Don Quijote Holdings / 7532

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

QUEST Integration

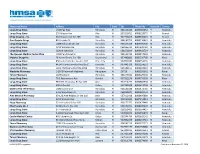

Pharmacy Name Address City State Zip Phone No Hours24 County Longs Drug Store 1330 Pali Hwy Honolulu Hi 968132230 8085365542 Y Honolulu Longs Drug Store 555 Kilauea Ave Hilo Hi 967203011 8089359075 Y Hawaii Shiigi Drug Co., Inc. 333 Kilauea Ave Ste 109 Hilo Hi 967203013 8089350001 N Hawaii Don Quijote Drugs 801 Kaheka St Honolulu Hi 968143725 8089736661 N Honolulu Longs Drug Store 1088 Bishop St Ste 113 Honolulu Hi 968133109 8085365706 N Honolulu Longs Drug Store 4211 Waialae Ave Honolulu Hi 968165319 8087320782 N Honolulu Longs Drug Store 1620 N School St Honolulu Hi 968171844 8088410724 Y Honolulu The Queens Medical Center Phcy 1301 Punchbowl St Honolulu Hi 968132402 8085474238 Y Honolulu Molokai Drugs Inc 28 Kamoi Street Ste 100 Kaunakakai Hi 967480000 8085535790 N Maui Longs Drug Store 850 Kamehameha Hwy Ste 107 Pearl City Hi 967822682 8084554555 Y Honolulu Longs Drug Store 46-047 Kamehameha Hwy Ste C Kaneohe Hi 967443736 8082354551 Y Honolulu Longs Drug Store 1450 Ala Moana Blvd Ste 2004 Honolulu Hi 968144671 8089494010 N Honolulu Westside Pharmacy 1-3845 Kaumualii Highway Hanapepe Hi 96716 8083355342 N Kauai Times Pharmacy 1425 Liliha St Honolulu Hi 968173522 8085225078 N Honolulu Longs Drug Store 70 E Kaahumanu Ave Kahului Hi 967322176 8088770068 N Maui Longs Drug Store 98-1005 Moanalua Rd Spc 400 Aiea Hi 967014775 8084880958 N Honolulu Longs Drug Store 609 Kailua Rd Kailua Hi 967342839 8082619794 N Honolulu Queens Pob I Pharmacy 1380 Lusitana St Honolulu Hi 968132449 8085474745 N Honolulu Longs Drug Store 2750 Woodlawn Dr Honolulu Hi 968221841 8089882151 N Honolulu Aiea Medical Pharmacy 99-128 Aiea Heights Dr Ste 103 Aiea Hi 967013916 8088405680 N Honolulu Longs Drug Store 3221 Waialae Ave Honolulu Hi 968165842 8087352811 Y Honolulu Plaza Pharmacy 321 N Kuakini St Ste 105 Honolulu Hi 968172375 8085479440 N Honolulu Pharmacare No. -

Don Quijote - Kaheka 801 KAHEKA STREET, HONOLULU, HAWAII 96814

FOR LEASE > FOOD COURT SPACE Don Quijote - Kaheka 801 KAHEKA STREET, HONOLULU, HAWAII 96814 Food Court Space for lease The food court is situated in the premier hub of commerce in the The space is located in the Don Quijote food court, which includes a Ala Moana area, just 5 minutes delightful array of local and Asian cuisines. The foot court provides walking distance to Ala Moana strong co-tenant synergies and ample outdoor seating for customers. Center, Ross Dress for Less, Walmart and Sam’s Club. Property Information Available Space: Space 14 (430 SF) Kapiolani Blvd Base Rent: Negotiable Kalakaua Ave Operating Expenses: $1.83 PSF/Mo Term: 3 - 5 years Features & Benefits: > Great visibility > Excellent foot traffic > The largest Asian grocery store on Oahu WAIKIKI MARIA SU (S) COLLIERS INTERNATIONAL | Hawaii Retail Services Division 220 S. King Street, Suite 1800 808 524 2666 Honolulu, Hawaii 96813 www.colliers.com/hawaii [email protected] This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers International and/or its licensor(s). ©2020. All rights reserved.. -

Die Antwort Auf Das Discountmodell

R Die Antwort auf das Discountmodell Ein neues Geschäftsmodell für den Lebensmitteleinzelhandel? Projekt XI August 2005 Eine Studie im Auftrag von The Coca-Cola Retailing Research Council Europe durchgeführt von McKinsey & Company Der Auftraggeber / Die Verfasser The Coca-Cola Retailing Research Council, Europe The Coca-Cola Retailing Research Council, Europe (CCRRCE) hat sich zur Aufgabe gemacht, den Lebensmitteleinzelhandel und das damit verbundene System der Warenverteilung in Europa besser zu verstehen. Er konzentriert sich darauf, wichtige Themen und Probleme zu erkennen und gezielt zu untersuchen. Die gewonnenen Erkenntnisse werden ggf. in einem geeigneten Forum präsentiert, damit die Informationen voll dazu genutzt werden können, die Warenverteilung des Lebensmitteleinzelhandels weiterzuentwickeln und effektiver zu gestalten. McKinsey & Company McKinsey & Company ist eine Managementberatung, die führenden Unternehmen und Organisationen hilft, ihre Performance durch entscheidende, nachhaltige und substanzielle Verbesserungen zu steigern. Über die letzten sieben Jahrzehnte hat die Firma stets an ihrem Hauptziel festgehalten: Unternehmen als vertrauenswürdigster, externer Berater zur Seite zu stehen, wenn die Unternehmensführung vor kritischen Entscheidungen steht. Mit etwa 7.800 Beratern, die sich auf 85 Niederlassungen in 44 Ländern verteilen, berät McKinsey Unternehmen über Strategie, operatives Geschäft, Organisation und Technologie. Die Firma verfügt nicht nur über umfassende Erfahrung in allen großen Branchen und Hauptfunktionsbereichen, -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

Recent Revisions to Japanese Tender Offer Rules: Toward Transparency and Fairness

JUNE 2007 JONES DAY COMMENTARY Recent REvisions to JApanesE Tender Offer RulEs: TOward Transparency and Fairness DEvElOpments iN ThE JApanesE economy in 1991, Japanese businesses underwent significant corporate restructuring for more than a M&A Market decade, and the number of tender offers gradually Japanese tender offer regulations were substantially increased as part of the effort to recover from the amended in December 2006 in the wake of recent deflationary economy in the late 1990s. Tender offers hostile-takeover activities in Japan. The tender offer in Japan in 2005 and 2006 numbered 50 and 68, regulations, which were first introduced in Japan in respectively. However, after the collapse of the eco- 1971, were substantially revised in 1990. These revised nomic bubble, hostile offers were almost nonexistent regulations form the basis of the current legal frame- in Japan until 2000, when a Japanese activist fund work. The additional revisions made in 2006 (the managed by Mr. Yoshiaki Murakami engaged in a “Revisions”) are intended to increase the transparency hostile offer for Shoei Co., Ltd., a real estate com- and fairness of tender offers by, for example, enhanc- pany. This was followed by hostile tender offers made ing the disclosure requirements and expanding the simultaneously for two mid-sized companies, Sotoh scope of application of the tender offer rules. Corporation and Yushiro Chemical Industry Co., Ltd., by Steel Partners Japan, a U.S.-based activist fund, in Historically, the pace of M&A activity, particularly take- December 2003. While the level of hostile offers is still overs, in Japan has been relatively slow. -

Global Powers of Retailing 2019 Contents

Global Powers of Retailing 2019 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Global Powers of Retailing Top 250 11 Geographic analysis 19 Product sector analysis 23 New entrants 27 Fastest 50 30 Study methodology and data sources 35 Endnotes 39 Contacts 41 Welcome to the 22nd edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2017 (fiscal years ended through June 2018), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2017 Minimum retail US$4.53 US$18.1 revenue required to be trillion billion among Top 250 Aggregate Average size US$3.7 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 5.7% revenue growth net profit margin 5.0% Composite (CAGR from Composite year-over-year retail FY2012-201 2.3% return on assets revenue growth 3.3% Top 250 retailers with foreign 23.6% 10 operations Share of Top 250 Average number aggregate retail revenue of countries where 65.6% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2019. Analysis of financial performance and operations for fiscal years ended through June 2018 using company annual reports, Supermarket News, Forbes America’s largest private companies and other sources. 4 Global economic outlook 5 Global Powers of Retailing 2019 | Global economic outlook The global economy is currently at a turning point. -

JRTR No.65 Topics

August 2014–January 2015 August 12 — Japanese government announced decision to consign maintenance of Boeing B777-300 used by 1 — EuroCity passenger expressed carrying about 250 Emperor and Prime Minister for official overseas visits people collided with freight train near Mannheim, to ANA Holdings; two planes including spare plane to Germany, overturning 2 carriages and injuring enter service from 2019 replacing current B747-400 35 people 13 — Front three carriages of Swiss 8-car Rhaetian Railway 1 — Part Chinese-owned low-cost carrier airline Spring tourist train derailed by landslide with one car sliding Airlines Japan started three international services out into valley, injuring 11 of 140 passengers, including 5 of New Tokyo International Airport at Narita, Japan Japanese visitors 3 — Magnitude 6.5 earthquake struck Zhaotong City in 13 — Small private plane carrying Brazilian presidential Yunnan Province, China, killing at least 617 people candidate and others crashed during bad weather and leaving another 112 missing near Santos City, Brazil, killing everyone onboard 4 — Overloaded ferry carrying more than 200 people 13 — Currently restructuring Tosa Electric Railway and across Padma River, near Dacca, Bangladesh, sank, Kochi Prefectural transport board announced leaving many people missing after about 100 people decision to create new third-sector transport business rescued Tosaden Transport following business integration; new company to be inaugurated on 1 October 6 — Hitachi Ltd. announced first placement of order from UK Network -

Deloitte Studie

Global Powers of Retailing 2018 Transformative change, reinvigorated commerce Contents Top 250 quick statistics 4 Retail trends: Transformative change, reinvigorated commerce 5 Retailing through the lens of young consumers 8 A retrospective: Then and now 10 Global economic outlook 12 Top 10 highlights 16 Global Powers of Retailing Top 250 18 Geographic analysis 26 Product sector analysis 30 New entrants 33 Fastest 50 34 Study methodology and data sources 39 Endnotes 43 Contacts 47 Global Powers of Retailing identifies the 250 largest retailers around the world based on publicly available data for FY2016 (fiscal years ended through June 2017), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook and looks at the 50 fastest-growing retailers and new entrants to the Top 250. This year’s report will focus on the theme of “Transformative change, reinvigorated commerce”, which looks at the latest retail trends and the future of retailing through the lens of young consumers. To mark this 21st edition, there will be a retrospective which looks at how the Top 250 has changed over the last 15 years. 3 Top 250 quick statistics, FY2016 5 year retail Composite revenue growth US$4.4 net profit margin (Compound annual growth rate CAGR trillion 3.2% from FY2011-2016) Aggregate retail revenue 4.8% of Top 250 Minimum retail Top 250 US$17.6 revenue required to be retailers with foreign billion among Top 250 operations Average size US$3.6 66.8% of Top 250 (retail revenue) billion Composite year-over-year retail 3.3% 22.5% 10 revenue growth Composite Share of Top 250 Average number return on assets aggregate retail revenue of countries with 4.1% from foreign retail operations operations per company Source: Deloitte Touche Tohmatsu Limited. -

OAHU WIC VENDORS (72 Stores)

Koolauloa (2) Foodland (Laie) Waialua (2) Tamura’s (Hauula) Koolaupoko (11) Foodland (Pupukea) Foodland (Kaneohe) Malama Market (Haleiwa) Foodland (Kailua) Kaneohe Bay Commissary Safeway (Aikahi Park) Wahiawa (6) Safeway (Enchanted Lakes) Foodland (Mililani) WAIALUA KOOLAULOA Safeway (Kailua) Foodland (Wahiawa) Safeway (Kaneohe) Safeway (Mililani) Shima’s Market (Waimanalo) Schofield Commissary Times Super Market (Kailua) Times Market (Mililani) Times Super Market (Kaneohe) Tamura’s Wahiawa Times Super Market (Temple Valley) WAHIAWA KOOLAUPOKO AIANAE Waianae (4) W EWA Nanakuli Super (Nanakuli) WEST Sack ‘N Save (Nanakuli) Tamura Super Market HONOLULU Waianae Store (Waianae) EAST HONOLULU Ewa (22) West Honolulu (10) East Honolulu (15) Don Quijote (Pearl City) Foodland (Dillingham) Don Quijote (Kaheka) Don Quijote (Waipahu) Foodland (School Street) Food Pantry (Kuhio Ave) Foodland (Ewa Beach) Kmart (Salt Lake) Food Pantry (Eaton Square) Foodland (Pearl City) Sack ‘N Save (Salt Lake) Foodland Farms Aina Haina Foodland (Kapolei) Safeway (Pali) Foodland (Beretania) Foodland (Waipio Gentry) Safeway (Salt Lake) Foodland (Market City) Hickam Commissary Target (Salt Lake) Safeway (Beretania) Kmart –(Kapolei) Times Market (Kam Shopping Cntr) Safeway (Hawaii Kai) Kmart (Waikele) Times Super Market (Liliha) Safeway (Kapahulu)) Malama Market Makakilo (Kapolei) Walmart (Pearl City) Safeway (Manoa) Pacific Supermarket (Waipahu) Times Super Market (Beretania) Pearl Harbor Commissary Times Super Market (Kahala) Safeway (Ewa Beach) Times Super Market (Kaimuki) Safeway (Kapolei) Times Super Market (McCully) Tamura’s Kalaeloa Walmart (Keeaumoku) Target (Kapolei) Safeway (Aiea) Times Super Market (Aiea) Times Super Market (RoyalKunia) Times Super Market (Waimalu) Times Super Market (Waipahu) Walmart (Kapolei) OAHU WIC VENDORS (72 Stores) 05/04/2015 . -

Food and Beverage Industry Insight February 2019

www.peakstone.com Food and Beverage Industry Insight February 2019 0 Food and Beverage Industry Insight | February 2019 Food and Beverage M&A Update Food and Beverage categories continue to be active in M&A activity, but less than 2017 levels For 2018, total U.S. F&B announced transactions of 440, slightly less than 2017 levels of 453 deals. Both 2018 and 2017 exceeded 2016 levels of 453 deals. Select Recent Notable Publicly Announced U.S. M&A Transactions Transaction Date Status Target Buyer Size 2/12/2019 Dec-2018 Closed Undisclosed Nov-2018 Announced $750 million Nov-2018 Announced $1,800 million Nov-2018 Announced $494 million 2018 Closed Gourmet Gift Concepts Undisclosed www.peakstone.com 1 Food and Beverage Industry Insight | February 2019 Industry Insight: A Focus In-Store Bakery Industry Trends Bakery Industry Revenues ($ in billions) ▪ In-store bakeries drive consumers into stores ─ Aldi, for example, is now adopting in-store bakeries into their store plan after successful testing in select stores $60.9 $61.6 $59.4 $60.4 ▪ Most in-store bakeries are no longer baking in the store itself $55.9 due to high store labor costs, but average bakery department $53.6 square footage has grown since 2014 $49.5 $45.9 ▪ The $15+ billion U.S. in-store bakery market is projected to grow 3.8% annually through from 2017 to 2022 ▪ To satisfy any consumer, offerings range from good for you to indulgent products 2010 2011 2012 2013 2014 2015 2016 2017 ▪ Key market drivers for in-store bakery purchases at grocery stores and food markets: Bakery Industry at a Glance ─ Small Format Portion Control ─ Grab & Go Convenience Revenue Net Profit Wages $61.6 billion $2.4 billion $2.6 billion ─ Premium Indulgence ─ Better-for-You ─ Hosting & Entertaining The Wholesale Bakery industry remains very fragmented ─ Fully-Baked Products with many small companies and no clear industry leader. -

Feature Advertising by U.S. Supermarkets Meat and Poultry

United States Department of Agriculture Agricultural Feature Advertising by U.S. Supermarkets Marketing Service Meat and Poultry Livestock, Poultry and Seed Program Independence Day 2017 Agricultural Analytics Division Advertised Prices effective through July 04, 2017 Feature Advertising by U.S. Supermarkets During Key Seasonal Marketing Events This report provides a detailed breakdown of supermarket featuring of popular meat and poultry products for the Independence Day marketing period. The Independence Day weekend marks the high watershed of the summer outdoor cooking season and is a significant demand period for a variety of meat cuts for outdoor grilling and entertaining. Advertised sale prices are shown by region, state, and supermarket banner and include brand names, prices, and any special conditions. Contents: Chicken - Regular and value packs of boneless/skinless (b/s) breasts; b/s thighs; split, bone-in breasts; wings; bone-in thighs and drumsticks; tray and bagged leg quarters; IQF breast and tenders; 8-piece fried chicken. Northeast .................................................................................................................................................................. 03 Southeast ................................................................................................................................................................. 21 Midwest ................................................................................................................................................................... -

Flood Area Detection Using Sar Images with Deep Neural Network During, 2020 Kyushu Flood Japan

FLOOD AREA DETECTION USING SAR IMAGES WITH DEEP NEURAL NETWORK DURING, 2020 KYUSHU FLOOD JAPAN Vaibhav Katiyar (1), Nopphawan Tamkuan (1), Masahiko Nagai (1) (2) 1 Graduate School of Sciences and Technology for Innovation, Yamaguchi University, 2-16-1, Tokiwadai, Ube, Yamaguchi, 755-8611, Japan 2 Center for Research and Application of Satellite Remote Sensing, Yamaguchi University, 2-16- 1, Tokiwadai, Ube, Yamaguchi, 755-8611, Japan Email: [email protected]; [email protected]; [email protected] KEY WORDS: Flood Mapping, Semantic Segmentation, Deep Learning, Synthetic Aperture Radar (SAR) ABSTRACT: Disasters are on the rise and with global warming, the frequency of floods has seen an exponential increase. Flood area detection becomes necessary to prioritize the focus area for reducing the response time and saving more lives. As flood inundates larger area (several hundreds of square-km), remote sensing becomes important to monitor this affected area. However, flood and bad weather are in general occurs simultaneously, this restricts us to use Optical images and thereby Synthetic Aperture Radar (SAR) images become the obvious choice. In the recent Kyushu flood in Japan, which occurred due to concentrated rain in the first week of July 2020, led to the flooding of Kuma River and its tributaries. SAR images of previous flood events in Japan were utilized as training data. Due to the limited training data and binary class (flooded vs non-flooded area) segmentation problem, this study chooses U-Net, as it has shown better results in the above- mentioned situation. In this study, U-Net with alternate 5x5 convolution to 3x3 convolution in the encoder part has been used to grasp more contextual information.