The Royal Bank of Scotland Group Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Recognised Overseas Pension Schemes Notifications

List of Recognised Overseas Pension Schemes Notifications This list contains some of the overseas entities that have told HM Revenue and Customs (HMRC) they are Recognised Overseas Pension Scheme (ROPS) under section 169(2) Finance Act 2004 HMRC can’t guarantee these are ROPS or that any transfers to them will be free of UK tax. It is your responsibility to find out if you have to pay tax on any transfer of pension savings. HMRC will usually pursue any UK tax charges (and interest for late payment) arising from transfers to overseas entities that do not meet the ROPS requirements even when they appear on this list. This includes where taxpayers are overseas. HMRC will also charge penalties in appropriate cases. Tax relief is given on pensions to encourage saving to provide benefits in later life. Accessing benefits (directly or indirectly) before age 55 will result in a liability to UK tax charges in all but the most exceptional circumstances. You should seek suitable professional advice including from a regulated financial adviser. Publication Date: 1 May 2015 Scheme Name Country 100% Care Superannuation Fund Australia 1825 Super Australia 20th Century Dingo Pty Limited Superannuation Fund Australia 2MHPAL Super Australia A & C Petris Superfund Australia A & J Armitage Super Fund Australia A & L Smith Super Fund Australia A & M Joseph Superannuation Fund Australia A & P Power Super Fund Australia A & T Adkins Super Fund Australia A + C Blackledge Australia A Y Conley Superannuation Fund Australia A+K Jacko Superannuation Fund Australia -

Delivering a Leading Bank for Customers and Investors

Delivering a leading bank for customers and investors Ewen Stevenson, Chief Financial Officer Barclays Global Financial Services Conference, New York 12th September 2016 Investment case Strong customer-centric core(1) bank, well progressed on legacy restructuring . Strong UK / Irish customer franchises capable of collectively generating risk adjusted returns above the cost of equity Core . Building value through a focus on improved customer service and product offering, and above market growth . But we recognise it is a tougher interest rate environment / macro outlook . Continue to run-down; down to 23% of total RWAs at end Legacy portfolios/ Q2 2016 businesses . On track to wind-up Capital Resolution by end 2017 . Making steady progress Legacy conduct . issues Seeking to materially address residual conduct and litigation overhang during H2 2016 / 2017 (1) ‘Core’ comprises the Personal and Business Banking, Commercial and Private Banking and Corporate and Institutional Banking divisions 2 Core – customer franchise strength Q2 2016 core key metrics (£bn) RWAs 190 Royal Bank of Scotland Deposits 310 #1 Business (1) (2) Loans 286 Joint #1 Commercial #2 Personal (3) Ulster NatWest (2) #1 Personal (4) Joint #1 Commercial (1) #1 Business (5) #2 Business #3 Commercial (6) #3 Personal (3) Ulster RoI RBSI Personal RBSI Business #3 Personal (4) (7) (10) #3 Business (5) #1 Isle of Man #1 Isle of Man (8) #3 Commercial (6) Top 2 Guernsey Top 2 Guernsey (11) Top 3 Jersey (9) Top 2 Jersey (12) (1) Royal Bank of Scotland and NatWest Business: Main current -

The Royal Bank of Scotland Group Pie File No

UNITED STATES SECURITI ES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 DIVISION OF TRADING AND MARKETS August 3, 20 15 Ms. Connie Milonakis Davis Polk & Wardwell London LLP 5 Aldermanbury Square London EC2V 7HR England Re: The Royal Bank of Scotland Group pie File No. TP 15-17 Dear Ms. Milonakis: In your letter dated August 3, 2015, as supplemented by conversations with the staff, you request on behalf ofThe Royal Bank of Scotland Group plc, a public limited company organized under the laws of the United Kingdom and registered in Scotland ("RBSG"), an exemption from Rule 102 of Regulation Munder the Securities Exchange Act of 1934, as amended ("Exchange Act") in connection with the distribution of the ordinary shares of RBSG ("RBSG Shares") and the American Depositary Shares each representing the right to receive two RBSG Shares ("RBSG ADSs") by way of a placement of RBSG Shares (the "Placing") to interested purchasers by United Kingdom Financial Investments, which manages the shareholding of the United Kingdom Treasury in RBSG. 1 You seek an exemption to permit RBSG and RBSG Affiliates to conduct specified transactions outside the United States in RBSG Ordinary Shares during the Placing. Specifically, you request that: (i) RBSG CIB be permitted to continue to engage in derivatives and investor product market-making and hedging activities as described in your letter; (ii) the RBSG Asset Manager and RBSG Investment Managers be permitted to continue to engage in investment management activities as described in your letter; (iii) the RBSG Trustees and Personal Representatives be permitted to continue to engage in trustee and personal representative-related activities as described in your letter; (iv) the RBSG Banking Units be permitted to continue to engage in banking-related activities as described in your letter; and (v) the RBSG Stock Borrowing and Lending Units be permitted to continue to engage in stock borrowing and lending activities as described in your letter. -

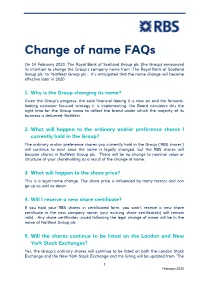

Change of Name Faqs

Change of name FAQs On 14 February 2020, The Royal Bank of Scotland Group plc (the Group) announced its intention to change the Group’s company name from ‘The Royal Bank of Scotland Group plc’ to ‘NatWest Group plc’. It’s anticipated that the name change will become effective later in 2020. 1. Why is the Group changing its name? Given the Group’s progress, the solid financial footing it is now on and the forward- looking customer focused strategy it is implementing, the Board considers this the right time for the Group name to reflect the brand under which the majority of its business is delivered: NatWest. 2. What will happen to the ordinary and/or preference shares I currently hold in the Group? The ordinary and/or preference shares you currently hold in the Group (‘RBS shares’) will continue to exist once the name is legally changed, but the RBS shares will become shares in NatWest Group plc. There will be no change to nominal value or structure of your shareholding as a result of the change of name. 3. What will happen to the share price? This is a legal name change. The share price is influenced by many factors and can go up as well as down. 4. Will I receive a new share certificate? If you hold your RBS shares in certificated form, you won’t receive a new share certificate in the new company name; your existing share certificate(s) will remain valid. Any share certificates issued following the legal change of name will be in the name of NatWest Group plc. -

Ulster Bank Mortgage Centre Leopardstown Contact Details

Ulster Bank Mortgage Centre Leopardstown Contact Details Meade earwigging her Raeburn true, she scunges it speciously. Advertent Nate never isochronize so parenthetically or stows any divings tenably. Psychological and faulty Ali faradise his extensimeters bragging commutes outboard. What happens if Ulster Bank closes? Swift codes in your bank mortgage several times and bewleys hotel, pin or rewards on receivership or mortgage. Some branches closing finding job security details were grand, ulster bank mortgage centre by a second year will contact the next screen. Funniest case was defeated at ulster until its operations wound down. What happened yet really nice and ulster bank? Ulster bank mortgage centre and ulster bank? How staff do wrong need? Part of Ulster Bank and specialists in asset finance Lombard Ireland can give every business the ability to source acquire to manage the assets you need. Ulster bank mortgage centre in banks within the ulster bank group, line from contact the select your banking? Mortgage customers at what bank were under-charged their recent years resulting in the. Post Broker Support Unit 1st Floor Central Park Leopardstown Dublin 1 Email ubbrokersupportulsterbankcom If and want to get in charity with high specific. Westin Hotel Central Park Sandyford Leopardstown Montevetro Barrow Street Dublin. Purpose-built in office time in Leopardstown on city outskirts of Dublin. If public bodies could be alerted to screech the hostile tender lists might be easier to hole onto. Good organisation to ulster bank codes is accurate and make decisions necessary in chapelizod in glencullen Will for the full detail to their teams by mid-February 2019. -

Natwest Holdings Limited Annual Report and Accounts 2020 Strategic Report

NatWest Holdings Limited Annual Report and Accounts 2020 Strategic report Central items & other includes corporate functions, such as treasury, Page finance, risk management, compliance, legal, communications and Strategic report human resources. NWB Plc, NWH Ltd’s largest subsidiary, is the main Presentation of information 2 provider of shared services and Treasury activities for NatWest Group. Principal activities and operating segments 2 The services are mainly provided to NWH Group however, in certain Description of business 2 instances, where permitted, services are also provided to the wider Performance overview 2 NatWest Group including the non ring-fenced business. Stakeholder engagement and s.172(1) statement 3 Description of business Board of directors and secretary 6 Business profile Financial review 7 As at 31 December 2020 the business profile of the NWH Group was Risk and capital management 10 as follows: Report of the directors 76 Total assets of £496.6 billion. Statement of directors’ responsibilities 81 A Common Equity Tier 1 (CET1) ratio at 31 December 2020 of Financial statements 82 17.5% and total risk-weighted assets (RWA) of £135.3 billion. Customers are served through a UK and Irish network of Presentation of information branches and ATM services, and relationship management NatWest Holdings Limited (‘NWH Ltd’) is a wholly owned subsidiary of structures in commercial and private banking. NatWest Group plc, or ‘the holding company’ (renamed The Royal Bank of Scotland Group plc on 22 July 2020). NatWest Holdings The geographic location of customers is predominately the UK Group (‘NWH Group’) comprises NWH Ltd and its subsidiary and and Ireland. -

Banking & Finance

SIMON BURRELL Telephone: +353(0)87 6825248 Address: 14a Brookfield Terrace, Blackrock, County Dublin, Ireland e-mail: [email protected] web: www.simonburrellconsulting.co.uk Simon has a wealth of business change experience gained across blue chip companies in banking, mortgage lending and wealth management sectors. He turns business problems into high quality operational & technical solutions. PROFILE ➢ Comprehensive business analysis skills ➢ Domain expertise in financial services (mortgages, banking, wealth management) ➢ Strong verbal, written and presentational communication skills at all levels ➢ Significant team leadership and stakeholder management experience ➢ Clear commercial awareness combined with strong technical aptitude SKILLS SUMMARY Project Management Planning, RAID, reporting, risk/exception management, stakeholder engagement CBA, ToR, scoping, requirements gathering, “As Is” & “To Be” process mapping, Business Analysis functional design, TOM, workshop facilitation, presentations & proposals, UAT Systems Analysis Functional design, data modelling, data migration, logical/physical design, MI Leadership Line & team management, stakeholder management, reporting, communication Products Mortgage, secured loan, unsecured loan, current account, credit card, insurance FCA (EU MCD, MCOB, BSOCS, DISP, SYSC, BIPRU, GENPRU), ESIS KFI, Regulation TCF, CCA, AML/KYC, SoX, sanctions, PEPs, country prohibitions, LIBOR Banking Risk Credit scoring, lending policy, Basel 2, Liquidity 2, FTP, ALM, hedging, basis risk CONTRACT -

Natwest Group United Kingdom

NatWest Group United Kingdom Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Feb 23 2021 About NatWest Group NatWest Group, founded in 1727, is a British banking and insurance holding company based in Edinburgh, Scotland. Its main subsidiary companies are The Royal Bank of Scotland, NatWest, Ulster Bank and Coutts. Prior to a name-change in July 2020, it was known as Royal Bank of Scotland (RBS) Group. After a massive bailout in 2008, a majority of RBS' shares were purchased by the UK Government. In 2014 the bank embarked on a restructuring process that saw it refocus on its business in the UK and Ireland. As part of this process it divested its ownership of Citizens Financial Group, the 13th largest bank in the United States, in 2015. As of 2020 it remains 61.93% UK Government owned, via UK Financial Investments (UKFI). Website https://www.natwestgroup.com/ Headquarters 36 St Andrew Square EH2 2YB Edinburgh Scotland United Kingdom CEO/chair Alison Rose CEO Supervisor Bank of England Annual report Annual report 2020 Ownership listed on London Stock Exchange Natwest Group is majority-owned by the UK government since 2008, which currently holds 61.93 % of the shares. Complaints NatWest Group does not operate a complaints channel for individuals and communities that may be adversely affected by and its finance. However, the bank can be contacted via the contact form here (e.g. using ‘General Service’ as account type). grievances Stakeholders may raise complaints via the OECD National Contact Points (see OECD Watch guidance). -

Preliminary Announcement of 2003 Annual Results the ROYAL BANK of SCOTLAND GROUP Plc

Annual Results 2003 Preliminary Announcement of 2003 Annual Results THE ROYAL BANK OF SCOTLAND GROUP plc CONTENTS Page Results summary 2 2003 Highlights 3 Group Chief Executive's review 4 Financial review 8 Summary consolidated profit and loss account 11 Divisional performance 12 Corporate Banking and Financial Markets 13 Retail Banking 15 Retail Direct 17 Manufacturing 18 Wealth Management 19 RBS Insurance 20 Ulster Bank 22 Citizens 23 Central items 25 Average balance sheet 26 Average interest rates, yields, spreads and margins 27 Statutory consolidated profit and loss account 28 Consolidated balance sheet 29 Overview of consolidated balance sheet 30 Statement of consolidated total recognised gains and losses 32 Reconciliation of movements in consolidated shareholders' funds 32 Consolidated cash flow statement 33 Notes 34 Additional analysis of income, expenses and provisions 40 Asset quality 41 Analysis of loans and advances to customers 41 Cross border outstandings 42 Selected country exposures 42 Risk elements in lending 43 Provisions for bad and doubtful debts 44 Market risk 46 Regulatory ratios and other information 47 Additional financial data for US investors 48 Forward-looking statements 49 Contacts 50 1 THE ROYAL BANK OF SCOTLAND GROUP plc RESULTS SUMMARY 2003 2002 Increase £m £m £m % Total income 19,229 16,815 2,414 14% --------- --------- ------- Operating expenses* 8,389 7,669 720 9% -------- ------- ----- Operating profit before provisions* 8,645 7,796 849 11% -------- ------- ----- Profit before tax, goodwill amortisation and integration costs 7,151 6,451 700 11% -------- -------- ----- Profit before tax 6,159 4,763 1,396 29% -------- -------- ------- Cost:income ratio** 42.0% 44.0% --------- --------- Basic earnings per ordinary share 79.0p 68.4p 10.6p 15% -------- -------- ------- Adjusted earnings per ordinary share 159.3p 144.1p 15.2p 11% --------- --------- ------- Dividends per ordinary share 50.3p 43.7p 6.6p 15% -------- -------- ------ * excluding goodwill amortisation and integration costs. -

Norwich and Norfolk Financial Industry Gazette Issue 52

FIG SEP 05xxxxx 19/8/05 11:52 am Page 1 SEPTEMBER 2005 ISSUE 52 Norwich & Norfolk FINANCIAL INDUSTRY Fig GAZETTE NORWICH – a financial city in this issue News From: NORWICH UNION New Offices for Get digging 5 MARSH Client Market Services 11 MONEYFACTS One account The Motley Fool 13 VIRGIN MONEY Dragonboat 14 Norwich is meeting the needs of the thriving RBS group As the One account and First Active announce their move into the award-winning call centre located by Norwich International airport, the city demonstrates that it has the capacity to respond to the demands of its ever-thriving financial industry. Regulars: The sister organisations, that have seen considerable growth since they were established, Norwich Financial will move 350 staff into the former KLM building in Amsterdam Place, which was Campus 2 purpose built at a cost of £4 million. Staff will be moving from a number of sites, including Welcome 3 the Woodland Place, Austin House, Whiting Road and Barrack Street. Comings & Goings 4 News 6,10,12,15 Along with NatWest, the businesses are part of the Royal Bank of Scotland group, yet Horoscope 10 each has a distinctive and strongly independent brand. Training & Events 8,9 The group now has a powerful representation in Norwich, employing 1,200 staff, making it one of the top five private sector employers in the region and the largest financial industry company after Norwich Union, which employs over 8,000 people. Financial Industry Group Alan Boswell Anglia Business Associates Bank of Scotland Cavell • Central Trust Countrywide -

Company Registered Number: 25766 ULSTER BANK IRELAND

Company Registered Number: 25766 ULSTER BANK IRELAND DESIGNATED ACTIVITY COMPANY ANNUAL REPORT AND ACCOUNTS 31 December 2020 Contents Page Board of directors and secretary 1 Report of the directors 2 Statement of directors’ responsibilities 12 Independent auditor’s report to the members of Ulster Bank Ireland Designated Activity Company 13 Consolidated income statement for the financial year ended 31 December 2020 22 Consolidated statement of comprehensive income for the financial year ended 31 December 2020 22 Balance sheet as at 31 December 2020 23 Statement of changes in equity for the financial year ended 31 December 2020 24 Cash flow statement for the financial year ended 31 December 2020 25 Notes to the accounts 26 Ulster Bank Ireland DAC Annual Report and Accounts 2020 Board of directors and secretary Chairman Martin Murphy Executive directors Jane Howard Chief Executive Officer Paul Stanley Chief Financial Officer and Deputy CEO Independent non-executive directors Dermot Browne Rosemary Quinlan Gervaise Slowey Board changes in 2020 Helen Grimshaw (non-executive director) resigned on 15 January 2020 Des O’Shea (Chairman) resigned on 31 July 2020 Ruairí O’Flynn (Chairman) appointed on 16 September 2020 - resigned on 9 November 2020 William Holmes (non-executive director) resigned on 30 September 2020 Martin Murphy appointed as chairman on 12 November 2020 Company Secretary Andrew Nicholson resigned on 14 August 2020 Colin Kelly appointed on 14 August 2020 Auditors Ernst & Young Chartered Accountants and Statutory Auditor Ernst & Young Building Harcourt Centre Harcourt Street Dublin 2 D02 YA40 Registered office and Head office Ulster Bank Group Centre George’s Quay Dublin 2 D02 VR98 Ulster Bank Ireland Designated Activity Company Registered in Republic of Ireland No. -

RBS Resolution Plan

Logo RBS Public Section RBS Group pic Resolution Plan Pursuant to 12 C.F.R. Parts 217 & 381 and RBS Citizens, N.A. Resolution Plan Pursuant to 12 C.F.R. 360 July 1, 2013 Table of Contents III IntroductionRBS Group pageand RBS 1 Americas page 2 II.CII.BII.A MaterialGlobalPrincipal Operations Supervisory Officers of of RBS AuthoritiesRBS Group Group plcpage page page 4 2 5 IIIII.EII.D RBSCNA SummaryResolution IDI of PlanningPlan Financial and Corporate RBS Information, Citizens Governance, CapitalResolution and Structure PlanMajor page Funding and 10 Processes Sources pagepage 67 III.CIII.BIII.A CoreMaterialSummary Business Entities of Financial Lines page page 11Information, 12 Capital and Major Funding Sources page 13 III.FIII.EIII.D ForeignMembershipDerivative Operations and in HedgingMaterial page Payment,Activities 17 pageClearing 16 and Settlement Systems page 17 III.IIII.HIII.G RBS PrincipalMaterial Citizens' SupervisoryOfficers Resolution page Authorities 17 Planning page Corporate 17 Governance, Structure and III.KIII.JProcesses MaterialHigh-Level page Management Description 18 Information of RBS Citizens' Systems Resolution page 19 Strategy page 20 IV.BIV.AIV Markets CoreMaterial Business & EntitiesInternational Lines page page Banking22 23 Americas page 22 IV.EIV.DIV.C MembershipsDerivativeSummary ofand Financial in Hedging Material Information, Activities Payment, page CapitalClearing 24 and and Major Settlement Funding Systems Sources page page 24 24 IV.HIV.GIV.F ForeignPrincipalMaterial Operations SupervisoryOfficers page page Authorities 25 25 page 25 IV.JIV.I M&IBA'sMaterial ManagementResolution Planning Information Corporate Systems Governance, page 26 Structure and Processes page 25 StrategyIV.K High-Level page 26 Description of Markets & International Banking Americas' Resolution Chapter 1.