Ratings and Accreditation Fund Fa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

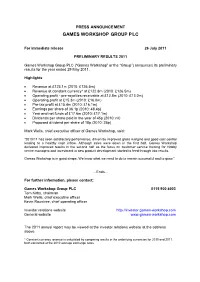

Games Workshop Group Plc

PRESS ANNOUNCEMENT GAMES WORKSHOP GROUP PLC For immediate release 26 July 2011 PRELIMINARY RESULTS 2011 Games Workshop Group PLC (“Games Workshop” or the “Group”) announces its preliminary results for the year ended 29 May 2011. Highlights • Revenue at £123.1m (2010: £126.5m) • Revenue at constant currency* at £122.8m (2010: £126.5m) • Operating profit - pre-royalties receivable at £12.8m (2010: £13.0m) • Operating profit at £15.3m (2010: £16.0m) • Pre-tax profit at £15.4m (2010: £16.1m) • Earnings per share of 36.1p (2010: 48.4p) • Year end net funds of £17.6m (2010: £17.1m) • Dividends per share paid in the year of 45p (2010: nil) • Proposed dividend per share of 18p (2010: 25p) Mark Wells, chief executive officer of Games Workshop, said: “2010/11 has seen satisfactory performance, driven by improved gross margins and good cost control leading to a healthy cash inflow. Although sales were down in the first half, Games Workshop delivered improved results in the second half as the focus on customer service training for Hobby centre managers and investment in new product development started to feed through into results. Games Workshop is in good shape. We know what we need to do to remain successful and to grow.” …Ends… For further information, please contact: Games Workshop Group PLC 0115 900 4003 Tom Kirby, chairman Mark Wells, chief executive officer Kevin Rountree, chief operating officer Investor relations website http://investor.games-workshop.com General website www.games-workshop.com The 2011 annual report may be viewed at the investor relations website at the address above. -

Consolidated Profit & Loss Account

PRESS ANNOUNCEMENT GAMES WORKSHOP GROUP PLC 14 January 2020 HALF-YEARLY REPORT Games Workshop Group PLC (‘Games Workshop’ or the ‘Group’) announces its half-yearly results for the six months to 1 December 2019. Highlights: Six months to Six months to 1 December 2019 2 December 2018 Revenue £148.4m £125.2m Revenue at constant currency* £145.6m £125.2m Operating profit pre-royalties receivable £48.5m £35.3m Royalties receivable £10.7m £5.5m Operating profit £59.2m £40.8m Operating profit at constant currency* £57.1m £40.8m Profit before taxation £58.6m £40.8m Cash generated from operations £60.4m £36.0m Basic earnings per share 145.9p 101.3p Dividend per share declared in the period 100p 65p Kevin Rountree, CEO of Games Workshop, said: “Our business and the Warhammer Hobby continue to be in great shape. We are pleased to once again report record sales and profit levels in the period. The global team have worked their socks off to deliver these great results. My thanks go out to them all. Sales for the month of December are in line with our expectations. We are also announcing that the Board has today declared a dividend of 45 pence per share, in line with the Company’s policy of distributing truly surplus cash.” …Ends… For further information, please contact: Games Workshop Group PLC 0115 900 4003 Kevin Rountree, CEO Rachel Tongue, Group Finance Director Investor relations website investor.games-workshop.com General website www.games-workshop.com *Constant currency revenue and operating profit are calculated by comparing results in the underlying currencies for 2018 and 2019, both converted at the average exchange rates for the six months ended 2 December 2018. -

Financial Highlights

FINANCIAL HIGHLIGHTS 2007 2006 Revenue £111.5m £115.2m Pre-exceptional operating profit £1.9m £4.2m Exceptional items - cost reduction programme £(4.0)m - Operating (loss)/profit £(2.1)m £4.2m Pre-tax (loss)/profit £(2.9)m £3.7m Year end net borrowings £10.2m £2.2m (Loss)/earnings per share (11.2)p 6.5p Dividend per share 4.95p 18.975p Contents 1 Financial highlights 2 Chairman's preamble 3 Business review 9 Financial review 11 Directors' report 16 Corporate governance 20 Remuneration report 23 Statement of directors' responsibilities 23 Company’s directors and advisers 24 Independent auditors' report 25 Income statement 25 Statements of recognised income and expense 26 Balance sheets 27 Cash flow statements 28 Notes to the financial statements 54 Five year summary and financial calendar 55 Notice of meeting 57 Appendix - Chairman's preambles from previous annual reports Games Workshop Group PLC 1 CHAIRMAN’S PREAMBLE To paraphrase Margaret Thatcher: 'The wisdom of hindsight, so useful to analysts and some shareholders, is sadly denied to practising businessmen.' Or least it is when we take our decisions. Like everyone else I wonder about the decisions I took and the things I said over the last few months and years. One can lose a great deal of sleep that way, but it is, of course, a futile exercise unless one is an historian. The real question is: did I do what I did and say what I said in good faith, with serious intent and with appropriate cognisance of the needs of all our stakeholders? Now, this is a good question and the answer for every one alive, never mind the few of us leading public companies, had better be yes. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Financial Highlights

FINANCIAL HIGHLIGHTS 2008 2007 Revenue £110.3m £109.5m Operating profit - pre-exceptional and pre-royalties receivable £3.2m £0.8m Royalties receivable £1.7m £1.4m Operating profit - pre-exceptional £4.9m £2.2m Exceptional items - cost reduction programme £(2.4)m £(4.0)m Operating profit/(loss) £2.5m £(1.8)m Pre-tax profit/(loss) £1.1m £(2.6)m Discontinued operations - loss for the year £(1.2)m £(0.3)m Year end net borrowings £10.1m £10.2m Loss per share (2.4)p (11.2)p Dividend per share - 4.95p Contents 1 Financial highlights 2 Chairman's preamble 3 Business review 9 Financial review 12 Directors' report 17 Corporate governance 20 Remuneration report 23 Statement of directors' responsibilities 23 Company’s directors and advisers 24 Independent auditors' report 25 Income statement 25 Statements of recognised income and expense 26 Balance sheets 27 Cash flow statements 28 Notes to the financial statements 57 Five year summary and financial calendar 58 Appendix - Chairman's preambles from previous annual reports Games Workshop Group PLC 1 CHAIRMAN’S PREAMBLE We have had a better year. Not as good as we would like, not as good as it will be, but better nevertheless. The better year is due, of course, to our new chief executive, Mark Wells. Mark has worked here since the turn of the century and has gradually made himself the leader the business needs. I didn't so much give him the role as watch while he took it away from me. We complement each other very well. -

Imbeaumbsthesis.Pdf (2.574Mb)

Copyright is owned by the Author of the thesis. Permission is given for a copy to be downloaded by an individual for the purpose of research and private study only. The thesis may not be reproduced elsewhere without the permission of the Author. Title Page Cooperation in Competitive Miniatures Games: An examination of coopetitive behaviour A thesis presented in partial fulfilment of the requirements for the degree of Master of Business Studies in Management at Massey University Auckland, New Zealand Jean-Sebastien Imbeau 2019 1 Abstract The following study uses competitive miniatures board games as a novel research environment to examine how, when and why individuals choose between cooperative and competitive strategies to advance their interests, both within the game match itself and within the broader community of gamers, and what factors affect these decisions. Drawing on literature from the study fields of coopetition (a situation of simultaneous cooperation and competition) and decision making, the study focuses on environmental factors and systemic features of the games and game cultures, and how these impact player decisions and perspectives on the competitive/cooperative paradox. Findings supported value creation as a key motivator in player behaviour. Participants overall expressed a non zero-sum understanding of the coopetitive environment. The existence of a coopetitive tension within competitive miniatures games was acknowledged across the board, although its severity was perceived differently across participants. Participants also identified a number of key strategies and tools used to mitigate or navigate this tension. These included reciprocity, communicating intent, following the principles of clean play, and adhering to a set of unwritten rules and norms around sportsmanship and fairness. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, March 31, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 96.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.4% Legrand SA 131,321 8,375,908 AGL Energy Ltd. 880,686 9,216,678 L’Oreal SA 104,607 27,073,419 Aristocrat Leisure Ltd. 728,775 9,443,206 Orange SA 949,535 11,496,452 ASX Ltd. 162,820 7,642,885 Peugeot SA 1,014,598 13,209,331 BHP Group Ltd. 471,264 8,549,345 Schneider Electric SE 553,434 46,777,833 CIMIC Group Ltd. 332,784 4,713,315 STMicroelectronics NV 400,446 8,608,225 CSL Ltd. 166,037 30,097,798 Total SA 1,095,152 41,264,011 Fortescue Metals Group Ltd. 4,669,354 28,614,857 Total 209,274,345 (a),(b) IDP Education Ltd. 447,152 3,487,548 Germany 4.2% Inghams Group Ltd. 1,200,179 2,405,115 Adidas AG 22,586 5,014,708 Magellan Financial Group Ltd. 729,823 19,356,167 Allianz SE, Registered Shares 319,746 54,451,936 Regis Resources Ltd. 1,318,187 2,929,557 Continental AG 32,324 2,304,645 Santos Ltd. 4,606,425 9,460,470 Dialog Semiconductor PLC(c) 82,878 2,154,248 (c) Saracen Mineral Holdings Ltd. 3,513,246 7,900,242 Hugo Boss AG 273,602 6,848,821 Technology One Ltd. 897,813 4,336,750 MTU Aero Engines AG 74,698 10,801,095 Total 148,153,933 SAP SE 91,344 10,198,367 Austria 0.2% Siemens Healthineers AG 179,517 6,939,504 OMV AG 81,189 2,221,890 Total 98,713,324 Raiffeisen Bank International AG 111,223 1,599,856 Hong Kong 3.9% Total 3,821,746 CK Hutchison Holdings Ltd. -

Annual Report 2017

GAMES WORKSHOP GROUP PLC Annual report 2017 FINANCIAL HIGHLIGHTS 2017 2016 £000 £000 Revenue 158,114 118,069 Revenue at constant currency* 143,375 118,069 Operating profit - pre-royalties receivable 30,832 10,921 Royalties receivable 7,491 5,939 Operating profit 38,323 16,860 Profit before taxation 38,403 16,948 Cash generated from operations 49,370 26,782 Earnings per share 95.1p 42.1p Dividends per share declared in the year** 74p 40p CONTENTS Chairman’s preamble 2 Strategic report 4 Directors’ report 14 Corporate governance report 19 Remuneration report 23 Directors’ responsibilities statement 31 Company directors and advisers 32 Independent auditors’ report 33 Consolidated income statement 38 Statements of comprehensive income 38 Balance sheets 39 Consolidated and Company statements of changes in total equity 40 Consolidated and Company cash flow statements 41 Notes to the financial statements 42 Five year summary 63 Financial calendar 63 Notice of annual general meeting 64 *Constant currency revenue is calculated by comparing results in the underlying currencies for 2017 and 2016, both converted at the 2016 average exchange rates as set out on page 12. **See page 14 of the directors’ report. 1 Games Workshop Group PLC CHAIRMAN’S PREAMBLE Most companies don’t live for long. Leaving aside banks and finance houses that can continue doing pretty much the same thing year upon year there are only a handful of companies that were in the Fortune 500 in 1900 still going today. Looking at the sector weightings in the US for 1900 62.8% of value was generated by Railroads; in 2000 it was 0.2%. -

WH Smith PLC ANNUAL REPORT and ACCOUNTS 2008 WH Smith PLC Is One of the UK’S Leading Retail Groups

WH Smith PLC ANNUAL REPORT AND ACCOUNTS 2008 WH Smith PLC is one of the UK’s leading retail groups. We aim to be Britain’s most popular bookseller, stationer and newsagent. ABOUT US • WH Smith PLC, one of the UK’s leading retailers, is made up of two businesses – Travel and High Street • Our extensive store portfolio spans high streets, airports, train stations, motorway service areas and hospitals across the UK • WHSmith Direct – www.whsmith.co.uk – serves customers on the internet 24 hours a day • Overall WHSmith employs approximately 18,000 staff across the UK • WH Smith PLC is listed on the London Stock Exchange (SMWH) and is part of the FTSE 250 index • A commitment to the principles of corporate responsibility is at the heart of the WHSmith brand. grOUP aT a gLaNCE fiNaNCiaL HigHLights WH Smith PLC has delivered another year of strong profit performance with Group profit before tax and exceptional items 15 per cent ahead of last year at £76m. The Travel business continues its strong performance and the High Street business again made further progress in line with its plan. PrOfiT bEfOrE ExceptionaL itemS aNd TaxaTion (£m) CONTENTS 80 1 Group at a glance 76 2 Chairman’s statement 70 66 4 Business review 60 — WHSmith Travel 50 51 — WHSmith High Street 14 Financial review 40 39 20 Corporate responsibility review 30 24 Board of Directors 25 Directors’ report 20 30 Corporate governance 10 34 Remuneration report 0 42 Independent auditors’ report to the 2005 2006 2007 2008 members of WH Smith PLC 43 Group income statement 80 UNdErLyiNg -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 20 May 2021 08:30 BST Upcoming Events Select headline to navigate to article easyJet Nothing really to report in the H121 release Company Events 20-May easyJet; Q221 Results Builders Merchants Kingfisher delivers blow out Q1 LFL’s 24-May Hilton Food Group; Q121 Trading Update and a strong start to Q2 25-May Greencore; Q221 Results Harworth Group; AGM Fever-Tree Drinks AGM statement indicates trading is in- 26-May British Land Company; FY21 Results Hibernia REIT; FY Results line with expectations Games Workshop Group FY21 Trading Update signals strength of online offering Irish Banks ECB stability review highlights risks still in system; Climate risk becoming more embedded Irish Banks PTSB drops a few clues on Ulster Bank process at its AGM Irish Economic View Ireland appears to be making other friends, trade data shows Economic Events Ireland 21-May PPI Apr21 Wholesale Price Index Apr21 United Kingdom 21-May Retail Sales Apr21 United States Europe This document is intended for the sole use of Goodbody Investment Banking and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap easyJet Nothing really to report in the H121 release th With the headline H121 numbers pre-released on April 14 and the return to the skies Recommendation: Buy stalled until the Q4/September quarter, there was little in this morning’s release for the Closing Price: £9.83 market to get its teeth into. -

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021 FTF - FTF Franklin UK Mid Cap August 31, 2021 Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date B132NW2 ASHMORE GROUP PLC 5,750,000 £22,954,000 1.89% N/A N/A 0066701 AVON PROTECTION PLC 701,792 £13,186,671 1.08% N/A N/A 0090498 BELLWAY PLC 925,000 £32,550,750 2.68% N/A N/A B3FLWH9 BODYCOTE PLC 4,450,000 £42,920,250 3.53% N/A N/A BMH18Q1 BYTES TECHNOLOGY GROUP PLC 4,500,000 £23,130,000 1.90% N/A N/A 0231888 CRANSWICK PLC 935,000 £37,082,100 3.05% N/A N/A 0265274 DERWENT LONDON PLC 825,000 £31,292,250