Mumbai Residential Marketbeat Q3 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bandra Kurla Complex Routes (Air Conditioned)

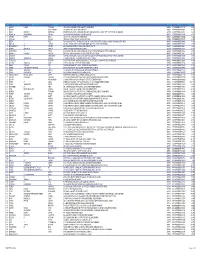

Bandra Kurla Complex Routes (Air Conditioned) SR Route From Trip Times To Trip Times NO No. ITINERARY DHARAVI DEPOT to 6.35 6.50 BORIVALI STN (E) to BKC 7.30 7.45 BKC-DIAMOND MRKT-MMRDA-KALANAGAR-VAKOLA-HANUMAN BORIVALI STN (E) 7.05 7.20 8.00 8.15 ROAD-GUNDHAVLI-GOREGAON -PUSPA PARK-MAGATHANE- 7.35 8.30 BORIVALI STN (E) 1 BKC-10 BKC to BORIVALI STN(E) 18.00 18.15 BORIVALI STN (E) to DHARAVI 19.40 19.55 18.30 18.45 DEPOT 20.10 20.25 19.00 20.40 DHARAVI DEPOT to 6.25 6.35 HIRANANDANI ( THANE) to 7.30 7.45 MMRDA-BHARAT NAGAR-DIAMoND MRKT-GODREJ CO.-BHANDUP BKC-11 HIRANANDANI ( THANE) 6.50 7.00 B.K.C 8.00 8.15 PUMPING CENTER-LOUIS WADI-MAJIWADA-MANPADA-PATLI PADA 2 B.K.C to HIRANANDANI 18.00 18.20 HIRANANDANI ( THANE) to 19.40 20.00 HIRANANDANI ESTATE (THANE) 18.40 19.00 DHARAVI DEPOT 20.20 20.40 DHARAVI DEPOT to 6.25 6.40 JALVAYU VIHAR,KHARGHAR 7.30 7.45 MMRDA-BHARAT NAGAR-Diamond MRKT-CHHEDA NAGAR-TURBHE BKC-12 JALVAYU VIHAR,KHARGHAR 6.50 7.00 TO B.K.C 8.00 8.15 POLICE STN-URAN PHATA-SHILP CHK-JALVAYU VIHAR 3 B.K.C to JAL VAYU VIHAR, 18.00 18.20 JALVAYU VIHAR,KHARGHAR 19.40 20.00 KHARGHAR 18.40 19.00 to DHARAVI DEPOT 20.20 20.40 DHARAVI DEPOT to 6.25 6.35 M.P.CHOWK,MULUND to 7.30 7.45 BKC- INCOME TAX OFFICE-BHARAT NAGAR-Diamond MRKT- BKC-13 M.P.CHOWK,MULUND 6.50 7.00 B.K.C 8.00 8.15 KURLA DEPOT-SARVODAYA HOSP.-GANDHI NAGAR-BHANDUP STN(W)- 4 B.K.C to M.P.CHOWK,MULUND 18.00 18.20 M.P.CHOWK,MULUND to 19.40 20.00 M.P.CHOWK(MULUND) 18.40 19.00 DHARAVI DEPOT 20.20 20.40 SR Route First Last First Last From To Frequency NO No. -

Mumbai Residential June 2019 Marketbeats

MUMBAI RESIDENTIAL JUNE 2019 MARKETBEATS 2.5% 62% 27% GROWTH IN UNIT SHARE OF MID SHARE OF THANE SUB_MARKET L A U N C H E S (Q- o - Q) SEGMENT IN Q2 2019 IN LAUNCHES (Q2 2019) HIGHLIGHTS RENTAL VALUES AS OF Q2 2019* Average Quoted Rent QoQ YoY Short term Submarket New launches see marginal increase (INR/Month) Change (%) Change (%) outlook New unit launches have now grown for the third consecutive quarter, with 15,994 units High-end segment launched in Q2 2019, marking a 2.5% q-o-q increase. Thane and the Extended Eastern South 60,000 – 700,000 0% 0% South Central 60,000 - 550,000 0% 0% and Western Suburbs submarkets were the biggest contributors, accounting for around Eastern 25,000 – 400,000 0% 0% Suburbs 58% share in the overall launches. Eastern Suburbs also accounted for a notable 17% Western 50,000 – 800,000 0% 0% share of total quarterly launches. Prominent developers active during the quarter with new Suburbs-Prime Mid segment project launches included Poddar Housing, Kalpataru Group, Siddha Group and Runwal Eastern 18,000 – 70,000 0% 0% Suburbs Developers. Going forward, we expect the suburban and peripheral locations to account for Western 20,000 – 80,000 0% 0% a major share of new launch activity in the near future. Suburbs Thane 14,000 – 28,000 0% 0% Mid segment dominates new launches Navi Mumbai 10,000 – 50,000 0% 0% The mid segment continues to be the focus with a 62% share of the total unit launches during the quarter; translating to a q-o-q rise of 15% in absolute terms. -

Physico-Chemical Assessment of Waldhuni River Ulhasnagar (Thane, India): a Case Study D.S

ISSN: 2347-3215 Volume 3 Number 4 (April-2015) pp. 234-248 www.ijcrar.com Physico-chemical assessment of Waldhuni River Ulhasnagar (Thane, India): A case study D.S. Pardeshi and ShardaVaidya* SMT. C H M College Ulhasnagar (Thane), India *Corresponding author KEYWORDS A B S T R A C T Physico-chemical The contamination of rivers,streams, lakes and underground water by assessment, chemical substances which are harmful to living beings is regarded as water water body, pollution.The physico-chemical parameters of the water body are affected by Temperature, its pollution. The changes in these parameters indicate the quality of water. pH, Dissolved Hence such parameters of WaldhuniRiver were studied and analyzed for a Oxygen (DO), period of two years during May2010to April2012. The analysis was done for Biological Oxygen the parameters such as Temperature, pH, Dissolved Oxygen (DO), Biological Demand (BOD), Oxygen Demand (BOD), Chemical Oxygen Demand (COD), Carbon dioxide, Chemical Oxygen Total Hardness, Calcium, Magnesium, T S, TDS, &TSS. The results are Demand (COD) indicated in the present paper. Introduction The Waldhuni River is a small River requirement of water is increased. Good originating at Kakola hills, Kakola Lake quality of water with high Dissolved near Ambernath and unites with Ulhas River oxygen, low BOD and COD, minimum salts near Kalyan. Its total length is 31.8km. The dissolved in it is required for living beings. river is so much polluted that it is now The quality of water is dependent on referred to as Waldhuni Nallah. It flows physical, chemical and biological through thickly populated area of parameters (Jena et al, 2013).Rapid release Ambernath, Ulhasnagar and Vithalwadi and of municipal and industrial sewage severely is severely polluted due to domestic and decreases aquatic environment. -

165 Bus Time Schedule & Line Route

165 bus time schedule & line map 165 Dharavi Depot - Kasturba Gandhi Chowk [C.P.Tank] View In Website Mode The 165 bus line (Dharavi Depot - Kasturba Gandhi Chowk [C.P.Tank]) has 2 routes. For regular weekdays, their operation hours are: (1) Dharavi Depot: 12:00 AM - 11:40 PM (2) Kasturba Gandhi Chowk (C.P.Tank): 4:20 AM - 11:40 PM Use the Moovit App to ƒnd the closest 165 bus station near you and ƒnd out when is the next 165 bus arriving. Direction: Dharavi Depot 165 bus Time Schedule 51 stops Dharavi Depot Route Timetable: VIEW LINE SCHEDULE Sunday 12:00 AM - 11:40 PM Monday 12:00 AM - 11:40 PM Kasturba Gandhi Chowk (C.P.Tank) / कतुरबा गांधी चौक (सी.पी.टॅंक) Tuesday 12:00 AM - 11:40 PM Gulal Wadi / Yadnik Chowk Wednesday 12:00 AM - 11:40 PM Brig Usman Marg (Erskine Road), Mumbai Thursday 12:00 AM - 11:40 PM Alankar Cinema Friday 12:00 AM - 11:40 PM Dr M G Mahimtura Marg (Northbrook Street), Mumbai Saturday 12:00 AM - 11:40 PM Khambata Lane / Alankar Cinema Khambata Lane 254/264 Patthe Bapurao Marg (Falkland Road), Mumbai 165 bus Info Anjuman College Direction: Dharavi Depot Stops: 51 Two Tanks Trip Duration: 42 min Line Summary: Kasturba Gandhi Chowk (C.P.Tank) / Hasrat Mohani Chowk कतुरबा गांधी चौक (सी.पी.टॅंक), Gulal Wadi / Yadnik Maulana Azad Road (Duncan Road), Mumbai Chowk, Alankar Cinema, Khambata Lane / Alankar Cinema, Khambata Lane, Anjuman College, Two Madanpura Tanks, Hasrat Mohani Chowk, Madanpura, Salvation Army Nagpada, New Agripada, Hindustan Mill, Sant Salvation Army Nagpada Gadge Maharaj Chowk, Mahalaxmi Railway Station, -

Dharavi, Mumbai: a Special Slum?

The Newsletter | No.73 | Spring 2016 22 | The Review Dharavi, Mumbai: a special slum? Dharavi, a slum area in Mumbai started as a fishermen’s settlement at the then outskirts of Bombay (now Mumbai) and expanded gradually, especially as a tannery and leather processing centre of the city. Now it is said to count 800,000 inhabitants, or perhaps even a million, and has become encircled by the expanding metropolis. It is the biggest slum in the city and perhaps the largest in India and even in Asia. Moreover, Dharavi has been discovered, so to say, as a vote- bank, as a location of novels, as a tourist destination, as a crime-site with Bollywood mafiosi skilfully jumping from one rooftop to the other, till the ill-famous Slumdog Millionaire movie, and as a planned massive redevelopment project. It has been given a cult status, and paraphrasing the proud former Latin-like device of Bombay’s coat of arms “Urbs Prima in Indis”, Dharavi could be endowed with the words “Slum Primus in Indis”. Doubtful and even treacherous, however, are these words, as the slum forms primarily the largest concentration of poverty, lack of basic human rights, a symbol of negligence and a failing state, and inequality (to say the least) in Mumbai, India, Asia ... After all, three hundred thousand inhabitants live, for better or for worse, on one square km of Dharavi! Hans Schenk Reviewed publication: on other categories of the population, in terms of work, caste, the plans to the doldrums.1 Under these conditions a new Saglio-Yatzimirsky, M.C. -

Section 124- Unpaid and Unclaimed Dividend

Sr No First Name Middle Name Last Name Address Pincode Folio Amount 1 ASHOK KUMAR GOLCHHA 305 ASHOKA CHAMBERS ADARSHNAGAR HYDERABAD 500063 0000000000B9A0011390 36.00 2 ADAMALI ABDULLABHOY 20, SUKEAS LANE, 3RD FLOOR, KOLKATA 700001 0000000000B9A0050954 150.00 3 AMAR MANOHAR MOTIWALA DR MOTIWALA'S CLINIC, SUNDARAM BUILDING VIKRAM SARABHAI MARG, OPP POLYTECHNIC AHMEDABAD 380015 0000000000B9A0102113 12.00 4 AMRATLAL BHAGWANDAS GANDHI 14 GULABPARK NEAR BASANT CINEMA CHEMBUR 400074 0000000000B9A0102806 30.00 5 ARVIND KUMAR DESAI H NO 2-1-563/2 NALLAKUNTA HYDERABAD 500044 0000000000B9A0106500 30.00 6 BIBISHAB S PATHAN 1005 DENA TOWER OPP ADUJAN PATIYA SURAT 395009 0000000000B9B0007570 144.00 7 BEENA DAVE 703 KRISHNA APT NEXT TO POISAR DEPOT OPP OUR LADY REMEDY SCHOOL S V ROAD, KANDIVILI (W) MUMBAI 400067 0000000000B9B0009430 30.00 8 BABULAL S LADHANI 9 ABDUL REHMAN STREET 3RD FLOOR ROOM NO 62 YUSUF BUILDING MUMBAI 400003 0000000000B9B0100587 30.00 9 BHAGWANDAS Z BAPHNA MAIN ROAD DAHANU DIST THANA W RLY MAHARASHTRA 401601 0000000000B9B0102431 48.00 10 BHARAT MOHANLAL VADALIA MAHADEVIA ROAD MANAVADAR GUJARAT 362630 0000000000B9B0103101 60.00 11 BHARATBHAI R PATEL 45 KRISHNA PARK SOC JASODA NAGAR RD NR GAUR NO KUVO PO GIDC VATVA AHMEDABAD 382445 0000000000B9B0103233 48.00 12 BHARATI PRAKASH HINDUJA 505 A NEEL KANTH 98 MARINE DRIVE P O BOX NO 2397 MUMBAI 400002 0000000000B9B0103411 60.00 13 BHASKAR SUBRAMANY FLAT NO 7 3RD FLOOR 41 SEA LAND CO OP HSG SOCIETY OPP HOTEL PRESIDENT CUFFE PARADE MUMBAI 400005 0000000000B9B0103985 96.00 14 BHASKER CHAMPAKLAL -

Sunteckcity Brochure

www.sunteckaer.com INTRODUCING DECK LIVING STAY HOME & ENJOY THE OUTDOOR LIVING AT YOUR PRIVATE DECKS ON AER EXPERIENCE YOUR HOMES UNLOCK EXCLUSIVE LOCKDOWN OFFERS Artist’s Impression Nearing Possession OSHIWARA DISTRICT CENTRE (ODC) GOREGAON (W) www.sunteckcity.com OSHIWARA DISTRICT CENTRE: THE NEXT BKC OF MUMBAI THE BIGGEST OPPORTUNITY TO INVEST IN THE DESTINATION OF TOMORROW THE HUB OF CONNECTIVITY & CONVENIENCE SPREAD ACROSS 160 ACRES THE NEW CENTRAL BUSINESS DISTRICT OF MUMBAI KEY TO APPRECIATION & LUXURY Oshiwara District Centre (ODC) is being envisioned by MMRDA as the next BKC of Mumbai. Conveniently located between Andheri (W) and Goregaon (W), this neighbourhood has been planned to provide the best of mixed use development. Explore the endless possibilities at Oshiwara District Centre to get the perfect balance of personal and professional life. OSHIWARA DISTRICT CENTRE (ODC) MAP BY MMRDA NOTICES ISSUED BY MMRDA FOR CONSTRUCTING D. P. ROAD DEVELOPED D. P. ROAD D. P. ROAD UNDER CONSTRUCTION 13.00 MT WIDE ROAD PROPOSED TO BE WIDENED TO 25.00 MT WIDTH Adaptation of MMRDA Map A STRATEGIC LOCATION, PAVING WAY TOWARDS AN EVOLVING TOMORROW INORBIT MALL CITY CENTRE MALL Vibgyor High School Cinemax Cinema NIRLON Carnival Cinema KNOWLEDGE PARK HUB MALL NESCO Oshiwara Police Avenue 1 & 2 - Approx. 7 Acres Avenue 3, 4, 5 & 6 - Approx. 16 Acres Station KOKILABEN AMBANI Hospital HOSPITAL SOCIAL INFRASTRUCTURE AROUND OSHIWARA DISTRICT CENTRE (ODC) Corporate Hubs - Nirlon | Nesco Schools - Vibgyor High School | Ryan International School | Oberoi International School Malls - Infiniti Mall | Inorbit Mall | Oberoi Mall Medical Facility - Kokilaben Dhirubhai Ambani Hospital Hotels - The Westin Hotel | JW Marriott | Novotel | Sun-n-Sand LOCATION ADVANTAGE INFRASTRUCTURE UPCOMING Close proximity to Chhatrapati Ram Mandir Station Metro line 7 Shivaji International & Domestic - 2 mins Drive Airport (25 mins. -

Mumbai Slum Improvement Board

MUMBAI SLUM IMPROVEMENT BOARD A REGIONAL UNIT OF (MAHARASHTRA HOUSING AND AREA DEVELOPMENT AUTHORITY) Tel no. – 022-66405484 E-mail – [email protected] Ref n o. EE/City/MSIB / e-tender/Labour Soc. / 07 / 2020-21 e-TENDER NOTICE for Labour Co-op. Society registered under DDR Mumbai City District (City) Digitally Signed & unconditional online Tender in form ``B-1'' (Percentage Rate) are invited by the Executive Engineer (City) Division Mumbai Slum Improvement Board (Unit of MHADA) Room no. 539 4th floor Griha Nirman Bhavan Bandra (East) Mumbai 400 051 for the various work from the Labour Co-Op. Society registered under appropriate class with DDR Mumbai City District (City) e- Name of Works Estimated Security Registration Tender Time limit Tender Cost. Rs. Deposit 1% of (Class) of Price for No. Estimated cost L.C.S. under including completion Rs. Deputy 12% GST of work (50% initially District in Rs. & 50% Register through bill) 1 Renovation of Sabhagruha for Sant 2136936.00 21369.00 Class-A 560.00 12 Rohidas at Dharavi and above Months (MPSSVY) (Dharavi) (including monsoon) 2 Concreting Work and Fixing 2059697.00 20597.00 Class-A 560.00 12 Ladikaran Near Sant Rohidas and above Months Sabhagruha at Dharavi (including (MPSSVY) (Dharavi) monsoon) 3 Renovation of Vyayamshala at Ashok 2136936.00 21369.00 Class-A 560.00 12 Mill Compound, Dharavi and above Months (MPSSVY) (Dharavi) (including monsoon) 4 Construction of Wall at Ashok Mill 2136936.00 21369.00 Class-A 560.00 12 Compound, Dharavi and above Months (MPSSVY) (Dharavi) (including monsoon) 5 Construction of Open Sabhagruha and 2136936.00 21369.00 Class-A 560.00 12 Fixing Shahbad Ladi Near Shahu and above Months Collage at Dharavi (including (MPSSVY) (Dharavi) monsoon) 6 Renovation of Sabhagruha for Dr. -

Zetia Bungalow Option 11 Blue Option Ashish

Zetia Villa AN ISLAND OF TRANQUILLITY Altamount Road, Mumbai The Opportunity Tucked away in the quiet and green to enjoy his/her privacy. The structure gives its neighbourhood of Altamount road, is a three residents the flexibility to change the storied villa known by the name of ‘Zetia Villa’. It configuration on every floor. Each floor can be has been the prized possession of an esteemed modified to accommodate two self-contained, family in Mumbai for the last 6 decades. The separate units (a 3BHK and a 2BHK). Access to property was an heirloom of the Maharaja of the three floors is available through a staircase as Gwalior- Jiwaji Rao Scindia. Knight Frank brings well as an elevator. you the rare opportunity to turn this magnificent jewel of a house into your new home. The large windows allow maximum sunlight, cross-ventilation and offer views of the The villa is situated on a private road which is surrounding greenery at every level. The terrace lined with tall, flowering trees, all planted by the of the villa overlooks popular buildings in the owner. Entrance to the road is guarded by a vicinity. As this area comes under the VVIP security service employed by the residents of the category, there is ample water supply and road and Antilia, which is on the same road. virtually no electricity failure. Also, it is well Residents of the villa can avail 7 reserved car connected with various bus routes which make it parks in the private lane. easy for domestic help to travel to the property. -

2 Bedroom Apartment / Flat for Rent in Prabhadevi, Mumbai (P16508743

https://www.propertywala.com/P16508743 Home » Mumbai Properties » Residential properties for rent in Mumbai » Apartments / Flats for rent in Prabhadevi, Mumbai » Property P16508743 2 Bedroom Apartment / Flat for rent in Prabhadevi, Mumbai 43,000 2BHK Apartment In Shilpa Apartment Advertiser Details Shilpa Apartment, Prabhadevi, Mumbai - 400104 (Mahar… Area: 60.39 SqMeters ▾ Bedrooms: Two Bathrooms: Two Monthly Rent: 43,000 Rate: 712 per SqMeter -15% Available: Immediate/Ready to move Description Scan QR code to get the contact info on your mobile 2BHK Apartment in Shilpa Apartment. This is nice vibes property in prabhadevi, behind sidhi binayak View all properties by Nitesh Property Consultant temple. Pictures When you call, don't forget to mention that you found this ad on PropertyWala.com. Features Other features Carpet Area: 60.39 sq.m. East Facing Balconies: 1 Floor: 6th of 7 Floors 5 to 10 years old Society: Shilpa Apartment Furnishing: Furnished Gated Community Reserved Parking Location * Location may be approximate Landmarks Nearby Localities Dadar West, Dadar East, Century Bazaar, Naigaon, Manor, Lower Parel, Vangani, Worli, Prashant Nagar, Parel * All distances are approximate Locality Reviews Prabhadevi, Mumbai Prabhadevi is ideally located equidistantly, from the city's old business district of Nariman Point and its new powerhouses of Lower Parel and Bandra-Kurla Complex. In the name of road connectivity, most of the city's arterial roads connect and converge on Prabhadevi. The 8 lane (one way) Bandra-Worli Sealink is an architectural marvel and a sure shot way to beat the rush hour traffic. Wide tree lined avenues and immaculately maintained roads, mean than driving here is bliss. -

Srl Dpid Lf Cltid Hold Name Jt1 Jt2 Add1 Add2 City Pin Amt 1 002313 100 Nareshkumar Banka 709 Nai Basti Iind Floor Katra Neel Ch

SRL DPID LF_CLTID HOLD NAME JT1 JT2 ADD1 ADD2 CITY PIN AMT 1 002313 100 NARESHKUMAR BANKA 709 NAI BASTI IIND FLOOR KATRA NEEL CH CHOWK DELHI 110006 925 2 004814 100 VIKAS AGGARWAL 3184, LAL DARWAZA, BAZAR SITA RAM, DELHI 110006 925 3 002365 100 RAJENDRA KUMAR JAIN 163 STATE BANK COLONY 2ND FLOOR, G T KARNAL ROAD DELHI 110009 925 4 002360 100 S P VERMA K-14 KIRTI NAGAR NEW DELHI 110015 925 5 002362 100 S PRAKASH K-14 KIRTI NAGAR NEW DELHI 110015 925 6 12023000 00169221 4 SANDEEP GARG A-28, GALI NO.-8, KANTI NAGAR,KRISHNA NAGAR DELHI 110051 37 7 002808 100 PUSHPA AGRAWAL A-177/1 ASHOK VIHAR PHASE I DDA FLATS DELHI 110052 925 8 002810 100 SANJAY AGRAWAL A-177/1 ASHOK VIHAR PHASE I DDA FLATS DELHI 110052 925 9 002343 100 NAIMUDDIN 1015, NARMADA RESDL. COMPLEX, J.N.U., NEW DELHI 110062 925 HEMANT K. 10 A00018 100 ANJU GUPTA GUPTA 342, CHOUDHERY WARA, REWARI, HARYANA 123401 925 11 A00019 100 ANJU GUPTA NANCY MENDES 342, CHOUDHERY WARA, REWARI, HARYANA 123401 925 12 A00020 100 ANJU GUPTA SHARON GUPTA 342, CHOUDHERY WARA, REWARI, HARYANA 123401 925 13 004820 100 RAJIV MISRA PARMATMA INVESTMENTS, 124, BRAHM PUTRA COMPLEX, KALA AAM BULANDSHAHR UP 203001 925 14 003627 100 PREM SINGHANIA M/S SRI KRISHANDAS DAMODAR DAS KOTE GATE FAR BAZAR, RAJ BIKANER 334001 925 15 003571 100 SUNIL KUMAR AGARWAL SHYAM KHOKHARIA SHAHJI KA BAG, RAJ KUCHAMAN 341508 925 16 003447 100 MANMOHAN VYAS NEAR SHRINTHJI KI HAVELI UMMED PURA PHALODI 342301 925 MARJORIE 17 003751 100 HAROLD MASCARENHAS MASCARENHAS HONEYCOMB OFFRS QTRS A F STATION JAMNAGAR 361003 925 18 002209 100 SITARAM PAREEK C/O KAMADGIRI SYNTHETICS LTD 31/3 GANGADEVI ROAD UMBERGAON 396171 925 19 002210 200 TARACHAND REPSWAL RCL 14/150 GIDC COLONY, UMBERGAON VALSAD 396171 1850 20 002257 100 VIMAL MEHTA J-1601-9-1&2 GIDC PO UMBERGAON GUJARAT, DIST. -

Powai Report.Cdr

® Powai, Mumbai From a tiny hamlet in the peripheries to being a densely populated residential market Micro Market Overview Report August 2018 About Powai THE CONSTRUCTION ACTIVITY IN POWAI PICKED UP IN THE LATE 90’S AND THERE HAS BEEN NO LOOKING BACK SINCE THEN FOR THE MICRO MARKET. Decades ago, Powai was an unfamiliar hamlet in There are numerous educational institutions the north eastern suburbs of Mumbai on the banks namely Hiranandani Foundation School, Bombay of Powai Lake, catering to the drinking water Scottish School, Podar International School and supply needs of the city. In 1958, the establishment Kendriya Vidyalaya. Dr. L H Hiranandani Hospital, of the technology and research institution – Indian Nahar Medical Centre and Powai Hospital are a few Institute of Technology, Bombay brought the prominent healthcare facilities. micro market into limelight. The construction activity in Powai picked up in the late 90’s and Convenience stores such as D Mart and shopping there has been no looking back since then for the complexes like Galleria and R City Mall (located micro market. less than 4 km from Powai) are also available for the shopping needs of residents. Apart from Powai is surrounded by hills of Vikhroli Parksite in residential developments, there are corporate the south east, Sanjay Gandhi National Park in the offices such as Crisil, Bayer, L&T, Nomura, Colgate- north and L.B.S. Road in the north eastern Palmolive, Deloitte and Cognizant. Additionally, direction. Powai is equipped with excellent social the micro market also provides a scenic view of the infrastructure. Powai Hills and the Sanjay Gandhi National Park.