Land Value Is a Progressive and Efficient Property Tax Base: Evidence from Victoria

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Proposal for a Simple Average-Based Progressive Taxation System

A proposal for a simple average-based progressive taxation system DIRK-HINNERK FISCHER, Ph.D.* SIMONA FERRARO, Ph.D.* Preliminary communication** JEL: H21, H24 https://doi.org/10.3326/pse.43.2.2 * We would like to thank the participants of the FairTax special session of the conference “Enterprise and Competitive Environment 2017” for their comments on a draft of this paper. We would also like to thank Ton Notermans of Tallinn University of Technology for his advice on the paper as well as the two anonymous referees. ** Received: January 9, 2019 Accepted: April 1, 2019 Dirk-Hinnerk FISCHER Tallinn University of Technology, Akadeemia tee 3, 12611 Tallinn, Estonia e-mail: [email protected] ORCiD: 0000-0002-1040-8347 Simona FERRARO Tallinn University of Technology, Akadeemia tee 3, 12611 Tallinn, Estonia e-mail: [email protected] ORCiD: 0000-0001-5175-5348 Abstract 142 This paper is a first theoretical presentation of a simple progressive taxation sys- tem. The system is based on two adaptations of one easily calculable formula that is based on the societal average income of the previous year. The system contrib- utes to academic discussions as it is a novel approach. It is a progressive tax that 43 (2) 141-165 (2019) ECONOMICS PUBLIC does not discriminate against anyone as the progression increases continuously SECTOR and the increase in tax payment does not go beyond the additional income. The analysis in the paper shows that the core advantage of the system is its simple, transparent and adaptable mechanism. Keywords: taxation, flat tax, progressive tax, taxation efficiency 1 INTRODUCTION A DIRK PROPOSAL Complicated taxation systems do not only lead to a significant increase in admin- - HINNERK istrative costs for all parties involved, but they can also lead to unjustified tax FOR exemptions and loopholes. -

Regressive Sin Taxes

NBER WORKING PAPER SERIES REGRESSIVE SIN TAXES Benjamin B. Lockwood Dmitry Taubinsky Working Paper 23085 http://www.nber.org/papers/w23085 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 January 2017 We thank Hunt Allcott, Alan Auerbach, Raj Chetty, Stefano DellaVigna, Emmanuel Farhi, Xavier Gabaix, Nathaniel Hendren, Louis Kaplow, David Laibson, Erzo F.P. Luttmer, Matthew Rabin, Alex Rees-Jones, Emmanuel Saez, Jim Sallee, Florian Scheuer, Stefanie Stantcheva, Matthew Weinzierl, and participants at seminars and conferences for helpful comments and discussions. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2017 by Benjamin B. Lockwood and Dmitry Taubinsky. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Regressive Sin Taxes Benjamin B. Lockwood and Dmitry Taubinsky NBER Working Paper No. 23085 January 2017 JEL No. H0,I18,I3,K32,K34 ABSTRACT A common objection to “sin taxes”—corrective taxes on goods like cigarettes, alcohol, and sugary drinks, which are believed to be over-consumed—is that they fall disproportionately on low-income consumers. This paper studies the interaction between corrective and redistributive motives in a general optimal taxation framework. On the one hand, redistributive concerns amplify the corrective benefits of a sin tax when sin good consumption is concentrated on the poor, even when bias and demand elasticities are constant across incomes. -

An Analysis of the Graded Property Tax Robert M

TaxingTaxing Simply Simply District of Columbia Tax Revision Commission TaxingTaxing FairlyFairly Full Report District of Columbia Tax Revision Commission 1755 Massachusetts Avenue, NW, Suite 550 Washington, DC 20036 Tel: (202) 518-7275 Fax: (202) 466-7967 www.dctrc.org The Authors Robert M. Schwab Professor, Department of Economics University of Maryland College Park, Md. Amy Rehder Harris Graduate Assistant, Department of Economics University of Maryland College Park, Md. Authors’ Acknowledgments We thank Kim Coleman for providing us with the assessment data discussed in the section “The Incidence of a Graded Property Tax in the District of Columbia.” We also thank Joan Youngman and Rick Rybeck for their help with this project. CHAPTER G An Analysis of the Graded Property Tax Robert M. Schwab and Amy Rehder Harris Introduction In most jurisdictions, land and improvements are taxed at the same rate. The District of Columbia is no exception to this general rule. Consider two homes in the District, each valued at $100,000. Home A is a modest home on a large lot; suppose the land and structures are each worth $50,000. Home B is a more sub- stantial home on a smaller lot; in this case, suppose the land is valued at $20,000 and the improvements at $80,000. Under current District law, both homes would be taxed at a rate of 0.96 percent on the total value and thus, as Figure 1 shows, the owners of both homes would face property taxes of $960.1 But property can be taxed in many ways. Under a graded, or split-rate, tax, land is taxed more heavily than structures. -

Taxation of Land and Economic Growth

economies Article Taxation of Land and Economic Growth Shulu Che 1, Ronald Ravinesh Kumar 2 and Peter J. Stauvermann 1,* 1 Department of Global Business and Economics, Changwon National University, Changwon 51140, Korea; [email protected] 2 School of Accounting, Finance and Economics, Laucala Campus, The University of the South Pacific, Suva 40302, Fiji; [email protected] * Correspondence: [email protected]; Tel.: +82-55-213-3309 Abstract: In this paper, we theoretically analyze the effects of three types of land taxes on economic growth using an overlapping generation model in which land can be used for production or con- sumption (housing) purposes. Based on the analyses in which land is used as a factor of production, we can confirm that the taxation of land will lead to an increase in the growth rate of the economy. Particularly, we show that the introduction of a tax on land rents, a tax on the value of land or a stamp duty will cause the net price of land to decline. Further, we show that the nationalization of land and the redistribution of the land rents to the young generation will maximize the growth rate of the economy. Keywords: taxation of land; land rents; overlapping generation model; land property; endoge- nous growth Citation: Che, Shulu, Ronald 1. Introduction Ravinesh Kumar, and Peter J. In this paper, we use a growth model to theoretically investigate the influence of Stauvermann. 2021. Taxation of Land different types of land tax on economic growth. Further, we investigate how the allocation and Economic Growth. Economies 9: of the tax revenue influences the growth of the economy. -

Horizontal Equity Effects in Energy Regulation

NBER WORKING PAPER SERIES HORIZONTAL EQUITY EFFECTS IN ENERGY REGULATION Carolyn Fischer William A. Pizer Working Paper 24033 http://www.nber.org/papers/w24033 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 November 2017, Revised July 2018 Previously circulated as "Equity Effects in Energy Regulation." Carolyn Fischer is Senior Fellow at Resources for the Future ([email protected]); Professor at Vrije Universiteit Amsterdam; Marks Visiting Professor at Gothenburg University; Visiting Senior Researcher at Fondazione Eni Enrico Mattei; and CESifo Research Network Fellow. William A. Pizer is Susan B. King Professor of Public Policy, Sanford School, and Faculty Fellow, Nicholas Institute for Environmental Policy Solutions, Duke University ([email protected]); University Fellow, Resources for the Future; Research Associate, National Bureau of Economic Research. Fischer is grateful for the support of the European Community’s Marie Sk odowska–Curie International Incoming Fellowship, “STRATECHPOL – Strategic Clean Technology Policies for Climate Change,” financed under the EC Grant Agreement PIIF-GA-2013-623783. This work was supported by the Alfred P. Sloan Foundation, Grant G-2016-20166028. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2017 by Carolyn Fischer and William A. Pizer. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. -

Ecotaxes: a Comparative Study of India and China

Ecotaxes: A Comparative Study of India and China Rajat Verma ISBN 978-81-7791-209-8 © 2016, Copyright Reserved The Institute for Social and Economic Change, Bangalore Institute for Social and Economic Change (ISEC) is engaged in interdisciplinary research in analytical and applied areas of the social sciences, encompassing diverse aspects of development. ISEC works with central, state and local governments as well as international agencies by undertaking systematic studies of resource potential, identifying factors influencing growth and examining measures for reducing poverty. The thrust areas of research include state and local economic policies, issues relating to sociological and demographic transition, environmental issues and fiscal, administrative and political decentralization and governance. It pursues fruitful contacts with other institutions and scholars devoted to social science research through collaborative research programmes, seminars, etc. The Working Paper Series provides an opportunity for ISEC faculty, visiting fellows and PhD scholars to discuss their ideas and research work before publication and to get feedback from their peer group. Papers selected for publication in the series present empirical analyses and generally deal with wider issues of public policy at a sectoral, regional or national level. These working papers undergo review but typically do not present final research results, and constitute works in progress. ECOTAXES: A COMPARATIVE STUDY OF INDIA AND CHINA1 Rajat Verma2 Abstract This paper attempts to compare various forms of ecotaxes adopted by India and China in order to reduce their carbon emissions by 2020 and to address other environmental issues. The study contributes to the literature by giving a comprehensive definition of ecotaxes and using it to analyse the status of these taxes in India and China. -

PROGRESSIVE TAX REVENUE RAISERS HI TAX FAIRNESS January 2021

YES PROGRESSIVE TAX REVENUE RAISERS HI TAX FAIRNESS January 2021 www.hitaxfairness.org HAWAI‘I CAN PULL ITS ECONOMY OUT OF RECESSION BY USING TAX FAIRNESS MEASURES TO RAISE REVENUE & AVOID CUTS As Hawai‘i’s leaders head into 2021 Revenue Proposal Revenue Estimate while facing high unemployment (Millions) rates, an economic recession, and state budget shortfalls, it’s important Low High to keep in mind that deep government Raise income taxes on the richest 2% $12.6 $100.2 spending cuts would have a devastating effect on our already Phase out low tax rates $18.5 $153.9 injured economy, as well as hobble for those at the top social services that have become more and more essential during the Tax investments the same way $80.2 $80.2 pandemic crisis. regular income is taxed That’s because spending is the fuel Increase taxes on wealthy inheritances $6.6 $18.3 that keeps our economic engines running. As the private sector Raise corporate taxes $2.9 $103.0 engine of our economy sputters, the government needs to throttle Make global corporations pay taxes $38.0 $38.0 up its spending in order to keep the in Hawai‘i economy going. Past recessions have Make REITs pay their fair share of taxes $30.0 $60.0 shown us that state spending cuts just exacerbate the economic damage. Increase taxes on the sales of mansions $17.0 $71.5 At this crucial time, cutting government spending would be akin Tax vaping and increase $21.1 $24.1 to taking our foot off the pedal and other tobacco taxes letting the second engine of the Place a fee on sugary drinks $65.8 $65.8 economy sputter as well. -

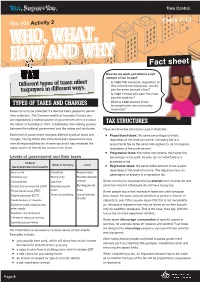

WHO, WHAT, HOW and WHY Fact Sheet

Ta x , Super+You. Take Control. Years 7-12 Tax 101 Activity 2 WHO, WHAT, HOW AND WHY Fact sheet How do we work out what is a fair amount of tax to pay? • Is it fair that everyone, regardless of Different types of taxes affect their income and expenses, should taxpayers in different ways. pay the same amount of tax? • Is it fair if those who earn the most pay the most tax? • What is a fair amount of tax TYPES OF TAXES AND CHARGES for people who use community resources? Taxes can only be collected if a law has been passed to permit their collection. The Commonwealth of Australia Constitution Act established a federal system of government when it created TAX STRUCTURES the nation of Australia in 1901. It distributes law-making powers between the national government and the states and territories. There are three tax structures used in Australia: Each level of government imposes different types of taxes and Proportional taxes: the same percentage is levied, charges. During World War II the Australian Government took regardless of the level of income. Company tax is a over all responsibilities for income tax and it has remained the proportional tax as the same rate applies for all companies, major source of federal tax revenue ever since. regardless of the profit earned. Progressive taxes: the higher the income, the higher the Levels of government and their taxes percentage of tax paid. Income tax for individuals is a Federal progressive tax. State or territory Local (Australian/Commonwealth) Regressive taxes: the same dollar amount of tax is paid, regardless of the level of income. -

Co-Op Profits and Equity Basics Mid Iowa Cooperative Associate Board Program Conrad, Iowa February 13, 2018

Extension and Outreach / Department of Economics Co-op Profits and Equity Basics Mid Iowa Cooperative Associate Board Program Conrad, Iowa February 13, 2018 Keri L. Jacobs, Assistant Prof & Extension Economist Iowa Institute for Cooperatives Endowed Economics Professor HISTORY Extension and Outreach / Dept. of Economics The Problem • Railroad movement (1840s – 1870s) led to rapid expansion and fueled the industrial revolution • Farmers were largely left behind o little representation in Washington D.C. o no mechanism for organizing formally Producers had no way to be on even footing with their trade partners, and no options. Extension and Outreach / Dept. of Economics The Solutions Beginning in 1850s, farmer associations began to form, but these came under attack. • Sherman Antitrust Legislation, 1890 • Clayton Act, 1914 It wasn’t until 1922 that producers could form organizations to act collectively, legally. • Capper-Volstead Act Extension and Outreach / Dept. of Economics Capper-Volstead Requirements o One member one vote OR limit dividends on non- farmer equity to 8% o Member business must be greater than non- member business (2016: 88% member business) o All voting members must be agricultural producers o Association must operate for the benefits of its members Allows producers to organize voluntarily to produce, handle, and market farm products to improve their terms of trade. Extension and Outreach / Dept. of Economics In Iowa • IA’s first co-op statute was 1915, current version is 1935. • Chapter 499 is primarily used (Mid Iowa is a 499 co-op organized in 1907 – perpetual stock company) • Gives producer organizations the authority to engage in “any lawful purpose” and to exercise any power “suitable or necessary, or incident to, accomplishing any of its powers” • Can have voting and non-voting members • Voting rights limited to persons “engaged in producing a product marketed by the co-op; or who use the supplies, services or commodities handled by the coop”. -

Horizontal Equity As a Principle of Tax Theory

Horizontal Equity as a Principle of Tax Theory David Elkinst I. INTRODUCTION The principle of horizontal equity demands that similarly situated individuals face similar tax burdens.1 It is universally accepted as one of the more significant criteria of a "good tax." It is relied upon in discussions of the tax base, 2 the tax unit,.3 the reporting period, 45 and more.5 Violation of horizontal t Lecturer, School of Law, Netanya College, Israel. Visiting Professor of Law, Southern Methodist University. Ph.D., Bar-Ilan University 1999; LL.M., Bar-Ilan University 1992; LL.B., Hebrew University of Jerusalem 1982. This Article is based upon a doctoral thesis submitted to the University of Bar-Ilan. I wish to thank David Gliksberg of the Hebrew University of Jerusalem Faculty of Law and Daniel Statman of the Haifa University Department of Philosophy for their invaluable comments. Any errors that remain are, of course, my own responsibility. 1. Cf THOMAS HOBBES, LEVIATHAN 238 (Richard Tuck ed., Cambridge Univ. Press 1996) (1651) ("To Equall Justice, appertaineth also the Equall imposition of Taxes."); JOHN STUART MILL, PRINCIPLES OF POLITICAL ECONOMY 155 (Donald Winch ed., Penguin Books 1970) (1848) ("For what reason ought equality to be the rule in matters of taxation? For the reason, that it ought to be so in all affairs of government."); see also HENRY SIDGWICK, THE PRINCIPLES OF POLITICAL ECONOMY 562 (London, MacMillan 1883). However, references to equality made before the twentieth century were generally in the context of what is referred to today as vertical equity, the principles by which the tax burden should be spread out over the entire population. -

SUGARY DRINK TAXES: How a Sugary Drink Tax Can Benefit Rhode Island

SUGARY DRINK TAXES: how a sugary drink tax can benefit Rhode Island As of now, seven cities across the nation have successfully implemented sugar-sweetened beverage (SSB) taxes, also known as sugary drink taxes. Evaluations of these taxes not only show the important health benefits of adopting this tax but shed light on the best strategies for implementation of this policy. Below are some valuable findings from the cities that have implemented SSB taxes and how this data can be used to implement the tax in Rhode Island. How do SSB taxes impact health? Currently, SSBs are the leading source of added sugar in the American diet and there is extensive evidence showing an association between these beverages and an increased risk of type 2 diabetes, cardiovascular disease, dental caries, osteoporosis, and obesity.1 Yet, multiple cities that have implemented the SSB tax have seen downward trends in the consumption of SSBs that could lead to improved health outcomes and greater healthcare savings.1 Three years after implementing the tax, Berkeley saw a 50% average decline in SSB consumption with an increase in water consumption. Similarly, in Philadelphia, the probability of consuming regular soda fell by 25% and the intake of water rose by 44% only six months after the tax was effective.2 Philadelphia adults who typically consumed one regular soda per day before the tax transitioned to drinking soda every three days after the tax.2 This shift in behavior has very important health implications; SSB taxes are linked with a significant reduction in the incidence of cardiovascular diseases and with a decrease in BMI and body weight. -

Issuespaper the Impact of Selective Food and Non-Alcoholic Beverage Taxes

International Tax and Investment Center June 2016 IssuesPaper The Impact of Selective Food and Non-Alcoholic Beverage Taxes A report by: International Tax and Investment Center Oxford Economics The International Tax and Investment Center (ITIC) Oxford Economics (OE) was founded in 1981 as a is an independent, nonprofit research and education commercial venture with Oxford University’s business organization founded in 1993 to promote tax reform college to provide economic forecasting and modelling and public-private initiatives to improve the investment to UK companies and financial institutions expanding climate in transition and developing economies. abroad. Since then, OE has become one of the world’s foremost independent global advisory firms, providing With a dozen affiliates and offices around the world, ITIC reports, forecasts and analytical tools on 200 countries, works with ministries of finance, customs services and 100 industrial sectors and over 3,000 cities. tax authorities in 85 countries, as well as international and regional financial institutions working on tax policy Headquartered in Oxford, England, with a dozen offices and tax administration issues. ITIC’s analytic agenda, across the globe, OE employs over 250 full-time people, global thematic initiatives, regional fiscal forums, and including more than 150 professional economists, capacity-building efforts are supported by nearly 100 industry experts and business editors—one of the largest corporate sponsors. teams of macroeconomists and thought leadership specialists producing econometric modelling, scenario framing, and economic impact analysis. Oxford Economics is a key adviser to corporate, financial and government decision-makers and thought leaders, with a client base of more than 1000 international organisations, including leading multinational companies and financial institutions; key government bodies and trade associations; and top universities, consultancies, and think tanks.