Investor Presentation 2008 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Major Investment Properties

Review of Operations – Business in Mainland China and Macau Major Investment Properties During the year, rental properties in mainland China generated business and will become a major source of steady income in a total gross rental income of HK$192.9 million, an increase mainland China. of HK$114.3 million over the previous year. With the gradual In order to better manage its property portfolio, in August 2007 completion of some of the above investment properties, which the Group increased its stakes in some of the rental properties, comprise mainly Grade-A offi ce space, rental income is set to which comprise commercial podia and car park basements: increase significantly during the years to come. The property investment business will complement the property development Major Completed Mainland Investment Properties Group’s share of developable gross fl oor area Group’s interest (million square Project name and location (%) feet) Commercial Podium & Car Parks Henderson Centre, Beijing 100 1.1 Skycity, Shanghai 75 0.3 Hengbao Plaza, Guangzhou 100 1.0 Sub-total: 2.4 Offi ce Offi ce Tower II, Grand Gateway, Shanghai 100 0.7 Sub-total: 0.7 Total: 3.1 Annual Report 2007 Henderson Land Development Company Limited 75 Review of Operations – Business in Mainland China and Macau Major Investment Properties Status of Major Completed Mainland Investment Properties Henderson Centre, Beijing (100% owned) Beijing Henderson Centre was completed in 1997. In order to offer a refreshing retail experience for shoppers and to promote sale for tenants, the atrium of its shopping mall has been undergoing a major renovation since March 2007. -

2020 Shanghai Foreign Investment Guide Shanghai Foreign Shanghai Foreign Investment Guide Investment Guide

2020 SHANGHAI FOREIGN INVESTMENT GUIDE SHANGHAI FOREIGN SHANGHAI FOREIGN INVESTMENT GUIDE INVESTMENT GUIDE Contents Investment Chapter II Promotion 61 Highlighted Investment Areas 10 Institutions Preface 01 Overview of Investment Areas A Glimpse at Shanghai's Advantageous Industries Appendix 66 Chapter I A City Abundant in 03 Chapter III Investment Opportunities Districts and Functional 40 Enhancing Urban Capacities Zones for Investment and Core Functions Districts and Investment Influx of Foreign Investments into Highlights the Pioneer of China’s Opening-up Key Functional Zones Further Opening-up Measures in Support of Local Development SHANGHAI FOREIGN SHANGHAI FOREIGN 01 INVESTMENT GUIDE INVESTMENT GUIDE 02 Preface Situated on the east coast of China highest international standards Secondly, the openness of Shanghai Shanghai is becoming one of the most At the beginning of 2020, Shang- SHFTZ with a new area included; near the mouth of the Yangtze River, and best practices. As China’s most translates into a most desired invest- desired investment destinations for hai released the 3.0 version of its operating the SSE STAR Market with Shanghai is internationally known as important gateway to the world, ment destination in the world char- foreign investors. business environment reform plan its pilot registration-based IPO sys- a pioneer of China’s opening to the Shanghai has persistently functioned acterized by increasing vitality and Thirdly, the openness of Shanghai is – the Implementation Plan on Deep- tem; and promoting the integrated world for its inclusiveness, pursuit as a leader in the national opening- optimized business environment. shown in its pursuit of world-lead- ening the All-round Development of a development of the YRD region as of excellence, cultural diversity, and up initiative. -

Instantaneous Electric Water Heater Series

Instantaneous Electric Water Heater Series 全機德國設計及製造 RENOWNED GERMAN CRAFTSMANSHIP 傳承德國工藝 品質享負盛名 German technology is renowned for refined 德國工藝以做工精細、持久耐用及講究實效而 craftsmanship, durability, and functionality. Designed 享譽世界,德國寶即熱式電熱水器研發及生產基 in Lüneburg, Northern Germany, German Pool’s 地均位於德國北部的呂訥堡,從研發、製造到 Instantaneous Electric Water Heaters are manufactured 質檢包裝,都全線在德國本土進行,每個部件的 to an exacting standard under the watchful eyes of 生產都由高素質工程師依照相關標準嚴格把關, our highly qualified German engineers. Nothing carries 盡得德國工藝精髓。優異的品質和技術的創新印 the German Pool label unless we are proud of it; and 證德國寶對精細做工孜孜不倦的追求。 頂尖德國科技始於 our Instantaneous Electric Water Heaters are proof of our commitment to exceptional craftsmanship and SINCE 1951 impeccable quality. 全機德國設計及製造 榮獲歐盟A級能源效益認證 2 | GERMAN POOL Instantaneous Electric Water Heater Series 德國寶即熱式電熱水器系列 | 3 單相電源 三相電源 GPI-M3 單相電源 Single-Phase Power Supply Three-Phase Power Supply 水壓控制 HYDRAULIC CONTROL 1-Phase Power Supply 迷你系列 Mini Series 洗手盆 鋅盆 洗手盆 Wash Basin Kitchen Sink Wash Basin 㷃⩢㔶⏅ 㷃⩢㔶⏅ ⋷梊ⳟ㔶⏅ Hydraulic Hydraulic Full Electronic Control Control Control GPI-M3 GPI-M6 GPI-M8 纖巧系列 Compact Series G & U LU SE P ⋷梊ⳟ㔶⏅ ⋷梊ⳟ㔶⏅ 鋅盆 洗手盆 淋浴 Full Electronic 浴盆 鋅盆 洗手盆 淋浴 Full Electronic Control Control Kitchen Sink Wash Basin Shower Bath Kitchen Sink Wash Basin Shower 一 插 即 用 CEX-9 CEX13 CEX21 > 迷你外型極致纖巧,配備13A插頭革命性 「一插即用」設計 Ultra-compact design, revolutionary 13A socket 'Plug & Use' design > 適合安裝於洗手盆 Specially designed for handwashing > 適用於辦公室、醫院、學校、商場等洗手盤 Great for facilities like offices, hospitals, schools, malls… CEX-9U -

管理層之討論及分析 Management Discussion and Analysis

管理層之討論及分析 MANAGEMENT DISCUSSION AND ANALYSIS 本年主要事項 22 KEY EVENTS OF THE YEAR 業務概覽及策略 2 BUSINESS OVERVIEW AND STRATEGIES 香港物業租賃 26 HONG KONG PROPERTY LEASING 香港物業發展及銷售 36 HONG KONG PROPERTY DEVELOPMENT AND SALES 中國內地業務 2 MAINLAND CHINA OPERATIONS 業務展望 0 FROM STRATEGY TO REALITY : NEXT MOVES 集團主要物業 6 MAJOR GROUP PROPERTIES 62 財務業績及狀況回顧 REVIEW OF FINANCIAL RESULTS AND POSITION 財務回顧 6 FINANCIAL REVIEW 風險管理 66 RISK MANAGEMENT 得獎項目 68 PROJECT AWARDS 企業公民 7 CORPORATE CITIZENSHIP 僱員關係 78 EMPLOYEE RELATIONS 管理層之討論及分析 MANAGEMENT DISCUSSION AND ANALYSIS 本年主要事項 KEY EVENTS OF THE YEAR 07 與長沙市芙蓉區人民政府簽署意向書,於長沙市 發展一個具世界建築水平的大型綜合發展項目─ 2006 「長沙恒隆廣場」。 Signed a Memorandum of Understanding with the district government of Furong District, Changsha City to develop “Changsha Hang Lung Plaza” — a world class, large scale multi-complex in Changsha City. 08 11 2006 2006 以人民幣約8.95億元成功投得遼 我們以先舊後新方式配售4.1億股,配售 寧省瀋陽市市政府廣場南面、瀋 價每股港幣16.3元,集資額約達港幣67 河區青年大街旁一幅約92,000平 億元,並計劃將所得款項淨額用於核心物 方米土地,作為我們其中一項大 業發展及投資業務,特別是中國內地。 型綜合發展項目。 Raised approximately HK$6.7 billion Acquired a prime lot of about through a placement of 410 million 92,000 square metres on the shares at HK$16.30 per share. We south side of City Plaza, intend to apply such net proceeds along Qingnian Street, for our core property development Shenhe District of Shenyang and investment activities, City, Liaoning Province, for particularly in mainland China. approximately RMB 895 million. We intend to develop a grand scale multi-complex development. 22 恒 隆 地 產 有 限 公 司 二零零六 /零七年年報 12 2006 以約人民幣6.85億元成功投得無錫市崇安區人民中路一幅 面積約37,324平方米之黃金地塊,以發展一項大型綜合發 展項目,包括世界級購物中心及辦公室大樓。該項目將命名 為「無錫恒隆廣場」,總樓面面積約255,000平方米。 Acquired a prime lot of circa 37,324 square metres at Renmin Zhong Road, in the Chongan District of Wuxi City, for approximately RMB 685 million for development of a large-scale multi-complex project comprising a world-class shopping mall and office towers. -

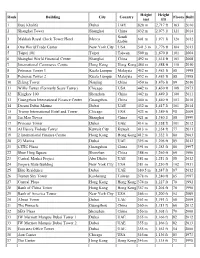

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Enjoy up to 20% Off at Renowned Chinese Restaurants

Enjoy up to 20% off at renowned Chinese restaurants Discount CNY100 off when spend minimum CNY500/ sale slip for renowned Chinese restaurants with ICBC (Thai) UnionPay card at selected restaurants in Beijing, Shanghai, Guangzhou, Shenzhen and Chengdu From 20 May – 20 November 2019 Conditions:1. This promotion is apply with UnionPay cards issued outside Mainland China (card number starting with 62). Excluded UnionPay cards issued in Mainland China. 2.Offers are only valid with card-based payment or mobile QuickPass payment. 3.One card per event day can only enjoy the discount once. All participating restaurants share the daily quota. 4.Beijing Time (GMT+8) is adopted in transaction confirmation. Due to the system cut-off, event day commences at 23:00 p.m. and terminates at 22:59 p.m. the next natural day. Due to daily system maintenance, offers are not valid during 22:58 p.m. to 23:05 p.m. 5.The receipt will indicate original amount of bill without discount, even though the discount is applied. Please refer to transaction SMS or bank statement for actual payment amount. 6.In the event of refund, only the amount paid by cardholders will be returned, excluding the discount amount. 7.Limited quantity of offers on a first-come-first-served basis for all UnionPay cards issued from all banks in Thailand. 8.Bills are not allowed to be split for payment. UnionPay International and merchants reserve the right to withdraw or cancel a discount offer in case of any alleged violation or abuse of the offer rules. -

News Release Ascott Exceeds 2019

The Ascott Limited (Regn No: 197900881N) 168 Robinson Road #30-01 Capital Tower Singapore 068912 t (65) 6713 2888 f (65) 6713 2121 www.the-ascott.com NEWS RELEASE ASCOTT EXCEEDS 2019 RECORD GROWTH TO ADD OVER 14,200 UNITS GLOBALLY IN 2020 DESPITE COVID-19 Achieves 80% year-on-year growth in China with over 9,400 units secured in the country for 2020 Singapore, 12 January 2021 – CapitaLand’s wholly owned lodging business unit, The Ascott Limited (Ascott) has added a record of over 14,200 units across 71 properties globally for 2020. Despite COVID-19, this exceeds the number of units secured in 2019, marking a fourth consecutive year of record growth for Ascott. In China, Ascott has also achieved an 80% year- on-year growth in units compared to 20191. The new properties secured will boost Ascott’s annual fee income by over S$27 million as they progressively open and stabilise. Since October 2020, Ascott added more than 4,900 units across 23 properties. This includes over 3,800 units across 17 properties in China. Ascott will make its first foray into the city of Yangzhou while expanding in other cities such as Beijing, Chengdu, Chongqing, Guangzhou, Hangzhou, Shanghai, Shenzhen and Wuhan. Among the newly secured properties are two rental housing properties in Shanghai and Hangzhou, marking Ascott’s increased presence in China’s high growth rental housing sector. As China continues to urbanise, an estimated 252 million tenants will make up a RMB3 trillion rental market by 20252. Outside of China, Ascott has sealed contracts for over 1,000 new units across 6 properties. -

Hang Lung Properties Limited ଊɾদሃʥʗ㞫ඊδଐτࠉʔ̇ 23ٲဳଉᄙྦྷඑ྆ Managementhang Discussionlung Properties and Analysis Limited of the Group’S Performance

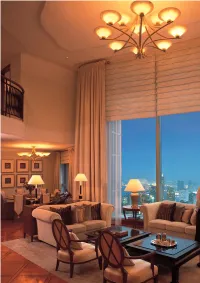

22 㞫ඊΔଐτࠉʔ̇ Hang Lung Properties Limited ଊɾদሃʥʗ㞫ඊΔଐτࠉʔ̇ 23ٲဳଉᄙྦྷඑ྆ ManagementHang DiscussionLung Properties and Analysis Limited of the Group’s Performance ಲሃЄࣂЄΔc Ɉॖሔঢ়ࢋe Irrespective of location, we scale the heights of quality. ลᙴ 24 OVERVIEW พೕࢄʥሻਕ 24 PROPERTY DEVELOPMENT AND SALESذ พै༉ 28 PROPERTY LEASINGذ ဳଉ 38 FINANCE AND TREASURY OPERATIONSټল৻ʥ༅ ࡗ 40 EMPLOYEES ผஐͨ 40 SOCIAL RESPONSIBILITYم ϹȾ᎘ɾ7KH+DUERXU6LGHכࢋؿᄖౖ۪ᜨତશϽ Spacious living room of The Summit overlooking The HarbourSide on West Kowloon 24 㞫ඊΔଐτࠉʔ̇ Hang Lung Properties Limited ଊɾদሃʥʗٲဳଉᄙྦྷඑ྆ MANAGEMENT DISCUSSION AND ANALYSIS OF THE GROUP’S PERFORMANCE ȹΣࠗಋֺτΔଐʔ̇c̯එ྆ΕᏜ α۹ɾᏪพᔾɎࠌܧшྊɎᏪe̯ল ϛʗɾʄᒨʄϭಋྫྷɀɊɍყɄɝɍϛ αʑ٦්ၣɾϾΩכɀɊຒʏc˚߬ͅ ௰Ͻሻ൴ಕʭֺߎɀཌྷཌྷɀαiɀɊȼ ௰ϽhɀཌྷཌྷȹαiɍɊʒ௰Ͻe ΐϊcౝٖٖᎶЌक़Сಕʭϛʗɾ ɊɀᒨɄϭಋྫྷɊɀყཌྷȼϛຒʏe̯ ᘪݢೕ̱౨ٖࢠҰٖౝٖɀӯۺඑ྆ c̊Ͳα۹ౝٖޚȾ˦cၤ˾α۹ eޚࢠݯ̒ӯc͛ၤɐα۹ٖ ಳంйc̒ඖ˚߬ณϾΩඖ͌එ̯྆ כϹȾ᎘ිࣵਂʥȹඖϽכɍඖϽܢ˳ Єʼ̈́ɾܪɮི߮cя̳Σ౨൬Ϸe ԞϬࠗಋਆ⭕dᄘΥᅢdϾΩʥɮพþ αʑɎࠌcכνɃټพɾᐢैذᄘΥᅢ אνɃτХټЎԞϬɐࣵԭඖ͌ɾै ሻϊൡఝe ྡྷؗeಳ̟ܮඑ྆ܰα۹ɾพᐜʦ̯ ȹȾȾȾαʥɀכඑ̯྆כϤcͫͅ ཌྷཌྷཌྷαࣂᄗᑪɃሔϾΩɠΔcΐ ൙ΔϽeכThe HarbourSide ϊ̯එ྆ଊ୮ พೕࢄʥሻਕذ ลᙴ ̯එ྆̒ඖሔϾΩඖ͌ଊ̳ܪɮc൬ גα۹c㞫ඊΔଐࠍྦྷʑ ۹я˿͌ᅟɾໃιˀ౨e̯එ྆ܧࡄ༦˾ɾলכ ʶc˞೩௰Ͻɾሔॖ˞ʥ̯එ྆ڌኝeඑ྆ɰ τܥʥᏪਆྊԞɾஈΛ cܪ૭ɣສพτࠉʔ̇ ݯҰඖֺ͌၀ʶ೪ིɾࡨஉܢ˳ѧιࠇୂcԯɻ Ίݯ㞫ඊΔଐτ ೩ඖ͌ࢄሻਕི߮ࣂcੀ˿ઘᆅמ˂ɀཌྷཌྷȹαɊɀכ ֺτΔଐඖ͌я͚ͅ ईɾ̟ʦᎶe܃ࠉʔ̇eඑ྆ʌ 㞫ඊΔଐ߲ஐc˥එ྆˞ഁ͂༅ʥ ዀᚁ༏Ⱦ᎘ॎכॶɈe 7KH+DUERXU6LGH Ͻجᘏړᆢ ଊɾদሃʥʗ 25ٲԜೕࢄɾɠΔௐ ဳଉᄙྦྷඑ྆˿ Development Land Bank Management Discussion and Analysis of the Group’s Performance ɀཌྷཌྷɀαʒ˂ɍɊˀat 30 June 2002כ 11% 89% ■ ϾΩ Residential ■ ਆ⭕ Commercial OVERVIEW Hong Kong declined during the year. However income from our two projects in Hang Lung Properties has faced many Shanghai has helped offset this decline. challenges over the past financial year - both internally and within the marketplace in Our results this year reflect market reality. which it operates. -

Report on the Investment Environment of Changning District, Shanghai

Report on the Investment Environment of Changning District, Shanghai 上海长宁_en.indd 1 2015/11/16 9:41:31 Map of China Geographical Location of Shanghai Changning District Shanghai Yangzhou Zhenjiang Nantong Map of the Yangtze River Delta region Nanjing Chongming Island Changzhou Yangzhou Zhenjiang Nantong Nanjing Changzhou Wuxi Shanghai Yangtze River Bridge Wuxi Suzhou Shanghai Shanghai Changning Waigaoqiao Pot Huzhou District Jiaxing Suzhou Shanghai Hangzhou Zhoushan Shanghai Pudong International Airport Shaoxing Ningbo Hongqiao Airport Tai Lake Hongqiao Transport Hub Donghai Bridge Huzhou Jiaxing Yangshan Port Legend Provincial Capital Major Cities Hangzhou Bay Sea-Crossing Bridge Railway Station Airport 銭塘江 Port Wharf Boundaries of Province, Hangzhou autonomous region and municipalities Hangzhou Xiaoshan Zhoushan Expressway International Airport Railway Fresh water lake, salt water lake Shaoxing Ningbo 上海长宁_en.indd 2 2015/11/16 9:41:32 Map of China Geographical Location of Shanghai Changning District Shanghai Yangzhou Zhenjiang Nantong Map of the Yangtze River Delta region Nanjing Chongming Island Changzhou Yangzhou Zhenjiang Nantong Nanjing Changzhou Wuxi Shanghai Yangtze River Bridge Wuxi Suzhou Shanghai Shanghai Changning Waigaoqiao Pot Huzhou District Jiaxing Suzhou Shanghai Hangzhou Zhoushan Shanghai Pudong International Airport Shaoxing Ningbo Hongqiao Airport Tai Lake Hongqiao Transport Hub Donghai Bridge Huzhou Jiaxing Yangshan Port Legend Provincial Capital Major Cities Hangzhou Bay Sea-Crossing Bridge Railway Station Airport -

Osservatorio Olivicolo

ERSAT: Progetto “Informatore della Campagna” OSSERVATORIO OLIVICOLO V° Report Trimestrale Febbraio 2006 DATABANK SPA – Via dei Piatti, 11 – 20123 MILANO P.IVA e C.F.: 03126910151 – Tel.: 02-809556 – Fax: 02-8056495 INDICE INTRODUZIONE 4 1. LE CIFRE DEL SETTORE 4 1.1. La superficie olivicola 5 1.2. La produzione di olive da olio 7 1.3. La produzione di olio 8 1.4. L’olio DOP e IGP 10 2. IL COMMERCIO CON L’ESTERO 11 2.1. Le esportazioni-importazioni di oli e grassi 11 2.2. Le esportazioni-importazioni di oli e grassi dall’Italia alla Cina 14 2.3. Lo scenario internazionale: interscambio Italia-Cina 18 3. IL CONSUMO 20 3.1. L’evoluzione del consumo verso una riscoperta della tradizione 20 3.2. Evoluzioni e tendenze del consumo dell’olio di oliva confezionato 22 4. LA DISTRIBUZIONE 23 4.1. La distribuzione in Italia 23 4.2. La distribuzione dell’olio di oliva in Italia 26 4.3. La distribuzione moderna in Cina e Hong Kong 29 5. LO SCENARIO COMPETITIVO 46 5.1. I fattori critici di successo in Italia 46 5.2. Le migliori performance in Sardegna 49 5.3. Le migliori performance in Italia 50 5.4. I modelli di business 53 Ersat Sardegna - Servizio per l'Assistenza al Marketing e alla Valorizzazione dell'Offerta Agricola 2 Via Caprera n. 8.– 09123 - Cagliari – www.ersat.it 6. NOVITA’ E AGGIORNAMENTI 56 6.1. Il valore della marca 56 6.2. Notizie dal settore 60 6.3. Fiere del settore 62 Allegato 1 65 Allegato 2 66 Allegato 3 67 Ersat Sardegna - Servizio per l'Assistenza al Marketing e alla Valorizzazione dell'Offerta Agricola 3 Via Caprera n. -

品牌 Brand 门店 Outlet(EN)

品牌 门店 地址 电话 Brand Outlet(EN) Address Hotline 芝乐坊餐厅 WF CENTRAL, Beijing 412-419, 4th Floor, East Block, WF CENTRAL, 269 Wangfujing Street, Beijing 010-65251238 The Cheesecake Factory Disney Town, Shanghai No. 720, Lane 255, West Shendi Road, Shanghai (Broadway Plaza, Disney Town) 021-58936018 Baker & Spice WF CENTRAL, Beijing Outside the West Block, Shop 111, WF CENTRAL, Building 1, No. 269, Wangfujing Street, Beijing 010-65266580 Café Landmark WF CENTRAL, Beijing 2nd Floor, East Block, WF CENTRAL, 269 Wangfujing Street, Beijing 010-65256623 The RUG Café WF CENTRAL, Beijing Room 112, West Block, WF CENTRAL, Building 1, No. 269, Wangfujing Street, Beijing 010-65283966 The Woods Café WF CENTRAL, Beijing Shop 310, 3rd Floor, West Block, WF CENTRAL, 269 Wangfujing Street, Beijing 010-68525880 Tiago Home Kitchen WF CENTRAL, Beijing 411B, 4th Floor, East Block, WF CENTRAL, 269 Wangfujing Street, Beijing 010-85179177 Tribe WF CENTRAL, Beijing 416C, 4th Floor, East Block, WF CENTRAL, Building 1, No. 269, Wangfujing Street, Beijing 010-65262690 Hongkou, Shanghai 2nd Floor, Hall of the Moon, Ruihong Tiandi, 188 Ruihong Road, Shanghai 021-65571777 上海1号私藏菜 Luwan, Shanghai 3rd Floor, Haixing Plaza, 1 South Ruijin Road, Shanghai 021-64189777 Shanghai No.1 Seafood Jingan, Shanghai 3rd Floor, Ju'an Building, 1856 West Nanjing Road, Shanghai 021-62891777 Village Huangpu, Shanghai 6th Floor, Xinshang Digital Plaza, 233 South Xizang Road, Shanghai 021-33317177 Yangpu, Shanghai L6-05, Zijing Plaza, 1628 Kongjiang Road, Shanghai 021-55083777 Hong Kong Metropolis, -

Osservatorio Ortofrutticolo

ERSAT: Progetto “Informatore della Campagna” OSSERVATORIO ORTOFRUTTICOLO V° Report Trimestrale Febbraio 2006 DATABANK SPA – Via dei Piatti, 11 – 20123 MILANO P.IVA e C.F.: 03126910151 – Tel.: 02-809556 – Fax: 02-8056495 INDICE INTRODUZIONE 4 1. IL MERCATO 4 1.1. La superficie ortofrutticola 5 1.2. La produzione ortofrutticola 9 2. IL COMMERCIO CON L’ESTERO 14 2.1. Le esportazioni-importazioni di ortofrutta 14 2.1.1. Le esportazioni-importazioni di pomodori 16 2.1.2. Le esportazioni-importazioni di asparagi 18 2.1.3. Le esportazioni-importazioni di carciofi 20 2.1.4. Le esportazioni-importazioni di fragole 22 2.2. Le esportazioni-importazioni di ortofrutta dall’Italia e dalla Sardegna alla Cina 24 2.2.1. Le Importazioni di asparagi dall’Italia alla Cina 26 2.3. Lo scenario internazionale: interscambio Italia-Cina 27 3. IL CONSUMO 29 3.1. L’evoluzione del consumo verso una riscoperta della tradizione 29 3.2. Evoluzioni e tendenze del consumo di ortofrutta 31 4. LA DISTRIBUZIONE 33 4.1. La distribuzione in Italia 33 4.2. La distribuzione dell’ortofrutta in Italia 36 4.3. La distribuzione moderna in Cina e Hong Kong 38 Ersat Sardegna - Servizio per l'Assistenza al Marketing e alla Valorizzazione dell'Offerta Agricola 2 Via Caprera n. 8.– 09123 - Cagliari – www.ersat.it 5. LO SCENARIO COMPETITIVO 55 5.1. I fattori critici di successo in Italia 55 5.2. Le aziende ortofrutticole operanti in Italia e in Sardegna 58 6. NOVITA’ E AGGIORNAMENTI 65 6.1. Il valore della marca 65 6.2.