A Fearless Advocate for His Clients, Steven Acts in Highstakes, Complex

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Annual Report Built Drive to Growth

BUILT TO DRIVE GROWTH 2018 ANNUAL REPORT BUILT TO DRIVE BUILT GROWTH CP 2018 ANNUAL REPORT PERFORMANCE HIGHLIGHTS $ in millions, except per share data, ratios or unless otherwise indicated 2014 2015 2016 2017 2018 EXCHANGELISTINGS FINANCIAL HIGHLIGHTS Total revenues $ 6,620 $ 6,712 $ 6,232 $ 6,554 $ 7,316 The common shares of Canadian Pacific Railway Limited are (1) Operating income 2,202 2,618 2,411 2,519 2,831 listed on the Toronto and New York stock exchanges under Adjustedoperatingincome(1)(2) 2,198 2,550 2,411 2,468 2,831 the symbol CP. Operating ratio (1) 66.7% 61.0% 61.3% 61.6% 61.3% Adjusted operating ratio (1)(2) 66.7% 62.0% 61.3% 62.4% 61.3% Net income 1,476 1,352 1,599 2,405 1,951 Adjusted income (2) 1,482 1,625 1,549 1,666 2,080 CONTACTUS Diluted earnings per share (EPS) 8.46 8.40 10.63 16.44 13.61 Investor Relations AdjusteddilutedEPS(2) 8.50 10.10 10.29 11.39 14.51 Email: [email protected] Cash from operations 2,123 2,459 2,089 2,182 2,712 Free cash (2) 969 1,381 1,007 874 1,289 Canadian Pacific Investor Relations Return on invested capital (ROIC) (2) 14.4% 12.9% 14.4% 20.5% 15.3% 7550 Ogden Dale Road S.E. Adjusted ROIC (2) 14.5% 15.2% 14.0% 14.7% 16.2% Calgary, AB, Canada T2C 4X9 Shareholder Services STATISTICAL HIGHLIGHTS(3) Email: [email protected] Revenue ton-miles (RTMs) (millions) 149,849 145,257 135,952 142,540 154,207 Canadian Pacific Shareholder Services Carloads (thousands) 2,684 2,628 2,525 2,634 2,740 Office of the Corporate Secretary Gross ton-miles (GTMs) (millions) 272,862 263,344 242,694 252,195 275,362 7550 Ogden Dale Road S.E. -

Market Index Uniflex 10%

Investment and retirement 5% 10% Market Index Uniflex 10% 25% Main Product Features 25% 6-year term (not redeemable before maturity) Guarantee of principal on maturity of 100% Low management fees of 1% per year 10% 15% $500 minimum deposit An easy way to diversify Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Even under a scenario where the return of each share is negative, this product may produce a global positive return Sector diversification of the Market Index Uniflex How it works On the settlement date, a starting level will be determined for each Canadian share included in the portfolio. On the maturity date, a ratio of the closing level over the starting level for each share will be computed. The 8 best performing shares during the 6-year term will be automatically assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) Exposure to 20 Canadian companies included in the S&P/TSX 60 Index Company Sector Company Sector Metro Inc. Scotiabank Consumer staples Loblaw Companies Limited The Toronto-Dominion Bank Royal Bank of Canada Financial services Bank of Montreal Enbridge Inc. Sun Life Financial Inc. TransCanada Corporation Cenovus Energy Inc. Energy Canadian Natural Resources Limited Canadian National Railway Industrials Suncor Energy Inc. -

Saskatchewan's Mining Supply Chain

Saskatchewan Mining Supply Chain First in Canada and top ten in the world for mining investment the past six of seven years. Fraser Institute, Survey of Mining Companies 2019 Our Mining Industry Saskatchewan mineral sales totalled $7.9 billion in In addition, the province has deposits of copper, zinc, 2019. Natural Resources Canada (NRCan) estimates that nickel, rare earth minerals and platinum group metals Saskatchewan accounted for 14% of national sales value, third as well as various industrial minerals including sodium highest in Canada. sulphate and salt. The province is the largest potash producer in the world, Major Mining Companies Operating in Saskatchewan accounting for approximately one-third of total production • Nutrien in 2019, and hosting over half of the globe’s potash reserves. • Mosaic Company Saskatchewan is also one of the world’s largest producers of uranium, with the Athabasca Basin containing the largest • BHP Billiton Canada Inc. high-grade uranium deposits in the world. • K+S Potash Canada Saskatchewan is Canada’s third-largest producer of coal, • ORANO Canada producing an average of 10 million tonnes per year. • Cameco The province is also home to one of the world’s largest fields • Vale Limited of diamond-bearing kimberlite. This discovery has led to • Rio Tinto extensive exploration and evaluation. • Acron Saskatchewan has large underexplored areas with high gold potential. The Seabee Operation produced 112,137 ounces • Yancoal of gold in 2019, a record annual production up 17% for the previous year. saskatchewan.ca/invest -

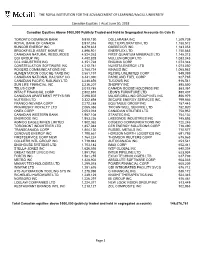

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2018 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) TORONTO DOMINION BANK 9,910,190 DOLLARAMA INC 1,209,739 ROYAL BANK OF CANADA 8,917,316 KELT EXPLORATION LTD 1,188,512 SUNCOR ENERGY INC 6,879,833 QUEBECOR INC 1,183,053 BROOKFIELD ASSET MGMT INC 4,896,921 ENERFLEX LTD 1,150,883 CANADIAN NATURAL RESOURCES 4,524,263 FIRST QUANTUM MINERALS LTD 1,145,213 CGI GROUP INC 4,482,828 MULLEN GROUP LTD 1,083,045 CCL INDUSTRIES INC 4,351,728 ENCANA CORP 1,073,348 CONSTELLATION SOFTWARE INC 4,212,781 NUVISTA ENERGY LTD 1,073,050 ROGERS COMMUNICATIONS INC 3,788,734 KINAXIS INC 1,065,983 ALIMENTATION COUCHE-TARD INC 3,581,197 RECIPE UNLIMITED CORP 949,389 CANADIAN NATIONAL RAILWAY CO 3,441,390 PARKLAND FUEL CORP 927,785 CANADIAN PACIFIC RAILWAY LTD 3,240,856 TUCOWS INC 916,541 SUN LIFE FINANCIAL INC 3,236,207 SHOPIFY INC 895,850 TELUS CORP 3,013,785 CANADA GOOSE HOLDINGS INC 883,361 INTACT FINANCIAL CORP 2,802,815 LEON'S FURNITURE LTD 880,407 CANADIAN APARTMENT PPTYS REI 2,498,502 MAJOR DRILLING GROUP INTL INC 856,979 NUTRIEN LTD 2,322,898 SECURE ENERGY SERVICES INC 799,566 FRANCO-NEVADA CORP 2,272,288 EQUITABLE GROUP INC 787,443 PRAIRIESKY ROYALTY LTD 2,065,386 TRICAN WELL SERVICE LTD 782,920 ONEX CORP 2,053,018 CANADIAN UTILITIES LTD 758,952 CANADIAN WESTERN BANK 1,987,108 STANTEC INC 754,132 ENBRIDGE INC 1,953,226 LASSONDE INDUSTRIES INC 745,893 AGNICO EAGLE MINES LIMITED 1,902,362 COGECO COMMUNICATIONS -

Mine 2019 Resourcing the Future

Mine 2019 Resourcing the future www.pwc.com/mine Shifting expectations Welcome to our annual review of futures markets, not present markets. And Copper and battery metals, which stand to global trends in the mining industry, when investors and other stakeholders gain as the energy mix moves away from as represented by the Top 40 mining look at the future of the mining industry, combustion engines to electricity including companies by market capitalisation. it is clear they have concerns about the renewable energy, are receiving the bulk industry’s perception on vital issues such of capital investment. (However, as coal Judged by traditional metrics, things are as safety, the environment, technology and contributes 38% to global electricity looking good for the world’s top miners. consumer engagement. generation, it remains an important part In 2018, the world’s 40 largest miners of the basket and continues to receive consolidated the stellar performance In spite of the strong operating substantial capital investment and of 2017. As a group, they increased performance, both investors and transaction focus.) production, boosted cash fl ow, paid down consumers seem to be down on the brand debt, and provided returns to shareholders of mining. They question whether the Mining companies are also streamlining at near record highs. And there was still industry can responsibly create sustainable their operating portfolio by disposing of cash left to increase capital expenditure value for all stakeholders. Discrete events, non-core assets and optimising project for the fi rst time in fi ve years. All while such as safety or environmental incidents, portfolios in line with long-term strategies. -

Supplemental Filing #1

Schedule 1 Notification Correspondence to Adjacent Landowners: Ms. Sandra Mitchell (on behalf of the estate of Raymond Machmeyer) Mr. Carl Young 7550 Ogden Dale Road SE Calgary Alberta Canada T2C 4X9 www.cpr.ca December 5th, 2018 Sandra Mitchell 120 Armitage Close Red Deer, AB T4R 2K6 Executrix for Raymond Machmeyer In reference to: CP project adjacent to lands legally described as NE-6-56-21 W4 __________________________________________________________________________________________ Dear Sandra, As part our part our due process, Canadian Pacific Railway would like to advise you of a project adjacent to lands you are listed on title for legally described as - NE-6-56-21 W4. Enclosed you will find an information page describing the intended project for your review. If you have any questions or concerns, please free to contact me by phone at 403-319-3436 or email at [email protected] Yours truly, Frank Gulas Specialist Real Estate Prairies CP Scotford Sub Extension Project Fall 2018/Winter 2019 Project Summary Canadian Pacific (CP) is proposing to extend its existing track in The proposed extension of approximately 4 km of new track will Alberta’s Industrial Heartland to private track at Interpipeline’s occur within CP wholly -owned right-of-way on the west side of new Heartland Petrochemical Complex which is currently under Range Road 220. No additional lands are required for construction construction. The extension would provide Interpipeline with or operation of the proposed railway infrastructure. Construction is additional options to connect their new plant to national and anticipated in mid-2019 with operations commencing in late-2020. -

UNIFLEX OPERATION on the Settlement Date, a Starting Level Will Be Determined for SECTOR DIVERSIFICATION of the Each Canadian Share Included in the Portfolio

CANADIAN MARKET INDEX UNIFLEX OPERATION On the settlement date, a starting level will be determined for SECTOR DIVERSIFICATION OF THE each Canadian share included in the portfolio. CANADIAN MARKET INDEX UNIFLEX On the maturity date, a ratio of the closing level over the starting level for each share will be computed. 5% 10% The 8 best performing shares during the 6-year term will be automatically 10% assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. 25% 25% The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) 10% 15% MAIN PRODUCT FEATURES 6-year term (not redeemable before maturity) An easy way to diversify Guarantee of principal on maturity of 100% Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Low management fees of 1% per year Even under a scenario where the return of each share is $500 minimum deposit negative, this product may produce a global positive return EXPOSURE TO 20 CANADIAN COMPANIES INCLUDED IN THE S&P/TSX 60 INDEX COMPANY COMPANY PROFILE SECTOR Metro Inc. Operates as a food distributor Loblaw Companies Limited Operates as a food distributor Consumer staples Enbridge Inc. Produces crude oil and natural gas TransCanada Corporation Transports and markets natural gas Husky Energy Inc. Explores for, produces and markets crude oil and natural gas Energy Encana Corporation Produces crude oil Suncor Energy Inc. -

Cameco 2021 Management Proxy Circular

What’s inside Message from the Chair of the Board and the CEO 1 ESG Content map 4 Notice of our 2021 annual meeting of shareholders 5 Management proxy circular 6 Business of the meeting 7 • Delivery of meeting materials 9 • Voting 9 About the nominated directors 17 • Director profiles • 2020 Meetings and attendance • Director compensation and share ownership Our board 32 • Board structure, composition and succession • Skills, attributes and experience • Board diversity • Board, committee and director assessments • Director development Our corporate governance 41 Key elements of our corporate governance 41 How the board operates 41 • Role of the board • Executive succession planning and leadership development • Internal controls Our expectations of directors 47 • Code of conduct and ethics • Serving on other boards • Board interlocks • Change in position Board independence standards 50 Stakeholder engagement 50 • Disclosure • Engagement with the investment community • Say on pay • How to engage with the board Voting results 53 Shareholder proposals 53 Advance notice by-law 53 Accessing our governance and other regulatory disclosure 53 Compliance 54 Governance guidelines 54 Board committees 55 • Committee responsibilities What’s inside • Committee membership • Committee chair rotation • Cross-committee attendance • Access to management and outside advisors • Committee reports Message from the Chair of Human Resources and 62 Compensation Committee Compensation discussion and analysis 65 Our 2020 named executive officers 66 Compensation governance -

AI Powered International Equity ETF Schedule of Investments August 31, 2020 (Unaudited)

AI Powered International Equity ETF Schedule of Investments August 31, 2020 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.4% Argentina - 1.1% 360 Globant SA (a) $ 63,929 Australia - 3.3% 512 Atlassian Corporation plc - Class A (a) 98,182 700 Australia & New Zealand Banking Group, Ltd. - ADR 9,463 3,684 Mesoblast, Ltd. - ADR (a) 71,323 1,568 National Australia Bank, Ltd. - ADR 10,396 189,364 Belgium - 1.5% 233 Galapagos NV - ADR (a) 31,026 1,375 Materialise NV - ADR (a) 55,908 86,934 Canada - 38.0% 7,200 Alexco Resource Corporation (a) 22,248 1,089 Algonquin Power & Utilities Corporation 15,061 914 Aurinia Pharmaceuticals, Inc. (a) 13,555 12,605 Auryn Resources, Inc. (a) 24,580 1,140 B2Gold Corporation 7,684 2,052 Ballard Power Systems, Inc. (a) 34,063 1,650 Barrick Gold Corporation 48,923 132 BCE, Inc. 5,677 4,774 BlackBerry, Ltd. (a) 24,920 748 Brookfield Asset Management, Inc. - Class A 25,238 1,049 CAE, Inc. (a) 16,585 376 Canada Goose Holdings, Inc. (a) 9,208 462 Canadian National Railway Company 48,316 1,963 Canadian Natural Resources, Ltd. 38,612 146 Canadian Pacific Railway, Ltd. 43,169 1,491 Canadian Solar, Inc. (a) 48,443 1,635 Canopy Growth Corporation (a) 26,963 840 Canopy Growth Corporation (a) 13,877 2,220 Cascades, Inc. 23,607 2,744 Celestica, Inc. (a) 21,815 11 Constellation Software, Inc. 12,734 1,064 Descartes Systems Group, Inc. (a) 64,851 2,039 Dollarama, Inc. 79,600 1,597 Eldorado Gold Corporation (a) 18,238 13,136 EMX Royalty Corporation (a) 38,357 17,174 Enerplus Corporation 45,511 1,337 Fortis, Inc. -

Putnam Dynamic Asset Allocation Growth Fund the Fund's Portfolio 12/31/20 (Unaudited)

Putnam Dynamic Asset Allocation Growth Fund The fund's portfolio 12/31/20 (Unaudited) COMMON STOCKS (70.1%)(a) Shares Value Basic materials (3.0%) Akzo Nobel NV (Netherlands) 23,248 $2,497,284 Albemarle Corp. 29,230 4,312,010 Anglo American PLC (United Kingdom) 159,528 5,313,448 AptarGroup, Inc. 10,100 1,382,589 Ashland Global Holdings, Inc. 11,200 887,040 Asian Paints, Ltd. (India) 40,804 1,547,129 Axalta Coating Systems, Ltd.(NON) 45,800 1,307,590 BHP Billiton, Ltd. (Australia) 138,357 4,507,518 BHP Group PLC (United Kingdom) 50,941 1,342,490 Brenntag AG (Germany) 31,177 2,412,754 Celanese Corp. 7,400 961,556 Chemours Co. (The) 28,800 713,952 Compagnie De Saint-Gobain (France)(NON) 98,509 4,516,939 Covestro AG (Germany) 35,237 2,173,514 CRH PLC (Ireland) 189,981 8,030,907 Dow, Inc. 83,016 4,607,388 DuPont de Nemours, Inc. 40,327 2,867,653 Eastman Chemical Co. 24,400 2,446,832 Eiffage SA (France)(NON) 10,365 1,001,919 Fortescue Metals Group, Ltd. (Australia) 105,444 1,906,463 Fortune Brands Home & Security, Inc. 28,319 2,427,505 Freeport-McMoRan, Inc. (Indonesia) 269,290 7,006,926 ICL Group, Ltd. (Israel) 109,965 561,260 Koninklijke DSM NV (Netherlands) 15,524 2,674,257 LafargeHolcim, Ltd. (Switzerland) 33,896 1,860,118 LG Chemical, Ltd. (South Korea) 3,538 2,693,163 Linde PLC 6,200 1,610,164 NewMarket Corp. 1,200 477,948 Nitto Denko Corp. -

The Miatello Quarterly January 2020

The Miatello Quarterly January 2020 @ Let's co nn ect The Way Ahead (same as the way behind) Miatello Investment Management It is normal at New Year to reflect on the past and consider the future. BMO Nesbitt Burns Brian Miatello, CFA The past year, and indeed the last decade, provided numerous Portfolio Manager economic and geopolitical shocks that threatened to derail the world’s 1 First Canadian Place, economies. There were wars, real and economic; massive political 39th Floor upheavals; income/wealth inequality; countries near bankruptcy; Toronto, Ontario populism ascendant; autocrats elected or more entrenched; and M5X 1H3 monetary policy worldwide in unchartered territory. Tel: 416-359-5793 [email protected] Many thought at various points that the conditions are too dire, that www.miatello.ca catastrophe awaits. The market just doesn’t realize that there is a crash coming. I heard it on the news. SELL! You would have to be an idiot to invest now. Yet, our job is not to fret about the world’s problems, but to invest in the face of the storming seas. That is what we did and we delivered outstanding returns for our clients over the decade. We are comforted that a recent gathering at the University of Chicago of 40 top US academic economists provided no consensus on 2020 economic conditions. This is hardly surprising as my own crystal ball on future macroeconomic conditions has been consistently cloudy for the last decade. If you can’t come to a consensus on the macro, that should be evidence there is little informational content as to investment direction coming from economists. -

Holdings Report

AI Powered International Equity ETF Schedule of Investments February 29, 2020 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.7% Australia - 1.4% 253 Atlassian Corporation plc (a) $ 36,675 477 Australia & New Zealand Banking Group, Ltd. - ADR 7,642 1,749 Mesoblast, Ltd. - ADR (a) 12,400 1,574 National Australia Bank, Ltd. - ADR 12,781 69,498 Belgium - 0.8% 193 Galapagos NV - ADR (a) 40,792 Canada - 31.3% (b) 2,230 Algonquin Power & Utilities Corporation 33,272 2,287 Aurora Cannabis, Inc. (a) 3,065 9,434 Auryn Resources, Inc. (a) 11,415 2,640 B2Gold Corporation 10,534 3,135 Ballard Power Systems, Inc. (a) 27,902 438 BCE, Inc. 19,417 1,273 Brookfield Asset Management, Inc. - Class A 76,329 435 BRP, Inc. 17,818 1,605 CAE, Inc. 43,030 343 Canadian National Railway Company 29,124 1,329 Canadian Natural Resources Ltd. 34,288 86 Canadian Pacific Railway, Ltd. 21,394 1,640 Canadian Solar, Inc. (a) 33,456 1,591 Canopy Growth Corporation (a) 29,879 1,710 Cascades, Inc. 13,899 3,856 Celestica, Inc. (a) 24,370 25 Constellation Software, Inc. 25,469 1,882 Cronos Group, Inc. (a) 11,009 994 Descartes Systems Group, Inc. (a) 41,072 1,383 Eldorado Gold Corporation (a) 12,018 2,691 Enerplus Corporation 11,679 838 Fortis, Inc. 33,906 1,900 Gildan Activewear, Inc. 46,018 15,956 Hudbay Minerals, Inc. 39,092 5,196 IAMGOLD Corporation (a) 14,757 2,146 Kirkland Lake Gold, Ltd. 68,843 3,888 MAG Silver Corporation (a) 32,698 1,068 Northland Power, Inc.