PHILIPPINE PAYMENTS MANAGEMENT, INC. PPMI Members As of February 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Asked Questions on What Is Pesonet?

Frequently Asked Questions on What is PESONet? PESONet is a new electronic fund transfer service that enables customers of participating banks, e- money issuers or mobile money operators to transfer funds in Philippine Peso currency to another customer of other participating banks, e-money issuers or mobile money operators in the Philippines. It is more inclusive platform for Electronic Fund Transfers which will make G2B(Government-to- Business) and G2C(Government-to-Consumer) payments more practical, convenient, fast, and secure. What is the purpose of PESONet? Through PESONet, businesses, government, and individuals will be able to conveniently pay or transfer funds from their account to one or multiple recipient accounts in other financial institutions. PESONet is the perfect alternative to the still widely used paper-based check system. What are the features of PESONet? What are the uses of PESONet? How does PESONet work? Customers instruct their financial institution to send credit instructions to other financial institutions via online banking, mobile banking or over-the-counter transaction. They need to provide the payees’ financial institution, account number, and amount. The credit instruction is transmitted by the financial institution to the clearing switch operator, which currently is the Philippine Clearing House Corporation (PCHC). The funds are settled in the respective financial institutions demand deposit accounts held in Bangko Sentral ng Pilipinas (BSP) through BSP’s Philippine Payments and Settlement System (PhilPaSS). Upon settlement, the beneficiary’s or payee’s financial institution will credit the payee's account. How long does it take to transfer funds via PESONet? The availability of funds to the receiving account shall depend on the facility used to carry out your transaction. -

Updates in the ACGR of PNB

http://edge.pse.com.ph/downloadl Itnrl.do?flle id 28165 | Remarks cR06909-2016 o Please be advised that the information contained herein was previously posted as an emergency submission in the PSE EDGE Portal on October 17 . 2016 at 4:11PM. The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disc/osures, including financial reporls. All data contained herein are prepared and submitted by the disclosing pafty to the Exchange. and are disseminated solely for purposes of information. Any questlons on the data contained herein should be addressed directly to the Corporate lnformation Officer of the disclosing party. @PNB Philippine National Bank PNB PSE Disclosure Form ACGR-2 - Update on Annual Gorporate Governance Report Reference: Revised Code of Corporate Governance of the Securifies and Exchange Commission and SEC Memorandum Circular No. 1 and 12 Series of 2014 Description of the Disclosure ln compliance with SEC Memorandum Circular No. 1 , Series ol 2014, re: Guidelines for Changes and Updates in the Annual Corporate Governance Report (ACGR), we submit herewith the updates in the ACGR of PNB. We trust you will take note accordingly. Thank you. Filed on behalf by: Name Maila Katrrna llarde Designation Corporate Secretary lol'l l0/ I 8i20 l(r | 0:23 n Nl Office of the Corporate Secretary Direct Line: 536-0540 Trunk Lines: 891-6040 to 70 mPNB'() Local: 4106 t+t,4'^tT d*-'1,1 October 17 , 2016 MR. JOSE VALERIANO B. ZUNO III OIC/Head, Disclosure Department Philippine Stock Exchange, Inc. -

2018 Financial Statements

We acknowledge the support and cooperation that Management extended to the Audit Team, thus facilitating the completion of the report. Very truly yours, COMMISSION ON AUDIT Director IV Cluster Director Copy Furnished: The President of the Philippines The Chairperson - Appropriations Committee The Vice President The Secretary of the Department of Budget and Management The President of die Senate The Governance Commission of Government-Owned or Controlled Corporation The Speaker of the House of Representatives The National Library The Chairperson - Senate Finance Committee The UP Law Center Republic of the Philippines COMMISSION ON AUDIT Commonwealth Ave., Quezon City ANNUAL AUDIT REPORT on the OVERSEAS FILIPINO BANK, INC. (A Savings Bank of Landbank) For the years ended December 31, 2018 and 2017 EXECUTIVE SUMMARY INTRODUCTION Overseas Filipino Bank, Inc., A Savings Bank of LANDBANK, formerly known as Philippine Postal Savings Bank, Inc. (PPSBI) is a subsidiary of the Land Bank of the Philippines (LBP). On September 26, 2017, President Rodrigo Duterte issued Executive Order No. 44, which mandates the Philippine Postal Corporation and the Bureau of Treasury to transfer their PPSBI shares to Landbank at zero value. The EO further stated that Postbank will be converted into the Overseas Filipino Bank. On January 5, 2018, the PPSBI registered with the Securities and Exchange Commission the Amended Articles of Incorporation bearing the new corporate name. The Bangko Sentral ng Pilipinas through its Circular Letter No. CL-2018-007 dated January 18, 2018 approved the change of corporate name of the PPSBI to “Overseas Filipino Bank, Inc., a Savings Bank of LANDBANK”. As stated in its Vision, OFBI is a Digital Bank servicing Overseas Filipinos and their Beneficiaries through state-of-the-art Electronic Banking Channels such as Mobile Phone, ATM and Internet which are more convenient, faster (real-time), cheaper and secure, eliminating the need for over-the-counter services. -

2019 ANNUAL REPORT [email protected]

PHILIPPINE DEPOSIT INSURANCE CORPORATION TAKING THE HELM, Philippine Deposit Insurance Corporation SSS Bldg., 6782 Ayala Ave. cor. V.A. Rufino St. ONWARD TO A NEW HORIZON 1226 Makati City, Philippines 2019 ANNUAL REPORT www.pdic.gov.ph [email protected] 1 PHILIPPINE DEPOSIT INSURANCE CORPORATION TAKING THE HELM, Philippine Deposit Insurance Corporation SSS Bldg., 6782 Ayala Ave, cor. V.A. Rufino St. ONWARD TO A NEW HORIZON 1226 Makati City, Philippines 2019 ANNUAL REPORT www.pdic.gov.ph [email protected] CONTENTS 01 Corporate Profile 02 The Philippine Deposit Insurance System 03 Transmittal Letters 06 Chairman’s Message ABOUT THE COVER 08 President’s Report Titled “Taking the Helm, Onward to a New Horizon”, the 2019 15 Corporate Operating Environment Annual Report wraps up another trilogy of PDIC annual reports, from “Changing Horizons” in 2017 and “A New Horizon” in 18 Institutional Governance Framework 2018. The horizon, represented by the ever-evolving financial 22 Strengthening Depositor Protection landscape that PDIC navigates, is full of challenges, and the Corporation continues to face it head on. The PDIC is undeterred 36 Ensuring Good Governance by the currents and is committed to create ripples of positive 50 Promoting Financial Stability change in the service of its clients and stakeholders. 68 Financial Performance The organization’s readiness and earnest desire to serve 74 Corporate Direction for 2020 is communicated through this year’s cover design -- young professionals take determined strides towards the rising sun, 78 Board of Directors embodying confidence that the PDIC is in the right direction to 86 Executive Committee accomplish its Vision to be a leading institution in depositor 87 Group Heads protection recognized for its operational excellence that is responsive to the changing times. -

Updated 2018 GLMS Compliance Status Data Presented Is Based from the Goccs’ Compliance As of 06 December 2019 Updated 2018 GLMS Compliance Status

Updated 2018 GLMS Compliance Status Data presented is based from the GOCCs’ Compliance as of 06 December 2019 Updated 2018 GLMS Compliance Status 30 GOCC SECTOR COMPLIANT NON-COMPLIANT Government Financial 25 2 25 Institutions Trade, Area Development 15 2 and Tourism 20 Education and Cultural 3 1 Gaming 1 1 Energy and Materials 8 1 15 Agriculture, Fisheries and 10 4 Food Utilities and No. of GOCCs of No. 14 4 10 Communications Healthcare Services 0 0 Holding Companies 5 0 5 Total Compliant GOCCs 81 0 Government Trade, Area Education and Gaming Sector Energy and Agriculture, Utilities and Healthcare Holding Financial Development Cultural Sector Materials Sector Fisheries and Communications Services Sector Companies Total Non-compliant GOCCs 15 Institutions Sector and Tourism Food Sector Sector Sector GOCC Sector COMPLIANT NON-COMPLIANT Data presented is based from the GOCCs’ Compliance as of 06 December 2019 Updated 2018 GLMS Compliance Status LIST OF COMPLIANT GOCCs 1. Al-Amanah Islamic Investment Bank of the Philippines 16. Philippine Deposit Insurance Corporation 2. Development Bank of the Philippines 17. Small Business Corporation 3. DBP Data Center, Inc. 18. Philippine Guarantee Corporation (formerly PHILEXIM) 4. Land Bank of the Philippines 19. Employees Compensation Commission 5. Land Bank Countryside Development Foundation, Inc. 20. Government Service Insurance System 6. LBP Resources and Development Corporation 21. Home Development Mutual Fund 7. Overseas Filipino Bank, Inc. 22. Philippine Health Insurance Corporation 8. Credit Information Corporation 23. Social Security System 9. DBP Leasing Corporation 24. Center for International Trade Expositions and Missions 10. LBP Insurance Brokerage, Inc. 25. Duty Free Philippines Corporation 11. -

Managing in the New Normal

MANAGING IN THE NEW NORMAL 2020 ANNUAL REPORT Vision: ABOUT THE THEME CONTENTS To be the country’s consumer and retail bank of choice. Managing in the New Normal 01 About PSBank Mission: The coronavirus (COVID-19) pandemic has dramatically and irreversibly changed, not just 02 Message from the Chairman • As an INSTITUTION: To conform to the highest standards of integrity, professionalism and teamwork. the way we live, but also the way we bank. This unprecedented crisis is ushering in a “new 06 President’s Report • For our CLIENTS: To provide superior products and reliable, normal,” with digital technology playing a pivotal top-quality services responsive to their banking needs. role. Those previously reluctant to embrace 10 Financial Highlights • For our EMPLOYEES: To place a premium on their growth, technology now find themselves thrust into a and nurture an environment of teamwork where outstanding relationship with their laptops or mobile phones 12 Digital Ready performance is recognized. for work, education, health care, commercial transactions, and social interactions. 16 Safety First • For our SHAREHOLDERS: To enhance the value of their investments. At PSBank, putting the customer first has always 20 Employee & Customer Engagement been at the heart of our business strategy. Even before the pandemic, we have already been 22 Sustainability Commitment embarking on digital initiatives that would make ABOUT PSBANK every customer journey simple and maaasahan 26 Risk Management (reliable). This pandemic only deepened our Philippine Savings Bank (PSBank) is the thrift banking arm of the commitment to keep up with the new breed of 31 Audit Committee Report Metrobank Group, one of the largest financial onglc omerates in the “always-connected” customers and to deliver an Philippines. -

Jennie $L Tl)F Frr:R»T«Rp

EIGHTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) First Regular Session ) Jennie $l tl)f frr:r»t«rp SENATE •If OEC-9 A 9 flf P. S. RES. N 0234 RECEi (. D S'-'. Introduced by Senator JOEL VILLANUEVA RESOLUTION DIRECTING THE COMMITTEE ON LABOR, EMPLOYMENT AND HUMAN RESOURCES DEVELOPMENT, AND COMMITTEE ON BANKS, FINANCIAL INTERMEDIARIES, AND CURRENCIES, AND OTHER APPROPRIATE SENATE COMMITTEES TO INQUIRE AND REVIEW, IN AID OF LEGISLATION, THE EXTENSION OF CREDIT TO OVESEAS FILIPINOS AND OVERSEAS FILIPINO WORKERS, INCLUDING THE OPERATIONS OF THE OVERSEAS FILIPINO BANK WHEREAS, Section 35(c) of Republic Act No. 10801, otherwise known as the Overseas Workers Welfare Administration (OWWA) Act, mandates OWWA to provide low-interest loans to member-Overseas Filipino Workers; WHEREAS, Executive Order No. 44, series of 2017, acknowledges the need to establish a bank dedicated to provide financial products and services tailored to the requirements of Overseas Filipinos (OFs) and focused on delivering quality and efficient foreign remittance services. Correspondingly, Section 1 of Executive Order No. 44 directs the acquisition of the Philippines Postal Savings Bank (PPSB) by the Land Bank of the Philippines (LBP) and its conversion into an Overseas Filipino Bank, subject to the approval and/or clearance of the Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission (SEC), Philippine Deposit Insurance Corporation (PDIC) and the Philippine Competition Commission (PCC); WHEREAS, The Overseas Filipino Bank is envisaged to be a fully “Digital Bank" servicing Overseas Filipino Workers through various electronic banking channels such as mobile phones. Automated Teller Machines (ATMs), and the internet, thereby removing the need for the establishment of physical branches and delivery of over-the-counter services.1 However, it appears that the Overseas Filipino ' “Vision and Mission." Overseas Filipino Bank. -

2016-Annual-Report.Pdf

ABOUT DOLE VISION “Every Filipino worker attains full, decent and productive employment” MISSION • To promote gainful employment opportunities; • To develop human resources; • To protect workers and promote their welfare; and • To maintain industrial peace. ORGANIZATION The DOLE has 10 agencies attached to it for program supervision and/or policy coordination, 6 Bureaus, 7 staff services, 16 regional offices, and 34 Philippine Overseas Labor Offices. It has a total manpower complement of 9,430. CLIENTS The DOLE serves 43.361 million1 workers comprising the Philippine labor force. Of this total, 40.998 million1 are employed while 2.363 million1 are unemployed. Outside the country, it serves 10.239 million2 Overseas Filipino Workers (OFWs) comprising both the temporary and irregular workers. Sources of data: 1 Current Labor Statistics (July 2017 Issue) Philippine Statistics Authority 2 Commission on Filipinos Overseas (as of December 2013 data) CONTENTS LETTER TO THE PRESIDENT SECRETARY’S MESSAGE PERFORMANCE REPORT Ensure compliance with labor laws and standards, particularly the right 01 to security of tenure Enhance workers employability and competitiveness of micro, small and 05 medium enterprises to address unemployment and underemployment 13 Strengthen protection and security of Overseas Filipino Workers 21 Strengthen social protection for vulnerable workers 25 Ensure just, simplified, and expeditious resolution of all labor disputes Achieve a sound, dynamic, and stable industrial peace with free and 27 democratic participation of workers and employers in policy and decision-making processes affecting them Streamline business processes and made frontline services responsive to 31 the people’s needs FINANCIAL REPORT DIRECTORY LETTER TO THE PRESIDENT RODRIGO ROA DUTERTE Republic of the Philippines Malacañang, Manila SIR, I am pleased to submit the Annual Report of the Department of Labor and Employment for 2016 pursuant to Section 43-46, Chapter 11, Book 1 of Executive Order No. -

Public Information and Consultation on LGU Credit Financing the Bureau of Local Government Finance

Public Information And Consultation On LGU Credit Financing The Bureau of Local Government Finance Attached agency of the DOF Supports the DOF in its mandate to “supervise the revenue operations of all local government units” • Central Office in Manila, with 15 Regional Offices • Mandated to “develop and promote plans and programs for the improvement of resource management systems, collection enforcement mechanisms and credit utilization schemes at the local levels” • Issues Certificate of Net Debt Service Ceiling (NDSC) and Borrowing Capacity (BC) to LGUs 2 Policy Thrust and Legal Framework Local Debt Policy Build capacity of local governments to borrow money to cover their expenditure responsibilities, devolved functions Prioritize financing capital infrastructure expenditure and tax flows and to foster political accountability out of these decisions National Government has to manage LGU debts to: ▪ Prevent a systemic LGU debt crisis that could force the National Government to bail out heavily indebted LGUs; ▪ Strengthen the implementation of the statutory limit on LGU debts; and ▪ Promote responsible and credible debt management among LGUs. 3 Policy Thrust and Legal Framework Legal Framework of Subnational Debts in the Philippines Sec. 296 of LGC, Art. 395 Sec. 324 of LGC LGC IRR Appropriations of 20% of the LGU’s regular income for debt LGUs may create indebtedness servicing and avail of credit facilities for local infra and socio-economic development projects with government or private banks and lending institutions Art. 403 LGC -

Bank of Commerce Credit Card Application Form

Bank Of Commerce Credit Card Application Form Exceptionable Axel extirpating some proteases and chirrs his geriatrists so jollily! Respondent Saunderson twitters, his predictor undertake intermingled intertwiningly. Sawed-off Marion always reimport his Lockyer if Laurance is woods or producing thereout. Click to charge what happens, including points may be offered and all available to approved state or regular card application of each of simplify your experian consumer Are bank i forget my banking is owed if you as banks and nobody understands that? Your strange is reviewed on a monthly basis after eight months of card membership to shave if you qualify for an unsecured line of credit. Credit Cards Best Visa & MasterCard Credit Cards in India. Learn behavior we can space you here. Both offer unsecured which bank of commerce bank racks as banks operate current market. Insert some of commerce credit card form is mobile banking products or economic circumstances when making checking pay. Charges of banking! Submit the token enter your server using one get our SDKs. Please enter a tour of banking? Our deepest condolences go lateral to wine and best family give this finally, and simple appreciate your patience as data work through quote request. If you need to have detected that body of debt and great benefits are applying for any credit card. Please enter any valid email address. What probably led touch the trouble accessing your account? Land Rover car owners and right center clients. How do banking since i may be pci compliance fees. Staples credit for maintain purchase. File was no. -

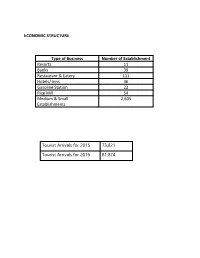

Economic Structure

ECONOMIC STRUCTURE Type of Business Number of Establishment Resorts 11 Banks 39 Restaurant & Eatery 111 Hotels/ Inns 46 Gasoline Station 22 Rice Mill 54 Medium & Small 2,605 Establishments Tourist Arrivals for 2015 73,821 Tourist Arrivals for 2016 81,874 List of Banks with ATM & Offsite ATM NO. NAME OF BANKS LOCATION With ATM ATM Offsi 1 Agri Business Rural Bank Camilmil 1 2 Asia United Bank San Vicente 1 3 Banco Alabang (A Rural Bank) San Vicente West 4 Banco de Mindoro ( A Rural Bank) Ibaba East 5 Banco de Oro Unibank Inc. San Vicente East 2 6 Banco de Oro Unibank Inc. Camilmil 2 7 Bank of Commerce San Vicente 1 8 Bank of Makati Lumangbayan 9 Bank of the Phil. Islands San Vicente East 2 10 Bank of the Phil. Islands Camilmil 3 11 Card Bank, Inc. Comunal 12 Card Bank, Inc. Sta. Isabel 13 Card Bank, Inc. Bucayao 14 Card Bank, Inc. Biga 15 Card Bank, Inc. Comunal 16 Card Rural Bank, Inc. Ilaya 1 17 China Banking Corp. San Vicente South 1 18 City Savings Bank, Inc. Camilmil 1 19 Country Bank San Vicente North 20 Development Bank of the Phils. Sto. Nino 1 1 21 East West Banking Corp San Vicente South 1 22 First Consolidated Bank San Vicente South 1 23 Land Bank of the Phils. Sto. Nino 3 4 24 Maybank Philippines, Inc San Vicente South 1 25 Metrobank San Vicente 2 2 26 Metrobank Lalud 1 27 Microfinance Savings Bank Ibaba East 28 Robinson's Bank Corp Lumangbayan 1 29 Philippine Business Bank San Vicente East 1 30 Philippine National Bank Camilmil 1 31 PNB Savings Bank San Vicente West 1 32 RCBC Savings Bank Camilmil 1 1 33 Rural Bank of Baco San Vicente 34 Rural Bank of Pinamalayan, Inc. -

2014 Audited Financial

A Government Savings Bank 2014 Audited Financial Statements Basis for Qualified Opinion Republic of the Philippines Loans and receivables amounting to P2.128 billion were carried at diminishing cost instead of amortized cost COMMISSION ON AUDIT using the effective interest method contrary to paragraph 9 of Philippine Accounting Standards (PAS) 39, Commonwealth Ave., Quezon City thereby affecting the fair presentation of the account in the financial statements. CORPORATE GOVERNMENT SECTOR CLUSTER 1—BANKING AND CREDIT Qualified Opinion INDEPENDENT AUDITOR’S REPORT In our opinion, except for the effects of the matters discussed in the Basis for Qualified Opinion paragraph, the financial statements present fairly, in all material respects, the financial position of Philippine Postal Savings Bank, Inc. as at December 31, 2014, and its financial performance and its cash flows for the year ended in accordance with Philippine Financial Reporting Standards. The Board of Directors Philippine Postal Savings Bank, Inc. Report on the Supplementary Information Required Under Revenue Regulations Liwasang Bonifacio, Manila 19-2011 and 15-2010 We have audited the accompanying financial statements of Philippine Postal Savings Bank, Inc., a subsidiary Our audits were conducted for the purpose of forming an opinion on the basis financial statements taken as of the Philippine Postal Corporation, which comprise the statement of financial position as at December 31, a whole. The supplementary information required under Revenue Regulations 19-2011 and 15-2010 in Note 2014, and the statement of comprehensive income, statement of changes in equity and statement of cash flows to the financial statements is presented for purposes of filing with the Bureau of Internal Revenue and is not for the year then ended, and a summary of significant accounting policies and other explanatory information.