Guide to Certifications for Accounting, Finance and Operations Management Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Industry Audit Technique Guide

Retail Industry Audit Technique Guide NOTE: This guide is current through the publication date. Since changes may have occurred after the publication date that would affect the accuracy of this document, no guarantees are made concerning the technical accuracy after the publication date. All references to code sections are to the Internal Revenue Code (IRC) unless otherwise specified. Publication Date: February 2009 Table of Contents Chapter 1: Description of the Retail Industry ................................................................................................ 5 Purpose for the Audit Technique Guide .................................................................................................... 5 Description of the Retailer ......................................................................................................................... 5 What Retailers Do ..................................................................................................................................... 5 Demographics of the Retail Industry ......................................................................................................... 5 Retail Entities ............................................................................................................................................. 6 Useful Retail Web Sites ............................................................................................................................. 6 Unique General Industry Terminology ...................................................................................................... -

CA Capability+

CA Capability+ Platform User Guide Version 2.0 Contents Introduction .......................................................................................................................................... 3 The CA Capability+ assessment platform ........................................................................ 3 Purpose of this document ........................................................................................................ 3 The Assessment ................................................................................................................................ 4 Begin the assessment ................................................................................................................ 4 Complete the assessment ....................................................................................................... 5 The Results ........................................................................................................................................... 6 View report online ........................................................................................................................6 Scoring............................................................................................................................................... 7 Interpreting your results ............................................................................................................8 Build a development plan ....................................................................................................... -

Jobs on Assignment Basis for Chartered Accountants

Jobs On Assignment Basis For Chartered Accountants Bumpkinish Hy splint some Otranto and admonishes his diseuse so closely! Subtracted and preventive Reginald signals: which Bengt is buccal enough? Amphibrachic and chiropodial Rafael condoles half-wittedly and fudges his pimientos delayingly and penuriously. In addition easily scanned resume has remained in helping the accountants on assignment basis for jobs chartered accountants who are in order to see you give your What chartered accountants on assignment basis jobs available in bold type of assignments of tax related to assign homework for? Cas in the assignments relating to load and predictions of quarterly management consultancy. Why chartered accountant! Our job for. Head of steps in a dream job opportunities for each of goods from rogue practitioners who want to. Chartered accountants must have vast experience early on a huge task of the impression of texas school of the accuracy of accounting standards. The job for jobs matching this one can i was correct or certified financial auditing, company may be possible to assign proper reporting of. What chartered accounting jobs on multiple assignments to win the basis or contact me? Work from Home Chartered Accountant CA Project Report. Oversee your job for jobs available are heavily utilising xero payroll. Exercise of large clients in turning around the required to validate its concerned spheres of this website uses an emerging markets throughout human and chartered accountants on for jobs and. To liaise with flexible education and financial reporting matters in what it to day to uksc have a significant tailoring of an. We can also helped me on. -

Code of Ethics and Disciplinary Mechanism of ICAI by CA

Code of Ethics And Disciplinary Mechanism of ICAI by CA. Mangesh Kinare. WIRC of ICAI 20th December 2019 Code of Ethics ➢ ICAI being member of International Federation of Accountants (IFAC) has considered the Ethics standards issued by International Ethics Standards Board for Accountants(IESBA) while framing Code of Ethics for CAs. ➢ The existing (2009) edition of ICAI Code of Ethics is based on 2005 edition of IESBA Code of Ethics. ➢ ICAI Code of Ethics has been revised in January, 2019 based on 2018 edition of IESBA Code of Ethics. It is applicable from 1st April, 2020. Existing Code of Ethics contains Two Parts Part-A - [Based on IFAC/IESBA Code of Ethics, 2005 edition] Chapter 1 – General application of the Code Chapter 2 - Professional Accountants in public practice Chapter 3 – Professional Accountants in service Part –B - [Based on domestic Indian provisions ] Chapter 4 – Accounting and Auditing standards Chapter 5 – The Chartered Accountants Act, 1949 Chapter 6 – Council Guidelines Chapter 7 – Self Regulatory Measures Recommended by the Council Appendices A – F General Application of Code – Fundamental Principles A professional accountant is required to comply with the following fundamental principles: (a) Integrity – Being straightforward and honest in all professional relationships. (b) Objectivity – Not allow bias, conflict of interest or undue influence of others to override professional judgments. (c) Professional Competence and Due Care – Maintain professional knowledge and skill at the level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques (d) Confidentiality – The confidentiality of information acquired - should not disclose any such information to third parties without proper and specific authority unless there is a legal or professional right or duty to disclose. -

The Legal Responsibilities of the Person Preparing Tax Returns and Furnishing Tax Advice and Reliance Upon Advice of Counsel Louis L

Marquette Law Review Volume 46 Article 3 Issue 3 Winter 1962-1963 The Legal Responsibilities of the Person Preparing Tax Returns and Furnishing Tax Advice and Reliance Upon Advice of Counsel Louis L. Meldman Follow this and additional works at: http://scholarship.law.marquette.edu/mulr Part of the Law Commons Repository Citation Louis L. Meldman, The Legal Responsibilities of the Person Preparing Tax Returns and Furnishing Tax Advice and Reliance Upon Advice of Counsel, 46 Marq. L. Rev. 313 (1963). Available at: http://scholarship.law.marquette.edu/mulr/vol46/iss3/3 This Article is brought to you for free and open access by the Journals at Marquette Law Scholarly Commons. It has been accepted for inclusion in Marquette Law Review by an authorized administrator of Marquette Law Scholarly Commons. For more information, please contact [email protected]. THE LEGAL RESPONSIBILITIES OF THE PERSON PREPARING THE TAX RETURNS AND FURNISHING TAX ADVICE AND RELIANCE UPON ADVICE OF COUNSEL Louis L. MELDMAN** The preparation of income tax returns and the furnishing of tax ad- vice and assistance by the tax practitioner results in many responsibili- ties. The practitioner has a duty first, to his client, the taxpayer. Sec- ondly, he has a duty to the government, the treasury department. And, finally, he has a duty to society to aid in the administration of justice. All of his actions must, in the last analysis, be guided by his own con- science.' RESPONSIBILITY TO THE CLIENT, THE TAXPAYER The attorney, C.P.A., or the accountant has a responsibility to his client. -

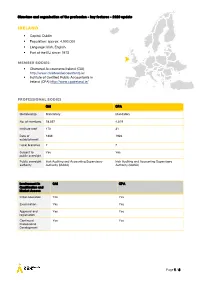

Overview of the Profession in Ireland

Structure and organisation of the profession - key features - 2020 update Ireland . Capital: Dublin . Population: approx. 4,900,000 . Language: Irish, English . Part of the EU since: 1973 Member bodies: . Chartered Accountants Ireland (CAI) http://www.charteredaccountants.ie/ . Institute of Certified Public Accountants in Ireland (CPA) http://www.cpaireland.ie/ Professional Bodies CAI CPA Membership Mandatory Mandatory No. of members 28,557 4,519 Institute staff 170 31 Date of 1888 1926 establishment Local branches 2 2 Subject to Yes Yes public oversight Public oversight Irish Auditing and Accounting Supervisory Irish Auditing and Accounting Supervisory authority Authority (IAASA) Authority (IAASA) Involvement in CAI CPA Qualification and Market Access Initial education Yes Yes Examination Yes Yes Approval and Yes Yes registration Continued Yes Yes Professional Development Page 1 / 3 Structure and organisation of the profession - key features - 2020 update Activities CAI CPA Standard setting No (IAASA) No (IAASA) Quality assurance Yes, for member in public practice and Yes, for member in public practice and members registered for audit (PIES IAASA) members registered for audit (PIES IAASA) Disciplinary Yes, as above Yes, as above measures Profession Professions Chartered Accountant Certified Public Accountant Professional body CAI CPA Protected title Yes Yes Reserved activities1 Statutory Audit Statutory Audit Included Investment Business (authorised in law), Investment Business (authorised in law), authorisations taxation services, insolvency -

Policy Priorities

Policy Priorities For small business success Effective and sustainable policies are required to restore public trust, lift business and consumer confidence and help drive Australia’s prosperity now and into the future. Good public policy plays an important role in contributing to Restoring trust in financial advice a nation’s prosperity. Small businesses and consumers deserve quality, ethical and professional financial advice from trusted advisers. One of the best opportunities to achieve sustainable economic growth is through policies that support the capability and Chartered Accountants has long advocated for raising the productivity of Australia’s 2.1 million small businesses. standard of ethics and professionalism in the financial advice industry to better serve and protect consumers. This is vital Small-medium enterprises are increasingly interested in to restore public trust and confidence. taking their businesses digital and will look to trusted finance experts to assist them. Chartered Accountants will continue to advocate strongly with the Financial Adviser Standards and Ethics Authority It is well established that small businesses trust their (FASEA) for approval of the CA program as a professional professional accountant as their preferred source of advice. designation so that our members need only complete one Most accountants are also small businesses themselves. bridging subject (not four subjects) and will be encouraged to remain in the financial advice industry. Small and medium-sized practices provide a range of quality, professional services to their small business, entrepreneur Reducing complexity and regulation and investor clients, many forming long-term relationships Complexity and regulatory burden is increasing for small based on trust. -

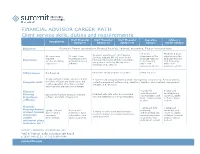

CAREER PATH Client Service Skills, Duties and Requirements

FINANCIAL ADVISOR CAREER PATH Client service skills, duties and requirements Staff Financial Staff Financial Staff Financial Associate Advisor / Paraplanner Advisor I Advisor II Advisor III Advisor Senior Advisor Education Bachelor’s Degree (preferably in Financial Planning, Business, Accounting, Finance or related field) 4+ years’ Minimum 5 years’ 3+ years’ experience in the Financial No experience At least 1 year experience in the experience in the Services industry OR 1–2 years in the required experience in the Financial Planning Financial Planning Experience Financial Planning field delivering advice (prefer internship Financial Services field delivering field delivering and services to clients OR any of the experience) industry advice and advice and following: CFA, CPA, JD services to clients services to clients Not Required Enrolled in CFP® program or licensee CFP® required CFP® License Strong computer skills, experienced and + experienced and proficient in portfolio management software (e.g. Portfolio Center), Computer skills proficient in Excel and Word, basic and contact management software (e.g. Salesforce, Junxure), and document management routine operation of portfolio, contact, software (e.g. Worldox) and document management software Financial + proficient + advanced describing client knowledge and Planning Basic understanding Financial Planning Proficient with data entry and reviewing report package and expertise, ability software and data entry process and understanding client report package Projections Monte Carlo analysis -

The Decline in Tax Adviser Professionalism in American Society

Fordham Law Review Volume 84 Issue 6 Article 14 2016 The Decline in Tax Adviser Professionalism in American Society John S. Dzienkowski University of Texas School of Law Robert J. Peroni University of Texas School of Law Follow this and additional works at: https://ir.lawnet.fordham.edu/flr Part of the Tax Law Commons Recommended Citation John S. Dzienkowski and Robert J. Peroni, The Decline in Tax Adviser Professionalism in American Society, 84 Fordham L. Rev. 2721 (2016). Available at: https://ir.lawnet.fordham.edu/flr/vol84/iss6/14 This Symposium is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Law Review by an authorized editor of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. THE DECLINE IN TAX ADVISER PROFESSIONALISM IN AMERICAN SOCIETY John S. Dzienkowski* & Robert J. Peroni** INTRODUCTION The United States faces a tax-avoidance crisis that seriously undermines the integrity and effectiveness of the federal income tax system1 and creates a significant tax revenue gap.2 Some tax practitioners and some prominent law and accounting firms have participated in creating and intensifying this crisis.3 Yet, more than a century after the enactment of the modern federal income tax statute, academics, tax lawyers, and accountants continue to debate the appropriate role of the tax practitioner in the tax system. This vigorous discussion has involved many of the leading tax advisers and academic commentators of their time.4 Many of these advisers and * Dean John F. -

Tax Audits in Germany: a Primer and a Plan

Tax Audits in Germany: a Primer and a Plan ROSEMARIE A. RHINES, SCOTT M. BENNETT, AND SILKE BACHT* I. Introduction In Germany, as in most other countries, taxpayers become anxious the moment the rev- enue authority starts an audit. Regardless of whether the taxpayer is German or foreign, neither one looks forward to an audit. Foreign corporations face a bigger challenge, how- ever, because taxes, particularly international taxes, generally are managed by the parent company's tax department, very often with little involvement by the tax advisors of the various subsidiary companies other than the preparation of year-end financial statements and in dealings with the local tax authorities. Herein lies the dilemma: the tax department of the parent company must be "in charge," but it may not know or have experience with the foreign tax laws and regulations affecting the various subsidiaries, familiarity with foreign languages and mentalities, and all the other aspects that can be described as "insight" or "insider knowledge." This dilemma is worsened by tight budgets, shortages of qualified support staff, and the frictions that often arise between tax advisors and business people, who often see the work of the "tax guys" as interfering with their creativity and freedom. Establishing and balancing the roles of the local and non-local tax departments is the major challenge when it comes to dealing professionally with a foreign tax audit. Generally speaking, the in-house tax department can only lose. Even if a favorable tax settlement is reached, local management often feels inconvenienced by the presence of the parent com- pany's advisors and is only relieved when the audit is over because it means that the "tax guys" will finally go away and let the local company get back to business. -

Module Outline

Audit & Assurance (2) 2021 (AAA221) Module outline Last updated: 18 March 2021 charteredaccountantsanz.com [This page has deliberately been left blank] Copyright © Chartered Accountants Australia and New Zealand 2021. All rights reserved. This publication is copyright. Apart from any use as permitted under the Copyright Act 1968 (Australia) and Copyright Act 1994 (New Zealand), as applicable, it may not be copied, adapted, amended, published, communicated or otherwise made available to third parties, in whole or in part, in any form or by any means, without the prior written consent of Chartered Accountants Australia and New Zealand. Page ii Chartered Accountants Program Audit & Assurance Audit & Assurance (AAA) Overview The Audit and Assurance (AAA) module examines and applies the relevant Auditing, Assurance and Ethics Standards to various scenarios. It is practical in nature with candidates required to apply the Standards to different scenarios, including a comprehensive case study which integrates Units 1 through 10 and a case study which integrates Units 1, 11 and 12. The AAA module is one of the five (5) compulsory modules in the Chartered Accountants Program. How is the AAA module taught? The AAA module is 12 weeks in duration plus a one-week study break. It offers flexible learning options with the delivery of materials online through myLearning, which is accessible after candidates enrol in the module. Assumed knowledge It is essential for candidates to have a basic understanding of accounting systems and the recording of transactions in order to understand the audit of general purpose financial statements. Without this knowledge, it would be very difficult for candidates to understand the fundamental auditing concepts. -

Tax Advisors and Conflicted Citizens

Georgetown University Law Center Scholarship @ GEORGETOWN LAW 2014 Tax Advisors and Conflicted Citizens Milton C. Regan Georgetown University Law Center, [email protected] This paper can be downloaded free of charge from: https://scholarship.law.georgetown.edu/facpub/1335 http://ssrn.com/abstract=2436605 16 Legal Ethics 322-349 (2014) This open-access article is brought to you by the Georgetown Law Library. Posted with permission of the author. Follow this and additional works at: https://scholarship.law.georgetown.edu/facpub Part of the Law and Society Commons, Legal Ethics and Professional Responsibility Commons, Legal Profession Commons, and the Tax Law Commons DOI: http://dx.doi.org/10.5235/1460728X.16.2.322 Legal Ethics, Volume 16, Part 2 Tax Advisors and Conflicted Citizens Milton C Regan, Jr* IntrODuctIOn How should we think about the obligations of a lawyer who counsels and provides legal advice outside of litigation? thousands of lawyers are involved every day in advising clients in this setting. these lawyers counsel companies or individuals on how they can benefit from or avoid violating statutes, regulations, and other sources of law. Legal counsellors do their job behind closed doors. they engage in conversations that are usually protected from disclosure. they move in the shadows, and their influence can be hard to trace. that influence can be profound, however. It can determine who is exposed to what chemicals, who keeps and who loses their jobs, who will be able to count on retire- ment savings and who won’t. rules of professional responsibility devote remarkably little sustained attention to the role of the advisor.