The Nobel Foundation Annual Report 2013 (Pdf)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Nobel Prize Sweden.Se

Facts about Sweden: The Nobel Prize sweden.se The Nobel Prize – the award that captures the world’s attention The Nobel Prize is considered the most prestigious award in the world. Prize- winning discoveries include X-rays, radioactivity and penicillin. Peace Laureates include Nelson Mandela and the 14th Dalai Lama. Nobel Laureates in Literature, including Gabriel García Márquez and Doris Lessing, have thrilled readers with works such as 'One Hundred Years of Solitude' and 'The Grass is Singing'. Every year in early October, the world turns Nobel Day is 10 December. For the prize its gaze towards Sweden and Norway as the winners, it is the crowning point of a week Nobel Laureates are announced in Stockholm of speeches, conferences and receptions. and Oslo. Millions of people visit the website At the Nobel Prize Award Ceremony in of the Nobel Foundation during this time. Stockholm on that day, the Laureates in The Nobel Prize has been awarded to Physics, Chemistry, Physiology or Medicine, people and organisations every year since and Literature receive a medal from the 1901 (with a few exceptions such as during King of Sweden, as well as a diploma and The Nobel Banquet is World War II) for achievements in physics, a cash award. The ceremony is followed a magnificent party held chemistry, physiology or medicine, literature by a gala banquet. The Nobel Peace Prize at Stockholm City Hall. and peace. is awarded in Oslo the same day. Photo: Henrik Montgomery/TT Henrik Photo: Facts about Sweden: The Nobel Prize sweden.se Prize in Economic Sciences prize ceremonies. -

Böcker Från Svenska Akademien 2018

Böcker från Svenska Akademien 2018 Om Svenska Akademiens bokutgivning Svenska Akademien bedriver en omfattande bokutgivning inom sina två huvudsakliga verksamhetsområden: språk och litteratur. Utgivning- en sker i samarbete med Norstedts förlag och Bokförlaget Atlantis med undantag av några titlar som utges i form av behovstryck (»print on demand«). Den språkliga utgivningen innefattar bl.a. standardverk som Svenska Akademiens ordbok, Svenska Akademiens ordlista och Svenska Akademiens grammatik. För främjande av svensk litteratur utger Svenska Akademien serien Svenska klassiker. En annan viktig del av utgivningen på det litterära området gäller Nobelpriset i litteratur. Hit hör även böcker om Nobelbiblioteket och böcker utgivna av Nobelbiblioteket. Akademien dokumenterar den egna verksamheten i serien Svenska Akademiens handlingar. I handlingarna ingår också den minnesteckning som Akademien varje år utger över en bemärkt svensk. I serien Minnesbiblioteket utges ett urval biografiska och historiska texter som tidigare publicerats i handlingarna. Ett flertal böcker är avsedda att tillgodose omvärldens behov av information om Akademien själv, dess verksamhet och historia. I utgivningen ingår också enstaka publikationer som mer indirekt har samband med Akademien och dess verksamhet. De presenteras under rubriken »Övrig utgivning«. Några av Akademiens böcker finns även utgivna på andra språk, främst engelska. * I denna katalog presenteras samtliga under året tillgängliga titlar som utgivits av Svenska Akademien. De kan köpas i eller beställas genom bokhandeln. För en mer fullständig förteckning, som även inkluderar äldre titlar vilka inte längre finns i handeln, hänvisas till Akademiens webbplats: www.svenskaakademien.se/publikationer. nyheter 2018 4 Nyheter 2018 Eufemiavisorna I–II (i serien Svenska klassiker) Eufemiavisorna är samlingsnamnet på vår litteraturs tre äldsta skönlitterära verk, versromanerna Flores och Blanzeflor, Hertig Fredrik av Normandie och Ivan lejonriddaren, som översattes till svenska i början av 1300-talet. -

Climate at the Peace Center

A human size bird's nest is among the installations in the exhibition KlimaLab, showing at the Nobel Peace Center from april 2019. (Photo: Johannes Granseth / Nobel Peace Center) Apr 15, 2019 13:09 CEST Climate at the Peace Center KlimaLab is a new, large exhibition on climate change at the Nobel Peace Center. Here the whole family can share their thoughts about the climate crisis and be inspired to make changes in their own lives. “Climate change is one of the largest challenges of our time. In many places in the world we see how environmental disasters and climate change lead to human suffering and contribute to the strengthening of differences, unrest and conflict. With the KlimaLab exhibition we hope to get the audience involved in the climate cause and give them the belief that they can contribute to a solution,” says Liv Tørres, Executive Director of the Nobel Peace Center. The ground floor of the Nobel Peace Centre is filled with trees and plants, and tactile art installations to touch and enter into. The exhibition is inspired by the founder of the Nobel Peace Prize, Alfred Nobel, and his idea of acting “for the greatest benefit to humankind”, as well as the Nobel Peace Prize Laureates Wangari Maathai, Al Gore and the UN Intergovernmental Panel on Climate Change, who were all awarded the prize for their work to combat climate change. Next to these Peace Prize Laureates new voices in the debate on climate change are given space in the exhibition. On Friday the 22nd March, 40.000 young people gathered all over Norway to protest about the lack of political action to combat climate change. -

The Nobel Prize Sweden.Se

Facts about Sweden: The Nobel Prize sweden.se The Nobel Prize – the award that captures the world’s attention The Nobel Prize is considered the most prestigious award in the world. Prize- winning discoveries include X-rays, radioactivity and penicillin. Peace Laureates include Nelson Mandela and the 14th Dalai Lama. Nobel Laureates in Literature, including Gabriel García Márquez and Doris Lessing, have thrilled readers with works such as 'One Hundred Years of Solitude' and 'The Grass is Singing'. Every year in early October, the world turns Nobel Day is 10 December. For the prize its gaze towards Sweden and Norway as the winners, it is the crowning point of a week Nobel Laureates are announced in Stockholm of speeches, conferences and receptions. and Oslo. Millions of people visit the website At the Nobel Prize Award Ceremony in of the Nobel Foundation during this time. Stockholm on that day, the Laureates in The Nobel Prize has been awarded to Physics, Chemistry, Physiology or Medicine, people and organisations every year since and Literature receive a medal from the 1901 (with a few exceptions such as during King of Sweden, as well as a diploma and The Nobel Banquet is World War II) for achievements in physics, a cash award. The ceremony is followed a magnificent party held chemistry, physiology or medicine, literature by a gala banquet. The Nobel Peace Prize at Stockholm City Hall. and peace. is awarded in Oslo the same day. Photo: Henrik Montgomery/TT Henrik Photo: Facts about Sweden: The Nobel Prize sweden.se Prize in Economic Sciences prize ceremonies. -

New Swedish Titles 2000

original 00-11-0710.22Sida1 New Swedish Titles 2000 Titles Swedish New THE SWEDISH INSTITUTE THE SWEDISH Pernilla Stalfelt Bo R Holmberg Mirja Unge Annika Thor Christine Falkenland Mats Wahl Moni Nilsson-Brännström Ann-Marie Ljungberg Lars Gustafsson Peter Kihlgård Hans Olsson Mikael Niemi original 00-11-07 10.22 Sida 2 The Swedish Institute To read literature solely as though it were a mirror of society and its interpreters would be a precarious business, as Ingrid Elam points out at the beginning of her article on new Swedish prose. On the other hand, Kajsa Lindsten Öberg demonstrates that literature, be it for adults or for children, is not entirely uninfluenced by current affairs. Mirror or not, the following two articles about recent Swedish titles identify themes connected with public debate, but also include some exposing testimonies about the most private sphere. There is a mounting international interest in Swedish literature. Swedish books are found on bestseller and “critics’ choice” charts all over the world, and the publication of translations is no longer limited to a handful of specialist publishers. Bidding for titles occurs more and more often, even for translations of previously unpublished writers. Ingrid Elam and Kajsa Lindsten Öberg have been requested to com- ment on this year’s published books for the Frankfurt Book Fair 2000. The selection of titles and the opinions are entirely their own. The com- ments are usually short but will hopefully encourage further reading. For more information about the authors, we refer you to each respective publisher. Information about funding of translations can be obtained from the Swedish Institute. -

An Appeal About China

Open Letter To Mr Hu Jintao President of the People’s Republic of China An Appeal about China Your Excellency, Mr President, We, undersigned organizations and individuals, welcome your visit to Sweden, whose purpose, we understand, is to reinforce economic and political cooperation between China and Sweden. We also realize that you want to contribute to a fruitful exchange of cultural activities and ideas between our countries. In this context we wish to express our sincere desire for the development of a vivid cooperation concerning thoughts, values, art, theatre, music, all kinds of creative human contacts between Sweden and China, the world’s largest nation, with an unbroken history and culture of many thousand years. We are convinced that economic cooperation between countries and people cannot be successful in the long run unless there is a deeper understanding, involving a free flow of information and thought between the countries and within them. In this regard we must draw attention to an imbalance. We are worried by the information that reaches us concerning the rule of law and human rights in your country. What particularly concerns us is the actual lack of freedom of expression, publication, association, religion and information in China. Despite a well-conceived Constitution and several special regulations concerning media, religion and civil law, the factual rule of law in your country does not seem to be ensured in a satisfactory manner. The authorities themselves do not follow the laws properly, according to many reports. Numerous citizens are exposed to legal abuses of different kinds. Full and detailed reports about these serious conditions have been spread inside as well as outside China. -

Verksamhetsberättelse 2018

Verksamhetsberättelse 2018 1 Innehåll 5 Svenska Akademien i siffror 6 Ständige sekreterarens berättelse vid Svenska Akademiens högtidssammankomst 2018 10 Svenska Akademiens ledamöter 12 Svenska Akademiens organisation 14 Översyn av Svenska Akademiens stadgar 16 Nobelpriset i litteratur 20 Priser och stipendier 22 Intervjuer med Eva Hedencrona och Elisabeth Skog 25 Kommittéernas arbete 26 Svenska Akademiens bokutgivning 28 Nobelbiblioteket 30 SAOL och SO – den moderna svenskans ordböcker 32 Svenska Akademiens ordbok – en 500-årig bildningsresa 36 Svenska Akademiens arkiv 37 Litteraturbanken 38 Intensivutbildning i svenska för nyanlända skolelever 40 Kalendarium 2018 44 Utdelade priser och stipendier 2018 48 Förvaltade stiftelser 52 Ekonomisk information 75 Revisionsberättelse 78 Fotografregister Svenska Akademien i siffror 0 1521 kronor kostar det att läsa och spara ned SAOB täcker svenska språket från 1521 svensk skönlitteratur från Litteraturbanken, till våra dagar. en ideell förening som finansieras av bland andra Akademien. Även Akademiens tre ordböcker är fritt sökbara på nätet och 1786 i appar. grundades Svenska Akademien. 7 1995 språk är skriften Nobelpriset i litteratur av utkom de första titlarna i serien Svenska Sture Allén och Kjell Espmark utgiven på: klassiker. Sedan dess har totalt 39 titlar svenska, engelska, tyska, franska, spanska, utkommit. ryska och kinesiska. 2744 20 sidor omfattar Svenska Akademiens ledamöter tänkte Gustaf III ursprungligen grammatik. att Akademien skulle bestå av. Men ”De Aderton” klingade bättre, tyckte han. 70 000 ord och betydelser, från före 1000talet till 39 2000talet, beskrivs i Svensk ordbok utgiven av bokstäver innehåller de båda längsta orden Svenska Akademien (SO). i Svenska Akademiens ordbok (SAOB). Ett av dem är ”rullföringsområdesbefäl havarebefattning”. 126 000 ord innehåller Svenska Akademiens ordlista 45 (SAOL). -

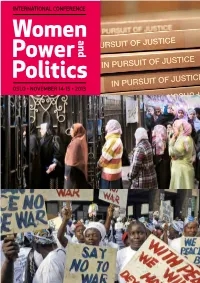

Conference-Program-Wpposlo.Pdf

Women, Power and Politics: Practical Information The Road to Sustainable Democracy Venue: Radisson Blu Scandinavia Hotel , Holbergsgt 30, 0166 Oslo, Norway Registration: Dear participants, sustainable develop- ment and economic From 8 AM on Thursday, 8:30 AM on Friday, in the foyer. Pick up your name tag As chair of the national committee for celebrat- growth. and information bag. ing the Centenary of Women’s Rights to Vote in Structures of most Norway, I am honored to welcome visitors from societies, including All participants must wear their name tags clearly visible throughout the conference. all over Norway and from all over the world to Norway, may discrimi- Oslo, Norway, and to the conference Women, nate against women. Lunch: Power and Politics about The Road to Sustaina- The inequality in power ble Democracy. results in lower status At the hotel restaurants for all participants. Please wear your name tag for access. Norway is often seen as one of the best for women, which in many cases are reinforced countries to live in. Still, a number of challenges by political, economic and social discrimination. Reception at Oslo City Hall, Thursday November 14th to gender equality remain and new gender relat- It gravely reduces women’s and girls’ ability to ed issues keep surfacing in Norway. This year, as exercise their fundamental human rights. Cocktail reception from 5PM-7PM. Due to security, participants must carry the we celebrate the Centenary for Women’s right We all know that an active civil society is of offical invitations. to vote in Norway, we have to acknowledge that crucial importance for true democracy and an equal society where women participate on development. -

The Nobel Foundation Annual Report 2020

THE NOBEL FOUNDATION ANNUAL REPORT • 2020 The Nobel Foundation Swedish registration number 802002-4462 © The Nobel Foundation, 2021. Nobel Prize® and the Nobel Prize® medal design mark are registered trademarks of the Nobel Foundation. Table of Contents THE NOBEL FOUNDATION ...................................... 2 REPORT OF THE DIRECTORS..................................... 4 Tasks and organisation ......................................... 4 THE NOBEL PRIZE ...............................................6 The 2020 Nobel Prize laureates . 6 The Nobel Week ............................................... 7 FINANCIAL MANAGEMENT . 8 Organisation and strategy of fnancial management ................ 8 Overall position and proft .....................................10 Outfow and expenses ..........................................11 The investment portfolio ....................................... 12 Investments in equities .........................................13 Fixed income investments...................................... 14 Alternative investments ........................................ 14 Properties .....................................................15 Currency hedging ..............................................15 Allocation of proft for the year ................................. 16 Change in equity .............................................. 16 FINANCIAL REPORT ............................................17 Income statement ..............................................17 Allocation of proft/loss for the year ..............................17 -

KURSPLAN HÖGSKOLAN I KALMAR Humanvetenskapliga Institutionen

KURSPLAN HÖGSKOLAN I KALMAR Humanvetenskapliga institutionen KURS SV500L Svenska - Språkets redskap IV 91-120 högskolepoäng The tools of language IV 91-120 higher education credits Utbildningsnivå: Grundnivå Huvudområde: Svenska Nivå: D Utbildningsområde: Humaniora 65%, Undervisning 30%, Teknik 5% Fastställd av Nämnden för lärarutbildning och utbildningsvetenskap 2007-03-21. Kursplanen gäller fr.o.m. höstterminen 2007. FÖRVÄNTADE STUDIERESULTAT Förväntade studieresultat för hela inriktningen Svenska – språkets redskap 1-90/120 hp är - att studenterna ska ha tillägnat sig goda kunskaper om språk och litteratur och sådana didaktiska kunskaper och färdigheter att de kan utveckla barns och ungdomars skrivande, läsande och talande - att studenterna ska ha förmåga att använda svenska språket i tal och skrift och färdigheter i att muntligt och skriftligt presentera och diskutera olika typer av texter. Efter avslutad kurs ska studenten ha - en vidgad beläsenhet i främst 1900-talets västerländska skönlitteratur och med skönlitteraturen förknippade genrer. - fördjupade insikter i med skönlitteraturen relaterade konstarter och gestaltande medier i övrigt. - utifrån modernare bruksprosa och skönlitteratur fördjupade språkteoretiska och språkhistoriska kunskaper om det svenska språkets variation och ställning i världen samt anknytning till de nordiska grannspråken. - en ökad medvetenhet om didaktiska processer samt en djupare förståelse för olika vägar till både erfarenheter och kunskaper. - förståelse för vikten av att integrera det litteraturvetenskapliga perspektivet med studiet av svenska språket. KURSENS INNEHÅLL Kursen består av följande tre delkurser med tematisk orientering efter den enskildes individuation och socialisering, från det personliga planet till de större sociala och internationella sammanhangen. DELKURS 1 Individen och identiteten, 12 hp Delkursen fokuserar på områden som språkutveckling, personlig integritet, barn- och föräldraperspektiv, syskonrelationer, familjeförhållanden, kamratrelationer, pubertet och sexualitet. -

Vol. 8 • No. 1 • 2014

Vol. 8 • No. 1 • 2014 Published by Umeå University & The Royal Skyttean Society Umeå 2014 The Journal of Northern Studies is published with support from The Royal Skyttean Society and Umeå University Editorial Note This special issue of the Journal of Northern Studies is published in view of Umeå having been appointed the European Capital of Culture 2014. The editors would like to thank editorial board-member professor Annegret Heitmann for acting as guest-editor for the issue. © The authors and Journal of Northern Studies ISSN 1654-5915 Cover picture Detail from the work of art Lev! [‘Live!’] created by the artists FA+, namely Ingrid Falk and Gustavo Aguerre. Lev! is a glass tunnel in the centre of Umeå with pictures from the writer Sara Lidman’s home area in Northern Västerbotten and with quota- tions from her authorship. In translation the text reads: ‘– And have you heard that in the south where they have everything and guzzle down apples and wheat and rose flowers they haven’t got cloudberries! – It serves them right!’ The quotation is from Lidman’s book Hjortronlandet [‘Cloudberry country,’ 1955]. Photo: Lotta Hortéll Design and layout Lotta Hortéll and Leena Hortéll, Ord & Co i Umeå AB Fonts: Berling Nova and Futura Paper: Invercote Creato 260 gr and Artic volume high white 115 gr Printed by TMG Tabergs Contents / Sommaire / Inhalt Editors & Editorial board ................................................................................................................5 Contributors ...................................................................................................................................... 7 Birgitta Holm, Foreword. Norrland with no Borders .............................................................11 Annegret Heitmann, ‘A Window on the World.’ Introduction. 13 Bjarne Thorup Thomsen, Eyvind Johnson’s Hybrid North. Dynamics of Place and Time in Travelogues and Memory Sketches 1943–1963 ...............................................19 Antje Wischmann, Performing Space—A Modernist Hembygd. -

The Nobel Foundation Annual Report 2015 (Pdf)

The NOBEL- FOUNDATION Annual Report 2015 THE NOBEL FOUNDATION SWEDISH REGISTRATION NUMBER 802002-4462 ANNUAL REPORT 2015 The Nobel Foundation, Box 5232, se-102 45 Stockholm, Sweden © The Nobel Foundation, 2016. Nobel Prize®, The Nobel Prize® medal design mark and the N® design mark are registered trademarks of the Nobel Foundation. TABLE OF CONTENTS REPORT OF THE DIRECTORS, 2015........................4 Tasks and organisation ..................................................4 The Nobel Prize .......................................................6 The 2015 Nobel Laureates .......................................6 The Nobel Week in Stockholm ....................................7 The Nobel Days in Oslo .........................................7 Overall strategy for the Nobel sphere ...............................7 Lawsuit, Stockholm District Court .................................8 Legal action in California ........................................8 Lindau.......................................................8 Nobel Symposia ...............................................8 Financial management...................................................9 Organisation and strategy of asset management .......................9 Overall position and earnings ....................................10 Outflow and expenses ..........................................10 The investment portfolio ........................................12 Investments in equities .........................................12 Fixed income investments .......................................13