Intu Annual Report 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

REAL ESTATE July 2020

LISTED MARKETS – REAL ESTATE July 2020 Leo Zielinski Partner Tel. +44 (0)7980 809031 [email protected] John Rodgers Partner Tel. +44 (0)7810 307422 [email protected] Will Strachan Partner Tel. +44 (0)7929 885859 [email protected] Lloyd Davies We track the share price movement and regulatory announcements Partner of 57 real estate owning listed entities (“Gerald Eve tracked index”). Tel. +44 (0)7767 311254 A summary of the Gerald Eve tracked index in terms of GAV, NAV, [email protected] LTV, Dividend, Share Price, Market Cap, Discount/Premium to NAV and their respective weekly movement is attached. Lorenzo Solazzo Data Analyst We provide a comparison to share price data from 3 February 2020 Tel. +44 (0)783 309 5582 [email protected] (pre-Covid-19 level) to present day to demonstrate the impact across certain entities as a direct result of Covid-19. James Brown Surveyor As at 30 of June, the Gerald Eve tracked index is currently down 30% to pre- Tel. +44 (0)7464 656563 Covid-19 level, under-performing the FTSE350 which is slowly recovering and is [email protected] now down 16%. The tracked listed REITs share price decreased on average 3% since 1 June 2020 (March: -25%, April: +6%, May: -3%). To provide context around the share price movement, the average discount to NAV is currently 31% against 3% pre-Covid-19. It is unsurprising to note that specialist sector entities across Industrial, Healthcare and Supermarkets have out-performed the REIT universe relative to other strategies within the Gerald Eve tracked index. -

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Modern Networks Transition IT Services of 12 Major Shopping Centres in Just Three Months Online Meetings

Modern Networks transition IT services of 12 major shopping centres in just three months Online meetings Modern Networks is pleased to PROJECT BY NUMBERS announce the successful completion of a major project to migrate all core IT services and support of 12 9 weeks flagship shopping centres to Savills as the new managing agent in just large shopping centres three months. The shopping centres 12 transitioned were Derby, Merry Hill, Milton Keynes, Chantry Place, users Watford, Nottingham Victoria Centre, 1600 Braehead, the Metrocentre, Gateshead, Uxbridge, Lakeside, the miles Trafford Centre and Barton Square. 2686 1 amazing team 2 A tight schedule Online meetings Modern Networks is a leading Additionally, Modern Networks UK- provider of IT managed services and based Service Desk is providing each support to the UK’s retail and site with 24/7 technical support, commercial property sector. Since continuous network monitoring and early September 2020, the company security. Modern Networks have also has met a challenging schedule of been able to retain the knowledge migrating one shopping centre every and expertise of nine on-site IT staff three to five days. Each technical by transferring them under TUPE transition included computer regulations. By the end of the project, hardware and business applications, Modern Networks had transitioned Internet, telephony, network 1600 users to our managed services infrastructure, Wi-Fi and Cloud across all 12 sites. services. 3 Transition without interruption Onnclien Ber imtaeine’sti nlagrgsest shopping centre owner Intu went into administration in June 2020. To ensure the on-going viability of each site and secure as many jobs as possible, it was essential the administrators found new owners quickly. -

Disclaimer Strictly Not to Be Forwarded to Any

DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before reading, accessing or making any other use of the attached document relating to SEGRO plc (the “Company”) dated 10 March 2017. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person. The attached document has been prepared solely in connection with the proposed rights issue and offering of nil paid rights, fully paid rights and new ordinary shares (the “Securities”) of the Company (the “Transaction”). The Prospectus has been published in connection with the admission of the Securities to the Official List of the UK Financial Conduct Authority (the ‘‘Financial Conduct Authority’’) and to trading on the London Stock Exchange plc’s main market for listed securities (together, ‘‘Admission’’). The Prospectus has been approved by the Financial Conduct Authority as a prospectus prepared in accordance with the Prospectus Rules made under section 73A of the Financial Services and Markets Act 2000, as amended. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

Exciting New Retail and Leisure Opportunity in the Centre of Milton Keynes

MILTON KEYNES EXCITING NEW RETAIL AND LEISURE OPPORTUNITY IN THE CENTRE OF MILTON KEYNES 809-811 Silbury Boulevard , Milton Keynes HOME INTRODUCTION LOCATION MILTON KEYNES RETAIL AND SITE PLAN AVAILABILITY LEISURE THE DEVELOPER OPPORTUNITY 02 CONTACT Retail and leisure units to let Two new commercial units with flexible planning consent for A1-A5 / D1 & B1 uses Unit sizes 1,959 sq ft (182 sq m) and 1,808 sq ft (168 sq m) Units can be combined to create one large unit of 3,767 sq ft (349 sq m) Directly opposite John Lewis entrance and Centre:MK Located directly beneath 132 new homes built for rent by Grainger Plc. For further information go to www.solstice-apartments.co.uk HOME INTRODUCTION LOCATION MILTON KEYNES SITE PLAN AVAILABILITY LOCATION THE DEVELOPER AERIAL 03 CONTACT SNOZONE / 12TH INTU SHOPPING CENTRE: JOHN XSCAPE STREET CENTRE MK LEWIS MILTON KEYNES MILTON KEYNES THEATRE ROSE HOME INTRODUCTION LOCATION MILTON KEYNES SITE PLAN AVAILABILITY LOCATION THE DEVELOPER NEIGHBOURS 04 CONTACT EAT/DRINK/RETAIL es) 1 Las Iguanas 18 Oliver Bonas M1 (2 mil 2 Byron Burger 19 White Stuff 3 Brasserie Blanc 20 Halifax 4 Carluccios 21 Pizza Hut 10 15 John Lewis 5 Lloyds Bank 22 McDonald’s Lloyds Court 5 8 1 6 Mothercare 23 Monsoon MK 6 Gallery 7 Ask Italian 24 Paperchase 7 16 9 Theatre 8 Next 25 Apple 2 13 24 9 Lakeland 26 Gap 14 4 11 10 John Lewis 27 H&M 17 Centre:MK 23 Secklow 11 Debenhams 28 Hollister 18 22 ard 19 7 12 Marks & Spencer 29 Michael Kors 12 21 Boulev 20 Gate 13 Primark 30 Sports Direct y 26 27 Snozone/Xscape A509 25 28 3 14 TK Maxx 31 T.M. -

The List of Pharmacies Registered to Sell Ppcs on Our Behalf Is Sorted Alphabetically in Postcode Order

The list of pharmacies registered to sell PPCs on our behalf is sorted alphabetically in postcode order. 0 NAME PREMISES ADDRESS 1 PREMISES ADDRESS 2 PREMISES ADDRESS 3 PREMISES ADDRESS 4 LLOYDS PHARMACY SAINSBURYS, EVERARD CLOSE ST ALBANS HERTFORDSHIRE AL1 2QU BOOTS UK LIMITED 9 ST PETERS STREET ST.ALBANS HERTFORDSHIRE AL1 3DH FREEMAN GRIEVES LTD 111-113 ST PETERS STREET ST.ALBANS HERTFORDSHIRE AL1 3ET LLOYDS PHARMACY PARKBURY HOUSE ST PETER ST ALBANS HERTFORDSHIRE AL1 3HD IMED PHARMACY 67 HATFIELD ROAD ST ALBANS HERTFORDSHIRE AL1 4JE LLOYDS PHARMACY SAINSBURYS, BARNET ROAD LONDON COLNEY ST ALBANS HERTFORDSHIRE AL2 1AB LLOYDS PHARMACY 17 RUSSELL AVENUE ST ALBANS HERTFORDSHIRE AL3 5ES CROWN PHAMRACY 65 HIGH STREET REDBOURN ST ALBANS HERTFORDSHIRE AL3 7LW MANOR PHARMACY (WHEATHAMPSTEAD) LTD 2 HIGH STREET WHEATHAMPSTEAD HERTFORDSHIRE AL4 8AA BOOTS UK LIMITED 23-25 HIGH STREET HARPENDEN HERTFORDSHIRE AL5 2RU LLOYDS PHARMACY 40 HIGH STREET WELWYN GARDEN CITY HERTFORDSHIRE AL6 9EQ LLOYDS PHARMACY 84 HALDENS WELWYN GARDEN CITY HERTFORDSHIRE AL7 1DD BOOTS UK LIMITED 65 MOORS WALK WELWYN GARDEN CITY HERTFORDSHIRE AL7 2BQ BOOTS UK LIMITED 31 COLE GREEN LANE WELWYN GARDEN CITY HERTFORDSHIRE AL7 3PP PEARTREE PHARMACY 110 PEARTREE LANE WELWYN GARDEN CITY HERTFORDSHIRE AL7 3UJ BOOTS UK LIMITED 126 PEARTREE LANE WELWYN GARDEN CITY HERTFORDSHIRE AL7 3XY BOOTS UK LIMITED 31 THE HOWARD CENTRE WELWYN GARDEN CITY HERTFORDSHIRE AL8 6HA LLOYDS PHARMACY SAINSBURYS, CHURCH ROAD WELWYN GARDEN CITY HERTFORDSHIRE AL8 6SA LLOYDS PHARMACY 9 SHOPLANDS WELWYN GARDEN -

Property Useful Links

PROPERTY - USEFUL LINKS Property - Useful Links 1300 Home Loan 1810 Malvern Road 1Casa 1st Action 1st Choice Property 1st Property Lawyers 247 Property Letting 27 Little Collins 47 Park Street 5rise 7th Heaven Properties A Place In The Sun A Plus New Homes a2dominion AACS Abacus Abbotsley Country Homes AboutProperty ABSA Access Plastics AccessIQ Accor Accord Mortgages Achieve Adair Paxton LLP Adams & Remrs Adept PROPERTY - USEFUL LINKS ADIT Brasil ADIT Nordeste Adriatic Luxury Hotels Advanced Solutions International (ASI) Affinity Sutton Affordable Millionaire Agence 107 Promenade Agency Express Ajay Ajuha Alcazaba Hills Resort Alexander Hall Alitex All Over GEO Allan Jack + Cottier Allied Pickfords Allied Surveyors AlmaVerde Amazing Retreats American Property Agent Amsprop Andalucia Country Houses Andermatt Swiss Alps Andrew and Ashwell Anglo Pacific World Movers Aphrodite Hills Apmasphere Apparent Properties Ltd Appledore Developments Ltd Archant Life Archant Life France PROPERTY - USEFUL LINKS Architectural Association School Of Architecture AREC Aristo Developers ARUP asbec Askon Estates UK Limited Aspasia Aspect International Aspinall Group Asprey Homes Asset Agents Asset Property Brokers Assetz Assoc of Home Information Pack Providers (AHIPP) Association of Residential Letting Agents (ARLA) Assoufid Aston Lloyd Astute ATHOC Atisreal Atlas International Atum Cove Australand Australian Dream Homes Awesome Villas AXA Azure Investment Property Baan Mandala Villas And Condominiums Badge Balcony Systems PROPERTY - USEFUL LINKS Ballymore -

Development Securities PLC Annual Report 2006

Development Securities PLC Annual Report 2006 1 Financial highlights Development Securities PLC Annual Report 2006 Financial highlights £23.6m 6.75p 63.4p Profit after tax Annual dividends per share Earnings per share £231.4m £14.4m 568p Net assets Net borrowings Net assets per share Net assets per share Earnings per share Dividends per share 06 568* 06 63.4* 06 6.75* 05 510* 05 54.8* 05 6.37* 04 472* 04 54.3* 04 6.0* 03 444 03 4.2 03 5.4 02 423 02 26.9 02 5.0 01 423 01 24.0 01 4.5 Contents 02 Chairman’s statement 04 Our strategy 12 Review of operations 18 Property investment portfolio 22 Sustainability report 24 Board of Directors 26 Report of the Directors 28 Corporate governance 32 Contents of the financial statements 68 Remuneration report 76 Financial calendar and advisors *stated in accordance with IFRS 2 Chairman’s statement Development Securities PLC Annual Report 2006 Chairman’s statement I am pleased to report another very for other potential property acquisitions. The growing size and strength of our satisfactory year for your Company, We were pleased with the strength of support balance sheet, recently augmented by the resulting in a significant uplift in demonstrated by both existing and new £23.1 million share placing, supports our shareholder funds. shareholders for this successful placing. adjusted business model, whereby we now consider it appropriate to secure direct An increased contribution from our development Strategy ownership of land for development. Our recent activities, coupled with a strong performance Shareholders will be aware that the strategic £33.5 million acquisition of Curzon Park, in from our property investment portfolio enables focus of our development activities over the equal partnership with Grainger PLC, is a me to report a profit after tax of £23.6 million last two years has been suburban London case in point. -

Trafford Park Masterplan Baseline Assessment

Trafford Park Masterplan Baseline Assessment A Report for the Trafford Economic Alliance By EKOS, CBRE, URBED and WSP August 2008 EKOS Consulting (UK) Ltd 2 Mount Street Manchester M2 5WQ TABLE OF CONTENTS LIST OF FIGURES AND TABLES............................................................................................ 6 EXECUTIVE SUMMARY......................................................................................................... 12 2 INTRODUCTION AND STUDY CONTEXT ..................................................................... 23 INTRODUCTION ....................................................................................................................... 23 STUDY CONTEXT.................................................................................................................... 23 HISTORICAL CONTEXT ............................................................................................................ 24 STUDY CONTEXT AND MASTERPLAN OBJECTIVES .................................................................... 29 STUDY AREA.......................................................................................................................... 31 BASELINE REPORT OBJECTIVES AND STRUCTURE.................................................................... 31 3 REGENERATION AND PLANNING POLICY REVIEW.................................................. 33 INTRODUCTION ....................................................................................................................... 33 NATIONAL POLICY -

Barton Upon Irwell Conservation Area Appraisal SPD5.6A

TRAFFORD COUNCIL SPD5.6: Barton Upon Irwell Conservation Area Appraisal SPD5.6a: Barton Upon Irwell Conservation Area Management Plan Consultation Statement March 2016 Conservation Area Appraisal and Management Plan Consultation Statement Trafford Council Contents 1. Introduction ................................................................................................................... 1 2. Statement of Community Involvement Review .............................................................. 1 3. Public Consultation ........................................................................................................ 1 4. Consultation Responses and Main Issues .................................................................... 3 5. Main Changes to the SPD ............................................................................................. 4 Appendix 1 – List of Consultees ........................................................................................ 13 Appendix 2 – Local Advertisement – Conservation Management Plan ............................. 17 Appendix 2 – Local Advertisement – Conservation Area Appraisal ................................... 18 Supplementary Planning Document Conservation Area Appraisal Consultation Statement Trafford Council 1. Introduction 1.1. In preparing Supplementary Planning Documents (SPDs), the Council is required to follow the procedures laid down in the Town and Country Planning (Local Planning) (England) Regulations 2012, and its adopted Statement of Community Involvement -

The Intu Difference Intu Properties Plc Annual Report 2016 Welcome to Our Annual Report 2016

The intu difference intu properties plc Annual report 2016 Welcome to our annual report 2016 Our purpose is to create compelling, joyful experiences that surprise and delight our customers and make them smile. We are a people business and everything we do is guided by our culture and our values. We’re passionate about providing people with their perfect shopping experience so that our retailers flourish. And it’s this that powers our business, creating opportunity for our retailers and value for our investors; benefiting our communities and driving our long-term success. Contents Overview Governance Highlights of 2016 2 Chairman’s introduction 58 Our top properties 4 Board of Directors 60 Executive Committee 62 Strategic report The Board 63 Chairman’s statement 6 Viability statement 68 Chief Executive’s review 8 Audit Committee 69 Our growth story 10 Nomination and Review Committee 74 Investment case 12 Directors’ remuneration report 76 Directors’ report 94 The intu difference Statement of Directors’ responsibilities 96 Making the difference 14 Understanding our markets 16 Financial statements Optimising asset performance 18 Independent auditors’ report 98 Delivering UK developments 20 Consolidated income statement 106 Making the brand count 22 Consolidated statement of Seizing the growth opportunity in Spain 24 comprehensive income 107 At the heart of communities 26 Balance sheets 108 Our business model 28 Statements of changes in equity 109 Relationships 30 Statements of cash flows 112 Strategy overview 32 Notes to the financial statements -

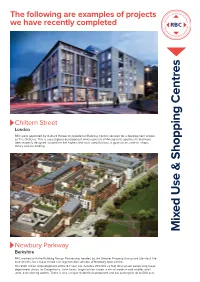

RBC Mixed Use Sheet.Indd

The following are examples of projects we have recently completed Chiltern Street London RBC were appointed by Galliard Homes to provide full Building Control services for a development known as The Chilterns. This is a prestigious development which consists of 44 exquisite apartments that have been expertly designed to combine the highest technical specifications; a gymnasium, cinema, shops, library and car parking. Mixed Use & Shopping Centres Mixed Newbury Parkway Berkshire RBC worked with the Building Design Partnership headed by the Shearer Property Group and Standard Life Investments, for a major mixed-use regeneration scheme of Newbury town centre. The £120 million redevelopment of the 5.7 acre site includes 270,000 sq ft of retail space comprising major department stores for Debenhams, John Lewis, large fashion stores, a mix of medium and smaller retail units, and catering outlets. There is also a major residential component and car parking for up to 600 cars. Shopping Centres Nationwide RBC have worked on many high profile shopping centres, providing building control services for retail clients, below is a small selection of these: Arndale Centre Swan Shopping Centre Manchester Eastleigh Brentcross Shopping Centre Telford Shopping Centre London Shropshire Bullring Shopping Centre The Chimes Shopping Centre Birmingham Middlesex Churchill Square Shopping Centre The Cornbow Shopping Centre Brighton Halesowen Eagles Meadow Shopping Centre The Gracechurch Centre Wrexham West Midlands Eastgate Shopping Centre The Oracle Shopping Centre