Corporate Governance Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

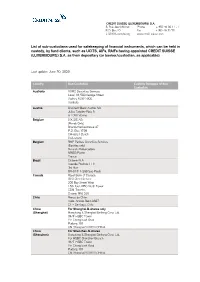

List of Sub-Custodians Used for Safekeeping of Financial Instruments

CREDIT SUISSE (LUXEMBOURG) S.A. 5, Rue Jean Monnet Phone + 352 46 00 11 - 1 P.O. Box 40 Fax + 352 46 32 70 L-2010 Luxembourg www.credit-suisse.com List of sub-custodians used for safekeeping of financial instruments, which can be held in custody, by fund clients, such as UCITS, AIFs, RAIFs having appointed CREDIT SUISSE (LUXEMBOURG) S.A. as their depositary (or banker/custodian, as applicable) Last update: June 30, 2020 Country Sub-Custodian Custody Delegate of Sub- Custodian Australia HSBC Securities Services Level 13, 580 George Street Sydney NSW 2000 Australia Austria UniCredit Bank Austria AG Julius Tandler-Platz 3 A-1090 Vienna Belgium SIX SIS AG (Bonds Only) Brandschenkestrasse 47 P.O. Box 1758 CH-8021 Zurich Switzerland Belgium BNP Paribas Securities Services (Equities only) 9 rue du Débarcadère 93500 Pantin France Brazil Citibank N.A. Avenida Paulista 1111 3rd floor BR-01311-290 Sao Paulo Canada Royal Bank of Canada GSS Client Service 200 Bay Street West 15th floor, RBC North Tower CDN-Toronto, Ontario M5J 2J5 Chile Banco de Chile Avda. Andrés Bello 2687 CL – Santiago, Chile China For Shanghai-B-shares only (Shanghai) Hongkong & Shanghai Banking Corp. Ltd. 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA China For Shenzhen-B-shares (Shenzhen) Hongkong & Shanghai Banking Corp. Ltd. For HSBC Shenzhen Branch 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA Colombia Cititrust Colombia S.A. Sociedad Fiduciaria Carrera 9A No. 99-02 First Floor Santa Fé de Bogotá D.C. -

Fast and Secure Transfers – Fact Sheet

FAST AND SECURE TRANSFERS – FACT SHEET NEW ELECTRONIC FUNDS TRANSFER SERVICE, “FAST” FAST (Fast And Secure Transfers) is an electronic funds transfer service that allows customers to transfer SGD funds almost immediately between accounts of the 24 participating banks and 5 non-financial institutions (NFI) in Singapore. FAST was originally launched on 17 March 2014 and included only bank participants. From 8th February onwards, FAST will also be available to the 5 NFI participants. FAST enables almost immediate receipt of money. You will know the status of the transfer by accessing your bank account via internet banking or via notification service offered by the participating bank or NFI. FAST is available anytime, 24x7, 365 days. Payment Type Receipt of Payments FAST Almost Immediate, 24x7 basis Cheque Up to 2 business days eGIRO Up to 3 business days Types of accounts that you can use to transfer funds via FAST (Updated on 25 Jan 2021) FAST can be used to transfer funds between customer savings accounts, current accounts or e-wallet accounts. For some banks, the service can also be used for other account types (see table below). Other Account types that you can use FAST Participating Bank to transfer funds via FAST Transfer from Transfer to (Receive) (Pay) 1 ANZ Bank MoneyLine MoneyLine 2 Bank of China Credit Card Credit Card MoneyPlus MoneyPlus 3 The Bank of Tokyo-Mitsubishi UFJ - - 4 BNP Paribas - - 5 CIMB Bank - - 6 Citibank NA - - 7 Citibank Singapore Limited - - 8 DBS Bank/POSB Credit Card Credit Card Cashline Cashline 9 Deutsche Bank - - 10 HL Bank - - 11 HSBC - - 12 HSBC Bank (Singapore) Limited - - 13 ICICI Bank Limited Singapore - - 14 Industrial and Commercial Bank of China Limited Debit Card Debit Card Credit Card 15 JPMorgan Chase Bank, N.A. -

Citibank Europe Plc Customer Information for the Purpose of Providing the Investment Services

CITIBANK EUROPE PLC CUSTOMER INFORMATION FOR THE PURPOSE OF PROVIDING THE INVESTMENT SERVICES Valid and effective from 1 April 2021 Citibank Europe plc, organizační složka Prague Czech Republic Citibank Europe plc, a company established and existing under the laws of Ireland, with its registered office at North Wall Quay 1, Dublin, Ireland, registered in the Company Register in the Irish Republic under No. 132781, conducting business in the Czech Republic through Citibank Europe plc, organizační složka, with its registered office at Bucharova 2641/14, Prague 5, Stodůlky, postal code 158 02, ID No. 28198131, incorporated in the Commercial Register administered by the Municipal Court in Prague, File Number A 59288. Member of Citigroup. The supervisory authority of Citibank Europe plc is the Central Bank of Ireland and to limited extent European Central Bank and Czech National Bank. Citibank Europe plc, a company established and existing under the laws of Ireland, with its registered office at North Wall Quay 1, Dublin, Ireland, registered in the Commercial Register in the Irish Republic under No. 132781, conducting its business in the Czech Republic through Citibank Europe plc, organizační složka, with its registered office at Praha 5, Stodůlky, Bucharova 2641/14, postal code: 158 02, Company ID No. 28198131, incorporated in the Commercial Register administered by the Municipal Court in Prague, File A 59288 (hereinafter “the Bank”). hereby announces to its customers, to whom it provides the investment services pursuant to the applicable legal regulations governing the capital market business, in particular Act No. 256/2004 Coll., on Undertaking on the Capital Market, as amended and Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 (hereinafter the "Legal Regulations"), certain information that the Bank is obliged to communicate to its customers under the aforementioned Legal Regulations. -

Electronic Access and User Agreement Please Read

ELECTRONIC ACCESS AND USER AGREEMENT PLEASE READ THIS ELECTRONIC ACCESS AND USER AGREEMENT (THE “AGREEMENT”) CAREFULLY. IT GOVERNS YOUR ACCESS TO AND USE OF ONE OR MORE ONLINE PLATFORMS FOR FOREIGN EXCHANGE TRADING AND RELATED INFORMATION OFFERED BY CITIBANK (THE “SYSTEM”). YOU MUST AGREE TO THE TERMS OF THIS AGREEMENT BEFORE BEING GRANTED ACCESS TO THE SYSTEM. This Agreement contains the terms and conditions under which You and Your employer (“Your Firm” which, if You are a third party trading adviser, investment manager or other agent (“Agent”), includes your principal) are provided with access to the System and permitted to use the products and services offered on the System, such as the information research, data, analytical tools, software, video, audio, graphics, pricing information and other content available on the System (“System Content”), and, where applicable, to transact and confirm foreign exchange and Bullion spot, forward, swaps and/or options transactions (“Transactions”), which may include use of proprietary and/or licensed Citibank algorithms (collectively, the “Algo Strategies” and each an “Algo Strategy”) as described and made available via the System or at www.citifx.com. For the purposes of this Agreement, Bullion shall mean gold, silver, platinum or palladium. This Agreement will amend and replace any previous agreement entered into by You or Your Firm covering Your use of and access to the System. References to “You” or “Your” are to both you as an individual or, if applicable, as an Agent and to Your Firm, unless expressly stated otherwise. References to “Citibank” are to Citibank, N.A. or its affiliated entities as identified in the Country Annex (as defined in Section 5 below) applicable to You. -

Settlement Instructions

SETTLEMENT INSTRUCTIONS BUYER/SELL Custodian DEAG / REAG SetClear ID / A/C Number at Market A/C Name Name Local Agent Executing Custodian Broker BIC Australia Citigroup Pty CITIAU3X CRLSUS3SCLR 2077070000 SETCLEAR PTE. Limited CHESS Code: LTD. - 20018 TRADEBOOK Austria Citibank N.A., CITIITMX CRLSUS3SCLR 7902299 SETCLEAR PTE Milan Branch Broker Code : LTD CIM TRADEBOOK Belgium Citibank Intl Plc. CITTGB2L CRLSUS3SCLR 0006005289 TRADEBOOK Brazil Concordia 95P REAG - for CNCVBRR1 CNPJ: Broker # 23 Corretora S.A sales 52.904.346/001- CVMCC 95P DEAG - for 08 purchases Canada Citibank Canada CITICATTXXX CRLSUS3SCLR 6015890002 SETCLEAR PTE. CUID: CITC LTD. - TRADEBOOK Cyprus Citibank CITIGRAA CRLSUS3SCLR 801819 TRADEBOOK International Plc, Greece Branch Czech Rep. Citibank Europe CITICZPX CRLSUS3SCLR 1090076957 TRADEBOOK plc, organizační složka Denmark Nordea Bank NDEADKKK CRLSUS3SCLR 0200010060180 Tradebook Denmark A/S 21 Estonia Nordea Bank HABAEE2X NDEAFIHH 99000546397 Nordea Bank Finland Plc. Danmark A/S - SetClear/ Tradebook Finland Nordea Bank NDEAFIHH CRLSUS3SCLR 0220001011256 Nordea Bank Finland Plc. 35 Danmark A/S - SetClear/ Tradebook France Citibank CITTGB2L CRLSUS3SCLR 0655945016 TRADEBOOK International Plc, SICV : 186 London Germany Citigroup Global CITIDEFF CRLSUS3SCLR 21488201 SETCLEAR PTE Markets Broker Code: LTD - Deutschland 7372 TRADEBOOK AG & Co. KGaA Page 1 of 3 BUYER/SELL Custodian DEAG / REAG SetClear ID / A/C Number at Market A/C Name Name Local Agent Executing Custodian Broker BIC Greece Citibank CITIGRAA CRLSUS3SCLR 801819 TRADEBOOK International Plc, Greece Branch Hong Kong Citibank, N.A. CITIHKHX CRLSUS3SCLR 1321760001 SetClear Pte Ltd Hong Kong CCASS ID: - Tradebook Branch C00010 Hungary Citibank Zrt. CITIHUHX CRLSUS3SCLR 7202274002 SETCLEAR PTE. LTD. TRADEBOOK Ireland Citibank N.A., CITIGB2L CRLSUS3SCLR 6011366408 SETCLEAR PTE London Branch Crest: ODOAD LTD Italy Citibank N.A., CRLSUS3SCLR CRLSUS3SCLR 1228569 Setclear PTE Milan Branch LTD TRADEBOOK Japan Citibank Japan CITIJPJT CRLSUS3SCLR 331192 SETCLEAR PTE Ltd. -

Citibank Is Top Bank in Singapore in Terms of S…

For Immediate Release Citigroup Inc. (NYSE symbol: C) Singapore, 16 March 2006 CITIBANK IS THE TOP BANK IN SINGAPORE IN TERMS OF SERVICE QUALITY Singapore Service Quality Barometer 2005 conducted by Asia Insight ranked Citibank highest in Customer Commitment Index score Singapore – Citibank has emerged as the clear leader amongst banks in the Singapore Service Quality Barometer 2005, the first-of-its-kind benchmarking survey by Asia Insight. The survey ranked 8 banks by polling more than 400 consumers in a random sample on 29 Key Performance Indicators of service quality, and providing a Customer Commitment Index score for each bank, and for the industry. Citibank received a Customer Commitment Index score of 61, compared to the other 7 banks, which scored between 52 to 59 (an average of 56). The bank also garnered top positions in 17 out of 29, and top 3 positions in 25 out of 29 Key Performance Indicators of service quality among all 8 banks surveyed (see Appendix 1). Asia Insight’s Service Quality Barometer was motivated by Singapore’s national effort to build a world-class culture of service excellence by boosting service quality. Mr. Jonathan Larsen, Chief Executive Officer and Country Business Manager, Citibank Singapore Ltd, said, “The survey findings are a strong endorsement by our customers. We work very hard to deliver superior service. However, we are far from satisfied. We are continuing to invest on most fronts to improve service levels and exceed our customers’ expectations. Our goal is to set a new benchmark for service in the banking sector in Singapore.” The Customer Commitment Index measures the respondents’ level of satisfaction and loyalty to the banks surveyed. -

L50440 364066 CTB Rewards World Mastercard.Ai

Citibank Rewards WORLD The Citibank Rewards Card MasterCard 10x rewards on all your shopping* With the Citibank Rewards Card, you earn 10X rewards whenever you shop for clothes, shoes or bags or at departmental stores or online shopping websites*. This means you earn 10 Reward Points or 4 Miles for every S$1 spent on your shopping purchases. What’s more, you continue to earn 1 Rewards Point for every S$1 spent on all other purchases. Fulfil your wishlist faster With 20,000 Rewards Points^, you can choose from: S$80 Vouchers S$60 8,000 Robinson Road P.O. Box 356, 356, Box P.O. Road Robinson BUSINESS REPLY SERVICE REPLY BUSINESS Attn: Asset Operations Unit Operations Asset Attn: (shopping/dining) Cash Rebates Miles Banking Consumer Global Citibank Singapore Ltd Singapore Citibank LICENCE NO. 02269 LICENCE NO. Singapore 900706 Singapore $ $ (Upgrade) Shoes/Clothes Dept Online /Bags Stores Shopping Every day is a sale Amount S$500 S$1,000 S$500 Total Rewards with Citibank 20,000 Points earned Rewards Card. Every Day is an Online Sale • Upto 40% off Online Shopping at Luxola, Blue Nile, Reebonz and more! Shopping vouchers Upgrade to Citibank Rewards WORLD MasterCard Now • Get shopping vouchers from your favourite brands that include Luxola, Zalora, Levi's, T.M.Lewin, Dockers, Klareti & many more! * Terms and conditions apply. Visit www.citibank.com.sg/rewardscard for more details. ^ For illustrative purpose only. Please refer to www.citibank.com.sg/rewards Singapore only. Singapore for more details on rewards programme and actual redemption. Note: willbe Postage Rewards Points refer to the Citi Dollars earned on the Credit Card account. -

Brown Brothers Harriman Global Custody Network Listing

BROWN BROTHERS HARRIMAN GLOBAL CUSTODY NETWORK LISTING Brown Brothers Harriman (Luxembourg) S.C.A. has delegated safekeeping duties to each of the entities listed below in the specified markets by appointing them as local correspondents. The below list includes multiple subcustodians/correspondents in certain markets. Confirmation of which subcustodian/correspondent is holding assets in each of those markets with respect to a client is available upon request. The list does not include prime brokers, third party collateral agents or other third parties who may be appointed from time to time as a delegate pursuant to the request of one or more clients (subject to BBH's approval). Confirmations of such appointments are also available upon request. COUNTRY SUBCUSTODIAN ARGENTINA CITIBANK, N.A. BUENOS AIRES BRANCH AUSTRALIA CITIGROUP PTY LIMITED FOR CITIBANK, N.A AUSTRALIA HSBC BANK AUSTRALIA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) AUSTRIA DEUTSCHE BANK AG AUSTRIA UNICREDIT BANK AUSTRIA AG BAHRAIN* HSBC BANK MIDDLE EAST LIMITED, BAHRAIN BRANCH FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BANGLADESH* STANDARD CHARTERED BANK, BANGLADESH BRANCH BELGIUM BNP PARIBAS SECURITIES SERVICES BELGIUM DEUTSCHE BANK AG, AMSTERDAM BRANCH BERMUDA* HSBC BANK BERMUDA LIMITED FOR THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED (HSBC) BOSNIA* UNICREDIT BANK D.D. FOR UNICREDIT BANK AUSTRIA AG BOTSWANA* STANDARD CHARTERED BANK BOTSWANA LIMITED FOR STANDARD CHARTERED BANK BRAZIL* CITIBANK, N.A. SÃO PAULO BRAZIL* ITAÚ UNIBANCO S.A. BULGARIA* CITIBANK EUROPE PLC, BULGARIA BRANCH FOR CITIBANK N.A. CANADA CIBC MELLON TRUST COMPANY FOR CIBC MELLON TRUST COMPANY, CANADIAN IMPERIAL BANK OF COMMERCE AND BANK OF NEW YORK MELLON CANADA RBC INVESTOR SERVICES TRUST FOR ROYAL BANK OF CANADA (RBC) CHILE* BANCO DE CHILE FOR CITIBANK, N.A. -

Citibank, N.A. 2018 Resolution Plan Public Section July 1, 2018

Citibank, N.A. 2018 Resolution Plan Public Section July 1, 2018 Citibank, N.A. Resolution Plan Public Section Table of Contents A. Introduction and Description of Resolution Strategy ....................................................................... 1 A.1. Multiple Acquirer Strategy ....................................................................................................... 2 A.2. Resulting Organization upon Completion of Resolution Process ............................................ 3 A.3. Citi’s Actions to Improve CBNA’s Resolvability ......................................................................... 4 B. Description of Core Business Lines ................................................................................................... 7 B.1. Banking CBLs ............................................................................................................................ 7 B.2. Markets & Securities Services CBLs ......................................................................................... 8 B.3. Global Consumer Banking CBLs ............................................................................................... 8 C. Background Information on Material Entities ................................................................................ 10 C.1. Banking Entities and Branches ............................................................................................... 12 C.2. Service MEs ........................................................................................................................... -

Protecting the Privacy of the World's Wealthiest Families

Protecting the privacy of the world’s wealthiest families Citi Private Capital Group Contents 3 Introduction 4 Why privacy is important for family offices 6 The dimensions of privacy 7 The audit 8 The assessment 9 The action 11 Practical privacy top tips 13 Conclusion 2 Protecting the privacy of the world’s wealthiest families | Citi Private Bank Introduction Family offices feel a strong sense of duty to protect the privacy of the ultra-high net worth families they “In a digitally-enabled world, wealth serve. Regardless of whether family members are owners and international families celebrities, high-profile business owners and executives, or famous philanthropists, there is an expectation have never found it harder to live that a family office will take effective measures to their lives privately. Yes, the rules safeguard the privacy of a family’s actions, assets, and may have changed, but that just personal affairs. means your approach to privacy needs to stay one step ahead.” 1 However, this has become a bigger challenge as we have moved towards an increasingly digital world. The information revolution has not only changed the way Magnus Boyd we view privacy; it also has fundamentally changed our Partner, Schillings expectations of it. Smartphones are now ubiquitous, with nearly everyone in the developed world not only owning one, but also relying on it for many of their day-to-day activities. With most people always example, leaked emails could have detrimental effects carrying their smartphones with them, there is also an on the professional reputation of a family business by expectation we are 'available’ at all times. -

Application Form

APPLICATION FORM WILLIAM BLAIR SICAV (the "Company") 31, Zone d'Activités Bourmicht, L-8070 Bertrange, Luxembourg 1 APPLICATION FORM Please complete, sign and return to: Citibank Europe plc, Luxembourg Branch 31, Zone d'Activités Bourmicht L-8070 Bertrange Luxembourg Fax: +352 45 14 14 852 As the Company's Custodian and Paying Agent, Central Administration Agent, Registrar and Transfer Agent Note If this form is sent by fax it must subsequently be forwarded by post within five business days. This subscription form should be read in conjunction with the latest Prospectus of the Company. Telegraphic transfer information For any payment in a currency other than the share class currency, the administrator will carry out a foreign exchange transac- tion. For US dollars – USD Pay to Citibank, N.A. New York ABA no. 021 0000 89 Swift code CITIUS33 For the account of Citibank Europe plc, Luxembourg Branch Account no 10957463 For further credit 0252636001 William Blair SICAV TA Collecting FFC WBF deal reference For the Euro, and any Pay to Citibank, N.A. London component currency Swift code CITIGB2L of the Euro For the account of Citibank Europe plc, Luxembourg Branch Account GB46 CITI 1850 0808 5436 31 For further credit 0252636003 William Blair SICAV TA Collecting FFC WBF deal reference For British Pound – GBP Pay to Citibank, N.A. London Sort code 18-50-08 Swift code CITIGB2L For the account of Citibank Europe plc, Luxembourg Branch Account no 557935 For further credit 0252636002 William Blair SICAV TA Collecting FFC WBF deal reference For Swiss Francs – CHF Pay to Citibank, N.A. -

Europe Strategy

Europe Strategy 1 April 2020 A new European investment paradigm Europe has moved from ‘containment’ to the ‘mitigation’ stage in relation to COVID-19 in most countries. We expect phased lockdowns in the months ahead, so as to ease pressures on national healthcare systems. Jeffrey Sacks Head - EMEA Investment Central bank and government financial support programes are necessary Strategy and have further to go. Implementation – ensuring that the individuals and +44.207 508 7325 companies most in need receive timely and sufficient support – will be very [email protected] challenging. Shan Gnanendran, CFA GDP contractions will be severe in the second quarter, with no powerful EMEA Investment Strategy recoveries to follow immediately. However, we are confident that support +44.207 508 0458 measures will help preserve long-term economic and corporate health. [email protected] More bond market stability – supported by liquidiity from the European Central Bank and the Bank of England – will help stabilise the outlook for regional equities. Equities are likely to have a prolonged consolidation phase within wide trading ranges. We expect selective buying opportunities, particularly in companies with strong balance sheets. The virus’s impact will likely reinforce some of our recommendations from the start of the year. These include staying invested, diversifying sensibly, and embracing higher volatility. Our long-term Unstoppable Trends like fintech and cybersecurity still offer attractive equity potential. Figure 1: Country sector performance – 1 month and YTD Source: Bloomberg as of March 31th 2020. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only.