Feasibility Study for Goderich Municipal Airport (YGD) and Richard W

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

V9.5 on Ipad Introduction

Pilot’s Guide to FOREFLIGHT MOBILE 55th Edition Covers ForeFlight Mobile v9.5 on iPad Introduction ...............................................................................................19 iPad Tips ....................................................................................................................................19 Setting-up ForeFlight Mobile ..............................................................21 Planning a Flight ......................................................................................22 Planning a fight using the Flights form ........................................................................22 Destination Services ................................................................................................................................23 Navlog, Briefng, Messages ...................................................................................................................24 Planning a fight on Maps using the Flight Plan Editor ..........................................25 Planning a fight on Maps using Touch .........................................................................26 Planning a fight on Maps using Search ........................................................................27 Scheduled Flight Search on Maps ......................................................................................................29 Airports ........................................................................................................31 About the Design ..................................................................................................................32 -

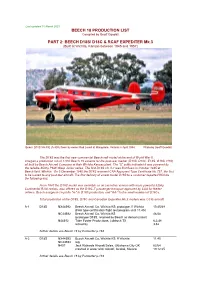

BEECH D18S/ D18C & RCAF EXPEDITER Mk.3 (Built at Wichita, Kansas Between 1945 and 1957)

Last updated 10 March 2021 BEECH 18 PRODUCTION LIST Compiled by Geoff Goodall PART 2: BEECH D18S/ D18C & RCAF EXPEDITER Mk.3 (Built at Wichita, Kansas between 1945 and 1957) Beech D18S VH-FIE (A-808) flown by owner Rod Lovell at Mangalore, Victoria in April 1984. Photo by Geoff Goodall The D18S was the first new commercial Beechcraft model at the end of World War II. It began a production run of 1,800 Beech 18 variants for the post-war market (D18S, D18C, E18S, G18S, H18), all built by Beech Aircraft Company at their Wichita Kansas plant. The “S” suffix indicated it was powered by the reliable 450hp P&W Wasp Junior series. The first D18S c/n A-1 was first flown in October 1945 at Beech field, Wichita. On 5 December 1945 the D18S received CAA Approved Type Certificate No.757, the first to be issued to any post-war aircraft. The first delivery of a new model D18S to a customer departed Wichita the following day. From 1947 the D18C model was available as an executive version with more powerful 525hp Continental R-9A radials, also offered as the D18C-T passenger transport approved by CAA for feeder airlines. Beech assigned c/n prefix "A-" to D18S production, and "AA-" to the small number of D18Cs. Total production of the D18S, D18C and Canadian Expediter Mk.3 models was 1,035 aircraft. A-1 D18S NX44592 Beech Aircraft Co, Wichita KS: prototype, ff Wichita 10.45/48 (FAA type certification flight test program until 11.45) NC44592 Beech Aircraft Co, Wichita KS 46/48 (prototype D18S, retained by Beech as demonstrator) N44592 Tobe Foster Productions, Lubbock TX 6.2.48 retired by 3.52 further details see Beech 18 by Parmerter p.184 A-2 D18S NX44593 Beech Aircraft Co, Wichita KS: ff Wichita 11.45 NC44593 reg. -

Town of Collingwood Community Profile

2015 Community Profile 2013 V 1.3 May 2015 © 2015 Town of Collingwood Information in this document is subject to change without notice. Although all data is believed to be the most accurate and up-to-date, the reader is advised to verify all data before making any decisions based upon the information contained in this document. For further information, please contact: Martin Rydlo Director, Marketing and Business Development Town of Collingwood 105 Hurontario Street PO Box 157, Collingwood, ON L9Y 3Z5 Phone: 705-445-8441 x7421 Email: [email protected] Web: www.collingwood.ca Table of Contents 1 INTRODUCTION......................................................................................................................... 1 1.1 Location ............................................................................................................................ 3 1.2 Climate .............................................................................................................................. 4 2 DEMOGRAPHICS ........................................................................................................................ 6 2.1 Population Size and Growth ................................................................................................. 6 2.2 Age Profile ......................................................................................................................... 6 2.3 Language Characteristics .................................................................................................... -

Massdot Aeronautics Division Offices the Logan Office Center One Harborside Drive, Suite 205N East Boston, MA 02128-2909

MASSACHUSETTS STATEWIDE AIRPORT SYSTEM PLAN MASSDOT AERONAUTICS DIVISION MASSACHUSETTS STATEWIDE AIRPORT SYSTEM PLAN (MSASP) PROJECT MANAGEMENT TEAM (PMT) MEETING #2 MEETING NOTES Thursday, December 10, 2009 (1 PM– 3 PM) MassDOT Aeronautics Division Offices The Logan Office Center One Harborside Drive, Suite 205N East Boston, MA 02128-2909 1. MEETING ATTENDANCE PMT Member Attendees: Member Name Affiliation Chris Willenborg MassDOT Aeronautics, Administrator Denise Garcia MassDOT Aeronautics, Manager of Aviation Planning William Benjamin Former MAC Commissioner Craig Dotlo (via phone) Aircraft Owners and Pilots Association (AOPA) Flavio Leo Massport Russ Maguire Massachusetts Airport Management Association (MAMA) Paul Nelson Massachusetts Executive Office of Transportation (EOT) Michelle Ricci (via phone) Federal Aviation Administration (FAA) Arthur Robert Massachusetts Office of Business Development (MOBD) Dean Saucier (via phone) National Business Aviation Association (NBAA) Absent PMT Member Attendees: Harold Bevis Delta Airlines / Air Transport Association (ATA) Dan Wolf Cape Air Other Meeting Attendees: Steven Rawding MassDOT Aeronautics, Aviation Planner Katie Servis MassDOT Aeronautics, Environmental Analyst Bob Mallard Airport Solutions Group (ASG) - Study Project Manager Pam Keidel-Adams Wilbur Smith Associates – Project Team Member James Miklas Wilbur Smith Associates – Project Team Member Marc Champigny Louis Berger Group – Project Team Member Nick Stefaniak Louis Berger Group – Project Team Member Jeremy Martelle Louis Berger -

Issue 2, 2017

publication agreement number 40050880 Issue 2, 2017 Recreational Aircraft Association Canada www.raa.ca The Voice of Canadian Amateur Aircraft Builders $6.95 From The features President’s Desk Lyncrest and the Vimy Flight Gary Wolf RAA 7379 The Vimy Flight visits the Lyncrest Fly-In / Bert Elam ...............................................................................4 In The Zone Gary Wolf on the new Drone regulations ................................................................................................8 LYCOMING AD ROTAX installation manual and check with the manufac- Lycoming has issued an AD dated August 15 2017 that con- turer of the aircraft to verify that a fuel return line has been Blowing In the Wind cerns connecting rod top end bushings. Connecting rods incorporated within the design of the aircraft's fuel system. A new threat to aviators? / by Dan Oldridge ..........................................................................................14 and bushings variously shipped between 2015 and 2017 Many 912 engines are operated on auto fuel, which has a are affected, and within ten hours the operators of affected higher vapour pressure (especially winter fuel) than avgas. Stampe on a Diet engines are required to comply. Google “Lycoming 632B” Rotax encourages builders to provide adequate cooling air A Belgian Company offers something new, something old / By Stefan DeGraef .....................................18 for the document. Table 1 lists the serial numbers of the to the fuel system components to minimize the possibility engines affected by this AD, and Table 2 indicates the ship- of vapour lock. The latest Rotax Installation Manual can be Zenith Redux ping dates of affected top end bushings and connecting rod found at www.FlyRotax.com OR www.RotaxOwner.com Restoring a piece of Aviation History / by Adrian Meilleur .....................................................................22 assemblies. -

Scalability of the Air Transportation System and Development of Multi-Airport Systems: a Worldwide Perspective

Scalability of the Air Transportation System and Development of Multi-Airport Systems: A Worldwide Perspective by Philippe A. Bonnefoy B. Ing., Mechanical Engineering, École Polytechnique de Montréal, Canada, 2002 S.M., Aeronautics & Astronautics, Massachusetts Institute of Technology, 2005 Submitted to the engineering systems division in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY at the MASSACHUSETTS INSTITUTE OF TECHNOLOGY June 2008 2008 Philippe A. Bonnefoy, All rights reserved. The author hereby grants to MIT the permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part. Signature of Author: ______________________________________________________ Philippe A. Bonnefoy Engineering Systems Division May 30th 2008 Certified by: _____________________________________________________________ R. John Hansman, Professor Department of Aeronautics and Astronautics and Engineering Systems Thesis Supervisor Certified by: _____________________________________________________________ Cynthia Barnhart, Professor Department of Civil and Environmental Engineering and Engineering Systems Certified by: _____________________________________________________________ Richard de Neufville, Professor Department of Civil and Environmental Engineering and Engineering Systems Certified by: _____________________________________________________________ Amedeo Odoni, Professor Department of Aeronautics and Astronautics and Civil and Environmental Engineering Accepted -

November-December

November - December 2007 Recreational Aircraft Association Canada www.raa.ca The Voice of Canadian Amateur Aircraft Builders $6.95 The Amazing SEAREY Gary Wolf Amateur Built Category Changes Ontario. The www.navcanada.ca md-ra.com 1-877-419-2111 RAA was recently contacted by website has a Montreal -Toronto- For planes that fit into our Basic the Chief of MD-RA, who asked that Windsor survey which is fairly Ultralight category, the procedure we let our membership know that difficult to fill out, but please per- is even simpler and the supply is there has been an important change severe and stake your claim to the larger. The US has recently been to the amateur-built category. An airspace you currently use. There cracking down on their “fat ultra- immediate call to Ottawa brought is also a box for suggestions, and lights”, planes that had for years forth the information that we are this is your chance to have your say. been flying illegally because they no longer allowed to use parts from For once NavCanada are asking for did not meet the 254 pound empty certified aircraft when construct- input, so please take fifteen mnutes weight requirement of the US ultra- ing an amateur-built plane, at least to let them know that we are here. light category. Many of these planes this is what Transport was initially If we sit back and do nothing, we weigh 350-500 pounds so they will saying. Subsequent calls brought could end up with only narrow fit nicely into our 1200 pound gross the news that the FAA was unhappy VFR corridors and expanded Class weight Basic Ultralight category. -

Council Report Template

70 PINE STREET, BRACEBRIDGE, ONTARIO P1L 1N3 Telephone (705) 645-2231 / Fax (705) 645-5319 / 1-800-461-4210 (705 area code) www.muskoka.on.ca To: Chair and Members Corporate and Emergency Services Committee From: Mark Stirling Muskoka Airport Manager Date: July 19, 2018 Subject: Helipad Coverage for Ornge Air Ambulance Services Report: CES-6-2018-2 ___________________________________________________________________________ Recommendation This report is provided for information. Origin On February 22, 2018, CES Committee received presentation; CES-2-2018-DEL-C entitled “Orgne Overview” from Rob Giguere, Chief Operating Officer and Deputy CEO of Ornge. In his presentation, Mr. Giguere made reference to the coverage of helipad locations available for Ornge Helicopter use and that Orgne can provide expert guidance in the development of new helipads. The following report provides some explanation and illustrations of landing facilities identifying the level of coverage available and support for the potential consideration of additional coverage with future growth requirements. Analysis In his presentation, Mr. Giguere made reference to the supply of “12 aerodromes within 60 nautical miles of Muskoka” and to the availability of “20 helipads.” Following the presentation, a list of ‘usable’ and ‘not usable’ sites was clarified with Ornge, and the attached two maps and a list were prepared showing landing sites within 60 nautical miles of Muskoka and within The District Municipality of Muskoka (District), see Appendices “I”, “II” and “III”. Interestingly, there are seven (7) Transport Canada registered aerodromes and one (1) Transport Canada registered helipad within the District that Ornge does not normally use because they are privately owned and operated, and seasonal in nature. -

Chapter 6: System Recommendations

6. System Recommendations 6.1. Introduction This chapter builds on the findings of Chapter 5. System Performance by establishing future performance targets and making recommendations for South Dakota’s aviation system to achieve those future targets. This chapter is organized around the three system goals established at the beginning of the study and includes a review of each goal’s associated performance measures (PMs) to identify gaps in system performance. Performance gaps are determined by comparing the existing performance (presented in Chapter 5) to the future performance targets established by the South Dakota Department of Transportation Office of Aeronautics Services (SDDOT) and stakeholder groups to identify the number of airports, by state role and system-wide, that are not meeting each PM. Evaluating the existing performance against future performance targets provides a list of airports that are deficient in meeting the PM and therefore are candidates for system plan project recommendations. However, it is important to note that while these lists of airports by PM are helpful in understanding the system gaps, resources are limited and therefore an airport’s mention in this chapter is not a guarantee of project funding. For more information on SDSASP recommended projects, including anticipated costs and project priorities, see Chapter 7. System Needs and Project Costs. As a supplement to this recommendations chapter, Appendix E – NPIAS Analysis and Recommendations offers recommendations related to airport inclusion and exclusion from National Plan of Integrated Airport Systems (NPIAS) and changes to ASSET classifications for SDSASP airports. While this information does not pertain directly to the recommendations included in this chapter, it does provide additional context as it relates to system recommendations. -

AGENDA 3.1 January 10, 2019, Airport Committee

A G E N D A Athabasca Airport Committee Athabasca County Thursday, January 10, 2019 - 9:30 a.m. FCSS Meeting Room Athabasca Airport Committee Athabasca County Thursday, January 10, 2019 - 9:30 a.m. Page 1. CALL TO ORDER 2. SELECTION OF A CHAIRPERSON 3. APPROVAL OF AGENDA 3.1 January 10, 2019, Airport Committee 4. APPROVAL OF MINUTES 4.1 October 4, 2018, Airport Minutes 3 - 5 5. BUSINESS ARISING FROM THE MINUTES 5.1 6. FINANCIALS 6.1 December 31, 2018 6 7. NEW BUSINESS 7.1 Alberta Airports Managers Association Seminar 7 7.2 Athabasca Airport Strategic Plan Update 8 - 10 7.3 2019 Lease Fees Review 11 7.4 2018 - 2021 Tourism and Economic Development Committee 12 - 31 Strategic Plan 7.5 Fuel Sales and Movement 32 - 33 7.6 7.7 8. INFORMATION 8.1 Manager's Report 34 8.2 October 31, 2018, AAMA Newsletter 35 - 42 8.3 November 30, 2018, AAMA Newsletter 43 - 50 8.4 December 31, 2018, AAMA Newsletter 51 - 58 8.5 9. IN CAMERA ITEMS 9.1 10. NEXT MEETING 10.1 April 4, 2019 11. ADJOURNMENT Page 2 of 58 AGENDA ITEM # 4.1 Athabasca Airport Committee Meeting Athabasca County October 04, 2018 - 9:30 AM County Office - Chambers PRESENT: Chair Brent Murray; Members Christi Bilsky, Dwayne Rawson, Travais Johnson, Derrick Woytovicz; Health Safety & Facilities Coordinator Norm De Wet; and Recording Secretary Iryna Kennedy. CALL TO ORDER: Chair Murray called the meeting to order at 9:36 a.m. APPROVAL OF AGENDA: October 4, 2018, Airport Committee Resolution Moved by Member Johnson that the agenda be adopted as AP 18-30 presented. -

Logo Goes Here

February 9, 2021 Town of Goderich 57 West Street Goderich, ON N7A 2K5 Attention: Ms. Janice Hallahan, Chief Administrative Officer RE: HM Aero Inc. Aeronautical Review: 33862 and 33884 Airport Road, Township of Ashfield-Colborne-Wawanosh Application Nos. ACW OPA No. 10 and ACW Z02-21 Dear Ms. Hallahan, HM Aero is pleased to submit our enclosed review of Application Nos. ACW OPA No. 10 and ACW Z02-21 that are to be considered by the Township of Ashfield-Colborne-Wawanosh. The analysis provided herein is limited to the consideration of the merits of the Planning Applications from an aviation standpoint. This letter should not be interpreted as a fulsome analysis of the consistency and conformity of the Planning Applications against the Planning Act, Provincial Policy Statement, and other applicable plans and policies. Thank you for the opportunity to support the Town through this assignment. If you have any questions, please do not hesitate to contact the undersigned. Sincerely, HM Aero Inc. R. Adam Martin, M.Sc., PMP Ben Crooks, RPP, MCIP President Aviation Planner cc: Sean Thomas, Director of Operations Andrea Fisher, Clerk / Planning Coordinator Aeronautical Review: 33862 and 33884 Airport Road i Table of Contents 1 INTRODUCTION ...................................................................................................................... 1 1.1 Goderich Municipal Airport ................................................................................................. 1 1.2 Subject Properties ............................................................................................................. -

The Creemore Echo

The Creemore INSIDE THE ECHO ECHO Friday, January 8, 2016 Vol. 16 No. 02 www.creemore.com CyberGirls Going the Distance New robotics team gets noticed Ultrarunner champion PAGE 3 PAGE 6 News and views in and around Creemore Publications Mail Agreement # 40024973 Staff photo: Trina Berlo BOOTS AND BLADES Brody Coe (left) was the first skater on this year's outdoor skating rink at Station on the Green but he was joined by other Creemore children who took to the ice despite not having skates. Marketing under way for aviation business park by Trina Berlo forecast to have double digit growth The four-person advisory board, of Design Lab Inc., a strategic An international marketing campaign over the course of the next decade…” charged with providing input and marketing firm with an international is being launched with the intention said Bonwick. “There is a myriad of experience in achieving the airpark’s client base and Tim Murphy, a of developing a world-class aviation different businesses that we will be long-term goals, will be chaired by senior partner in McMillan LLP law commerce centre next to the marketing to but what we are looking Charlie Tatham, former chair of firm, which specializes in national Collingwood Regional Airport. for is people who are interested in the Collingwood Regional Airport and international project finance, Project coordinator Paul Bonwick either extending their market share Services Board and founder and infrastructure, energy, construction, said they will be looking for industries within the North American market former president of C. C. Tatham and and public policy.