SECOND PROSPECTUS SUPPLEMENT DATED 2 September 2015 to the BASE PROSPECTUS DATED 22 MAY 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Van Dimensions

Van Dimensions Roof Height Vehicle Manufacture Vehicle Model Model Year Wheelbase Roof Height Rear Door Wheelbase (mm) (mm) Overall Length (mm) Citroen Berlingo First 1996 - 2009 L1 H1 Twin 2693 1796 4137 Citroen Berlingo 2008 - 2018 L1 H1 Twin 2728 1810 4380 Citroen Berlingo 2008 - 2019 L2 H1 Twin 2728 1810 4628 Citroen Berlingo 2008 - 2020 L2 H1 Tailgate 2728 1810 4628 Citroen Berlingo 2018 - Onwards L1 H1 Twin 2800 1850 4300 Citroen Berlingo 2018 - Onwards L2 H1 Twin 3000 1850 4700 Citroen Jumper 1994 - 2006 L1 H1 Twin 2850 2100 4963 Citroen Jumper 1994 - 2006 L1 H2 Twin 2850 2420 4963 Citroen Jumper 1994 - 2006 L2 H1 Twin 3200 2100 5413 Citroen Jumper 1994 - 2006 L2 H2 Twin 3200 2420 5413 Citroen Jumper 2006 - Onwards L1 H1 Twin 3000 2254 4963 Citroen Jumper 2006 - Onwards L2 H1 Twin 3450 2254 5413 Citroen Jumper 2006 - Onwards L2 H2 Twin 3450 2524 5413 Citroen Jumper 2006 - Onwards L3 H2 Twin 4035 2524 5998 Citroen Jumper 2006 - Onwards L3 H3 Twin 4035 2764 6363 Citroen Jumper 2006 - Onwards L4 H2 Twin 4035 2524 6363 Citroen Jumper 2006 - Onwards L4 H3 Twin 4035 2764 6363 Citroen Jumpy 1995 - 2007 L1 H1 Twin 3000 1980 4805 Citroen Jumpy 1995 - 2007 L2 H1 Twin 3122 1980 5135 Citroen Jumpy 1995 - 2007 L2 H1 Twin 3122 2276 5135 Citroen Jumpy 1995 - 2007 L1 H1 Tailgate 3000 1980 4805 Citroen Jumpy 1995 - 2007 L2 H1 Tailgate 3122 1980 5135 Citroen Jumpy 2008 - 2016 L1 H1 Twin 3000 1980 4805 Citroen Jumpy 2008 - 2016 L1 H1 Tailgate 3000 1980 4805 Citroen Jumpy 2008 - 2016 L2 H1 Twin 3122 1980 5135 Citroen Jumpy 2008 - 2016 L2 H1 Tailgate -

Questions and Answers for the Centenary of the Brand Price : €6 GRÉGOIRE THONNAT

Who is the founder of Citroën automobiles? What was the first car produced by Citroën? What is the ‘Citroën Central Asia’ Expedition? What do Citroën Traction Avant, Citroën 2 CV, Citroën DS and Citroën Ami 6 have in common? Who invented Citroën Mehari? What is the bestselling car in the Brand’s history? In 80 questions and answers, a timeline and the description of 10 iconic models, this little book will help you (re)discover Citroën’s fabulous history through iconic models, technical innovations and the people who wrote this unique industrial adventure that has revolutionised the history of the automobile since 1919. Questions and answers for the centenary of the Brand Price : €6 GRÉGOIRE THONNAT LE PETIT QUIZZ Questions and answers for the centenary of the Brand GRÉGOIRE THONNAT SUMMARY Preface 5 Questions and answers 7 A brief timeline of Citroën 89 10 iconic vehicles of the Brand 101 The Citroën brand 123 5 Dear readers, There is a reason why the Citroën 2 CV is as much a symbol of France as the Eiffel Tower…because we all have a Citroën story to tell! However, do you know the story of Citroën itself? Le Petit Quiz invites you to (re)discover Citroën’s journey from the origin of its logo to its many technological innovations, from legendary cars to its sporting achievements, and taking a detour through its cult advertising campaigns throughout the years. These 80 questions will help you discover amusing anecdotes and relive Citroën’s history! As the centenary of Citroën approaches, this is the essential tool to ensure you are ‘up to speed’ with one of the most collected car brands in the world… Linda Jackson, CEO, Citroën Brand 5 QUESTIONS AND ANSWERS 7 WHO WAS THE FOUNDER OF CITROËN? André Citroën! Born on 5 February 1878, André graduated from École Polytechnique and then went on to found Engrenages Citroën in 1905, before leading Mors automobiles in 1908. -

New Citroën C5 Aircross Suv

NEW CITROËN C5 AIRCROSS SUV 1 During the 90s Le Tone had a major hit, “Joli Dragon”, and devoted himself to music for 15 years before progressively moving towards illustrative art. Since 2011 his creations have been exhibited in famous places such as the Pompidou centre. An admirer of artists who know how to make the best use of colour, Le Tone confesses to having a weakness for black and white, which he uses to tell simple stories by using felt pen drawings in notebooks. 1974 2016 Citroën launches CX. It’s the ultimate Experience Concept reinvents mix of technical innovation and the prestige saloon. A bold, advanced design with the engine and fresh silhouette, a high-end stylish gearbox positioned together at the interior and the latest technology front. Sophisticated hydropneumatic combine to inspire the world of suspension, concave rear screen and a automotive design. futuristic dashboard help it to succeed amongst more ordinary rivals. 1934 1939 1948 1955 1968 2017 Discover the models that make up Citroën revolutionises the automotive Citroën launches the ‘TUB’, a supremely The much-loved 2CV is created as Unveiled to a stunned public at the 1955 It’s a golden age for light and agile Winners of the Manufacturers’ Rally Raid World Cup from Citroën’s extraordinary history, landscape with the Traction Avant. practical modern design with a sliding side a “safe and economical vehicle, Paris Motor Show, the DS takes futuristic vehicles like the Ami 6, Dyane and 1993 to 1997; Rally Raid World Cup Drivers’ Champion from 1919 to the present day. -

The Case of Foreign Workers in the French Automobile Assemble Industry

Michigan Journal of International Law Volume 6 Issue 1 1984 Industrial Policy and the Rights of Labor: The Case of Foreign Workers in the French Automobile Assemble Industry Mark J. Miller University of Delaware Follow this and additional works at: https://repository.law.umich.edu/mjil Part of the Comparative and Foreign Law Commons, International Trade Law Commons, Labor and Employment Law Commons, and the Transportation Law Commons Recommended Citation Mark J. Miller, Industrial Policy and the Rights of Labor: The Case of Foreign Workers in the French Automobile Assemble Industry, 6 MICH. J. INT'L L. 361 (1984). Available at: https://repository.law.umich.edu/mjil/vol6/iss1/20 This Article is brought to you for free and open access by the Michigan Journal of International Law at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Michigan Journal of International Law by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. Industrial Policy and the Rights of Labor: The Case of Foreign Workers in the French Automobile Assembly Industry Mark J. Miller* The foreign labor which made possible Western Europe's postwar economic growth' has become a permanent, if belatedly recognized, component of the region's labor markets. 2 Technological change and new industrial policies stress- ing efficiency, skilled labor, and rationalization threaten foreign workers, raising complex and important issues of law and social policy in the debate over labor's role in industrial policy. These changes already have resulted in grave problems which make agreement and clarification of the rights of foreign workers in national and international law a matter of considerable urgency. -

Video Interface for Toyota, Opel, Peugeot, Citroen Manual

Installation Manual HDMI Interface for New PEUGEOT / CITROEN car-solutions.com [email protected] car-solutions.com •Specification Compatibility: PG3008, Picasso C4 2017~ Components: Interface Main*1 Interface Input / Output specification: Input: HDMI*1 Analog RGB*1 (No USE) A/V*1 CVBS(Front Camera)*1 CVBS(Rear Camera)*1 Output: To LCD*1 AUDIO OUT*1 Power Spec: Input Power: 8VDC ~ 18VDC Consumption: 5WATT Switch input mode: 1. External video sources skip function: Able to control input videos on and off via Dip switches 2. Able to switch videos via the remote and button switch 3. Able to detect the rear view camera by CAN or rear lamp cable •Features 1. High-resolution display through HDMI input 2. Control EXT devices(DVD/DTV) via Multi Media Touch GUI 3. Adjustablecar-solutions.com screen position of external device 4. Improved Screen Display(user-oriented interface) 5. Mode switching with OEM button 6. Power output for front and rear camera drive 7. Dynamic PAS(parking assistance system) 2 [email protected] car-solutions.com •Components MAIN BOARD POWER CABLE AV CABLE LCD CABLE QCPASS1260 HARETC0298 HAVCAB0060 HLCDCA0017 TOUCH CABLE UART CABLE BUTTON CABLE REMOTE CONTROL HRGBCA0022 HARETC0144 HARETC0001 REMOTE0001 car-solutions.com 3 [email protected] car-solutions.com •DIP Switch Setting ※ ON : DOWN / OFF : UP PIN FUNCTION Dip S/W SELECT OFF : HDMI MODE 1 HDMI ON : HDMI MODE SKIP OFF : LVDS MODE 2 LVDS ON : LVDS MODE SKIP OFF : AV MODE 3 AV ON : AV MODE SKIP OFF: EXT 4 FRONT CAMERA ON: OEM OFF: CITROEN 5 CAR MODEL ON: PEUGEOT 6 N/C OFF : OEM 7 REAR CAMERA ON : EXT 8 N/C ※ Please make sure to disconnect the power cable of the interface and reconnect the power cable again to apply the dip switch setting whenever changing DIP switch. -

Automotive: PSA Peugeot Citroën

Success Story Save time tooling at PSA with OPEN MIND A great many tools have to be created to mass produce quality vehicles, and they have to be flawless. Their quality and cost are key factors in international competi- tion. The skill of the toolmakers and their machine-tool programming have a… ...crucial role to play in meeting these chal- In their search for a solution, Laurent Siffer- lenges. len, head of the process group at PSA (too- ling, CAD/CAM, quality) and Serge Locher The role of the PSA factory’s tool shop in met with Jorge de Carvalho, application en- Mulhouse involves designing and producing gineer at OPEN MIND and writer of the CAD/ aluminium foundry moulds, casting and CAM software hyperMILL®. The management stamping tools for the automotive group. was won over by hyperMILL®’s functionali- The 270 on-site professionals have access ties, ease of handling, its ability to manage to a sizable pool of CNC machines for tack complex paths, as well as its options for welding, drilling, milling and jig grinding. recording personalised macro instructions The increasing performance requirements easily, and saving them. An initial program- mean that methods and resources have to be continuously improved. This rule applies Behind an aluminium mould for casting, Serge equally to the machines’ programming. Locher (on the right) in discussion with Jorge de CAD/CAM programming software appeared Carvalho about the various ways of understan- seven years ago, bringing significant pro- About PSA Peugeot Citroën ding programming with hyperMILL®. ductivity gains. With its three world-renowned brands, Peugeot, Citroën and DS, PSA Peugeot Ci- Meeting, tests and adopting software troën sold 3 million vehicles worldwide in The PSA tool shop in Mulhouse adopted 2014. -

![[Encode Sans 47 Pt Light] on Several Lines LOREM](https://docslib.b-cdn.net/cover/6403/encode-sans-47-pt-light-on-several-lines-lorem-1876403.webp)

[Encode Sans 47 Pt Light] on Several Lines LOREM

CHIEF EXECUTIVE OFFICER Carlos TAVARES Carlos Tavares held various positions within the Renault Group between 1981 and 2004, before joining the Nissan Group. Carlos Tavares was appointed Executive Vice President, Chairman of the Management Committee Americas and President of Nissan North America in 2009, before being appointed as Chief Operating Officer of Renault, a position he held until 2013. Carlos Tavares served as Chairman of the PSA Managing Board from March 31, 2014, having joined the PSA Managing Board on January 1, 2014. He also serves as a director of Airbus Holding S.A., and is a member of the board of directors of the European Automobile Manufacturers’ Association (ACEA). Carlos Tavares was appointed Executive Director of Stellantis with effect from January 17, 2021 and Chief Executive Officer on January 17, 2021. Born in Portugal, Carlos Tavares graduated from École Centrale de Paris. 2021/01/19 Communication Department HEAD OF AMERICAS Mike MANLEY Michael Manley has a deep background in all aspects of global business operations including strategy, business development, commercial, brand, product planning and operational activities. Bringing extensive experience in the international automobile business, Manley joined DaimlerChrysler in 2000 as Director - Network Development (United Kingdom). He was responsible for product planning and all sales activities outside North America, appointed to this position in December 2008. He later served as Executive Vice President - International Sales and Global Product Planning Operations. Manley was the lead executive for the international activities of Chrysler Group outside of North America, where he was responsible for implementing the co-operation agreements for distribution of Chrysler Group products through Fiat’s international distribution network. -

Stellantis Organization

Contact: Shawn Morgan Stellantis Bertrand Blaise Stellantis + 33 6 33 72 61 86 (office) [email protected] Andrea Pallard Stellantis +39 335 873 7298 (office) [email protected] Pierre Olivier Salmon Stellantis +33 6 76 86 45 48 (office) [email protected] Appointment of the Top Executive Team to Steer Stellantis January 19, 2021, Auburn Hills, Mich. - Stellantis is establishing an efficient governance from day one with the appointment of the top executive team,together with the nine dedicated committees covering company-wide performance and strategy.* Carlos Tavares, CEO of Stellantis, said: “This highly competitive, committed and well-balanced team will leverage its combined skills and diverse backgrounds to guide Stellantis to become a great company.” *Strategy Council, Business Review, Global Program Committee, Industrial Committee, Allocations Committee, Region Committee, Brand Committee, Styling Review, Brand Review Chief Executive Officer - Carlos Tavares Strategic and Performance: Head of Americas: Mike Manley Global Corporate Office: Silvia Vernetti Chief Performance Officer: Emmanuel Delay Chief Software Officer: Yves Bonnefont Chief Affiliates Officer: Philippe de Rovira (sales finance, used cars, parts and service, retail network) Region Chief Operating Officers: Enlarged Europe: Maxime Picat Deputy: Davide Mele Eurasia: Xavier Duchemin North America: Mark Stewart South America: Antonio Filosa Middle East and Africa: Samir Cherfan China: Grégoire Olivier (interim, in charge of DPCA) -

Video Interface for Citroen, Opel, Peugeot, Toyota Manual

Video Interface Compatible with Citroen, Peugeot and Toyota vehicles with NAC or RCC infotainment Opel vehicles with Navi 5.0 (NAC low) ProductCar-Solutions.com features Video-inserter for factory infotainment systems 2 CVBS video-inputs for after-market devices (e.g. DVD-Player, DVB-T tuner) 1 Rear-view camera CVBS video-input Automatic switching to rear-view camera input on engagement of reverse gear Activatable parking guide lines for the rear-view camera (not available for all vehicles) Video-in-motion in drive mode (ONLY for connected video-sources) Video-inputs PAL and NTSC compatible Version 31.01.2019 [email protected] car-solutions.com Contents 1. Prior to installation 1.1. Delivery contents 1.2. Checking the compatibility of vehicle and accessories 1.3. Warning notes 1.4. Connection Video-Interface 1.5. Settings of the 8 Dip switches (black) 1.5.1. Enabling the interface’s video inputs (dip 2-3) 1.5.2. Rear-view camera setting (dip 5) 1.5.3. Choosing the corresponding head unit version 1.6. Settings of the 4 Dip switches (CAN function – red) 2. Installation 2.1. Place of installation – video interface 2.2. Connection schema 2.3. Connection to the head-unit 2.3.1. Connection LVDS – video interface 2.3.1.1. High version head unit (2 X 4 PIN HSD) 2.3.1.2. Low version head unit (1 X 4 PIN HSD) 2.3.2. Connection to the head-unit – Power / CAN 2.4. Connecting video sources 2.4.1. Video-sources to Video IN1 and Video IN2 2.4.2. -

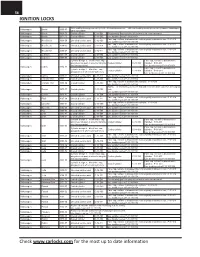

IGNITION LOCKS Check for the Most Up

56 IGNITION LOCKS With locking steering column try C-00-101 described above. With non-locking steering column try classic Volkswagen Volkswagen Beetle 1960-67 parts specialists. Volkswagen Beetle 1968-70 Coded cylinder C-31-101 Disassembly and rekeying of this lock is not recommended. Volkswagen Beetle 1971-79 Coded cylinder C-31-102 Use tumbler series P-31-201/204 Face cap, remove to disassemble lock originally installed on car: P-31-615 Volkswagen New Beetle 1998-03 Uncoded service pack C-12-108 Use tumbler series P-31-171/178 Face cap, remove to disassemble lock originally installed on car: P-31-612 Volkswagen New Beetle 2004-05 Uncoded service pack C-12-110 Use tumbler series P-31-171/178 Face cap, remove to disassemble lock originally installed on car: P-31-614 Volkswagen New Beetle 2006-07 Uncoded service pack C-12-111 Use tumbler series P-31-171/178 Volkswagen Cabriolet 1981-87 Coded cylinder C-31-104 Use tumbler series P-31-101/104 Volkswagen Cabriolet 1988-93 Coded cylinder C-31-108 Use tumbler series P-31-101/104 Cylinder design 1: chrome face cap, Face cap, remove to disassemble plug does not push in when turning the Coded cylinder C-31-110 cylinder: P-31-611 key (more popular) Use tumbler series P-31-151/154 Volkswagen Cabrio 1994-99 Face cap, remove to disassemble Cylinder design 2: black face cap, Coded cylinder C-31-109 cylinder: P-31-610 plug pushes in when turning the key Use tumbler series P-31-151/154 Volkswagen Cabrio 1999-02 Uncoded service pack C-31-112 Use tumbler series P-31-171/178 Volkswagen Corrado G60 1989 Coded cylinder C-31-108 Use tumbler series P-31-101/104 Face cap, remove to disassemble cylinder: P-31-610 Volkswagen Corrado G60 1990-94 Coded cylinder C-31-109 Use tumbler series P-31-151/154 NOTE: In emergency use C-31-104 and reuse the drive cam from the original Volkswagen Dasher 1973-77 Coded cylinder C-31-105 lock. -

STELLANTIS N.V. (Translation of Registrant’S Name Into English)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _______________________________ FORM 6-K _______________________________ REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934 For the month of January 2021 Commission File No. 001-36675 _______________________________ STELLANTIS N.V. (Translation of Registrant’s Name Into English) _______________________________ Singaporestraat 92-100 1175 RA Lijnden the Netherlands Tel. No.: +31 20 3421 707 (Address of Principal Executive Offices) _______________________________ Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1): Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(7): The following exhibit is furnished herewith: Exhibit 99.1 Press release issued by Stellantis N.V. dated January 16, 2021. Exhibit 99.2 Press release issued by Stellantis N.V. dated January 17, 2021. Exhibit 99.3 Press release issued by Stellantis N.V. dated January 19, 2021. Exhibit 99.4 Press release issued by Stellantis N.V. dated January 19, 2021. SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: January 19, 2021 STELLANTIS N.V. By: /s/ Richard K. -

Carlos Tavares Presents PSA Peugeot Citroen's Strategy at the French National Assembly<PEUP.PA>

Carlos Tavares Presents PSA Peugeot Citroen's Strategy at the... http://uk.reuters.com/article/2015/04/15/psa-peugeot-citron-... EDITION: UK SIGN IN REGISTER Search Reuters HOME BUSINESS MARKETS WORLD UK TECH MONEY OPINION BREAKINGVIEWS SPORT LIFE PICTURES VIDEO Landing | Wed Apr 15, 2015 11:59am BST Carlos Tavares Presents PSA Peugeot Citroen's Strategy at the French National Assembly Carlos Tavares Presents PSA Peugeot Citroen's Strategy at the French National ADVERTISEMENT Assembly TRENDING ON REUTERS Regulatory News: Senior Iranian Revolutionary Guards On 15 April, at a French National Assembly hearing before the Economic Affairs and general killed in Syria - IRGC 1 Sustainable Development committees, Carlos Tavares, Chairman of the PSA Peugeot Islamic State closes in on city of Aleppo Citroën (Paris:UG) Managing Board, took the floor to reaffirm the Group's strategy. in Syrian fighting | 2 In so doing, he referred to the main drivers of the Group's financial reconstruction: NASA Mars rover finds clear evidence for ancient, long-lived lakes 3 Three different, yet complementary brands. A targeted product strategy. Europe needs better relations with Russia Profitable global growth regions. - Juncker 4 Carlos Tavares reiterated that he aims to improve the company's financial performance by focusing on manufacturing excellence and, at the same time, ensure it remains a major Businesses, MPs launch 'Vote Leave' campaign to push for Brexit 5 industry player in France. Repeating the message he gave at an initial hearing in July 2014, he reaffirmed the Group's commitment to proposing sustainable, clean mobility solutions, notably through: Sponsored Financial Content (?) – The development of innovative, high-performance technologies for the vehicle of the What does US non-farm payroll actually tell us? Saxo Markets future, such as rechargeable hybrids and electric cars.