Acergy and Subsea 7 Agree to Combine

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Leveraging Our Global Capabilities

Subsea 7 S.A. Annual Report and Financial Statements 2010 Leveraging our global capabilities Subsea 7 S.A. (Formerly Acergy S.A.) Annual Report and Financial Statements 2010 Leveraging our global capabilities Subsea 7 S.A. is a global leader in seabed-to-surface engineering, construction and services. The Combination of Acergy S.A. and Subsea 7 Inc. in January 2011 created a global leader in seabed-to-surface engineering, construction and services able to offer clients access to a high end, diversified fleet, comprising 42 vessels supported by extensive fabrication and onshore facilities able to deliver the full spectrum of subsea engineering, construction and services. Subsea 7 S.A. is well positioned to take advantage of future growth opportunities in the global seabed-to-surface market. We are leveraging our global capabilities through our greater depth of project management, engineering and technical expertise along with our high-end diversified fleet to secure and deliver complex offshore projects on behalf of our clients, in safe and sustainable ways. For all the latest up-to-date information visit www.subsea7.com Subsea 7 S.A. Registered office: 412F, route d’Esch L-2086 Luxembourg Registered number: B 43 172 Creating a new force in seabed-to-surface May 2010 Awarded $120 million Dec 2009 Dec 2009 contract, offshore Acquires Borealis Awarded three-year Nigeria Acergy acquired Borealis, a DSV contract Awarded Conventional state-of-the-art deepwater Awarded three-year project for the removal construction and pipelay contract for the provision of existing risers, vessel. Borealis is ideally of Dive Support Vessel the installation of new suited to meeting the services to the DSVi pipelines and associated exacting requirements of Collective of companies risers, together with ultra-deep and deepwater in the North Sea. -

Innovation in Non Destructive Testing

Innovation in Non Destructive Testing Entrepreneurship Casper Wassink Innovation in Non Destructive Testing Proefschrift Ter verkrijging van de graad van doctor aan de Technische Universiteit Delft, op gezag van de Rector Magnificus prof.ir. K.C.A.M. Luyben, voorzitter van het College van Promoties, in het openbaar te verdedigen op donderdag 12 januari 2012 om 12:30 uur door Casper Harm Philip WASSINK Natuurkundig Ingenieur geboren te Aalsmeer Dit proefschrift is goedgekeurd door de promotor: Prof. dr. ir. A.J. Berkhout Copromotor: Dr. J.R. Ortt Samenstelling promotiecommissie: Rector Magnificus, Technische Universiteit Delft, Voorzitter Prof. dr. ir. A.J. Berkhout, Technische Universiteit Delft, Promotor Dr. J.R. Ortt, Technische Universiteit Delft, Copromotor Prof. dr. A.H. Kleinknecht, Technische Universiteit Delft Prof. dr. ir. J.G. Slootweg, Technische Universiteit Eindhoven Prof. dr. B.J.M. Ale, Technische Universiteit Delft Prof. dr. U. Ewert, Bundesanstalt für Materialforschung und -prüfung Dr. ir. M. Lorenz, Shell Global Solutions Prof. dr. ir. P.M. Herder, Technische Universiteit Delft, reservelid ISBN 978-90-8570-795-0 Copyright © 2011 Casper Wassink, Rotterdam, The Netherlands Printed by: Wöhrmann Print Service All rights reserved, No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior consent of the author. Samenvatting Innovatie is vandaag de dag geen activiteit meer die kan worden overgelaten aan een aparte afdeling of een kennisinstituut. Het is een kerncompetentie van succesvolle ondernemingen. Echter, in veel gevestigde ondernemingen is de snelheid van innovatie laag. De Niet Destructie Onderzoek sector is een voorbeeld van een sector waar de snelheid van innovatie zeer laag is. -

Acergy S.A. Announces Second Quarter Results

Acergy S.A. Announces Second Quarter Results London, England – July 14, 2010 – Acergy S.A. (NASDAQ-GS: ACGY; Oslo Stock Exchange: ACY), announced today results for the second quarter which ended on May 31, 2010. The Group’s accounts are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and as adopted by the European Union and were approved by the Board on July 14, 2010. Highlights - Revenue from continuing operations was $581 million (Q2 2009: $526 million) - Adjusted EBITDA(a) from continuing operations was $121 million (Q2 2009: $113 million) corresponding to an Adjusted EBITDA margin of 20.9% (Q2 2009: 21.5%) - Income from continuing operations was $63 million (Q2 2009: $76 million) - Strong cash and cash equivalents position of $631 million (February 28, 2010: $667 million) - Awarded $120 million Conventional contract, offshore Nigeria - As part of our ongoing fleet development programme, Acergy acquired two vessels post quarter end; the Polar Queen and the Antares, a shallow water barge for the West African Conventional market - Post quarter end, on June 21, 2010 the Boards of Directors of Acergy S.A. and Subsea 7 Inc. announced that they had agreed to combine the two companies Jean Cahuzac, Chief Executive Officer, said: “We have delivered a solid quarterly performance driven by excellent project execution, additional variation orders on ongoing projects and strong Conventional activity. We remain on track to deliver our 2010 expectations. In line with our strategy to develop the fleet, we acquired the Antares and Polar Queen, reinforcing our commitment to capture opportunities and invest in the business. -

RA BRS 2007 Int GB

Shipping and Shipbuilding Markets 2 0 0 7 Shipping and Shipbuilding Markets in 2006 THE BRS ANNUAL REVIEW OF WORLD SHIPPING AND SHIPBUILDING DEVELOPMENTS IN 2006 AND PROSPECTS FOR THE COMING MONTHS… 1 Foreword 3 The shipbuilding market in 2006 23 The cruise market in 2006 29 The tanker market in 2006 45 The offshore and specialised ships markets in 2006 51 The chemical carrier market in 2006 57 The liquefied petroleum gas shipping market in 2006 67 The liquefied natural gas shipping market in 2006 73 The dry bulk market in 2006 81 The containership market in 2006 97 The ro-ro market in 2006 101 The marine insurance markets in 2006 107 French shipyards deliveries and orderbook in 2006 110 French orders to foreign shipyards in 2006 Crystal Ball AFTER FOUR YEARS OF BUOYANT the world’s population, originating from SHIPPING MARKETS, GIVING STATIS- a group of countries known as B.R.I.C. TICS NEVER SEEN BEFORE, THERE (Brazil, Russia, India, China), in the global ARE A NUMBER OF DISQUIETING VOI- economy. CES BEING HEARD PREDICTING A However, recent forecasts published by SEVERE CORRECTION OF THE MARK- the World Bank over the next 25 years ETS OR EVEN A NEW CRISIS RECALL- lead us to believe that a collapse in the ING THE SAD DAYS OF THE 80’S. markets, following the historic increases, It is true that we are in a cyclical industry is neither a necessity nor a compulsory and that the current swelling of the passage. Certainly growth is seldom orderbooks, which equates to an average linear and we should prepare ourselves of 25 % of the existing fleet, and even for market corrections, linked to tempor- close to 50 % in some sectors, gives ary imbalances between supply and cause for concern even to the most demand, especially in the tanker and serene spirits. -

Dp Companies

DP COMPANIES Company Name Address 1 Address 2 Address 3 City Postcode County Country Bourbon Offshore Surf 148 Rue Sainte Marseille 13007 France Bourbon Offshore Greenmar SA Chemin du Canal 5 Nyon 1260 Switzerland EDT Offshore Ltd PO Box 54548 Limassol CY-3725 Cyprus Farstad Marine Ltd Farstad House Badentoy Park Portlethen, Aberdeen AB12 4YB Scotland Gulf Offshore N.S. Ltd The Exchange No.1 62-104 Market Street Aberdeen AB11 5PJ Scotland Maersk, London Maersk House Braham Street London E1 8EP England A.P. Moller-Maersk A/S T.O. Marine HR 50 Esplanaden 50 Copenhangen DK-1098 Denmark Acergy Tangen 7 Stavanger 4004 Norway Adams Offshore 5th Floor Regent Centre Regent Rd Aberdeen AB11 5NS Scotland London Design Support Services Lloyd's Register EMEA 71 Fenchurch Street London EC3M 4BS England Lloyd's Register EMEA Galleria Protti Trieste 1 I-34121 Italy CCC-Underwater Engineering PO Box 224 Abu Dhabi Musaffah UAE Private Students Seacor Worldwide Inc Columbus Buildings Waveney Road Lowestoft NR32 1BN Suffolk Maersk Training Centre UK Ltd Floor 6, Stockbridge House Gardens Quayside Newcastle-Upon-Tyne NE1 2HJ England Lauritzen Fleet Management A/S Skt. Annae Plads 28 Copehagen DK-1291 Denmark Northern Marine Management (India) Pvt Ltd 301/302, "B" Wing Delphi Orchard Avenue Hirnandani Business Park Powai 400 076 Mumbai India Halul Offshore Company PO Box 24600 Alfardan Building Grand Hamad Str. Doha Qatar Ahlers International Societe Anonyme 9b, Boulevard Prince Henri Luxemburg L1724 Luxemburg Northern Marine Manning Services Ltd Alba House 2 Central Avenue Clydebank Business Park Glasgow G81 2QR Scotland AGR Asia Pacific 342 Flinders Street Melbourne 3000 Victoria Australia Tide Water Marine Egypt No.7 Corner Roads Maadi Cairo 150/100 Egypt Tidewater Inc 601 Poydras Street Suite 1900 New Orleans 70130 Louisiana USA Ahlers International S.A. -

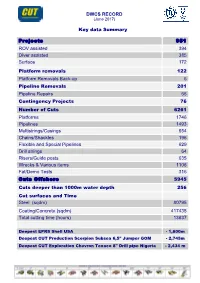

DWCS RECORD Key Data Summary Projects 951 ROV Assisted 394

DWCS RECORD (June 2017) Key data Summary Projects 951 ROV assisted 394 Diver assisted 385 Surface 172 Platform removals 122 Platform Removals Back-up 6 Pipeline Removals 201 Pipeline Repairs 66 Contingency Projects 76 Number of Cuts 6261 Platforms 1746 Pipelines 1493 Multistrings/Casings 654 Chains/Shackles 196 Flexible and Special Pipelines 629 Drill strings 64 Risers/Guide posts 635 Wrecks & Various items 1106 Fat/Demo Tests 316 Cuts Offshore 5945 Cuts deeper than 1000m water depth 256 Cut surfaces and Time Steel (sqdm) 80795 Coating/Concrete (sqdm) 417435 Total cutting time (hours) 13637 Deepest EPRS Shell USA - 1,600m Deepest CUT Production Scorpion Subsea 6,5” Jumper GOM - 2,745m Deepest CUT Exploration Chevron Texaco 8" Drill pipe Nigeria - 2,434 m DWCS RECORD (June 2017) Projects details Year Assisted Water Customer Project by Depth m Location Details 2017 Diver 80 Boskalis/Bongkot Field/MMA Prestige Cutting of 18" Spool Siemen-Ge-Tennet/Boskalis/Offshore 2017 Diver 12 Germany/Dowlin/Constructor 106" Pile and Sleeves Cutting Technip France/Offshore 2017 ROV 765 Congo/Moho Nord/Deep Pioneer 6,625" Pipelines Cutting Moho Nord Dong Energy/Briggs Marine/East Irish Sea/West of Duddon Sands/Briggs 2017 Diver 25 Worrior 12" Cable Protection Cut Dong Energy/Seaway Heavy Lifting/Racebank/Walney Offshore 2017 Diver 50-80 Wind Farm Contingency 96” OD Pile Cutting and 84” OD Piles Cutting TOTAL/Technip/Moho Nord/Lewek 2017 ROV 705 Inspector 6" Pipeline Cutting Chevron Niugini Limited/Neptune/Lagifu Ridge, Kutubu, Papua New Guinea/Crest 2017 -

Investor Presentation March 2012 Investor Relations Contacts

Investor Presentation March 2012 Investor Relations Contacts Karen Menzel [email protected] T: +44 (0) 208 210 5568 M: +44 (0) 7766 702481 www.subsea7.com Certain statements made in this announcement may include “forward-looking statements”. These statements may be identified by the use of words like “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “forecast”, “project,” “will,” “should,” “seek,” and similar expressions. These statements include, but are not limited to, statements about expectations as to the Group’s performance in 2012, including expected revenue and Adjusted EBITDA for 2012 and relevant expectations, statements as to the outlook for the Group’s industry, statements contained in the "Outlook" section. The forward-looking statements reflect our current views and assumptions and are subject to risks and uncertainties. The principal risks and uncertainties which could impact the Company and the factors affecting the bibusiness resultsareonoutline d in the “Ris k ftfactors ”section in the C’Company’s AlAnnual RtReport and Financ ia l Sta temen ts. These ftfactors, and others which are discussed in our public filings, are among those that may cause actual and future results and trends to differ materially from our forward-looking statements: actions by regulatory authorities or other third parties; unanticipated costs and difficulties related to the integration of Subsea 7 S.A. and Subsea 7 Inc. and our ability to achieve benefits therefrom; our ability to recover costs on significant projects; the general economic conditions and competition in the markets and businesses in which we operate; our relationship with significant clients; the outcome of legal and administrative proceedings or governmental enquiries; uncertainties inherent in operating internationally; the timely delivery of ships on order and the timely completion of ship conversion programmes; the impact of laws and regulations; and operating hazards, including spills and environmental damage. -

Stolt Nielsen Sa

SECURITIES AND EXCHANGE COMMISSION FORM 20-F Annual and transition report of foreign private issuers pursuant to sections 13 or 15(d) Filing Date: 2006-05-31 | Period of Report: 2005-11-30 SEC Accession No. 0001104659-06-038575 (HTML Version on secdatabase.com) FILER STOLT NIELSEN S A Mailing Address Business Address C/O STOLT NIELSEN LTD C/O STOLT NIELSEN LIMITED CIK:831980| IRS No.: 000000000 | State of Incorp.:I0 | Fiscal Year End: 1130 ALDWYCH HOUSE 71-91 ALDWYCH HOUSE 71-91 Type: 20-F | Act: 34 | File No.: 000-16977 | Film No.: 06877768 ALDWYCH ALDWYCH SIC: 4412 Deep sea foreign transportation of freight LONDON X0 00000 LONDON WC2B 4HN ENGL X0 00000 2036259400 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document As filed with the Securities and Exchange Commission on May 31, 2006 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended November 30, 2005 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 000-16977 STOLT-NIELSEN S.A. (Exact name of Registrant as specified in its charter) LUXEMBOURG (Jurisdiction of incorporation or organization) -

DOF Subsea Group Q1 2019 Highlights

Quarterly Presentation Q1 2019 DOF Subsea Group Q1 2019 highlights • The operating revenue for the quarter was NOK 1 103 million1), EBITDA was NOK 365 million1) and overall vessel utilisation was 67% As a result of the continued challenging market situation, the Group have experienced that • The joint venture with TechnipFMC took delivery of regular rollover (or refinancing) of existing loan the newbuild Skandi Olinda and the vessel facilities is very challenging. This new situation is commenced the 8-year contract with Petrobras. likely to result in the Group being in breach of its The delivery of Skandi Olinda marks the successful financial covenants in the near future and the conclusion of the JV’s and DOF Subsea Group’s Group being unable to repay (or rollover) certain of its existing loans when they fall due. The newbuild program management will commence a dialogue with the • Geoholm and Skandi Neptune have mobilised on involved parties and believes it is possible to reach agreements to solve the expected new contracts in the Red Sea and Guyana challenging situation for the Group, although no respectively assurance can be given that the Group will be • A continuing weak market has increased the successful in this respect. The effects of such breach is further described in note 6 Net interest- liquidity risk for the Group bearing debt to the quarterly accounts. • Increased refinancing and financial risk 1) Note: Figures according to management reporting DOF Subsea 2 DOF Subsea Group at a glance 2005 NOK 1.1bn1) NOK 14.7bn 1 1702) DOF -

SUBSEA Who We Are

SUBSEA Who We Are One Company – Meeting Stringent Standards Over many years Hydratight has provided, as its core business, world class bolted joint solutions and continues to set international standards in joint integrity for its customers on a global scale. In addition, Hydratight can provide innovative and unique subsea engineered solutions, including Morgrip DNV approved mechanical couplings and HydraQuick Release System. Both are field- proven in deepwater applications. Hydratight works in partnership with the world’s leading OEMs using the latest computer technology and market leading development facilities. We continue to push back the boundaries of technology to provide fast, accurate and reliable solutions to critical assembly problems. Our people are the key to our success: qualified, competent and innovative – working closely with our customers ensures a total understanding of their requirements. One Company – Meets Standards Totally committed to safety and quality, all Hydratight products and services are designed, manufactured and carried out within a management system in accordance with ISO 9001:2008 (quality management); ISO 14001:2004 (environmental management); OHSAS 18001:2007 (occupational health and safety) Our extensive engineering services include: • DNV approved Morgrip technology • HydraQuick Release System • Unique engineered solutions • Torque and tension bolting equipment • Portable machining equipment • Product sales, rental and technical support • Product service and training LRQ 0912064 LRQ 4003099 659747 2 What Makes Us Different One Company – A Multitude of Solutions Hydratight plays a leading role within the complex and changing world of subsea, providing innovative and unique services to improve cost effectiveness in this competitive industry. MORGRIP® Morgip is a range of weldless mechanical couplings, which provide high-integrity connections for all types of metal pipe work. -

DOF Subsea ASA Company Structure

CAPITAL MARKET DAY DOF Subsea ASA CEO Mons S. Aase October 19th 2007 Agenda 1. Overview of DOF Subsea ASA 2. Highlights 1st half year 2007 1 DOF Subsea ASA Company Structure DOF Subsea ASA DOF Subsea DOF Subsea Dof subsea Shipowning DOF Subsea Century UK AKOFS (25%) Brasil UK Norway AS Companies Singapore RESCOM - DOF Subsea CSL DOF (50%) Asia/Pacific Century Century US DOF Subsea CAN DOF Subsea Angola Australia Company history Geoconsult AS founded 1979 Established 50/50 Joint Venture in Brunei DOF ASA acquired Geoconsult AS in May August 2006 2005 and Acquired 50% of engineering company established Geo ASA SEMAR AS in Private placement of shares of NOK 715 mill January 2007 in June 2005 Offered to acquire all outstanding shares in Listed on Oslo Stock Exchange in November DOFCON ASA 2005 January 2007 Acquired Century Subsea Ltd in November Acquisition of Skandi Achiever February 2005 2007 Established Geo Subsea in November 2005 Establishment of Aker Oilfield Services Directed share issue of NOK 276,5 mill in March 2007 January 2006 Name change to DOF Subsea ASA March Acquired Covus Corp. in February 2006 2007 (merged with Geo Subsea) Acquisition of CSL Set up Geo do Brazil in May 2006 Merger of Management company with DOF Management AS 2 DOF Subsea Group Assets DOF Subsea Group Assets 2007 Total DOF Subsea Vessels Geofjord, Geosea, Geobay, Geosund, Geoholm, Geosounder, Geo Challenger, Skandi Bergen, Geo Brasil (Aker ROV06) , Geograph, Skandi Inspector,Skandi 16 Carla, Skandi Patagonia, Skandi Singapore DSV06 (FMV - Geo Subsea), Skandi Achiever (DSV06), Geocat (nearshore) DOFCON Vessels Aker OSCV 03 (1), Aker OSCV 03 (2), Aker OSCV 06 (1), Aker OSCV 06 (2), Aker OSCV 06L (1), Aker OSCV 06L (2), Aker OSCV06L (3), 7 Total number of vessels 23 ROVs XL14 - XL37- T12, UHD 1,2, 3, 4 - XLS 11,12, 16, 18, 23, 31, 32 - XLX 5, 6, 7, 8 - MRV4 - Scorpion - T1 Tiger Comanche - Mohican x 2 25 AUV 1 Diving Spreads Air diving 9 Saturation diving 2 Markets DOF and DOF Subsea Offices Geographical Focus Areas 3 Newbuilding fleet Design: Aker ROV 06 LOA 106m No. -

The DOF Fleet Booklet

The Fleet Asset overview DOF is your innovative partner in offshore solutions. Content All specifications are subject to changes without prior notice. Please contact DOF for details and verifications. Subsea 4 AHTS 33 Geoholm 5 Skandi Amazonas 34 Geosea 6 Skandi Angra 35 Geosund 7 Skandi Atlantic 36 Skandi Acergy 8 Skandi Botafogo 37 Skandi Achiever 9 Skandi Emerald 38 Skandi Açu 10 Skandi Fluminense 39 Skandi Africa 11 Skandi Hera 40 Skandi Buzios 12 Skandi Iceman 41 Skandi Carla 13 Skandi Iguaçu 42 Skandi Chieftain 14 Skandi Ipanema 43 Skandi Commander 15 Skandi Paraty 44 Skandi Constructor 16 Skandi Peregrino 45 Skandi Darwin 17 Skandi Rio 46 Skandi Hawk 18 Skandi Urca 47 Skandi Hercules 19 Skandi Vega 48 Skandi Hugen 20 Skandi Neptune 21 PSV 49 Skandi Niteroi 22 Skandi Aukra 50 Skandi Olinda 23 Skandi Barra 51 Skandi Olympia 24 Skandi Caledonia 52 Skandi Patagonia 25 Skandi Captain 53 Skandi Recife 26 Skandi Feistein 54 Skandi Salvador 27 Skandi Flora 55 Skandi Seven 28 Skandi Foula 56 Skandi Singapore 29 Skandi Gamma 57 Skandi Skansen 30 Skandi Kvitsøy 58 Skandi Vinland 31 Skandi Marøy 59 Skandi Vitoria 32 Skandi Mongstad 60 Skandi Nova 61 Skandi Rona 62 Skandi Sotra 63 Content page DOF ASA is a world leading provider of essential offshore and subsea services to the global offshore industry, and has vessels operating in all major oil and gas regions. We operate within three different business segments in relation to strategic types of activities and vessel types: Subsea vessels (Subsea), Anchor Handling Tug Supply vessels (AHTS) and Platform Supply Vessels (PSV).