Prosus FY21 Results Press Release 21 June

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Longleaf Partners International Fund Commentary 2Q21

July 2021 Longleaf Partners International Fund Commentary 2Q21 Longleaf Partners International Fund added 1.19% in the quarter and 8.00% year-to- date, trailing the MSCI EAFE Index’s 5.17% and 8.83% for the same periods. US markets continued the monetary liquidity fueled run to ever sillier valuation levels, while non-US lagged relatively. The majority of our holdings were positive in the quarter. The Fund’s exposure to China and Hong Kong (including Netherlands-listed Prosus, whose business is driven by the Chinese consumer) was the biggest geographic headwind. FX was a moderate contributor to the Fund, as well as the MSCI EAFE index. Despite relative underperformance, it was a solid period for value per share growth at our holdings. “Value” had a (we believe temporary) pullback vs. “growth” in the second quarter on the back of lower interest rates and various other factors. Over the last year, we have seen interest rate consensus go from “low rates forever” for most of 2020 to “rates are definitely going up” in February/March of 2021 to what now feels like magical goldilocks thinking for growth stocks in the 1-2% US 10-year range. While we cannot predict precisely what rates will do in the near term, we welcome increased volatility on this all- Average Annual Total Returns for the Longleaf Partners International Fund (6/30/21): Since Inception (10/26/98): 7.45%, Ten Year: 4.50%, Five Year: 10.64%, One Year: 34.82%. Average Annual Total Returns for the MSCI EAFE (6/30/21): Since Inception (10/26/98): 5.62%, Ten Year: 5.89%, Five Year: 10.28%, One Year: 32.35%. -

Ishares AEX UCITS ETF EUR (Dist)

iShares AEX UCITS ETF EUR (Dist) IAEX August Factsheet Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug- 2021 All other data as at 10-Sep-2021 For Investors in Austria. Investors should read the Key Investor Information Document and Capital at risk. All financial investments Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of 25 of the largest Dutch vary and your initial investment amount cannot companies listed on NYSE Euronext Amsterdam. be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency EUR Targeted exposure to the most traded Dutch stocks 1 Share Class Currency EUR 2 Direct investment into 25 companies, listed in the Netherlands Fund Launch Date 18-Nov-2005 Share Class Launch Date 18-Nov-2005 3 Single country exposure Benchmark AEX-Index ISIN IE00B0M62Y33 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. Total Expense Ratio 0.30% Distribution Type Quarterly This means the Fund is more sensitive to any localised economic, market, political or regulatory Domicile Ireland events. The value of equities and equity-related securities can be affected by daily stock market Methodology Replicated movements. Other influential factors include political, economic news, company earnings and Product Structure Physical significant corporate events. Counterparty Risk: The insolvency of any institutions providing Rebalance Frequency Annual services such as safekeeping of assets or acting as counterparty to derivatives or other UCITS Yes instruments, may expose the Fund to financial loss. -

PROSUS N.V. (Previously Myriad International Holdings N.V) (Incorporated in the Netherlands) (Legal Entity Identifier: 635400Z5L

PROSUS N.V. (previously Myriad International Holdings N.V) (Incorporated in the Netherlands) (Legal Entity Identifier: 635400Z5LQ5F9OLVT688) ISIN: NL0013654783 Euronext Amsterdam and JSE Share code: PRX ("Prosus" or the "Company") RESULTS OF ANNUAL GENERAL MEETING Amsterdam, 18 August 2020 – Prosus N.V. (Prosus) (AEX and JSE: PRX) The annual general meeting (AGM) of Prosus N.V. was held through electronic communication today. Shareholders are advised that all resolutions set out in the notice of the AGM were passed by the requisite majority of shareholders represented at the annual general meeting and adopted. We note that the issued share capital of Prosus is as follows: Number of Nominal value Issued Authorised Class of share votes per share share capital share capital per share Ordinary Share N EUR0.05 1 1 624 652 070 5 000 000 000 (N shares) Ordinary Share A1 EUR0.05 1 3 511 818 10 000 000 (A shares) The number of ordinary shares that could have been voted at the meeting: 1 628 163 888. The total number of ordinary shares voted at the meeting was: 1,518,995,600 which is 93.3% of the total issued share capital. Details of voting results1: NO. AGENDA ITEM VOTES % VOTES % VOTES VOTES % of FOR AGAINST ABSTAIN TOTAL ISSUED SHARE CAPITAL VOTED 2 To approve the directors’ remuneration report 1,281,624,109 84.75 230,641,199 15.25 6,730,292 1,518,995,600 93.30% 3 To adopt the annual accounts 1,518,139,247 100.00 27,759 0.00 828,594 1,518,995,600 93.30% Proposal to make a distribution (including reduction of Prosus’s 4(a) issued capital and -

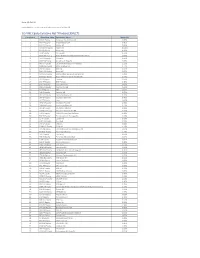

R&Co Risk-Based International Index – Weighting

Rothschild & Co Risk-Based International Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) Jardine Matheson Holdings Ltd Singapore 1.46 LEG Immobilien SE Germany 0.98 Ajinomoto Co Inc Japan 0.95 SoftBank Corp Japan 0.89 Shimano Inc Japan 0.85 FUJIFILM Holdings Corp Japan 0.73 Singapore Exchange Ltd Singapore 0.72 Japan Tobacco Inc Japan 0.72 Cellnex Telecom SA Spain 0.69 Nintendo Co Ltd Japan 0.69 Carrefour SA France 0.67 Nexon Co Ltd Japan 0.66 Deutsche Wohnen SE Germany 0.65 Bank of China Ltd Hong Kong 0.64 REN - Redes Energeticas Nacion Portugal 0.63 Pan Pacific International Hold Japan 0.63 Japan Post Holdings Co Ltd Japan 0.62 Nippon Telegraph & Telephone C Japan 0.61 Roche Holding AG Switzerland 0.61 Nestle SA Switzerland 0.61 Novo Nordisk A/S Denmark 0.59 ENEOS Holdings Inc Japan 0.59 Nomura Research Institute Ltd Japan 0.59 Koninklijke Ahold Delhaize NV Netherlands 0.59 Jeronimo Martins SGPS SA Portugal 0.58 HelloFresh SE Germany 0.58 Toshiba Corp Japan 0.58 Hoya Corp Japan 0.58 Siemens Healthineers AG Germany 0.58 MS&AD Insurance Group Holdings Japan 0.57 Coloplast A/S Denmark 0.57 Kerry Group PLC Ireland 0.57 Scout24 AG Germany 0.57 SG Holdings Co Ltd Japan 0.56 Symrise AG Germany 0.56 Nitori Holdings Co Ltd Japan 0.56 Beiersdorf AG Germany 0.55 Mitsubishi Corp Japan 0.55 KDDI Corp Japan 0.55 Sysmex Corp Japan 0.55 Chr Hansen Holding A/S Denmark 0.55 Ping An Insurance Group Co of Hong Kong 0.55 Eisai Co Ltd Japan 0.54 Chocoladefabriken Lindt & Spru Switzerland 0.54 Givaudan -

Cambiar Europe Select Adr Commentary 2Q 2021 Market Review

CAMBIAR EUROPE SELECT ADR COMMENTARY 2Q 2021 MARKET REVIEW European equities continued their positive momentum recovery relative to the U.S. Cambiar’s constructive in the second quarter, with the MSCI Europe Index outlook for Europe is a function of reasonable valuations posting a gain of 7.4%. Although the region is trailing (average P/E in Europe is 3-4 multiple turns below the U.S. as it relates to vaccination progress and the S&P 500) and the region’s high leverage to the corresponding reopening timelines, the global revenue more traditional value industries, which are poised to footprint for many EU companies is providing sufficient demonstrate a meaningful earnings acceleration over a visibility for investors to bid up the space in anticipation forward 1–2 year timeframe. And although Europe/UK is of an ensuing earnings recovery. incurring a rise in prices, inflation readings remain well below levels that would warrant consideration in altering Given the asynchronized nature of the global rebound, the ECB’s accommodative posture. European markets are in the earlier innings of their EUROPE SELECT ADR CONTRIBUTORS DETRACTORS Top Five Avg. Weights Contribution Bottom Five Avg. Weights Contribution Deutsche Post 3.76 0.87 Siemens 3.76 -0.12 Entain 4.01 0.57 Enel 2.31 -0.15 Carlsberg 2.78 0.53 Aena SME 1.54 -0.21 ASML Holding 3.75 0.47 Koninklijke Philips 2.31 -0.26 Compagnie de Saint-Gobain 3.28 0.45 Prosus 3.51 -0.44 A complete description of Cambiar’s performance calculation methodology, including a complete list of each security that contributed to the performance of the Cambiar portfolio mentioned above is available upon request. -

Juin 2021 31 - 05 - 2021 Méthodologie

Guide Quantitatif Juin 2021 Cours arrêtés au 31-05-2021 Vincent COURTOIS Méthodologie Ce Stock-Guide se présente comme un modèle quantitatif conçu autour des données de la STOCK-GUIDE base Factset. Au total, il couvre 42 secteurs avec un maximum de 17 valeurs par secteur et combine des valeurs Big, Mid et Small Cap. Pour chaque secteur, une note est attribuée de 0 (la plus mauvaise note) à 5 (la plus forte), fonction de 5 critères : le momentum des BNA, la valorisation absolue et relative, les opinions « contrariennes » des analystes, la qualité des fondamentaux et la fiabilité historique des guidances. Notre opinion sectorielle est synthétisée par des flèches : vertes pour une opinion positive, oranges pour une opinion neutre et rouges pour une opinion négative. Valeurs par nationalité Valeurs par capitalisation Autres; 80; 14% 0-500M€; 49; 8% Fr.; 166; 30% 500M€-1000M€; 31; P-B; 19; 3% >10000M€; 270; 5% Belg.; 17; 3% 47% Esp.; 33; 6% It.; 35; 6% 1000M€-5000M€; 152; 26% U-K; 67; 12% US; 85; 15% 5000M€-10000M€; 79; All; 62; 11% 14% Avertissement : Entreprise d’investissement agréée par le CECEI le 25 juillet 1997 (Comité des Etablissements de Crédit et des Entreprises d’Investissement de la Banque de France) et par l’AMF (Autorité des Marchés Financiers), la FINANCIERE D’UZES est également membre d’Euronext. La FINANCIERE D’UZES relève des autorités compétentes que sont l’AMF et l’ACPR. Les informations contenues dans ce document ont été puisées aux meilleures sources mais ne sauraient entraîner notre responsabilité. Par ailleurs, La FINANCIERE D’UZES est organisée de manière à assurer l’indépendance de l’analyste ainsi que la gestion et la prévention des éventuels conflits d’intérêt. -

Monthly Index Key Facts

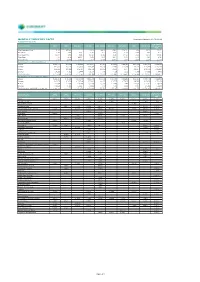

MONTHLY INDEX KEY FACTS Key Index Facts on 30/06/2021 EURONEXT INDICES AEX AMX BEL20 PX1 CACMD PSI20 ISE20 OBXP CESGP LC100 Low Carbon Financial Ratios AEX® AMX® BEL 20® CAC 40® CAC® Mid 60 PSI 20® ISEQ 20® OBX® CAC 40 ESG 100 Europe ® PAB Price/Earnings w Neg 31.16 482.97 - 72.23 49.16 12.91 114.11 0.84 68.02 27.72 Price/Book 10.56 4.88 2.71 4.56 3.00 2.14 3.09 3.98 3.74 5.70 Price/Cash Flow 62.98 9.65 8.56 19.23 10.51 8.75 18.02 2.33 17.07 15.55 Price/Sales 7.05 4.14 42.20 3.93 2.58 2.17 3.93 5.12 3.43 4.38 Dividend Yield 2.03% 1.78% 1.41% 2.10% 1.79% 3.54% 0.24% 2.51% 2.12% 2.20% Index Cap of Constituents (Millions) 0.0982 Largest € 135,770 € 4,393 € 16,426 € 183,588 € 5,208 € 1,419 € 24,745 € 20,398 € 113,331 € 134,618 Average € 30,814 € 2,076 € 6,363 € 37,487 € 2,082 € 592 € 6,179 € 5,014 € 28,559 € 26,036 Median € 19,858 € 1,934 € 4,038 € 25,053 € 1,654 € 558 € 870 € 3,510 € 19,805 € 15,296 Smallest € 4,365 € 813 € 1,444 € 5,078 € 61 € 38 € 203 € 348 € 4,562 € 4,489 Total index value € 770,345 € 51,893 € 127,252 € 1,499,466 € 124,929 € 10,650 € 123,582 € 125,355 € 1,142,372 € 2,603,601 Full Market Cap Of Constituents (Millions) Largest € 243,057 € 15,291 € 102,966 € 333,796 € 15,031 € 18,769 € 33,365 € 58,280 € 333,796 € 134,618 Average € 42,532 € 3,709 € 13,549 € 53,812 € 4,176 € 3,727 € 7,423 € 9,327 € 43,297 € 26,036 Median € 22,664 € 2,856 € 6,266 € 31,925 € 3,340 € 1,466 € 978 € 4,634 € 24,802 € 15,296 Smallest € 4,595 € 834 € 3,457 € 5,643 € 87 € 91 € 313 € 687 € 5,643 € 4,489 Total index value with full MC constituents € 1,063,309 -

Professional Investor Fund Factsheet

PAN EUROPEAN ESG EQUITIES - AE EUR THREADNEEDLE (LUX) PROFESSIONAL INVESTORS (FOR MARKETING PURPOSES) - ALL DATA AS AT 31 AUGUST 2021 SICAV United Kingdom Investment Objective & Policy The Fund aims to increase the value of your investment over the long term by investing in companies with strong or improving environmental, social and governance (ESG) Contact Details characteristics. It looks to outperform the MSCI Europe Index after the deduction of charges. The Fund invests at least two thirds of its assets in shares of large companies in Europe, including the UK, or companies that have significant operations there. Tel: +352 46 40 10 7190* The Fund may also invest in asset classes and instruments different from those stated above. [email protected] The fund manager focuses on selecting companies with strong or improving ESG characteristics, as outlined in the Fund’s ESG Investment Guidelines. Those companies will *Please note that calls and electronic communications demonstrate leadership through strong ESG practices. The fund manager also aims to exclude companies that are unable to satisfy those guidelines. The Fund’s ESG Investment Guidelines are available on request and on the Columbia Threadneedle Investments website. may be recorded. The fund manager will use measures that compare the ESG characteristics of the Fund against the MSCI Europe Index. This index also provides a helpful benchmark against which the IFDS, 47, avenue J.F. Kennedy, L-1855, Luxembourg financial performance can be compared and has been chosen for these purposes as a good representation of large and medium-sized companies within European developed market countries (including the UK). -

Euronext Options and Futures Traded at the Amsterdam Derivatives Markets

Euronext Options and Futures traded at the Amsterdam Derivatives Markets Last change: Added new Spotlight option contracts AFU & HAL Date: Effective per 07-06-2021 STANDARD EXPIRY CYCLE Trading American style equity options Serial Quarterly HY Annual symbol 1 2 3 6 9 12 18 24 36 48 60 ABN AMRO Bank ABN x x x x x x x x x x x AEGON AGN x x x x x x x x x x x Koninklijke Ahold Delhaize AH x x x x x x x x x x x Akzo Nobel AKZ x x x x x x x x x x x ASML Holding ASL x x x x x x x x x x x Koninklijke DSM DSM x x x x x x x x x x x Heineken HEI x x x x x x x x x x x ING Groep ING x x x x x x x x x x x Koninklijke KPN KPN x x x x x x x x x x x ArcelorMittal MT x x x x x x x x x x x Koninklijke Philips Electronics PHI x x x x x x x x x x x Royal Dutch Shell (A-shares) RD x x x x x x x x x x x RELX PLC (EUR) REN x x x x x x x x x x x Unilever UN x x x x x x x x x x x ASM International ASM x x x x x x x x x Prosus PRX x x x x x x x x x Adyen (contract size 10) ADY x x x x x x x x Air France-KLM AFA x x x x x x x x Ageas AGA x x x x x x x x Koninklijke BAM Groep BAM x x x x x x x x Fugro FUR x x x x x x x x Just Eat Takeaway.com TKW x x x x x x x x Koninklijke PostNL PNL x x x x x x x x Randstad RND x x x x x x x x SBM Offshore SBM x x x x x x x x TomTom TTM x x x x x x x x Unibail-Rodamco-Westfield UBL x x x x x x x x Wolters Kluwer WKL x x x x x x x x Alfen ALF x x x x x x AMG AMG x x x x x x Aperam AP x x x x x x BE Semiconductor Industries BES x x x x x x Koninklijke Boskalis westminster BOS x x x x x x Klépierre CIO x x x x x x JDE Peet's JDE x -

Dividend Derivatives

Eurex Dividend Derivatives August 2021 Eurex offers a wide range of Dividend Derivatives Evolution of the dividend market segment and product portfolio Launch of June expiries for EURO STOXX 50® Change of SSDF Launch of 43 Index Dividend Futures Launch of the FTSE Launch of Launch of 50 multiplier from Launch of 31 single stock and quarterly expiries for 100 Declared Dividend EuroStoxx 50 single stock 100 to 1000 Launch of UK European Single dividend futures EUR & CHF Single Index Futures (FTDD) Index Dividend dividend futures underlying single stock Stock Dividend and 2 Sector Stock Dividend Futures (CFTC Approval for US Futures (FEXD) (EuroStoxx 50) shares dividend futures Futures Dividend Futures (SSDF) Participants in June) Jun 2008 Jan/Mar 2010 Oct 2010 Feb 2011 Jan/Feb 2015 Jul 2019 Oct 2020 Mar/Jun 2021 Eurex Dividend Derivatives Jun 2009 May 2010 Nov 2010 Mar 2012 Jan 2017 Oct 2019 Nov 2020 Apr 2021 Launch of 4 Launch of Launch of 10 Launch of sector FEXD – CFTC Launch of 3 Launch of 21 Launch of 20 additional index options on Swiss single index dividend approval for U.S MSCI Index new single stock new single stock futures (SMI, DAX, EuroStoxx 50 stock dividend futures Participants Dividend Futures dividend futures dividend futures EuroStoxx Select Index Dividend futures Dividend, DivDAX) Futures (OEXD) 2 August 2021 Public Dividend Derivatives volume development Volume & Open Interest Eurex Index and Single Stock Dividend Derivatives Index Dividend Futures Traded Volume Index Dividend Options Traded Volume Single Stock Dividends Futures Traded Volume Total Open Interest 5.000.000 10.000.000 4.500.000 9.000.000 4.000.000 8.000.000 3.500.000 7.000.000 Open Interest 3.000.000 6.000.000 2.500.000 5.000.000 2.000.000 4.000.000 Traded Contracts 1.500.000 3.000.000 1.000.000 2.000.000 500.000 1.000.000 0 0 Jun 08 Mar 09 Dec 09 Sep 10 Jun 11 Mar 12 Dec 12 Sep 13 Jun 14 Mar 15 Dec 15 Sep 16 Jun 17 Mar 18 Dec 18 Sep 19 Jun 20 Mar 21 Traded Daily Order Book Market Share Volume Split Year YoY Change No. -

Citi VIBE Equity Eurozone Net TR Index (CIISRLET)

Date: 18-Oct-20 Index Weights as of quarterly rebalance date 06-Oct-20 Citi VIBE Equity Eurozone Net TR Index (CIISRLET) Constituent Bloomberg Ticker Constituent Name Weight(%) 1 ABI BB Equity Anheuser Busch Inbev NV 0.56% 2 ACA FP Equity Credit Agricole SA 0.45% 3 ADS GY Equity Adidas AG 0.86% 4 ADYEN NA Equity Adyen NV 10.00% 5 AD NA Equity Ahold NV 4.88% 6 AI FP Equity Air Liquide 1.31% 7 AKZA NA Equity AKZO NOBEL NV EUR0.50(POST REV SPLIT) 0.96% 8 ALV GY Equity Allianz SE 0.66% 9 AMS SM Equity Amadeus IT Hldg SA 0.60% 10 VNA GY Equity Deutsche Annington Immobilien 2.12% 11 ASML NA Equity ASML Holding NV 1.11% 12 BAS GY Equity BASF SE 0.59% 13 BAYN GY Equity Bayer AG 0.87% 14 BBVA SM Equity Banco Bilbao Vizcaya Argentaria SA 0.46% 15 BMW GY Equity Bayer Motoren Werke AG (BMW) 0.74% 16 BN FP Equity Danone 1.87% 17 BNP FP Equity BNP Paribas 0.40% 18 CAP FP Equity Cap Gemini SA 0.83% 19 CON GY Equity Continental AG 0.62% 20 CS FP Equity AXA 0.60% 21 DAI GY Equity Daimler AG 0.53% 22 DB1 GY Equity Deutsche Boerse AG 1.39% 23 DBK GY Equity Deutsche Bank AG 0.43% 24 DG FP Equity Vinci 0.64% 25 DPW GY Equity Deutsche Post AG 0.98% 26 DSM NA Equity Koninklijke DSM NV 3.12% 27 DTE GY Equity Deutsche Telekom 0.99% 28 DWNI GY Equity Deutsche Wohnen AG BR 3.55% 29 AIR FP Equity EADS NV-Euro Aero Defense 0.40% 30 EDP PL Equity Electricidade de Portugal SA 2.63% 31 EL FP Equity Essilor Intl 1.04% 32 ENEL IM Equity Enel SpA 0.79% 33 ENI IM Equity ENI SpA 0.68% 34 EOAN GY Equity E.ON AG 1.14% 35 FCA IM Equity FIAT CHRYSLER AUTOMOBILES NV 0.64% 36 FME GY Equity Fresenius Medical 1.70% 37 FP FP Equity TOTAL SA 0.69% 38 FRE GY Equity Fresenius SE & Co KGaA 0.87% 39 G IM Equity Assicurazioni Generali SpA 0.84% 40 GLE FP Equity Societe Generale 0.40% 41 ENGI FP Equity GDF Suez 0.73% 42 HEIA NA Equity Heineken NV 1.01% 43 HEN3 GY Equity Henkel AG & Co. -

Evaluation of the 2019 Agm Season

EVALUATION OF THE 2019 AGM SEASON Introduction Every year Eumedion1 prepares an evaluation of the season of annual reports and shareholders meetings, the AGM season. The main substantive findings concerning the annual reports for the year 2018 and the regular shareholders’ meetings held in 20192 are considered below. Highlights The average number of votes cast (excluding those cast by Trust Offices) at the AGMs of the largest listed (AEX) companies reached also this year a new record level: 73.2% (2018: 72.4%). Also the average number of votes cast (excluding the votes cast by Trust Offices) at AGMs of the midcap (AMX) companies increased: from 64.9% in 2018 to 65.8% in 2019. This is, however, still lower than the peak level of 67.4% in 2017. KPN was this year the first Dutch company that offered its shareholders the possibility to vote virtually and real time during the AGM. It was the first step to hold a so-called hybrid shareholders meeting. The number of contested voting issues (>20% dissent votes) decreased from 29 in 2018 to 26 in 2019. This decrease is likely due to more dialogues between listed companies and shareholders ahead of the AGM and the accommodation of the board-proposed AGM resolutions to the amended voting policies of several institutional investors and proxy advisors. At the same time, the number of rejected board-proposed AGM resolutions increased from only 1 in 2018 to 7 in 2019. These related to proposals that were not aligned with updated voting policies of institutional investors and proxy advisors on the authority to issue new shares without pre-emption rights and to a company-specific issue at ING Groep resulting in shareholders’ refusal to discharge the Executive and Supervisory Board.