Fsyejun302014.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Debt Liabilities Chenab Group Again As 14,000 People Are Next Generation of the Family Begins to Take Two Equal Fresh Loans I.E

The Business | EDITORFrIidaAy , FebL ruary 210, 26020 Is ChenOne, parent company Chief Editor about to make a comeback? Part 3 Irfan Athar Qazi HASSAN NAQVI is also a fact that banks have a vested inter - sent. However, their formal approval is in the new investor whereupon the banks will est in ensuring that the company is able to process. “We are still awaiting the approval also be requested to provide an equal amount E-mail: [email protected] he entire textile industry faces continue repaying its loans and would gen - of the banks set out in the hereto. of Rs350 million for Exports Based Limits them. And while facing those is - erally seek to avoid placing the company in Once these approvals are received, we to meet the working capital requirements. [email protected] sues, the industry as a whole had a a situation where the only solution to repay - will execute this term sheet and proceed to The plan stated that on account of prevailing verTy good year in 2011, growing revenues ing its loans would be to liquidate the whole finalise a scheme of arrangement in accor - situation, the fact that the Chenab Ltd’s oper - by 40.8 percent to Rs713 billion, according company. Banks start restricting working dance with our counsel’s advice,” the HBL ations are suspended since 2017 and in order Tijarat House, 14-Davis Road, Lahore to a compilation of financial data of all pub - capital financing generally when they do not letter stated. Chenab group’s short-term to make the project economically and finan - licly listed textile companies compiled by have confidence in the company’s manage - loans from different banks and financial cially viable, the rate of markup on the 0423-6312280, 6312480, 6312429, 6312462 the State Bank of Pakistan. -

4-- Financial Statement Period Ended 30-09-2015

Contents Company Information 02 Director’s Report to the Members 03 Balance Sheet 04 Profit & Loss Account 05 Statement of Comprehensive Income 06 Cash Flow Statement 07 Statement of Changing in Equity 08 Notes to the Financial Statement 09 01 Company Information Chief Executive Mian Muhammad Latif Mian Muhammad Javaid Iqbal Mr. Muhammad Naeem Mr. Muhammad Faisal Latif Mr. Muhammad Farhan Latif Mr. Muhammad Zeeshan Latif Mst. Shahnaz Latif Major Bankers Allied Bank Limited. Askari bank Limited AlBaraka Bank (Pakistan) Limited. Citibank, N.A Faysal Bank Limited First Credit & Investment Bank Limited. Habib Bank Limited. Habib Metropolitan Bank Limited. KASB Bank Limited. National Bank of Pakistan. NIB Bank Limited. Orix Leasing (Pakistan)Limited Pak Oman Investment Company Limited Pak Kuwait Investment Company (pvt)Limited Pak Libya Holding Company (pvt)Limited Saudi Pak Industrial & Agriculturan Invetment Company (pvt)Limited Silk Bank Limited Standard Chartered Bank (Pakistan) Limited. The Bank of Punjab. United Bank Limited. Company Secretary/ Chief Financial Officer ` Mr. Muhammad Arshad Audit Committee Mr. Muhammad Farhan Latif – Chairman Mr. Muhammad Zeeshan Latif Mst. Shahnaz Latif Auditors Avais Hyder Liaquat Nauman Charted Accountant Legal Advisor Ch. Shahid Mehmood (Advocate) Shares Registrar Consulting One (Pvt.) Limited. 478-D, Peoples Colony No.1, Faisalabad. Tel: 041-8541965 Registered Office Nishatabad, Faisalabad. Tel: +92 41 8754472-8 Fex: +92 41 8752700, 8752400 [email protected] Website Address www.chenabgroup.com Works -Spinning Unit – Toba Tek Singh -Weaving Unit – Kharianwala, Distt. Sheikhupura. -Weaving Unit – Shahkot, Distt. Nankana Sahib -Processing & Stitching Units – Nishatabad, Faisalabad. 02 DIRECTOR’S REPORT TO THE SHAREHOLDERS The directors are presenting before you un-audited financial statements of the company for the first quarter of financial year 2015-2016 ended on September 30, 2015. -

PROMOTING BETTER MANAGEMENT PRACTICES an Initiative of WWF – Pakistan to Reduce the Ecological Footprint of Thirsty Crops By: Hammad Naqi Khan1, Arif H

World Environment Day – June 2010 71 PROMOTING BETTER MANAGEMENT PRACTICES An Initiative of WWF – Pakistan to reduce the ecological footprint of thirsty crops By: Hammad Naqi Khan1, Arif H. Makhdum2, Zernash Jamil3, Asad Imran4, A. Rasheed Bhutto5 and Lall Khan Babar6 1 Director Programmes, World Wide Fund for Nature - Pakistan 2 Director Sustainable Agriculture, WWF - Pakistan 3 Project Officer, Sustainable Agriculture Programme, WWF - Pakistan 4 Manager, Sustainable Agriculture Programme, WWF - Pakistan 5 Project Coordinator Bahawalpur, Sustainable Agriculture Programme, WWF - Pakistan 6 Project Coordinator T.T. Singh, Sustainable Agriculture Programme, WWF - Pakistan 72 World Environment Day – June 2010 ABSTRACT Sugarcane and cotton are two of the major water intensive and polluting crops, respectively, grown in Pakistan. Sugarcane consumes more water per unit area of crop than any other crop and cotton accounts for 70% of all pesticides applied in Pakistan. As part of its Global Conservation Programme, WWF aims to help make cotton and sugarcane cultivation part of a sustainable industry so as to make its production environment friendly and to reduce its impacts on priority ecosystems. WWF – Pakistan, Pakistan‟s largest environmental organisation, took a step and launched the “Better Management Practices for Water Thirsty Crops” project to ensure sustainable sources of freshwater to support livelihoods of poor rural communities. The project created a mechanism for increasing water availability and reduced pollution by rationalizing use of water and pesticides in cotton and sugarcane production through developing site specific BMPs (Better Management Practices). BMPs are practices which optimize the three pillars of sustainability: social responsibility, environmental integrity and economic viability by marrying together the financial requirements of agriculture, such as high yield, with environmental and social concerns, such as water and pesticide use. -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

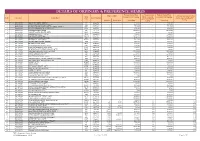

Details of Ordinary & Preference Shares

DETAILS OF ORDINARY & PREFERENCE SHARES Paid-up Capital/Total % of Shares available Paid-up Capital/Total Shares in CDS % of Shares available with ref: to Short Issue incl. GOP holding with ref: to paid up Issue excl. GOP holding S. No. Security Id Security Name Live / Setup Date paid up capital excluding GoP Name capital including GoP holding Available Market Value Shares/Units holding Shares/Units 1 PK0015401018 AGRO ALLIANZ LIMITED - FREEZE *** AAL 7/Aug/2014 - - 1,183,294 - 1,183,294 - 2 PK0021701013 FATIMA ENTERPRISES LIMITED - FREEZE *** FAEL 23/Sep/2016 - - 14,231,052 - 14,231,052 - 3 PK0042301017 DADABHOY CONSTRUCTION TECHNOLOGY LIMITED - FREEZE *** DCTL 17/Aug/2018 - - 2,322,800 - 2,322,800 - 4 PK0075701018 SG ALLIED BUSINESSES LIMITED - FREEZE *** SGABL 10/Apr/2006 - - 15,000,000 - 15,000,000 - 5 PK0084101010 PAKARAB FERTILIZERS LIMITED PFL 16/Jul/2005 - - 450,000,000 - 450,000,000 - 6 PK0095901010 ALPHA BETA CAPITAL (PRIVATE) LIMITED ABCPL 26/May/2009 - - 875,000 - 875,000 - 7 PK0100301016 HABIB MANAGEMENT (PVT.) LIMITED HMPL 26/Aug/2010 - - 1,500,000 - 1,500,000 - 8 PK0105601014 SSGC LPG (PVT.) LIMITED ◘◘ SSGCLPG 27/Dec/2012 - - 100,000,000 - 100,000,000 - 9 PK0110501019 E2E LOGISTICS (PRIVATE) LIMITED ◘◘ E2EL 19/Aug/2015 - - 21,993,579 - 21,993,579 - 10 PK0112401010 ANS CAPITAL (PRIVATE) LIMITED ANSCPL 25/Apr/2016 - - 68,412,100 - 68,412,100 - 11 PK0112501017 ADIL TEXTILE MILLS LIMITED - FREEZE*** ADTM 17/Aug/2016 - - 7,725,800 - 7,725,800 - 12 PK0116301018 BOTTLECO (PRIVATE) LIMITED BCPL 17/May/2018 - - 8,750,000 - 8,750,000 -

Project Report on Chenone

International Journal of Research e-ISSN: 2348-6848 p-ISSN: 2348-795X Available at https://journals.pen2print.org/index.php/ijr/ Volume 06 Issue 04 April 2019 Knowledge Hub of Fashion: Chen One Textile Industry Pakistan Sobia Naseem , Muhammad Mohsin , Shazia Salamat 1 Institute for Optimization and Decision Analytics, Liaoning Technical University [email protected] 1 Department of Business Administration, Liaoning Technical University, China [email protected] 1Department of Business Administration, Liaoning Technical University, China [email protected] Abstract fashion industry in their growth and updating according to latest fashion. This study based on a chain store of Pakistan which based on latest fashion industry. Chenone Introduction limited has today 10 local and 7 outlets in the In 1997, ChenOne opened its first branch in Middle East with an annual turnover of RS ten billion. Chenab limited is a manufacturing giant Jinnah Super, Islamabad. This was the first store operating in over seven countries. Chenab limited of its kind in Pakistan offering the complete range the company holds thirty million share. Chenab is of Fashion clothing & foot wear, Bed Linen, one of Pakistan’s leading manufactures and exporters of quality home textile products of Kitchen Accessories and Furniture. The quality home textile products and garments. tremendous success and acceptance of the idea Chenab’s one of the most popular brand is Chen reflected the maturity of our customers on one one. They segment Chen one’s market according hand, and on the other hand, prompted ChenOne to geographical location. Chen one target the Middle East upper middle and elite class segment to open branches nationally & internationally, so of the population. -

By Athar Iqbal 021-10-13795

Determinants of Political Governance and Investment Trends in Pakistan By Athar Iqbal 021-10-13795 A thesis Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy(PhD) to Dean (Business Administration Department) at the Iqra University, main campus, Karachi Karachi, Pakistan July , 2015 i CERTIFICATE It is certified that a PhD dissertation titled as “Determinants of Political Governance and Investment Trends in Pakistan” has been completed by Mr. Athar Iqbal, bearing a Registration No. 021-10-13795. It is being approved for the final submission. Supervisor, Dr. Muhammad Ayub Khan Meher Date: ii Dedication This dissertation is dedicated to my mother Mehrunnisa. Thanks for always being there for me, for her kindness, affection, thoughtfulness, devotion, and for her continuous encouragement. My mother has always encouraged me, even when I was in school. Her support, encouragement and interest in studies always gave strength to me to do something more in studies. She always took interest in the improvement of my reading and writing and forgave my mistakes when she realized that I am taking interest in studies. Her support, encouragement, determination and constant love have sustained me throughout my life. iii Acknowledgements All praises and veneration are attributed to Almighty Allah, the Compassionate and Merciful, who conferred upon me the wisdom, knowledge and ability to accomplish this thesis. It is my pleasure to express my profound gratitude to Dr. Muhammad Ayub Khan Mehar, Professor, Iqra University for his valuable guidance and encouragement as a research supervisor in completion of this dissertation. I am really thankful for his attention to details and for his demand for excellence. -

List of Data CVAS Licenses and Registrations

List of Data CVAS Licenses and Registrations Issuance S. No. Licensee Name Contact Person Address Phone No. Type Region Service Type License No. Email Addresses Date Geo Information Mr. Firous Khan G-614, Serena Bazar, Quetta 081- DATA DIR (L)/CVAS- 1 Balochistan Internet/Data 05-Jul-05 [email protected] Technologies (Pvt.) Ltd. Director Serena Hotel, QUETTA 2835380,284214 CVAS 137/PTA/2006 Mr. Rao I.D Communications 87, Main Colony, 18 KM VOICE DIR (L)/CVAS- 2 Muhammad 0300-9458488 Punjab CPPS 20-Sep-05 (Pvt) Ltd Ferozpur Road, Lahore CVAS 81/PTA/2006 Danish, GM Suite No. 3, 1st floor, National Direct Communications Rao Muhammad VOICE DIR (L)/CVAS- 3 Business Centre, Shamsabad, 0300-8524533 Punjab CPPS 31-Oct-05 (Pvt.) Ltd. Asif Khan, CEO CVAS 03/PTA/2005 Murree Road, Rawalpindi. 9-Tariq Plaza, Phase-1, 0313-9142265, Wide Band Hayatabad Peshawar. 2nd 091- Sardar Faisal DATA DIR (L)/CVAS- [email protected] 4 Communications (Pvt.) Address:- A-1,Al- Khair FLats 5816510,5817274 KPK Internet/Data 26-Dec-05 Aziz Director CVAS 26/PTA/2005 ,[email protected] Ltd. Canal Road, University Town, ,091-5850447, Peshawar Fax. 091-5619070 Mr. Aqeel GD Arcade, 73-E Fazal-ul- Micronet Broadband Khurshid Chief DATA DIR (L)/CVAS- 5 Haq Road, Blue Area, 051-111-114-444 Nationwide Internet/Data 02-Jan-06 [email protected], [email protected] (Pvt.) Ltd. Technology CVAS 18/PTA/2006 Islamabad. Officer New 111-288- 288 Fax 051- 2356063, 0300- Brig ® Phoenix Armour (Pvt.) EOBI Building, Ground 8224338, 0321- DATA DIR (L)/CVAS- 6 Muhammad Nationwide VTS 25-Jan-06 [email protected] Ltd. -

Determinants of Corporate Cash Holdings and Its Implications

Determinants of Corporate Cash Holdings and its Implications: Evidence from Pakistan’s Corporate Sector By Muhammad Faisal Rizwan A DISSERTATION SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY IN FINANCE Supervised by Dr. Abdul Raheman FACULTY OF MANAGEMENT AND SOCIAL SCIENCES MOHAMMAD ALI JINNAH UNIVERSITY, ISLAMABAD PAKISTAN Copyright © 2015 BY Muhammad Faisal Rizwan All rights reserved. No part of the material protected by this copyright notice may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopy, recording or by any information storage and retrieval system without the permission from the author. Table of Contents Abstract..............................................................................................................................................3 Chapter 1............................................................................................................................................5 Introduction........................................................................................................................................5 Chapter 2..........................................................................................................................................12 Pakistan Economy: A overview of Pakistan's Economy..................................................................12 Chapter 3..........................................................................................................................................24 -

1. Revised Phd Thesis Anjum Fayyaz Oct 31 2016

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Fayyaz, Anjum Doctoral Thesis Donor Interventions and SME Networking in Industrial Clusters in Punjab Province, Pakistan PhD Series, No. 9.2017 Provided in Cooperation with: Copenhagen Business School (CBS) Suggested Citation: Fayyaz, Anjum (2017) : Donor Interventions and SME Networking in Industrial Clusters in Punjab Province, Pakistan, PhD Series, No. 9.2017, ISBN 9788793483910, Copenhagen Business School (CBS), Frederiksberg, http://hdl.handle.net/10398/9463 This Version is available at: http://hdl.handle.net/10419/209017 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der -

Incorporating Social Media Into Integrated Marketing Communications of an Organization the Case of Warid Telecom, Pakistan

Incorporating Social Media into Integrated Marketing Communications of an organization The Case of Warid Telecom, Pakistan Master Degree Project in Business Administration One year, D-Level, 15 ECTS Spring Term 2011 Muhammad Taimoor khan Faraz Maqsood [email protected] [email protected] 073/ 9518400 076/ 2812791 Supervisor: Dr. Desalegn Abraha Examiner: Peter Hulten Date of submission: September 14, 2011 i | P a g e Acknowledgements This dissertation would not have been possible without the guidance and support of our supervisor Associate Professor Desalegn Abraha and examiner Peter Hulten Ph.D. We would like to thank them for their valuable comments and guidance. They deserve our sincere gratitude regarding their dedication throughout the program. We want to extend the help of several individuals who in one way or another contributed and extended their valuable assistance in the preparation and completion of this study. We are really thankful to Mr. Shahzad Ahmed (Warid Telecom, Pakistan), Mr. Shaham Saeed (Warid Telecom, Pakistan), Mr. Hammad (CIPE, Pakistan), Mr. Ashraf Chowdry (Ashraf Associates, Pakistan) and Babar Sheikh (Geo TV, Pakistan). Thanks to social media agencies as well as every single person who supported throughout our data collection. We warmly thank our friends for all the encouraging support and our special thanks goes to our families for backing us, with a continuous encouragement during the development of this thesis. Last but not the least we want to thank each other as a cooperative partner. Muhammad Taimoor Khan Ghauri Faraz Maqsood Page | i Declaration This thesis is submitted by Muhammad Taimoor khan Ghauri and Faraz Maqsood to the School of Technology and Society of the University of Skövde for the Master of Sciences Degree in Business Administration with majors in Marketing- One Year Master‘s Program 60 ECTS. -

News Updates

` Monday, September news 15, 2014 updates Office # 05, Ground Floor, Arshad Mansion, Near Chowk A.G Office, Nabha Road Lahore. Ph. 042-37350473 Cell # 0300-8848226 NEWS OF Mail to: [email protected], [email protected] THE DAY PLP NEWS ALERTS EMAIL No. 211-2014 NEWS HEADLINES Top Stories ................................................................................................................................................... 5 Rescue boat carrying wedding party capsizes .............................................................................................. 5 Breach occurs in Doaaba dyke: over a dozen villages of Multan inundated ................................................ 6 Fresh rain hampers rescue bid in flood-ravaged IHK .................................................................................... 7 US fully supports Zarb-e-Azb ......................................................................................................................... 8 Three soldiers killed in NW rocket attack ................................................................................................... 10 Qadri trying every trick in the book to stop Prime Minister from working ................................................ 11 Banks will not accept currency notes with political slogans: SBP ............................................................... 12 Dar warns Qadri against misleading people ............................................................................................... 13 Imran to launch