Maxar Technologies with Respect to Future Events, Financial Performance and Operational Capabilities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Istanbul Technical University Institute of Science And

İSTANBUL TECHNICAL UNIVERSITY « INSTITUTE OF SCIENCE AND TECHNOLOGY DESIGN STUDY OF A COMMUNICATION SUBSYSTEM AND GROUND STATION FOR ITU-pSAT II M.Sc. Thesis by Melih FİDANOĞLU Department : Institue of Science and Technology Programme : Defence Technologies JANUARY 2011 İSTANBUL TECHNICAL UNIVERSITY « INSTITUTE OF SCIENCE AND TECHNOLOGY DESIGN STUDY OF A COMMUNICATION SUBSYSTEM AND GROUND STATION FOR ITU-pSAT II M.Sc. Thesis by Melih FİDANOĞLU (514071013) Date of submission : 20 December 2010 Date of defence examination: 24 January 2011 Supervisor (Chairman) : Assoc. Prof. Dr. Gökhan İNALHAN (ITU) Members of the Examining Committee : Prof. Dr. İbrahim ÖZKOL (ITU) Prof. Dr. Metin Orhan KAYA (ITU) JANUARY 2011 İSTANBUL TEKNİK ÜNİVERSİTESİ « FEN BİLİMLERİ ENSTİTÜSÜ ITU-pSAT II İÇİN İLETİŞİM ALTSİSTEMİ VE YER İSTASYONU TASARIM ÇALIŞMASI YÜKSEK LİSANS TEZİ Melih FİDANOĞLU (514071013) Tezin Enstitüye Verildiği Tarih : 20 Aralık 2010 Tezin Savunulduğu Tarih : 24 Ocak 2011 Tez Danışmanı : Doç. Dr. Gökhan İnalhan (İTÜ) Diğer Jüri Üyeleri : Prof. Dr. İbrahim Özkol (İTÜ) Prof. Dr. Metin Orhan Kaya (İTÜ) OCAK 2011 FOREWORD First of all, I would like to thank my advisor, Gökhan İnalhan for the opportunity to work in the fantastic setup of Control and Avionics Laboratory and to work with the research team here. I would like to thank ITU-pSAT II project team including Emre Koyuncu, Melahat Cihan, Elgiz Başkaya and Soner Işıksal for being my project teammates. Also, my sincere thanks goes to Control and Avionics Lab's fellow labmates, including, but not limited to, Serdar Ateş, Oktay Arslan and Nazım Kemal Üre. A special thanks goes to TÜBİTAK. Without their contributions, this project would not be possible. -

From Air, Sea, and Space, Geospatial Technology Is Helping Nations Monitor One of Their Biggest and Most Understated Threats: the Open Ocean

» CARDILLO AND LONG Q&A » FUTURE GEOINT LEADERS » SMALLSAT WORKING GROUP 2014 ISSUE 4 THE OFFICIAL MAGAZINE OF THE UNITED STATES GEOSPATIAL INTELLIGENCE FOUNDATION WATCHING THE 2014 USGIF MEMBERSHIP DIRECTORY WATERFrom air, sea, and space, geospatial technology is helping nations monitor one of their biggest and most understated threats: the open ocean. © DLR e.V. 2014 and © Airbus 2014 DS/© DLR Infoterra e.V. GmbH 2014 WorldDEMTM Reaching New Heights The new standard of global elevation models with pole-to-pole coverage, unrivalled accuracy and unique quality to support your critical missions. www.geo-airbusds.com/worlddem CONTENTS 2014 ISSUE 4 The USS Antietam (CG 54), the USS O’Kane (DDG 77) and the USS John C. Stennis (CVN 74) steam through the Gulf of Oman. As part of the John C. Stennis Carrier Strike Group, these ships are on regularly scheduled deployments in support of Maritime Operations, set- ting the conditions for security and stability, as well as complementing counterterrorism and security efforts to regional nations. PHOTO COURTESY OF U.S. NAVAL FORCES CENTRAL COMMAND/U.S. 5TH FLEET 5TH COMMAND/U.S. CENTRAL FORCES NAVAL U.S. OF COURTESY PHOTO 02 | VANTAGE POINT Features 12 | ELEVATE Tackling the challenge of Fayetteville State University accelerating innovation. builds GEOINT curriculum. 16 | WATCHING THE WATER From air, sea, and space, geospatial technology 14 | COMMON GROUND 04 | LETTERS is helping nations monitor one of their biggest USGIF stands up SmallSat Trajectory readers offer Working Group. feedback on recent features and most understated threats: the open ocean. and the tablet app. By Matt Alderton 32 | MEMBERSHIP PULSE Ball Aerospace offers 06 | INTSIDER 22 | CONVEYING CONSEQUENCE capabilities for an integrated SkyTruth and the GEOINT enterprise. -

Space Industry Paper 2008

Spring 2008 Industry Study Final Report Space Industry The Industrial College of the Armed Forces National Defense University Fort McNair, Washington, D.C. 20319-5062 i SPACE 2008 The United States space industry delivers capabilities vital to America’s economy, national security, and everyday life. America remains preeminent in the global space industry, but budget constraints, restrictive export policies, and limited international dialogue are inhibiting the U.S. space industry’s competitiveness. To sustain America’s leadership among space-faring nations, the incoming administration should update and expand U.S. space policies and regulatory guidance, prioritize national space funding, and promote greater international cooperation in space. These steps will strengthen U.S. space industry. They will also enhance U.S. national security, spur technological innovation, stimulate the national economy, and increase international cooperation and goodwill. Mr. Stephen M. Bloor, Dept of Defense Mr. Robert A. Burnes, Dept of the Navy CAPT John B. Carroll, US Navy CDR Charles J. Cassidy, US Navy COL Welton Chase, Jr., US Army CDR R. Duke Heinz, US Navy Lt Col Lawrence M. Hoffman, US Air Force COL Daniel R. Kestle, US Army LtCol Brian R. Kough, US Marine Corps Col Michael J. Miller, US Air Force CDR Albert G. Mousseau, US Navy CDR Robert D. Sharp, US Navy Mr. Howard S. Stronach, Federal Emergency Management Agency CDR L. Doug Stuffle, US Navy Mr. William J. Walls, Dept of State CAPT Kelly J. Wild, US Navy Dr. Scott A. Loomer, National Geospatial-Intelligence -

International Space Station Program Mobile Servicing System (MSS) To

SSP 42004 Revision E Mobile Servicing System (MSS) to User (Generic) Interface Control Document Part I International Space Station Program Revision E, May 22, 1997 Type 1 Approved by NASA National Aeronautics and Space Administration International Space Station Program Johnson Space Center Houston, Texas Contract No. NAS15–10000 SSP 42004, Part 1, Revision E May 22, 1997 REVISION AND HISTORY PAGE REV. DESCRIPTION PUB. DATE C Totally revised Space Station Freedom Document into an International Space Station Alpha Document 03–14–94 D Revision D reference PIRNs 42004–CS–0004A, 42004–NA–0002, 42004–NA–0003, TBD 42004–NA–0004, 42004–NA–0007D, 42004–NA–0008A, 42004–NA–0009C, 42004–NA–0010B, 42004–NA–0013A SSP 42004, Part 1, Revision E May 22, 1997 INTERNATIONAL SPACE STATION PROGRAM MOBILE SERVICING SYSTEM TO USER (GENERIC) INTERFACE CONTROL DOCUMENT MAY 22, 1997 CONCURRENCE PREPARED BY: PRINT NAME ORGN SIGNATURE DATE CHECKED BY: PRINT NAME ORGN SIGNATURE DATE SUPERVISED BY (BOEING): PRINT NAME ORGN SIGNATURE DATE SUPERVISED BY (NASA): PRINT NAME ORGN SIGNATURE DATE DQA: PRINT NAME ORGN SIGNATURE DATE i SSP 42004, Part 1, Revision E May 22, 1997 NASA/CSA INTERNATIONAL SPACE STATION PROGRAM MOBILE SERVICING SYSTEM (MSS) TO USER INTERFACE CONTROL DOCUMENT MAY 22, 1997 Print Name For NASA DATE Print Name For CSA DATE ii SSP 42004, Part 1, Revision E May 22, 1997 PREFACE SSP 42004, Mobile Servicing System (MSS) to User Interface Control Document (ICD) Part I shall be implemented on all new Program contractual and internal activities and shall be included in any existing contracts through contract changes. -

US National Security and Economic Interests in Remote Sensing

NATIONAL GEOSPATIAL-INTELLIGENCE AGENCY 7500 GEOINT Drive Springfield. Virginia 22150 Steven Aftergood Sent via U.S. mail Federation of American Scientists November 28,2012 1725 Desales Street NW, Suite 600 Re: FOIA Case Number: 20100025F Washington, DC 20036 Dear Mr. Aftergood: This letter responds to your October 29, 2009 Freedom oflnformation Act (FOIA) request, which we received on October 29, 2009. You requested access to documents pertaining to "U.S. National Security and Economic Interests in Remote Sensing: The Evolution of Civil and Commercial Policy by James A. Vedda, Aerospace Corp., February 20, 2009, preparedfor NGA Sensor Assimilation Division." , A search ofNGA's system of records located one document (37 pages) that is responsive to your request. We reviewed the responsive documents and determined they are releasable in full. If you have any questions about the way we handled your request, or about our FOIA regulations or procedures, please contact Elliott Bellinger, Deputy FOIA Program Manager, at 571-557-2994 or by email at [email protected] or via postal mail at: National Geospatial-Intelligence Agency FOIA Requester Service Center 7500 GEOINT Drive, MS S71-0GCA Springfield, VA 22150-7500 Sincerely, ~ Elliott Belinger Deputy FOIA Program Manager UNCLASSIFIED AEROSPACE REPORT NO. TOR-2009(3601 )-8539 U.S. National Security and Economic Interests in Remote Sensing: The Evolution of Civil and Commercial Policy 20 February 2009 James A. Yedda NSS Programs Policy and Oversight National Space Systems Engineering Prepared for: National Geospatial-Intelligence Agency Sensor Assimilation Division Sunrise Valley Drive Reston, VA 20191-3449 Contract No. FA8802-09-C-OOO 1 Authorized by: National Systems Group Distribution Statement: Distribution authorized to U.S. -

NASA's Lunar Orbital Platform-Gatway

The Space Congress® Proceedings 2018 (45th) The Next Great Steps Feb 28th, 9:00 AM NASA's Lunar Orbital Platform-Gatway Tracy Gill NASA/KSC Technology Strategy Manager Follow this and additional works at: https://commons.erau.edu/space-congress-proceedings Scholarly Commons Citation Gill, Tracy, "NASA's Lunar Orbital Platform-Gatway" (2018). The Space Congress® Proceedings. 17. https://commons.erau.edu/space-congress-proceedings/proceedings-2018-45th/presentations/17 This Event is brought to you for free and open access by the Conferences at Scholarly Commons. It has been accepted for inclusion in The Space Congress® Proceedings by an authorized administrator of Scholarly Commons. For more information, please contact [email protected]. National Aeronautics and Space Administration NASA’s Lunar Orbital Platform- Gateway Tracy Gill NASA/Kennedy Space Center Exploration Research & Technology Programs February 28, 2018 45th Space Congress Space Policy Directive-1 “Lead an innovative and sustainable program of exploration with commercial and international partners to enable human expansion across the solar system and to bring back to Earth new knowledge and opportunities. Beginning with missions beyond low-Earth orbit, the United States will lead the return of humans to the Moon for long-term exploration and utilization, followed by human missions to Mars and other destinations.” 2 LUNAR EXPLORATION CAMPAIGN 3 4 STRATEGIC PRINCIPLES FOR SUSTAINABLE EXPLORATION • FISCAL REALISM • ECONOMIC OPPORTUNITY Implementable in the near-term with the buying -

For Immediate Release

NEWS RELEASE FOR IMMEDIATE RELEASE October 17, 2018 MDA leaders outline opportunities, challenges for Canada in space Speech to the Greater Saskatoon Chamber of Commerce highlights innovation and economic upsides for Canada, if government acts to secure our place in space Saskatoon, SK – MDA, a Maxar Technologies company (formerly MacDonald, Dettwiler and Associates Ltd.) (NYSE: MAXR) (TSX: MAXR), today outlined that Canada’s role and potential involvement in the growing new space economy requires a full commitment from the Government of Canada for a new space strategy that would secure Canada’s place as a leader in space, Mike Greenley, the Group President of MDA, said in a speech to the Greater Saskatoon Chamber of Commerce. “We need a long-term, fully funded space plan for Canada that establishes the requisite funding to maintain and enhance our existing world-leading capabilities in AI-based space robotics, satellite communications, Earth observation and space science, while cultivating new areas of leadership. And we need it now, because there are pressing decisions that need to be made,” Greenley said. Greenley and Holly Johnson, the president’s business manager at MDA, made their presentation today in Saskatchewan to highlight the impact space has in the region, from Canadian Light Source Inc. to Calian SED Systems, a partner with MDA in the Don’t Let Go Canada campaign currently underway. Greenley and Johnson took advantage of their time in Saskatchewan to discuss MDA Launchpad, the company’s initiative to bring more Canadians companies on board the space industry. MDA has tasked senior leaders to deal with small- to medium-sized enterprises looking to collaborate with MDA. -

July / August 2008

JULY / AUGUST 2008 THE MAGAZINE OF THE AMERICAN ASTRONAUTICAL SOCIETY ISSUE 4 VOLUME 47 SPACE TIMES • July/August 2008 1 AAS OFFICERS PRESIDENT Frank A. Slazer, SBD Consulting EXECUTIVE VICE PRESIDENT Lyn D. Wigbels, RWI International Consulting Services JULY / AUGUST 2008 VICE PRESIDENT–TECHNICAL Srinivas R. Vadali, Texas A&M University VICE PRESIDENT–PROGRAMS ISSUE 4–VOLUME 47 Mary L. Snitch, Lockheed Martin VICE PRESIDENT–PUBLICATIONS David B. Spencer, Penn State University VICE PRESIDENT–MEMBERSHIP J. Walter Faulconer, Applied Physics Laboratory VICE PRESIDENT–EDUCATION Kirk W. Kittell, SAIC VICE PRESIDENT–FINANCE THE MAGAZINE OF THE AMERICAN ASTRONAUTICAL SOCIETY Carol S. Lane, Ball Aerospace VICE PRESIDENT–INTERNATIONAL Clayton Mowry, Arianespace, Inc. VICE PRESIDENT–PUBLIC POLICY PRESIDENT’S MESSAGE William B. Adkins, Adkins Strategies, LLC The Banality of Success 3 VICE PRESIDENT–STRATEGIC COMMUNICATIONS AND OUTREACH Mary Lynne Dittmar, Dittmar Associates FEATURES LEGAL COUNSEL Franceska O. Schroeder, Fish & Richardson P.C. Lessons from Apollo, Space Shuttle, International Space Station, EXECUTIVE DIRECTOR and the Hubble Space Telescope: Learning from These Great James R. Kirkpatrick, AAS Legacies 4 A key theme enunciated by the White House in directing NASA’s AAS BOARD OF DIRECTORS future is to achieve major national goals in space using humans, TERM EXPIRES 2008 along with robots and autonomous systems. Peter M. Bainum, Howard University by Frank J. Cepollina David A. Cicci, Auburn University Lynn F.H. Cline Nancy S.A. Colleton, Institute for Global Sea Launch Regains Launch Tempo 10 Environmental Strategies Mark K. Craig, SAIC Against considerable odds, Sea Launch returned to launch operations Roger D. Launius, Smithsonian Institution with the launch of the Thuraya-3 mobile communications satellite on Jonathan T. -

Fiscal Year 1973, and Are the EROS Program Also Supports the ERTS Data Proiected at Almost $1 Million for Fiscal Year 1974

Aeronautics and Space Report of the President r973 Activities NOTE TO READERS: ALL PRINTED PAGES ARE INCLUDED, UNNUMBERED BLANK PAGES DURING SCANNING AND QUALITY CONTROL CHECK HAVE BEEN DELETED Aeronautics and Space Report of the President 1973 A c tivities National Aeronautics and Space Administration Washington, D.C. 20546 President’s Message of Transmittal To the Congress of the United States: the European Space Conference has agreed to con- struct a space laboratory-Spacelab-for use with the I am pleased to transmit this report on our Nation’s Shuttle. progress in aeronautics and space activities during Notable progress has also been made with the Soviet 1973. Union in preparing the Apollo-Soyuz Test Project This year has been particularly significant in that scheduled for 1975. We are continuing to cooperate many past efforts to apply the benefits of space tech- with other nations in space activities and sharing of nology and information to the solution of problems on scientific information. These efforts contribute to global Earth are now coming to fruition. Experimental data peace and prosperity. from the manned Skylab station and the unmanned While we stress the use of current technology to solve Earth Resources Technology Satellite are already being current problems, we are employing unmanned space- used operationally for resource discovery and manage- craft to stimulate further advances in technology and ment, environmental information, land use planning, to obtain knowledge that can aid us in solving future and other applications. problems. Pioneer 10 gave us our first closeup glimpse Communications satellites have become one of the of Jupiter and transmitted data which will enhance principal methods of international communication our knowledge of Jupiter, the solar system, and ulti- and are an important factor in meeting national de- mately our own planet. -

Navy Space and Astronautics Orientation. INSTITUTION Bureau of Naval Personnel, Washington, D

DOCUMENT RESUME ED 070 566 SE 013 889 AUTHOR Herron, R. G. TITLE Navy Space and Astronautics Orientation. INSTITUTION Bureau of Naval Personnel, Washington, D. C.; Naval Personnel Program Support Activity, Washington, D. C. REPORT NO NAVPERS- 10488 PUB DATE 67 NOTE 235p. '2 EDRS PRICE MF-$0.65 HC-$9.87 DESCRIPTORS Aerospace Education; AerospaceTechnology; *Instructional Materials; Military Science; *Military Training; Navigatioti; *Post Secondary Education; *Space Sciences; *Supplementary Textbooks; Textbooks ABSTRACT Fundamental concepts of the spatial environment, technologies, and applications are presented in this manual prepared for senior officers and key civilian employees. Following basic information on the atmosphere, solar system, and intergalactic space, a detailed review is included of astrodynamics, rocket propulsion, bioastronautics, auxiliary spacecraft survival systems, and atmospheric entry.Subsequentlythere is an analysis of naval space facilities, and satellite applications, especially those of naval interests, are discussed with a background of launch techniques, spatial data gathering, communications programs ,of)servation techniques, measurements by geodetic and navigation systems. Included is a description of space defense and future developments of both national and international space programs. Moreover, commercial systems are mentioned, such as the 85-pound Early Bird (Intelsat I) Intelsat II series, global Intelsat III series, and Soviet-made elMolnlyan satellites. The total of 29 men and one woman orbiting the earth In-1961-67 are tabulated in terms of their names, flight series, launching dates, orbit designations, or biting periods,. stand-up periods, and extra vehicular activity records. Besides numerous illustrations, a list ofsignificantspace launches and a glossary of special terms are included in the manual appendices along with two tables of frequencybanddesignation. -

Reliability Considerations for Communication Satellites

Copyright Warning & Restrictions The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Under certain conditions specified in the law, libraries and archives are authorized to furnish a photocopy or other reproduction. One of these specified conditions is that the photocopy or reproduction is not to be “used for any purpose other than private study, scholarship, or research.” If a, user makes a request for, or later uses, a photocopy or reproduction for purposes in excess of “fair use” that user may be liable for copyright infringement, This institution reserves the right to refuse to accept a copying order if, in its judgment, fulfillment of the order would involve violation of copyright law. Please Note: The author retains the copyright while the New Jersey Institute of Technology reserves the right to distribute this thesis or dissertation Printing note: If you do not wish to print this page, then select “Pages from: first page # to: last page #” on the print dialog screen The Van Houten library has removed some of the personal information and all signatures from the approval page and biographical sketches of theses and dissertations in order to protect the identity of NJIT graduates and faculty. RELIABILITY CONSIDERATIONS FOR COMMUNICATION SATELLITES BY FRANK POLIZZI A THESIS PRESENTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN MANAGEMENT ENGINEERING AT NEWARK COLLEGE OF ENGINEERING This thesis is to be used only with due regard to the rights of the author(s). Bibliographical references may be noted, but passages must not be copied without permission of the College and without credit being given in subsequent written or published work. -

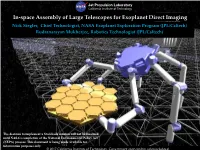

In-Space Assembly of Large Telescopes for Exoplanet

In-space Assembly of Large Telescopes for Exoplanet Direct Imaging Nick Siegler, Chief Technologist, NASA Exoplanet Exploration Program (JPL/Caltech) Rudranarayan Mukherjee, Robotics Technologist (JPL/Caltech) The decision to implement a Starshade mission will not be finalized until NASA’s completion of the National Environmental Policy Act (NEPA) process. This document is being made available for information purposes only. © 2017 California Institute of Technology. Government sponsorship acknowledged. Aperture size limited by launch vehicle Future science needs will require increasingly large telescopes In-Space Large Aperture Telescope Assembly Evolvable Space Telescope (NGAS) 5 6 4 1 3 2 3 4 m 1 2 Polidan et al. 2016 3 In-Space Large Aperture Telescope Assembly Using the Deep Space Gateway (cis-Lunar orbit) to assemble NASA GSFC 4 In-Space Large Aperture Telescope Upgrade Telescope returns from ESL2 for servicing at EML1 Courtesy: Future In-Space Operations (FISO) working group (2007) 5 In-Space Large Aperture Telescope Assembly Free-fliers (e.g. Orion) and assembly module docked to spacecraft bus NASA GSFC 6 DARPA Orbital Express (2007) • Multiple OEDMS autonomous berthing and docking maneuvers In-space firsts: • Transfer of fuel • Transfer of a battery through the use of 3-m long Astro robotic arm NEXTSat DARPA/Boeing/MDA/Ball Aerospace jpl.nasa.gov 7 Robotic Servicing Missions DARPA Robotic Servicing of Geosynchronous Satellites (RSGS) (SSL) DARPAjpl.nasa.gov Robotic Servicing Missions Restore-L (NASA GSFC) • Refueling an existing