Chapter 11 ) VALARIS PLC, Et Al.,1 ) Case No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEACHERS' RETIREMENT SYSTEM of the STATE of ILLINOIS 2815 West Washington Street I P.O

Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Performed as Special Assistant Auditors for the Auditor General, State of Illinois Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Table of Contents Schedule Page(s) System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control over Compliance, and on Supplementary Information for State Compliance Purposes 4 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 8 Schedule of Findings Current Findings – State Compliance 10 Supplementary Information for State Compliance Purposes Fiscal Schedules and Analysis Schedule of Appropriations, Expenditures and Lapsed Balances 1 13 Comparative Schedules of Net Appropriations, Expenditures and Lapsed Balances 2 15 Comparative Schedule of Revenues and Expenses 3 17 Schedule of Administrative Expenses 4 18 Schedule of Changes in Property and Equipment 5 19 Schedule of Investment Portfolio 6 20 Schedule of Investment Manager and Custodian Fees 7 21 Analysis of Operations (Unaudited) Analysis of Operations (Functions and Planning) 30 Progress in Funding the System 34 Analysis of Significant Variations in Revenues and Expenses 36 Analysis of Significant Variations in Administrative Expenses 37 Analysis -

2021 Annual General Meeting and Proxy Statement 2020 Annual Report

2020 Annual Report and Proxyand Statement 2021 Annual General Meeting Meeting General Annual 2021 Transocean Ltd. • 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT • 2020 ANNUAL REPORT CONTENTS LETTER TO SHAREHOLDERS NOTICE OF 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT COMPENSATION REPORT 2020 ANNUAL REPORT TO SHAREHOLDERS ABOUT TRANSOCEAN LTD. Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on ultra-deepwater and harsh environment drilling services, and operates one of the most versatile offshore drilling fleets in the world. Transocean owns or has partial ownership interests in, and operates a fleet of 37 mobile offshore drilling units consisting of 27 ultra-deepwater floaters and 10 harsh environment floaters. In addition, Transocean is constructing two ultra-deepwater drillships. Our shares are traded on the New York Stock Exchange under the symbol RIG. OUR GLOBAL MARKET PRESENCE Ultra-Deepwater 27 Harsh Environment 10 The symbols in the map above represent the company’s global market presence as of the February 12, 2021 Fleet Status Report. ABOUT THE COVER The front cover features two of our crewmembers onboard the Deepwater Conqueror in the Gulf of Mexico and was taken prior to the COVID-19 pandemic. During the pandemic, our priorities remain keeping our employees, customers, contractors and their families healthy and safe, and delivering incident-free operations to our customers worldwide. FORWARD-LOOKING STATEMENTS Any statements included in this Proxy Statement and 2020 Annual Report that are not historical facts, including, without limitation, statements regarding future market trends and results of operations are forward-looking statements within the meaning of applicable securities law. -

Empirical Inference of Related Trading Between Two Securities: Detecting Pairs Trading, Merger Arbitrage, and Strategy Rules*

Empirical inference of related trading between two securities: Detecting pairs trading, merger arbitrage, and strategy rules* Keith Godfrey The University of Western Australia Working paper: 5 September 2013 The traditional approach to studying pairs trading is to simulate profitability using ex-post historical prices. I study the actual trades reported anonymously in security pairs and build statistical inferences of related trading. The approach is based on the time differences between trades. It can distinguish intrinsically related securities from pseudo-random sets, find stocks involved in merger arbitrage in massive sets of paired index constituents, and infer dominant trading rules of mean reversion algorithms. Empirical inference of related trading can enable further studies into pairs trading, strategy rules, merger arbitrage, and insider trading. Keywords: Inferred trading, empirical inference, pairs trading, merger arbitrage. JEL Classification Codes: G00, G10, C10, C40, C60 The availability of intraday trading or “tick” data with time resolution of a millisecond or finer is opening many avenues of research into financial markets. Analysis of two or more streams of tick data concurrently is becoming increasingly important in the study of multiple-security trading including index tracking, pairs trading, merger arbitrage, and market-neutral strategies. One of the greatest challenges in empirical trading research is the anonymity of reported trades. Securities exchanges report the dates, times, prices, and volumes traded, without identifying the traders. In studies of a single security, this introduces uncertainty of whether each market order that caused a trade was the buy or sell order, and there are documented approaches of inference such as Lee and Ready (1991). -

To Arrive at the Total Scores, Each Company Is Marked out of 10 Across

BRITAIN’S MOST ADMIRED COMPANIES THE RESULTS 17th last year as it continues to do well in the growing LNG business, especially in Australia and Brazil. Veteran chief executive Frank Chapman is due to step down in the new year, and in October a row about overstated reserves hit the share price. Some pundits To arrive at the total scores, each company is reckon BG could become a take over target as a result. The biggest climber in the top 10 this year is marked out of 10 across nine criteria, such as quality Petrofac, up to fifth from 68th last year. The oilfield of management, value as a long-term investment, services group may not be as well known as some, but it is doing great business all the same. Its boss, Syrian- financial soundness and capacity to innovate. Here born Ayman Asfari, is one of the growing band of are the top 10 firms by these individual measures wealthy foreign entrepreneurs who choose to make London their operating base and home, to the benefit of both the Exchequer and the employment figures. In fourth place is Rolls-Royce, one of BMAC’s most Financial value as a long-term community and environmental soundness investment responsibility consistent high performers. Hardly a year goes past that it does not feature in the upper reaches of our table, 1= Rightmove 9.00 1 Diageo 8.61 1 Co-operative Bank 8.00 and it has topped its sector – aero and defence engi- 1= Rotork 9.00 2 Berkeley Group 8.40 2 BASF (UK & Ireland) 7.61 neering – for a decade. -

Preparing for Carbon Pricing: Case Studies from Company Experience

TECHNICAL NOTE 9 | JANUARY 2015 Preparing for Carbon Pricing Case Studies from Company Experience: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company Acknowledgments and Methodology This Technical Note was prepared for the PMR Secretariat by Janet Peace, Tim Juliani, Anthony Mansell, and Jason Ye (Center for Climate and Energy Solutions—C2ES), with input and supervision from Pierre Guigon and Sarah Moyer (PMR Secretariat). The note comprises case studies with three companies: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E). All three have operated in jurisdictions where carbon emissions are regulated. This note captures their experiences and lessons learned preparing for and operating under policies that price carbon emissions. The following information sources were used during the research for these case studies: 1. Interviews conducted between February and October 2014 with current and former employees who had first-hand knowledge of these companies’ activities related to preparing for and operating under carbon pricing regulation. 2. Publicly available resources, including corporate sustainability reports, annual reports, and Carbon Disclosure Project responses. 3. Internal company review of the draft case studies. 4. C2ES’s history of engagement with corporations on carbon pricing policies. Early insights from this research were presented at a business-government dialogue co-hosted by the PMR, the International Finance Corporation, and the Business-PMR of the International Emissions Trading Association (IETA) in Cologne, Germany, in May 2014. Feedback from that event has also been incorporated into the final version. We would like to acknowledge experts at Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E)—among whom Laurel Green, David Hone, Sue Lacey and Neil Marshman—for their collaboration and for sharing insights during the preparation of the report. -

Noble Corporation Plc 10K 2018 V1

Noble Corporation plc U.K. Annual Report and Financial Statements Registered number 08354954 31 December 2017 TABLE OF CONTENTS Page Strategic Report 1 Directors' Report 13 Directors' Remuneration Report & Policy 18 Independent Auditors' Report to the shareholders of Noble Corporation plc 38 Consolidated Noble Corporation plc (Noble-UK) Financial Statements: Consolidated Income Statement 46 Consolidated Statement of Comprehensive Income 47 Consolidated Statement of Financial Position 48 Consolidated Statement of Changes in Equity 49 Consolidated Statement of Cash Flows 50 Notes to Consolidated Financial Statements 51 Parent Company Financial Statements: Parent Company Statement of Financial Position 135 Parent Company Statement of Changes in Equity 136 Notes to Parent Company Financial Statements 137 NOBLE CORPORATION PLC AND SUBSIDIARIES STRATEGIC REPORT The directors present their strategic report on the group for the year ended 31 December 2017. Noble Corporation plc is a public limited company incorporated under the laws of England and Wales, and listed on the New York Stock Exchange. The terms “Noble,” “Noble plc,” “Noble-UK,” “Company,” “we,” “our” and “Group” refer to Noble Corporation plc and its consolidated subsidiaries, unless the context otherwise requires. The address of the registered office is Devonshire House, 1 Mayfair Place, London, England, W1J 8AJ. The Company registration number is 08354954. I. STRATEGY AND OUTLOOK Overview Noble Corporation plc, a public limited company incorporated under the laws of England and Wales, (“Noble-UK”), is a leading offshore drilling contractor for the oil and gas industry. We provide contract drilling services with our global fleet of mobile offshore drilling units. We report our contract drilling operations as a single reportable segment, Contract Drilling Services, which reflects how we manage our business. -

BP Plc Vs Royal Dutch Shell

FEBRUARY 2021 BP plc Vs Royal Dutch Shell 01872 229 000 www.atlanticmarkets.co.uk www.atlanticmarkets.co.uk BP Plc A Brief History BP is a British multinational oil and gas company headquartered in London. It is one of the world’s oil and gas supermajors. · 1908. The founding of the Anglo-Persian Oil Company, established as a subsidiary of Burmah Oil Company to take advantage of oil discoveries in Iran. · 1935. It became the Anglo-Iranian Oil Company · 1954. Adopted the name British Petroleum. · 1959. The company expanded beyond the Middle East to Alaska and it was one of the first companies to strike oil in the North Sea. · 1978. British Petroleum acquired majority control of Standard Oil of Ohio. Formerly majority state-owned. · 1979–1987. The British government privatised the company in stages between. · 1998. British Petroleum merged with Amoco, becoming BP Amoco plc, · 2000-2001. Acquired ARCO and Burmah Castrol, becoming BP plc. · 2003–2013. BP was a partner in the TNK-BP joint venture in Russia. Positioning BP is a “vertically integrated” company, meaning it’s involved in the whole supply chain – from discovering oil, producing it, refining it, shipping it, trading it and selling it at the petrol pump. BP has operations in nearly 80 countries worldwide and has around 18,700 service stations worldwide. Its largest division is BP America. In Russia, BP also own a 19.75% stake in Rosneft, the world’s largest publicly traded oil and gas company by hydrocarbon reserves and production. BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. -

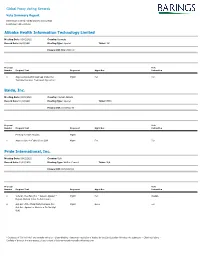

Global Proxy Voting Records

Global Proxy Voting Records Vote Summary Report Date range covered: 03/01/2021 to 03/31/2021 Location(s): All Locations Alibaba Health Information Technology Limited Meeting Date: 03/01/2021 Country: Bermuda Record Date: 02/23/2021 Meeting Type: Special Ticker: 241 Primary ISIN: BMG0171K1018 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Approve Revised Annual Cap Under the Mgmt For For Technical Services Framework Agreement Baidu, Inc. Meeting Date: 03/01/2021 Country: Cayman Islands Record Date: 01/28/2021 Meeting Type: Special Ticker: BIDU Primary ISIN: US0567521085 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction Meeting for ADR Holders Mgmt 1 Approve One-to-Eighty Stock Split Mgmt For For Pride International, Inc. Meeting Date: 03/01/2021 Country: USA Record Date: 12/01/2020 Meeting Type: Written Consent Ticker: N/A Primary ISIN: US74153QAJ13 Proposal Vote Number Proposal Text Proponent Mgmt Rec Instruction 1 Vote On The Plan (For = Accept, Against = Mgmt For Abstain Reject; Abstain Votes Do Not Count) 2 Opt Out of the Third-Party Releases (For = Mgmt None For Opt Out, Against or Abstain = Do Not Opt Out) * Instances of "Do Not Vote" are normally owing to: - Share-blocking - temporary restriction of trading by the Sub-Custodian following vote submission - Client restrictions - Conflicts of Interest. For any queries, please contact [email protected] Global Proxy Voting Records Vote Summary Report Date range covered: 03/01/2021 to 03/31/2021 Location(s): All Locations The -

Chapter 11 ) VALARIS PLC, Et Al.,1 ) Case No

Case 20-34114 Document 16 Filed in TXSB on 08/19/20 Page 1 of 63 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) VALARIS PLC, et al.,1 ) Case No. 20-34114 (MI) ) Debtors. ) (Jointly Administered) ) (Emergency Hearing Requested) DEBTORS’ EMERGENCY APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND APPOINTMENT OF STRETTO AS CLAIMS, NOTICING, AND SOLICITATION AGENT EMERGENCY RELIEF HAS BEEN REQUESTED. A HEARING WILL BE CONDUCTED ON THIS MATTER ON AUGUST 20, 2020 AT 2:00 PM IN COURTROOM 404, 4TH FLOOR, 515 RUSK AVENUE, HOUSTON, TX 77002. YOU MAY PARTICIPATE IN THE HEARING EITHER IN PERSON OR BY AUDIO/VIDEO CONNECTION. AUDIO COMMUNICATION WILL BE BY USE OF THE COURT’S DIAL-IN FACILITY. YOU MAY ACCESS THE FACILITY AT (832) 917-1510. YOU WILL BE RESPONSIBLE FOR YOUR OWN LONG-DISTANCE CHARGES. ONCE CONNECTED, YOU WILL BE ASKED TO ENTER THE CONFERENCE ROOM NUMBER. JUDGE ISGUR’S CONFERENCE ROOM NUMBER IS 954554. YOU MAY VIEW VIDEO VIA GOTOMEETING. TO USE GOTOMEETING, THE COURT RECOMMENDS THAT YOU DOWNLOAD THE FREE GOTOMEETING APPLICATION. TO CONNECT, YOU SHOULD ENTER THE MEETING CODE “JUDGEISGUR” IN THE GOTOMEETING APP OR CLICK THE LINK ON JUDGE ISGUR’S HOME PAGE ON THE SOUTHERN DISTRICT OF TEXAS WEBSITE. ONCE CONNECTED, CLICK THE SETTINGS ICON IN THE UPPER RIGHT CORNER AND ENTER YOUR NAME UNDER THE PERSONAL INFORMATION SETTING. HEARING APPEARANCES MUST BE MADE ELECTRONICALLY IN ADVANCE OF THE HEARING. TO MAKE YOUR ELECTRONIC APPEARANCE, GO TO THE SOUTHERN DISTRICT OF TEXAS WEBSITE AND SELECT “BANKRUPTCY COURT” FROM THE TOP MENU. -

E-Learning Most Socially Active Professionals

The World’s Most Socially Active Oil & Energy Professionals – September 2020 Position Company Name LinkedIN URL Location Size No. Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 Rystad Energy https://www.linkedin.com/company/572589 Norway 201-500 282 87 30.85% 2 Comerc Energia https://www.linkedin.com/company/2023479 Brazil 201-500 327 89 27.22% 3 International Energy Agency (IEA) https://www.linkedin.com/company/26952 France 201-500 426 113 26.53% 4 Tecnogera Geradores https://www.linkedin.com/company/2679062 Brazil 201-500 211 52 24.64% 5 Cenit Transporte y Logística de Hidrocarburos https://www.linkedin.com/company/3021697 Colombia 201-500 376 92 24.47% 6 Moove https://www.linkedin.com/company/12603739 Brazil 501-1000 250 59 23.60% 7 Evida https://www.linkedin.com/company/15252384 Denmark 201-500 246 57 23.17% 8 Dragon Products Ltd https://www.linkedin.com/company/9067234 United States 1001-5000 350 79 22.57% 9 Kenter https://www.linkedin.com/company/10576847 Netherlands 201-500 246 54 21.95% 10 Repower Italia https://www.linkedin.com/company/945861 Italy 501-1000 444 96 21.62% 11 Trident Energy https://www.linkedin.com/company/11079195 United Kingdom 201-500 283 60 21.20% 12 Odfjell Well Services https://www.linkedin.com/company/9363412 Norway 501-1000 250 52 20.80% 13 XM Filial de ISA https://www.linkedin.com/company/2570688 Colombia 201-500 229 47 20.52% 14 Energi Fyn https://www.linkedin.com/company/1653081 Denmark 201-500 219 44 20.09% 15 Society of Petroleum Engineers International https://www.linkedin.com/company/23356 United States 201-500 1,477 294 19.91% 16 Votorantim Energia https://www.linkedin.com/company/3264372 Brazil 201-500 443 86 19.41% 17 TGT Oilfield Services https://www.linkedin.com/company/1360433 United Arab Emirates201-500 203 38 18.72% 18 Motrice Soluções em Energia https://www.linkedin.com/company/11355976 Brazil 201-500 214 40 18.69% 19 GranIHC Services S.A. -

Halliburton Company

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (RULE 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240.14a-12 HALLIBURTON COMPANY (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: To Our Valued Shareholders: April 7, 2020 “Turning to 2020, . -

United States Bankruptcy Court Southern District of Texas Houston Division

Case 20-34114 Document 528 Filed in TXSB on 10/19/20 Page 1 of 58 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) VALARIS PLC, et al.,1 ) Case No. 20-34114 (MI) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES, METHODOLOGY, AND SPECIFIC DISCLOSURES REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Introduction Valaris plc (“Valaris”) and its debtor affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases (collectively, the “Debtors”), with the assistance of their advisors, have filed their respective Schedules of Assets and Liabilities (the “Schedules”) and Statements of Financial Affairs (the “Statements,” and together with the Schedules, the “Schedules and Statements”) with the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”), under section 521 of title 11 of the United States Code (the “Bankruptcy Code”), Rule 1007 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), and Rule 1007-1 of the Bankruptcy Local Rules for the Southern District of Texas (the “Local Rules”). These Global Notes, Methodology, and Specific Disclosures Regarding the Debtors’ Schedules of Assets and Liabilities and Statements of Financial Affairs (the “Global Notes”) pertain to, are incorporated by reference in, and comprise an integral part of all of the Debtors’ Schedules and Statements. The Global Notes should be referred to, considered, and reviewed in connection with any review of the Schedules and Statements. The Schedules and Statements do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), nor are they intended to be fully reconciled with the financial statements of each Debtor.