Retail Summary List Jan 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2010 PART 2 by Brian Warren

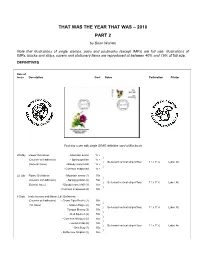

THAT WAS THE YEAR THAT WAS – 2010 PART 2 by Brian Warren Note that illustrations of single stamps, pairs and postmarks (except IMPs) are full size; illustrations of IMPs, blocks and strips, covers and stationery items are reproduced at between 40% and 75% of full size. DEFINITIVES Date of Issue Description Cost Notes Perforation Printer First day cover with single SOAR definitive used at Blackrock 20 May Flower Definitives - Mountain avens 1c + } (Counter self-adhesive) - Spring gentian 1c + } Se-tenant vertical strip of four 11 x 11¼ Label Art (General Issue) - Bloody crane's-bill 1c + } - Common knapweed 1c + 22 July Flower Definitives - Mountain avens (1) 55c } (Counter self-adhesive) - Spring gentian (2) 55c } Se-tenant vertical strip of four 11 x 11¼ Label Art (Bureau Issue) - Bloody crane's-bill (3) 55c } - Common knapweed (4) 55c 8 Sept Irish Animals and Marine Life Definitives (Counter self-adhesive) - Green Tiger Beetle (1) 55c } (1st Issue) - Golden Eagle (2) 55c } Se-tenant vertical strip of four 11 x 11¼ Label Art - Tompot Blenny (3) 55c } - Red Squirrel (4) 55c } - Common Octopus (5) 55c } - Hermit Crab (6) 55c } Se-tenant vertical strip of four 11 x 11¼ Label Art - Sea Slug (7) 55c } - Bottlenose Dolphin (8) 55c Flowers Issue: An Post commenced the rollout of Street, Dublin 7 (Ref: 1036). They all have a three printing self-adhesive postage stamps at the point of or four-digit code as indicated above which is purchase in post offices during 2010. Thanks to specific to that office. Fellow collector John Dublin dealer Declan O'Kelly I can confirm that the Lennon has recorded a total of 67 offices which first post office to introduce the new service was have used the Flowers design. -

The Avenue Cookstown, Tallaght

THE AVENUE COOKSTOWN, TALLAGHT FOR SALE BY PRIVATE TREATY THE AVENUE This site is located in Cookstown, Tallaght an established suburb in West Dublin. The site is approximately 13km from Dublin City Centre and is within walking distance of The Square Tallaght The providing amenities including shopping, dining, leisure facilities and significant cultural attractions such as the Rua Red Arts Theatre. Tallaght is home to 31 primary schools and 7 secondary schools including Scoil Maelruain Junior School, Sacred Heart Junior DunshaughlinLocation ASHBOURNENational School, Tallaght Community School and Kingswood Community College. SWORDS Malahide M2 Dublin M1 Portmarnock Airport M3 Finglas Blanchardstown MAYNOOTH North Bull Howth Island Cabra M50 Clontarf M4 Lucan DUBLIN Cellbridge Ballsbridge Dublin Bay Clondalkin Rathmines Straffan Booterstown Greenogue E20 Business Park Clane TALLAGHT Dun Laoghaire Dundrum Knocklyon City West Dalkey M50 N81 Rockbrook Stepaside THE AVENUE Carrickmines Johnstown M11 Manor BRAY Kilbride Blessington Greystones Wicklow Mountains National Park Poulaphouca Newtown Mount Kennedy Newcastle Roundwood For illustration purposes only. Tallaght is a thriving centre for business and is home to major state institutions including Tallaght Hospital (2,885 staff ), Institute of Technology Tallaght (6,000+ students) and the head office of South Dublin County Council (1,260 staff ). There are major employment The Avenue hubs nearby such as the Citywest Business Campus and Grange Castle Business Park. The continually expanding campus of Intel is located on Ireland in Leixlip is also just over a 20-minute drive. the Red Luas Tallaght also has numerous outdoor parks including Sean Walsh Memorial Park, Tymon Park and the Dublin Mountains. Tallaght line, in close is also home to the National Basketball Arena and Tallaght Football Stadium. -

Subject to Change Pending Confirmation from Licence Holder

Licensed Travel Agents Current at: 21st May 2018 Name, Address, Telephone No. Trading Name(s) Licence Expiry Date no. 747 Travel Agency Ltd 747 Travel 0271 30/04/19 First Floor, 81-82 Aungier Street, Dublin 2. Tel: 01- 4780099, Fax: 01- 4780451 Abbeytan Ltd Douglas Travel 0521 30/04/19 Kiosk 8, Douglas Court SC, Douglas, Co. Cork. Tel: 021-4365656, Fax: 021-4365659 Des Abbott Travel Ltd 0343 30/04/19 27 Glendhu Road, Navan Road, Dublin 7 Tel:01-8385266, Fax: 01-8385449 Ace Travel Ltd Ace Travel 0504 30/04/19 South Quay, Newcastle West, Co Limerick Tel: 069-22022 ;Fax: 069-22044 Adehy Ltd TUI Holiday Store/TUI 0001 31/10/18 Clondalkin Mills SC, D 22 Store Ph No. 01 4577300 Fax 01 4577303 (subject to change pending The Square, Tallaght, Dublin 24 confirmation from Licence Tel: 01-4526722 Fax: 01-4526582 Holder) Unit 22 City Square SC, Waterford 78 John St., Kilkenny Tel: 056-7722966; Fax: 056-7762965 Unit 6, Savoy Centre, Patrick Street, Cork Tel: 021-4278899; Fax: 021-4273398 97 Talbot Street, Dublin 1. Tel: 01-8873703; Fax: 01-8873702 Cresent SC, Limerick Tel: 061-498710; Fax: 061-498715 Wilton SC, Co. Cork Tel: 021-4346566; Fax: 021-4346370 Unit 4, Clare Hall SC Dublin 13 Tel: 01-8670711; Fax: 01-8670721 Unit 8, Mahon Point SC, Mahon, Co. Cork Tel: 021-4536022; Fax: 021-4536023 Omni Park SC, Santry Dublin 9 Tel: 01-8570851; Fax: 01-8570854 Affinion International Travel Ltd 0681 31/10/18 First Floor, Kettering Parkway, Kettering, Northants, NN15 6EY, England& 25/28 North Wall Quay, Dublin 1 Al Ansar Travel Limited 0778 31/10/18 Unit 6 Coolport, Peters Road, Coolmine Industrial Estate, Dublin 15 Arrow Tours (2000) Ltd Arrow Tours 0512 31/10/18 40 West Street, Drogheda, Co. -

0615 Richard Logue

Future-proofing Ireland A response to the National Planning Framework Richard Logue Introduction The Central Statistics Office predicts that the State’s population will increase by 1.7 million over the next 30 years. Unless the State is proactive and plans ahead for this significant increase in population we will be faced with even more unbalanced development than we already have. John Moran, the former Secretary of the Department of Finance has proposed that a counterweight to Dublin be established in the West in order to deal with the issue of population expansion. This idea should be given very serious consideration. At present nearly all significant development in the State is focussed on the Greater Dublin Area. We have a stark choice facing us for the future of Ireland; we can either allow Dublin to grow out of control or we can re-invent some of the most deprived and remote parts of Ireland for a brighter future in an uncertain world. Richard Logue London, March 2017. Biographical note I started working for London Underground in 1989 and since then have worked on a variety of major rail projects including the Jubilee Line extension, the Thameslink Programme and more recently for Network Rail’s Anglia route. My projects include the Crossrail project, Step Free Access at Stations, and the new Lea Bridge and Cambridge North stations. I am from Quigley’s Point in County Donegal and have lived in the UK since 1985. Developing the West to its potential The proposals in this document are a radical re-think of development in Ireland. -

04 Mallow Town Park Outline Construction

Proposed Improvement Works at Mallow Town Park, Mallow, Co. Cork Outline Construction and Environmental Management Plan (CEMP) Client: Cork County Council Date: 22 May 2021 DOCUMENT CONTROL SHEET 6615_RP_CEMP01_Outline Construction and Environmental Management Plan (CEMP) Project No. 6615 Client: Cork County Council Project Name: Proposed Improvement Works at Mallow Town Park, Mallow, Co. Cork Report Name: Outline Construction and Environmental Management Plan (CEMP) Document No. RP_CEMP01 Issue No. 01 Date: 22/05/2021 This document has been issued and amended as follows: Issue Status Date Prepared Checked 01 Planning 22 May 2021 DB TB Proposed Improvement Works at Mallow Town Park, Mallow, Co. Cork Outline Construction and Environmental Management Plan (CEMP) Table of Contents 1 Introduction ........................................................................................ 4 2 Regulatory and Policy Framework ....................................................... 6 2.1 Legislation .................................................................................................. 6 2.2 Policy & Guidance ....................................................................................... 6 3 Description of the Proposed Development .......................................... 7 4 Construction Programme and Phasing ................................................ 8 4.1 Restrictions on Working Hours ................................................................... 8 5 General Site Management .................................................................. -

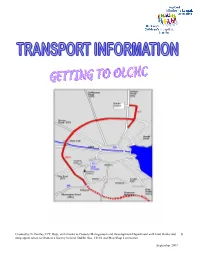

Created by N. Bartley,CPC Dept, with Thanks to Projects Management and Development Department with Kind Thanks and Deep Apprecia

Created by N. Bartley,CPC Dept, with thanks to Projects Management and Development Department with kind thanks and 9 deep appreciation to Ordnance Survey Ireland, Dublin Bus, LUAS and Map Shop Lamination September 2007 The following bus routes all pass OLCHC: BUS INFORMATION No 123 Crumlin to Marino (BUS TO NEAREST LUAS STATION) No 77 City Centre to Jobstown (Tallaght) No 77A City Centre to The Square (Tallaght) No 18 Old Lucan Road (Hollyville Lawn) to Sandymount Tower (St. John’s Church) No 210 Dolphin’s Barn to Liffey Valley Centre No 150 City Centre/Fleet Street to Rossmore No 50 City Centre to Citywest No 56A City Centre to The Square No 121 Ratoath Road to Crumlin No 122 Ashington to Drimnagh Road No 613 College Green to Liffey Valley www.dualwaycoaches.com A bus guide is available in the hospital shop. LUAS ZONES: Connolly and Busaras to Drimnagh: 3 zones Hueston and St James’s Hospital to Drimnagh: 2 zones Tallaght Shopping Centre & Hospital to Drimnagh: 2 Zones Red Cow “Park and Ride” to Drimnagh: 1 zone. LUAS Red Line (Connolly to Tallaght): Disembark at the Drimnagh stop, cross the road at the traffic lights, up the ramped pathway into Sperrin Road continue to the first cross roads (Galtymore Road and Sperrin Road). Here you can make one of two choices: 1. Take Bus number 123 to Hospital. Turn left along Galtymore Road and bus stop is a couple of meters down the road. 2. Walk along Sperrin Road to Hospital (approx 15 minutes). Continue straight through the first cross roads and walking along Sperrin Road, go straight at the large Roundabout keeping the Church on your right. -

Cultural Heritage Iarnród Éireann

Cork Line Level Crossings Volume 3, Chapter 12: Cultural Heritage Iarnród Éireann March 2021 EIAR Chapter 12 C ultural H eritage Iarnr ód Éir eann Volume 3, Chapter 12: Cultural Heritage Cork Line Level Crossings Project No: 32111000 Document Title: EIAR Chapter 12 Cultural Heritage Document No. 12 Revision: A04 Date: March 2021 Client Name: Iarnród Éireann Project Manager: Alex Bradley Author: AMS Ltd Jacobs U.K. Limited Artola House 3rd & 4th Floors 91 Victoria Street Belfast BT1 4PN T +44 (0)28 9032 4452 F +44 (0)28 9033 0713 www.jacobs.com © Copyright 2021 Jacobs U.K. Limited. The concepts and information contained in this document are the property of Jacobs. Use or copying of this document in whole or in part without the written permission of Jacobs constitutes an infringement of copyright. Limitation: This document has been prepared on behalf of, and for the exclusive use of Jacobs’ client, and is subject to, and issued in accordance with, the provisions of the contract between Jacobs and the client. Jacobs accepts no liability or responsibility whatsoever for, or in respect of, any use of, or reliance upon, this document by any third party. Document history and status Revision Date Description Author Checked Reviewed Approved A01 December Client Review AMS AMS RM AB 2019 A02 November Interim Draft pending Archaeological AMS HC HC AB 2020 Investigations A03 March Final draft AMS AMS RM AB 2021 A04 March For Issue to An Bord Pleanála AMS AMS HC/RM AB 2021 i Volume 3, Chapter 12: Cultural Heritage Contents 12. Cultural Heritage ................................................................................................................................................... -

GEOVIEW Q1 2014 GEOVIEW Quarterly Commercial Vacancy Rates Report

GEOVIEW Q1 2014 GEOVIEW Quarterly CommerCial VaCanCy rates report Analysis of Commercial Buildings in the GeoDirectory Database Q1 2014 This is the first GeoView quarterly analysis for 2014. It provides accurate and up‑to‑date data on the stock of Commercial Properties in Ireland. The information in this report is derived from the GeoDirectory database of commercial address points. This is a comprehensive address database of commercial buildings in the Republic of Ireland. The statistics in this report relate to commercial units as of 31st March 2014. This report includes an once‑off analsyis of commercial vacancy rates in key retail areas in Ireland’s five largest cities. Q1 2014 facts at a glance New in this report Stock of Commercial Properties This issue of GeoView contains an analysis of commercial vacancy rates in selected shopping centres and streets in Cork, Dublin, Galway, Kilkenny and Limerick. 223,336 Total stock of commercial properties These streets and shopping centres contain commercial units involved in different economic sectors but the majority are involved in retail. The comprehensive data includes every 195,545 Total stock of occupied properties business premises on the high streets that were reviewed. Total stock of vacant 27,791 commercial properties Street and Shopping Centre Vacancy Rates Average vacancy rate from selected Vacancy Rates 10.9% shopping centres Average vacancy rate from selected 12.4% Vacancy rate – unchanged from Q4 2013 13. 5% streets Highest vacancy rate recorded for Sligo Find out the streets and shopping centres with the highest and 16.0% – unchanged from Q4 2013 lowest vacancies in each city on pages 5 to 11. -

PPC 3 and 4 – Costings with Responses Budget 2021

PPC 3 and 4 – Costings with Responses Budget 2021 1. Indexation of Welfare Payments 1. Detailed description of item or policy on which a costing is required: To provide in tabular form, listed by payment type, the cost of increasing all social welfare payments under the following scenarios: Scenario 1 – a €5 increase on each weekly and monthly payment Scenario 2 – a €10 increase on each weekly and monthly payment Scenario 3 – indexation of all payments in line with increases to HICP Scenario 4 – indexation of all payments in line with assumed wage growth (compensation per employee) in 2021. 2. What assumptions/parameters do you wish the Department to make/specify? To use existing assumptions regarding the cohort who will continue to receive each category of payment during 2021. To include all benefits and allowances. To also provide the cost of such increases if introduced from the week beginning 4th January 2021 and 1st March 2021. Reply See Appendix 5 The costings requested above are outlined in the spreadsheet supplied. Please note that costings are on the basis of the estimated number of recipients in 2020, for all schemes except Jobseeker’s Allowance and Jobseeker’s Benefit, which are based on the estimated number of recipients in 2021. The department is finalising the Outturn for 2020 and ELS including recipient numbers for 2021, and as such these costings are subject to change 2. Increased participation fees for activation schemes 1. Detailed description of item or policy on which a costing is required: To provide in tabular form, listed by scheme, the cost of increasing participation fees for all activation schemes under the following scenarios: Scenario 1 – a €2.50 increase on each weekly payment Scenario 2 – a €5.00 increase on each weekly payment Scenario 3 – indexation of all payments in line with increases to HICP Scenario 4 – indexation of all payments in line with assumed wage growth (compensation per employee) in 2021. -

Cork, Ireland

SHOPPING CENTRE & RETAIL PARK CORK, IRELAND PRIME RETAIL INVESTMENT OPPORTUNITY BLACKPOOL SHOPPING CENTRE & RETAIL PARK CORK, IRELAND Introduction JLL and HWBC are delighted to present a unique opportunity to the market to acquire a large-scale retail scheme that is the dominant shopping and office centre in north Cork City. The combined Blackpool Shopping Centre and Retail Park offers an investor a stake in Ireland’s second largest city of Cork. Blackpool is a long established and dominant suburban retail offer effectively fully occupied (98% weighted by value). The package contains two complementary assets providing an investor with the opportunity to purchase 27,846 sq m (299,739 sq ft) of retail space with the benefit of an additional 10,081 sq m (108,513 sq ft) of self-contained offices in a well-designed and integrated mixed use commercial development. Blackpool is the only shopping centre north of the city offering a high concentration of international and nationally recognised retailers including; Dunnes Stores, New Look, Heatons, Next, Aldi, Woodie’s DIY, amongst others. There are also a number of community services provided in the scheme including; council library, post office and state health board. Investment Highlights • Excellent location and dominant retail offer position in its catchment • Destination retail hub with a purpose-built shopping centre and separate open use retail park with overhead modern offices • Long established since year 2000 for the shopping centre and 2004 for the retail park • Occupancy rate of 98% -

LIFFEY VALLEY Town Centre Valley Local Area Plan Iffey L

‘“facilitate the development of liffey Valley as a vibrant and sustainable Town Centre” LIFFEY VALLEY TOWN CENTRE Valley LOCal ARea PlaN iffey L that “where the whole community can avail of the highest standards of employment, services and amenities” of ” and proud be can accessibility, and and be to choose connections good people where environment, place a is built attractive “an • SOUTH DUBLIN COUNTY COUNCIL • PLANNING DEPARTMENT • MARCH 2008 • LIFFEY VALLEY TOWN CENTRE LOCAL AREA PLAN South Dublin County Council March 2008 This Local Area Plan was prepared under the direction of Tom Doherty, Director of Planning by the following: South Dublin County Council Project Team :- Paul Hogan Senior Planner Anne Hyland Senior Executive Planner Karen Kenny T/Senior Executive Planner Eddie Conroy County Architect Suzanne Furlong Public Realm Designer Helena Fallon Senior Executive Engineer Andrew O’ Mullane Senior Executive Engineer Larry McEvoy Chief Technician Alan O’Connor Executive Technician Garvan O’Keeffe Clerical Officer Additional Input: Bronagh Kennedy - EDAW - Urban Design Consultants Steve Crawhurst - Environmental Consultant JMP Transport Planners & Engineers Atkins Transport Planning Dublin Transportation Office Benoy - Architectural Consultants David Lennon - Architectural Consultant Simon Clear and Associates - Planning Consultants David Jordan Research - Economic Analysis and Survey Research Tom Doherty, Director of Planning This Local Area Plan was adopted by the elected members of South Dublin County Council on 10th March 2008 in accordance with Section 20 of the Planning and Development Act 2000 and will remain in force for six years unless amended or revoked by the Council. CONTENTS 1.0 Introduction ................................................................................7 4.4.3 Future Land Use ........................................................................................................... -

Retail Market Commentary Q1 | 2018 Retail Market Commentary | Q1 2018 02

RETAIL MARKET COMMENTARY Q1 | 2018 RETAIL MARKET COMMENTARY | Q1 2018 02 Q1 2018 AT A GLANCE PRIME RENTS OCCUPANCY (UNITS) CURRENT PRIME ZONE A RENTS (€ PER SQ. M.) HENRY/MARY STREET 100% GRAFTON STREET €7,000 GRAFTON STREET 96% HENRY STREET €4,500 DUNDRUM TOWN CENTRE €4,500 BLANCHARDSTOWN CENTRE €3,300 KEY ECONOMIC INDICATORS LIFFEY VALLEY SHOPPING CENTRE €2,800 PAVILIONS SHOPPING CENTRE €2,500 INDICATOR PERIOD ANNUAL % CHANGE THE SQUARE TALLAGHT €1,500 GDP 2017 7.8% TOTAL EMPLOYMENT 2017 3.1% FULL-TIME EMPLOYMENT 2017 5.4% UNEMPLOYMENT RATE OCCUPIER ACTIVITY March 2018 (MONTHLY) 6.0% KEY LETTINGS IN Q1 2018 DISPOSABLE INCOME 2017 5.3% AVERAGE WEEKLY EARNINGS Q4 2017 2.5% CONSUMER SPENDING 2017 3.2% CONSUMER SENTIMENT March 2018 6.1% OVERSEAS VISITORS 2017 3.6% RETAIL SALES VOLUMES February 18 (EX. MOTOR) 6.3% RETAIL SALES VALUES February 18 (EX. MOTOR) 3.8% CONSUMER SENTIMENT INDEX RETAIL SALES – ANNUAL GROWTH Q1 2006 TO Q1 2018 YEAR TO FEBRUARY 2018 120 All Retail Businesses 110 All Retail Businesses (Ex. Motor) 100 Furniture & Lighting 90 80 Electrical Goods 70 Hardware, Paints & Glass 60 Department Stores 50 Food 40 Clothing & Footwear 30 Books, Newspapers & Stationery Jul 11 Jul 17 Jul 12 Jul 13 Jul 15 Jul 16 Jul 14 Jul 10 Jul 07 Mar 11 Jul 06 Jul 09 Jul 08 Nov 11 Mar 17 Mar 12 Nov 17 Mar 13 Mar 15 Mar 16 Nov 12 Mar 18 Nov 13 Nov 15 Mar 14 Nov 16 Mar 10 Nov 14 Nov 10 Mar 07 Nov 07 Mar 06 Mar 09 Mar 08 Nov 06 Nov 09 Nov 08 Motor Trades -10% -5% 0% 5% 10% 15% Consumer Sentiment 3 Month Moving Average VALUE VOLUME Data sources: Bannon Research, CSO, KBC/ESRI Consumer Sentiment Index RETAIL MARKET COMMENTARY | Q1 2018 03 Strong economic performance driving retail recovery in Ireland ECONOMY The Irish economy continues to exceed expectations, with GDP growth of 7.8% in 2017 making Ireland the fastest growing economy in the European Union for the fourth consecutive year.