Mumbai Residential June 2019 Marketbeats

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CCIT-LTU.Pdf

LIST OF CENTRAL PUBLIC INFORMATION OFFICERS & FIRST APPELLATE AUTHORITIES COMMISSIONER OF INCOME-TAX (LTU), MUMBAI Sr. Designation of the CPIO Address of the Telephone Designated as CPIO First Appellate Address of FAA Telephone No. CPIO Number of for providing Authority (FAA) [For complete Number of [For complete the CPIO information office address , pl. FAA office address , pl. pertaining to the see the last page] see the last page] office of 1 Income-tax Officer (HQ) WTC / 29th Floor, 22167165 Pr. CIT (LTU) Pr. CIT (LTU) WTC / 29th Floor, 22167152 (LTU), Mumbai Mumbai Mumbai Mumbai Mumbai 2 Addl. Commissioner of WTC / 29th Floor, 22167158 Addl. CIT (LTU) Pr. CIT (LTU) WTC / 29th Floor, 22167152 Income-tax (LTU), Mumbai Mumbai Mumbai Mumbai Mumbai 3 Dy. Commissioner of Income- WTC / 29th Floor, 22167170 DCIT (LTU)-1, Addl. CIT (LTU) WTC / 29th Floor, 22167158 tax (LTU)-1, Mumbai Mumbai Mumbai Mumbai Mumbai 4 Dy. Commissioner of Income- WTC / 29th Floor, 22167170 DCIT (LTU)-2, Addl. CIT (LTU) WTC / 29th Floor, 22167158 tax (LTU)-2, Mumbai Mumbai Mumbai Mumbai Mumbai ABBREVIATIONS USED ADDRESS EPBX – TELEPHONE OPERATOR AB Aayakar Bhavan, M.K. Road, Churchgate, Mumbai-400020 22039131 /22001230 AIR Air India Building, Nariman Point, Mumbai-400021 BKC Bandra Kurla Complex Pratyakshakar Bhavan, Bandra (E), Mumbai-400051 26572599 / 26572554 / 26572580 CGO/PB Old CGO Building/ Near Aayakar Bhavan, M.K. Road, Churchgate, Mumbai-400020 22059028 / 22059232 / 22059344 Pratishtha Bhavan CR Charni Road, K.G. Mittal Aayurvedic Pracher Sanstha Bldg., Mumbai-400002 22812323 / 22819125 / 22819184 EH Earnest House Nariman Point, Mumbai-400021 22023216 / 22022738 / 22022887 MC Mittal Court 3rd Nariman Point, Mumbai-400021 22875505 MM Matru Mandir Tardeo, Grand Road, Mumbai-400007 23841961 / 23841962 / 23841963 PC Piramal Chambers Lalbaug, Parel, Mumbai-400012 24102731 / 24102737 Vashi Railway Station Bldg., 3rd & 4th Floor, Tower No. -

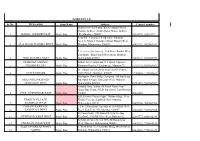

Reg. No Name in Full Residential Address Gender Contact No

Reg. No Name in Full Residential Address Gender Contact No. Email id Remarks 20001 MUDKONDWAR SHRUTIKA HOSPITAL, TAHSIL Male 9420020369 [email protected] RENEWAL UP TO 26/04/2018 PRASHANT NAMDEORAO OFFICE ROAD, AT/P/TAL- GEORAI, 431127 BEED Maharashtra 20002 RADHIKA BABURAJ FLAT NO.10-E, ABAD MAINE Female 9886745848 / [email protected] RENEWAL UP TO 26/04/2018 PLAZA OPP.CMFRI, MARINE 8281300696 DRIVE, KOCHI, KERALA 682018 Kerela 20003 KULKARNI VAISHALI HARISH CHANDRA RESEARCH Female 0532 2274022 / [email protected] RENEWAL UP TO 26/04/2018 MADHUKAR INSTITUTE, CHHATNAG ROAD, 8874709114 JHUSI, ALLAHABAD 211019 ALLAHABAD Uttar Pradesh 20004 BICHU VAISHALI 6, KOLABA HOUSE, BPT OFFICENT Female 022 22182011 / NOT RENEW SHRIRANG QUARTERS, DUMYANE RD., 9819791683 COLABA 400005 MUMBAI Maharashtra 20005 DOSHI DOLLY MAHENDRA 7-A, PUTLIBAI BHAVAN, ZAVER Female 9892399719 [email protected] RENEWAL UP TO 26/04/2018 ROAD, MULUND (W) 400080 MUMBAI Maharashtra 20006 PRABHU SAYALI GAJANAN F1,CHINTAMANI PLAZA, KUDAL Female 02362 223223 / [email protected] RENEWAL UP TO 26/04/2018 OPP POLICE STATION,MAIN ROAD 9422434365 KUDAL 416520 SINDHUDURG Maharashtra 20007 RUKADIKAR WAHEEDA 385/B, ALISHAN BUILDING, Female 9890346988 DR.NAUSHAD.INAMDAR@GMA RENEWAL UP TO 26/04/2018 BABASAHEB MHAISAL VES, PANCHIL NAGAR, IL.COM MEHDHE PLOT- 13, MIRAJ 416410 SANGLI Maharashtra 20008 GHORPADE TEJAL A-7 / A-8, SHIVSHAKTI APT., Male 02312650525 / NOT RENEW CHANDRAHAS GIANT HOUSE, SARLAKSHAN 9226377667 PARK KOLHAPUR Maharashtra 20009 JAIN MAMTA -

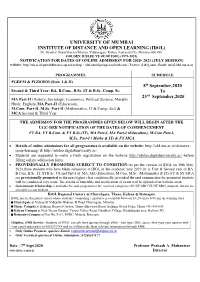

Notification for Dates of Online Admission For

UNIVERSITY OF MUMBAI INSTITUTE OF DISTANCE AND OPEN LEARNING (IDOL) Dr. Shankar Dayal Sharma Bhavan, Vidyanagari, Kalina, Santacruz (E), Mumbai-400 098. GOLDEN JUBLEE YEAR OF IDOL (1971-2021) NOTIFICATION FOR DATES OF ONLINE ADMISSION FOR 2020- 2021 (JULY SESSION) Website: http://mu.ac.in/portal/distance-open-learning/ ; [email protected] ; Twitter: @idol_uom ; Email: info@ idol.mu.ac.in PROGRAMMES SCHEDULE PGDFM & PGDORM (Sem. I & II) 8th September,2020 Second & Third Year: BA, B.Com., B.Sc. IT & B.Sc. Comp. Sc. To 23rd September,2020 MA Part-II (History, Sociology, Economics, Political Science, Marathi, Hindi, English),MA Part-II (Education), M.Com. Part-II, M.Sc. Part-II (Mathematics, IT & Comp. Sci) & MCA Second & Third Year THE ADMISSION FOR THE PROGRAMMES GIVEN BELOW WILL BEGIN AFTER THE UGC-DEB NOTIFICATION OF THE DATES OF COMMENCEMENT FY BA, FY B.Com. & FY B.Sc.(IT), MA Part-I, MA Part-I (Education), M.Com Part-I, M.Sc. Part-I ( Maths & IT) & FY MCA Details of online admissions for all programmes is available on the website: http://old.mu.ac.in/distance- open-learning/ & http://idoloa.digitaluniversity.ac/. Students are requested to make a fresh registration on the website http://idoloa.digitaluniversity.ac/ before filling online admission form. PROVISIONALLY PROMOTED SUBJECT TO CONDITION:As per the circular of IDOL on 19th May, 2020,those students who have taken admission at IDOL in the academic year 2019-20 in First & Second year of BA, B.Com, B.Sc. IT, SYB.Sc. CS and Part-I of MA, MA (Education), M.Com, M.Sc. -

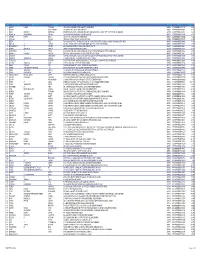

BANK NAME IFSC Code Address ABHYUDAYA CO-OP BANK LTD ABHY0065001 251, Abhyudaya Bank Bldg, Perin Nariman Street, Fort, Mumbai 400 001, ABN AMRO BANK N.V

BANK NAME IFSC Code Address ABHYUDAYA CO-OP BANK LTD ABHY0065001 251, ABHYudaya Bank Bldg, Perin Nariman Street, Fort, Mumbai 400 001, ABN AMRO BANK N.V. ABNA0000001 414, Empire Complex, Senapati Bapat Marg, Lower Parel (West), Mumbai 400 013 ABU DHABI COMMERCIAL BANK ADCB0000001 75-B,Rehmat Manzil,Vir Nariman Road,Chrchgate,Mumbai-4000020 ALLAHABAD BANK ALLA0888888 Allahabad Bank, 3rd Floor, Allahabad Bank Building, 37, Mumbai Samachar Marg, Fort ,Mumbai -23 AMERICAN EXPRESS BANK AMEX0000001 Oriental Building, Ground floor, 364 Dr. D. N. Road, Fort, Mumbai 400 001. ANDHRA BANK ANDB0TRESUY 1st Floor Bansi Lal Building, 11 Homi Modi Street, Fort, MUMBAI - 400 023 BANK OF AMERICA BOFA0MM6205 Express Towers, Nariman Point, Mumbai 400 021 BANK OF BAHRAIN AND KUWAIT BBKM0000001 225 Jolly Maker Chamber II,Nariman Point, Mumbai 400 021 BANK OF BARODA BARB0TREASU 6th Floor, Kalpataru Heritage Building,Nanik Motwani Marg, Fort, Mumbai - 400 023. BANK OF INDIA BKID000PIGW Star House, 8th floor, C-5, "G" Block, Bandra Kurla Complex, Bandra East, Mumbai 400 051 BANK OF MAHARASHTRA MAHB0003007 Treasury and International Banking Division, 2nd Floor, Maker Chamber III, Nariman Point, Mumbai 400 02 BANK OF NOVA SCOTIA NOSC0000MUM Mittal Tower ‘B’ Wing, Nariman Point, Mumbai 400 021 BANK OF RAJASTHAN BRAJ0003350 Treasury Branch, 18/20 Cawasji Patel Street, Jeevan Jyoti Bldg., Fort, Mumbai - 400 023.(Maharastra) BARCLAYS BANK PLC BARC0INBB01 21/23, Maker Chambers VI, Nariman Point, Mumbai 400 021 BHARAT COOPERATIVE BANK BCBM0000999 Marutagiri, Plot No 13/9A,Sonawala Road,Samant Wadi,Goregaon LTD (e),Mumbai - 400 063 BK OF TOKYO MITSUBISHI UFJ BOTM0003611 JEEVAN VIHAR BUILDING, 3 PARLIAMENT STREET, NEW DELHI - LTD 110001 BNP PARIBAS BNPA0009066 French Bank Bldg.,62, Homji Street, Mumbai - 400 001 CALYON BANK CRLY0000001 Hoechst House, 11th, 12th, 14th Floor, Nariman Point, Churchgate, Mumbai - 400 021. -

NOBLE PLUS Sr No

NOBLE PLUS Sr No. Br Location Shop Name Address Contact number Indian Oil Petrol Pump, Below Airport Metro Station, Andheri - Kurla Road, Marol, Andheri 1 MAROL, ANDHERI EAST Noble Plus (E), Mumbai - 400059 28349999, 28391199 Shop No. 1, Joanna Co-Operative Housing Society, Manuel Gonsalves Road, Bandra West, 2 M. G. ROAD, BANDRA WEST Noble Plus Mumbai, Maharashtra 400050 26431129, 9029069559 7-A, Seven Star Society, 33rd Road, Bandra West, Landmark : Mini Punjab Restaurant, Mumbai, 4 33RD, BANDRA WEST Noble Plus Maharashtra 400050 26493333, 9029069590 DIAMOND GARDEN, Bahari Auto Compound, S.T. Road, Opposite 5 CHEMBUR EAST Noble Plus Diamond Garden, Chembur (E), Mumbai-71 25202520, 9029069565 #6 , Maker Arcade ,Near World Trade Center, 6 CUFFE PARADE Noble Plus Cuffe Parade, Mumbai, 400005 22168888, 7718806670 Rustomjee Ozone Bldg, Goregaon - Mulund Link MULUND LINK ROAD, Rd, Sunder Nagar, Goregaon West, Mumbai, 7 GOREGAON WEST Noble Plus Maharashtra 400064 28710057, 9029069567 Ground Floor, Indian Oil Petrol Pump, Opp. Majas Bus Depot, JVLR Jogeshwari East Mumbai 8 JVLR, JOGESHWARI EAST Noble Plus 400060 28268888 #55, Krishna Vasant Sagar, Thakur village, Near THAKUR VILLAGE, Thakur Cinema, Kandivali East, Mumbai, 9 KANDIVALI EAST Noble Plus Maharashtra 400101 28855560, 9029069566 DAHANUKARWADI, 1,2 & 3, Kamalvan, Junction of Link Road, M.G. 10 KANDIVALI WEST Noble Plus Road, Kandivali (W), Mumbai -400067 28682349, 9029069568 #2,Tanna Kutir,17th Roaad,Next to Neelam 11 17TH ROAD, KHAR WEST Noble Plus Foodland,, 17th Rd, Khar West, Mumbai-52. 26047777, 8433915319 #2,Mahesh Society, 3rd TPS, 5th Road, Khar 12 5TH ROAD, KHAR WEST Noble Plus West, Mumbai, Maharashtra 400052 26492222, 7718805146 VEER SAVARKAR MARG, 3, West wind, Veer Savarkar Marg, Mahim West, 13 MAHIM Noble Plus Mumbai, Maharashtra 400016 24444141, 7718806673 Heera panna mall, Powai, Mumbai, Maharashtra 14 A. -

CRAMPED for ROOM Mumbai’S Land Woes

CRAMPED FOR ROOM Mumbai’s land woes A PICTURE OF CONGESTION I n T h i s I s s u e The Brabourne Stadium, and in the background the Ambassador About a City Hotel, seen from atop the Hilton 2 Towers at Nariman Point. The story of Mumbai, its journey from seven sparsely inhabited islands to a thriving urban metropolis home to 14 million people, traced over a thousand years. Land Reclamation – Modes & Methods 12 A description of the various reclamation techniques COVER PAGE currently in use. Land Mafia In the absence of open maidans 16 in which to play, gully cricket Why land in Mumbai is more expensive than anywhere SUMAN SAURABH seems to have become Mumbai’s in the world. favourite sport. The Way Out 20 Where Mumbai is headed, a pointer to the future. PHOTOGRAPHS BY ARTICLES AND DESIGN BY AKSHAY VIJ THE GATEWAY OF INDIA, AND IN THE BACKGROUND BOMBAY PORT. About a City THE STORY OF MUMBAI Seven islands. Septuplets - seven unborn babies, waddling in a womb. A womb that we know more ordinarily as the Arabian Sea. Tied by a thin vestige of earth and rock – an umbilical cord of sorts – to the motherland. A kind mother. A cruel mother. A mother that has indulged as much as it has denied. A mother that has typically left the identity of the father in doubt. Like a whore. To speak of fathers who have fought for the right to sire: with each new pretender has come a new name. The babies have juggled many monikers, reflected in the schizophrenia the city seems to suffer from. -

Maha Eseva Kendra List

महा-ई-सेवा कᴂ 饍ा車ची यादी Sr. VLE Name Palghar CSC Address Location Pincode Mobile Maha E Sewa Kendra Nitin Bhaidas Rampur 1 Rampur Kosbad Road Near 401702 8237635961 Mothe (551636) Market Rampur Jayprakash Gholwad Gholwad Near 2 Ramchandra Gholwad 401702 9860891473 Jalaram Temple Gholwad Bari Bhika Bandu Parnaka Parnaka Parnaka Dahanu (M 3 401602 9637999157 Sonawane Dahanu Cl) Ganpat At-Haladpada Amboli 4 Sukhad Halapada 401606 9960227641 Shishane Road Haladpada Dhangda Nr Saideep Hospital At Post Malyan Tq Dhanu Amul Ramdas Dahanu (M 5 East Dist Thane-401602 401602 9967910609 Tandel Cl) Malyan Sai Deep Hospital Dahanu E Santosh Muskan S S Sanstha 6 Ramchandra 16,Sidhhi Complex,Kasa Kasa Kh. 401607 9049494194 Patil Dahanu Jawhar Road Gayatri Enterprizes, Muskan 16,Siddhicomplex, 7 Swayamrojgar 16,Siddhicomplex Dahanu Kasa Kh. 401607 9049494194 Seva Sahakari Jawhar Road Near Bank Of Maharashtra Kasa Jahir Kasim Maha E Seva Kendra 8 Vangaon 401103 9423533665 Shaikh Chinchani Road Vangaon Maha E Seva Kendra Jayvanti Dahanu (M 9 Dahanu Fort Near Ganesh 401601 9273039057 Rajendra Bari Cl) Mandir Tahsildar Office Maha E Seva Center Dhakti Dahanu Dhakti Dhakti 10 Kishor R Bari 401601 9860002524 Dahanu Bariwada Near Bus Dahanu Stop Maha E Seva Kendra Bordi Akshay 11 Shop No 511 Netaji Road Bordi 401701 8149107404 Bprakash Raut Opp Ram Mandir Bordi Muskan Maha E Seva Kendra 12 Swayamrojgar Ashagad 401602 7066822781 Ashagad Seva Sahakari Maha E-Seva Kendra 2 Prafful Dahanu-Vangaon Road 13 Jaywant Saravali 401602 8087930398 Near Savta Bridge Vaidya Ghungerpada At Dhundalwadi Darshana Dhundalwad 14 Dhundalwadi Talathi 401606 9765284663 Vilas Hilim i Office Ramij Kashim Maha E Seva Kendra 15 Aine 401103 9423533665 Shaikh Charoti Road Aina Maha E Seva Center Chinchani Vangaon Naka 01 Prathomasatv Bulding Chinchani 16 Kishor R Bari 401503 9860002524 Dahanu Khadi - Boisar (Ct) Road Near State Bank A.T.M. -

Section 124- Unpaid and Unclaimed Dividend

Sr No First Name Middle Name Last Name Address Pincode Folio Amount 1 ASHOK KUMAR GOLCHHA 305 ASHOKA CHAMBERS ADARSHNAGAR HYDERABAD 500063 0000000000B9A0011390 36.00 2 ADAMALI ABDULLABHOY 20, SUKEAS LANE, 3RD FLOOR, KOLKATA 700001 0000000000B9A0050954 150.00 3 AMAR MANOHAR MOTIWALA DR MOTIWALA'S CLINIC, SUNDARAM BUILDING VIKRAM SARABHAI MARG, OPP POLYTECHNIC AHMEDABAD 380015 0000000000B9A0102113 12.00 4 AMRATLAL BHAGWANDAS GANDHI 14 GULABPARK NEAR BASANT CINEMA CHEMBUR 400074 0000000000B9A0102806 30.00 5 ARVIND KUMAR DESAI H NO 2-1-563/2 NALLAKUNTA HYDERABAD 500044 0000000000B9A0106500 30.00 6 BIBISHAB S PATHAN 1005 DENA TOWER OPP ADUJAN PATIYA SURAT 395009 0000000000B9B0007570 144.00 7 BEENA DAVE 703 KRISHNA APT NEXT TO POISAR DEPOT OPP OUR LADY REMEDY SCHOOL S V ROAD, KANDIVILI (W) MUMBAI 400067 0000000000B9B0009430 30.00 8 BABULAL S LADHANI 9 ABDUL REHMAN STREET 3RD FLOOR ROOM NO 62 YUSUF BUILDING MUMBAI 400003 0000000000B9B0100587 30.00 9 BHAGWANDAS Z BAPHNA MAIN ROAD DAHANU DIST THANA W RLY MAHARASHTRA 401601 0000000000B9B0102431 48.00 10 BHARAT MOHANLAL VADALIA MAHADEVIA ROAD MANAVADAR GUJARAT 362630 0000000000B9B0103101 60.00 11 BHARATBHAI R PATEL 45 KRISHNA PARK SOC JASODA NAGAR RD NR GAUR NO KUVO PO GIDC VATVA AHMEDABAD 382445 0000000000B9B0103233 48.00 12 BHARATI PRAKASH HINDUJA 505 A NEEL KANTH 98 MARINE DRIVE P O BOX NO 2397 MUMBAI 400002 0000000000B9B0103411 60.00 13 BHASKAR SUBRAMANY FLAT NO 7 3RD FLOOR 41 SEA LAND CO OP HSG SOCIETY OPP HOTEL PRESIDENT CUFFE PARADE MUMBAI 400005 0000000000B9B0103985 96.00 14 BHASKER CHAMPAKLAL -

Hotel List 19.03.21.Xlsx

QUARANTINE FACILITIES AVAILABLE AS BELOW (Rate inclusive of Taxes and Three Meals) NO. DISTRICT CATEGORY NAME OF THE HOTEL ADDRESS SINGLE DOUBLE VACANCY POC CONTACT NUMBER FIVE STAR HOTELS 1 Mumbai Suburban 5 Star Hilton Andheri (East) 3449 3949 171 Sandesh 9833741347 2 Mumbai Suburban 5 Star ITC Maratha Andheri (East) 3449 3949 70 Udey Schinde 9819515158 3 Mumbai Suburban 5 Star Hyatt Regency Andheri (East) 3499 3999 300 Prashant Khanna 9920258787 4 Mumbai Suburban 5 Star Waterstones Hotel Andheri (East) 3500 4000 25 Hanosh 9867505283 5 Mumbai Suburban 5 Star Renaissance Powai 3600 3600 180 Duty Manager 9930863463 6 Mumbai Surburban 5 Star The Orchid Vile Parle (East) 3699 4250 92 Sunita 9169166789 7 Mumbai Suburban 5 Star Sun-N- Sand Juhu, Mumbai 3700 4200 50 Kumar 9930220932 8 Mumbai Suburban 5 Star The Lalit Andheri (East) 3750 4000 156 Vaibhav 9987603147 9 Mumbai Surburban 5 Star The Park Mumbai Juhu Juhu tara Rd. Juhu 3800 4300 26 Rushikesh Kakad 8976352959 10 Mumbai Suburban 5 Star Sofitel Mumbai BKC BKC 3899 4299 256 Nithin 9167391122 11 Mumbai City 5 Star ITC Grand Central Parel 3900 4400 70 Udey Schinde 9819515158 12 Mumbai Suburban 5 Star Svenska Design Hotels SAB TV Rd. Andheri West 3999 4499 20 Sandesh More 9167707031 13 Mumbai Suburban 5 Star Meluha The Fern Hiranandani Powai 4000 5000 70 Duty Manager 9664413290 14 Mumbai Suburban 5 Star Grand Hyatt Santacruz East 4000 4500 120 Sonale 8657443495 15 Mumbai City 5 Star Taj Mahal Palace (Tower) Colaba 4000 4500 81 Shaheen 9769863430 16 Mumbai City 5 Star President, Mumbai Colaba -

Sample Product Assessment and Urban Design Guidelines Study

XYZ developer, August, 201X Forward Liases Foras was approached by SD Corporation to conduct Product Viability Study and Design Brief Development that can help them take a decision on future development plan for their XYZ Redevelopment Project located in Tardeo in Mumbai, Maharashtra. While, there are many ways to arrive at the recommendations related to product, price and phasing, we have considered rationales that according to urban economics are most crucial for success of any location. All the recommendations and suggestions mentioned in the report are directly or indirectly governed by scientifically laid down theories and methodologies of Urban Economics. We hope the report will be helpful to SD Corporation to envisage the project and its future market outlook. Disclaimer The information provided in this report is based on the data collected by Liases Foras. Liases Foras has taken due care in the collection of the data. However, Liases Foras does not warranty the correctness of the information provided in this report. The report is available only on "as is" basis and without any warranties express or implied. Liases Foras disclaims all warranties including the implied warranty of merchantability and fitness for any purpose. Without prejudice to the above, Liases Foras will not be liable for any damages of any kind arising from the use of this report, including, but not limited to direct, indirect, incidental, punitive, special, consequential and/ or exemplary damages including but not limited to, damages for loss of profit goodwill resulting from: The incorrectness and/or inaccuracy of the information available on or through the Site Any action taken, proceeding initiated, transaction entered into on the basis of the information available in this report Terms of usage, Except as expressly permitted below, users of this report should not copy, modify, alter, reverse engineer, disassemble, sell, transfer, rent, license, publish, distribute, disseminate or otherwise allow access to all or any of the Information. -

Ariisto Codename Big Boom A4

MUMBAI'S HAPPIEST REAL ESTATE BOOM LIMITED PERIOD PRE-LAUNCH: 19 AUG - 3 SEP LOCATION 22ND CENTURY BOOMTIME A BOOMING PRE-LAUNCH PRIMED FOR A BOOM LIFESTYLE BOOM FOR REAL ESTATE OPPORTUNITY CODENAME BIG BOOM - MUMBAI’S HAPPIEST PRE-LAUNCH BEGINS! THE LUXURY OF SOBO • THE PRIVILEGED LIFESTYLE OF POWAI • NOW AT THANE PRICES Ariisto presents the first and biggest RERA-registered pre-launch opportunity to acquire 22nd century 2 and 3 bed techno-luxury homes in the most awaited neighbourhood of Mumbai’s happiest and most liveable suburb - Mulund. A block-buster offering to move into the rarest location of Mumbai at never-seen-before prices starting `1.35 Cr^, limited to an extremely short-lived pre-launch opportunity from 19th August - 3rd September. OFFER HIGHLIGHTS Mumbai is India’s most expensive and thriving real estate market with prices for a quality Grade-A • Mumbai's first RERA-registered mega pre-launch. 2 BHK ranging from `2 Cr (Suburbs) to `10 Cr+ (South Mumbai) and 3 BHK ranging from `2.5 Cr • Mumbai's finest neighbourhood in the serene to `15 Cr+. The demand for sub-1.5 Cr luxury homes setting of Yogi Hills, Mulund. has forced movement to Thane and Navi Mumbai. • Mumbai's first-ever 22nd century homes at Codename Big Boom presents a once-in-a-lifetime Thane prices. opportunity to own luxury residences at the most desired location of Mumbai at Thane prices. • 2 and 3 bed techno-luxury residences starting at just `1.35 Cr^. Naturally-blessed locations in Mumbai are rare and command up to 55% higher premium as seen in • Book a home by paying just 10% now and the Malabar Hill in South Mumbai, Five Gardens in Central rest spread conveniently until possession. -

Redharavi1.Pdf

Acknowledgements This document has emerged from a partnership of disparate groups of concerned individuals and organizations who have been engaged with the issue of exploring sustainable housing solutions in the city of Mumbai. The Kamala Raheja Vidyanidhi Institute of Architecture (KRVIA), which has compiled this document, contributed its professional expertise to a collaborative endeavour with Society for Promotion of Area Resource Centres (SPARC), an NGO involved with urban poverty. The discussion is an attempt to create a new language of sustainable urbanism and architecture for this metropolis. Thanks to the Dharavi Redevelopment Project (DRP) authorities for sharing all the drawings and information related to Dharavi. This project has been actively guided and supported by members of the National Slum Dwellers Federation (NSDF) and Dharavi Bachao Andolan: especially Jockin, John, Anand, Savita, Anjali, Raju Korde and residents’ associations who helped with on-site documentation and data collection, and also participated in the design process by giving regular inputs. The project has evolved in stages during which different teams of researchers have contributed. Researchers and professionals of KRVIA’s Design Cell who worked on the Dharavi Redevelopment Project were Deepti Talpade, Ninad Pandit and Namrata Kapoor, in the first phase; Aditya Sawant and Namrata Rao in the second phase; and Sujay Kumarji, Kairavi Dua and Bindi Vasavada in the third phase. Thanks to all of them. We express our gratitude to Sweden’s Royal University College of Fine Arts, Stockholm, (DHARAVI: Documenting Informalities ) and Kalpana Sharma (Rediscovering Dharavi ) as also Sundar Burra and Shirish Patel for permitting the use of their writings.