairness & Privacy cases There are no Fairness and Privacy cases in this issue of the bulletin Other programmes not in breach/resolved 16 2 Ofcom Broadcast Bulletin, Issue 126 26 January 2009 Introduction The Broadcast Bulletin reports on the outcome of investigations into alleged breaches of those Ofcom codes which broadcasting licensees are required to comply. These include: a) Ofcom’s Broadcasting Code (“the Code”) which took effect on 25 July 2005 (with the exception of Rule 10.17 which came into effect on 1 July 2005). This Code is used to assess the compliance of all programmes broadcast on or after 25 July 2005. The Broadcasting Code can be found at http://www.ofcom.org.uk/tv/ifi/codes/bcode/ b) the Code on the Scheduling of Television Advertising (“COSTA”) which came into effect on 1 September 2008 and contains rules on how much advertising and teleshopping may be scheduled in programmes, how many breaks are allowed and when they may be taken. -

Capital Birmingham Should Not Be Allowed to Make the Changes to The

Spence, Mr Consultation question: Should regional radio station Capital FM (Birmingham) be permitted to make the changes to its Character of Service as proposed with particular regard to the statutory criteria as set out in the summary? (The Broadcasting Act 1990 Section 106 (1A) (b) and (d) relating to Format changes). Capital Birmingham should not be allowed to make the changes to the Character of Service as this would essentially change the station from am urban/black music station to a hit music station format which can potentially stop playing urban music if they wanted to if in the future it becomes less mainstream. The format change represents a real danger to the radio landscape in Birmingham as it can so significantly reduce the choice of music available in the area over time. It will make the station sound too similar to it's main competitors in the area on FM. I am not happy with the decision in particular to remove the commitment to listeners of African or Afro-Caribbean origin in terms of content and music. I do not believe the music output of Capital Birmingham should be allowed to be aligned to that of Yorkshire or London without a readvertisement of the license as the change requested is far too significant. I believe that the format must retain the words 'URBAN CONTEMPORARY BLACK MUSIC' and 'REGGAE, RnB AND HIP HOP' in order to be an acceptable request. The new requested format is already provided in much better quality by BBC Radio 1. I am not happy with the way the station has been allowed to gradually change from Choice FM in the mid 90s to the present day Capital FM with such a dramatic change in music output despite only slight changes to the official OFCOM agreed station format, while Choice London and Capital FM co-exist in London providing 2 very different sounding services. -

Temtum™ & the Temporal Blockchain

Cryptocurrency. Evolved. temtum™ & The Temporal Blockchain Cryptocurrency crosses into the mainstream Technical White Paper V4 Contributors: Founders: Richard Dennis, Dr Gareth Owenson & Ginger Saltos Supported by: Dr Doug Meakin, Cintya Aguirre, Adam Grist, Bo Lasater, Kevin Telfer 1 Cryptocurrency. Evolved. Abstract temtum has set out to solve all inherent improves network efficiency and uses problems faced by not only many existing a source of light for quantum effect cryptocurrencies but peer-to-peer randomness. The result is a fast, quantum blockchain networks as a whole both now, secure, environmentally friendly and highly and in the most technologically advanced scalable payment coin that has been of futures, where speed, scalability, security developed to both integrate into existing and high resource requirements are most payment infrastructures and deliver as a pertinent and continue to limit adoption. standalone cryptocurrency, allowing even The Temporal Blockchain, developed by the most under resourced individuals Dragon Infosec, combined with temtum’s to benefit from immediate, feeless innovative Consensus Algorithms and AI transactions, no matter who or where they powered Performance Integrity Protocol, are in the world - TEM. removes network competition, drastically 2 TEMTUM WHITE PAPER 2019 Our Vision. We believe in the power of blockchain. It provides amazing opportunities that have so far barely been touched on. For cryptocurrencies to thrive, blockchain now needs to take the next step in its evolution. And that’s where temtum comes in. temtum can help to secure a truly distributed, decentralised and democratic future for financial transactions. It is a future that does not destroy the environment. A future for everyone, wherever they live in the world, in which the benefits of cryptocurrencies are available and accessible for all. -

Galaxy Digital Asset Management: August 2021 Month End AUM

NEWS RELEASE Galaxy Digital Asset Management: August 2021 Month End AUM 9/2/2021 NEW YORK, Sept. 2, 2021 /CNW/ - Galaxy Digital Holdings Ltd. (TSX: GLXY) ("Galaxy Digital") announced that its aliate, Galaxy Digital Asset Management ("GDAM") reported preliminary assets under management of $2,130.8 million as of August 31, 2021. Assets Under Management ("AUM")(a)(In millions) 8/31/21 7/31/21 6/30/21 5/31/21 (b) (b) (b) (b) 4/30/21 3/31/21 2/28/21 1/31/21 12/31/20 11/30/20 10/31/20 9/30/20 8/31/20 Total $2,130.8 $1,628.2 $1,423.5 $1,357.8 $1,615.8 $1,275.0 $1,051.9 $834.7 $807.3 $572.7 $446.3 $407.4 $404.9 (a) All gures through 12/31/20 are audited; and all other gures are unaudited. AUM is inclusive of sub-advised funds, committed capital closed-end vehicles, seed investments by aliates, and fund of fund products. Changes in AUM are generally the result of performance, contributions, withdrawals, and acquisitions. (b) Preliminary, AUM associated with GVH Multi-Strategy FOF LP is as of April 30, 2021. Additional information regarding GDAM funds can be found on our website at https://www.galaxydigital.io/services/asset-management. About Galaxy Digital Asset Management 1 Galaxy Digital Asset Management is a diversied asset management rm dedicated to the digital assets and blockchain technology industry. The rm manages capital on behalf of external clients in two distinct business lines: Galaxy Fund Management and Galaxy Interactive. -

Fintech Monthly Market Update | May 2021

Fintech Monthly Market Update MAY 2021 EDITION Leading Independent Advisory Firm Houlihan Lokey is the trusted advisor to more top decision-makers than any other independent global investment bank. Corporate Finance Financial Restructuring Financial and Valuation Advisory 2020 M&A Advisory Rankings 2020 Global Distressed Debt & Bankruptcy 2001 to 2020 Global M&A Fairness All U.S. Transactions Restructuring Rankings Advisory Rankings Advisor Deals Advisor Deals Advisor Deals 1,500+ 1 Houlihan Lokey 210 1 Houlihan Lokey 106 1 Houlihan Lokey 956 2 JP Morgan 876 Employees 2 Goldman Sachs & Co 172 2 PJT Partners Inc 63 3 JP Morgan 132 3 Lazard 50 3 Duff & Phelps 802 4 Evercore Partners 126 4 Rothschild & Co 46 4 Morgan Stanley 599 23 5 Morgan Stanley 123 5 Moelis & Co 39 5 BofA Securities Inc 542 Refinitiv (formerly known as Thomson Reuters). Announced Locations Source: Refinitiv (formerly known as Thomson Reuters) Source: Refinitiv (formerly known as Thomson Reuters) or completed transactions. No. 1 U.S. M&A Advisor No. 1 Global Restructuring Advisor No. 1 Global M&A Fairness Opinion Advisor Over the Past 20 Years ~45% Top 5 Global M&A Advisor 1,400+ Transactions Completed Valued Employee-Owned at More Than $3.0 Trillion Collectively 1,000+ Annual Valuation Engagements Leading Capital Markets Advisor ~$4.5 Billion Market Cap North America Europe and Middle East Asia-Pacific Atlanta Miami Amsterdam Madrid Beijing Sydney >$1 Billion Boston Minneapolis Dubai Milan Hong Kong Tokyo Annual Revenue Chicago New York Frankfurt Paris Singapore Dallas -

QUARTERLY SUMMARY of RADIO LISTENING Survey Period Ending 27Th March 2011

QUARTERLY SUMMARY OF RADIO LISTENING Survey Period Ending 27th March 2011 PART 1 - UNITED KINGDOM (INCLUDING CHANNEL ISLANDS AND ISLE OF MAN) Adults aged 15 and over: population 51,618,000 Survey Weekly Reach Average Hours Total Hours Share in Period '000 % per head per listener '000 TSA % ALL RADIO Q 47266 92 20.5 22.4 1058098 100.0 ALL BBC Q 35074 68 11.3 16.6 581870 55.0 ALL BBC 15-44 Q 15955 63 7.6 12.1 193775 43.1 ALL BBC 45+ Q 19120 73 14.8 20.3 388095 63.7 All BBC Network Radio1 Q 31889 62 9.5 15.3 488535 46.2 BBC Local/Regional Q 10197 20 1.8 9.2 93335 8.8 ALL COMMERCIAL Q 34046 66 8.7 13.3 451178 42.6 ALL COMMERCIAL 15-44 Q 18556 73 9.5 13.0 241582 53.8 ALL COMMERCIAL 45+ Q 15490 59 8.0 13.5 209596 34.4 All National Commercial1 Q 15943 31 2.4 7.7 123363 11.7 All Local Commercial (National TSA) Q 27305 53 6.4 12.0 327815 31.0 Other Listening Q 3255 6 0.5 7.7 25051 2.4 Source: RAJAR/Ipsos MORI/RSMB 1 See note on back cover. For survey periods and other definitions please see back cover. Embargoed until 00.01 am Enquires to: RAJAR, 2nd floor, 5 Golden Square, London W1F 9BS 12th May 2011 Telephone: 020 7292 9040 Facsimile: 020 7292 9041 e mail: [email protected] Internet: www.rajar.co.uk ©Rajar 2011. -

Metro Radio Is Very Much in Touch with ‘Love of Life Round Here’

1 2 With Key 103 & Magic 1152’s weekly audience of 532,000 we can fill the Manchester Arena capacity 25 times! Source: RAJAR, Key 103 TSA. 6 Months, PE Sep 2012. Key 103 & Magic 1152 = Bauer Manchester 3 AUDIENCE POTENTIAL : 2,445,000 Male = 1,211,000 Female = 1,234,000 Source: RAJAR, Key 103 TSA. 6 Months, PE Sep 2012. 4 “Key 103 & Magic 1152 – Still Manchester’s Number One” • Key 103 and Magic 1152 retain their position as the commercial market leader in Greater Manchester with 532,000 listeners tuning into the stations each week. • Key 103’s Mike and Chelsea is Manchester’s most listened to commercial Breakfast show with 320,000 listeners tuning in each week, and OJ Borg’s Home time show continues to grow, increasing the station’s share in the afternoon to 8.9% (from 8) • In our core 25–44 demographic Key 103 remains number 1 for reach & share commercially, with a 17% higher share than Capital and 97.2% higher share for the demo than Smooth Source: RAJAR, Key 103 TSA. 6 Months, PE Sep 2012. Key 103 & Magic 1152 = Bauer Manchester 5 Combined Audience Mixed of adult contemporary music with unrivalled news and sports coverage, phone-ins and local information 61% 53% 47% 44% 39% 34% 22% Men Wome n 15 -24 25- 44 45+ ABC1 C2DE This shows a breakdown of our demographic here at Key103 & Magic 1152 to show a representation of the type of listeners we have and potential customers you could have. Breakdown by gender, age & social class in percentages respectively.