The Global Value Chain and China Automotive Industry Upgrading Strategy1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competing in the Global Truck Industry Emerging Markets Spotlight

KPMG INTERNATIONAL Competing in the Global Truck Industry Emerging Markets Spotlight Challenges and future winning strategies September 2011 kpmg.com ii | Competing in the Global Truck Industry – Emerging Markets Spotlight Acknowledgements We would like to express our special thanks to the Institut für Automobilwirtschaft (Institute for Automotive Research) under the lead of Prof. Dr. Willi Diez for its longstanding cooperation and valuable contribution to this study. Prof. Dr. Willi Diez Director Institut für Automobilwirtschaft (IfA) [Institute for Automotive Research] [email protected] www.ifa-info.de We would also like to thank deeply the following senior executives who participated in in-depth interviews to provide further insight: (Listed alphabetically by organization name) Shen Yang Senior Director of Strategy and Development Beiqi Foton Motor Co., Ltd. (China) Andreas Renschler Member of the Board and Head of Daimler Trucks Division Daimler AG (Germany) Ashot Aroutunyan Director of Marketing and Advertising KAMAZ OAO (Russia) Prof. Dr.-Ing. Heinz Junker Chairman of the Management Board MAHLE Group (Germany) Dee Kapur President of the Truck Group Navistar International Corporation (USA) Jack Allen President of the North American Truck Group Navistar International Corporation (USA) George Kapitelli Vice President SAIC GM Wuling Automobile Co., Ltd. (SGMW) (China) Ravi Pisharody President (Commercial Vehicle Business Unit) Tata Motors Ltd. (India) © 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved. Competing in the Global Truck Industry – Emerging Markets Spotlight | iii Editorial Commercial vehicle sales are spurred by far exceeded the most optimistic on by economic growth going in hand expectations – how can we foresee the with the rising demand for the transport potentials and importance of issues of goods. -

Marketing Strategies for Chery Automobile Corporation

ISSN 1712-8056[Print] Canadian Social Science ISSN 1923-6697[Online] Vol. 9, No. 4, 2013, pp. 177-183 www.cscanada.net DOI:10.3968/j.css.1923669720130904.2560 www.cscanada.org Marketing Strategies for Chery Automobile Corporation ZHANG Junjie[a],*; DAI Xiajing[b] [a] Lecturer of Business and Management, Department of Business and Management, Business School, Jiaxing University. Jiaxing, Zhejiang, 1. RESEARCH BACKGROUND China. INTRODUCTION [b] Business School, Jiaxing University. Jiaxing, Zhejiang, China. *Corresponding author. In our modern consumer society, any organization which aims to survive and develop in the market should be marketing orientated. Satisfying customers’ needs and Abstract meeting their expectations are the most crucial ways to A marketing strategy is a road map for the marketing retain, expand a business. While marketing plan plays activities of an organization for future period of time. It a key role in the actualization of marketing activities. A always helps the organization to understand clearly about marketing plan is a road map for the marketing activities the questions like these: what are we now? Where do we of an organization for future period of time. In this want to go? How do we allocate our resources to get to business report, we mainly recommend a marketing plan where we want to go? How do we convert our plans into for Chery Automobile Corp through the studies about its actions? How do our results compare our plans, and do external business environment and internal environment deviations require new plans and actions? The paper tries by some useful business analytical tools like PEST to formulate a marketing strategy for Chery Automobile analysis and SWOT analysis. -

Groupe Renault Sets Its New Strategy for China

PRESS RELEASE Groupe Renault sets its new Strategy for China • Groupe Renault will focus in China on light commercial vehicles (LCV) and electric vehicles (EV). • Groupe Renault will transfer its shares in Dongfeng Renault Automotive Company Ltd (DRAC) to Dongfeng Motor Corporation. DRAC will stop its Renault brand-related activities. • LCV business is operated through Renault Brilliance Jinbei Automotive Co., Ltd. (RBJAC), leveraging Jinbei legacy with Renault know-how. • EV business will be developed through the two existing joint ventures: eGT New Energy Automotive Co., Ltd (eGT) and Jiangxi Jiangling Group Electric Vehicle Co. Ltd (JMEV). Boulogne-Billancourt, April 14th, 2020 - Groupe Renault unveiled today its new strategy for the Chinese Market, building on two of its key pillars: Electric Vehicles (EV) and Light Commercial Vehicles (LCV). Within this new strategy, Groupe Renault activities in China will be driven as follow: About Chinese ICE Passenger Car Market Regarding ICE passenger car, Groupe Renault has entered into a preliminary agreement with Dongfeng Motor Corporation under which Renault transfers its shares to Dongfeng. DRAC will stop its Renault brand-related activities. Renault will continue to provide high quality aftersales service for its 300,000 customers through Renault dealers but also through Alliance synergies. Further development for Renault brand passenger cars will be detailed later within future new mid-term-plan Renault. Furthermore, Renault and Dongfeng will continue to cooperate with Nissan on new generation engines like components supply to DRAC and diesel license to Dongfeng Automobile Co., Ltd. Renault and Dongfeng will also engage in innovative cooperation in the field of intelligent connected vehicles. -

Analysis of the Dynamic Relationship Between the Emergence Of

Annals of Business Administrative Science 8 (2009) 21–42 Online ISSN 1347-4456 Print ISSN 1347-4464 Available at www.gbrc.jp ©2009 Global Business Research Center Analysis of the Dynamic Relationship between the Emergence of Independent Chinese Automobile Manufacturers and International Technology Transfer in China’s Auto Industry Zejian LI Manufacturing Management Research Center Faculty of Economics, the University of Tokyo E-mail: [email protected] Abstract: This paper examines the relationship between the emergence of independent Chinese automobile manufacturers (ICAMs) and International Technology Transfer. Many scholars indicate that the use of outside supplies is the sole reason for the high-speed growth of ICAMs. However, it is necessary to outline the reasons and factors that might contribute to the process at the company-level. This paper is based on the organizational view. It examines and clarifies the internal dynamics of the ICAMs from a historical perspective. The paper explores the role that international technology transfer has played in the emergence of ICAMs. In conclusion, it is clear that due to direct or indirect spillover from joint ventures, ICAMs were able to autonomously construct the necessary core competitive abilities. Keywords: marketing, international business, multinational corporations (MNCs), technology transfer, Chinese automobile industry but progressive emergence of independent Chinese 1. Introduction automobile manufacturers (ICAMs). It will also The purpose of this study is to investigate -

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto “The mountains are high and the emperor is far away.” (Chinese Proverb)1 Title: The Rise of China's Auto Industry: Automobility with Chinese Characteristics Curriculum Project: The project is part of an interdisciplinary course taught in the Political Science Department entitled: The Machine that Changed the World: Automobility in an Age of Scarcity. This course looks at the effects of mass motorization in the United States and compares it with other countries. I am teaching the course this fall; my syllabus contains a section on Chinese Innovations and other global issues. This project will be used to expand this section. Grade Level: Undergraduate students in any major. This course is part of Towson University’s new Core Curriculum approved in 2011. My focus in this course is getting students to consider how automobiles foster the development of a built environment that comes to affect all aspects of life whether in the U.S., China or any country with a car culture. How much of our life is influenced by the automobile? We are what we drive! Objectives and Student Outcomes: My objective in teaching this interdisciplinary course is to provide students with an understanding of how the invention of the automobile in the 1890’s has come to dominate the world in which we live. Today an increasing number of individuals, across the globe, depend on the automobile for many activities. Although the United States was the first country to embrace mass motorization (there are more cars per 1000 inhabitants in the United States than in any other country in the world), other countries are catching up. -

Sustainability Report Bmw Brilliance Automotive Ltd. Contents

2015 SUSTAINABILITY REPORT BMW BRILLIANCE AUTOMOTIVE LTD. CONTENTS CONTENTS INTRODUCTION SUSTAINABILITY MANAGEMENT PRODUCT RESPONSIBILITY Preface 3 1.1 Our management approach 10 2.1 Our management approach 39 Our point of view 4 1.2 Stakeholder engagement 16 2.2 Efficient mobility 44 Highlights 2015 5 1.3 Compliance, anti-corruption and 18 2.3 Product safety 48 An overview of BMW Brilliance 6 human rights 2.4 Customer satisfaction 51 ENVIRONMENTAL PROTECTION SUPPLIER MANAGEMENT EMPLOYEES 3.1 Our management approach 57 4.1 Our management approach 72 5.1 Our management approach 87 3.2 Energy consumption and emissions 59 4.2 Minimising supplier risk 77 5.2 Attractive employer 90 3.3 Waste reduction 63 4.3 Utilising supplier opportunities 83 5.3 Occupational health and safety 96 3.4 Water 68 5.4 Training and development 99 CORPORATE CITIZENSHIP APPENDIX 6.1 Our management approach 107 7.1 About this report 120 6.2 Corporate citizenship 112 7.2 UN Global Compact index 121 7.3 GRI G4 content index 125 2 PREFACE Next, a further step in developing China’s very own new energy vehicle brand. In the future, we will expand our offering of locally developed, produced and environmentally friendly premium vehicles for our Chinese customers. Digitalisation is an important driver for sustainability. We are developing new solutions for intelligent mobility AT BMW BRILLIANCE, WE SEE SUSTAINABILITY AS products and services. At the same time, we are increasing the quality of our products, as well as the speed A KEY TO OUR CONTINUOUS SUCCESS IN CHINA. -

Incentives to Invest in New Technology: the Effect of Fuel Economy Standards on China’S Automakers

Incentives to Invest in New Technology: The Effect of Fuel Economy Standards on China’s Automakers Sabrina T. Howell⇤ May 5, 2015 Abstract Technology absorption is critical to emerging market growth. To study this process I exploit fuel economy standards, which compel automakers to either acquire fuel ef- ficiency technology or reduce vehicle quality. With novel, unique data on the Chinese auto market between 1999 and 2012, I evaluate the effect of China’s 2009 fuel economy standards on firms’ vehicle characteristic choices. Through differences-in-differences and triple differences designs, I show that Chinese firms responded to the new policy by manufacturing less powerful, cheaper, and lighter vehicles. Foreign firms manufac- turing for the Chinese market, conversely, continued on their prior path. For example, domestic firms reduced model torque and price by 12% and 13% of their respective means relative to foreign firms. Private Chinese firms outperformed state-owned firms and were less affected by the standards, but Chinese firms in joint ventures with for- eign firms suffered the largest negative effect regardless of ownership. My evidence suggests that fuel economy standards and joint venture mandates - both intended to increase technology transfer - have instead retarded Chinese firms’ advancement up the automotive manufacturing quality ladder. (Click Here for Latest Version and Appendices) JEL classifications: G3, O2, O3, P2, P3, Q4, Q5, L5, L9 ⇤Harvard University. I wish to thank Anthony Saich, Henry Lee, Wang Qing, Lu Mai, Lilei Xu, Ariel Pakes, and Martin Rotemberg. I am grateful to the China State Council Development Research Center for its support and data access. -

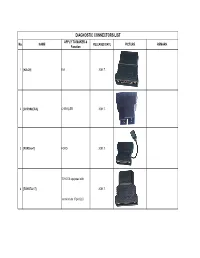

DIAGNOSTIC CONNECTORS LIST APPLY to MAKER & No

DIAGNOSTIC CONNECTORS LIST APPLY TO MAKER & No. NAME RELEASED DATE PICTURE REMARK Function 1 [KIA-20] KIA 2001.7. 2 [CHRYSLER-6] CHRYSLER 2001.7. 3 [FORD-6+1] FORD 2001.7. TOYOTA equipped with 4 [TOYOTA-17] 2001.7. semicircular 17pin DLC 5 [MITSUBISHI/HYUNDAI-12+16] MITSUBISHI & HYUNDAI 2002.11. 6 [HONDA-3] HONDA 2002.11. MAZDA equipped with 7 [MAZDA-17] 2002.12. semicircular 17pin DLC 8 [HAIMA-17] HAINAN MAZDA 2002.12. Most maker any model 9 [SMART OBDII-16] 2002.5. without CAN BUS 10 [NISSAN-14+16] NISSAN 2003.10. 11 [CHANGAN-3] CHANGAN 2003.11. 12 [JIANGLING-16] JIANGXI ISUZU 2003.3. 13 [SUZUKI-3] SUZUKI 2003.3. 14 [ZHONGHUA-16] ZHONGHUA CAR 2003.3. 15 [HAINAN MAZDA-17F] HAINAN MAZDA 2003.4. 16 [AUDI-4] AUDI 2003.6. 17 [DAIHATSU-4] DAIHATSU 2003.6. 18 [BENZ-38] BENZ 2003.7. 19 [UNIVERSAL-3] BENZ 2003.7. 20 [BMW-20] BMW 2003.9. All BMW models with 16 pin 21 [BMW-16] 2003.9. DLC 22 [HAIMA-16] HAINAN MAZDA 2004.10. 23 [FIAT-3] FIAT 2004.10. 24 [HAIMA-3] HAINAN MAZDA 2004.10. 25 [FORD-20] Australia FORD 2004.11. For 2002- LX470 and LAND 26 [TOYOTA-16] TOYOTA 2004.11. CRUISE 27 [HONDA5] HONDA 2004.11. Only for Russian HONDA 28 [GM/VAZ-12] GMVAZ 2004.3. 29 [DAEWOO-12] DAEWOO,SPARK 2004.3. 30 [SEDAN-3] VW models in Mexico 2004.3. Only for Mexico 31 [COMBI-4] VW models in Mexico 2004.3. Only for Mexico 32 [GAZ-12] GAZ 2004.5. -

Alixpartners Automotive Electrification Index Second Quarter 2017 ALIXPARTNERS AUTOMOTIVE ELECTRIFICATION INDEX Alixpartners Automotive Electrification Index E-Range

AlixPartners Automotive Electrification Index Second Quarter 2017 ALIXPARTNERS AUTOMOTIVE ELECTRIFICATION INDEX AlixPartners Automotive Electrification Index e-range • By automaker, segment, region, and country E-RANGE = • Note: e-range does not include range from internal-combustion- engine (ICE) sources in plug-in hybrids—only the battery range Sum of electric is included range of all electric • The e-range attempts to rank the electrically driven range, and vehicles (EV) sold as such, does not include non-plug-in hybrids (HEVs) such as the standard Toyota Prius 2 ALIXPARTNERS AUTOMOTIVE ELECTRIFICATION INDEX AlixPartners Automotive Electrification Index ICE-vehicle equivalent market share • By automaker, segment, region, and country Using e-range data, • Full-ICE-equivalent EVs are defined as the electric range of the we can calculate an vehicle sold divided by 311 miles (500 km) ICE-vehicle • Note: to make the EV equivalent to an internal combustion engine equivalent vehicle (ICE), the 311-mile (500-km) range approximates an market share equivalent range between fill-ups for ICE vehicles. Dividing by this factor results in a more illuminating view of overall electrification, Total number of as it counts vehicles with high-electric ranges as full alternatives full-ICE-equivalent- to ICE vehicles and discounts small range city cars or compliance range EVs sold vehicles Total number of • Note: range of the ICE vehicles are not normalized to 311 miles (500 km)—each ICE unit sold is counted as a full vehicle vehicles sold (EV and ICE) 3 -

Chinese Carmakes General Information

C O N T E N T 1 Chinese Carmakes – General Situation 2 What Do We Have In Update 3/2005? 3 Which Carmakes Are Sold Out Of China? 4 What Is Built In China? – Co-operators In China 5 Websites of the new carmakers 1. Chinese Carmakes – General Situation Over the last months more and more carmakes from China got into the European Market. With this Color News we try to answer as much questions about these new brands as we are able to. We would like to share with you all informations we have today – but still there are holes to fill in. 2. What Do We Have In Update 3/2005? In the update 3/2005 (coming up in December) you will find four new carmakers with European formulae: 1. Brilliance 5 colors 2. Geely 25 colors 3. Great Wall 5 colors 4. Jiangling 9 colors Some formulae are just copied from the Chinese formulae if we had no panel available. Thus you will only find formulae for our conventional paint systems. For the colors we got panels there are also the waterborne formulae available. Additional carmakers will be inserted if we get panels or formulae from our colleagues in China. 3. Which Carmakers Are Sold Out Of China? At the moment we know the following: BYD Auto Flyer exported to Russia Brilliance / Jinbei Cars (Zhonghua) exported to Europe and the Middle-East (Jinbei) First Auto Vans exported to Russia Geely Cars exported to the Middle-East Great Wall Cars exported to Russia Iritobus Busses exported to Russia Jiangling Cars exported to the Netherlands Xinkai Cars exported to Russia 4. -

State of Automotive Technology in PR China - 2014

Lanza, G. (Editor) Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Shanghai Lanza, G. (Editor); Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Institute of Production Science (wbk) Karlsruhe Institute of Technology (KIT) Global Advanced Manufacturing Institute (GAMI) Leading Edge Cluster Electric Mobility South-West Contents Foreword 4 Core Findings and Implications 5 1. Initial Situation and Ambition 6 Map of China 2. Current State of the Chinese Automotive Industry 8 2.1 Current State of the Chinese Automotive Market 8 2.2 Differences between Global and Local Players 14 2.3 An Overview of the Current Status of Joint Ventures 24 2.4 Production Methods 32 3. Research Capacities in China 40 4. Development Focus Areas of the Automotive Sector 50 4.1 Comfort and Safety 50 4.1.1 Advanced Driver Assistance Systems 53 4.1.2 Connectivity and Intermodality 57 4.2 Sustainability 60 4.2.1 Development of Alternative Drives 61 4.2.2 Development of New Lightweight Materials 64 5. Geographical Structure 68 5.1 Industrial Cluster 68 5.2 Geographical Development 73 6. Summary 76 List of References 78 List of Figures 93 List of Abbreviations 94 Edition Notice 96 2 3 Foreword Core Findings and Implications . China’s market plays a decisive role in the . A Chinese lean culture is still in the initial future of the automotive industry. China rose to stage; therefore further extensive training and become the largest automobile manufacturer education opportunities are indispensable. -

2009-Mmrc-269

MMRC DISCUSSION PAPER SERIES No. 269 The Role of International Technology Transfer in the Chinese Automotive Industry Zejian Li, Ph.D. Project Research Associate Manufacturing Management Research Center (MMRC) Faculty of Economics, THE UNIVERSITY OF TOKYO July 2009 東京大学ものづくり経営研究センター Manufacturing Management Research Center (MMRC) Discussion papers are in draft form distributed for purposes of comment and discussion. Contact the author for permission when reproducing or citing any part of this paper. Copyright is held by the author. http://merc.e.u-tokyo.ac.jp/mmrc/dp/index.html The Role of International Technology Transfer in the Chinese Automotive Industry Zejian Li, Ph.D. (E-mail: [email protected]) Project Research Associate Manufacturing Management Research Center (MMRC) Faculty of Economics, THE UNIVERSITY OF TOKYO May 2009 Abstract The so called Independent Chinese Automobile Manufacturers (ICAMs), such as CHERY, Geely and BYD, emerged at the end of 1990's as new entrants to Chinese passenger vehicle market and have achieved remarkable growth. The phenomenon of these autonomous Chinese Automakers is drawing increasing attention not only from academia but also from business and government circles. This paper attempts to clarify the relationship between emergence of ICAMs and International Technology Transfer. Many scholars indicate the use of outside supplies (of engines and other key-parts), as a sole reason for high-speed growth of ICAMs. However, the internal approach, at a level of how companies act, is also necessary to outline all the reasons and factors that might contribute to the process. This paper, based on organizational view, starts from historical perspective and clarifies the internal dynamics of the ICAMs.