Automotive Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Termeni Contractuali Garantie Extinsa Ford Protect (PDF 127KB)

PROTECT nerealizate, ocazionate de indisponibilizarea FORD autovehiculului pentru reparatii. - Orice reparaţie de caroserie şi vopsire (inclusiv barele de protecţie și elemente de caroserie metalice), Garan ţie Extinsă pentru geamuri, tapiţerie şi ornamente, precum şi accesorii interioare și exterioare. Vehicule Noi - Modificări/înlocuiri (de piese) neautorizate aduse vehiculului sau componentelor acestuia. Termeni și Condiţii Limită ri/ Excluderi adi ţionale aplicabile modelului Ford Mondeo Hybrid Acesta este un contract încheiat de dumneavoastră cu Ford Motor Company, reprezentată de Ford România SA După expirarea primului dintre următoarele termene, și (având datele de identificare situate în subsolul acestei anume după 100.000 kilometri sau după 5 ani de la pagini). Prin semnarea acestuia, sunteţi de acord cu achiziţionarea autovehiculului nou Ford Mondeo Hybrid, termenii, condiţiile şi excluderile de mai jos. garanţia extinsă pentru vehicule noi Ford Protect nu va mai acoperi următoarele elemente: Termeni și Condiţii Vehicule Noi - Modulul de control Transmisie Ford Motor Company (Compania) acordă (clientului) o - Cutia de Viteză Garanţie comercială/convenţională Extinsă denumită - Compresorul electric de aer condiţionat Ford Protect, după cum urmează: - Cablajul bateriei de înaltă tensiune - Bateria de înaltă tensiune Compania garantează că defecţiunea cauzată de - Cutia cu joncţiuni a bateriei de înaltă tensiune manoperă sau materiale deficitare la orice piesă sau - Modulul de control al energiei bateriei vehicul fabricate original de Ford, altele decât cele - Modulul de control convertor curent continuu excluse în mod specific (a se vedea mai jos), va fi - Senzorul de temperatură aer aspiraţie răcire a reparată (sau înlocuită, la opţiunea Companiei) gratuit bateriei de înaltă tensiune de un Service Autorizat Ford, pe baza condiţiilor și - Siguranţă curenţi de mică intensitate a excluderilor de mai jos. -

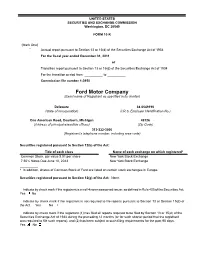

Ford Motor Company (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K (Mark One) Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2011 or Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from __________ to __________ Commission file number 1-3950 Ford Motor Company (Exact name of Registrant as specified in its charter) Delaware 38-0549190 (State of incorporation) (I.R.S. Employer Identification No.) One American Road, Dearborn, Michigan 48126 (Address of principal executive offices) (Zip Code) 313-322-3000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered* Common Stock, par value $.01 per share New York Stock Exchange 7.50% Notes Due June 10, 2043 New York Stock Exchange __________ * In addition, shares of Common Stock of Ford are listed on certain stock exchanges in Europe. Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Research Center New and Unprocessed Archival Accessions

NEW AND UNPROCESSED ARCHIVAL ACCESSIONS List Published: April 2020 Benson Ford Research Center The Henry Ford 20900 Oakwood Boulevard ∙ Dearborn, MI 48124-5029 USA [email protected] ∙ www.thehenryford.org New and Unprocessed Archival Accessions April 2020 OVERVIEW The Benson Ford Research Center, home to the Archives of The Henry Ford, holds more than 3000 individual collections, or accessions. Many of these accessions remain partially or completely unprocessed and do not have detailed finding aids. In order to provide a measure of insight into these materials, the Archives has assembled this listing of new and unprocessed accessions. Accessions are listed alphabetically by title in two groups: New Accessions contains materials acquired 2018-2020, and Accessions 1929-2017 contains materials acquired since the opening of The Henry Ford in 1929 through 2017. The list will be updated periodically to include new acquisitions and remove those that have been more fully described. Researchers interested in access to any of the collections listed here should contact Benson Ford Research Center staff (email: [email protected]) to discuss collection availability. ACCESSION NUMBERS Each accession is assigned a unique identification number, or accession number. These are generally multi-part codes, with the left-most digits indicating the year in which the accession was acquired by the Archives. There, are however, some exceptions. Numbering practices covering the majority of accessions are outlined below. - Acquisitions made during or after the year 2000 have 4-digit year values, such as 2020, 2019, etc. - Acquisitions made prior to the year 2000 have 2-digit year values, such as 99 for 1999, 57 for 1957, and so forth. -

Ford's 2019 Annual Report

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2019 or Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from __________ to __________ Commission file number 1-3950 Ford Motor Company (Exact name of Registrant as specified in its charter) Delaware 38-0549190 (State of incorporation) (I.R.S. Employer Identification No.) One American Road Dearborn, Michigan 48126 (Address of principal executive offices) (Zip Code) 313-322-3000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbols Name of each exchange on which registered Common Stock, par value $.01 per share F New York Stock Exchange 6.200% Notes due June 1, 2059 FPRB New York Stock Exchange 6.000% Notes due December 1, 2059 FPRC New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Profitable Growth for All Ford Motor Company 2012 Annual Report Operating Highlights

Profitable Growth for All Ford Motor Company 2012 Annual Report Operating Highlights Revenues 2012 2011 Worldwide wholesale unit volumes by automotive segment (in thousands) Ford North America 2,784 2,686 Ford South America 498 506 Ford Europe 1,353 1,602 Ford Asia Pacific Africa 1,033 901 Total 5,668 5,695 Revenues (in millions) Automotive $ 126,567 $ 128,168 Financial Services 7,685 8,096 Total $ 134,252 $ 136,264 Financial Results Income before income taxes (in millions) Automotive $ 6,010 $ 6,250 Financial Services 1,710 2,431 Total $ 7,720 $ 8,681 Amounts Attributable to Ford Motor Company Net income (in millions) $ 5,665 $ 20,213 Diluted net income per share of Common and Class B Stock $ 1.42 $ 4.94 Cash and Spending Automotive capital expenditures Amount (in billions) $ 5.5 $ 4.3 As a percentage of Automotive sales 4.3% 3.3% Automotive cash at year end (in billions) Automotive gross cash (a) $ 24.3 $ 22.9 – Cash net of Automotive debt 10.0 9.8 Shareholder Value Dividends paid per share $ 0.20 $ 0.00 Total shareholder returns % (b) 23% (36)% (a) Automotive gross cash includes cash and cash equivalents and net marketable securities. (b) Source: Standard & Poor’s, a division of the McGraw Hill Companies, Inc. Content On the Cover 1 More Products People Want The One Ford plan enables accelerated development of products 2 A Message from the Executive Chairman that customers truly want and value, resulting in a full-line of cars, 3 A Message from the President and CEO utilities and trucks that meet and exceed owner expectations 7 Board of Directors and Executives across global markets. -

Certificat Delivre

CERTIFICATE SQ/ 2358-C COMPANY : FORD MOTOR COMPANY REGISTRATION LIMITS : FORD OF EUROPE 50735 COLOGNE GERMANY and sites as shown in appendix STANDARD : ISO 9001 (2015 Edition) Exclusions are detailed on our website www.utacceram.com REGISTRATION SCOPE : The design, development, manufacture, sales & services of passenger cars, commercial vehicles, components and supporting processes CERTIFICATION VALIDITY : from December 08, 2017 to December 07, 2020 Gilles FOUGERE Certification, Audits & Inspections Department Manager Certificat délivré par Union Technique de l'Automobile, du Motocycle et du Cycle Siège Social : Autodrome de Linas-Montlhéry - B.P. 20212 - 91311 MONTLHERY CEDEX - France FO_CAI_PC3_033 rev02 CERTIFICATE APPENDIX SQ/ 2358-C SUPPORT FUNCTION : SCOPE : FORD-WERKE GmbH Quality | Product Development | Marketing, Sales & Service HENRY-FORD-STRASSE 1 | IT| Purchasing | Supplier Technical Assistance (STA) | 50735 COLOGNE Material Planning & Logistics | Powertrain Operations (PTO) | Vehicle Operations (VO)|Central Workshop Cologne | Human Resources |Ford Land Europe FORD-WERKE GmbH Quality GEESTEMUENDER STRASSE 48 50735 COLOGNE FORD-WERKE GmbH Quality |Product Development SPESSART STRASSE 50725 COLOGNE FORD-WERKE GmbH Human resources |Vehicle Operations (VO) HENRY-FORD-STRASSE 1 66740 SAARLOUIS FORD-WERKE GmbH Marketing, Sales & Service EDSEL FORD STRASSE 2-14 50769 COLOGNE FORD-WERKE GmbH Product Development OUDE DIESTERSEBAAN 135 3920 LOMMEL FMC AUTOMOBILES SAS- FORD FRANCE Marketing, Sales & Service CENTRE NATIONAL DE LOGISTIQUE DE PIECES DE RECHANGE ROUTE NATIONAL 17 60190 ESTREES-ST DENIS FORD AQUITAINE INDUSTRIES SAS Powertrain Operations (PTO) 10, RUE SAINT EXUPERY -BP32- F-33292 BLANQUEFORT This appendix contains 4 page(s) updated 8 December 2017 Page 1/4 Certificat délivré par Union Technique de l'Automobile, du Motocycle et du Cycle Siège Social : Autodrome de Linas-Montlhéry - B.P. -

Ford Motor Company in Romania§

MUZEUL NAŢIONAL Vol. XXII 2010 FORD MOTOR COMPANY IN ROMANIA§ Lavinia Popica* MOTTO: “Today [i.e.1930] life is changing. Under the influence of Americanisme, Europe is searching for a new social form. Under the heat of American civilization, superficial and dull but very well organized, the European soul is transforming. What will it be its fate/form is not yet to be foreseen? […]”1. Abstract Ford Motor Company in Romania studies the history of Ford Motor Company in Romania from its beginning in early twentieth century to nowadays. Ford Motor Company transformed Romanians’ perception about the United States. Royal Garage imported Ford cars as early as 1911. Despite several attempts, Ford Motor Company made its entrance on Romanian market only in 1931. On May 15, 1936 the assembly plant opened. As elsewhere in Europe, Ford Motor Company is representative for American consumerism. It redefined industrial labor relations, production techniques, and it offered an alternative model in Romania. Based on archival studies in Romania and the United States, this essay explains, through the example of Ford Motor Company in Romania, how consumerism of American manufactured goods became important in interwar Romania and contributed to the creation of new cultural practices linked to modernization. Key words: Ford Motor Company, Ford Romania, fordism, consumerism, americanization. § This study originated as a master thesis - American Consumerism in Interwar Romania: Ford Motor Company of Romania, in the History Department at the University of Bucharest. I thank my advisor, Mirela Luminita Murgescu, who with her constant support and insightful comments helped me more than words can express. -

Ford România a Produs Motorul Cu Numărul UN MILION La Fabrica Sa Din Craiova

NEWS www.youtube.com/fordofeurope www.twitter.com/FordEu www.youtube.com/fordo feurope Ford România a produs motorul cu numărul UN MILION la fabrica sa din Craiova • Ford România marchează astăzi producția a 1 milion de motoare EcoBoost de 1,0 litri fabricate la uzina din Craiova • Motorul construit la Craiova este primul motor în trei cilindri din lume care dispune de sistemul de dezactivare a cilindrilor • De la momentul lansarii sale în 2012, motorul Ford EcoBoost de 1,0 litri a câștigat 10 premii în cadrul competiției „Motorul Internațional al Anului” • Până în prezent, investiția Ford în modernizarea Fabricii de Motoare de la Craiova se ridică la peste 200 de milioane de euro CRAIOVA, 29 MARTIE 2019 - Ford România sărbătorește astăzi 1 milion de motoare EcoBoost de 1,0 litri fabricate la uzina din Craiova, de la lansarea producției acestuia în 2012. Motorul cu numărul un milion produs astăzi la Craiova este o versiune de 125 CP și va echipa un model EcoSport Titanium pentru un client din Craiova. „Atingerea cifrei de un milion de motoare EcoBoost de 1,0 litri fabricate la Ford Craiova este o mare realizare pentru uzina noastră și pentru angajații noștri”, a spus Ian Pearson, președintele Ford România și directorul fabricii Ford Craiova. „Motorul EcoBoost de 1,0 litri a revoluționat industria noastră și suntem foarte mândri să contruim acest motor la Craiova", a adaugat Ian. Motorul Ford EcoBoost de 1,0 litri a fost lansat pentru prima dată pe modelul Ford Focus în 2012 și utilizează tehnologiile Ford EcoBoost care includ injecția directă de înaltă presiune, axe cu came cu geometrie variabilă și turbocompresor, pentru eficientizarea consumului de combustibil, oferind puterea și performanțele echivalente unui motor aspirat de 1,6 litri. -

Ford Otomotiv Sanayi A.Ş. Information Document for the 15 March 2019 Ordinary General Assembly to Review Financial Year 2018

FORD OTOMOTIV SANAYİ A.Ş. INFORMATION DOCUMENT FOR THE 15 MARCH 2019 ORDINARY GENERAL ASSEMBLY TO REVIEW FINANCIAL YEAR 2018 1. INVITATION TO THE 15 MARCH 2019 ORDINARY GENERAL ASSEMBLY MEETING Ford Otomotiv Sanayi A.Ş.’s Ordinary General Assembly Meeting shall be convened on 15 March 2019 Friday at 14:00 at the address of “Divan Istanbul Hotel - Asker Ocağı Caddesi No:1 34367 Şişli / İstanbul (Tel: +90 212 315 55 00, Faks: +90 212 315 55 15)”. At the meeting, the activities of the Company for the fiscal year 2018 will be reviewed, the following agenda will be discussed, and a resolution regarding the agenda will be reached. In accordance with the legal requirements, 2018 Financial Statements, the Independent Auditor’s Report, the Corporate Governance Compliance Report, and the Board of Directors’ Annual Report, including the dividend distribution proposal of the Board of Directors, along with the following agenda and the Memorandum containing the information required by Capital Markets Board regulations shall be made available to the shareholders at Company Headquarters in Sancaktepe İstanbul, Kocaeli Gölcük Plant, İnönü Plant, on the Company’s corporate website at www.fordotosan.com.tr , and in the Electronic General Meeting System of the Central Registry Agency (CRA) three weeks prior to the meeting. Shareholders unable to attend the meeting in person, save for the rights and obligations of the ones participating electronically via the Electronic General Assembly System, shall prepare their proxy documents as per the legislation, or shall obtain a proxy sample form from Yapı Kredi Yatırım Menkul Değerler A.Ș. -

Profitable Growth For

PROFITABLE GROWTH FOR ALL Ford Motor Company / 2011 Annual Report OPERATING HIGHLIGHTS CONTENT 1 About the Revenues (a) 2011 2010 Company Worldwide wholesale unit volumes 2 A Message from the by automotive segment (in thousands) Executive Chairman Ford North America 2,686 2,413 Ford South America 506 489 3 A Message from the Ford Europe 1,602 1,573 President and CEO Ford Asia Pacific Africa 901 838 6 Board of Directors Volvo – 211 and Executives Total 5,695 5,524 7 Profitable Growth for All Revenues (in millions) Automotive $ 128,168 $ 119,280 8 Great Products Financial Services 8,096 9,674 18 Strong Business Total $ 136,264 $ 128,954 22 Better World Financial Results (a) 25 Financial Contents Income/(loss) before income taxes (in millions) 184 Shareholder Automotive $ 6,250 $ 4,146 Information Financial Services 2,431 3,003 Total $ 8,681 $ 7,149 185 Global Overview Amounts Attributable to Ford Motor Company (a) Net income/(loss) (in millions) $ 20,213 $ 6,561 Diluted net income/(loss) per share of Common and Class B Stock $ 4.94 $ 1.66 Cash and Spending (a) Automotive capital expenditures Amount (in billions) $ 4.3 $ 4.1 As a percentage of Automotive sales 3.3% 3.4% Automotive cash at year end (in billions) Automotive gross cash (b) $ 22.9 $ 20.5 – Cash net of Automotive debt 9.8 1.4 (a) Data presented includes Volvo Shareholder Value through August 2, 2010. (b) Automotive gross cash includes Dividends declared per share $ 0.05 $ - cash and cash equivalents and net marketable securities. -

Certificat Delivre

CERTIFICATE N° SQ/3228-3 COMPANY : FORD MOTOR COMPANY REGISTRATION LIMITS : FORD OF EUROPE 50725 Cologne Germany and sites as shown in appendix STANDARD : ISO 9001 (2015 Edition) Exclusions are detailed on our website www.utacceram.com REGISTRATION SCOPE : The design, development, manufacture, sales & services of passenger cars, commercial vehicles, components and supporting processes. CERTIFICATION VALIDITY : from 4 December 2020 to 3 December 2023 Eric LEBEAU Certification, Audits & Inspections Department Certificat délivré par Union Technique de l'Automobile, du Motocycle et du Cycle Siège Social : Autodrome de Linas-Montlhéry - B.P. 20212 - 91311 MONTLHERY CEDEX - France FO_CAI_PC3_033 rev02 CERTIFICATE APPENDIX N° SQ/3228-3 FORD-WERKE GmbH Central Workshop Cologne | Ford Land | Human 50725 COLOGNE Resources (HR)| IT | Marketing, Sales & Service (MS&S) | GERMANY Material Planning & Logistics (MP&L) | Purchasing | Quality | Supplier Technical Assistance (STA) |Vehicle Operations (VO) | Powertrain Operations (PTO) FORD-WERKE GmbH Quality GEESTEMUENDER STRASSE 48 50735 COLOGNE GERMANY FORD-WERKE GmbH Product Development (PD) |Quality | Sustainability, SPESSART STRASSE Environmental & Safety Engineering (SE&SE) 50769 COLOGNE GERMANY FORD-WERKE GmbH Marketing, Sales & Service (MS&S) EDSEL-FORD-STRASSE 2-14 50769 COLOGNE GERMANY FORD-WERKE GmbH Human Resources| Vehicle Operations (VO) HENRY-FORD-STRASSE 1 66740 SAARLOUIS GERMANY FORD-WERKE GmbH Product Development (PD) OUDE DIESTERSEBAAN 135 3920 LOMMEL BELGIUM FORD MOTOR COMPANY, s.r.o. Supplier Technical Assistance (STA) OREGON HOUSE REVNICKA 170/4 PRAHA – ZLICIN 15521 CZECH REPUBLIC Certificat délivré par Union Technique de l'Automobile, du Motocycle et du Cycle Siège Social : Autodrome de Linas-Montlhéry - B.P. 20212 - 91311 MONTLHERY CEDEX - France FO_CAI_PC3_033 rev02 CERTIFICATE APPENDIX N° SQ/3228-3 FMC AUTOMOBILES SAS - FORD FRANCE Marketing, Sales & Service (MS&S) CENTRE NATIONAL DE LOGISTIQUE DE PIECES DE RECHANGE ROUTE NATIONAL 17, BP 163 F-60190 ESTREES-ST. -

Lista Stabilimenti Più Importanti

LISTA STABILIMENTI PIÙ IMPORTANTI Criteri: sono stati selezionati i 5/6 produttori più impattanti a livello europeo. DAIMLER (MERCEDES BENZ) Impianti americani Fabbrica in Alabama vicino alla città di Vance: Mercedes GLE, GLS e la Classe C. Tuscaloosa/USA: Mercedes GLS Brasile: Iracemápolis/Brasile (dal 2016): Classe C e SUV GLA Impianti di produzione in Europa Bremen/Germania East London/South Africa Hambach/Francia: Mercedes EQ Kecskemét/Ungheria: Classe A, Classe B e CLA Rastatt/Germania: Classe A Sindelfingen/Germania: Mercedes Benz CLS, CLS Shooting Brake, E-Class (Saloon and Estate), S-Class, S-Class Coupé, Mercedes-AMG GT, Mercedes‑ Maybach S- Class GRUPPO VOLKSWAGEN Stabilimenti americani fabbrica in Tennessee: Passat e Atlas; sono impiegate circa 2.500 persone. Impianto di Chattanooga: Volkswagen Passat NAR e Volkswagen Atlas NAR, specifiche per il mercato americano. Nel Messico sono 4 gli impianti VW che troviamo; a Puebla vengono prodotte Volkswagen Jetta, Volkswagen Beetle, Volkswagen Beetle Cabriolet, Volkswagen Tiguan, Volkswagen Golf, Volkswagen Golf Estate. A San José Chiapa l’Audi Q5. Brasile (9 impianti) A Pacheco Volkswagen Spacefox/Suran, Volkswagen Amarok; a Sao José Dos Pinhais Volkswagen Fox, Volkswagen Golf, Audi Q3, Audi A3 Limousine; ad Anchieta Volkswagen Gol, Volkswagen New Saveiro, Volkswagen Polo, Volkswagen Virtus; a Taubaté Volkswagen Gol, Volkswagen New Saveiro, Volkswagen Polo, Volkswagen Virtus. Africa In Sud Africa, ad Uitenhage: Volkswagen Polo, Volkswagen Polo Vivo, Volkswagen Polo Vivo Sedan. In Europa 71 gli impianti presenti in Europa Ingolstadt: Audi A3, Audi A3 Sportback, Audi A4, Audi A4 Avant, Audi A4 Allroad, Audi A5 Coupé, Audi A5 Sportback, Audi Q2, Audi Q5.