Living in a 1% World

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Natwest Markets N.V. Annual Report and Accounts 2020 Financial Review

NatWest Markets N.V. Annual Report and Accounts 2020 Financial Review Page Description of business Financial review NWM N.V., a licensed bank, operates as an investment banking firm serving corporates and financial institutions in the European Economic Presentation of information 2 Area (‘EEA’). NWM N.V. offers financing and risk solutions which 2 Description of business includes debt capital markets and risk management, as well as trading 2 Performance overview and flow sales that provides liquidity and risk management in rates, Impact of COVID-19 3 currencies, credit, and securitised products. NWM N.V. is based in Chairman's statement 4 Amsterdam with branches authorised in London, Dublin, Frankfurt, Summary consolidated income statement 5 Madrid, Milan, Paris and Stockholm. Consolidated balance sheet 6 On 1 January 2017, due to the balance sheet reduction, RBSH 7 Top and emerging risks Group’s regulation in the Netherlands, and supervision responsibilities, Climate-related disclosures 8 transferred from the European Central Bank (ECB), under the Single Risk and capital management 11 Supervisory Mechanism. The joint Supervisory Team comprising ECB Corporate governance 43 and De Nederlandsche Bank (DNB) conducted the day-to-day Financial statements prudential supervision oversight, back to DNB. The Netherlands Authority for the Financial Markets, Autoriteit Financiële Markten Consolidated income statement 52 (AFM), is responsible for the conduct supervision. Consolidated statement of comprehensive income 52 Consolidated balance sheet 53 UK ring-fencing legislation Consolidated statement of changes in equity 54 The UK ring-fencing legislation required the separation of essential Consolidated cash flow statement 55 banking services from investment banking services from 1 January Accounting policies 56 2019. -

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Industry Analysis

Investment Banks “Teaser” Industry Report Industry Analysis Investment Banks Q1 2012 Industry Overview Raising capital by underwriting and acting on behalf of individuals, corporations, and governments in the issuance of securities is the main thrust of investment banks. They also assist companies involved in mergers and acquisitions (M&As) and provide ancillary services like market making, derivatives trading, fixed income instruments, foreign exchange, commodities, and equity securities. Investment banks bannered the 2008 global financial and economic crisis, with U.S. investment bank Bear Sterns saved by J.P. Morgan Chase. Later in the year, Lehman Brothers filed for bankruptcy due to liquidity, leverage, and losses, as Merrill Lynch narrowly escaped such a fate with its purchase by Bank of America. Lehman Brothers was the largest bankruptcy in history at the time, with liabilities of more than $600 billion. Such unprecedented events caused panic in world markets, sending bonds, equities, and other assets into a severe decline. Morgan Stanley survived with an investment from Japan-based Mitsubishi UFJ Financial Group, and Goldman Sachs took a major investment from Warren Buffet’s Berkshire Hathaway. All major financial players took large financial bailouts from the U.S. government. Post-Lehman Brothers, both American and British banks took a huge beating. In the U.K., hundreds of billions of pounds of public money was provided to support HBOS, Lloyds, and Royal Bank of Scotland (RBS). Upon the government’s pressure, Lloyds took over HBOS to create Lloyds Banking Group and after three years, taxpayers end 2011 nursing a loss on their stake of almost £40 billion ($62.4 billion). -

List of Recognised Overseas Pension Schemes Notifications

List of Recognised Overseas Pension Schemes Notifications This list contains some of the overseas entities that have told HM Revenue and Customs (HMRC) they are Recognised Overseas Pension Scheme (ROPS) under section 169(2) Finance Act 2004 HMRC can’t guarantee these are ROPS or that any transfers to them will be free of UK tax. It is your responsibility to find out if you have to pay tax on any transfer of pension savings. HMRC will usually pursue any UK tax charges (and interest for late payment) arising from transfers to overseas entities that do not meet the ROPS requirements even when they appear on this list. This includes where taxpayers are overseas. HMRC will also charge penalties in appropriate cases. Tax relief is given on pensions to encourage saving to provide benefits in later life. Accessing benefits (directly or indirectly) before age 55 will result in a liability to UK tax charges in all but the most exceptional circumstances. You should seek suitable professional advice including from a regulated financial adviser. Publication Date: 1 May 2015 Scheme Name Country 100% Care Superannuation Fund Australia 1825 Super Australia 20th Century Dingo Pty Limited Superannuation Fund Australia 2MHPAL Super Australia A & C Petris Superfund Australia A & J Armitage Super Fund Australia A & L Smith Super Fund Australia A & M Joseph Superannuation Fund Australia A & P Power Super Fund Australia A & T Adkins Super Fund Australia A + C Blackledge Australia A Y Conley Superannuation Fund Australia A+K Jacko Superannuation Fund Australia -

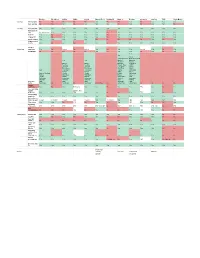

You Can View the Full Spreadsheet Here

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

Meet the Exco

Meet the Exco 18th March 2021 Alison Rose Chief Executive Officer 2 Strategic priorities will drive sustainable returns NatWest Group is a relationship bank for a digital world. Simplifying our business to improve customer experience, increase efficiency and reduce costs Supporting Powering our strategy through customers at Powered by Simple to Sharpened every stage partnerships deal with capital innovation, partnership and of their lives & innovation allocation digital transformation. Our Targets Lending c.4% Cost Deploying our capital effectively growth Reduction above market rate per annum through to 20231 through to 20232 CET1 ratio ROTE Building Financial of 13-14% of 9-10% capability by 2023 by 2023 1. Comprises customer loans in our UK and RBS International retail and commercial businesses 2. Total expenses excluding litigation and conduct costs, strategic costs, operating lease depreciation and the impact of the phased 3 withdrawal from the Republic of Ireland Strategic priorities will drive sustainable returns Strengthened Exco team in place Alison Rose k ‘ k’ CEO to deliver for our stakeholders Today, introducing members of the Executive team who will be hosting a deep dive later in the year: David Lindberg 20th May: Commercial Banking Katie Murray Peter Flavel Paul Thwaite CFO CEO, Retail Banking NatWest Markets CEO, Private Banking CEO, Commercial Banking 29th June: Retail Banking Private Banking Robert Begbie Simon McNamara Jen Tippin CEO, NatWest Markets CAO CTO 4 Meet the Exco 5 Retail Banking Strategic Priorities David -

Leading a Revolution in Banking

Leading a Revolution in Banking Identifying a Product positioning is the way in By embracing new technology, Technology has facilitated this revolu- Meeting Gap in the Market which a product and its associated Intelligent Finance has developed a tionary new system of banking. This Customer Needs Introduction brand is perceived by customers in rela- new approach to delivering both prod- allows customers to connect products together, taking account of both their tion to other competitive products. ucts and services, in a highly innovative The Chartered Institute of Marketing In today’s technology driven, modern borrowings and savings. This means Changes in society, markets and economies has Different customers value different com- way. This looks set to transform the tra- use the following definition to describe world, most organisations operate in that by connecting products together, intensified the need for most organisations to binations of product or service attribut- ditional retail bank as we know it – by marketing. highly competitive markets, this is par- interest is only paid on the balance. For be more and more innovative with the products es, based on the extent to which it meets putting the customer first. ticularly true of the financial services example, a customer may have two "Marketing is the management process that they offer, in order to attract new customers their particular need at that given time. sector. Technology has been one of the products with Intelligent Finance, a responsible for identifying, anticipating For example, the diagram shows that and increase product holdings. New products key drivers of change within this The Proposition personal loan and a current account. -

Allied Irish Bank (GB) Comes Top Again in Comprehensive UK Banking Survey 27Th November 2000

Allied Irish Bank (GB) comes top again in comprehensive UK banking survey 27th November 2000 Allied Irish Bank (GB) has today been named Best Business Bank for the fourth consecutive time in the Forum of Private Business’s (FPB) comprehensive survey into the strength of service offered by banks to private businesses. The FPB report, Private Businesses and Their Banks 2000, is a biennial survey of tens of thousands of British businesses and shows that Allied Irish Bank (GB) has maintained its No. 1 position over other major UK banks since 1994. Aidan McKeon, General Manager of Allied Irish Bank (GB) and Managing Director AIB Group (UK) p.l.c., commented: "While we are delighted to win this award for the fourth time, we are far from complacent. We continue to listen closely to our customers and to invest in the cornerstones of our business: recruiting, training and retaining quality people; building 'true’ business relationships; and ongoing commitment to maintaining short lines of decision making. At the same time, we are exploiting technology to make our service as customer- responsive and efficient as possible." Allied Irish Bank (GB), one of the forerunners in relationship banking, scores highest in the survey for knowledge and understanding. The bank also scored highly on efficiency, reliability and customer satisfaction. Mr. McKeon continued: "We recognise that business customers have particular needs and concerns and we are always striving to ensure that our customers receive a continually improved service. We shall look carefully at this survey and liaise with our customers to further strengthen our service." Stan Mendham, Chief Executive of the FPB commented: "The FPB congratulates Allied Irish Bank (GB) on being voted Best Business Bank in Britain for the fourth time. -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Annual-Financial-Report-2009.Pdf

Contents 4 Chairman’s statement 255 Statement of Directors’ responsibilities in relation to the Accounts 6 Group Chief Executive’s review 256 Independent auditor’s report 8 Corporate Social Responsibility 258 Additional information 12 Financial Review 276 Principal addresses - Business description 278 Index - Financial data - 5 year financial summary - Management report - Capital management - Critical accounting policies - Deposits and short term borrowings - Financial investments available for sale - Financial investments held to maturity - Contractual obligations - Off balance sheet arrangements 59 Risk Management - Risk Factors - Framework - Individual risk types - Supervision and regulation 106 Corporate Governance - The Board & Group Executive Committee - Directors’ Report - Corporate Governance statement - Employees 119 Accounting policies 136 Consolidated income statement 137 Balance sheets 139 Statement of cash flows 141 Statement of recognised income and expense 142 Reconciliations of movements in shareholders’ equity 146 Notes to the accounts 1 Forward-Looking Information This document contains certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Group and certain of the plans and objectives of the Group. In particular, among other statements, certain statements in the Chairman’s statement, the Group Chief Executive’s review, and the Financial Review and Risk Management sections, with regard to management objectives, trends in results of operations, margins, risk management, competition and the impact of changes in International Financial Reporting Standards are forward-looking in nature.These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. -

BACKING OUR CUSTOMERS HALF-YEARLY FINANCIAL REPORT for the Six Months Ended 30 June 2021

BACKING OUR CUSTOMERS HALF-YEARLY FINANCIAL REPORT For the six months ended 30 June 2021 AIB Group plc ENSURING A GREENER TOMORROW BY BACKING THOSE BUILDING IT TODAY. AIB is a financial services group. Our main business activities are retail, business and corporate banking, as well as mobile payments and card acquiring. We are committed to supporting the transition to the low-carbon economy and backing sustainable communities. Merchant Services Beekeeper and AIB employee Kevin Power attending to his bees on the roof of our head office in Molesworth St, Dublin. Half-Yearly Financial Report For the six months ended 30 June 2021 01 02 OVERVIEW BUSINESS REVIEW 2 Business performance 16 Operating and financial review 4 Chief Executive’s review 31 Capital 11 Our strategy 12 Highlights 03 04 RISK MANAGEMENT FINANCIAL STATEMENTS 36 Update on risk management and governance 84 Condensed consolidated interim financial statements 37 Credit risk 91 Notes to the condensed consolidated interim 78 Funding and liquidity risk financial statements 82 Interest rate benchmark reform 131 Statement of Directors’ Responsibilities 132 Independent review report to AIB Group plc 133 Forward looking statements This Half-Yearly Financial Report contains forward looking statements with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives. See page 133. 2 Business Performance AIB Group plc Half-Yearly Financial Report 2021 BUSINESS PERFORMANCE -

NATIONAL WESTMINSTER BANK PLC (Incorporated Under the Laws

NATIONAL WESTMINSTER BANK PLC (incorporated under the laws of England and Wales with limited liability under the Companies Act 1948 to 1980, with registered number 00929027) €25 billion Global Covered Bond Programme unconditionally and irrevocably guaranteed as to payments of interest and principal by NatWest Covered Bonds Limited Liability Partnership (a limited liability partnership incorporated in England and Wales) Under this €25 billion global covered bond programme (the Programme), National Westminster Bank Plc (the Issuer and NatWest) may from time to time issue bonds (the Covered Bonds) denominated in any currency agreed between the Issuer and the relevant Dealer(s) (as defined below). The price and amount of the Covered Bonds to be issued under the Programme will be determined by the Issuer and the relevant Dealer at the time of issue in accordance with prevailing market conditions. NatWest Covered Bonds Limited Liability Partnership (the LLP) has guaranteed payments of interest and principal under the Covered Bonds pursuant to a guarantee which is secured over the Portfolio (as defined below) and its other assets. Recourse against the LLP under its guarantee is limited to the Portfolio and such assets. The Issuer under the Programme was previously The Royal Bank of Scotland plc (RBS). Pursuant to a ring fencing transfer scheme under Part VII of the Financial Services and Markets Act 2000 (the Ring Fencing Transfer Scheme), certain elements of RBS's business were transferred to National Westminster Bank Plc. Following the approval of the Ring Fencing Transfer Scheme by the Court of Session in Scotland, all accrued rights and obligations of RBS in its various capacities under the Programme, including as Issuer, but excluding the roles of Arranger and Dealer have been transferred to, and vested in or became liabilities of (as applicable), National Westminster Bank Plc.