Securities and Exchange Commission Sec Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

October 26, 2020

October 26, 2020 October 26, 2020 US equities and European equities fell on the back of the increase in COVID-19 cases. Asian equities gained as China posted positive GDP growth. Global yields rose as investors awaited for developments on the US stimulus package. Global oil prices dropped due to fuel demand setbacks as infections rose. Global Equities US equities declined as investors remained cautious due to 1.0% 0.77% the surge in the number of COVID-19 cases in the US. This is despite the hopes for an additional fiscal stimulus. The DJIA closed at 28,335.57 (-0.95% WoW), while the S&P 500 closed at 3,465.39 (-0.53% WoW). 0.0% Asian equities rose as economic recovery accelerated, driven by its Gross Domestic Product (GDP) -0.39% -0.53% growing by 4.9% in July-September from last year, on the -1.0% back of rebound in exports. The MSCI APxJ closed at 585.03 -0.95% (+0.77% WoW). -1.30% European equities declined following the resurgence of -2.0% COVID-19 cases and reimposition of mobility restrictions. MSCI MSCI MSCI Asia DJIA S&P 500 This was also driven by uncertainties over the Brexit trade World Europe ex-Japan deal. MSCI Europe closed at 120.10 (-1.30% WoW). US Treasuries German Bunds 0.000 2.000 -0.154 16-Oct 23-Oct 16-Oct 23-Oct 1.529 -0.349 1.641 -0.202 -0.500 -0.574 -0.394 1.000 0.746 -0.698 -0.758 -0.773 0.843 -0.622 0.322 -0.674 0.091 0.112 0.143 -0.775 0.377 -0.801 0.000 -1.000 0.107 0.155 0.0863m 6m 2y 5y 10y 30y 1y 2y 5y 10y 20y 30y US Treasury yields rose as investors awaited on the COVID-19 stimulus Japanese Government Bonds package. -

June 15 2017, the Board of Directors of Macroasia Corporation Approved to Appropriate P=210.0 Million to Buy Back Shares of Macroasia Corporation at Market Price

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N (Company’s Full Name) 1 2 t h F l o o r , P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) AMADOR T. SENDIN 8840-2001 (Contact Person) (Company Telephone Number) 1 2 3 1 2 0 - I S 0 7 1 7 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) MSRD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 845 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. NOTICE OF ANNUAL STOCKHOLDERS’ MEETING Notice is hereby given that the Annual Stockholders’ Meeting of MACROASIA CORPORATION will be conducted virtually on Friday, 17 July 2020, at 3:00 P.M., the details of which can be found in http://www.macroasiacorp.com/asm. The Agenda for the meeting is as follows: 1. Call to Order 2. Certification of Notice and Quorum 3. Approval of the Minutes of the Annual Stockholders’ Meeting held on 19 July 2019 4. President’s Report 5. -

Definitive Information Statement

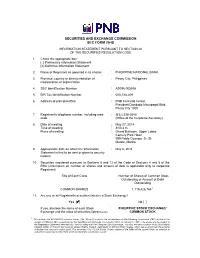

SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 20 OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: [ ] Preliminary Information Statement [X] Definitive Information Statement 2. Name of Registrant as specified in its charter : PHILIPPINE NATIONAL BANK 3. Province, country or other jurisdiction of : Pasay City, Philippines incorporation or organization 4. SEC Identification Number : AS096-005555 5. BIR Tax Identification Number : 000-188-209 6. Address of principal office : PNB Financial Center President Diosdado Macapagal Blvd. Pasay City 1300 7. Registrant’s telephone number, including area : (632) 536-0540 code (Office of the Corporate Secretary) 8. Date of meeting : May 27, 2014 Time of meeting : 8:00 a.m. Place of meeting : Grand Ballroom, Upper Lobby Century Park Hotel 599 Pablo Ocampo, Sr. St. Malate, Manila 9. Approximate date on which the Information : May 6, 2014 Statement is first to be sent or given to security holders 10. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate Registrant): Title of Each Class Number of Shares of Common Stock Outstanding or Amount of Debt Outstanding COMMON SHARES 1,119,426,7641/ 11. Are any or all Registrant’s securities listed in a Stock Exchange? Yes [9] No [ ] If yes, disclose the name of such Stock : PHILIPPINE STOCK EXCHANGE/ Exchange and the class of securities listed therein COMMON STOCK 1/ This includes the 423,962,500 common shares (the “Shares”) issued to the stockholders of Allied Banking Corporation (ABC) relative to the merger of PNB and ABC as approved by the Securities and Exchange Commission (SEC) on January 17, 2013. -

Profile of Independent Directors in Selected Philippine Publicly Listed

94 Predictors of Life Satisfaction of the Expatriate Spouse/Partner Philippine Management Review 2020, Vol. 27, 95-128. ppendix Profile of Independent Directors in Selected Philippine ediatin oe of Sef- efficac in the eationship eteen Support fro Fai and Life Satisfaction Publicly Listed Companies by Sector: An Update ebbie Chua un Pho, Ph..* Variales Coefficients University of the Philippines, Cesar .A. Virata School of usiness, iliman ueon City 1101, Philippines Step 1: Support from family and Life satisfaction Independent directors have a crucial and defining role in corporate governance. his paper Constant .09 looks at the extent o compliance by selected Philippine-listed companies with the new Support ro aiy .20** corporate governance code (2016), which took effect on anuary 1, 2017. he baning sector has the highest compliance rate among the various sectors in terms o proportion o Dummy (Support ro ai an ie satisactin) -2.88** independent directors to board sie, number o directorships in other listed companies, and R2 .331 separation o chairman and CE. lthough an Audit Committee is required or all listed companies, not all SEC 17-A reports contain information on board committees and their F-test 28.24** memberships. he qualiications o the udit Committee Chairman in some companies also Step 2: Support from family and Self-efficacy appear to have not met the prescriptions by the new corporate governance code. t is suggested that a SEC 17-A template be provided to listed companies, so that uniform and 1.551 Constant consistent data can be obtained rom this report by the SEC to acilitate their monitoring role. -

06 Power and Politics in the Philippine Banking Industry.Pdf

• Power and Politics in the Philippine Banking Industry An Analysis of State-Oligarchy Relations· Paul D. Hutchcroft·· Neither Lucio TannorVicente Tan, two Filipino-Chinese businessmen, were particularly noteworthy in 1965, the year that Ferdinand Marcos first • became President. Lucio was busy setting upa small cigarette factory inIlocos, the home region of Marcos, while Vicente (no relation to Lucio) was building updiversified operations in insurance andrealestate, andbadjust acquired 10% interest in a minor bank. By 1986, the yearthat Marcos was deposed, Lucio Tanwas a notorious crony who had built a large financial and manufacturing conglomerate, based around a bank said to be 60% owned by Marcos himself. Vicente Tan, on the otherhand, had beenforced during the martial law years to signover ownership of two banks to associates of Herminio Disini, a golfing partner and crony of President Marcos's, in orderto end three years of imprisonment without trial. In the late 1980s, his business empire was so diminished as to be based in a • small apartment fronting Manila Bay. I The stories of the fate of these two men, I will argue, shed light on thenature oftherelationship between thePhilippine state anddominant economic interests. For each Lucio Tan, one can think of scores of other oligarchs and cronies, both Filipino and Filipino-Chinese, who have plundered the state for particularistic advantage--not only during the time of Marcos, but also in the pre-martial law period (1946-72) and in the Aquino years, since 1986. Vicente Tan is perhaps a more unusual figure, in certain respects, but his decline highlights both theenormous limitations ofwealth accumulation inthePhilippines • forthose lacking access tothepolitical machinery, andtheharsh punitive powers that Philippine state officials are occasionally capable of exacting on their enemies. -

Diversification Strategies of Large Business Groups in the Philippines

Philippine Management Review 2013, Vol. 20, 65‐82. Diversification Strategies of Large Business Groups in the Philippines Ben Paul B. Gutierrez and Rafael A. Rodriguez* University of the Philippines, College of Business Administration, Diliman, Quezon City 1101, Philippines This paper describes the diversification strategies of 11 major Philippine business groups. First, it reviews the benefits and drawbacks of related and unrelated diversification from the literature. Then, it describes the forms of diversification being pursued by some of the large Philippine business groups. The paper ends with possible explanations for the patterns of diversification observed in these Philippine business groups and identifies directions for future research. Keywords: related diversification, unrelated diversification, Philippine business groups 1 Introduction This paper will describe the recent diversification strategies of 11 business groups in the Philippines. There are various definitions of business groups but in this paper, these are clusters of legally distinct firms with a managerial relationship, usually by virtue of common ownership. The focus on business groups rather than on individual firms has to do with the way that business firms in the Philippines are organized and managed. Businesses that are controlled and managed by essentially the same set of principal owners are often organized as separate corporations, not as separate divisions within the same firm, as is often the case in American corporations like General Electric, Procter and Gamble, or General Motors (Echanis, 2009). Moreover, studies on emerging markets have pointed out that business groups often occupy dominant positions in the business landscape in markets like India, Korea, Indonesia, Thailand, and the Philippines (Khanna & Palepu, 1997; Khanna & Yafeh, 2007). -

Tanduay Distillers, Inc

G AINING MOMENTUM 11th Floor Unit 3 Bench Tower, 30th Street corner Rizal Drive Cresent Park West 5, Bonifacio Global City, Taguig City, Philippines ltg.com.ph G AINING MOMENTUM ANNUAL REPORT ANNUAL REPORT 2018 2018 Contents 2 Financial Highlights 3 Our Businesses at a Glance The LT Group Logo 4 Our Partnerships Strength and solidarity. This is the essence of the LT Group (LTG) logo. The 6 clean balance lines and curves are central elements -- a mystical Chairman’s Message symmetrical tree. Drawn in an Eastern-Oriental style, it gives hint to the 8 President’s Message Company’s Chinese heritage. 12 CFO’s Message Tree is life. Life is growth. Like a tree, a company with rm roots, properly 14 Asia Brewery, Inc. nurtured, will continuously grow and give value. 16 Eton Properties Philippines, Inc. The tree’s trunk is upright, and the branches spread out -- a symbolic 18 PMFTC Inc. consolidation of the subsidiaries and stakeholders within two circles, one for continuity, the outer one for solidarity. 24 Philippine National Bank 26 Tanduay Distillers, Inc. 28 Corporate Governance Report VISION 36 Corporate Social Responsibility To be a world-class conglomerate at the forefront of Philippine economic e Tan Yan Kee Foundation, Inc. growth, successfully maintaining a strong presence and dominant position in key Philippine industries while ensuring continuous benets to its Asia Brewery, Inc. consumers, communities, employees, business partnerts, and shareholders. Eton Properties Philippines, Inc. MISSION PMFTC Inc. Anchored to its Vision, the LT Group commits: Philippine National Bank To increase stockholder values through long-term growth in its major Tanduay Distillers, Inc. -

The Socio-Cultural and Political Dimensions of the Economic Success of the Chinese in the Philippines*

Perspectives on China and the Chinese Through the Years: Perspectives on China Aand Retrospective the Chinese Collection, Through 1992-2013 the Years: A Retrospective Collection, 1992-2013 Chinese Studies Journal, vol. 13 | October 2020 | ISSN: 0117-1933 THE SOCIO-CULTURAL AND POLITICAL DIMENSIONS OF THE ECONOMIC SUCCESS OF THE CHINESE IN THE PHILIPPINES* Teresita Ang See Introduction From the barren hills of Fujian and Guangdong to the corporate boardrooms of Makati; from crude sweatshops to huge commercial complexes; from the barefoot vendors in tattered clothing to owners of state-of-the-art megamalls; from illiterate peasants to prominent professionals – the Chinese in the Philippines have indeed come a long, long way. Behind these triumphs, however, were the silent years of hardships and struggles; of blood, sweat, and tears that brought them to where they or at least where their children are today. While some of the poignant stories of the early immigrants have been documented, they are focused mostly on the success stories. What few people realize is that for every success story, there are more untold stories of failures and heartbreaks. They have remained _________________________ *First published in Ellen Huang Palanca, ed. China, Taiwan, and the Ethnic Chinese in the Philippine Economy, Chinese Studies, vol. 5. Quezon City: Philippine Association for Chinese Studies, 1995, pp. 93-106. 142 © 2020 Philippine Association for Chinese Studies The Socio-Cultural and Political Dimensions of the Economic Success of the Chinese in the Philippines undocumented because the Chinese will be that last to remember or record incidents where they lose face. While we dissect the role of the Chinese in the Philippine economy in academic forums, it would also be worthwhile to recall the many untold stories behind each economic success that is presented. -

Corporate Governance Issues in Philippine-Listed Companies

Philippine Management Review 2019, Vol. 26, 1-16. Corporate Governance Issues in Philippine-Listed Companies Arthur S. Cayanan* University of the Philippines, Cesar E.A. Virata School of Business, Diliman, Quezon City 1101, Philippines This paper discusses corporate governance issues in Philippine-listed companies such as ownership structure, separation of Chairman and CEO positions, independent directors, related party transactions, among others, and how non-controlling stockholders are adversely affected by these issues. The paper also assesses the sufficiency of existing rules and regulations and the effectiveness of regulators in protecting minority interest. 1 Introduction Corporate Governance is defined as the system of stewardship and control to guide organizations in fulfilling their long-term economic, moral, legal and social obligations towards their stakeholders.1 On November 10, 2016, the Securities and Exchange Commission (SEC) approved the Code of Corporate Governance for Publicly-Listed Companies (CG Code for PLCs).2 The Code provides a list of the governance responsibilities of the board of directors (BOD), corporate disclosure policies, standards for the selection of external auditor, and duties to stockholders, among others. In this paper, emphasis will be on ownership structure, the positions of Chairman and Chief Executive Officer (CEO) being held by separate individuals, the independence of independent directors, some related party transactions, and how these issues affect the interest of non-controlling stockholders.3 2 Objectives This study has the following objectives: 1. To assess some corporate governance practices of the 30 Philippine Stock Exchange index (PSEi) PSEi-indexed stocks, e.g., ownership structure, different individuals holding the positions of the chairman of the BOD and CEO, related party transactions, and tender offers. -

Arianas %Riety;~ Micronesia's Leading Newspaper Since 1972 · ~ ~ La Fiesta Reports Guam

~--·. arianas %riety;~ Micronesia's Leading Newspaper Since 1972 · ~ ~ La Fiesta reports Guam. legislature .1,· 30% revenue drop I Mall tenants come and go, says GM By Jojo Dass with tenants closing down rented in 'land:mark win' Variety News Staff space for new ones to occupy. LA FIESTA San Roque, seen as "It's not permanent," he said By Jojo Santo Tomas legislation. Saipan 's premier shopping mall, though. Variety News Staff Charfauros played a tape he is experiencing a 30-percent rev- Aria, nevertheless, dismissed HAGATNA - In a ruling that received anonymously during ses i enue decline due to decreasing the possibility of closing down effectively kills a current Supe sion last week, causing a stir that t tourist arrivals, Toshiro Aria, its the five-year old retail estab- rior Court case regarding tapes of led to a civil case, a temporary ' general manager, said yesterday. lishment, saying management is telephone conversations played restraining order, over a dozen i "We are suffering from that "doing every effort" to survive. inside the legislature last week, subpoenas, and emergency appeal 1 (low tourist arrivals). Sales are This, he said, include making the Supreme Court of Guam to the Supreme Court. '. getting low. Thirty percent of the mall more enticing with ten- : granted a stay on Civil Case No. The Supreme Court has can : the .revenues decreased in the ants doing more services to sur- i 2211-98. celled all depositions and lifted past nine months," said Aria, in vive. "This is a landmark victory, and the restraining order which had an interview. -

Philippine Airlines, Inc

PAL Holdings, Inc. Sustainability Report 2020 Contents 26 -- Governance 27 Compliance with laws and 32 Data security regulations 33 Customer privacy Introduction 28 Effective, accountable, and transparent governance 03 The Chairman’s message 04 Executive summary 06 About the Company 34 -- Social 14 Company highlights 35 Health and safety 44 Employee training and development 50 Customer management 19 -- About this report 53 Employee hiring and benefits 20 Purpose, Reporting Standards, Scope and Coverage 20 PHI’s Material Topics 54 -- Environment 55 Resource Management 58 Ecosystem and biodiversity 58 Environmental impact 21 -- Economic 22 Direct economic value generated and distributed 25 Outlook 62 – Our people and values 63 Employee welfare and communication 64 Corporate social responsibilities The Chairman's Message To our Dear Stakeholders, The mission of sustainability gained special force in 2020 when PAL We transformed our services to incorporate New Normal Holdings Inc. faced the greatest challenge in its history, no less than safety protocols that protect our employees and passengers: the survival of the PAL Group, which includes Philippine Airlines full Personal Protective Equipment (PPE) for our crew; modified (PAL) and PAL express (PALex), and their transformation into viable meals, amenities, facilities and digital assets to promote airline businesses for a vastly changed aviation market. healthy travel practices; stronger cleaning and disinfection measures; and new testing centers that helped authorities Impact of a Global Pandemic reopen borders and allow safe increases in travel volumes. The worldwide spread of COVID-19 shut down aviation markets and crippled the economies of most nations. PAL and PALex were forced Public Service and Public Accolades to cancel flights, affecting millions of passengers, wiping out more Our efforts as a responsible flag carrier contributed greatly to than USD 2 Billion in revenues and placing extreme pressure on the Philippine repatriation drive, with PAL flying majority of the liquidity. -

MARKET CALL Capital Markets Research

1 August 2017 The MARKET CALL Capital Markets Research FMIC and UA&P Capital Markets Research Macroeconomy 3 Fixed-Income Securities 10 Equity Markets 17 Recent Economic Indicators 22 Contributors 24 The Market Call - May 2017 Executive Summary Faster NG Spending in June + Rise in Exports by 13.7% = Faster Q2 GDP • NG spending (excluding interest payments) accelerated to 23.4% in June from 21.4% in May. • Capital goods imports bounce back by 20.1% in May after a minor slip in April. • Together with Industrial output up by 5.8% in May, domestic demand should improve from 5.9% in Q1. • A further boost should come from exports, which in May expanded by 13.7%. • The bond market showed a slowdown in demand, while the PSEi continued to rise. Macroeconomy NG spending surged by 22.6% in June still driven by strong spending on Infrastructure. • Capital goods imports rebounded by 20.1% in May, after posting a decline a month ago. • Manufacturing kept a robust growth of 5.8% in May. • Exports continued to expand at a double-digit rate pace, posting a 13.7% increase in May. • Inflation up 2.8% in July, a tad faster than 2.7% in June but YTD rate remained within target. Outlook: We believe that economic expansion in Q2 will record faster than Q1 on the back of a robust investment spending and a resurgence in manufacturing. The double-digit growth in exports and vigourous capital goods imports, likewise, support our view of a faster growth in Q2. The speedier NG disbursements should moreover push further the country’s growth.