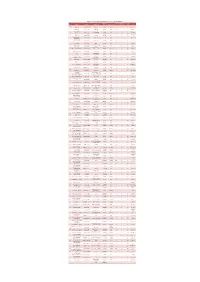

Balance of Major Monetary and Credit Aggregates at the End of Tir 1399

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ORIGINAL ARTICLE a Study on the Relationship Between Temperature

Bulletin of Environment, Pharmacology and Life Sciences Bull. Env. Pharmacol. Life Sci., Vol 3 [12] November 2014: 42-45 ©2014 Academy for Environment and Life Sciences, India Online ISSN 2277-1808 Journal’s URL:http://www.bepls.com CODEN: BEPLAD Global Impact Factor 0.533 Universal Impact Factor 0.9804 ORIGINAL ARTICLE A study on the relationship between temperature and height in Ardabil province, according to the meteorological data Bahman Bahari Bighdilu Department of Agriculture, Pars Abad Moghan Branch, Islamic Azad University, pars Abad Moghan, Iran Email: [email protected] ABSTRACT the relationship between temperature and height was investigated Based on the review of one of the most important climatic parameters (temperature) in order to provide scientific solutions to meet the social needs and careful planning in the region in the field of agriculture. There was a significant relationship on the basis of Laps Rate phenomenon, so that the differences between heating and cooling processes of 70 degrees Celsius and the height difference of 1500 meters in the province show this important issue. Keywords: temperature, according, meteorological data Received 10.09.2014 Revised 09.10.2014 Accepted 02.11. 2014 INTRODUCTION Location, range and area This region with the area of 17,867 square kilometers is located at the north of Iran plateau between the coordinates of '45 and ‘37 to '42 and '39 North latitude and '55 and 48 to '3 and 47 east longitudes from the Greenwich meridian. Based on the assessment studies of Land resources in this area (Ardabil Province) a total of 7 major types and one type of mixed lands and 32 units of land have been identified. -

The Calendars of India

The Calendars of India By Vinod K. Mishra, Ph.D. 1 Preface. 4 1. Introduction 5 2. Basic Astronomy behind the Calendars 8 2.1 Different Kinds of Days 8 2.2 Different Kinds of Months 9 2.2.1 Synodic Month 9 2.2.2 Sidereal Month 11 2.2.3 Anomalistic Month 12 2.2.4 Draconic Month 13 2.2.5 Tropical Month 15 2.2.6 Other Lunar Periodicities 15 2.3 Different Kinds of Years 16 2.3.1 Lunar Year 17 2.3.2 Tropical Year 18 2.3.3 Siderial Year 19 2.3.4 Anomalistic Year 19 2.4 Precession of Equinoxes 19 2.5 Nutation 21 2.6 Planetary Motions 22 3. Types of Calendars 22 3.1 Lunar Calendar: Structure 23 3.2 Lunar Calendar: Example 24 3.3 Solar Calendar: Structure 26 3.4 Solar Calendar: Examples 27 3.4.1 Julian Calendar 27 3.4.2 Gregorian Calendar 28 3.4.3 Pre-Islamic Egyptian Calendar 30 3.4.4 Iranian Calendar 31 3.5 Lunisolar calendars: Structure 32 3.5.1 Method of Cycles 32 3.5.2 Improvements over Metonic Cycle 34 3.5.3 A Mathematical Model for Intercalation 34 3.5.3 Intercalation in India 35 3.6 Lunisolar Calendars: Examples 36 3.6.1 Chinese Lunisolar Year 36 3.6.2 Pre-Christian Greek Lunisolar Year 37 3.6.3 Jewish Lunisolar Year 38 3.7 Non-Astronomical Calendars 38 4. Indian Calendars 42 4.1 Traditional (Siderial Solar) 42 4.2 National Reformed (Tropical Solar) 49 4.3 The Nānakshāhī Calendar (Tropical Solar) 51 4.5 Traditional Lunisolar Year 52 4.5 Traditional Lunisolar Year (vaisnava) 58 5. -

Summer/June 2014

AMORDAD – SHEHREVER- MEHER 1383 AY (SHENSHAI) FEZANA JOURNAL FEZANA TABESTAN 1383 AY 3752 Z VOL. 28, No 2 SUMMER/JUNE 2014 ● SUMMER/JUNE 2014 Tir–Amordad–ShehreverJOUR 1383 AY (Fasli) • Behman–Spendarmad 1383 AY Fravardin 1384 (Shenshai) •N Spendarmad 1383 AY Fravardin–ArdibeheshtAL 1384 AY (Kadimi) Zoroastrians of Central Asia PUBLICATION OF THE FEDERATION OF ZOROASTRIAN ASSOCIATIONS OF NORTH AMERICA Copyright ©2014 Federation of Zoroastrian Associations of North America • • With 'Best Compfiments from rrhe Incorporated fJTustees of the Zoroastrian Charity :Funds of :J{ongl(pnffi Canton & Macao • • PUBLICATION OF THE FEDERATION OF ZOROASTRIAN ASSOCIATIONS OF NORTH AMERICA Vol 28 No 2 June / Summer 2014, Tabestan 1383 AY 3752 Z 92 Zoroastrianism and 90 The Death of Iranian Religions in Yazdegerd III at Merv Ancient Armenia 15 Was Central Asia the Ancient Home of 74 Letters from Sogdian the Aryan Nation & Zoroastrians at the Zoroastrian Religion ? Eastern Crosssroads 02 Editorials 42 Some Reflections on Furniture Of Sogdians And Zoroastrianism in Sogdiana Other Central Asians In 11 FEZANA AGM 2014 - Seattle and Bactria China 13 Zoroastrians of Central 49 Understanding Central 78 Kazakhstan Interfaith Asia Genesis of This Issue Asian Zoroastrianism Activities: Zoroastrian Through Sogdian Art Forms 22 Evidence from Archeology Participation and Art 55 Iranian Themes in the 80 Balkh: The Holy Land Afrasyab Paintings in the 31 Parthian Zoroastrians at Hall of Ambassadors 87 Is There A Zoroastrian Nisa Revival In Present Day 61 The Zoroastrain Bone Tajikistan? 34 "Zoroastrian Traces" In Boxes of Chorasmia and Two Ancient Sites In Sogdiana 98 Treasures of the Silk Road Bactria And Sogdiana: Takhti Sangin And Sarazm 66 Zoroastrian Funerary 102 Personal Profile Beliefs And Practices As Shown On The Tomb 104 Books and Arts Editor in Chief: Dolly Dastoor, editor(@)fezana.org AMORDAD SHEHREVER MEHER 1383 AY (SHENSHAI) FEZANA JOURNAL FEZANA Technical Assistant: Coomi Gazdar TABESTAN 1383 AY 3752 Z VOL. -

235 Farzane Ahmadzad

Proceedings of the 2010 International Conference on Industrial Engineering and Operations Management Dhaka, Bangladesh, January 9 – 10, 2010 Model for Forecasting Passenger of Airport Farzane Ahmadzade Department of Industrial Engineering Islamic Azad University of Karaj Branch Karaj, Tehran, Iran Abstract This research forecasts the growth of air traffic in one of int’l airport. It actually estimates the growth of air traffic with the trend model, and then the growth is forecasted by monthly air traffic and time series data. To estimate the coefficient of the model in general econometric methods use the time series data, it is suggested that the data should be stationary, otherwise false regression would be probable. Then before using, the data (variables), the data should be tested so as to be stationary. However, there are different methods to make data stationary such as Drawing Diagram and Augmented Dickey- Fuller Test (ADF), which were used in this dissertation. Finally, the estimation is base on the fifth month, namely (Mordad). Keywords forecasting , Augmented Dickey Fuller Test (ADF),time series, stationary. 1. Introduction Civil Aviation, through a complicated interaction with other econometric sectors, benefits from and contributes to the economic development of all nations. As incomes and production level increase, the demand for aviation services expands. Therefore prospective tourism, trade and employment could be forecasted as well. Civil Aviation is an important instrument in economic development, and air transport also provides an intangible benefits by facilitating the international treaties and understanding. On the other, the role of air transport as a catalyst for general economic and social development is due to the expedition and flexibility, which has been provided by the global air transport system. -

Consumer Price Index in the Month of Mordad of the Year 1399F

Consumer Price Index in the Month of Mordad of the Year 13991 Increase in National Point-to-Point Inflation Rate Point-to-Point Inflation rate refers to the percentage change in the price index in comparison with the corresponding month in the previous year. The point-to-point inflation rate in the month of Mordad2 of the year 1399 stood at 30.4 percent, that is to say, that the national households spent, on average, 30.4 percent higher than the month of Mordad of the year 1398 for purchasing “the same goods and services”. Moreover, in this month, the point-to-point inflation rate experienced a 3.5 percentage point increase in comparison with the previous month (Tir, the year 1399). The point-to-point inflation rate for the major groups of "food, beverages and tobacco" and "non-food items and services" were 26.0 percent (with a 5.0 percentage point increase) and 32.6 percent (with a 2.8 percentage point increase), respectively. This is while the point-to-point inflation rate for urban households stood at 30.6 percent, which has increased by 3.6 percentage points in comparison with the previous month. Moreover, this rate was 29.6 percent for rural households which increased by 3.7 percentage points in comparison with the previous month. Decrease in the Monthly National Households Inflation Rate The monthly inflation rate refers to the percentage change in the price index in comparison with the previous month. The monthly inflation rate in the month of Mordad of the year 1399 stood at 3.5 percent, which decreased by 2.9 percentage points in comparison with the previous month (Tir, the year 1399). -

RIVIVAL of the ANCIENT ZARATHUSHTI CALENDAR 3753 Ze

UNIFIED ZARATHUSHTI CALENDAR RIVIVAL OF THE ANCIENT ZARATHUSHTI CALENDAR 3753 ze “I learn about and work with the solar year, the righteous period”. Yasna Ha1.9, Ha 3.11, Ha 4.14 THE ANCIENT MAZDIYASNI CALENDAR updated by Zarathushtra was the most accurate calendar that has ever existed in the civilized world to this day. The year always started with the Vernal Equinox whereby the leap year was automatically taken care of. Its accuracy was further strengthened by dividing into months the number of days of each individual season marked by the position of the earth in its orbit round the sun. The proof of this is in the four festivals that are celebrated to this day. 1- Vernal Equinox the beginning of Spring as New Year – Now Rooz 2- Summer Solstice the beginning of Summer as Tirgan 3- Autumnal Equinox the beginning of Fall as Mehregan 4- Winter Solstice the beginning of winter as Yalda (Deygan) These four positions and the four seasons although they may seem to be of equal length, in reality they are not equal. The path of the earth around the sun is such that it does not divide the time taken to travel, from one position to another, into four equal parts as one would ordinarily believe. In fact none of the four parts are equal. Spring has 92.8 days, Summer 93.6 days Autumn 89.9 days and winter 88.9 days. Each individually divided works out to 31 days each for the first six months, the next 5 months of 30 days and the last month of the balance of the days before the Vernal Equinox which is 29 and automatically 30 every fourth years. -

Price Indices

IRAN STATISTICAL YEARBOOK 1393 22.PRICE INDICES Introduction elow you will find a short history of price index for goods. The year 1353 witnessed B examination of prices and calculation of some changes in national economic conditions, the related indices for urban and rural areas which caused it to be selected as the new base by both the Central Bank of the Islamic Republic year, and the indices calculation underwent the of Iran and the SCI. third revision. A. Consumer price index of urban households Considering the changes happened in the The National Bank of Iran first calculated the household consumption pattern resulted from cost of living index1 in urban areas and socio-economic developments after the 1357 wholesale price index for goods in the year 1315. Islamic Revolution, the year 1361 was adopted In the year 1338, the calculation of the cost of as the base and the indices calculation was living index and wholesale price index for goods revised again. was revised due to change of the base year. By In the year 1369 after the end of the Iran-Iraq establishment of the Central Bank of Iran in the War, which caused changes in economic year 1339, the responsibility for calculating such conditions, revision in the base year was indices was shifted to this Bank. With respect to considered necessary and the Central Bank of remarkable changes in households’ consumption Iran adopted the year 1369 as the new base for patterns and expenditure composition, the the calculation. Central Bank of Iran took the year 1348 as the In the year 1378, the Central Bank of Iran base and made the second revision in the changed the base year from the year 1369 to the calculation of cost of living index and wholesale year 1376 for calculation of price index of 837 22..PRICE INDICES IRAN STATISTICAL YEARBOOK 1393 consumption goods and services in urban areas. -

The Development of Iranian Calendar Historical and Astronomical

The development of Iranian calendar: historical and astronomical foundations Musa Akrami Department of Philosophy of Science Islamic Azad University - Science and Research Branch of Tehran Tehran, Iran E-mail: [email protected] Abstract. The official Iranian calendar is a solar one that in both the length and the first day of its year is based not on convention, but on two natural (i.e. astronomical) factors: a) the moment of coincidence of the centre of the Sun and the vernal equinox during the Sun’s apparent revolution around the Earth; and b) the time length between two successive apparent passages of the Sun’s center across that point. These factors give this calendar the chance that 1) its beginning is the beginning of natural solar year, 2) its length is the length of solar year, and 3) the length of its months is very close to the time of the Sun’s passage across twelve signs of the Zodiac from Farvardin/Aries to Esfand/Pisces. In this paper it would be shown that a) discussions concerning these facts have their own historical backgrounds, and b) up-to-date computations, being based on choosing the tropical year (i.e. 365.24219879 days) as the length of the calendar year, give the best possible intercalation with its specific system of leap years. Thus, on the grounds of historical documents, astronomical data, and mathematical calculations, we establish the Iranian calendar with the highest possible accuracy, which gives it the unique exemplary place among all calendars. Keywords: Solar calendrical systems, Iranian calendar, -

CPI Decile Ordibehesht 1400

National Consumer Price Index by Expenditure Deciles in the Month of Ordibehesht1 of the year 14002 The national inflation rate for the month of Ordibehesht of the year 1400 stood at 41.0 percent, fluctuating between 40.1 percent for the first and fifth deciles (those with the lowest and middle incomes, respectively) and 47.5 percent for the tenth decile (those with the highest income) among the expenditure deciles. The range of the twelve-month inflation changes in the major group of "food, beverages and tobacco" was between 44.8 percent for the tenth decile and 50.1 percent for the second decile. The major group of "non-food items and services” also saw these fluctuations, ranging from 30.9 percent for the first decile to 48.2 percent for the tenth decile1. Inflation Rate for Major Groups(%) General Inflation Rate (%) 60 50 47.5 49.7 50.1 49.9 46.1 48.2 43.5 49.4 48.7 48.5 47.9 46.9 41.1 41.6 50 42.5 44.8 45 40.1 40.7 40.5 40.2 40.1 40.2 39.0 40 33.1 33.5 34.4 35.1 37.4 40 30.9 32.5 35 30 30 20 25 20 10 15 0 10 5 0 First decile First Fifth decile Sixth decile Sixth Third decile Third Ninth decile Tenth Tenth decile Fourth Fourth decile decile Eighth Second decile Seventh decile Seventh First decile First Fifth decile Food, beverages and tobacco Non-food items and services decile Sixth Third decile Third Ninth decile Tenth Tenth decile Fourth Fourth decile decile Eighth Second decile Seventh decile Seventh 1. -

2 Mehr and Mehregan

MEHREGAN - MEHR 2 Mehr and Mehregan Pireyeh Yaghmaii Writer and Poet o Mehr! As we have not been amongst Mehr-Dorujansl free us from needs, from all needs. You have the power to prevail, fear and worry over the bodies of the Mehr-Dorujans. You have the might, when you are angry, to take away: their strength of arms their energy of knees, their sight of eyes, and the hearing of their ears (Mehr-Yasht, vi, 23).2 Ancient Persians believed happiness to be a grace from Ahura-Mazda and sadness an evil from the Devil. Happiness was so dear to them that the Achaemenian kings saw it in unity with the creation of the heavens and the Earth, as was engraved at the beginning of their tablets: Ahura-Mazda is the great Lord who created this Earth and created that sky and created the human being and created happiness for human beings. The ancient Persians did not even mourn the death of people and considered mourning and grieving a great sin, and struggled for happiness; they used every occasion as an excuse to celebrate.3 The ancient Persians did not observe week days. They had twelve months of 30 days each, in which every day had a name.4 They regarded the extra five days at the end of the year as celebration days, called andargah. Within the 30 day cycle there were twelve days, each named after the months. when the name of the day coincided with the name of the month, that day was celebrated and special events were organized. -

List of Issued Sukuk Through Spvs

Sukuk Issued through SPVs in Iran Capital Market Amount in Tenor Return Payment Rate (% No. Originator Issue Date Underlying Asset Sukuk Structure SPV Millions IRR (years) Periods (months) annually) 1 Mahan Air March 12, 2011 1 airplane 291,500 Ijarah 4 3 20 Bahman Co. 2 Bank Saman June 18, 2011 8 buildings 1,000,000 Ijarah 4 3 20 Esfand Co. Omid Investment 3 August 16, 2011 3 pieces of land 1,087,000 Ijarah 4 3 20 Farvardin Co. Management Ordibehesht 4 Mahan Air August 23, 2011 4 airplanes 914,250 Ijarah 4 3 20 Co. Joopar Passenger and 5 January 8, 2012 railway wagons 415,250 Ijarah 4 3 20 Qordad Co. Freight Trains Maskan Investment 6 June 6, 2012 building 238,000 Ijarah 4 3 20 Tir Co. Management 7 Sina Leasing June 16, 2012 stores 100,000 Ijarah 4 3 20 Mordad Co. 6 turbines of gas power 8 MAPNA Group June 17, 2012 2,000,000 Ijarah 4 3 20 Mehr Co. plant Water Heater Raw 9 Butane Industrial Company March 16, 2013 301,306 Murabaha 2 3 20 Aban Co. Materials 10 Rayan Saipa Leasing April 17, 2013 Apartments 227,865 Ijarah 4 3 20 Shahrivar Co. machinery and 11 Pars Oil April 27, 2013 1,040,000 Ijarah 4 3 20 Azar Co. equipments Chadormalu Mining and machinery and 12 October 1, 2013 1,500,000 Ijarah 4 3 20 Farvardin I Co. Industrial Company equipments machinery and 13 MAPNA Group October 21, 2013 1,970,000 Ijarah 4 3 20 Mordad I Co. -

UNIT 9 MONTHS of an IRANIAN CALANDER (Maah

B PE L -011 BPEL-011 Basics of Persian Indira Gandhi National Open University Language School of Foreign Languages Block 2 READING AND WRITING-II Block Introduction 3 UNIT 7 Count Your Things 5 UNIT 8 Day of a Week 15 UNIT 9 Months of an Iranian Calendar 27 UNIT 10 Seasons of a Year 41 UNIT 11 The Restaurant 51 UNIT 12 In the Garden 61 BLOCK 2 INTRODUCTION Block two of this course also contains following Six Units: Unit 7 Count your Things: The main objective of this unit is to enable you to learn and understand the counting of words and numbers in Persian. The unit is supported by many exercises and examples to consolidate your learning. Unit 8 Days of a Week: The main objective of this unit is to enable you to learn counting Persian days of the week. This unit is also supported by many exercises and examples to consolidate your learning. Unit 9 Months of an Iranian Calendar: The main objective of this unit is to enable you to become familiar with the months of year in Persian. Unit 10 Seasons of a Year: In this unit you will learn the names and months of a particular season of Iran. You will also learn how to pronounce it in Persian. Unit 11 In the Restaurant: The prime objective of this unit is to make you familiar with some new Persian words. You will also learn some Persian sentences used in a restaurant. Unit 12 In the Garden: This unit has been prepared to familiarize you with the common expressions that are used while visiting the garden.