2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Asked Questions on What Is Pesonet?

Frequently Asked Questions on What is PESONet? PESONet is a new electronic fund transfer service that enables customers of participating banks, e- money issuers or mobile money operators to transfer funds in Philippine Peso currency to another customer of other participating banks, e-money issuers or mobile money operators in the Philippines. It is more inclusive platform for Electronic Fund Transfers which will make G2B(Government-to- Business) and G2C(Government-to-Consumer) payments more practical, convenient, fast, and secure. What is the purpose of PESONet? Through PESONet, businesses, government, and individuals will be able to conveniently pay or transfer funds from their account to one or multiple recipient accounts in other financial institutions. PESONet is the perfect alternative to the still widely used paper-based check system. What are the features of PESONet? What are the uses of PESONet? How does PESONet work? Customers instruct their financial institution to send credit instructions to other financial institutions via online banking, mobile banking or over-the-counter transaction. They need to provide the payees’ financial institution, account number, and amount. The credit instruction is transmitted by the financial institution to the clearing switch operator, which currently is the Philippine Clearing House Corporation (PCHC). The funds are settled in the respective financial institutions demand deposit accounts held in Bangko Sentral ng Pilipinas (BSP) through BSP’s Philippine Payments and Settlement System (PhilPaSS). Upon settlement, the beneficiary’s or payee’s financial institution will credit the payee's account. How long does it take to transfer funds via PESONet? The availability of funds to the receiving account shall depend on the facility used to carry out your transaction. -

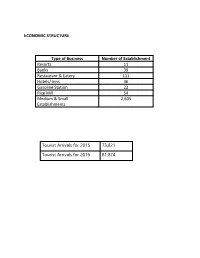

Economic Structure

ECONOMIC STRUCTURE Type of Business Number of Establishment Resorts 11 Banks 39 Restaurant & Eatery 111 Hotels/ Inns 46 Gasoline Station 22 Rice Mill 54 Medium & Small 2,605 Establishments Tourist Arrivals for 2015 73,821 Tourist Arrivals for 2016 81,874 List of Banks with ATM & Offsite ATM NO. NAME OF BANKS LOCATION With ATM ATM Offsi 1 Agri Business Rural Bank Camilmil 1 2 Asia United Bank San Vicente 1 3 Banco Alabang (A Rural Bank) San Vicente West 4 Banco de Mindoro ( A Rural Bank) Ibaba East 5 Banco de Oro Unibank Inc. San Vicente East 2 6 Banco de Oro Unibank Inc. Camilmil 2 7 Bank of Commerce San Vicente 1 8 Bank of Makati Lumangbayan 9 Bank of the Phil. Islands San Vicente East 2 10 Bank of the Phil. Islands Camilmil 3 11 Card Bank, Inc. Comunal 12 Card Bank, Inc. Sta. Isabel 13 Card Bank, Inc. Bucayao 14 Card Bank, Inc. Biga 15 Card Bank, Inc. Comunal 16 Card Rural Bank, Inc. Ilaya 1 17 China Banking Corp. San Vicente South 1 18 City Savings Bank, Inc. Camilmil 1 19 Country Bank San Vicente North 20 Development Bank of the Phils. Sto. Nino 1 1 21 East West Banking Corp San Vicente South 1 22 First Consolidated Bank San Vicente South 1 23 Land Bank of the Phils. Sto. Nino 3 4 24 Maybank Philippines, Inc San Vicente South 1 25 Metrobank San Vicente 2 2 26 Metrobank Lalud 1 27 Microfinance Savings Bank Ibaba East 28 Robinson's Bank Corp Lumangbayan 1 29 Philippine Business Bank San Vicente East 1 30 Philippine National Bank Camilmil 1 31 PNB Savings Bank San Vicente West 1 32 RCBC Savings Bank Camilmil 1 1 33 Rural Bank of Baco San Vicente 34 Rural Bank of Pinamalayan, Inc. -

Remittance Bank List of Philippines Bank Name

Remittance Bank List of Philippines Bank Name AL AMANAH ISLAMIC INVESTMENT BANK ALLBANK ANZ BANK ASIA UNITED BANK BANK OF AMERICA BANK OF CHINA BOF, INC (A Rural Bank) - (BANK OF Florida) BANGKOK BANK PUBLIC CO LTD BDO - BANCO DE ORO BDO NETWORK BANK BDO PRIVATE BANK BOC - BANK OF COMMERCE BPI - BANK OF THE PHILIPPINE ISLANDS BPI FAMILY BANK BPI DIRECT BANKO CAMALIG BANK, INC (A Rural Bank) CEBUANA LHUILLIER RURAL BANK INC CHINA BANK CHINA BANK SAVINGS CTBC BANK ( FORMER CHINA TRUST) CIMB BANK PHILIPPINES, INC. CITIBANK DBP - DEVELOPMENT BANK OF THE PHILIPPINES DEUTSCHE BANK DUNGGANON BANK EAST WEST BANK EASTWEST RURAL BANK EQUICOM SAVINGS BANK INC FIRST CONSOLIDATED BANK HSBC - HONGKONG AND SHANGHAI BANKING CORPORATION HSBC SAVINGS BANK INDUSTRIAL BANK OF KOREA ING BANK N.V. ISLA BANK INC. KEB HANA (Korea Exchange Bank) JP MORGAN CHASE BANK LBP - LAND BANK OF THE PHILIPPINES MALAYAN BANK SAVINGS AND MORTGAGE BANK INC (MALAYAN SVGS) MAYBANK PHILIPPINES INC (PNB Republic) MEGA INTL COMML BANK CO LTD (ICBC) MIZUHO BANK LTD (FUJI BANK) MUFG BANK LTD (BANK OF TOKYO) PARTNER RURAL BANK (COTABATO) INC PBCOM - PHILIPPINE BANK OF COMMUNICATIONS PHIL BUSINESS BANK PHILIPPINE VETERANS BANK PHILTRUST CO (Philtrust Bank) PNB - PHILIPPINE NATIONAL BANK (Allied Bank) PRODUCERS SAVINGS BANK CORP PSBANK - PHILIPPINE SAVINGS BANK QUEZON CAPITAL RURAL BANK INC RCBC - RIZAL COMMERCIAL BANKING CORPORATION ROBINSONS BANK CORPORATION RURAL BANK OF GUINOBATAN INC (RBGI) SECURITY BANK CORPORATION SHINHAN BANK STERLING BANK OF ASIA SUMITOMO MITSUI BANKING CORP SUN SAVINGS BANK INC THE STANDARD CHARTERED BANK UCPB - UNITED COCONUT PLANTERS BANK UCPB SAVINGS BANK UNION BANK OF THE PHILIPPINES (City Savings Bank) UNITED OVERSEAS BANK PHILIPPINES WEALTH DEVELOPMENT BANK YUANTA SAVINGS BANK PHILS INC (Tongyang) . -

Annual Report 2017

ANNUAL REPORT 2017 METRO CEBU PUBLIC SAVINGS BANK Email: [email protected] Address: Sia Bldg., N. Bacalso Ave., Brgy. Duljo Fatima, Cebu City Tel No.: 231-4043 / 231-3923 2 CONTENTS CORPORATE POLICY______________________________________________________ 3 Vision __________________________________________________________________ 3 Mission _________________________________________________________________ 3 Company Profile __________________________________________________________ 4 A MESSAGE FROM THE PRESIDENT _________________________________________ 5 Financial Highlights 2017 ___________________________________________________ 7 Financial Summary ______________________________________________________ 10 RISK MANAGEMENT FRAMEWORK __________________________________________11 Overall Risk Management Culture and Philosophy ______________________________ 11 AML Governance and Culture ______________________________________________ 12 CORPORATE GOVERNANCE _______________________________________________ 13 Governance Structure ____________________________________________________ 13 Chairman of the Board of Directors __________________________________________ 14 Board Composition_______________________________________________________ 15 THE BOARD OF DIRECTORS _______________________________________________ 16 Board Committees, Membership and Functions __________________________________ 21 Directors’ Attendance at Board and Committee Meetings __________________________ 27 List of Executive Officers ____________________________________________________ -

Annual Report 2008

ANNUAL STOCKHOLDERS’ MEETING Message from the Chairman April 21, 2018 The outlook for the global economy is cautiously optimistic. The largest economies are doing well; however, the interest rate is too low in many countries, leaving central banks without much leeway to cut interest rates in case of a need to stimulate their economies. Central banks have stopped their quantitative easing programs and are now biased towards increasing rates or utilizing tighter economic policies. The most serious threat to the global economy is a trade war. The US economy remains strong, with the dollar increasing in value and unemployment returning to pre-crisis levels. The Federal Reserve raised interest rates by 1/4 % in March 2018, and is expected to increase rates two more times this year. The increase in US rates places pressure on emerging markets, as hot money flows back towards developed economies. In line with increasing rates and rising inflation, there is the possibility of a steeper market correction some time in the next few years, as valuations appear too high compared to the underlying company fundamentals. We can expect that international trade will also evolve, as President Trump applies his brute force tactics to advance his America First policy. China continues with its shift from a manufacturing-driven economy to consumption-led, in order to boost growth. Debt levels in China, as well as non- performing loan levels, remain a concern—but President Xi is aggressively managing his deleveraging campaign, having imposed over 2.9 billion yuan in penalties and confiscations of funds on over 1,000 financial institutions. -

FIRST BATCH – 19 June ‐ 15 July 2017

FIRST BATCH – 19 June ‐ 15 July 2017 1 ROBINSONS BANK CORPORATION 97 BDO LEASING & FINANCE INC 2 CTBC BANK (PHILIPPINES) CORP 98 LBP LEASING CORPORATION 3 JP MORGAN CHASE BANK NATIONAL ASSN. 99 ALLIED LEASING & FINANCE CORP 4 KEB HANA BANK ‐ MANILA BRANCH 100 UCPB LEASING AND FINANCE CORP 5 MAYBANK PHILIPPINES INCORPORATED 101 BPI CENTURY TOKYO LEASE & FIN CORP 6 MEGA INT'L COMM'L BANK CO LTD 102 DBP LEASING CORPORATION 7 UNITED OVERSEAS BANK LIMITED MANILA 103 CITIFINANCIAL CORPORATION 8 EQUICOM SAVINGS BANK INC 104 CITICORP FINL SERV & INS BROKE PHIL 9 WORLD PARTNERS BANK (A THRIFT BANK) 105 EAST WEST LEASING AND FINANCE CORP 10 BANK ONE SAVINGS AND TRUST CORP. 106 PNB HOLDINGS CORPORATION 11 CENTURY SAVINGS BANK CORPORATION 107 DBP DAIWA SECURITIES CAPITAL MARKET 12 SUN SAVINGS BANK INC 108 FIRST METRO SEC BROKERAGE CORP 13 STERLING BANK OF ASIA INC (A SB) 109 BDO NOMURA SECURITIES INC 14 PNB SAVINGS BANK 110 RCBC SECURITIES INC 15 PACIFIC ACE SAVINGS BANK INC 111 AB CAPITAL SECURITIES INC 16 ISLA BANK(A THRIFT BANK) INC 112 BDO SECURITIES CORP. 17 MALAYAN BANK SAVINGS AND MORT BANK 113 S B EQUITIES 18 HSBC SAVINGS BANK(PHILS) INC 114 BPI SECURITIES CORP 19 YUANTA SAVINGS BANK PHILIPPINES INC 115 UNICAPITAL SECURITIES INC 20 PHIL POSTAL SAVINGS BANK INC 116 UCPB SECURITIES INC 21 PHIL SAVINGS BANK 117 PNB SECURITIES INC 22 RCBC SAVINGS BANK INC 118 BANCASIA CAPITAL CORPORATION 23 UCPB SAVINGS BANK 119 CHINA BANK CAPITAL CORPORATION 24 PRODUCERS SAVINGS BANK CORPORATION 120 ARMED FORCES AND POLICE SLAI 25 CARD SME BANK INC A THRIFT BANK 121 AIR MATERIEL WING SLA INC 26 PHIL RESOURCES SB CORP (PR SB) 122 ARSENAL SLA, INC. -

PNB Mobile Banking App Faqs for Interbank Funds Transfer Via Pesonet

PNB Mobile Banking App FAQs for Interbank Funds Transfer via PESONet 1. What is PESONet? PESONet is an electronic fund transfer service (via batch processing) that allows depositors to perform non-time sensitive fund transfers to any participating bank (“interbank”) within the Philippines. It is available to retail customers with Peso- denominated savings and current accounts who are enrolled in the PNB Mobile Banking App. PESONet provides a secure, faster and more convenient way to send funds or to settle payments in lieu of cash or checks. TRANSFER RECEIVING FUNDS FUNDS USING BANK CREDITED TO THE PNB MOBILE BENEFICIARY BANKING APP ACCOUNT 2. How do I perform a PESONet transaction using the PNB Mobile Banking App? You will receive notifications in your registered email and mobile numbers when PNB has successfully received your transaction for transmittal to the receiving bank. 3. Is there a cut-off for PESONet Transactions? PESONet is available during banking days, subject to a prescribed cut-off of 2PM for same day transmittal to the receiving bank. Transactions received after cut-off, on holidays or weekends will be processed for transmission to the receiving bank on the next banking day. 4. How much can I transact for PESONet via the PNB Mobile Banking App? You may transfer up to P100,000 per transaction. You can make multiple transactions up to the daily transfer limit of Php600,000 per account. 5. Are there any applicable fees for using PESONet via the PNB Mobile Banking App? A nominal fee of P30 will be charged per transaction. The fee shall be automatically debited from your nominated source account after successful OTP confirmation. -

List of Supervised Financial Institutions with FCDU/EFCDU

BANKS WITH FCDU/EFCDU AUTHORITY as of 31 May 2021 I. UNIVERSAL AND COMMERCIAL BANKS A. EFCDU 1 Al-Amanah Islamic Investment Bank of the Philippines 2 Asia United Bank Corporation 3 Australia and New Zealand Banking Group Limited 4 Bangkok Bank Public Co. Ltd. 5 Bank of America, N.A. 6 Bank of China Limited-Manila Branch 7 Bank of Commerce 8 Bank of the Philippine Islands 9 BDO Unibank, Inc. 10 Cathay United Bank Co., LTD. - Manila Branch 11 Chang Hwa Commercial Bank, Ltd. - Manila Branch 12 China Banking Corporation 13 CIMB Bank Philippines Inc. 14 Citibank, N.A. 15 CTBC Bank (Philippines) Corporation 16 Deutsche Bank AG 17 Development Bank of the Philippines 18 East West Banking Corporation 19 First Commercial Bank, Ltd., Manila Branch 20 Hua Nan Commercial Bank, Ltd. - Manila Branch 21 Industrial and Commercial Bank of China Limited - Manila Branch 22 Industrial Bank of Korea Manila Branch 23 ING Bank N.V. 24 JP Morgan Chase Bank, N.A. 25 KEB Hana Bank - Manila Branch 26 Land Bank of the Philippines 27 Maybank Philippines, Incorporated 28 Mega International Commercial Bank Co., Ltd. 29 Metropolitan Bank and Trust Company 30 Mizuho Bank, Ltd. - Manila Branch 31 MUFG Bank, Ltd. 32 Philippine Bank of Communications 33 Philippine National Bank 34 Philippine Veterans Bank 35 Rizal Commercial Banking Corporation 36 Security Bank Corporation 37 Shinhan Bank - Manila Branch 38 Standard Chartered Bank 39 Sumitomo Mitsui Banking Corporation-Manila Branch 40 The Hongkong & Shanghai Banking Corporation 41 Union Bank of the Philippines 42 United Coconut Planters Bank 43 United Overseas Bank Limited, Manila Branch B. -

28118-01-Landbank-Harvest-Of

HARVEST OF HEROES All rights reserved. No part of this publication may be reproduced or used in any form - graphic, electronic or mechanical - including photocopying, recording, taping or by information storage and retrieval system, without written permission from the publisher. Published by: Land Bank of the Philippines 1598 M.H. Del Pilar cor. Dr. Quintos Sts. Malate, Manila Philippines Design by: OP Communications, Inc. Authored by: Jose Dalisay Contributing writers: Daniel Pineda Glenn Diaz Homer Novicio Om Narayan Velasco Photographs by: Edwin Tuyay Doroteo Palines Michael Mariano HARVEST of HEROES by Jose Dalisay CONTENTS 6 Message from the President of the Philippines 8 Foreword From Countryside to Countrywide: The LANDBANK Story 12 Some Called It Hope A Creation Fable 14 The Bounty of Earth and Water Farmers and Fishers 52 Small Steps to Big Dreams Micro, Small and Medium Enterprises 98 Coming Home to New Hopes Overseas Filipinos 112 All Together Now Cooperatives 174 Fertilizing the Grassroots Rural Banks 196 Partners in Wealth Creation Corporations 214 Hands Across Borders Multilateral/Bilateral Partners 220 LANDBANK Vision/Mission MESSAGE A nation’s progress is borne of interwoven tales of industry, determination, and solidarity. It relates to a broader platform the triumphs of a people whose individual successes created tides of empowerment, cleared the path for development, and collectively attained milestones of greater magnitude. The Harvest of Heroes introduces us to some of these personages and provides us with narratives to emulate as we propel the growth of our regions. May this compilation be a source of inspiration for our citizens, as we maximize the opportunities afforded to us by our resurgence. -

Annual Report 2008

Annual Stockholders’ Meeting Chairman’s Message April 18, 2015 The world economy continues to grow at 3 % for 2015 but remains fragile with Europe, China, Japan and South America needing government stimulus programs to boost their economies. The US is having a strong growth, after years of heavy government support, and is expected to increase interest rates by the 2nd half of 2015. Russia is being isolated due to the Ukraine conflict and the weakening of commodity prices is making the situation even worse. The good news is that Asia continues to perform well. The Philippines remains one of the best performing economies in the world. Economic growth for 2015 is expected at 6%. The reduction of fuel costs further improves the Philippine economy, minimizes the impact of inflation, and provides flexibility for the BSP on monetary policies. The Philippines does have problems which are well known and will take years, if not a decade, to solve. The most important issue is poverty and implementing “inclusive” growth. Another major challenge is the impact of natural disasters, such as typhoons, floods, and earthquakes, and the mitigating measures. The Philippines has the opportunity to be a developed country in 20 years if the proper infrastructure and legislation are implemented thereby resulting in a sustainable and inclusive growth. ASEAN economic integration will have a positive impact on the overall economy of the Philippines. However, there are sectors which will be adversely affected, such as manufacturing and agriculture, and we hope the Philippine government will provide assistance to these sectors. Philippine banking is expected to continue to perform well but needs to face the challenges of competing with international banks and local competitors, both formal and informal. -

Annual Report 2008

ANNUAL STOCKHOLDERS’ MEETING Chairman’s Message April 15, 2017 Globally, the year 2016 was quite a rollercoaster. We saw disruptions to the international political status quo—starting with the Brexit vote and ending with Donald Trump’s victory as US president. These were the results of protest votes, with people blaming problems on immigration and globalization. The new order is slanted towards economic nationalism: re-focusing policies domestically. The global landscape is a complicated one because of such divergent interests. Japan and Europe remain fragile, with negative policy rates. The US, despite its high debt level, continues to improve slowly, with the strengthening dollar, rising interest rates, and low unemployment levels. China is also struggling with burgeoning debt levels, as well as maintaining its growth as it gradually attempts to shift as an export-dependent manufacturer to a consumption-driven economy. As rates increase, funds from emerging markets will continue to flow back to the developed countries. Locally, Filipinos also clamored for change, as the country voted for a non- traditional politician as the new president. President Duterte has begun acting on many campaign promises, among them to cleanse the Philippines of illegal drugs, to reduce government corruption, and to spread the economic wealth beyond Manila. The Philippines continues to be one of the fastest growing economies, but we will need to be wary of the potential impacts of other countries enacting protectionist trade policies. Competition in Philippine banking remains very stiff. Our major competitors persist, and are heavily marketing rates and services against our own. They, along with the universal and commercial banks, also continue to open branches in our service areas. -

General List of Banks of the Philippines

Powers of a universal bank A universal bank has the same powers as a commercial bank with the following additional powers: the powers of an investment house as provided in existing laws and the power to invest in non-allied enterprises. List of local universal banks Government-owned Al-Amanah Islamic Investment Bank of the Philippines Development Bank of the Philippines Land Bank of the Philippines Private-owned 1. Banco de Oro Universal Bank 2. Metropolitan Bank and Trust Company 3. Bank of the Philippine Islands 4. Philippine National Bank 5. Rizal Commercial Banking Corporation 6. UnionBank of the Philippines 7. China Banking Corporation 8. Citibank 9. East West Bank 10. Philippine Savings Bank 11. Philtrust Bank (Philippine Trust Company) 12. Security Bank 13. United Coconut Planters Bank 14. Allied Bank Corporation Powers of a commercial bank In addition to having the powers of a thrift bank, a commercial bank has the power to accept drafts and issue letters of credit; discount and negotiate promissory notes, drafts, bills of exchange, and other evidences of debt; accept or create demand deposits; receive other types of deposits and deposit substitutes; buy and sell foreign exchange and gold or silver bullion; acquire marketable bonds and other debt securities; and extend credit. List of local commercial banks Asia United Bank Bank of Commerce BDO Private Bank (subsidiary of Banco de Oro) Philippine Bank of Communications Philippine Veterans Bank Robinsons Bank Corporation List of foreign banks with commercial banking operations Branches Australia and New Zealand Banking Group Bangkok Bank Bank of America, N.A. Bank of China Chinatrust Commercial Bank Citibank, N.A.