First Consolidated Bank Annual Report 2019.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Asked Questions on What Is Pesonet?

Frequently Asked Questions on What is PESONet? PESONet is a new electronic fund transfer service that enables customers of participating banks, e- money issuers or mobile money operators to transfer funds in Philippine Peso currency to another customer of other participating banks, e-money issuers or mobile money operators in the Philippines. It is more inclusive platform for Electronic Fund Transfers which will make G2B(Government-to- Business) and G2C(Government-to-Consumer) payments more practical, convenient, fast, and secure. What is the purpose of PESONet? Through PESONet, businesses, government, and individuals will be able to conveniently pay or transfer funds from their account to one or multiple recipient accounts in other financial institutions. PESONet is the perfect alternative to the still widely used paper-based check system. What are the features of PESONet? What are the uses of PESONet? How does PESONet work? Customers instruct their financial institution to send credit instructions to other financial institutions via online banking, mobile banking or over-the-counter transaction. They need to provide the payees’ financial institution, account number, and amount. The credit instruction is transmitted by the financial institution to the clearing switch operator, which currently is the Philippine Clearing House Corporation (PCHC). The funds are settled in the respective financial institutions demand deposit accounts held in Bangko Sentral ng Pilipinas (BSP) through BSP’s Philippine Payments and Settlement System (PhilPaSS). Upon settlement, the beneficiary’s or payee’s financial institution will credit the payee's account. How long does it take to transfer funds via PESONet? The availability of funds to the receiving account shall depend on the facility used to carry out your transaction. -

Cpes Reports)

CONSTRUCTION INDUSTRY AUTHORITY OF THE PHILIPPINES – PHILIPPINE DOMESTIC CONTRUCTION BOARD CONSOLIDATED CONSTRUCTORS PERFORMANCE SUMMARY REPORT (CPES REPORTS) (ON-GOING/COMPLETED PROJECTS) From January 1, 2005 – December 31, 2007 You may access this report on this website http://www.gppb.gov.ph CONSTRUCTION INDUSTRY AUTHORITY OF THE PHILIPPINES (CIAP) PHILIPPINE DOMESTIC CONSTRUCTION BOARD (PDCB) 3/F, Jupiter Bldg., #56 Jupiter St., Bel-Air Village, Makati City Telephone Nos. 896-1801; 897-0791; Fax No. 897-0791 CONSOLIDATED CONSTRUCTORS PERFORMANCE SUMMARY REPORT CPES Reports - On-going and Completed Projects from January 1, 2005 – December 31, 2007 BACKGROUND: REPORT COVERAGE: This report is prepared in connection with the implementation of This report contains CPES rating and other project-related Constructors Performance Evaluation System (CPES) pursuant to information of on-going and completed foreign assisted (FA) Section 12, Annex E - Evaluation of Contractors Performance of and locally funded (LF) infrastructure projects being the Implementing Rules and Regulations (IRR) of RA No. 9184 undertaken by either local, foreign or joint venture (Government Procurement Reform Act). Item 4 - Submission and constructors. The projects presented in these report covers: Dissemination of Evaluation Results of Section 12, specifically road, bridge, housing, building, ports and harbor, irrigation mandated PDCB to consolidate the CPES evaluation results of all and flood control, and water supply projects. ongoing and completed projects and disseminate the same to all offices/agencies/corporations concerned. REPORT CONTENTS: USES OF CPES INFORMATION: Presented in this report are the names of constructors The CPES rating and other information is designed to serve the arranged alphabetically with the corresponding project information needs of the following: a) government agencies classification. -

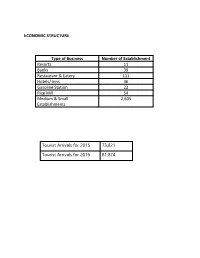

Economic Structure

ECONOMIC STRUCTURE Type of Business Number of Establishment Resorts 11 Banks 39 Restaurant & Eatery 111 Hotels/ Inns 46 Gasoline Station 22 Rice Mill 54 Medium & Small 2,605 Establishments Tourist Arrivals for 2015 73,821 Tourist Arrivals for 2016 81,874 List of Banks with ATM & Offsite ATM NO. NAME OF BANKS LOCATION With ATM ATM Offsi 1 Agri Business Rural Bank Camilmil 1 2 Asia United Bank San Vicente 1 3 Banco Alabang (A Rural Bank) San Vicente West 4 Banco de Mindoro ( A Rural Bank) Ibaba East 5 Banco de Oro Unibank Inc. San Vicente East 2 6 Banco de Oro Unibank Inc. Camilmil 2 7 Bank of Commerce San Vicente 1 8 Bank of Makati Lumangbayan 9 Bank of the Phil. Islands San Vicente East 2 10 Bank of the Phil. Islands Camilmil 3 11 Card Bank, Inc. Comunal 12 Card Bank, Inc. Sta. Isabel 13 Card Bank, Inc. Bucayao 14 Card Bank, Inc. Biga 15 Card Bank, Inc. Comunal 16 Card Rural Bank, Inc. Ilaya 1 17 China Banking Corp. San Vicente South 1 18 City Savings Bank, Inc. Camilmil 1 19 Country Bank San Vicente North 20 Development Bank of the Phils. Sto. Nino 1 1 21 East West Banking Corp San Vicente South 1 22 First Consolidated Bank San Vicente South 1 23 Land Bank of the Phils. Sto. Nino 3 4 24 Maybank Philippines, Inc San Vicente South 1 25 Metrobank San Vicente 2 2 26 Metrobank Lalud 1 27 Microfinance Savings Bank Ibaba East 28 Robinson's Bank Corp Lumangbayan 1 29 Philippine Business Bank San Vicente East 1 30 Philippine National Bank Camilmil 1 31 PNB Savings Bank San Vicente West 1 32 RCBC Savings Bank Camilmil 1 1 33 Rural Bank of Baco San Vicente 34 Rural Bank of Pinamalayan, Inc. -

Church Pushes Back 500 Years of Christianity

CBCP AUGUST 31 - SEPTEMBER 27, 2020, VOL.Monitor 24, NOS. 18 & 19 [email protected] PROTAGONIST OF TRUTH, PROMOTER OF PEACE Church pushes back 500 Pope names US Years of Christianity archbishop as celebration new nuncio to the By Roy Lagarde Philippines THE quincentennial celebration of the arrival of Christianity in the Philippines will be extended for another year due to the pandemic, a church official said. The scheduled culmination of the celebration in April 2021 will now be the launch of a yearlong celebration that will end in April 2022. Bishop Pablo Virgilio David, acting president of bishops’ conference, said Pope Francis and Archbishop Charles John Brown in the Vatican in December, 2018. the decision to move the VATICAN MEDIA dates of the historic event POPE Francis on Sept. 28 envoy to Asia’s most was due to the health crisis. Catholic bishops arrive for a Mass at the Cebu Metropolitan Cathedral on Jan. 27, 2018. PHOTO BY ROY LAGARDE “Due to the crisis caused has chosen Archbishop predominantly Christian by the Covid-19 pandemic, 31, 1521. Clergy set on Aug. 4 to 6, The preparation kicked Charles John Brown to be nation. it was necessary to change On Sept. 12, the Diocese 2021 has been cancelled. off in 2013, with each year his next ambassador to the Bishop Broderick Pabillo, the schedule of our of Maasin began a 200-day Instead of a retreat, the dedicated to a specific theme Philippines. the apostolic administrator celebration of the 500 years countdown to the 500th bishops’ Commission on the related to the faith and new The 60-year-old American of Manila, assured Brown of of Christianity,” David said. -

Remittance Bank List of Philippines Bank Name

Remittance Bank List of Philippines Bank Name AL AMANAH ISLAMIC INVESTMENT BANK ALLBANK ANZ BANK ASIA UNITED BANK BANK OF AMERICA BANK OF CHINA BOF, INC (A Rural Bank) - (BANK OF Florida) BANGKOK BANK PUBLIC CO LTD BDO - BANCO DE ORO BDO NETWORK BANK BDO PRIVATE BANK BOC - BANK OF COMMERCE BPI - BANK OF THE PHILIPPINE ISLANDS BPI FAMILY BANK BPI DIRECT BANKO CAMALIG BANK, INC (A Rural Bank) CEBUANA LHUILLIER RURAL BANK INC CHINA BANK CHINA BANK SAVINGS CTBC BANK ( FORMER CHINA TRUST) CIMB BANK PHILIPPINES, INC. CITIBANK DBP - DEVELOPMENT BANK OF THE PHILIPPINES DEUTSCHE BANK DUNGGANON BANK EAST WEST BANK EASTWEST RURAL BANK EQUICOM SAVINGS BANK INC FIRST CONSOLIDATED BANK HSBC - HONGKONG AND SHANGHAI BANKING CORPORATION HSBC SAVINGS BANK INDUSTRIAL BANK OF KOREA ING BANK N.V. ISLA BANK INC. KEB HANA (Korea Exchange Bank) JP MORGAN CHASE BANK LBP - LAND BANK OF THE PHILIPPINES MALAYAN BANK SAVINGS AND MORTGAGE BANK INC (MALAYAN SVGS) MAYBANK PHILIPPINES INC (PNB Republic) MEGA INTL COMML BANK CO LTD (ICBC) MIZUHO BANK LTD (FUJI BANK) MUFG BANK LTD (BANK OF TOKYO) PARTNER RURAL BANK (COTABATO) INC PBCOM - PHILIPPINE BANK OF COMMUNICATIONS PHIL BUSINESS BANK PHILIPPINE VETERANS BANK PHILTRUST CO (Philtrust Bank) PNB - PHILIPPINE NATIONAL BANK (Allied Bank) PRODUCERS SAVINGS BANK CORP PSBANK - PHILIPPINE SAVINGS BANK QUEZON CAPITAL RURAL BANK INC RCBC - RIZAL COMMERCIAL BANKING CORPORATION ROBINSONS BANK CORPORATION RURAL BANK OF GUINOBATAN INC (RBGI) SECURITY BANK CORPORATION SHINHAN BANK STERLING BANK OF ASIA SUMITOMO MITSUI BANKING CORP SUN SAVINGS BANK INC THE STANDARD CHARTERED BANK UCPB - UNITED COCONUT PLANTERS BANK UCPB SAVINGS BANK UNION BANK OF THE PHILIPPINES (City Savings Bank) UNITED OVERSEAS BANK PHILIPPINES WEALTH DEVELOPMENT BANK YUANTA SAVINGS BANK PHILS INC (Tongyang) . -

Annual Report 2017

ANNUAL REPORT 2017 METRO CEBU PUBLIC SAVINGS BANK Email: [email protected] Address: Sia Bldg., N. Bacalso Ave., Brgy. Duljo Fatima, Cebu City Tel No.: 231-4043 / 231-3923 2 CONTENTS CORPORATE POLICY______________________________________________________ 3 Vision __________________________________________________________________ 3 Mission _________________________________________________________________ 3 Company Profile __________________________________________________________ 4 A MESSAGE FROM THE PRESIDENT _________________________________________ 5 Financial Highlights 2017 ___________________________________________________ 7 Financial Summary ______________________________________________________ 10 RISK MANAGEMENT FRAMEWORK __________________________________________11 Overall Risk Management Culture and Philosophy ______________________________ 11 AML Governance and Culture ______________________________________________ 12 CORPORATE GOVERNANCE _______________________________________________ 13 Governance Structure ____________________________________________________ 13 Chairman of the Board of Directors __________________________________________ 14 Board Composition_______________________________________________________ 15 THE BOARD OF DIRECTORS _______________________________________________ 16 Board Committees, Membership and Functions __________________________________ 21 Directors’ Attendance at Board and Committee Meetings __________________________ 27 List of Executive Officers ____________________________________________________ -

2020 Annual Report

Chairman’s Message While 2020 will be remembered as the year of COVID-19, it was also year that allowed us at FCB to reflect. The year 2020 showed us PURPOSE. The importance of our role as bankers to ensure the functionality and strength of our communities was made exceedingly clear to us. Our depositors need continued access to their deposits, and our borrowers need access to liquidity for their needs, especially during times of calamity. We at FCB are proud to have provided steadfast service in all our areas. The year 2020 proved our RESILIENCE. We have had to be mentally and emotionally strong to face the unexpected challenges this year, as individuals, and as an organization. Our company was committed to taking care of our people, and our people remained committed to our mission to provide affordable banking services to our clients. The year 2020 is also a year that showed us the importance of ADAPTABILITY. COVID-19 has reminded us that we operate in a Darwinian landscape. It is not the biggest or largest that will survive, but the fastest to adapt. We have adjusted as restrictions and rules kept changing. We have maintained a proactive mindset, while providing tools to support this mindset and to adjust to the New Normal. Offering the online application process for qualified borrowers, offering various outlets for releases, introducing new products, and identifying new markets have all been part of adapting. Maintaining support staff in regional clusters in order to ensure operational continuity has also been essential. We are also proud to announce that our mobile banking app, FCBPay, which is not only responsive to the needs of this time but also an important step towards the future, was officially launched in February 2021. -

Caltex Stations As of 21 July 2020

List of Liquid Fuel Retail Stations or LPG Dealers Implementing the 10% Tariff (EO 113) Company: CHEVRON As of: July 21, 2020 Note: Passing on of additional import duties to retailers for diesel has ceased on July 9, 2020. This submission may change should there be local purchases that have levied the additional duties. Address Implementation Tariff Rate No. Retailer Name Source Depot Province City/Municipality Date (PhP) 1 RDL FUEL POINT INC. Valenzuela North Expressway, MalInta, Valenzuela 1.62 Batangas 2 NORTH WEST STAR GAS CORP.-WILSON San Juan OrtIgas Ave / WIlson St., San Juan 1.62 Batangas 3 ACHIEVERS MCKINLEY San Juan OrtIgas Ave/McKInley, San Juan 1.62 Batangas 4 STAREV MOTORIST SERVICE CENTER Mandaluyong EDSA / BonI Ave, Mandaluyong CIty 1.62 Batangas 5 RDL FUEL POINT INC. MakatI EDSA/Harvard, MakatI CIty 1.62 Batangas 6 DON DEXTER- SLEX Laguna San AntonIo, San Pedro, Laguna 1.62 Batangas 7 NORTHERN STAR ENERGY AND FUEL PasIg Pioneer/Shaw Blvd, PasIg CIty 1.62 Batangas 8 RDL FUEL POINT INC. Pampanga San Fernando, Pampanga 1.62 MarIveles 9 RDL FUEL POINT DISTRIBUTION Pampanga Mcarthur HIghway, BarrIo Dolores, San Fernando, Pampanga 1.62 MarIveles 10 MARIA MAY ORINO LEE Bicol Goa, CamarInes Sur 1.62 Batangas 11 GARDENSTATE ENTERPRISES INC. Agusan Ochoa St. Cor. L. Jaena St.,Butuan CIty, Agusan Norte 1.62 Cabadbaran 12 IRON CITY STATION SurIgao Claver, SurIgao del Norte 1.62 Cabadbaran 13 ANELYN DAUBNEY Zamboanga TampIlIsan, Zamboanga Del Norte 1.62 Jimenez 14 WILLIAM TAN ENT. INC. (TINIGUIBAN) Palawan NatIonal HIghway, TInIguIban, Puerto PrIncesa, Palawan 1.62 Batangas 15 WILLIAM TAN ENT. -

Annual Report 2008

ANNUAL STOCKHOLDERS’ MEETING Message from the Chairman April 21, 2018 The outlook for the global economy is cautiously optimistic. The largest economies are doing well; however, the interest rate is too low in many countries, leaving central banks without much leeway to cut interest rates in case of a need to stimulate their economies. Central banks have stopped their quantitative easing programs and are now biased towards increasing rates or utilizing tighter economic policies. The most serious threat to the global economy is a trade war. The US economy remains strong, with the dollar increasing in value and unemployment returning to pre-crisis levels. The Federal Reserve raised interest rates by 1/4 % in March 2018, and is expected to increase rates two more times this year. The increase in US rates places pressure on emerging markets, as hot money flows back towards developed economies. In line with increasing rates and rising inflation, there is the possibility of a steeper market correction some time in the next few years, as valuations appear too high compared to the underlying company fundamentals. We can expect that international trade will also evolve, as President Trump applies his brute force tactics to advance his America First policy. China continues with its shift from a manufacturing-driven economy to consumption-led, in order to boost growth. Debt levels in China, as well as non- performing loan levels, remain a concern—but President Xi is aggressively managing his deleveraging campaign, having imposed over 2.9 billion yuan in penalties and confiscations of funds on over 1,000 financial institutions. -

FIRST BATCH – 19 June ‐ 15 July 2017

FIRST BATCH – 19 June ‐ 15 July 2017 1 ROBINSONS BANK CORPORATION 97 BDO LEASING & FINANCE INC 2 CTBC BANK (PHILIPPINES) CORP 98 LBP LEASING CORPORATION 3 JP MORGAN CHASE BANK NATIONAL ASSN. 99 ALLIED LEASING & FINANCE CORP 4 KEB HANA BANK ‐ MANILA BRANCH 100 UCPB LEASING AND FINANCE CORP 5 MAYBANK PHILIPPINES INCORPORATED 101 BPI CENTURY TOKYO LEASE & FIN CORP 6 MEGA INT'L COMM'L BANK CO LTD 102 DBP LEASING CORPORATION 7 UNITED OVERSEAS BANK LIMITED MANILA 103 CITIFINANCIAL CORPORATION 8 EQUICOM SAVINGS BANK INC 104 CITICORP FINL SERV & INS BROKE PHIL 9 WORLD PARTNERS BANK (A THRIFT BANK) 105 EAST WEST LEASING AND FINANCE CORP 10 BANK ONE SAVINGS AND TRUST CORP. 106 PNB HOLDINGS CORPORATION 11 CENTURY SAVINGS BANK CORPORATION 107 DBP DAIWA SECURITIES CAPITAL MARKET 12 SUN SAVINGS BANK INC 108 FIRST METRO SEC BROKERAGE CORP 13 STERLING BANK OF ASIA INC (A SB) 109 BDO NOMURA SECURITIES INC 14 PNB SAVINGS BANK 110 RCBC SECURITIES INC 15 PACIFIC ACE SAVINGS BANK INC 111 AB CAPITAL SECURITIES INC 16 ISLA BANK(A THRIFT BANK) INC 112 BDO SECURITIES CORP. 17 MALAYAN BANK SAVINGS AND MORT BANK 113 S B EQUITIES 18 HSBC SAVINGS BANK(PHILS) INC 114 BPI SECURITIES CORP 19 YUANTA SAVINGS BANK PHILIPPINES INC 115 UNICAPITAL SECURITIES INC 20 PHIL POSTAL SAVINGS BANK INC 116 UCPB SECURITIES INC 21 PHIL SAVINGS BANK 117 PNB SECURITIES INC 22 RCBC SAVINGS BANK INC 118 BANCASIA CAPITAL CORPORATION 23 UCPB SAVINGS BANK 119 CHINA BANK CAPITAL CORPORATION 24 PRODUCERS SAVINGS BANK CORPORATION 120 ARMED FORCES AND POLICE SLAI 25 CARD SME BANK INC A THRIFT BANK 121 AIR MATERIEL WING SLA INC 26 PHIL RESOURCES SB CORP (PR SB) 122 ARSENAL SLA, INC. -

PNB Mobile Banking App Faqs for Interbank Funds Transfer Via Pesonet

PNB Mobile Banking App FAQs for Interbank Funds Transfer via PESONet 1. What is PESONet? PESONet is an electronic fund transfer service (via batch processing) that allows depositors to perform non-time sensitive fund transfers to any participating bank (“interbank”) within the Philippines. It is available to retail customers with Peso- denominated savings and current accounts who are enrolled in the PNB Mobile Banking App. PESONet provides a secure, faster and more convenient way to send funds or to settle payments in lieu of cash or checks. TRANSFER RECEIVING FUNDS FUNDS USING BANK CREDITED TO THE PNB MOBILE BENEFICIARY BANKING APP ACCOUNT 2. How do I perform a PESONet transaction using the PNB Mobile Banking App? You will receive notifications in your registered email and mobile numbers when PNB has successfully received your transaction for transmittal to the receiving bank. 3. Is there a cut-off for PESONet Transactions? PESONet is available during banking days, subject to a prescribed cut-off of 2PM for same day transmittal to the receiving bank. Transactions received after cut-off, on holidays or weekends will be processed for transmission to the receiving bank on the next banking day. 4. How much can I transact for PESONet via the PNB Mobile Banking App? You may transfer up to P100,000 per transaction. You can make multiple transactions up to the daily transfer limit of Php600,000 per account. 5. Are there any applicable fees for using PESONet via the PNB Mobile Banking App? A nominal fee of P30 will be charged per transaction. The fee shall be automatically debited from your nominated source account after successful OTP confirmation. -

List of Supervised Financial Institutions with FCDU/EFCDU

BANKS WITH FCDU/EFCDU AUTHORITY as of 31 May 2021 I. UNIVERSAL AND COMMERCIAL BANKS A. EFCDU 1 Al-Amanah Islamic Investment Bank of the Philippines 2 Asia United Bank Corporation 3 Australia and New Zealand Banking Group Limited 4 Bangkok Bank Public Co. Ltd. 5 Bank of America, N.A. 6 Bank of China Limited-Manila Branch 7 Bank of Commerce 8 Bank of the Philippine Islands 9 BDO Unibank, Inc. 10 Cathay United Bank Co., LTD. - Manila Branch 11 Chang Hwa Commercial Bank, Ltd. - Manila Branch 12 China Banking Corporation 13 CIMB Bank Philippines Inc. 14 Citibank, N.A. 15 CTBC Bank (Philippines) Corporation 16 Deutsche Bank AG 17 Development Bank of the Philippines 18 East West Banking Corporation 19 First Commercial Bank, Ltd., Manila Branch 20 Hua Nan Commercial Bank, Ltd. - Manila Branch 21 Industrial and Commercial Bank of China Limited - Manila Branch 22 Industrial Bank of Korea Manila Branch 23 ING Bank N.V. 24 JP Morgan Chase Bank, N.A. 25 KEB Hana Bank - Manila Branch 26 Land Bank of the Philippines 27 Maybank Philippines, Incorporated 28 Mega International Commercial Bank Co., Ltd. 29 Metropolitan Bank and Trust Company 30 Mizuho Bank, Ltd. - Manila Branch 31 MUFG Bank, Ltd. 32 Philippine Bank of Communications 33 Philippine National Bank 34 Philippine Veterans Bank 35 Rizal Commercial Banking Corporation 36 Security Bank Corporation 37 Shinhan Bank - Manila Branch 38 Standard Chartered Bank 39 Sumitomo Mitsui Banking Corporation-Manila Branch 40 The Hongkong & Shanghai Banking Corporation 41 Union Bank of the Philippines 42 United Coconut Planters Bank 43 United Overseas Bank Limited, Manila Branch B.