Car Manufacturing in N. Europe and Its Influence on Fastener Demand

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Energy Technology Programmes 1993-1998. Intermediate Report

T£££s/n>-W--4/?l Energy Technology Research Programmes 1993- 1998 Intermediate report gyflgeermxytwooeWKewturaE) /Z TECHNOLOGY DEVELOPMENT CENTRE FINLAND Technology Programme Report 4/97 Helsinki 1997 Tekes - Your contact for Finnish technology Takes primary objective is to promote the technological competitiveness in Finnish industry. Activities should lead to an increase and diversification of industrial production and exports and an improvement of well-being in society. Annually, Tekes grants about one and a half billions Finnish marks for financing applied and industrial R&D in Finland. Tekes offers excellent channels for technological co-ope ration with Finnish companies, universities and research institutes. Technology programmes - part of the innovation chain The technology programmes for developing innovative products and processes, are an essential part of the Finnish innovation system. These programmes are characterised by close co-operation of the industry, universities and research institutes.The programmes also form a solid basis for international co-operation. Currently there are about 50 active technology programmes ISBN 951-53-0756-2 ISSN 1239-1336 Cover: Oddball Graphics Oy Pages layout: DTPage Oy Printers: Paino-Center Oy, 1997 DISCLAIMER Portions of tins document may be illegible in electronic image products. Images are produced from the best available original document. Contents Chapter I Energy technology research programmes 1993-1998 ... 7 Chapter 2 BIOENERGY - Bioenergia Research Programme ..........IS 1 Background -

Global Brand List

Global Brand List Over the last ten years Superbrand, Topbrand and Grande status in over 10 countries: Marque status have become recognised as the benchmark for brand success. The organisation has produced over 5000 case DHL, American Express, Audi, AVIS, Sony, studies on brands identified as high achievers. These unique McDonald's, MasterCard, Philips, Pepsi, Nokia, stories and insights have been published in 100 branding bibles, Microsoft, Gillette, Kodak and Heinz. 77 of which were published in Europe, the Middle East and the Indian sub-continent. The following brands have achieved Superbrands ® 1C Aim Trimark Amstel Asuransi Barbie 3 Hutchison Telecom AIMC *Amsterdam AT Kearney Barca Velha 3 Korochki Air Asia Amsterdam Airport Atlas Barclaycard 36,6 Air Canada Amway Atlas Hi-Fi Barclays Bank 3FM Air France An Post Aton Barista 3M Air Liquide Anadin atv BARMER 7-Up Air Miles Anakku Audi Barnes & Noble 8 Marta Air Sahara Anchor Audrey Baron B A Blikle Airbus Ancol Jakarta Baycity Aurinkomatkat Basak¸ Emeklilik A&E Airland Andersen Consulting Australia Olympic Basak¸ Sigorta A-1 Driving Airtel Andersen Windows Committee BASF AA2000 AIS Andrex Australia Post Basildon Bond AAJ TAK Aiwa Angel Face Austrian Airlines Baskin Robins AARP Aji Ichiban Anlene Auto & General Baso Malang AB VASSILOPOULOS Ak Emekliik Ann Summers Auto Bild Bassat Ogilvy ABBA Akari Annum Automibile Association Bata abbey Akbank Ansell AV Jennings Batchelors ABC Al Ansari Exchange Ansett Avance Bates Abenson Inc Al Ghurair Retail City Antagin JRG AVE Battery ABN Amro -

Inu- 7 the Worldbank Policy Planningand Researchstaff

INU- 7 THE WORLDBANK POLICY PLANNINGAND RESEARCHSTAFF Infrastructure and Urban Development Department Public Disclosure Authorized ReportINU 7 Operating and Maintenance Features Public Disclosure Authorized of Container Handling Systems Public Disclosure Authorized Brian J. Thomas 9 D. Keith Roach -^ December 1987 < Technical Paper Public Disclosure Authorized This is a document publishedinformally by the World Bank The views and interpretationsherein are those of the author and shouldnot be attributedto the World Bank,to its affiliatedorganizations, or to any individualacting on their behalf. The World Bank Operating and Maintenance Features of Container Handling Systems Technical Paper December 1987 Copyright 1987 The World Bank 1818 H Street, NW, Washington,DC 20433 All Rights Reserved First PrintingDecember 1987 This manual and video cassette is published informally by the World Bank. In order that the informationcontained therein can be presented with the least possibledelay, the typescript has not been prepared in accordance with the proceduresappropriate to formal printed texts, and the World Bank accepts no responsibilityfor errors. The World Bank does not accept responsibility for the views expressedtherein, which are those of the authors and should not be attributed to the World Bank or to its affiliated organisations. The findings,-inerpretations,and conclusionsare the results of research supported by the Bank; they do not necessarilyrepresent official policy of the Bank. The designationsemployed, the presentationof material used in this manual and video cassette are solely for the convenienceof th- reader/viewerand do not imply the expressionof any opinion whatsoeveron the part of the World Bank or its affiliates. The principal authors are Brian J. Thomas, Senior Lecturer, Departmentof Maritime Studies,University of Wales Institute of Science and Technology,Cardiff, UK and Dr. -

E 1 E---- I ,:, Ii' !11 -'-J :!,/ T T Ii ! I 3, - L$ .-Rar-=

:* '.'#d:-:#i Sisu's KB 1 12 was 1.-*, the first EuroPean tiLt d .Pltl cabbed truck in regu[ar production in 1962 , Jrlfi lfl,e+ J +--lr€*ALLlj il rr,;rr :, E 1 E---- I ,:, ii' !11 -'-J :!,/ t t ii ! I 3, - l$ .-rar-= i Typical. of Sisu's production in the [ate '1960s was this impressive Ro[Ls Royce-powered K 142 r t:t !'tl'!! The M 162 was Sisu s f [agship modeI f rom 1970 The maker c[aims that a dozen are stit[ operated commerc ally q This sM Model, was hard at work this summer outside Helsinkr after it was buiLt RenauLt rn haul.ing rock a good 20 years The E12 was the f irst model offered foLlowrnq the tte-tn with tor.cot _:' ' 1=eclAt lv0T0R 1110115 SISU AUTO 39 lruckswith guts -HE FINNISH WORD Sisu has no direct English CM visits FinLand's Sisu Auto and takes ranslation. but a close approximation is "determination", resilience" or - simply - "guts". which has proven to be stock of the activities of one of Europe s ppropriate in respect of the trucks that have carried the rame since 1931. most enigmatic truck manufacturers Early Sisus were built in rnodest numbers with rroduction in the first year amounting to a mere By Richard Stanier 2 chassis of Volvo-based design. Chief engineer Tor ,{essling was appointed in 1932 and by 1935 his SH Model Nessling cemented his place in European truck-making rad paved the way for the company's progress under his history with the introduction of the lifting bogie in 19-58. -

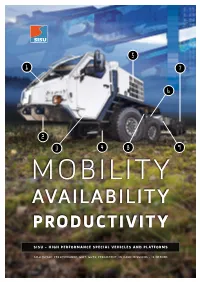

Availability Availability

5 1 7 6 2 3 4 8 9 MOBILITY AVAILABILITY PRODUCTIVITY SISU – HIGH PERFORMANCE SPECIAL VEHICLES AND PLATFORMS SISU [SI’SU]: PERSEVERANCE; GRIT; GUTS; PERSISTENT; IN HARD MISSIONS ~ IS NEEDED. DESIGN VEHICLE TECHNOLOGY SOLUTIONS PROJECT SERVICES COMPRISE, You name it – We have it IN ADDITION TO VEHICLE DESIGN, High Mobility Vehicles FOR EXAMPLE; and Platforms for e.g. − Aerial platforms RESEARCH – − Fire vehicles – SITE SURVEYS − Heavy duty tippers – ANALYSES − Service vehicles – FIELD TESTING − Towing trucks – TRAINING − Work Over Rigs WE HAVE THE SOLUTION – Numerous other solutions FOR also available -<4000>+ 3 5 -<2567>+ 2 1 YOUR 4 NEEDS 6 7 – < 20.6° > + – < 151.3° > + – < 33.8° > + –< 2615 >+ –< 1875 >+ -< 4775 >+ –< 1450 >+ –< 1520 >+ CABIN POWERTRAIN CHASSIS COMPONENTS AXLES ASSEMBLY Both standard and The powertrain options are designed individually Components are selected As an independent manufacturer All SISU vehicles are characterized Skilled assembly staff on in- task-specific special cabins according to the requirements of the customer and placed taking into Sisu Auto uses components from by high payload and mobility. house production line results in and related protection and the usage of the truck. Various engine types account the end use of the leading manufacturers worldwide. Therefore number of axles and high quality products. Combined features are available. complying to different emission standards are the vehicle. Modular design Use of standard truck components axle configuration is always chosen with our flexible vehicle design available and the transmission can be automatic, ensures cost-effective •••••••••• in special vehicles ensures low service for optimal manoeuvrability and team it also enables integration automated manual or manual. -

Sisu Oy Sisu Auto Ab Manufactures Heavy Duty Sisu Trucks and Imports Renault Trucks

Sisu_HMTV_esite.2004 29.6.2004 13:35 Page 1 HMTV For tough transport tasks – Sisu Oy Sisu Auto Ab manufactures heavy duty Sisu trucks and imports Renault trucks. Sisu Auto is in charge of the sales, servicing and spare part functions of the two truck brands. Sisu Auto's servicing shop network of 42 outlets is the largest in Finland. The company net sales amount to about EUR 125 million and it employs a staff of 540 persons. Sisu Auto was established in 1931. Manufacturer: Oy Sisu Auto Ab Tammisaarentie 45 FI-10300 Karjaa Finland Tel. +358 19 2751 Fax +358 19 233 001 Composite Sisu_HMTV_esite.2004 29.6.2004 13:35 Page 2 SISU High Mobility Tactical Vehicle • The Sisu HMTV is designed to operate in the varying conditions of transport. • High top speed and high average speed in convoys. • High transportation capacity. • Enables transportation in exacting off-road conditions. • The heavy duty frame has high bending resistance and torsional stiffness. The basic SISU HMTV Off-road Truck, E11T-6X6 / 4150+1400 chassis has a high load bearing capacity, GVW 25 500 kg and is suited for a variety of roles. Permissible axle front axle 7500 kg • Low location of cargo area and center of weights rear axles 10 000 + 10 000 kg gravity. Chassis weight 10 500 kg • The Sisu HMTV tactical truck is based on Payload 15 000 kg commercial design and components but has Top speed 110 km/h been developed to meet military requirements. Engine Cummins, volume 11 l • Good handling properties. Even an untrained Max. -

NATIONAL HYDROGEN ROADMAP for Finland

1 NATIONAL HYDROGEN ROADMAP for Finland Juhani Laurikko, Jari Ihonen, Jari Kiviaho, Olli Himanen, Robert Weiss, Ville Saarinen, Janne Kärki, Markus Hurskainen November 2020 2 ISSN 1797-7339 ISBN 978-952-457-657-4 Business Finland is an accelerator of global growth. We create new growth by helping businesses go global and by supporting and funding innovations. Our top experts and the latest research data enable companies to seize market opportunities and turn them into success stories. Copyright Business Finland 2020. All rights reserved. This publication includes materials protected under copyright law, the copyright for which is held by Business Finland or a third party. The materials appearing in publications may not be used for commercial purposes. The contents of publications are the opinion of the writers and do not represent the official position of Business Finland or the Finnish Government. Business Finland bears no responsibility for any possible damages arising from their use. The original source must be mentioned when quoting from the materials. 3 TABLE OF CONTENTS A Short Preface .......................................................................................4 Mapping of current hydrogen production and use ..............................23 Reasons for high interest in low-carbon hydrogen .............................. 6 Cost-estimates for low-carbon hydrogen production .................... 24-25 Global and EU hydrogen market and selected national cases ..............7 Storage and transport of hydrogen ......................................................26 -

Valmet-Automotive Chooses Solving Movers

2003 French precision in China Dongfeng Peugeot Citroën Automobile Co., Ltd (DCAC) is a French-Chinese joint-venture company manufacturing Peugeot and Citroën cars. Located in the city of Wuhan in the Hubei province of China, DCAC employs 5000 people. To monitor the quality of DCAC’s pressed steel body panels, a measuring station incorporating a 3D scanner checks the precision of the parts to within a hundredth of a millimetre. Effi cient measuring method Body panels are attached to air-fi lm mobile bedplates, which in turn sit on each of two air fi lm-based Solving Movers. The movers can dock with the measuring station from either side, allowing one bedplate and mover to be prepared and manoeuvred into position while the other is docked at the measuring station. Once the mover has docked, the bedplate fl oats from the mover to the measuring table, guided by a fi xed rail, positioning the body panel accurately under Valmet-Automotive the scanner. The system is entirely pneumatic and cannot therefore interfere with the measuring system’s electronics. Successful French-Finnish project chooses Solving Movers Similar devices are in use at Peugeot and Citroën in France and have proved very satisfactory. Applying the French Valmet-Automotive, in Uusikaupunki, Finland, has established To help meet these challenges a Solving Automated Guided measuring method to the Chinese factory was therefore an a reputation for manufacturing quality specialist cars since the Vehicle (AGV) system has been selected to marry Porsche Box- easy choice to make. 1970s. A range of Saab’s, for example, has been manufactured ster engine and transmission assemblies with the bodies, and in Uusikaupunki for many years, and a recently signed long-term Solving Electric Movers will also be used to handle engine as- Solving’s French representative I.M.S. -

Sähköautojen Akkutuotannon Erityisvaatimukset Työkalunvalmistajille

SPECIAL REQUIREMENTS FOR TOOL MANUFACTURERS REGARDING ELECTRIC VEHICLE BATTERIES 21.01.2021 / Ilkka Heikkilä 1 INTERNAL CONTENT • Valmet Automotive EV Systems • Special requirements for tool manufacturers to produce tools for electric vehicle batteries © Valmet Automotive 2 VALMET AUTOMOTIVE – OUR HISTORIC LANDMARKS Competence in building electric vehicles since 2009 1968 1969 1986 1992 1995 1997 2009 2010 2011 2013 2017 2018 2019 Founded as To become Pontos and Tesi CATL as New SALO Saab-Valmet independent stepped in as a new plant SOP Joint Venture from Saab, new shareholders shareholder of high- between Saab- fully owned volume Scania and by Valmet battery Valmet Acquisition of systems Renamed to Karmann Valmet Convertible Roof Automotive Systems © Valmet Automotive VISION 3 OUR DELIVERABLES – WE MAKE [ELECTRIC] VEHICLES HAPPEN EV BATTERY SYSTEM VEHICLE ROOF & CONTRACT KINEMATIC MANUFACTURING SYSTEMS Existing & new vehicle Engineering & Existing & concepts Production new customers © Valmet Automotive MISSION 4 ELECTRIFYING ELECTRIC VEHICLES (EV) SYSTEMS THE FAST LANE OF LIFE: ELECTRIC. BATTERY MODULES AND SYSTEMS BUSINESS MODELS 48V & HIGH-VOLTAGE CONTRACT MANUFACTURING & SYSTEM SUPPLY PRODUCTION FROM PROTOTYPES TO HIGH VOLUME SERIES © Valmet Automotive © Valmet Automotive ELECTRIFYING ELECTRIC VEHICLES (EV) SYSTEMS BATTERY MODULES AND SYSTEMS • 48 Volt & High-Voltage (All Cell Formats) • Automotive & Off-Highway Applications • Components – Junction Box, CMC & BMU PRODUCTION • Manufacturing Engineering • Module & Battery Pack Assembly -

A CASE STUDY on CARBON NEUTRAL Architecture & Spatial Planning by Kremena Dyakova

Lifelong Learning Programme | ERASMUS ´Intensive Program´ “THE CARBON NEUTRAL CITY NEUSIEDL AM SEE in 2050” A CASE STUDY ON CARBON NEUTRAL Architecture & Spatial planning by Kremena Dyakova There is no doubt that environmental issues substantially influence our cities, culture and society. This effectively impacts on the planning process as well. “Virtually every city and country […] will, sooner or later, need to plan for its sustainable future or its very economic, environmental, and social survival.” 1 The fact of the matter is, Architecture and Planning have an undeniable say in how social and economic landscapes be changed in order to satisfy the needs of people for a high quality of life. Lessening the ecological impacts of growth in the cities is at present a must for cultivating successful development models, or livable communities for that matter. My own professional interest and experience with that subject is best reflected by the diploma project I prepared toward graduation in the Urban planning department at UACEG 2. “Lifestyle and Urban planning” examines the possibilities for a small urban settlement to be developed in accordance with both locally and globally sustainable objectives. The word goes of Sibbesborg area - situated approximately 30 kilometers east of the center of Helsinki. The project area encompasses 2 000 ha with a population of 3 000 inhabitants and less than 1000 jobs established by the year 2010. An open international planning competition for sustainable community development was organized in 2011 by Sipoo Municipality.3 The purpose of the competition was to enable the development of the Sibbesborg area and help it respond to the needs of the growing metropolitan region (fig.1|fig.2|fig.3). -

Establishing Vehicle Manufacturing Capabilities in Uganda

Establishing Vehicle Manufacturing Capabilities in Uganda What is the Kiira Motors Corporation? Kiira Motors Corporation is a Presidential Initiative for Science and Technology Innovations aimed at establishing vehicle (Pickups, SUVs, Sedans, Light & Medium Duty Trucks, and Buses) manufacturing capabilities in Uganda. This is a practical step toward the transformation of Uganda into a middle income nation by 2040 through leveraging the vitality and potential of citizenry by providing a platform for intellectual application and provision of high-tech employment opportunities. Kiira Motors Corporation is committed to championing the progressive development of local capacity for Vehicle Manufacturing and Vehicle Technology Innovation, which is recognized as a key ingredient for institutionalizing a sustainable Vehicle Manufacturing industry in Uganda. Who owns Kiira Motors Corporation? The Kiira Motors Corporation was incorporated as a Limited Liability Company with Certificate No. 181052. The Equity Partners in Kiira Motors Corporation are Makerere University and Uganda Development Corporation on behalf of Government. Uganda Development Corporation (UDC) is an investment institution fully owned by the Government of Uganda under the Ministry of Trade Industry and Cooperatives, established to facilitate industrial and economic development by making long-term investments in strategic sectors of the economy in order to stimulate industrial and economic development and thus spur private sector growth. Who are the project’s major partners and funders? The Kiira Motors Project is fully funded by the Government of the Republic of Uganda through the Presidential Initiative for Science and Technology. The key partners are: Kettering University in Flint, Michigan, USA; Center for Automotive Research (CAR), at Ohio State University, Columbus, Ohio; RLE International the Americas, Detroit, Michigan; ARUP, London, UK; Valmet Automotive Inc., Uusikaupunki, Finland; and Automotive Investment Holdings, Pretoria, South Africa. -

Partek Annual Report 1997

Annual Report 1997 Competence and Nordic limestone are the cornerstones on which Partek has grown to become today’s global engineering company. Partek celebrates its centenary year focusing on increasing the company’s value. The changes implemented during the year have strengthened Partek’s structure and strategic position considerably. Each of the three businesses now has the strength to grow and the capacity to produce results. Partek 1997 LOAD HANDLING Container handling Cargo handling Partek is the world’s leading supplier of Partek is the world’s leading manufac- logistical solutions for ports and freight turer of cargo handling equipment for terminals. vehicles. Partek is particularly strong in the Hiab general cargo cranes are market market for terminal tractors, straddle leaders globally while Loglift and carriers, reachstackers and heavy lift Jonsered timber cranes and Multilift trucks. Other products include mobile demountable equipment lead in Europe gantry cranes and timber-handling and Norba refuse vehicles in Scandina- equipment. via. The customer base consists of pri- Ottawa, Kalmar and Sisu are globally vate truck owners, transport companies, renowned brands. Customers are prima- forest machine manufacturers and en- rily stevedoring companies, ports, rail- trepreneurs, suppliers of construction ways, distribution terminals and industry. materials, waste-handling companies, the public sector and defence forces in several countries. AGRIFOREST Forest machines Tractors Partek is the world’s second largest Partek is the leading manufacturer of manufacturer of forest machines for cut- tractors in Scandinavia and second larg- to-length method. The environmentally est in South America. The focus is on the preferred cut-to-length method involves rapidly expanding high-powered tractors harvesters, as they are called, which fell, segment of 60-190 hp.